UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16

or 15d-16

of the Securities Exchange

Act of 1934

For the month of May, 2021

Commission File Number:

001-36000

XTL Biopharmaceuticals

Ltd.

(Translation of registrant’s

name into English)

5 Badner St.

Ramat Gan,

4365603, Israel

(Address of principal executive

offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ________

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): _______

RAMAT GAN, ISRAEL - (May 19, 2021)

– XTL Biopharmaceuticals Ltd. (NASDAQ: XTLB, TASE: XTLB.TA) (“XTL” or the “Company”), a clinical-stage

biopharmaceutical Company, today announced financial results for the three months ended March 31, 2021.

The Company is expanding its IP portfolio surrounding

hCDR1 and has decided, at this time, to explore cooperation with a strategic partner in order to execute its clinical trials. In parallel,

the Company will look to expand and identify additional assets to add to XTL’s portfolio.

The outbreak of the COVID-19 virus (hereafter,

“Coronavirus”) in the world in the first half of 2020 and its spread, causes great uncertainty in the world capital markets

and major macroeconomic implications, which are characterized by sharp declines and volatility in many securities’ prices.

As of the date of issuance of the financial reporting,

there was no material effect of the Coronavirus on the operations and financial results of the Company. Although, due to the ongoing

uncertainty around the scope and duration of the Coronavirus, as of the financial statement publication date, there is uncertainty regarding

its impact on the economy and the market state at all, and those impacts on the value of the securities held by the Company.

The Company is monitoring and will continue to

monitor the developments around the world in connection with the spread of the Coronavirus, and will examine the implications for its

activities.

Financial Overview for Three Months Ended

March 31, 2021

XTL reported approximately $3.39 million in cash

and cash equivalents as of March 31, 2021 and approximately $3.54 million in other current assets (mainly marketable securities). The

decrease of $0.24 million since December 31, 2020, in cash and cash equivalents derives from operating expenses.

Research and development expenses for the three

months ended March 31, 2021 were $12 thousand compared to $3 thousand for the corresponding period in 2020. The increase of $9 thousands

is due to professional consulting.

General and administrative expenses for the three

months ended March 31, 2021 were $220 thousand compared to $254 thousand for the corresponding period in 2020. The decrease of $34 thousand

derives mainly from expenses related to replacing the CEO of the Company in 2020.

Finance income, net for the three months ended

March 31, 2021 were $518 thousand compared to $430 thousand for the corresponding period in 2020. The difference is primarily from revaluation

of marketable securities and warrants.

XTL reported an operating loss for the three

months ended March 31, 2021 of $232 thousand compared to $257 thousand for the corresponding period in 2020. The Company reported a total

net income for the period ended March 31, 2021 of approximately $286 thousand or $0.001 per share, compared to $173 thousand or $0.000

per share in the corresponding period in 2020. The change is driven primarily by the revaluation of marketable securities and warrants

as described above.

XTL Biopharmaceuticals, Ltd. and Subsidiary

(USD in thousands)

Consolidated Statements of Financial Position

- Selected Data

|

|

|

As of

March 31,

2021

|

|

|

As

of

December 31,

2020

(Restated)

|

|

|

Cash, cash equivalents

|

|

$

|

3,394

|

|

|

$

|

3,631

|

|

|

Other current assets

|

|

|

3,535

|

|

|

|

2,490

|

|

|

Non-current assets

|

|

|

382

|

|

|

|

382

|

|

|

Total assets

|

|

$

|

7,311

|

|

|

$

|

6,503

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

$

|

251

|

|

|

$

|

254

|

|

|

Non-current liabilities

|

|

|

2,693

|

|

|

|

2,637

|

|

|

Shareholders’ equity

|

|

|

4,367

|

|

|

|

3,612

|

|

|

Total liabilities and shareholders’ equity

|

|

$

|

7,311

|

|

|

$

|

6,503

|

|

XTL Biopharmaceuticals, Ltd. and Subsidiary

(USD in thousands, except per share amounts)

Consolidated Statements of Comprehensive Income

- Selected Data

|

|

|

For the three

months ended

|

|

|

For the year

ended

|

|

|

|

|

March 31,

|

|

|

December 31,

|

|

|

|

|

2021

|

|

|

2020

|

|

|

2020

|

|

|

|

|

|

|

|

As Restated

|

|

|

As Restated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and Development expenses

|

|

$

|

(12

|

)

|

|

$

|

(3

|

)

|

|

$

|

(38

|

)

|

|

General and administrative expenses

|

|

|

(220

|

)

|

|

|

(254

|

)

|

|

|

(910

|

)

|

|

Operating Loss

|

|

$

|

(232

|

)

|

|

$

|

(257

|

)

|

|

$

|

(948

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revaluation of marketable securities

|

|

$

|

1,037

|

|

|

$

|

277

|

|

|

$

|

138

|

|

|

Revaluation of warrants to purchase ADS’s

|

|

|

(512

|

)

|

|

|

146

|

|

|

|

(2,172

|

)

|

|

Other finance income (loss), net

|

|

|

(7

|

)

|

|

|

7

|

|

|

|

28

|

|

|

Finance income (expenses), net

|

|

$

|

518

|

|

|

$

|

430

|

|

|

$

|

(2,006

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total income for the period

|

|

$

|

286

|

|

|

$

|

173

|

|

|

$

|

(2,954

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted income (loss) per share (in U.S. dollars):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From continuing operations

|

|

$

|

0.001

|

|

|

$

|

0.000

|

|

|

$

|

(0.006

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of issued ordinary shares

|

|

|

527,187,599

|

|

|

|

514,205,799

|

|

|

|

514,205,799

|

|

Restatement of previously issued consolidated

financial statements for Three Months Ended March 31, 2020

In March 2018 the Company’s warrants were

recorded as share premium as a result of the cancellation of the cashless exercise mechanism.

During the second quarter of 2021, the Company

concluded that the cashless exercise mechanism was not in fact cancelled when the registration statement originally declared effective

in March 2018 became stale, as a result of which the right to exercise the warrants on a cashless basis was again possible, resulting

in the situation that the warrants should have been recorded as non-current liabilities, and not as equity instruments.

The

financial statements for the year ended December 31, 2020 were restated and filed on May 19, 2021

The impacts of the warrant change of classification

for the three months ended March 31, 2020 and for the year ended December 31, 2020 are as follows:

Impact on the consolidated statement

of comprehensive income (loss):

|

|

|

Three months ended March 31,

|

|

|

|

|

2020

|

|

|

|

|

As

previously

reported

|

|

|

As restated

|

|

|

Adjustments

|

|

|

|

|

U.S. dollars in thousands

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revaluation of warrants to purchase ADSs

|

|

|

-

|

|

|

|

146

|

|

|

|

146

|

|

|

Finance income (expenses), net

|

|

|

284

|

|

|

|

430

|

|

|

|

146

|

|

|

Total comprehensive income (loss) for the period

|

|

|

27

|

|

|

|

173

|

|

|

|

146

|

|

|

Basic and diluted earnings (loss) per share (in U.S. dollars):

|

|

|

0.000

|

|

|

|

0.000

|

|

|

|

0.000

|

|

|

|

|

Year ended December 31,

|

|

|

|

|

2020*

|

|

|

|

|

As

previously

reported

|

|

|

As restated

|

|

|

Adjustments

|

|

|

|

|

U.S. dollars in thousands

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revaluation of warrants to purchase ADSs

|

|

|

-

|

|

|

|

(2,172

|

)

|

|

|

(2,172

|

)

|

|

Finance income (expenses), net

|

|

|

166

|

|

|

|

(2,006

|

)

|

|

|

(2,172

|

)

|

|

Total comprehensive income (loss) for the year

|

|

|

(782

|

)

|

|

|

(2,954

|

)

|

|

|

(2,172

|

)

|

|

Basic and diluted earnings (loss) per share (in U.S. dollars):

|

|

|

0.002

|

|

|

|

0.006

|

|

|

|

0.004

|

|

|

|

*

|

see also Company’s 20F/A.

The disclosure in this 6-K is qualified in its entirety by reference to the Company’s

Amended and Restated Annual Report on Form 20-F/A, filed on May 19, 2021.

|

Impact on the consolidated statements

of financial position:

|

|

|

March 31,

|

|

|

|

|

2020

|

|

|

|

|

As

previously

reported

|

|

|

As restated

|

|

|

Adjustments

|

|

|

|

|

U.S. dollars in thousands

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

-

|

|

|

|

319

|

|

|

|

319

|

|

|

Additional paid in capital

|

|

|

147,708

|

|

|

|

146,015

|

|

|

|

(1,693

|

)

|

|

Accumulated deficit

|

|

|

(153,885

|

)

|

|

|

(152,511

|

)

|

|

|

1,374

|

|

|

Total equity

|

|

|

7,025

|

|

|

|

6,706

|

|

|

|

(319

|

)

|

|

|

|

December 31,

|

|

|

|

|

2020*

|

|

|

|

|

As

previously

reported

|

|

|

As restated

|

|

|

Adjustments

|

|

|

|

|

U.S. dollars in thousands

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

-

|

|

|

|

2,637

|

|

|

|

2,637

|

|

|

Additional paid in capital

|

|

|

147,708

|

|

|

|

146,015

|

|

|

|

(1,693

|

)

|

|

Accumulated deficit

|

|

|

(154,661

|

)

|

|

|

(152,605

|

)

|

|

|

(944

|

)

|

|

Total equity

|

|

|

6,249

|

|

|

|

3,612

|

|

|

|

(2,637

|

)

|

|

|

*

|

see also Company’s 20F/A.

The disclosure in this 6-K is qualified in its entirety by reference to the Company’s

Amended and Restated Annual Report on Form 20-F/A, filed on May 19, 2021.

|

The Company is planning to file during the upcoming weeks an F-3 Registration

Statement, which once effective, shall register the shares underlying the warrants, the result of which will irrevocably cancel the right

to exercise the warrants on a cashless basis, following which the warrants shall once again be recorded as an equity instrument and not

a non-current liability. The Company cannot guarantee that the F-3 Registration Statement will be declared effective or the timeline thereof.

About hCDR1

hCDR1 is a novel compound with a unique mechanism

of action and clinical data on over 400 patients in three clinical studies. The drug has a favorable safety profile, is well tolerated

by patients and has demonstrated efficacy in at least one clinically meaningful endpoint. For more information please see a peer reviewed

article in Lupus Science and Medicine journal (full article).

About XTL Biopharmaceuticals Ltd. (XTL)

XTL Biopharmaceuticals

Ltd. is a clinical-stage biotech company focused on the development of pharmaceutical products for the treatment of autoimmune diseases.

The Company’s lead drug candidate, hCDR1, is a clinical asset for the treatment of autoimmune diseases including systemic lupus

erythematosus (SLE) and Sjögren’s Syndrome (SS). The few treatments currently on the market for these diseases are not effective

enough for many patients and some have significant side effects. hCDR1 has robust clinical data in three clinical trials with 400 patients

and over 200 preclinical studies with data published in more than 40 peer reviewed scientific journals.

XTL is traded on

the Nasdaq Capital Market (NASDAQ: XTLB) and the Tel Aviv Stock Exchange (TASE: XTLB.TA). XTL shares are included in the following indices:

Tel-Aviv Biomed, Tel-Aviv MidCap, and Tel-Aviv Tech Index.

For further information, please contact:

Investor Relations, XTL Biopharmaceuticals

Ltd.

Tel: +972 3 611 6666

Email: ir@xtlbio.com

www.xtlbio.com

Cautionary Statement

This disclosure may contain forward-looking statements,

about XTL’s expectations, beliefs or intentions regarding, among other things, its product development efforts, business, financial

condition, results of operations, strategies or prospects. In addition, from time to time, XTL or its representatives have made or may

make forward-looking statements, orally or in writing. Forward-looking statements can be identified by the use of forward-looking words

such as “believe,” “expect,” “intend,” “plan,” “may,” “should” or “anticipate”

or their negatives or other variations of these words or other comparable words or by the fact that these statements do not relate strictly

to historical or current matters. These forward-looking statements may be included in, but are not limited to, various filings made by

XTL with the U.S. Securities and Exchange Commission, press releases or oral statements made by or with the approval of one of XTL’s

authorized executive officers. Forward-looking statements relate to anticipated or expected events, activities, trends or results as

of the date they are made. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently

subject to risks and uncertainties that could cause XTL’s actual results to differ materially from any future results expressed

or implied by the forward-looking statements. Many factors could cause XTL’s actual activities or results to differ materially

from the activities and results anticipated in such forward-looking statements, including, but not limited to, the factors summarized

in XTL’s filings with the SEC and in its periodic filings with the TASE. In addition, XTL operates in an industry sector where

securities values are highly volatile and may be influenced by economic and other factors beyond its control. XTL does not undertake

any obligation to publicly update these forward-looking statements, whether as a result of new information, future events or otherwise.

Please see the risk factors associated with an investment in our ADSs or ordinary shares which are included in our Amended and Restated

Annual Report on Form 20-F/A filed with the U.S. Securities and Exchange Commission on May 19, 2021.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: May 19, 2021

|

XTL BIOPHARMACEUTICALS LTD.

|

|

|

|

|

|

By:

|

/s/

Shlomo Shalev

|

|

|

|

Shlomo Shalev

Chief Executive Officer

|

6

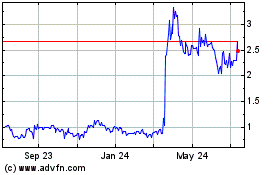

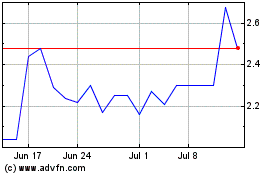

XTL Biopharmaceuticals (NASDAQ:XTLB)

Historical Stock Chart

From Nov 2024 to Dec 2024

XTL Biopharmaceuticals (NASDAQ:XTLB)

Historical Stock Chart

From Dec 2023 to Dec 2024