true

0001898604

0001898604

2024-07-05

2024-07-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

(Amendment

No. 2)

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July

5, 2024

Yoshiharu

Global Co.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41494 |

|

87-3941448 |

(State

or other Jurisdiction

of

Incorporation) |

|

(Commission

File

No.) |

|

(IRS

Employer

Identification

No.) |

6940

Beach Blvd., Suite D-705

Buena

Park, CA 90621

(Address

of principal executive offices and zip code)

(714)

694-2403

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

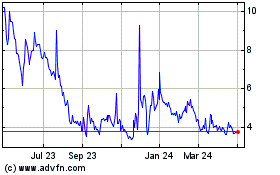

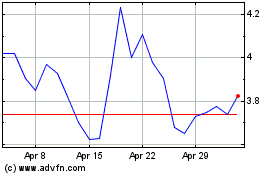

| Class

A Common Stock, $0.0001 par value |

|

YOSH |

|

The

Nasdaq Stock Market LLC

(Nasdaq

Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Explanatory

Note

This

report hereby amends and restates Item 1.01 of the Current Report on Form 8-K filed on July 5, 2024 to provide the pro forma financial

statements associated with Yoshiharu Global Co.’s acquisition of the three Las Vegas restaurant entities (Jjanga LLC, Ramen Aku

LLC and HJH LLC) owned by Mr. Jiyuck Hwang, a restaurant operator. This report also includes a revised version of the Seller Carry

Loan Note filed as Exhibit 10.2. This revised Seller Carry Loan Note corrects the two repayment dates from November 30, 2024 to April

12, 2025 and from November 30, 2025 to April 12, 2026.

Item 1.01 Entry into a Material Definitive Agreement

On June 12, 2024, Yoshiharu

Global Co. (the “Company”) executed an amended and restated asset purchase agreement (the “A&R Asset Purchase Agreement”),

dated June 12, 2024, by and between the Company and Mr. Jiyuck Hwang, a restaurant operator (“Seller”) which amended and

restated that certain Asset Purchase Agreement originally dated as of November 21, 2023 as described in the Company’s Form 8-K

filed with the SEC on November 27, 2023. The parties executed the A&R Asset Purchase Agreement to allow for separate closings of

the restaurants at the request of a lender, and for each closing to become effective as of April 20, 2024.

Pursuant to the A&R Asset

Purchase Agreement, the Company will purchase all or substantially all of the assets of the following three restaurant entities owned

by the Seller: Jjanga, HJH and Aku (the “Acquisition”). The Company agreed to pay the Seller $1,800,000 in cash, a promissory

note in the principal amount of $600,000 (the “Promissory Note”) and a convertible note having a principal amount of $1,200,000

which shall be convertible into the Company’s Class A common stock in accordance with the terms therein (the “Convertible

Note”). Additionally, the Company has entered into an employment agreement with the Seller whereby the Seller will serve as the

Managing Director of each restaurant upon consummation of the Agreement (the “Employment Agreement”). The A&R Asset Purchase

Agreement also contains customary representations, warranties, indemnification provisions and closing conditions including the required

audit of target assets in accordance with applicable SEC regulations.

The principal sum of the Promissory

Note shall be repaid by the Company to the Seller in two equal installments due November 30, 2024 and November 30, 2025. Each annual

installment shall be in the amount of $300,000. The Promissory Note specifies that payments shall be made without the addition of interest.

If the Company fails to make any payments as required, the Promissory Note states that the entire balance shall become immediately due

and payable.

The Convertible Note states

that the principal sum shall accrue interest at a rate of 0.5% per annum and specifies that the maturity date is one year from the closing

date. The terms of the Convertible Note provide that upon the maturity date, the Seller has the right to convert any outstanding and

unpaid portion of the Convertible Note into the Class A Common stock of the Company. If the Seller chooses to exercise this right, the

conversion price will be 150% of the average of the highest and lowest prices of the Company’s stock during the five business days

immediately after the closing date of the Amended Asset Agreement (the “Conversion Price Formula”). If the closing stock

price on the conversion date is lower than the price produced via the Conversion Price Formula, the Seller shall have the option to choose

the cash receipt of any outstanding and unpaid portion of the Convertible Note or convert any outstanding and unpaid portion of the Convertible

Note into the Company’s stock using the same Conversion Price Formula. If the stock price on the conversion date is higher than

the price produced by the Conversion Price Formula, the Seller shall convert any outstanding and unpaid portion of the Convertible Note

into the Company’s stock. Upon choosing to convert, the Seller must provide written notice to the Company indicating the portion

of the Convertible Note to be converted.

The Employment Agreement sets

out Mr. Hwang’s position, duties, compensation, employment term and termination rights. Mr. Hwang will serve as Managing Director

of Yoshiharu LV which will manage the new Las Vegas restaurants. He will be paid an annual base salary of $180,000 with a performance

bonus schedule based on how much money in excess of the target EBITDA Yoshiharu LV achieves. Under this performance incentive program,

Mr. Hwang is eligible for Restricted Stock Units worth up to $100,0000. The Employment Agreement specifies that he will be employed for

an initial term of 3 years, beginning immediately after the closing date of the Amended Asset Agreement, subject to extension or early

termination. The termination clause of the Employment Agreement provides that either party may terminate employment with or without cause

upon 60 days written notice to the other party. If Mr. Hwang’s employment is terminated with or without cause, he is not entitled

to receive a severance package.

Item 2.01 Completion of Acquisition or Disposition of Assets

On June 12, 2024, the Company

closed the Acquisition described in Item 1.01 above for an aggregate $3.6 million. The Company intends on filing the requisite financial

statements required by the SEC by amendment.

The summary provided herein

of the A&R Asset Purchase Agreement is qualified in its entirety by reference to the whole of such agreement, which is included as

Exhibit 10.1 attached hereto and the summarizes of the Promissory Note, Convertible Note and the Employment Agreement are qualified in

their entirety by reference to the whole of each instrument, which were each included as Exhibits to the Company’s Current Report

on Form 8-K filed with the SEC on November 27, 2023 (and also referenced herein).

Item

9.01 Financial Statements and Exhibits

The

Promissory Note, Convertible Note and Employment Agreement were previously filed with the SEC on the Company’s Current Report on

Form 8-K on November 27, 2023. There were no changes to any of these agreements in the A&R Asset Purchase Agreement, except for

the Seller Carry Loan Note which has been revised to correct the two repayment dates from November 30, 2024 to April 12, 2025 and from

November 30, 2025 to April 12, 2026. The financial statements required by this Item 9.01(a) is included by Exhibit to this Current

Report on Form 8-K. The financial statements include: (i) the combined financial statements as of and for the years ended December 31,

2023 and 2022, (ii) the unaudited combined financial statements as of and for the three months ended March 31, 2024 and 2023 and (iii)

the combined pro forma financial statements as of and for the year ended December 31, 2023.

(d)

Exhibits.

| Exhibit

No. |

|

Description |

| |

|

|

| 10.1 |

|

Amended and Restated Asset Purchase Agreement by and between the Company and the Seller dated June 12, 2024 |

| |

|

|

| 10.2 |

|

Seller Carry Loan Note. |

| |

|

|

| 10.3 |

|

Convertible Note Agreement (incorporated by reference to Exhibit 99.3 to our Current Report on Form 8-K filed on November 27, 2023) |

| |

|

|

| 10.4 |

|

Employment Offer Letter of Jiyuck Hwang (incorporated by reference to Exhibit 99.4 to our Current Report on Form 8-K filed on November 27, 2023) |

| |

|

|

| 99.1 |

|

Press Release |

| |

|

|

| 99.2

|

|

Combined

Audited Financial Statements of Jjanga LLC, HJH LLC and Ramen Aku LLC for the years ended December 31, 2023 and

2022. |

| |

|

|

| 99.3 |

|

Unaudited

Combined Financial Statements of Jjanga LLC, HJH LLC and Ramen Aku LLC for the three months ended March

31, 2024 and 2023. |

| |

|

|

| 99.4 |

|

Combined Pro Forma Financial Statements of Yoshiharu Global Co., Jjanga LLC, HJH LLC and Ramen Aku LLC at March 31, 2024. |

| |

|

|

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

August 26, 2024

| YOSHIHARU

GLOBAL CO. |

|

| |

|

|

| By: |

/s/

James Chae |

|

| Name:

|

James

Chae |

|

| Title:

|

Chief

Executive Officer |

|

Exhibit

10.1

AMENDED

AND RESTATED ASSET Purchase agreement

THIS

AMENDED AND RESTATED ASSET PURCHASE AGREEMENT, dated as of June 12, 2024, is being executed in connection with that certain Asset Purchase

Agreement dated as of November 21, 2023 (the “Agreement”), by and among JJANGA LLC “Jjanga Entity”,

HJH LLC (“HJH Entity”), and RAMEN AKU LLC (“AKU Entity”, and together with Jjanga Entity and HJH

Entity, the “Restaurant Entities”), Jihyuck Hwang, a natural person (together with the Restaurant Entities, collectively,

the “Sellers”), Yoshiharu Global Co., a Delaware corporation (“YOSH”) and Yoshiharu LV, Inc., a

Nevada corporation and wholly owned subsidiary of YOSH (together with YOSH, the “Buyer”).

W I T N E S S E T H:

WHEREAS,

Jihyuck Hwang is the sole owner of Jjanga Entity, which is the sole owner of the restaurant called “Jjanga” (the “Jjanga”),

located at 6125 S. Fort Apache Road, Suite 200, Las Vegas, NV 89148 (the “Jjanga Location”), Jihyuck Hwang is the

sole owner of HJH Entity, which is the sole owner of the restaurant called “HJH” (“HJH”), located at 280

E Flamingo Road, Suite C, Las Vegas, NV 89169 (the “HJH Location”) and Jihyuck Hwang is the sole owner of Aku Entity,

which is the sole owner of the restaurant called “Aku” (“Aku”), located at 6572 N Decatur Blvd., Las Vegas,

NV 89131 (the “Aku Location (the assets relating to the operation of Jjanga and Aku are referred to as the “Financed

Business”, and together also with HJH, collectively the “Business”);

WHEREAS,

Buyer desires to purchase and acquire from Seller, and Seller desires to sell, transfer and assign to Buyer, all or substantially all

of the assets of the Restaurant Entities used or useful in the Business and to assume certain liabilities relating to the Business as

set forth herein below, for the Purchase Price (as defined herein) and upon and subject to terms and conditions hereinafter set forth;

WHEREAS,

simultaneous with and as a condition to the HJH Closing (as defined below) of this Agreement, Buyer shall pay to HJH Entity for a total

purchase price of $600,000 (the “HJH Purchase Price”), of which (a) $300,000 shall be paid in cash, (b) $100,000 shall

be paid in the form of a promissory note in the form of Exhibit A attached hereto (a “Carry Loan Note”) having

a principal amount of $100,000 and (b) $200,000 shall be paid in the form of a convertible note in the form of Exhibit B attached

hereto (a “Convertible Note”) having a principal amount of $200,000 which shall be convertible into Class A common

shares of the Company, par value $0.0001 per share (“YOSH Shares”) on the terms set forth therein, in the form of

the Convertible Note;

WHEREAS,

sim1ultaneously with and as a condition to the Financed Business Closing (as defined below) of this Agreement, Buyer shall pay to Jjanga

Entity and Aku Entity for the Financed Business a total purchase price of $3,000,000 (the “Financed Business Purchase Price”),

of which (a) $1,500,000 shall be paid in cash, (b) $500,000 shall be paid in the form of a Carry Loan Note having the principal amount

of $500,000, (c) $1,000,000 shall be paid in the form of a Convertible Note having the principal amount of $1,000,000; and

WHEREAS,

Mr. Hwang to enter into an employment agreement with Buyer in the form of Exhibit C attached hereto (the “Employment

Agreement” and together with this Agreement, the Carry Loan Note and the Convertible Note, the “Transaction Documents”)

pursuant to which Mr. Hwang shall serve as the Managing Director of each restaurant constituting the Business.

NOW

THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth, the parties hereby agree as follows:

1.

Purchase and Sale of Business and Acquired Assets.

1.1

Acquired Assets. Subject to and upon the terms and conditions set forth in this Agreement, Sellers will sell, transfer, convey,

assign and deliver to Buyer, and Buyer will purchase and acquire from Sellers at each respective Closing (as defined herein) using a

new company subsidiary, all right, title and interest of Sellers on April 20, 2024 (including, without limitation, all cash generated

on and after April 20, 2024, which shall be set aside to be delivered to Buyer at each Closing) in and to all or substantially all of

the assets of the Restaurant Entities being sold pursuant to each such Closing which are used or useful in the Business of Sellers listed

on Schedule 1.1 hereto (the “Acquired Assets”). The Acquired Assets shall also mean all right, title and interest

in and to all of the assets of the Restaurant Entities of every kind, character and description, other than the Excluded Assets, which

are related to or used in connection with the conduct and operation of the Business, whether personal or real, tangible or intangible

and wherever located, whether or not reflected on the Restaurant Entities’ financial statements, as such assets may exist on each

Closing Date, including, but not limited to, all of its: (a) inventory and all furniture, furnishings, signage, fixtures, machinery,

trade fixtures, inc1uding, but not limited to, leasehold improvements, security systems, kitchen and other equipment including, but not

limited to, pots, pans, glassware, dishes, silverware and small wares, computer equipment, alarm systems, cameras and recording devices,

protective cages, electrical installations, safes and all other tangible assets relating to the Business of the Restaurant Entities of

every kind and nature; (b) goodwill associated with the Business, all value of the Business as a going concern, and all records related

to the Business including, without limitation, customer records, customer information, customers cards, operations manuals, advertising

matter, correspondence, mailing lists, credit records, purchasing materials and records, personnel records, blueprints, data bases, distributors,

supplier information and records and all other data and know-how related to the Business, in any form or medium wherever located; (c)

proprietary items including, but not limited to, menus, promotional items and literature, the use of the Mr. Hwang’s name, face

and likeness as it relates to the Restaurant Entities, the history of the Restaurant Entities, memorabilia, photographs and decor; (d)

telephone and fax numbers, trade names, trademarks and trademark applications, service marks and service mark applications, patents and

patent applications, designs, inventions, copyrights, assumed names, fictitious names, slogans, domain names, web addresses, web sites,

all software and software licenses and all rights in all data processing systems and networks, and all operations manuals, computer hardware,

data bases, related documentation and proprietary rights, trade secrets, recipes and know-how of any kind (collectively, “Intellectual

Property”); (e) credits, prepaid expenses, advance payments, security deposits and prepaid items; (f) contracts, agreements,

commitments, and personal property leases of the Restaurant Entities relating to the Business that are described in detail on Schedule

1.1 which Buyer affirmatively elects in writing to assume (the “Purchased Commitments”); (g) to the extent assignable,

licenses and permits relating to the Business or the Acquired Assets; (h) privileges and advantages of every nature, kind and description,

being personal or real, tangible or intangible, located at the Restaurant Entities or in any way used in connection with the Restaurants

or possessed or owned by any Restaurant Entities or in which any Restaurant Entities has any interest whatsoever, including, without

limitation, all of the licenses, permits, easements, regulatory rights, access rights, air rights, roof rights, antenna rights, developer

and use rights, and wallscape and signage rights, leases, subleases and rights thereunder; and (j) contractors’ and manufacturers’

guarantees, warranties, indemnities or similar rights in favor of the Restaurant Entities with respect to any of Acquired Assets. All

of the Acquired Assets are being sold, assigned, transferred, conveyed and delivered to Buyer hereunder free and clear of any mortgage,

pledge, lien, claim, security interest, assessment, conditional sale agreement, burden, restriction, prior assignment, charge or encumbrance

of any kind or nature whatsoever, including, without limitation, any Uniform Commercial Code lien or tax lien (“Liens”).

The Acquired Assets shall be conveyed free and clear of all liabilities, obligations, liens and encumbrances excepting only those liabilities

and obligations which are expressly agreed to be assumed by Buyer hereunder.

1.2

Excluded Assets. The Acquired Assets shall not include the assets listed on Schedule 1.2 attached hereto, licenses that

are not assignable (which are set forth on Schedule 1.2), and all leases, contracts, agreements, commitments not relating to the Business,

and all of the Restaurant Entities’ rights under this Agreement (collectively, the “Excluded Assets”).

1.3

Liabilities Assumed. On and subject to the terms and conditions of this Agreement, at each Closing, defined below, Buyer will

only assume and agree to pay, perform and discharge only the obligations of the Restaurant Entities first arising from the operation

of the Business following April 20, 2024 under the Purchased Commitments listed on Schedule 1.3 (the “Assumed Liabilities”).

Notwithstanding any other provision of this Agreement, Buyer will not assume and shall not be responsible for the payment, performance

or discharge of any liabilities or obligations of the Restaurant Entities, whether now existing or hereafter arising, relating to the

Business unless specifically set forth on Schedule 1.3. Without limiting the foregoing, the Restaurant Entities, and not Buyer, shall

be responsible for any and all of its respective liabilities, responsibilities, expenses and obligations relating to: (a) the Business

(or any part thereto) incurred, accruing or arising before April 20, 2024, even if not asserted or discovered until on or after each

Closing Date, and (b) the Excluded Assets.

1.4

Excluded Liabilities. On each Closing Date, except for the Assumed Liabilities, Buyer shall not assume or become liable for any

obligations and liabilities of Sellers whatsoever.

2.

Closing; Purchase Price.

2.1

Time and Place of Closing. Each closing of the sale of the Acquired Assets and the assumption of the Liabilities with respect

to HJH, on the one hand (the “HJH Closing”), and the Financed Business, on the other hand (the “Financed

Business Closing”, and together with HJH Closing, each, a “Closing”) shall take place no later than thirty

(30) days after satisfaction or waiver of conditions precedent, at the offices of Pryor Cashman LLP, 7 Times Square, New York, New York,

or such other time and place as the parties may agree upon, including by electronic means. The parties hereby agree that, to the extent

allowable under law, the effective date of each such Closing shall be April 20, 2024. The HJH Closing and the Financed Business Closing

may occur simultaneously or separately from each other. The date when each Closing actually takes place is herein sometimes referred

to as a “Closing Date”.

2.2

Purchase Price. On the terms and subject to the conditions set forth in this Agreement, Buyer agrees to pay or cause to be paid

to Sellers an aggregate of $3,600,000 (the “Purchase Price”) for the Business, which consists of the HJH Purchase

Price of $600,000 and the Financed Business Purchase Price of $3,000,000, of which (a) $10,000 shall be paid in cash to the escrow accounts

of the Sellers as honest money set forth on Exhibit D (the “Escrowed Payment”), (b) a balance of $1,790,000

shall be paid in cash, by wire transfer of immediately available funds to the bank account of the Sellers set forth on Exhibit E

(which consists of $295,000 in cash payable for HJH and $1,495,000 in cash payable for the Financed Business), (c) $600,000 shall be

paid with the issuance and delivery by the Buyer to the Sellers of Carry Loan Notes (a Carry Loan Note having the principal amount of

$100,000 for the purchase of HJH and a Carry Loan Note having a principal amount of $500,000 for the purchase of the Financed Business)

and (d) $1,200,000 shall be paid with the issuance of Convertible Notes (a Convertible Note having a principal amount of $200,000 for

the purchase of HJH and a Convertible Note of $1,000,000 for the purchase of the Financed Business). The Parties also hereto agree that

(i) $2,600,000 of the Purchase Price shall be allocated towards the purchase of Jjanga, (ii) $600,000 of the Purchase Price shall be

allocated towards the purchase of HJH and (iii) $400,000 of the Purchase Price shall be allocated towards the purchase of Aku. In the

event and to the extent the Purchase Price is mutually adjusted after the date hereof by the parties hereto as a result of an event or

condition which has resulted in or that is reasonably likely to result in a Material Adverse Effect on the Business or the Acquired Assets,

the parties hereto agree that such adjustment shall be made to the principal amount of the Carry Loan Note, the Convertible Note, or

both, and shall not be an adjustment to the cash amount payable by the Buyer to the Sellers pursuant to Section 2.2(b) herein.

3.

Representation and Warranties of Sellers. To induce Buyer to execute this Agreement and consummate the Transaction Documents contemplated

hereunder, Sellers represent and warrant to Buyer as follows:

3.1

Power and Authority. Mr. Hwang is a natural person and the Restaurant Entities are corporations or limited liability companies

that are duly incorporated or organized and validly existing under the laws of the State of Nevada and each other applicable jurisdiction.

Each of Mr. Hwang and the Restaurant Entities all have the requisite power and authority to own, dispose of, operate and lease the Acquired

Assets and the Business and to operate the Acquired Assets and the Business as such Acquired Assets and the Business are now owned, leased

or operated by Sellers. Sellers have the full power and authority to enter into this Agreement required hereunder and to carry out the

transactions contemplated herein.

3.2

Ownership of the Acquired Assets; Title; Sufficiency of Acquired Assets. Sellers own 100% of the Acquired Assets, and own the

Acquired Assets directly and not through any other divisions or any affiliates of Sellers or through its stockholders. Sellers have,

and upon payment therefor Buyer will have, good, valid and marketable title to all of the Acquired Assets and the Acquired Assets shall

be free and clear of any liens, charges, options, security interests and any other interests or encumbrances. All of the Acquired Assets

are, and will be at each Closing in good operating condition and repair, and no maintenance, repairs, or replacement thereof has been

deferred. The Acquired Assets include, and upon the purchase of the Acquired Assets Buyer will own or have the uncontested right to use,

all rights, properties (including Sellers’s Intellectual Property), interests in properties, and assets necessary to permit Buyer

to carry on the Business as presently conducted by Sellers. The Acquired Assets constitute all of the assets, tangible and intangible,

of any nature whatsoever, necessary to operate the Business in the manner presently operated by Sellers.

3.3

Compliance with Laws. In operating the Business, the Sellers have complied in all material respects with all regulations, rules,

ordinances, laws, statutes, orders and decrees of any governmental authority applicable to it (collectively, the “Applicable

Laws”). Sellers have not received any written notice asserting any violation thereof or non-compliance therewith and there

is no pending or, threatened investigation, inquiry or audit by any federal, state, or local governmental authority relating to the Business

or the Acquired Assets.

3.4

Permits and Licenses. The Sellers and the Business have provided Buyer with true and complete copies of all existing licenses

and permits, and (i) such licenses and permits constitute all of the licenses and permits currently necessary for the ownership and operation

of the Business; (iii) no default has occurred in the due observance or condition of any license or permit which has not been heretofore

corrected; (iv) the Sellers and the Business have not received any written notice from any source to the effect that there is lacking

any license or permit needed in connection with the operation of the Business and its Acquired Assets; and (v) all licenses and permits

are assignable to Buyer. Each permit and license held by the Sellers is valid and in full force and effect. There is not pending nor

threatened, any investigation or proceeding which would reasonably be expected to result in the termination, revocation, limitation,

suspension, restriction or impairment of any such license or permit or the imposition of any fine, penalty or other sanctions for violation

of any such license or permit requirements. The Sellers now have, and have had at all relevant times, all licenses and permits required

to legally own and use the Acquired Assets.

3.5

No Brokers or Advisors. The Sellers have not employed, either directly or indirectly, or incurred any liability to, any broker,

advisor, finder or other agent in connection with the transactions contemplated by this Agreement.

3.6 Commitments.

The Restaurant Entities have delivered or made available to Buyer true and correct copies of all written contracts, agreements,

commitments, arrangements and personal property leases which relate to the Business and/or the Acquired Assets, including without

limitation, all amendments thereto (“Commitments”). The Sellers and the Business have provided Buyer with a true,

correct and complete list and summary description of all such written documents and any and all oral contracts, agreements,

commitments, arrangements and personal property leases which relate to the Business and/or the Acquired Assets. The Sellers and the

Business have provided Buyer with true and complete copies of the Commitments to be assumed by Buyer (“Purchased

Commitments”). All Purchased Commitments are in full force and effect (and are expected to be in full force and effect

immediately following each Closing) and represent the valid and binding obligations of the Restaurant Entities and the other parties

thereto. The Restaurant Entities and all other parties thereto have performed in all material respects all obligations required to

be performed by it or them thereunder, respectively. Neither the Restaurant Entities nor any other party is (with or without the

lapse of time or the giving of notice, or both) in default under any such Purchased Commitment and the Restaurant Entities have not

received any notice of any default or termination of any such Purchased Commitment from any other party thereto and the Restaurant

Entities are not aware of any facts or circumstances (with or without the lapses of time or the giving of notice or both) under

which it would be reasonably likely that there would be a default or termination of any such Purchased Commitment. The Restaurant

Entities have no outstanding powers of attorney relating to the Business or the Acquired Assets.

3.7 No

Change. Since July 31, 2023, there has not been: (a) any material change in the condition of the Acquired Assets; (b) any

contract, agreement, lease or other commitment or arrangement (written or oral) entered into or amended relating to the Business;

(c) any indebtedness, liability or obligation created, incurred or assumed by the Restaurant Entities; (d) any acquisition by the

Restaurant Entities of any Acquired Assets in any transactions with any of the Restaurant Entities’ officers, directors or

Shareholders, or any relative by blood or marriage or, any party which is directly or indirectly controlling, controlled by or under

common control with another person or entity (the “Affiliate”) thereof or of the Restaurant Entities, or any

acquisition of any Acquired Assets of material value in any transaction with any other person or entity; or any relative by blood or

marriage or Affiliate (as hereinafter defined) thereof or of the Restaurant Entities, or any acquisition of any Acquired Assets of

material value in any transaction with any other person or entity; (e) any material change in the Restaurant Entities’

maintenance of its books of account; (f) any sale, lease or other disposition of or agreement to sell, lease or otherwise dispose of

any of the Acquired Assets, except in the ordinary course of business and consistent with past practice; or (g) any other event,

condition, change or circumstance which has had, or is reasonably expected to have, a Material Adverse Effect, on the Business or

the Acquired Assets.

3.8

No Conflict; Consents and Approval. The Sellers and the Business have provided Buyer with true and complete copies of all third

party (including landlords under the leases) and government consents. The execution, delivery and performance of this Agreement by Sellers

will not, with or without the giving of notice or the passage of time, or both, conflict with, result in a default, right to accelerate

or loss of rights under, or result in the creation of any lien, charge or encumbrance pursuant to, any provision of Sellers’ certificate

of incorporation or operating agreement (if applicable) or any franchise agreement, mortgage, deed of trust, lease, license, agreement,

understanding, law, rule or regulation or any order, judgment or decree to which Sellers are a party or by which Sellers may be bound

or affected. No consent, approval, order or authorization of, notice to, or registration, declaration or filing with, any federal, state,

administrative agency or other governmental authority or entity, domestic or foreign, is required on the part of Sellers in connection

with the execution and delivery of this Agreement or the consummation of the transactions contemplated hereby.

3.9

Authorization and Approval of Agreement; Binding Obligations. All proceedings and corporate or other action required to be taken

by Sellers relating to the execution and delivery of this Agreement and the consummation of the transactions contemplated hereby have

been taken. This Agreement has been duly executed and delivered by Sellers and constitutes the legal, valid and binding obligation of

Sellers enforceable against Sellers in accordance with its terms.

3.10

Legal Proceedings. There are no actions, suits, litigation, proceedings or investigations pending or, threatened, by or against

the Business or Sellers, and the Sellers have not received any written claim, complaint or notice of any such proceeding or claim.

3.11

Taxes. The Sellers (with respect to the Business) are not delinquent with respect to money due to any federal, state, or local

taxing authority or any other governmental entity for income tax or any other tax, or interest, penalties, assessments or deficiencies

relating thereto (collectively, “Taxes”). The Sellers (with respect to the Business) have each filed all federal,

state and local and all other tax returns which they are required to have filed. The Sellers have paid or made adequate reserves for

the payment of all Taxes which have or may become due pursuant to said returns or pursuant to any assessment received with respect thereto,

or which is otherwise due and payable by the Business. As of each Closing Date, the Sellers shall have paid all accrued sales taxes owed

by the Business in the State of Nevada and each other applicable jurisdiction. No adjustment of or deficiency of any Taxes or claim for

additional Taxes has been proposed, or threatened, asserted or assessed against the Business. There are no audits or other examinations

being conducted or, threatened, by any taxing authority, and there is no deficiency or refund litigation or controversy in progress or,

threatened, with respect to any Taxes previously paid by the Sellers or with respect to any returns previously filed by the Sellers or

on behalf of the Sellers. The Sellers have not made any express waiver of any statute of limitations relating to the assessment or collection

of Taxes.

3.12

Ownership. Jihyuck Hwang directly controls and owns 100% of the equity interests in each Restaurant Entity. The Restaurant Entities

own 100% of the Acquired Assets and the Business. The Sellers (and no other person or entity) own all right, title or interest in personal

property of any kind that was actually used or was necessary to the disposition of the Acquired Assets whether tangible or intangible,

wherever located.

3.13

Employee Matters. No employee of the Business has a written employment agreement or is other than an “at will” employee.

The Sellers do not have nor maintain any pension, profit sharing, thrift or other retirement plan, employee benefit plan, employee stock

ownership plan, deferred compensation, stock option, stock purchase, performance share, bonus or other incentive plan, severance plan,

health, group insurance or other welfare plan, or other similar plan, agreement, policy or understanding. The Sellers are not a party

to, and the Acquired Assets are not subject to, any collective bargaining or other agreement or understanding with any labor union, and

no approval by any labor union is required to complete this transaction. The Sellers are not privy to or involved in any labor or union

controversy or other interaction of any kind. There are no grievances, disputes or controversies with any individual or group of employees

which could reasonably be expected to have a material and adverse effect on the Business or Acquired Assets. Sellers have not received

written notice of any labor action for failure to pay the Sellers’ employees appropriately and there are no potential wage disputes

or claims for unpaid minimum wages and they are in compliance with the Fair Standard Labor Act. There is no unfair labor practice charge

or other employee-related or employment-related complaint against Sellers or Business pending or, threatened, before any governmental

authority. The Sellers have complied with, and are currently in substantial compliance with, all Applicable Laws and governmental requirements

relating to any of its employees or consultants (including, without limitation, any governmental requirement of the Occupational Safety

and Health Administration or the Affordable Care Act), and the Sellers have not received from any governmental authority any written

notice of the Business’s failure to comply with any such governmental requirement. All employees of the Business will be provided

with the appropriate WARN Act notices and then terminated by the Restaurant Entities as of each Closing Date, and Buyer may hire any

or all of said employees effective from each Closing Date, as determined in Buyer’s sole and absolute discretion.

3.14

Books and Records. The books of account and other financial records of Sellers which have been made available to Buyer, are complete

and correct and represent actual, bona fide transactions and have been maintained in accordance with sound business practices.

3.15

Absence of Default; No Liens.

(a)

Sellers (i) are not in default under or in violation of any agreement relating to or included in the Acquired Assets or the Business,

and (ii) has not received any notice that it is in violation of any law, ordinance, rule, regulation or directive pertaining or relating

to the Acquired Assets or the Business or the operation thereof, and is not in violation of any such law, ordinance, rule, regulation,

or directive the violation of which would have a material adverse effect on the Acquired Assets or the operations, financial condition

or prospects of the Business (a “Material Adverse Effect”).

(b)

The Sellers and the Business have provided Buyer with true and complete copies of all leases to which the Business relates (each, a “Lease”).

Each Lease is in full force and effect and is enforceable by Sellers in accordance with its terms. Sellers have not received any written

notice regarding any actual or possible violation or breach of, or default under, any Lease.

3.16

Undisclosed Liabilities. The Business does not have any indebtedness, obligations, or other liabilities, whether accrued, absolute,

or contingent, of any nature, except those that (i) are accrued or reserved against in the Financial Statements or reflected in the notes

thereto, (ii) were incurred in the ordinary course of business since the respective dates of the Financial Statements, (iii) have been

or shall be discharged or paid in full prior to each Closing Date, or (iv) would not individually or in the aggregate, have a Material

Adverse Effect.

3.17

Bank Accounts. The Sellers and the Business have provided Buyer with true and complete copies of all bank accounts, safety deposit

boxes, and lockboxes (designating each signatory with respect thereto) of the Business.

3.18

Financial Statements.

| (a) | Sellers

have previously delivered to Buyer true and complete copies of: (i) the audited balance sheets

and statements of income, retained earnings and cash flows as of and for its fiscal years

ended December 31, 2022, and December 31, 2021, including all applicable footnotes with respect

to the Business; and (ii) unaudited interim balance sheets and statements of income, retained

earnings and cash flows as of and for the nine-month period ended September 30, 2023 (the

“Current Financial Statements” and, together with the items described

in clause (i) above, the “Financial Statements”) of the Business. |

| (b) | The

Financial Statements present fairly in all material respects the financial condition of Sellers

as at the end of the covered periods and the results of its operations and its cash flows

for the periods covered thereby. The Financial Statements were prepared in accordance with

GAAP, applied on a consistent basis throughout the covered periods, subject, in the case

of the Current Financial Statements, to year-end audit adjustments (which will not, in the

aggregate, be material) and the lack of footnotes. |

| (c) | Except

as and to the extent disclosed in the Current Financial Statements, Sellers have no liabilities

of any kind other than (x) executory obligations under Sellers agreements that are not required

to be set forth in the Current Financial Statements in accordance with GAAP, (y) liabilities

incurred in connection with the transactions contemplated by this Agreement and the other

Transaction Documents, and (z) liabilities incurred in the ordinary course of business since

July 31, 2023 (the “Financial Statement Date”). |

| (d) | The

books of account and other financial records of Sellers with respect to the Business, all

of which have been made available to Buyer are materially complete and correct and represent

actual, bona fide transactions and have been maintained materially in accordance with sound

business practices and the requirements of Section 13(b)(2) of the Exchange Act (regardless

of whether Sellers are subject to that Section or not), including the maintenance of a materially

adequate system of internal controls. |

| (e) | the

Business maintains a system of internal accounting controls sufficient, in all material respects,

to provide reasonable assurances (i) that transactions are recorded as necessary to permit

preparation of financial statements in accordance with GAAP, (ii) that receipts and expenditures

are being made in accordance with appropriate authorizations of management and (iii) regarding

prevention or timely detection of unauthorized acquisition, use or disposition of assets

of Sellers or its affiliates. |

3.19

Investment Intent. Sellers are acquiring the Convertible Note, including any YOSH Shares issuable upon conversion thereunder,

for its own account, for investment, and not with the intent to make or to offer or resell in connection with a distribution in violation

of the Securities Act of 1933 (and the rules and regulations promulgated thereunder) or a distribution in violation of any other applicable

securities laws.

3.20

Inventories. All items included in the inventories consist of a quality and quantity usable and, with respect to finished goods,

saleable, in the ordinary course of business of Sellers except for obsolete items and items of below-standard quality, all of which have

been written off or written down to net realizable value in the balance sheets contained in the Financial Statements. Sellers are not

in possession of any inventory not owned by Sellers, including goods already sold. All of the Inventories have been valued at the lower

of cost or net realizable value on a first in, first out basis. Inventories now on hand that were purchased after the date of the balance

sheet contained in the Current Financial Statements were purchased in the ordinary course of business of Sellers at a cost not exceeding

market prices prevailing at the time of purchase. The quantities of each item of inventories (whether raw materials, work-in-process

or finished goods) are not excessive but are reasonable in the present circumstances of Sellers. Work-in-process inventories are now

valued, and will be valued on each Closing Date, according to GAAP.

3.21.

Full Disclosure. No representation or warranty of Sellers in this Agreement or in any exhibit, certificate, or schedule attached

or furnished, contains, or on the Closing Date will contain, any untrue statement of material fact or omits, or on each Closing Date

will omit, to state any fact necessary in order to make the statements contained therein, in light of the circumstances in which they

are made, not misleading. All such statements, representations, warranties, exhibits, certificates, and schedules shall be true and complete

in all material respects on and as of each Closing Date as though made on that date. Sellers does not have knowledge of any fact that

has specific application to Sellers (other than general economic or industry conditions) and that may materially adversely affect the

assets, business, prospects, financial condition or results of operations of Sellers that has not been set forth in this Agreement.

3.22.

Environmental Matters. Sellers are and have been in compliance with all applicable laws, including federal, state, local, foreign,

and international laws, relating in any way to pollution, the environment (including ambient air, surface water, groundwater, land surface

or subsurface strata), preservation or reclamation of natural resources, the climate, the presence, management or release of or exposure

to hazardous materials, or to human health and safety in respect of the foregoing, or the protection of endangered or threatened species

(“Environmental Laws”). There is no judicial, administrative, or other actions, suits, or proceedings relating to

or arising under Environmental Laws that is pending or threatened against or affecting Sellers. Sellers and the Business has not received

any written notice of violation, demand, request for information, citation, summons, or order or entered into or assumed, by contract

or operation of law or otherwise, any obligation, liability, or settlement relating to or arising under any Environmental Laws. No facts,

circumstances or conditions exist that would reasonably be expected to result in Sellers incurring any liability pertaining to the environment.

There have been no releases of hazardous materials on properties since they were owned, operated or leased by Sellers or previously.

Sellers

have obtained and currently maintains all permits necessary under Environmental Laws for the operation of the Business (“Environmental

Permits”). There is no investigation, nor any action pending or threatened against or affecting Sellers and the Business or

any real property owned, operated or leased by Sellers and the Business to revoke such Environmental Permits. Sellers and the Business

has not received any written notice from any person to the effect that there is lacking any Environmental Permit required under Environmental

Law for the current use or operation of any property owned, operated or leased by Sellers and the Business. Neither the execution and

delivery of this Agreement by Sellers and the Business, nor the consummation by Sellers and the Business of the transactions contemplated

hereby, nor compliance by Sellers and the Business with any of the provisions hereof, will result in the termination or revocation of,

or a right of termination or cancellation under, any Environmental Permit.

None

of the properties or products of Sellers and the Business or any of its predecessors have contained or currently contain any asbestos

or asbestos-containing materials, polychlorinated biphenyls, silica or any other substance listed in the Stockholm Convention on Persistent

Organic Pollutants.

3.23

Intellectual Property. The Sellers and the Business have provided Buyer with true and complete copies of all Intellectual Property

that is either (i) subject to any issuance, registration, application or other filing by, to or with any governmental authority or authorized

private registrar in any jurisdiction (collectively, “Intellectual Property Registrations”), including registered

trademarks, domain names and copyrights, issued and reissued patents and pending applications for any of the foregoing; or (ii) used

in or necessary for the Business’s current or planned business or operations, and in each case, the owner or licensor thereof.

All required filings and fees related to the Intellectual Property Registrations have been timely filed with and paid to the relevant

governmental authorities and authorized registrars, and all Intellectual Property Registrations are otherwise in good standing. The Sellers

have provided or made available to the Buyer true and complete copies of material file histories, documents, certificates, office actions,

correspondence and other materials related to all Intellectual Property Registrations.

The

Sellers and the Business own or have a valid license, sublicense, agreement or other permission with respect to all Intellectual Property

used in, or necessary to, the operation of the Business in the manner in which the Business is currently being conducted or currently

proposed to be conducted. After giving effect to the transactions contemplated hereby, Buyer will own or have a valid license, sublicense,

agreement or other permission with respect to all Intellectual Property used in, or necessary to, the operation of the Business in the

manner in which the Business is currently being conducted or currently proposed to be conducted. Without limiting the generality of the

foregoing, the Sellers and the Business have entered into binding, written agreements (including the execution of the applicable employee

handbook) with certain current and former employees of the Business, and with certain current and former independent contractors, whereby

such employees and independent contractors (assigned to the Sellers or the Business any ownership interest and right they may have in

the Intellectual Property. The Sellers and Business have provided, or made available to, Buyer true and complete copies of all such agreements.

The Business is in material compliance with all legal requirements applicable to the Intellectual Property and the ownership and use

thereof.

The

Sellers and the Business have provided Buyer with true and complete copies of all licenses, sublicenses and other agreements whereby

Sellers or the Business is granted rights, interests and authority, whether on an exclusive or non-exclusive basis, with respect to any

licensed Intellectual Property that is material or necessary for the Business. All such agreements are valid, binding and enforceable

and Sellers and the Business and such the other parties thereto are in compliance with the terms and conditions of such agreements in

all material respects.

The

Intellectual Property and licensed Intellectual Property as currently owned, licensed or used or proposed to be used in the conduct of

its Business as currently and formerly conducted and proposed to be conducted have not, do not and will not infringe, violate or misappropriate

the Intellectual Property of any person. None of Sellers or the Business have received any communication, and no claim or action has

been instituted, settled or threatened, that alleges any such infringement, violation or misappropriation, and none of the Intellectual

Property is subject to any outstanding governmental order. In addition, no person has infringed, violated or misappropriated, or is infringing,

violating or misappropriating, any Intellectual Property.

The

Sellers and the Business have provided Buyer with true and complete copies of all licenses, sublicenses and other agreements pursuant

to which Sellers or the Business grants rights or authority to any person with respect to any Intellectual Property or licensed Intellectual

Property. All such agreements are valid, binding and enforceable and such other parties are in full compliance with the terms and conditions

of such agreements.

4.

Representations and Warranties of Buyer. Each Buyer represents and warrants to Sellers as follows:

4.1

Organization, Standing and Qualification. Buyer is a company duly organized or incorporated, validly existing under the laws of

Delaware, has all requisite corporate power and authority to enter into this Agreement and to carry out the transactions contemplated

by this Agreement and the other Transaction Documents to which it is a party, to carry on its business as now being conducted and to

own, lease or operate its properties.

4.2

Authorization and Approval of Agreement; Binding Obligations. All proceedings or corporate action required to be taken by Buyer

relating to the execution and delivery of this Agreement, and the consummation of the transactions contemplated hereby, shall have been

taken at or prior to each Closing. This Agreement and the other Transaction Documents to which it is a party constitute the legal valid

and binding obligations of Buyer enforceable against Buyer in accordance with their respective terms.

4.3

No Conflict. The execution, delivery and performance of this Agreement and the other Transaction Documents to which it is a party

by Buyer will not, with or without the giving of notice or the passage of time, or both, conflict with, result in a default, right to

accelerate or loss of rights under, or, result in the creation of any lien, charge or encumbrance pursuant to, any provision of Buyer’s

operating agreement or any franchise, mortgage, deed of trust, lease, license, agreement, understanding, law, rule or regulation or any

order, judgment or decree to which Buyer is a party or by which Buyer may be bound or affected.

5.

Access to Information and Documents. After each Closing and upon reasonable notice and during regular business hours, Buyer will

give to Sellers and its representatives full access to any information, documents and books and records related to the Acquired Assets

prior to each Closing Date; provided that its access is required for the purpose of (i) completing and/or filing any documents,

the preparation and/or filing of which is required by law or regulation, (ii) prosecuting, defending or investigating any threatened

or pending adversary proceeding before any court or other tribunal or (iii) responding to any subpoena issued by a court, tribunal or

agency of government.

6.

Non-Solicitation; Non-Hire. During the Restricted Period (as defined below), the Sellers will not, to the extent permitted by

Law: (i) hire or retain any employees of the Buyer or its subsidiaries or (ii) solicit or induce any of the employees of the Buyer or

its subsidiaries to leave such employment; provided, however, that (x) it shall not be a violation of the foregoing subclauses (i) and

(ii) if any Seller hires any employee more than one hundred eighty (180) days after the cessation of such employee’s employment

with the Buyer or its subsidiaries or from hiring or retaining any such employee if the person’s employment with the Buyer or its

subsidiaries was terminated by the Buyer or any of its subsidiaries following each Closing without cause, and (y) it shall not be a violation

of the foregoing subclauses (i) and (ii) for the Seller to make a general solicitation for employment which is not directed specifically

to the employees of the Company or its subsidiaries (including in newspapers or magazines, over the internet or by any search or employment

agency). “Restricted Period” means the period beginning on the first Closing Date to occur and ending upon the two

(2) year anniversary of such Closing Date.

7.

Non-Competition. Sellers shall not, during the Restricted Period, directly or indirectly, without the prior written consent of

the Buyer: (i) engage in any of the same or substantially similar activities as the Buyer or the duties, or responsibilities in the line

of business or relating to the line of business that any Seller had responsibility for or knowledge of while an employee of the Buyer

or its subsidiaries, for any other company that competes with such line of business of the Buyer or its subsidiaries, or (ii) assist

any person or entity in any way to do, or attempt to do, anything prohibited by (i) the above.

8.

If any provision or clause of this Agreement, or portion thereof, is held by any court or other tribunal of competent jurisdiction to

be illegal, invalid, unreasonable, or otherwise unenforceable against the Employee, the remainder of such provision shall not be thereby

affected and will be deemed to be modified to the minimum extent necessary to remain in force and effect for the longest period and largest

geographic area that would not constitute such an unreasonable or unenforceable restriction. It is the express intention of the parties

that, if any court or other tribunal of competent jurisdiction construes any provision or clause of this Agreement, or portion thereof,

is held by any court or other tribunal of competent jurisdiction to be illegal, invalid, unreasonable, or otherwise unenforceable against

any Seller because of the duration of such provision, the scope of the subject matter, or the geographic area covered thereby, such court

or tribunal shall reduce the duration, scope, or area of such provision, and, in its reduced form, such provision shall then be enforceable

and be enforced. Moreover, notwithstanding the fact that any provision of this Agreement is determined not to be enforceable in equity,

the Buyer will nevertheless be entitled to recover monetary damages as a result of any Seller’s breach of such provision.

9.

Conditions to Obligations of Each Party. The respective obligations of Sellers and Buyer to consummate the transactions contemplated

by this Agreement are subject to the condition that there shall be no action or proceeding by any governmental agency or authority or

other person pending before any court or administrative body and no action or proceeding threatened by any person or governmental agency

or authority, to restrain, enjoin or otherwise prevent the consummation of the transactions contemplated hereby or to recover any damages

or obtain other relief as a result thereof.

10.

Conditions Precedent to Buyer’s Obligations. All obligations of Buyer to consummate the transactions intended hereunder

are subject, at the option of Buyer, to the fulfillment of each of the following conditions at or prior to each Closing:

10.1

Truth of Representations. All representations and warranties of Sellers contained herein or in any document delivered pursuant

hereto shall be true and correct in all respects as of each Closing Date.

10.2

Covenants. All covenants, agreements and obligations required by the terms of this Agreement to be performed by Sellers at or

before each Closing shall have been duly and properly performed in all respects.

10.3

Consents. Sellers shall have obtained and delivered to Buyer written consents to the transfer or assignment to Buyer of the Acquired

Assets, where the consent of any other party to any such contract may, in the opinion of Buyer’s counsel, be required for such

assignment or transfer. Sellers shall provide landlord’s written consent for any assignment and assumption of leases, in a form

satisfactory to Buyer.

10.4

Title. Sellers shall have delivered to Buyer at each Closing all documents, certificates and agreements necessary to transfer

to Buyer good and marketable title to the Acquired Assets, free and clear of any and all liens thereon.

10.5

Corporate Proceedings. All corporate and other proceedings of Sellers in connection with the transactions contemplated by this

Agreement, and all documents and instruments incident to such corporate proceedings, shall be reasonably satisfactory in substance and

form to Buyer and its counsel, and Buyer and its counsel shall have received all such documents and instruments, or copies thereof, certified

if requested, as may be reasonably requested.

10.6

Employment Agreement. Sellers shall have executed and delivered to Buyer the Employment Agreement.

10.7

Liquor and Other Licenses or Permits. Buyer shall have obtained all requisite liquor and other applicable licenses and permits

in connection with the Acquired Assets and Business. The consent or approval of, or the expiration of the applicable waiting period imposed

by, any governmental authority (in connection with the transactions contemplated by this Agreement) shall have been obtained.

10.8

Litigation. There shall be no pending or threatened action by or before any governmental entity or arbitrator (i) seeking to restrain,

prohibit or invalidate any of the transactions contemplated by this Agreement or (ii) seeking monetary relief against Buyer by reason

of the consummation of these transactions, and there shall not be in effect any order, writ, judgment, injunction or decree issued by

any governmental entity by which Buyer or any of its properties or assets is bound that has that effect.

10.9

Maintenance of Owned Intellectual Property. All maintenance and renewal fees for all Intellectual Property shall have been paid

in a timely manner, and all requisite acts, preparations and filings of all applications, responses, affidavits and all other documents

shall have been taken in a timely manner in the course of prosecution and maintenance of the Intellectual Property.

10.10

Required Financial Statements. Sellers shall have delivered the Super 8-K Financial Statements to Buyer.

10.11

Material Adverse Effect. No Material Adverse Effect shall have occurred between the date of this Agreement and eachClosing Date

with respect to the Business or the Acquired Assets.

11.

Conditions Precedent to Sellers’ Obligations. All obligations of Sellers to consummate the transactions intended hereunder

are subject, at the option of Sellers, to the fulfillment of each of the following conditions at or prior to each Closing, and Buyer

shall exert its reasonable commercial efforts to cause each such condition to be so fulfilled:

11.1

Truth of Representations. All representations and warranties of Buyer contained herein or in any document delivered pursuant hereto

shall be true and correct in all material respects as of each Closing Date.

11.2

Covenants. All covenants, agreements and obligations required by the terms of this Agreement and the other Transaction Documents

to be performed by Buyer at or before each Closing shall have been duly and properly performed in all material respects.

11.3

Corporate Proceedings. All corporate and other proceedings of Buyer in connection with the transactions contemplated by this Agreement

and the other Transaction Documents to be entered into by it, and all documents and instruments incident to such corporate proceedings,

shall be reasonably satisfactory in substance and form to Sellers and its counsel, and Sellers and its counsel shall have received all

such documents and instruments, or copies thereof, certified if requested, as may be reasonably requested.

11.4

Carry Loan Note. Buyer shall have executed and delivered to Sellers the requisite Carry Loan Notes.

11.5

Convertible Note. Buyer shall have executed and delivered to Sellers the requisite Convertible Notes.

11.6

Employment Agreement. Buyer shall have executed and delivered to Sellers the Employment Agreement.

12.

Operation of Business.

(a)

Except as expressly permitted by the terms of this Agreement, from the date hereof until the final Closing Date, Sellers will conduct

the business in the ordinary course in substantially the same manner as presently conducted and consistent with the past practices of

Sellers, in accordance with all applicable city, state and federal laws, rules and regulations. In addition, except as expressly permitted

by the terms of this Agreement, Sellers will not do any of the following prior to the final Closing Date without the prior written consent

of Buyer:

(i)

borrow or agree to borrow any funds or incur, or assume or become subject to, whether directly or by way of guarantee or otherwise, any

liability (absolute or contingent), except in the ordinary course of business consistent with the past practices of Sellers;

(ii)

acquire by merging or consolidating with, by purchasing a substantial portion of the assets of, or in any other manner, any business

or any corporation, partnership, association or other business organization or division thereof or otherwise acquire any assets, except

in the ordinary course of business consistent with the past practices of Sellers;

(iii)

make any sale, assignment, transfer, abandonment or other conveyance of, or in any way encumber, any of the Acquired Assets;

(iv)

amend, modify, terminate, extend, renew, restate, breach or violate any assigned contract, enter into material contract, commitment or

agreement relating to the Acquired Assets or the Restaurant Entities, or enter into any contract or become subject to any liability not

discharged by Sellers on or prior to each applicable Closing Date;

(v)

permit any of its insurance policies to be canceled or terminated, or any of the coverage thereunder to lapse, unless simultaneously

with such termination, cancellation or lapse, replacement policies are in full force and effect providing coverage, in form, substance

and amount equal to or greater than the coverage under those canceled, terminated or lapsed for substantially similar premiums;

(vi)

take any action that might reasonably be expected to interfere with the transactions contemplated by this Agreement;

(vii)

remove any stock-in-trade; or

(viii)

agree, whether in writing or otherwise, to do any of the foregoing. Except as specifically permitted hereby, Sellers shall not take any

action prior to each Closing that would, or that would reasonably be expected to, result in any of the representations and warranties

of Sellers set forth in this Agreement becoming untrue.

(b)

Sellers agrees that, between the date of this Agreement and each Closing Date, Sellers shall: (i) promptly advise Buyer of all developments

relevant to the Acquired Assets and the transactions contemplated hereby, (ii) cooperate in permitting Buyer to make such investigation

as it may reasonably request to verify the accuracy of the representations and warranties of Sellers herein; (iii) maintain and preserve

intact its business organization so as to retain the present employees regularly assigned to such organization in order that they will

be available to Buyer on and after each Closing Date, (iv) maintain existing relationships with suppliers, customers and others so that

such relationships will be preserved for Buyer on and after each Closing Date, (v) promptly notify Buyer of any change as to the information

contained in the Schedules attached to this Agreement or any change as to the accuracy of the representations and warranties of Sellers,

(vi) advise Buyer promptly in writing of the commencement or threat of any litigation, administrative proceeding or investigation known

to Sellers, and to which Sellers and/or Buyer are or may be made a party or which may affect Sellers, its products, Acquired Assets or

business, and (vii) take such action as may reasonably be requested by Buyer to protect Buyer from liability for claims of creditors

of Sellers not explicitly assumed by Buyer as contemplated hereby.

13.

Cooperation on Financial Statements. Sellers shall coordinate in good faith with the Company’s auditors to prepare and deliver

to Buyer the audited and unaudited financial statements of the Business and Acquired Assets as may be required for the filing of the

Form 8-K (the “Super 8-K Financial Statements”) in connection with each Closing. Any financial statements of the Business

and Acquired Assets provided by Sellers and filed following the first Closing in such Form 8-K will (a) comply, as to form in all material

respects with Regulation S-X of the U.S. Securities and Exchange Commission (the “SEC”), (b) will be prepared in accordance

with GAAP applied on a consistent basis during the periods involved (except as may be indicated in the notes thereto or, in the case

of the unaudited statements, as permitted by Rule 10-01 of Regulation S-X of the SEC), and (c) will fairly present, in all material respects,

the financial condition and the results of operations, changes in shareholders’ equity and cash flows of the Business and Acquired

Assets as at the respective dates of and for the periods referred to in such financial statements, all in accordance with GAAP.

14.

Indemnification; Remedies.

(a)

Sellers shall jointly and severally indemnify and hold harmless Buyer and its successors and assigns at all times after each Closing

Date against and in respect of any damage, loss, cost, expense or liability (including reasonable attorneys’ fees) (i) resulting

to Buyer from any breach of any representation, warranty or covenant by Sellers arising out of or relating to the transactions contemplated

by this Agreement or (ii) resulting to Buyer from any claims arising out of or relating to the use, conduct and ownership of the Business

or Acquired Assets prior to April 20, 2024.

(b)

Sellers, jointly and severally, shall indemnify Buyer for any breaches under the Employment Agreement.

(c)

Buyer shall indemnify and hold harmless Sellers and its successors and assigns, at all times after each Closing Date against and in respect

of any damage, loss, cost, expense or liability (including reasonable attorneys’ fees) (i) resulting to Sellers from any breach

of representation, warranty or covenant by Buyer arising out of or relating to the transactions contemplated by this Agreement or (ii)

resulting to Sellers from any claims arising out of or relating to the use, conduct and ownership of the Business or Acquired Assets

on or after April 20, 2024.

(d)

Each of the parties hereunder shall give the other prompt notice of any demands, claims, actions or causes of action which might give

rise to a claim by any of them for indemnification hereunder.

(e)

In addition, the parties agree that they shall be entitled to an injunction or injunctions, or any other appropriate form of specific

performance or equitable relief, to prevent breaches of this Agreement and to enforce specifically the terms and provisions hereof in

the California Courts, this being in addition to any other remedy to which they are entitled at law or in equity

15.

Termination and Waiver.

15.1

Termination. This Agreement may be terminated at any time prior to the Closing only as follows:

(a)

by Buyer if, between the date hereof and the time scheduled for the Closing: (i) an event or condition occurs that has resulted in or

that is reasonably likely to result in a Material Adverse Effect on the Business or the Acquired Assets; (ii) any representation or warranty

of Sellers set forth in this Agreement shall not have been true and correct in all respects when made or ceases to be true and correct

in all respects at any time subsequent to the date hereof; (iii) Sellers shall not have complied in all respects with any covenant or

agreement to be complied with by it prior to the Closing Date; or (iv) Sellers makes a general assignment for the benefit of creditors,

or any proceeding shall be instituted by or against Sellers seeking to adjudicate Sellers a bankrupt or insolvent, or seeking liquidation,

winding up or reorganization, arrangement, adjustment, protection, relief or composition of its debts under any law relating to bankruptcy,

insolvency or reorganization or a receiver, trustee, liquidator, sequestrator, guardian or similar person is appointed for Sellers or

any of its assets; or

(b)

by Buyer or Sellers if each Closing shall not have occurred on or prior to June 30, 2024; provided, however, that the parties may mutually

agree to extend each Closing to a later date; and further provided, however, that the right to terminate this Agreement under this Section

shall not be available to any party whose failure to fulfill any obligation under this Agreement shall have been the cause of, or shall

have resulted in, the failure of each Closing to occur on or prior to such date; or

(c)

by Buyer or Sellers in the event that any governmental authority shall have issued an order, decree or ruling or taken any other action

restraining, enjoining or otherwise prohibiting the transactions contemplated by this Agreement and such order, decree, ruling or other

action shall have become final and nonappealable; or

(d)

by the mutual written consent of each of Buyer and Sellers.

Promptly

upon any such termination, the Escrowed Payment shall be refunded to Buyer.

15.2

Waiver. Each party to this Agreement may (a) extend the time for the performance of any of the obligations or other acts of any

other party, (b) waive any inaccuracies in the representations and warranties of any other party contained herein or in any document

delivered by such other party pursuant hereto, or (c) waive compliance with any of the agreements or conditions of any other party contained

herein. Any such extension or waiver shall be valid only if set forth in an instrument in writing signed by the party to be bound thereby.

Any waiver of any term or condition shall not be construed as a waiver of any subsequent breach or a subsequent waiver of the same term

or condition, or a waiver of any other term or condition, of this Agreement. The failure of any party to assert any of its rights hereunder

shall not constitute a waiver of any of such rights.

16.

Miscellaneous.

16.1

Notices. Any notices, requests, demands and other communications made in connection with this Agreement shall be in writing and

shall be deemed to have been duly given (i) on the date of delivery, if delivered to the persons identified below, (ii) seven calendar

days after mailing if mailed, with proper postage, by certified or registered mail, air mail postage prepaid, return receipt requested,

or (iii) when sent by facsimile transmission (providing confirmation of transmission by the transmitting equipment) or e-mail of a .pdf

attachment (with confirmation of receipt by non-automated reply e-mail from the recipient or its counsel) addressed as follows:

| |

If

to Buyer: |

Yoshiharu

Global Co. |

| |

|

6940

Beach Blvd. |

| |

|

Suite

D-705 |

| |

|

Buena

Park, CA 90621 |

| |

|

Attn:

James Chae, Chief Executive Officer |

| |

|

Email:

rcho@yoshiharuramen.com |

| |

|

Phone

Number: 714 694-2403 |

| |

With

a copy to: |

Pryor

Cashman LLP |

| |

|

7

Times Square, 40th Floor |

| |

|

New

York, NY 10036 |

| |

|

Attn:

Matthew Ogurick, Esq. |