ZyVersa Therapeutics, Inc. (Nasdaq: ZVSA, or “ZyVersa”), a

clinical-stage specialty biopharmaceutical company developing

first-in-class drugs for the treatment of renal and inflammatory

diseases with high unmet medical needs, reports financial results

for the quarter ended March 31, 2024 and provides business update.

“We are pleased to announce that ZyVersa is on track to achieve

key development milestones over the next 3 quarters,” stated

Stephen C. Glover, ZyVersa’s Co-founder, Chairman, CEO, and

President. “Our Phase 2a clinical trial with Cholesterol Efflux

MediatorTM VAR 200 in diabetic kidney disease is expected to enroll

the first patient(s) within the next few months, with initial data

read-out in the second half of the year. Inflammasome ASC Inhibitor

IC 100’s indication expansion studies are nearing completion for

atherosclerosis, expected to conclude in June, and

obesity-associated metabolic comorbidities, expected to conclude by

year’s end. IND preparation has been initiated for IC 100, with

submission targeted for year’s end, and initiation of a phase 1

clinical trial in first quarter 2025. We believe achievement of

these milestones is a key inflection point for ZyVersa and for

shareholder value.”

BUSINESS Update

CHOLESTEROL EFFLUX MEDIATORTM VAR 200 FOR RENAL DISEASE

- Phase 2a clinical trial in diabetic

kidney disease is on target to begin H1-2024

- CRO, George

Clinical, was engaged in December 2023 to initiate and manage the

trial.

- A central Institutional Review Board

(IRB) approved the clinical trial protocol for trial

initiation.

- Two clinical research sites have

been selected, with contracting nearing completion.

- Enrollment of first patient(s) is expected in the next few

months.

INFLAMMASOME ASC INHIBITOR IC 100 FOR INFLAMMATORY DISEASES

- Inflammasome ASC Inhibitor IC 100’s

preclinical program nearing completion, with GLP toxicology studies

expected to begin H1-2024. IND submission is planned for Q4-2024,

followed by initiation of a Phase 1 clinical trial in Q1-2025.

- Data from a scientific collaboration

with an undisclosed partner to assess the potential of Inflammasome

ASC Inhibitor IC 100 as a treatment for atherosclerosis in a

well-established animal model is expected in June.

- A scientific collaboration with

inflammasome and neurology experts at University of Miami Miller

School of Medicine to assess the potential of Inflammasome ASC

Inhibitor IC 100 as a treatment for obesity-associated metabolic

comorbidities is expected to begin in Q2-2024, with completion in

Q4-2024.

- In vitro preclinical research funded

by The Michael J. Fox Foundation (MJFF) and conducted by

researchers at University of Miami (UM) Miller School of Medicine

supported Inflammasome ASC Inhibitor IC 100’s mechanism of action

and potential to block damaging neuroinflammation that induces

neural degeneration in Parkinson’s disease. At the suggestion of

MJFF, UM researchers are developing a grant request to further the

research in an established animal model.

FIRST QUARTER FINANCIAL RESULTS

Net losses were approximately $2.8 million for the three months

ended March 31, 2024, with an improvement of $0.7 million or 20.2%

compared to a net loss of approximately $3.5 million, for the three

months ended March 31, 2023.

Based on its current operating plan, ZyVersa expects its cash of

$2.0 million as of March 31, 2024 will be sufficient to fund its

operating expenses and capital expenditure requirements on a

month-to-month basis. ZyVersa will need additional financing to

support its continuing operations and to meet its stated

milestones. ZyVersa will seek to fund its operations and clinical

activity through public or private equity or debt financings or

other sources, which may include government grants, collaborations

with third parties or outstanding warrant exercises. During Q1,

ZyVersa raised approximately $2.7 million from investors exercising

in-the-money warrants.

Research and development expenses were $0.5 million for the

three months ended March 31, 2024, a decrease of $0.5 million or

51.4% from $1.1 million for the three months ended March 31, 2023.

The decrease is attributable to lower manufacturing costs of IC 100

of $0.4 million and lower research and development payroll costs of

$0.2 million due to fewer employees. This was offset by an increase

in CRO fees of $0.1 million for VAR 200.

General and administrative expenses were $2.3 million for the

three months ended March 31, 2024, a decrease of $1.2 million or

34.6% from $3.5 million for the three months ended March 31, 2023.

The decrease is primarily attributable to a decrease of $0.4

million in payments for the Effectiveness Failure related to the

PIPE shares, a decrease of $0.4 million for bonus accruals, a $0.2

million decrease in accounting fees and a $0.1 million decrease in

director and officer insurance.

About ZyVersa Therapeutics, Inc.

ZyVersa (Nasdaq: ZVSA) is a clinical stage specialty

biopharmaceutical company leveraging advanced, proprietary

technologies to develop first-in-class drugs for patients with

renal and inflammatory diseases who have significant unmet medical

needs. The Company is currently advancing a therapeutic development

pipeline with multiple programs built around its two proprietary

technologies – Cholesterol Efflux Mediator™ VAR 200 for treatment

of kidney diseases, and Inflammasome ASC Inhibitor IC 100,

targeting damaging inflammation associated with numerous CNS and

peripheral inflammatory diseases. For more information, please

visit www.zyversa.com.

Cautionary Statement Regarding Forward-Looking

Statements

Certain statements contained in this press release regarding

matters that are not historical facts, are forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, and the Private Securities

Litigation Reform Act of 1995. These include statements regarding

management’s intentions, plans, beliefs, expectations, or forecasts

for the future, and, therefore, you are cautioned not to place

undue reliance on them. No forward-looking statement can be

guaranteed, and actual results may differ materially from those

projected. ZyVersa Therapeutics, Inc. (“ZyVersa”) uses words such

as “anticipates,” “believes,” “plans,” “expects,” “projects,”

“future,” “intends,” “may,” “will,” “should,” “could,” “estimates,”

“predicts,” “potential,” “continue,” “guidance,” and similar

expressions to identify these forward-looking statements that are

intended to be covered by the safe-harbor provisions. Such

forward-looking statements are based on ZyVersa’s expectations and

involve risks and uncertainties; consequently, actual results may

differ materially from those expressed or implied in the statements

due to a number of factors, including ZyVersa’s plans to develop

and commercialize its product candidates, the timing of initiation

of ZyVersa’s planned preclinical and clinical trials; the timing of

the availability of data from ZyVersa’s preclinical and clinical

trials; the timing of any planned investigational new drug

application or new drug application; ZyVersa’s plans to research,

develop, and commercialize its current and future product

candidates; the clinical utility, potential benefits and market

acceptance of ZyVersa’s product candidates; ZyVersa’s

commercialization, marketing and manufacturing capabilities and

strategy; ZyVersa’s ability to protect its intellectual property

position; and ZyVersa’s estimates regarding future revenue,

expenses, capital requirements and need for additional

financing.

New factors emerge from time-to-time, and it is not possible for

ZyVersa to predict all such factors, nor can ZyVersa assess the

impact of each such factor on the business or the extent to which

any factor, or combination of factors, may cause actual results to

differ materially from those contained in any forward-looking

statements. Forward-looking statements included in this press

release are based on information available to ZyVersa as of the

date of this press release. ZyVersa disclaims any obligation to

update such forward-looking statements to reflect events or

circumstances after the date of this press release, except as

required by applicable law.

This press release does not constitute an offer to sell, or the

solicitation of an offer to buy, any securities.

Corporate, Media, IR Contact

Karen CashmereChief Commercial

Officerkcashmere@zyversa.com786-251-9641

|

|

|

ZYVERSA THERAPEUTICS, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

|

| |

|

|

|

|

|

|

|

|

|

March 31, |

|

December 31, |

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

(Unaudited) |

|

|

|

Assets |

|

|

|

|

| |

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

| |

Cash |

$ |

2,033,576 |

|

|

$ |

3,137,674 |

|

| |

Prepaid expenses and other current assets |

|

866,476 |

|

|

|

215,459 |

|

| |

|

Total Current Assets |

|

2,900,052 |

|

|

|

3,353,133 |

|

|

Equipment, net |

|

|

4,333 |

|

|

|

6,933 |

|

|

In-process research and development |

|

18,647,903 |

|

|

|

18,647,903 |

|

|

Vendor deposit |

|

|

98,476 |

|

|

|

98,476 |

|

|

Operating lease right-of-use asset |

|

- |

|

|

|

7,839 |

|

| |

|

|

|

|

|

|

| |

|

Total Assets |

$ |

21,650,764 |

|

|

$ |

22,114,284 |

|

| |

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

| |

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

| |

Accounts payable |

|

$ |

8,127,746 |

|

|

$ |

8,431,583 |

|

| |

Accrued expenses and other current liabilities |

|

1,454,970 |

|

|

|

1,754,533 |

|

| |

Operating lease liability |

|

- |

|

|

|

8,656 |

|

|

|

|

Total Current Liabilities |

|

9,582,716 |

|

|

|

10,194,772 |

|

|

Deferred tax liability |

|

|

844,914 |

|

|

|

844,914 |

|

| |

|

Total Liabilities |

|

10,427,630 |

|

|

|

11,039,686 |

|

| |

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

| |

|

|

|

|

|

|

|

Stockholders' Equity: |

|

|

|

|

| |

Preferred stock, $0.0001 par value, 1,000,000 shares

authorized: |

|

|

|

| |

Series A preferred stock, 8,635 shares designated, 50 shares

issued |

|

|

|

| |

and outstanding as of March 31, 2024 and December 31, 2023 |

|

- |

|

|

|

- |

|

| |

Series B preferred stock, 5,062 shares designated, 5,062 shares

issued |

|

|

|

| |

and outstanding as of March 31, 2024 and December 31, 2023 |

|

1 |

|

|

|

1 |

|

| |

Common stock,

$0.0001 par value, 250,000,000 shares authorized; |

|

|

|

| |

834,903 and 405,212 shares issued as of March 31, 2024 and |

|

|

|

| |

December 31, 2023, respectively, and 834,896 and 405,205 shares

outstanding |

|

|

|

| |

as of March 31, 2024 and December 31, 2023, respectively |

|

83 |

|

|

|

40 |

|

|

|

Additional paid-in-capital |

|

117,276,079 |

|

|

|

114,300,849 |

|

|

|

Accumulated deficit |

|

(106,045,861 |

) |

|

|

(103,219,124 |

) |

| |

Treasury stock, at cost, 7 shares at March 31, 2024 and December

31, 2023, |

|

|

|

| |

respectively |

|

|

(7,168 |

) |

|

|

(7,168 |

) |

| |

|

Total Stockholders' Equity |

|

11,223,134 |

|

|

|

11,074,598 |

|

| |

|

|

|

|

|

|

| |

|

Total Liabilities and Stockholders' Equity |

$ |

21,650,764 |

|

|

$ |

22,114,284 |

|

| |

|

|

|

|

|

|

|

ZYVERSA THERAPEUTICS, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

For the Three Months EndedMarch 31, |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

Operating Expenses: |

|

|

|

| |

Research and development |

$ |

512,937 |

|

|

$ |

1,055,943 |

|

| |

General and administrative |

|

2,313,699 |

|

|

|

3,536,136 |

|

| |

|

Total Operating Expenses |

|

2,826,636 |

|

|

|

4,592,079 |

|

|

|

|

|

|

|

|

| |

|

Loss From Operations |

|

(2,826,636 |

) |

|

|

(4,592,079 |

) |

|

|

|

|

|

|

|

|

Other (Income) Expense: |

|

|

|

| |

Interest (income) expense |

|

101 |

|

|

|

(1,078 |

) |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Pre-Tax Net Loss |

|

(2,826,737 |

) |

|

|

(4,591,001 |

) |

|

|

|

Income tax benefit |

|

- |

|

|

|

1,047,051 |

|

|

|

|

Net Loss |

|

(2,826,737 |

) |

|

|

(3,543,950 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Net Loss Per Share |

|

|

|

| |

|

- Basic and Diluted |

$ |

(4.53 |

) |

|

$ |

(135.88 |

) |

|

|

|

|

|

|

|

| |

|

Weighted Average Number of |

|

|

|

| |

|

Common Shares Outstanding |

|

|

|

| |

|

- Basic and Diluted |

|

623,600 |

|

|

|

26,081 |

|

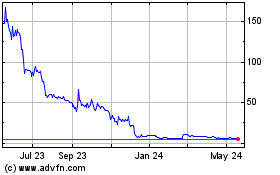

ZyVersa Therapeutics (NASDAQ:ZVSA)

Historical Stock Chart

From Dec 2024 to Jan 2025

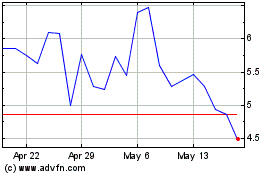

ZyVersa Therapeutics (NASDAQ:ZVSA)

Historical Stock Chart

From Jan 2024 to Jan 2025