false

0001859007

0001859007

2024-09-03

2024-09-03

0001859007

dei:BusinessContactMember

2024-09-03

2024-09-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

As

filed with the Securities and Exchange Commission on September 3, 2024

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

ZYVERSA

THERAPEUTICS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

86-2685744 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

Number) |

2200

N. Commerce Parkway, Suite 208

Weston,

FL 33326

(754)

231-1688

(Address,

including zip code, and telephone number, including

area

code, of registrant’s principal executive offices)

Stephen

C. Glover

Chief

Executive Officer

ZyVersa

Therapeutics, Inc.

2200

N. Commerce Parkway, Suite 208

Weston,

FL 33326

(754)

231-1688

(Name,

address, including zip code, and telephone number, including

area

code, of agent for service)

Copies

to:

Faith

L. Charles

Todd

Mason

Thompson

Hine LLP

300

Madison Avenue, 27th Floor

New

York, New York 10017-6232

Phone:

(212) 344-5680

Fax:

(212) 344-6101

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If

the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

|

|

|

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

|

|

| |

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective

on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. The selling stockholders may not resell these securities until the

registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these

securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject

to Completion, dated September 3, 2024

PRELIMINARY

PROSPECTUS

478,600

Shares of Common Stock

This

prospectus relates to the offer and resale of up to an aggregate of 478,600 shares of common stock, par value $0.0001 per share (the

“Common Stock”) of ZyVersa Therapeutics, Inc. (the “Company,” “we,” “our” or “us”),

held by the selling stockholder listed in this prospectus or its permitted transferees (the “Selling Stockholders”). The

shares of Common Stock registered for resale pursuant to this prospectus are comprised of 478,600 shares of Common Stock (the “Warrant

Shares”) issuable upon exercise of (i) Series A-1 warrants to purchase up to 392,000 shares of Common Stock and (ii) Series B-1

warrants to purchase up to 86,600 shares of Common Stock (collectively, the “Warrants”) issued to the selling stockholder

in a warrant inducement transaction (the “Private Placement”) which closed on August 2, 2024. For additional information

about the Private Placement, see “Private Placement.”

We

are registering the Warrant Shares on behalf of the Selling Stockholders to be offered and sold by them from time to time. We are not

selling any securities under this prospectus and will not receive any proceeds from the sale of our Common Stock by the Selling Stockholders

in the offering described in this prospectus. The Selling Stockholders may sell any, all or none of the Warrant Shares offered by this

prospectus. In the event the Selling Stockholders exercise all of the Warrants in cash at an exercise price per share of $3.46, we may

receive approximately $1,655,956 of gross proceeds resulting from such exercise. For more information, see “Use of Proceeds.”

The

Selling Stockholders, or their respective transferees, pledgees, donees or other successors-in-interest, may offer or sell the Warrant

Shares from time to time in a number of different ways and at varying prices, including through public or private transactions at prevailing

market prices, at prices related to prevailing market prices or at privately negotiated prices. See “Plan of Distribution”

on page 10 of this prospectus for more information about how the Selling Stockholders may sell or dispose of the shares of Common

Stock being registered pursuant to this prospectus.

This

prospectus describes the general manner in which the Warrant Shares may be offered and sold. When the Selling Stockholders sell shares

of Common Stock under this prospectus, we may, if necessary and required by law, provide a prospectus supplement that will contain specific

information about the terms of that offering. Any prospectus supplement may also add to, update, modify or replace information contained

in this prospectus. We urge you to read carefully this prospectus, any accompanying prospectus supplement and any documents we incorporate

by reference into this prospectus and any accompanying prospectus supplement before you make your investment decision.

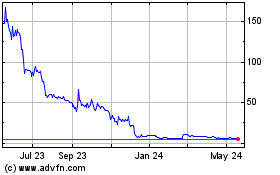

On

December 4, 2023 and April 25, 2024, we effected reverse-stock-splits at ratios

of 1-for-35 and 1-for-10, respectively. All share and share price information in this prospectus has been adjusted to give effect

to the reverse-stock-splits.

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties referenced under the heading

“Risk Factors” beginning on page 5 of this prospectus, as well as in the other documents that are incorporated by

reference into this prospectus.

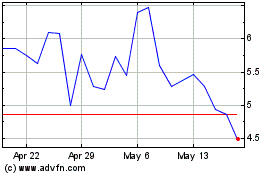

Our

common stock is listed on The Nasdaq Stock Market LLC (“Nasdaq”) under the symbol “ZVSA.” On August 30,

2024, the last reported sale price of our common stock was $2.77 per share.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2024

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 (the “Registration Statement”) that we filed with the Securities

and Exchange Commission (the “SEC”) using the “shelf” registration process. Under this shelf registration process,

the Selling Securityholders may, from time to time, sell the securities offered by it described in this prospectus. We will not receive

any proceeds from the sale of the Shares by the Selling Securityholders. In the event the Selling Securityholders exercise all of the

Warrants in cash at an exercise price per share of $3.46, we may receive approximately $1,655,956 of gross proceeds resulting from such

exercise. Any proceeds that we receive from the exercise of such Warrants will be used for working capital and general corporate purposes.

We

have not, and the Selling Securityholders have not, authorized anyone to provide you with information different than or inconsistent

with the information contained in or incorporated by reference in this prospectus, any applicable prospectus supplement or any free writing

prospectus that we have authorized for use in connection with this offering. Neither we nor the Selling Securityholders take responsibility

for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not, and the Selling

Securityholders are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted or in

which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or

solicitation. You should assume that the information contained in or incorporated by reference in this prospectus, any applicable prospectus

supplement or in any free writing prospectus that we have authorized for use in connection with this offering, is accurate only as of

the date of those respective documents, regardless of the time of delivery of those respective documents. Our business, financial condition,

results of operations and prospects may have changed since those dates. You should read this prospectus, any applicable prospectus supplement,

any free writing prospectus that we have authorized for use in connection with this prospectus and the documents incorporated by reference

in this prospectus, any applicable prospectus supplement, any free writing prospectus that we have authorized for use in connection with

this prospectus, in their entirety before making an investment decision. You should also read and consider the information in the documents

to which we have referred you in the sections titled “Where You Can Find More Information” and “Incorporation of Certain

Information by Reference.”

The

Selling Securityholders are offering to sell, and seeking offers to buy, the securities offered by the Selling Securityholders described

in this prospectus only in jurisdictions where offers and sales are permitted. The distribution of this prospectus and this offering

of our securities in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this

prospectus must inform themselves about, and observe any restrictions relating to, this offering of our securities and the distribution

of this prospectus outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to

sell, or a solicitation of an offer to buy, any securities offered by this prospectus by any person in any jurisdiction in which it is

unlawful for such person to make such an offer or solicitation.

In

this prospectus, unless otherwise stated or the context otherwise requires, references to “ZyVersa”, “Company”,

“we”, “us”, “our” or similar references mean ZyVersa Therapeutics, Inc.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you

should consider before deciding to invest in our securities. You should read this entire prospectus carefully, including all documents

incorporated by reference. In particular, attention should be directed to our “Risk Factors” section in this prospectus and

under similar captions in the documents incorporated by reference into this prospectus, including any prospectus supplement incorporated

by reference hereto, and the financial statements and related notes thereto contained herein or otherwise incorporated by reference hereto.

Overview

We

are a clinical stage biopharmaceutical company leveraging proprietary technologies to develop drugs for patients with chronic renal or

inflammatory diseases with high unmet medical needs. Our mission is to develop drugs that optimize health outcomes and improve patients’

quality of life.

We

have two proprietary globally licensed drug development platforms, each of which was discovered by research scientists at the University

of Miami, Miller School of Medicine (the “University of Miami” or “University”). These development platforms

are:

| |

● |

Cholesterol

Efflux MediatorTM VAR 200 (2-hydroxypropyl-beta-cyclodextrin or “2HPβCD”) is an injectable drug in clinical

development for treatment of renal diseases. VAR 200 was licensed to us from L&F Research LLC on December 15, 2015. L&F Research

was founded by the University of Miami research scientists who discovered the use of VAR 200 for renal diseases. |

| |

|

|

| |

● |

Inflammasome

ASC Inhibitor IC 100 is a humanized monoclonal antibody in preclinical development for treatment of inflammatory conditions. IC 100

was licensed from InflamaCore, LLC to us on April 18, 2019. InflamaCore, LLC was founded by the University of Miami research scientists

who invented IC 100. |

We

believe that each of our product candidates has the potential to treat numerous indications in their respective therapeutic areas. Our

strategy is to focus on indication expansion to maximize commercial potential.

Our

renal pipeline is initially focused on rare, chronic glomerular diseases. Our lead indication for VAR 200 is focal segmental glomerulosclerosis

(“FSGS”). On January 21, 2020, we filed an Investigational New Drug application (“IND”) for VAR 200, and the

United States Food and Drug Administration (“FDA”) has allowed our development plans to proceed to a Phase 2a trial in patients

with FSGS based on the risk/benefit profile of the active ingredient (2HPβCD). Prior to initiating a Phase 2a trial in patients

with FSGS, we are planning to initiate a small open-label Phase 2a trial in patients with diabetic kidney disease in the second half

of 2024, in which we expect to obtain patient proof-of-concept data more quickly than in an FSGS trial. This will enable assessment of

drug effects as patients proceed through treatment and will provide insights for developing a lager Phase 2a/b protocol in patients with

FSGS. An IND amendment for evaluation of VAR 200 in a Phase 2a trial in patients with diabetic kidney disease was filed with the FDA

on February 16, 2024. VAR 200 has pharmacologic proof-of-concept data in animal models representative of FSGS, Alport Syndrome, and diabetic

kidney disease providing opportunity for indication expansion.

Our

Inflammasome ASC Inhibitor IC 100 is nearing completion of preclinical development. Our focus is on advancing IC 100 toward a planned

IND submission in Q4-2024, followed by initiation of a Phase 1 trial in patients with obesity and certain metabolic complications, our

lead indication. IC 100 has preclinical data in animal models representing 5 different indications, each demonstrating that IC 100 attenuates

pathogenic inflammasome signaling pathways leading to reduced inflammation and improved histopathological and/or functional outcomes.

Those indications are multiple sclerosis (“MS”), retinopathy of prematurity (“ROP”), acute respiratory distress

syndrome (“ARDS”), spinal cord injury, and traumatic brain injury (TBI). Likewise, preclinical studies are underway in atherosclerosis,

Alzheimer’s disease, and Parkinson’s disease, and preparations are underway to initiate an IND-enabling preclinical study

in obesity with metabolic complications.

Preclinical

studies are underway in Parkinson’s disease, atherosclerosis, and obesity.

Private

Placement

On

August 1, 2024, we entered into a warrant exercise inducement offer letter (the “Inducement Letter”) with a certain holder

(the “Holder”) of outstanding Series A Common Stock purchase warrants exercisable for

up to an aggregate of 196,000 shares of Common Stock, and Series B Common Stock purchase warrants exercisable for up to an aggregate

of 43,300 shares of Common Stock (collectively, the “Existing Warrants”), which Existing Warrants were issued by the Company

on December 11, 2023, and were exercisable at an exercise price of $12.50 per share.

Pursuant

to the Inducement Letter, the Holder agreed to exercise the Existing Warrants for cash at a reduced exercise price of $3.46 per share

in consideration of the Company’s agreement to issue the Holder the Warrants to purchase up to a number of shares of Common Stock

equal to 200% of the number of shares of Common Stock issued pursuant to the Holder’s exercise of Existing Warrants, comprised

of (i) new Series A-1 warrants to purchase up to 392,000 shares of Common Stock with an exercise term of 5 years from the initial exercise

date and (ii) new Series B-1 warrants to purchase up to 86,600 shares of Common Stock with an exercise term of 18 months from the initial

exercise date. The initial exercise date of the Warrants is the Stockholder Approval Date (as defined below), and the exercise price

thereof is $3.46 per share.

The

Company received aggregate gross proceeds of approximately $830,000.

The

Company entered into a financial advisory agreement (the “Financial Advisory Agreement”) with A.G.P./Alliance Global Partners

(“AGP”) to act as its financial advisor in connection with the transactions summarized above. Pursuant to the Financial Advisory

Agreement, the Company paid AGP a $50,000 cash fee. Additionally, the Company reimbursed AGP for its documented accountable legal expenses.

Corporate

Information

On

December 12, 2022 (the “Closing Date”), we consummated a business combination pursuant to the terms of that certain Business

Combination Agreement, dated July 20, 2022, as amended from time to time (the “Business Combination Agreement”), by and among

ZyVersa Therapeutics, Inc., a Florida corporation (“Old ZyVersa”), the representative of Old ZyVersa’s shareholders

named therein (the “Securityholder Representative”), Larkspur Health Acquisition Corp., a Delaware corporation (“Larkspur”)

and Larkspur Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Larkspur (the “Merger Sub”). Pursuant

to the terms of the Business Combination Agreement (and upon all other conditions of the Business Combination Agreement being satisfied

or waived), on the Closing Date of the Business Combination and transactions contemplated thereby, (i) Larkspur changed its name to “ZyVersa

Therapeutics, Inc.”, a Delaware corporation and (ii) the Merger Sub merged with and into Old ZyVersa (the “Merger”),

with Old ZyVersa as the surviving company in the Merger and, after giving effect to such Merger, Old ZyVersa became a wholly-owned subsidiary

of the Company.

Our

principal executive offices are located at 2200 North Commerce Parkway, Suite 208, Weston, Florida 33326, and our telephone number is

(754) 231-1688. Our website address is http://www.zyversa.com. The information contained on or otherwise accessible through our website

is not part of this prospectus.

The

Offering

Shares

of Common

Stock offered by the

Selling Stockholders |

|

478,600

shares of Common Stock consisting of 478,600 Warrant Shares. |

| |

|

|

| Use

of proceeds |

|

We

are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of the shares of Common

Stock covered hereby by the Selling Stockholders. To the extent any Warrants are exercised for cash, we intend to use such proceeds

for working capital or general corporate purposes. See “Use of Proceeds.” |

| |

|

|

| Terms

of this offering; Determination of offering price |

|

The

Selling Stockholders, including their transferees, donees, pledgees, assignees and successors-in-interest,

may sell, transfer or otherwise dispose of any or all of the shares of Common Stock offered

by this prospectus from time to time on The Nasdaq Capital Market or any other stock exchange,

market or trading facility on which the shares are traded or in private transactions. The

Selling Stockholders may offer or sell the shares of Common Stock offered by this prospectus

at market prices prevailing at the time of sale, at prices related to prevailing market price

or at privately negotiated prices.

The

offering price of our Common Stock does not necessarily bear any relationship to our book value, assets, past operating results,

financial condition or any other established criteria of value. Our Common Stock might not trade at market prices in excess of the

offering price as prices for our Common Stock in any public market will be determined in the marketplace and may be influenced by

many factors, including the depth and liquidity. See “Determination of Offering Price” and “Plan of Distribution”

for more information. |

| |

|

|

| Nasdaq

symbol |

|

Our

Common Stock is listed on The Nasdaq Capital Market under the symbol “ZVSA”. |

| |

|

|

| Risk

Factors |

|

Investing

in our securities involves a high degree of risk. See the section titled “Risk Factors” on page 5 of this prospectus

and under similar headings in other documents incorporated by reference herein. |

RISK

FACTORS

Investment

in any securities offered pursuant to this prospectus involves risks. Before deciding whether to invest in our securities, you should

carefully consider the following risk factors and the risk factors discussed under the sections titled “Risk Factors” in

our most recent Annual Reports on Form 10-K and Form 10-K/A, any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form

8-K, and all other information contained in or incorporated by reference into this prospectus, as updated by our subsequent filings under

the Exchange Act. The risks and uncertainties we have described are not the only ones facing our Company. Additional risks and uncertainties

not presently known to us or that we currently believe are not material may also affect our business operations. Past financial performance

may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future

periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flows could be seriously

harmed. This could cause the trading price of our securities to decline, resulting in a loss of all or part of your investment in the

offered securities. The discussion of risks includes or refers to forward-looking statements. You should read the explanation of the

qualifications and limitations on such forward-looking statements contained in or incorporated by reference into this prospectus and

in any applicable prospectus supplement or free writing prospectus.

Risks

Related to This Offering

The

sale or availability for sale of shares issuable upon exercise of the Warrants may depress the price of our Common Stock and encourage

short sales by third parties, which could further depress the price of our Common Stock.

To

the extent that the Selling Securityholders sell shares of our Common Stock issued upon exercise of the Warrants, the market price of

such shares may decrease due to the additional selling pressure in the market. In addition, the dilution from issuances of such shares

may cause stockholders to sell their shares of our Common Stock, which could further contribute to any decline in the price of our Common

Stock. Any downward pressure on the price of our Common Stock caused by the sale or potential sale of such shares could encourage short

sales by third parties. Such sales could place downward pressure on the price of our Common Stock by increasing the number of shares

of our Common Stock being sold, which could further contribute to any decline in the market price of our Common Stock.

Future

sales and issuances of our Common Stock or other securities might result in significant dilution and could cause the price of our Common

Stock to decline.

To

raise capital, we may sell Common Stock, convertible securities or other equity securities in one or more transactions, at prices and

in a manner we determine from time to time. We may sell shares or other securities in any other offering at a price per share that is

less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could

have rights superior to existing stockholders. The price per share at which we sell additional shares of our Common Stock, or securities

convertible or exchangeable into Common Stock, in future transactions may be higher or lower than the price per share paid by investors

in this offering.

We

cannot predict what effect, if any, sales of shares of our Common Stock in the public market or the availability of shares for sale will

have on the market price of our Common Stock. However, future sales of substantial amounts of our Common Stock in the public market,

including shares issued upon exercise of outstanding options, or the perception that such sales may occur, could adversely affect the

market price of our Common Stock.

Management

will have broad discretion as to the use of the proceeds from the offering, and uses may not improve our financial condition or market

value.

We

will not receive any proceeds from the sale of the Shares by the Selling Securityholders. In the event the Selling Securityholders exercise

all of the Warrants in cash at an exercise price per share of $3.46, we may receive approximately $1,655,956 of gross proceeds resulting

from such exercise. Any proceeds that we receive from the exercise of such Warrants will be used for working capital and general corporate

purposes.

Because

we have not designated the amount of proceeds from the offering to be used for any particular purpose, our management will have broad

discretion as to the application of such proceeds and could use them for purposes other than those contemplated hereby. Our management

may use the proceeds for corporate purposes that may not improve our financial condition or market value.

Risks

Related to Our Business, Financial Position and Need for Capital

We

may be unable to continue as a going concern.

We

are a development stage pharmaceutical company with no commercial products. Our primary product candidates are in the process of being

developed and will require significant additional preclinical and clinical development and investment before they could potentially be

commercialized. As a result, we have not generated any revenue from operations since inception, and we have incurred substantial net

losses to date. Moreover, our cash position is vastly inadequate to support our business plans and substantial additional funding will

be needed in order to pursue those plans, which include research and development of our primary product candidates, seeking regulatory

approval for those product candidates, and pursuing their commercialization in the United States and other markets. Our independent registered

public accounting firm’s report for the year ended December 31, 2023, contains an explanatory paragraph that expresses doubt about

our ability to continue as a going concern. Those circumstances raise substantial doubt about our ability to continue as a going concern.

In particular, we believe that our current cash on hand will only be sufficient to meet our anticipated cash requirements into the third

quarter of 2024. If we are unable to continue as a going concern, we might have to liquidate our assets and the values we receive for

our assets in liquidation or dissolution could be significantly lower than the values reflected in our financial statements. In addition,

our lack of cash resources and our potential inability to continue as a going concern may materially adversely affect the value of our

capital stock and our ability to raise new capital or to enter into critical contractual relations with third parties.

We

will need additional capital to develop and commercialize our product candidates. If we are unable to raise sufficient capital, we would

be forced to delay, reduce or eliminate our product development programs.

Developing

pharmaceutical products, including conducting preclinical studies and clinical trials, is expensive. We expect our research and development

expenses to increase in connection with our ongoing activities, particularly as we start clinical trials for VAR 200 and conduct preclinical

development of IC 100. We have no commitments or arrangements for any additional financing to fund our development and commercialization

efforts for VAR 200, IC 100, or any other product candidate that we may seek to develop. We will need to raise substantial additional

capital to develop and commercialize VAR 200, IC 100, and any other product candidate that we may seek to develop. Because successful

development of VAR 200 or IC 100 is uncertain, we are unable to estimate the actual funds required to complete their development and

commercialization.

Until

we can generate a sufficient amount of revenue from VAR 200, IC 100, or any other product candidate that we may seek to develop, if ever,

we expect to finance future cash needs through public or private equity offerings, debt financings or corporate collaborations and licensing

arrangements. Additional funds may not be available when we need them on terms that are acceptable to us, or at all. If adequate funds

are not available, we may be required to delay, reduce the scope of, or curtail, our operations. To the extent that we raise additional

funds by issuing equity securities, or securities convertible into equity securities, the ownership of our then existing stockholders

may be diluted, which dilution could be significant depending on the price at which we may be able to sell our securities. Also, if we

raise additional capital through the incurrence of indebtedness, we may become subject to additional covenants restricting our business

activities, the holders of debt instruments may have rights and privileges senior to those of our equity investors, and servicing the

interest and principal repayment obligations under such debt instruments could divert funds that would otherwise be available to support

research and development, clinical or commercialization activities. Corresponding, we may not be able to enter into collaborations that

we seek to establish. To the extent that we raise additional funds through collaborations and licensing arrangements, it may be necessary

to relinquish some rights to our technologies or our product candidates or grant licenses on terms that may not be favorable to us. We

may seek to access the public or private capital markets whenever conditions are favorable, even if we do not have an immediate need

for additional capital at that time.

Our

future funding requirements, both near and long-term, will depend on many factors, including, but not limited to:

| |

● |

the

initiation, progress, timing, costs and results of preclinical and clinical trials for our product candidates; |

| |

|

|

| |

● |

whether

the FDA requires that we perform additional studies for our product candidates that we seek to develop beyond those that we anticipate; |

| |

|

|

| |

● |

the

terms and timing of any future collaboration, licensing or other arrangements that we may establish; |

| |

|

|

| |

● |

the

outcome, timing and cost of regulatory approvals; |

| |

|

|

| |

● |

the

effect of competing technological and market developments; |

| |

|

|

| |

● |

the

cost and timing of establishing commercial-scale outsourced manufacturing capabilities; |

| |

|

|

| |

● |

market

acceptance of our product candidates, if we receive regulatory approval; |

| |

|

|

| |

● |

the

cost of establishing sales, marketing and distribution capabilities for our product candidates, if we receive regulatory approval;

and |

| |

|

|

| |

● |

the

extent to which we acquire, license or invest in businesses, products or technologies. |

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference herein and any prospectus supplement delivered with this prospectus may contain

forward-looking statements. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking

statements contained in Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). All statements other than statements of historical facts contained or incorporated by reference in this prospectus, including,

but not limited to, statements regarding our future results of operations and financial position, business strategy, plans and prospects,

existing and prospective products, research and development costs, timing and likelihood of success, and plans and objectives of management

for future operations and results, are forward-looking statements. These forward-looking statements can generally be identified by the

use of forward-looking terminology, including the terms “believes,” “can,” “could,” “estimates,”

“anticipates,” “expects,” “seeks,” “projects,” “intends,” “plans,”

“may,” “might,” “should,” “will” or “would” or, in each case, their negative

or other variations or comparable terminology, although not all forward-looking statements contain these identifying words. These statements

involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements

to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

Factors

that may impact such forward-looking statements include:

| |

● |

Our

ability to maintain adequate technology, intellectual property, data privacy and cybersecurity practices. |

| |

|

|

| |

● |

Our

reliance on third parties. |

| |

|

|

| |

● |

The

risks related to general economic and financial market conditions, including the impact of supply chain disruptions and inflationary

cost pressures. |

| |

|

|

| |

● |

The

possibility of an economic recession. |

| |

|

|

| |

● |

The

impact of the political, legal and regulatory environment. |

| |

|

|

| |

● |

The

changing landscape of the industries in which the we operate. |

| |

|

|

| |

● |

Our

ability to raise capital, which may not be available on acceptable terms or at all, to execute our business plan. |

| |

|

|

| |

● |

The

outbreak of an infectious disease, such as the COVID-19 or a new variant thereof, or emergence of another epidemic or pandemic that

can potentially disrupt our business plans, product development activities, ongoing clinical trials, including the timing and enrollment

of patients, and the health of our employees. |

| |

|

|

| |

● |

The

limited liquidity and trading of the our common stock. |

| |

|

|

| |

● |

Volatility

in the price of our common stock due to a variety of factors, including changes in the competitive and highly regulated industries

in which we operate, variations in performance across competitors and changes in laws and regulations affecting our business. |

| |

|

|

| |

● |

Our

ability to maintain the listing of our common stock on The Nasdaq Capital Market. |

| |

|

|

| |

● |

Geopolitical

changes and changes in applicable laws or regulations. |

| |

|

|

| |

● |

Our

operational risks. |

| |

|

|

| |

● |

Litigation

and regulatory enforcement risks, including the diversion of management time and attention and the additional costs and demands resulting

therefrom. |

Forward-looking

statements contained in this prospectus are based on the Company’s current expectations and beliefs and are based upon information

available to us as of the date of this prospectus, and while we believe such information forms a reasonable basis for such statements,

that information may be limited or incomplete. Our forward-looking statements should not be read to indicate that we have conducted an

exhaustive inquiry into, or review of, all relevant information. These forward-looking statements involve a number of risks, uncertainties

(some of which are beyond the Company’s control) or other assumptions that may cause actual results or performance to be materially

different from those expressed or implied by these forward-looking statements. Forward-looking statements are inherently uncertain, and

investors are cautioned not to unduly rely upon these statements.

These

risks and uncertainties include, but are not limited to, those factors discussed under the heading “Risk Factors” below and

those described in the section titled “Risk Factors” incorporated by reference into this prospectus from our most recent

Annual Reports on Form 10-K and Form 10-K/A, any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and all other

information contained in or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act

and in our other filings with the SEC. Should one or more of these risks or uncertainties materialize, or should any of the assumptions

prove incorrect, actual results may vary in material respects from those projected in our forward-looking statements. Furthermore, we

operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management

to predict all risk factors and uncertainties.

We

qualify all of our forward-looking statements by these cautionary statements. The Company will not and does not undertake any obligation

to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may

be required by law. You should read this prospectus and the documents incorporated by reference herein and filed as exhibits to the registration

statement of which this prospectus is a part with the understanding that our actual future results, levels of activity, performance,

and achievements may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary

statements.

USE

OF PROCEEDS

The

Common Stock to be offered and sold using this prospectus will be offered and sold by the Selling Stockholders named in this prospectus.

Accordingly, we will not receive any proceeds from any sale or disposition of shares of Common Stock held by the Selling Stockholders

pursuant to this prospectus. To the extent all of the Warrants are exercised for cash at the exercise price per share of $3.46, we would

receive in aggregate gross proceeds of $1,655,956. There can be no assurance that any of the Warrants will be exercised by the Selling

Stockholders or that they will exercise any of the Warrants for cash instead of using any applicable cashless exercise feature.

We

intend to use the net proceeds, if any, from the cash exercise of the Warrants for working capital or general corporate purposes.

DETERMINATION

OF OFFERING PRICE

The

Selling Stockholders will offer or sell the shares of Common Stock offered by this prospectus at market prices prevailing at the time

of sale, at prices related to prevailing market price or at privately negotiated prices. The offering price of our Common Stock does

not necessarily bear any relationship to our book value, assets, past operating results, financial condition or any other established

criteria of value. Our Common Stock might not trade at market prices in excess of the offering price as prices for our Common Stock in

any public market will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity. See

“Plan of Distribution” for more information.

SELLING

STOCKHOLDERS

This

prospectus covers the resale or other disposition by the Selling Stockholders identified in the table below of up to an aggregate 478,600

shares of our Common Stock issuable upon the exercise of the Warrants. The Selling Stockholders acquired their securities in the transactions

described above under the heading “Private Placement.”

The

Warrants held by the Selling Stockholders contain limitations which prevent the holder from exercising such Warrants if such exercise

would cause the Selling Stockholder, together with certain related parties, to beneficially own a number of shares of Common Stock which

would exceed 4.99% of our then outstanding shares of Common Stock following such exercise, excluding for purposes of such determination,

shares of Common Stock issuable upon exercise of the Warrants which have not been exercised.

The

table below sets forth, as of August 30, 2024, the following information regarding the Selling Stockholders:

| |

● |

the

names of the Selling Stockholders; |

| |

|

|

| |

● |

the

number of shares of Common Stock owned by the Selling Stockholders prior to this offering, without regard to any beneficial ownership

limitations contained in the Warrants; |

| |

|

|

| |

● |

the

number of shares of Common Stock to be offered by the Selling Stockholders in this offering; |

| |

|

|

| |

● |

the

number of shares of Common Stock to be owned by the Selling Stockholders assuming the sale of all of the shares of Common Stock covered

by this prospectus; and |

| |

|

|

| |

● |

the

percentage of our issued and outstanding shares of Common Stock to be owned by Selling Stockholders assuming the sale of all of the

shares of Common Stock covered by this prospectus based on the number of shares of Common Stock issued and outstanding as of August

30, 2024. |

Except

as described above, the number of shares of Common Stock beneficially owned by the Selling Stockholder has been determined in accordance

with Rule 13d-3 under the Exchange Act and includes, for such purpose, shares of Common Stock that the Selling Stockholder has the right

to acquire within 60 days of August 30, 2024.

All

information with respect to the Common Stock ownership of the Selling Stockholders has been furnished by or on behalf of the Selling

Stockholders. We believe, based on information supplied by the Selling Stockholders, that except as may otherwise be indicated in the

footnotes to the table below, the Selling Stockholder has sole voting and dispositive power with respect to the shares of Common Stock

reported as beneficially owned by the Selling Stockholders. Because the Selling Stockholders identified in the table may sell some or

all of the shares of Common Stock beneficially owned by them and covered by this prospectus, and because there are currently no agreements,

arrangements or understandings with respect to the sale of any of the shares of Common Stock, no estimate can be given as to the number

of shares of Common Stock available for resale hereby that will be held by the Selling Stockholders upon termination of this offering.

In addition, the Selling Stockholders may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose

of, at any time and from time to time, the shares of Common Stock they beneficially own in transactions exempt from the registration

requirements of the Securities Act after the date on which they provided the information set forth in the table below. We have, therefore,

assumed for the purposes of the following table, that the Selling Stockholders will sell all of the shares of Common Stock owned beneficially

by it that are covered by this prospectus, but will not sell any other shares of Common Stock that they presently own. Except as set

forth below, the Selling Stockholders have not held any position or office, or have otherwise had a material relationship, with us or

any of our subsidiaries within the past three years other than as a result of the ownership of our shares of Common Stock or other securities.

| Name of Selling Stockholders | |

Shares Owned prior to Offering (1) | | |

Shares Offered by this Prospectus | | |

Shares Owned after Offering | | |

Percentage of Shares Beneficially Owned after Offering (1) | |

| Armistice Capital, LLC | |

| 521,600 | (2) | |

| 478,600 | | |

| 43,000 | | |

| 4.0 | % |

*

Less than 1.0%.

| (1) |

Percentages

are based on 1,074,196 shares of Common Stock outstanding as of August 30, 2024, assuming the resale of all of the shares

of Common Stock covered by this prospectus. |

| |

|

| (2) |

Consists

of 43,000 shares of Common Stock and 478,600 shares of Common Stock underlying the Warrants. The securities are directly

held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”) and may be deemed to

be beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”), as the investment manager of the Master Fund;

and (ii) Steven Boyd, as the Managing Member of Armistice Capital. The Warrants are subject to a beneficial ownership limitation

of 4.99%, which such limitation restricts the Selling Stockholder from exercising that portion of the Warrants that would result

in the Selling Stockholder and its affiliates owning, after exercise, a number of shares of Common Stock in excess of the beneficial

ownership limitation. The address of Armistice Capital Master Fund Ltd. is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor,

New York, NY 10022. |

PLAN

OF DISTRIBUTION

Each

Selling Stockholder of the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any

or all of their securities covered hereby on The Nasdaq Capital Market or any other stock exchange, market or trading facility on which

the securities are traded or in private transactions. These sales may be at fixed or negotiated prices.

A Selling Stockholder may use

any one or more of the following methods when selling securities:

| ● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

| ● |

block

trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

| |

|

| ● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

| ● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

| ● |

privately

negotiated transactions; |

| |

|

| ● |

settlement

of short sales; |

| |

|

| ● |

in

transactions through broker-dealers that agree with the Selling Stockholders to sell a specified number of such securities at a stipulated

price per security; |

| |

|

| ● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

| ● |

a

combination of any such methods of sale; or |

| |

|

| ● |

any

other method permitted pursuant to applicable law. |

The

Selling Stockholders may also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available,

rather than under this prospectus.

Broker-dealers

engaged by the Selling Stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions

or discounts from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in

excess of a customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or

markdown in compliance with FINRA Rule 2121.

In

connection with the sale of the securities or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they

assume. The Selling Stockholders may also sell securities short and deliver these securities to close out their short positions, or loan

or pledge the securities to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option

or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the

delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer

or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The

Selling Stockholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act. Each Selling Stockholder has informed the Company that it does not have any written or oral agreement or understanding,

directly or indirectly, with any person to distribute the securities.

The

Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the securities. The Company

has agreed to indemnify the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under

the Securities Act.

We

agreed to keep this prospectus effective until the earlier of (i) the date on which the securities may be resold by the Selling Stockholders

without registration and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for

the Company to be in compliance with the current public information under Rule 144 under the Securities Act or any other rule of similar

effect or (ii) all of the securities have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule

of similar effect. The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable

state securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered

or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is

complied with.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously

engage in market making activities with respect to the Common Stock for the applicable restricted period, as defined in Regulation M,

prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the

Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the

Common Stock by the Selling Stockholders or any other person. We will make copies of this prospectus available to the Selling Stockholders

and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including

by compliance with Rule 172 under the Securities Act).

Our

Common Stock is listed on The Nasdaq Capital Market under the symbol “ZVSA”.

DESCRIPTION

OF SECURITIES

General

The

following description of our capital stock is not complete and may not contain all the information you should consider before investing

in our capital stock. The following description summarizes some of the terms of our Second Amended and Restated Certificate of Incorporation,

(the “Certificate of Incorporation”) Second Amended and Restated By-Laws (the “Bylaws”), and of the General Corporation

Law of the State of Delaware (the “DGCL”). This description is summarized from, and qualified in its entirety by reference

to, our Certificate of Incorporation and Bylaws, each of which has been publicly filed with the SEC, as well as the relevant provisions

of the DGCL.

Capital

Stock

Our

authorized capital stock consists of 250,000,000 shares of common stock, par value $0.0001 per share, and 1,000,000 shares of preferred

stock, par value $0.0001 per share.

Common

Stock

Holders

of shares of common stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders.

The holders of common stock do not have cumulative voting rights in the election of directors.

In

the event of our liquidation, dissolution or winding up and after payment in full of all amounts required to be paid to creditors and

to any future holders of preferred stock having liquidation preferences, if any, the holders of common stock will be entitled to receive

pro rata our remaining assets available for distribution. Holders of common stock do not have preemptive, subscription, redemption or

conversion rights. There are no redemption or sinking fund provisions applicable to the common stock. The rights, powers, preferences

and privileges of holders of the common stock are subject to those of the holders of any shares of preferred stock that the board of

directors may authorize and issue in the future.

Dividends

Declaration

and payment of any dividend is subject to the discretion of our board of directors. The time and amount of dividends is dependent upon,

among other things, our business prospects, results of operations, financial condition, cash requirements and availability, debt repayment

obligations, capital expenditure needs, contractual restrictions, covenants in the agreements governing current and future indebtedness,

industry trends, the provisions of Delaware law affecting the payment of dividends and distributions to stockholders and any other factors

or considerations our board of directors may regard as relevant.

We

currently intend to retain all available funds and any future earnings to fund the development and growth of our business, and therefore

do not anticipate declaring or paying any cash dividends on our common stock in the foreseeable future.

Anti-Takeover

Provisions

The

Certificate of Incorporation and Bylaws contain provisions that may delay, deter or discourage another party from acquiring control of

us. We expect that these provisions, which are summarized below, will discourage coercive takeover practices or inadequate takeover bids.

These provisions are also designed to encourage persons seeking to acquire control of us to first negotiate with our board of directors,

which may result in an improvement of the terms of any such acquisition in favor of our stockholders. However, they also give our board

of directors the power to discourage acquisitions that some stockholders may favor.

Authorized

but Unissued Shares

The

authorized but unissued shares of common stock and preferred stock are available for future issuance without stockholder approval, subject

to any limitations imposed by the listing standards of the Nasdaq. These additional shares may be used for a variety of corporate finance

transactions, acquisitions and employee benefit plans. The existence of authorized but unissued and unreserved common stock and preferred

stock could make more difficult or discourage an attempt to obtain control of us by means of a proxy contest, tender offer, merger or

otherwise.

Board

Composition, Filling Vacancies and Staggard Board.

The

Certificate of Incorporation provides that directors may be removed only for cause and only by the affirmative vote of the holders of

at least a majority of the voting power of all of the then outstanding shares of voting stock of the Company entitled to vote at an election

of directors. Any vacancies on the board of directors resulting from death, resignation, disqualification, retirement, removal or other

causes and any newly created directorships resulting from any increase in the number of directors shall be filled exclusively by the

affirmative vote of a majority of the directors then in office, even though less than a quorum, or by a sole remaining director (other

than any directors elected by the separate vote of one or more outstanding series of preferred stock), and shall not be filled by the

stockholders. Any director appointed in accordance with the preceding sentence shall hold office until the expiration of the term of

the class to which such director shall have been appointed or until his or her earlier death, resignation, retirement, disqualification,

or removal. Furthermore, the Certificate of Incorporation divides our board of directors into three classes with staggered three-year

terms. The classification of our board of directors and the limitations on the ability of our stockholders to remove directors and fill

vacancies could make it more difficult for a third party to acquire, or discourage a third party from seeking to acquire, control of

us.

Special

Meetings of Stockholders

Our

Certificate of Incorporation provides that a special meeting of stockholders may be called by the (a) the Chairperson of the board of

directors, (b) the board of directors or (c) the Chief Executive Officer or President of the Company, provided that such special meeting

may be postponed, rescheduled or canceled by the board of directors or other person calling the meeting. The Bylaws limit the business

that may be conducted at an annual or special meeting of stockholders to those matters properly brought before the meeting.

Action

by Written Consent

Our

Certificate of Incorporation provides that any action required or permitted to be taken by the stockholders must be effected at an annual

or special meeting of the stockholders, and may not be taken by written consent in lieu of a meeting.

Advance

Notice Requirements for Stockholder Proposals and Director Nominations

Our

Bylaws establish advance notice procedures with regard to stockholder proposals relating to the nomination of candidates for election

as directors or new business to be brought before meetings of our stockholders. These procedures provide that notice of stockholder proposals

must be timely given in writing and in proper form to our corporate secretary prior to the meeting at which the action is to be taken.

Generally, to be timely, notice must be received at the principal executive offices of the Company not less than 90 days nor more than

120 days prior to the first anniversary date of the annual meeting for the preceding year or, if later, the 10th day following the day

on which public disclosure of the date of such special meeting was first made. The Bylaws specify the requirements as to form and content

of all stockholders’ notices. These requirements may preclude stockholders from bringing matters before the stockholders at an

annual or special meeting.

Amendment

of Certificate of Incorporation or Bylaws

The

board of directors is expressly authorized to adopt, amend or repeal the Bylaws. Our stockholders also have the power to adopt, amend

or repeal the Bylaws; provided, that in addition to any vote of the holders of any class or series of stock of the Company required

by applicable law or by our Certificate of Incorporation and Bylaws, the adoption, amendment or repeal of the Bylaws by the stockholders

requires the affirmative vote of the holders of at least sixty-six and two-thirds percent (66⅔%) of the voting power of all of

the then outstanding shares of voting stock of the Company entitled to vote generally in an election of directors, voting together as

a single class.

Limitations

on Liability and Indemnification of Officers and Directors

Our

Certificate of Incorporation contains provisions that limit the liability of the Company’s current and former directors for monetary

damages to the fullest extent permitted by Delaware law. Delaware law provides that directors of a corporation will not be personally

liable for monetary damages for any breach of fiduciary duties as directors, except liability for:

| |

● |

any

breach of his duty of loyalty to us or our stockholders; |

| |

|

|

| |

● |

acts

or omissions not in good faith, or which involve intentional misconduct or a knowing violation of law; |

| |

|

|

| |

● |

unlawful

payments of dividends or unlawful stock repurchases or redemptions; and |

| |

|

|

| |

● |

any

transactions from which the director derived an improper personal benefit. |

These

provisions may be held not to be enforceable for violations of the federal securities laws of the United States.

Dissenters’

Rights of Appraisal and Payment

Under

the DGCL, with certain exceptions, our stockholders have appraisal rights in connection with a merger or consolidation of our Company.

Pursuant to Section 262 of the DGCL, stockholders who properly demand and perfect appraisal rights in connection with such merger or

consolidation have the right to receive payment of the fair value of their shares as determined by the Delaware Court of Chancery.

Stockholders’

Derivative Actions

Under

the DGCL, any of our stockholders may bring an action in our name to procure a judgment in its favor, also known as a derivative action,

provided that the stockholder bringing the action is a holder of our shares at the time of the transaction to which the action relates.

Transfer

Agent and Registrar

The

transfer agent and registrar for the common stock is Continental Stock Transfer & Trust Company.

Trading

Symbol and Market

Our

common stock is listed on the Nasdaq under the symbol “ZVSA.”

LEGAL

MATTERS

The

validity of the securities offered hereby will be passed upon for us by Thompson Hine LLP, New York, New York.

EXPERTS

The

consolidated financial statements of ZyVersa Therapeutics, Inc. at December 31, 2023 and the year ended December 31, 2023 incorporated

by reference in ZyVersa Therapeutics, Inc. Form S-1 have been audited by Marcum LLP, independent registered public accounting firm,

as set forth in their report thereon (which contains an explanatory paragraph describing conditions that raise substantial doubt about

the Company’s ability to continue as a going concern as described in Note 2 to the financial statements) appearing elsewhere herein,

and are included in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

The

consolidated financial statements of ZyVersa Therapeutics, Inc. at December 31, 2022, for the period from December 13, 2022 through

December 31, 2022 (Successor), for the period from January 1, 2022 through December 12, 2022 (Predecessor), and the year ended

December 31, 2022 incorporated by reference in ZyVersa Therapeutics, Inc. Annual Report for the year ended December 31, 2023,

included in the Post-effective Amendment No. 1 to Form S-1 (No. 333-275320) have been audited by Ernst & Young LLP,

independent registered public accounting firm, as set forth in their report thereon, (which contains an explanatory paragraph

describing conditions that raise substantial doubt about the Company’s ability to continue as a going concern as described in

Note 2 to the financial statements) incorporated by reference therein, and incorporated herein by reference. Such financial

statements are incorporated herein in

reliance upon the report of Ernst & Young LLP pertaining to such financial statements (to the extent covered by consents filed with the Securities and Exchange Commission) given on the authority of

such firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains a website that contains

reports, proxy and information statements and other information about issuers, such as us, who file electronically with the SEC. The

address of that website is www.sec.gov.

Copies

of certain information filed by us with the SEC are also available on our website at www.zyversa.com. The information contained

on, or that may be accessed through, our website is not part of, and is not incorporated into, this prospectus or any prospectus supplement.

Our website address is included in this prospectus as an inactive textual reference only.

This

prospectus and any prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the

information in the registration statement. The full registration statement may be obtained from the SEC through the SEC’s website

at the address provided above. Forms of the indenture and other documents establishing the terms of any offered securities are or may

be filed as exhibits to the registration statement or documents incorporated by reference in the registration statement. Statements in

this prospectus or any prospectus supplement about these documents are summaries, and each statement is qualified in all respects by

reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant

matters.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose

important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference

is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede

that information. Any statement contained in this prospectus or a previously filed document incorporated by reference will be deemed

to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or a subsequently

filed document incorporated by reference modifies or replaces that statement.

This

prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been

filed with the SEC:

| |

● |

our

Annual Report on Form 10-K/A for the fiscal year ended December 31, 2023, filed with the SEC on May 15, 2024; |

| |

|

|

| |

● |

our

Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on March 25, 2024; |

| |

|

|

| |

● |

our

Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2024 and June 30, 2024, filed with the SEC on May 15, 2024

and August 9, 2024, respectively; |

| |

|

|

| |

● |

our

Current Reports on Form 8-K filed with the SEC on March 1, 2024, March 8, 2024, April 17, 2024, April 25, 2024, and August 1, 2024; |

| |

|

|

| |

● |

our

audited financial statements for the years ended December 31, 2023 and 2022, and the reports of Marcum LLP and Ernst & Young

LLP thereon, contained on pages F-2 through F-28 of the Post-Effective Amendment No. 1 to our Registration Statement on Form

S-1 (File No. 333-275320) filed with the SEC on July 12, 2024; and |

| |

|

|

| |

● |

the

description of our securities set forth in Exhibit 4.8 of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023,

together with any amendment or report filed with the SEC for the purpose of updating such description. |

Notwithstanding

the foregoing, information furnished under Items 2.02 and 7.01 of any Current Report on Form 8-K, including the related exhibits under

Item 9.01, is not incorporated by reference in this prospectus or any prospectus supplement.

All

reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, prior to the termination

of this offering, including all such documents we may file with the SEC after the date of the initial registration statement of which

this prospectus forms a part and prior to the effectiveness of the registration statement, but excluding any information furnished to,

rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus

from the date of the filing of such reports and documents.

You

may obtain any of the documents incorporated by reference in this prospectus from the SEC through the SEC’s website at www.sec.gov.

You also may request a copy of any document incorporated by reference in this prospectus (excluding any exhibits to those documents,

unless the exhibit is specifically incorporated by reference in this document), at no cost, by writing or telephoning us at the following

address and phone number:

ZyVersa

Therapeutics, Inc.

Attn:

Secretary

2200

N. Commerce Parkway, Suite 208

Weston,

Florida 33326

(754)

231-1688

478,600

Shares of Common Stock

PROSPECTUS

We

have not authorized any dealer, salesperson or other person to give any information or to make any representations not contained in this

prospectus. You must not rely on any unauthorized information. This prospectus is not an offer to sell these securities in any jurisdiction

where an offer or sale is not permitted.

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

| Item

14. |

Other

Expenses of Issuance and Distribution. |

The

following table indicates the expenses to be incurred in connection with the offering described in this registration statement, other

than underwriting discounts and commissions, all of which will be paid by us. All amounts are estimated except the Securities and Exchange

Commission registration fee.

| | |

Amount | |

| SEC Registration Fee | |

$ | 198 | |

| Legal Fees and Expenses | |

| 20,000 | |

| Accounting Fees and Expenses | |

| 25,000 | |

| Transfer Agent and Registrar fees and expenses | |

| 5,000 | |

| Miscellaneous Expenses | |

| 4,802 | |

| Total expenses | |

$ | 55,000 | |

| Item

15. |

Indemnification

of Directors and Officers. |

Subsection

(a) of Section 145 of the General Corporation Law of the State of Delaware (the “DGCL”) empowers a corporation to indemnify

any person who was or is a party or who is threatened to be made a party to any threatened, pending or completed action, suit or proceeding,

whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the

fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the

corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise,

against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred

by the person in connection with such action, suit or proceeding if the person acted in good faith and in a manner the person reasonably

believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had

no reasonable cause to believe the person’s conduct was unlawful.

Subsection

(b) of Section 145 empowers a corporation to indemnify any person who was or is a party or is threatened to be made a party to any threatened,

pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that

the person acted in any of the capacities set forth above, against expenses (including attorneys’ fees) actually and reasonably

incurred by the person in connection with the defense or settlement of such action or suit if the person acted in good faith and in a