Tekla Healthcare Opportunities Fund Paid Distribution

April 28 2023 - 9:59AM

Business Wire

On April 28, 2023, Tekla Healthcare Opportunities Fund paid a

monthly distribution of $0.1125 per share. It is currently

estimated that this distribution is derived from net realized

short-term capital gains, net realized long-term capital gains and

return of capital or other capital source. The composition of this

and subsequent distributions may vary from month to month because

it may be materially impacted by future realized gains and losses

on securities. The aggregate of the net unrealized appreciation of

portfolio securities and net realized gains on sale of securities

is $138,400,650 of which $129,447,305 represents net unrealized

appreciation of portfolio securities.

The following table sets forth the estimated amounts of the

current distribution, paid on April 28, 2023, and the cumulative

distributions paid this fiscal year-to-date from the following

sources: net investment income, net realized short-term capital

gains, net realized long-term capital gains and return of capital

or other capital source. The Fund estimates that it has distributed

more than its income and net realized capital gains; therefore, a

portion of your distribution may be a return of capital. A return

of capital may occur, for example, when some or all the money that

you have invested in the Fund is paid back to you. A return of

capital distribution does not necessarily reflect the Fund’s

investment performance and should not be confused with ‘yield’ or

‘income’. All amounts are expressed per common share.

Current

Distribution

Percentage

Breakdown of

Current Distribution

Total Cumulative

Distributions for the

Fiscal Year to Date1

Percentage Breakdown

of the Total

Cumulative

Distributions for the

Fiscal Year to Date1

Net Investment Income

$0.0000

0%

$0.0049

1%

Net Realized ST Cap Gains

$0.0329

29%

$0.1683

21%

Net Realized LT Cap Gains

$0.0309

28%

$0.1304

17%

Return of Capital or Other Capital

Source

$0.0487

43%

$0.4839

61%

TOTAL (per common share):

$0.1125

100%

$0.7875

100%

The table below includes information relating to the Fund’s

performance based on its NAV for certain periods.

Average annual return at NAV for the

period from March 31, 2018 through March 31, 2023

10.28%

Annualized current distribution rate

expressed as a percentage of NAV as of March 31, 2023

6.42%

Cumulative total return at NAV for the

fiscal year, through March 31, 20232

7.69%

Cumulative fiscal year-to-date

distribution rate expressed as a percentage of NAV as of March 31,

20231

3.75%

You should not draw any conclusions about the Fund’s investment

performance from the amount of this distribution or from the terms

of the Fund’s managed distribution policy.

The amounts and sources of distributions reported in this press

release are only estimates and are not being provided for tax

reporting purposes. The actual amounts and sources of the amounts

for tax reporting purposes will depend upon the Fund’s investment

experience during the remainder of its fiscal year and may be

subject to changes based on tax regulations. The Fund will send you

a Form 1099-DIV for the calendar year that will tell you how to

report these distributions for federal income tax purposes.

Tekla Healthcare Opportunities Fund (NYSE: THQ) is a closed-end

fund that invests in companies in the healthcare industry.

Tekla Capital Management LLC, the Fund’s investment adviser, is

a Boston, MA based healthcare-focused investment manager with

approximately $3 billion of assets under management as of March 31,

2023. Tekla also serves as investment adviser to Tekla Healthcare

Investors (NYSE: HQH), Tekla Life Sciences Investors (NYSE: HQL)

and Tekla World Healthcare Fund (NYSE: THW), closed-end funds that

invest in companies in the healthcare and life sciences industries.

Information regarding the Funds and Tekla Capital Management LLC

can be found at www.teklacap.com.

Please contact Destra Capital Advisors, the Fund’s marketing and

investor support services agent, at THQ@destracapital.com or call

(877) 855-3434 if you have any questions regarding THQ.

1

The Fund’s current fiscal year

began on October 1, 2022.

2

Cumulative total return at NAV is

the percentage change in the Fund’s NAV and includes all

distributions and assumes the reinvestment of those distributions

for the period of September 30, 2022 through March 31, 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230428005329/en/

Destra Capital Advisors THQ@destracapital.com (877) 855-3434

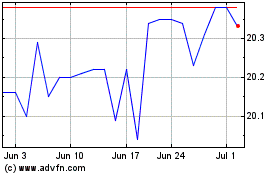

abrdn Healthcare Opportu... (NYSE:THQ)

Historical Stock Chart

From Oct 2024 to Nov 2024

abrdn Healthcare Opportu... (NYSE:THQ)

Historical Stock Chart

From Nov 2023 to Nov 2024