Y-mAbs Therapeutics, Inc. (the “Company” or “Y-mAbs”) (Nasdaq:

YMAB), a commercial-stage biopharmaceutical company focused on the

development and commercialization of novel radioimmunotherapy and

antibody-based therapeutic products for the treatment of cancer,

today reported financial results for the second quarter ended June

30, 2024.

“We demonstrated commercial progress with DANYELZA in the second

quarter of this year while continuing to advance our development

pipeline,” said Mike Rossi, President and Chief Executive Officer.

“Our dedicated U.S. sales team with deep neuroblastoma expertise

continues to penetrate new centers with DANYELZA, a leading

anti-GD2 therapy, added to two more hospital formularies in the

second quarter of 2024, while our ex-U.S. distribution partners

have gained traction in our Eastern Asia and Latin America markets.

Additionally, we remain focused on advancing our novel

Self-Assembly DisAssembly (“SADA”) Pretargeted Radioimmunotherapy

(“PRIT”) technology platform and continue to evaluate potential

expansion of indications for naxitamab in our mission of delivering

better and safer therapies to patients. Looking ahead, we are on

track to complete Part A of our GD2-SADA Phase 1 clinical trial in

the fourth quarter of this year with a data readout to follow and

are on track to dose the first patient in our CD38-SADA Phase 1 in

Non-Hodgkin’s Lymphoma trial in the second half of this year.”

Second Quarter 2024 and Recent Corporate

Highlights

- Appointed Peter Pfreundschuh as Chief Financial Officer and

deepened radiopharmaceutical expertise with the appointment of

Norman LaFrance, M.D. as Chief Development Officer.

- Y-mAbs’ distribution partner in Latin America, Adium, initiated

the commercial launch of DANYELZA in Brazil and Mexico.

- Entered into a distribution agreement with TRPharm İlaç Sanayi

Ticaret A.Ş. and TRPharm FZ-LLC for the named patient program

distribution of DANYELZA in Turkey.

- Received marketing authorization approval for DANYELZA in Hong

Kong. Y-mAbs’ Asian distribution partner, SciClone Pharmaceuticals,

is expected to initiate the commercial launch of DANYELZA in Hong

Kong this year.

- Presented preclinical GD2-SADA data at the Society of Nuclear

Medicine & Molecular Imaging 2024 annual Meeting on June 8-11,

2024, in Toronto, Canada.

- Highlighted new interim analysis of Phase 2 data for naxitamab

in several poster presentations and preclinical GD2-SADA data at

the 2024 American Society of Clinical Oncology (“ASCO”) Annual

Meeting on May 31-June 4, 2024, in Chicago, IL.

Financial Results

Revenues

Total net product revenues were $22.8 million and $42.2 million

for the quarter and six months ended June 30, 2024, which

represented an increase of 10% and 3%, respectively, over $20.8

million and $41.0 million in the comparable periods of 2023.

DANYELZA total net product revenues of $22.8 million in the

second quarter of 2024, represented a 10% increase compared to the

second quarter of 2023, primarily driven by increased international

revenues. Y-mAbs’ international DANYELZA net product revenues were

$7.6 million for the three months ended June 30, 2024, an increase

of 55% over $4.9 million in the comparable period in 2023. The

increase of net product revenue in the quarter ended June 30, 2024,

compared to the quarter ended June 30, 2023, was a result of

increased volume from Western Europe, as well as the commercial

launch for Brazil and Mexico in Latin America. U.S. DANYELZA net

product revenues were $15.2 million and $15.9 million for the three

months ended June 30, 2024 and 2023, respectively, representing a

4% decline driven by a volume decrease due to the launch of

competing therapy in another class of agents and some ongoing

clinical trial activities.

The Company’s total net product revenue was $42.2 million for

the six months ended June 30, 2024, as compared to $41.0 million in

the comparable period in 2023. The 3% increase was primarily driven

by a $1.2 million increase in the U.S. DANYELZA net product revenue

in the six months ended June 30, 2024, while international net

product revenue was relatively flat.

As of June 30, 2024, Y-mAbs has delivered DANYELZA to 65

centers across the U.S. since initial launch, with two new accounts

added in the U.S. in the second quarter of 2024. During the quarter

ended June 30, 2024, approximately 67% of the vials sold in

the U.S. were sold outside of Memorial Sloan Kettering Cancer

Center (“MSK”), compared to 60% in the first quarter ended

March 31, 2024.

The Company did not have license revenue for the quarters ended

June 30, 2024 and 2023. The Company had license revenues of $0.5

million for the six months ended June 30, 2024, from our

distribution partner, Adium, related to our acceptance of the price

for DANYELZA in Brazil from the Brazilian Medicines Market

Regulation Chamber. There was no license revenue recorded for the

six months ended June 30, 2023.

Operating Costs and Expenses

Cost of Goods Sold

Cost of goods sold was $3.0 million and $4.6 million for the

quarter ended June 30, 2024 and 2023, respectively. Cost of

goods sold was $5.1 million and $6.7 million for the six months

ended June 30, 2024 and 2023, respectively. The Company defines

gross margin as net product revenues less cost of goods sold

divided by net product revenues. Our gross margins increased in the

three and six months ended June 30, 2024, compared to the

comparable periods in 2023, due to a favorable gross profit mix

from lower vial volumes from our international regions.

Research and Development

Research and development expenses were $12.3 million for the

quarter ended June 30, 2024, and relatively flat compared to

$12.1 million for the quarter ended June 30, 2023. For the six

months ended June 30, 2024 and 2023, research and development

expenses were relatively flat at $25.6 million and $25.5 million,

respectively.

Selling, General, and Administration

Selling, general, and administrative expenses were $17.2 million

for the three months ended June 30, 2024, which was a $5.9 million

increase compared to $11.3 million for the three months ended June

30, 2023. The increase was primarily attributable to a net impact

of $3.6 million related to the Company’s settlement of a

shareholder class-action lawsuit, which is the net impact of the

Company’s $19.7 million accrued legal settlement, less the

corresponding insurance recovery of $16.1 million and an additional

legal settlement of $0.2 million in the three months ended June 30,

2024.

For the six months ended June 30, 2024, selling, general, and

administrative expenses were $28.7 million, an increase of $5.2

million for the six months ended June 30, 2023. The increase was

primarily attributable to a net impact of $3.8 million related to

the Company’s two legal settlements, as noted above.

Interest and Other Income

Interest and other income were $0.6 million for the three months

ended June 30, 2024, as compared to $1.1 million for the three

months ended June 30, 2023. The decrease of $0.5 million was

primarily due to a $0.2 million gain from repayment of a secured

promissory note in the three months ended June 30, 2023, and a $0.2

million increase in foreign currency transaction losses. The

Company did not have the repayment of a secured promissory note in

the three months ended June 30, 2024.

For the six months ended June 30, 2024 and 2023, the interest

and other income was $1.1 million and $2.2 million, respectively.

The decrease of $1.1 million was primarily due to a $0.8 million

increase in foreign currency transaction losses related to the

remeasurement of foreign currency denominated assets and

liabilities.

Net Loss

Y-mAbs reported a net loss for the three months ended June 30,

2024, of $9.2 million, or ($0.21) per basic and diluted share,

compared to net loss of $6.3 million, or ($0.14) per basic and

diluted share, for the three months ended June 30, 2023. For the

six months ended June 30, 2024, the Company reported a net loss of

$15.9 million, or ($0.36) per basic and diluted share, as compared

to net loss of $12.7 million, or ($0.29) per basic and diluted

share, for the six months ended June 30, 2023. The increase in net

loss for the three and six months ended June 30, 2024 was primarily

driven by the net $3.8 million in charges related to the Company’s

two legal settlements, as described above.

Cash and Cash Equivalents

As of June 30, 2024, Y-mAbs had approximately $77.8 million

in cash and cash equivalents which, together with anticipated

DANYELZA product revenues, is expected to support operations as

currently planned into 2027. This estimate reflects the Company’s

current business plan that is supported by assumptions that may

prove to be inaccurate. Cash utilized in the first half year of

2024 was $0.8 million, which was favorable to internal company

forecasts.

2024 Financial Guidance

Management updates its full year 2024 guidance:

- Anticipated Total Net Revenues now expected to be between $87

million and $95 million;

- Anticipated Operating Expenses expected to remain between $115

million and $120 million;

- Anticipated Total Annual Cash Burn expected to remain between

$15 million and $20 million; and

- Cash and Cash Equivalents anticipated to continue to support

operations as currently planned into 2027.

Webcast and Conference Call

Y-mAbs will host a conference call on Monday, August 12,

2024, at 8:00 a.m. ET. To participate in the call, please use

the following dial-in information:

Investors (domestic): (877) 407-0792Investors (international):

(201) 689-8263

To access the live webcast, please use this link. Prior to the

call and webcast, a slide presentation pertaining to the Company’s

quarterly earnings will be made available on the Investor Relations

section of the Y-mAbs website, www.ymabs.com, shortly before the

call begins.

About Y-mAbs

Y-mAbs is a commercial-stage biopharmaceutical company focused

on the development and commercialization of novel,

radioimmunotherapy and antibody-based therapeutic cancer products.

The Company’s technologies include its investigational

Self-Assembly DisAssembly (“SADA”) Pretargeted Radioimmunotherapy

Platform (“PRIT”) and bispecific antibodies generated using the

Y-BiClone platform. The Company’s broad and advanced product

pipeline includes the anti-GD2 therapy DANYELZA® (naxitamab-gqgk),

the first FDA-approved treatment for patients with relapsed or

refractory high-risk neuroblastoma in the bone or bone marrow after

a partial response, minor response, or stable disease to prior

therapy.

Forward-Looking Statements

Statements in this press release about future expectations,

plans and prospects, as well as any other statements regarding

matters that are not historical facts, may constitute

“forward-looking statements” within the meaning of Section 27A

of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Such statements include, but are

not limited to, statements about our business model, including

financial outlook for 2024 and beyond, including estimated

operating expenses, cash burn and DANYELZA product revenue and

sufficiency of cash resources and related assumptions; implied and

express statements regarding the future of the Company’s business,

including with respect to expansion and its goals; the Company’s

plans and strategies, development, commercialization and product

distribution plans; expectations with respect to the Company’s

products and product candidates, including potential territory and

label expansion of DANYELZA and the potential market opportunity

related thereto and potential benefits thereof, and the potential

of the SADA PRIT Technology and potential benefits and applications

thereof; the Company’s mission of delivering better and safer

therapies to patients; expectations relating to key anticipated

development milestones, including potential expansion and

advancement of commercialization and development efforts, including

potential indications, applications and geographies, and the timing

thereof; expectations with respect to current and future clinical

and pre-clinical studies and the Company’s research and development

programs, including with respect to timing and results;

expectations related to the timing of the initiation and completion

of regulatory submissions; additional product candidates and

technologies; expectations regarding collaborations or strategic

partnerships and the potential benefits thereof; expectations

related to the use of cash and cash equivalents, and the need for,

timing and amount of any future financing transaction; expectations

with respect to the Company’s future financial performance; and

other statements that are not historical facts. Words such as

“anticipate,” “believe,” “contemplate,” “continue,” “could,”

“estimate,” “expect,” “hope,” “intend,” “may,” “might,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,”

“would,” “guidance,” “goal,” “objective,” and similar expressions

are intended to identify forward-looking statements, although not

all forward-looking statements contain these identifying words. Our

product candidates and related technologies are novel approaches to

cancer treatment that present significant challenges. Actual

results may differ materially from those indicated by such

forward-looking statements as a result of various factors,

including but not limited to: risks associated with the Company’s

financial condition and need for additional capital; the risks that

actual results of the Company’s restructuring plan and revised

business plan will not be as expected; risks associated with the

Company’s development work; cost and success of the Company’s

product development activities and clinical trials; the risks of

delay in the timing of the Company’s regulatory submissions or

failure to receive approval of its drug candidates; the risks

related to commercializing any approved pharmaceutical product

including the rate and degree of market acceptance of product

candidates; development of sales and marketing capabilities and

risks associated with failure to obtain sufficient reimbursement

for products; the risks related to the Company’s dependence on

third parties including for conduct of clinical testing and product

manufacture; the Company’s ability to enter into partnerships; the

risks related to government regulation; risks related to market

approval, risks associated with protection of the Company’s

intellectual property rights; risks related to employee matters and

managing growth; risks related to the Company’s common stock, risks

associated with macroeconomic conditions, including the conflict

between Russia and Ukraine and sanctions related thereto, the state

of war between Israel and Hamas and the related risk of a larger

regional conflict, inflation, increased interest rates, uncertain

global credit and capital markets and disruptions in banking

systems; and other risks and uncertainties affecting the Company

including those described in the "Risk Factors" section included in

the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2023, the Company’s

Quarterly Report on Form 10-Q for the quarterly period ended

March 31, 2024, the Company’s Quarterly Report on Form 10-Q for the

quarterly period ended June 30, 2024, and future filings and

reports by the Company. Any forward-looking statements contained in

this press release speak only as of the date hereof, and the

Company undertakes no obligation to update any forward-looking

statement, whether as a result of new information, future events or

otherwise.

DANYELZA® and Y-mAbs® are registered trademarks of Y-mAbs

Therapeutics, Inc.

Investor Contact:

Courtney DuganVP, Head of Investor Relationscdu@ymabs.com

|

Y‑MABS THERAPEUTICS, INC. |

|

Consolidated Balance Sheets |

|

(unaudited) |

|

(In thousands, except share and per share data) |

|

|

|

|

|

|

|

|

|

June 30, |

|

December 31, |

|

|

2024 |

|

2023 |

|

ASSETS |

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

77,806 |

|

|

$ |

78,637 |

|

|

Accounts receivable, net |

|

22,191 |

|

|

|

22,454 |

|

|

Inventories |

|

8,498 |

|

|

|

5,065 |

|

|

Insurance recovery receivable related to legal settlement |

|

16,025 |

|

|

|

— |

|

|

Other current assets |

|

2,243 |

|

|

|

4,955 |

|

|

Total current assets |

|

126,763 |

|

|

|

111,111 |

|

|

Property and equipment, net |

|

87 |

|

|

|

224 |

|

|

Operating lease right-of-use assets |

|

1,271 |

|

|

|

1,412 |

|

|

Intangible assets, net |

|

2,454 |

|

|

|

2,631 |

|

|

Other assets |

|

13,460 |

|

|

|

12,491 |

|

|

TOTAL ASSETS |

$ |

144,035 |

|

|

$ |

127,869 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

Accounts payable |

$ |

10,190 |

|

|

$ |

6,060 |

|

|

Accrued liabilities |

|

12,788 |

|

|

|

13,166 |

|

|

Accrued legal settlement |

|

19,650 |

|

|

|

— |

|

|

Operating lease liabilities, current portion |

|

842 |

|

|

|

902 |

|

|

Total current liabilities |

|

43,470 |

|

|

|

20,128 |

|

|

Accrued milestone and royalty payments |

|

3,950 |

|

|

|

5,375 |

|

|

Operating lease liabilities, long-term portion |

|

432 |

|

|

|

517 |

|

|

Other liabilities |

|

847 |

|

|

|

864 |

|

|

TOTAL LIABILITIES |

|

48,699 |

|

|

|

26,884 |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Preferred stock, $0.0001 par value, 5,500,000 shares authorized and

none issued at June 30, 2024 and

December 31, 2023 |

|

— |

|

|

|

— |

|

|

Common stock, $0.0001 par value, 100,000,000 shares authorized at

June 30, 2024 and December 31, 2023; 44,567,334

and 43,672,112 shares issued and outstanding at

June 30, 2024 and December 31, 2023,

respectively |

|

4 |

|

|

|

4 |

|

|

Additional paid-in capital |

|

567,633 |

|

|

|

558,002 |

|

|

Accumulated other comprehensive income |

|

1,047 |

|

|

|

449 |

|

|

Accumulated deficit |

|

(473,348 |

) |

|

|

(457,470 |

) |

|

TOTAL STOCKHOLDERS’ EQUITY |

|

95,336 |

|

|

|

100,985 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

$ |

144,035 |

|

|

$ |

127,869 |

|

| |

|

|

|

|

|

|

Y-MABS THERAPEUTICS, INC. |

|

Consolidated Statements of Net Loss and Comprehensive

Loss |

|

(unaudited) |

|

(In thousands, except share and per share data) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended June 30, |

|

Six months ended June 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

Product revenue, net |

$ |

22,798 |

|

|

$ |

20,751 |

|

|

$ |

42,229 |

|

|

$ |

41,002 |

|

|

License revenue |

|

— |

|

|

|

— |

|

|

|

500 |

|

|

|

— |

|

|

Total revenues |

|

22,798 |

|

|

|

20,751 |

|

|

|

42,729 |

|

|

|

41,002 |

|

|

OPERATING COSTS AND EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold |

|

3,014 |

|

|

|

4,649 |

|

|

|

5,111 |

|

|

|

6,732 |

|

|

License royalties |

|

— |

|

|

|

— |

|

|

|

50 |

|

|

|

— |

|

|

Research and development |

|

12,341 |

|

|

|

12,055 |

|

|

|

25,608 |

|

|

|

25,473 |

|

|

Selling, general, and administrative |

|

17,232 |

|

|

|

11,270 |

|

|

|

28,657 |

|

|

|

23,521 |

|

|

Total operating costs and expenses |

|

32,587 |

|

|

|

27,974 |

|

|

|

59,426 |

|

|

|

55,726 |

|

|

Loss from operations |

|

(9,789 |

) |

|

|

(7,223 |

) |

|

|

(16,697 |

) |

|

|

(14,724 |

) |

|

OTHER INCOME, NET |

|

|

|

|

|

|

|

|

|

|

|

|

Interest and other income |

|

640 |

|

|

|

1,100 |

|

|

|

1,079 |

|

|

|

2,211 |

|

|

LOSS BEFORE INCOME TAXES |

|

(9,149 |

) |

|

|

(6,123 |

) |

|

|

(15,618 |

) |

|

|

(12,513 |

) |

|

Provision for income taxes |

|

100 |

|

|

|

179 |

|

|

|

260 |

|

|

|

179 |

|

|

NET LOSS |

$ |

(9,249 |

) |

|

$ |

(6,302 |

) |

|

$ |

(15,878 |

) |

|

$ |

(12,692 |

) |

|

Other comprehensive income/(loss) |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation |

|

199 |

|

|

|

18 |

|

|

|

598 |

|

|

|

(288 |

) |

|

COMPREHENSIVE LOSS |

$ |

(9,050 |

) |

|

$ |

(6,284 |

) |

|

$ |

(15,280 |

) |

|

$ |

(12,980 |

) |

|

Net loss per share attributable to common stockholders, basic and

diluted |

$ |

(0.21 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.36 |

) |

|

$ |

(0.29 |

) |

|

Weighted average common shares outstanding, basic and diluted |

|

44,022,356 |

|

|

|

43,663,112 |

|

|

|

43,900,639 |

|

|

|

43,667,385 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Y-MABS THERAPEUTICS, INC. |

|

Consolidated Statements of Cash Flows |

|

(unaudited) |

|

(In thousands) |

| |

|

|

|

|

|

|

|

Six months ended June 30, |

|

|

2024 |

|

2023 |

|

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

Net loss |

$ |

(15,878 |

) |

|

$ |

(12,692 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

312 |

|

|

|

406 |

|

|

Stock-based compensation |

|

7,285 |

|

|

|

8,920 |

|

|

Foreign currency and other transactions |

|

724 |

|

|

|

(774 |

) |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

Accounts receivable, net |

|

263 |

|

|

|

(6,587 |

) |

|

Inventories |

|

(3,433 |

) |

|

|

1,515 |

|

|

Insurance recovery receivable related to legal settlement |

|

(16,025 |

) |

|

|

— |

|

|

Other current assets |

|

2,712 |

|

|

|

1,402 |

|

|

Other assets |

|

(969 |

) |

|

|

(6,570 |

) |

|

Accounts payable |

|

3,406 |

|

|

|

(6,149 |

) |

|

Accrued liabilities and other |

|

(1,226 |

) |

|

|

2,671 |

|

|

Accrued legal settlement |

|

19,650 |

|

|

|

— |

|

|

NET CASH USED IN OPERATING ACTIVITIES |

|

(3,179 |

) |

|

|

(17,858 |

) |

|

CASH FLOWS FROM INVESTING ACTIVITIES |

|

— |

|

|

|

— |

|

|

CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

Proceeds from exercised stock options |

|

2,346 |

|

|

|

— |

|

|

NET CASH PROVIDED BY FINANCING ACTIVITIES |

|

2,346 |

|

|

|

— |

|

|

Effect of exchange rates on cash and cash equivalents |

|

2 |

|

|

|

5 |

|

|

NET DECREASE IN CASH AND CASH EQUIVALENTS |

|

(831 |

) |

|

|

(17,853 |

) |

|

Cash and cash equivalents at the beginning of period |

|

78,637 |

|

|

|

105,762 |

|

|

Cash and cash equivalents at the end of period |

$ |

77,806 |

|

|

$ |

87,909 |

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURE OF NON-CASH ACTIVITIES |

|

|

|

|

|

|

Right-of-use assets obtained in exchange for lease obligations |

$ |

320 |

|

|

$ |

— |

|

|

Acquisition of treasury shares upon repayment of secured promissory

note |

$ |

— |

|

|

$ |

480 |

|

| |

|

|

|

|

|

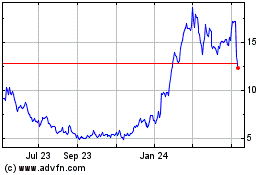

Y mAbs Therapeutics (NASDAQ:YMAB)

Historical Stock Chart

From Nov 2024 to Dec 2024

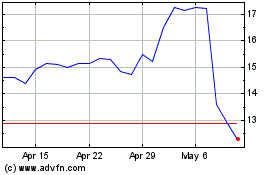

Y mAbs Therapeutics (NASDAQ:YMAB)

Historical Stock Chart

From Dec 2023 to Dec 2024