Form 8-K - Current report

March 07 2024 - 4:16PM

Edgar (US Regulatory)

false

0001083220

0001083220

2024-03-07

2024-03-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 7, 2024

XCEL BRANDS, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-37527 |

|

76-0307819 |

(State or Other Jurisdiction of

Incorporation) |

|

(Commission File

Number) |

|

(IRS Employer Identification

No.) |

| |

|

|

|

|

|

1333 Broadway, New York, New York

(Address of Principal Executive

Offices) |

|

|

|

10018

(Zip Code) |

Registrant’s telephone number, including

area code (347) 727-2474

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which

registered |

| Common Stock, par value $0.001 per share |

XELB |

Nasdaq Capital Market |

| Item 2.02 |

Results of Operations and Financial Conditions |

On March 7, 2024, Xcel Brands,

Inc, (the “Registrant” or the “Company”) is presenting at an investor conference and will be providing the following

preliminary estimated financial information for the three months and year ended December 31, 2023:

| | |

| |

| | |

Three

Months Ended

December 31, 2023 | | |

Year Ended

December 31, 2023 | |

| Revenue | |

$ | 2,130,000 | | |

$ | 17,600,000 | |

| Pretax net loss(1) | |

$ | (5,454,000 | ) | |

$ | (19,708,000 | ) |

| Net

Loss | |

$ | (6,654,000 | ) | |

$ | (20,908,000 | ) |

| Adjusted EBITDA | |

$ | (1,073,000 | ) | |

$ | (5,645,000 | ) |

| (1) | Pretax loss is lower than net loss because the Registrant expects to record an income tax provision of $1.2 million in the fourth quarter

and for the year ended December 31, 2023. Although the Company is expected to present a net loss, the income tax provision relates to adjusting

the reserve for an existing deferred tax asset, and would be a non-cash expense. |

The Registrant also

estimates that it had approximately $3,000,000 of cash and cash equivalents at December 31, 2023. The estimated results for 2023 are

preliminary and unaudited, represent management’s estimate as of the date of the release and are subject to completion of its

financial closing procedures. The Registrant’s independent registered public accounting firm has not conducted an audit or

review of and does not express an opinion or any other form of assurance with respect to the preliminary unaudited results.

Accordingly, undue reliance should not be placed on the preliminary estimates. The preliminary estimates are not necessarily

indicative of any future period results.

In addition, the Registrant

filed a Current Report on Form 8-K on December 4, 2023, that included a presentation which included a forecast for 2024 of top line revenue

and EBITDA of $17.7 million and $5.1 million, respectively. The amounts presented were intended to be company goals, and not indicative

of a forecast. As indicated in the presentation, the goals were provided for illustrative purposes and should not be relied upon as necessarily

being indicative of future results. The assumptions and estimates underlying such information are inherently uncertain and are subject

to a wide variety of significant, business, economic, competitive and other risks and uncertainties that could cause the Registrant‘s results to differ

materially from these stated goals.

The preliminary estimated

financial information contains non-U.S. generally accepted accounting principles (“GAAP”) financial measures. Exhibit 99.1

sets forth the reasons it provided such measures and a reconciliation of the non-U.S. GAAP measures to U.S. GAAP measures. Readers should

consider non-GAAP measures in addition to, and not as a substitute for, measures of financial performance prepared in accordance with

U.S. GAAP.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: March 7, 2024 |

XCEL BRANDS, INC. |

| |

|

| |

|

| |

By: |

/s/ James F. Haran |

| |

Name: |

James F. Haran |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

Reconciliation of Adjusted EBITDA to Net Loss

Amounts presented in $(000’s)

| |

|

Three Months Ended |

|

|

Year Ended |

|

| |

|

December 31, 2023 |

|

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

| Net loss attributable to Xcel Brands, Inc. stockholders |

|

$ |

(6,654 |

) |

|

$ |

(20,908 |

) |

| Depreciation and amortization |

|

|

1,694 |

|

|

|

6,954 |

|

| Proportion share of trademark amortization of equity method investee |

|

|

515 |

|

|

|

2,060 |

|

| Interest and finance expense |

|

|

363 |

|

|

|

381 |

|

| Income tax provision |

|

|

1,200 |

|

|

|

1,200 |

|

| State and local franchise taxes |

|

|

23 |

|

|

|

76 |

|

| Stock-based compensation and cost of licensee warrants |

|

|

32 |

|

|

|

216 |

|

| Gain on the sale of assets and investments |

|

|

(8 |

) |

|

|

(359 |

) |

| Gain on lease termination |

|

|

- |

|

|

|

(445 |

) |

| Asset impairment |

|

|

- |

|

|

|

100 |

|

| Costs associated with restructuring of operations |

|

|

1,762 |

|

|

|

5,080 |

|

| Adjusted EBITDA |

|

$ |

(1,073 |

) |

|

$ |

(5,645 |

) |

Adjusted EBITDA is a non-GAAP unaudited measure,

which the Company defines as net income (loss) attributable to Xcel Brands, Inc. stockholders, before depreciation and amortization, interest and

finance expenses, proportional share of trademark amortization of equity method investee, stock-based compensation, gain on the sale of

assets, gain on lease termination, asset impairment, losses from discontinued businesses and income tax provision and other state and

local franchise taxes.

Management uses Adjusted EBITDA as a measure of

operating performance to assist in comparing performance from period to period on a consistent basis and to identify business trends relating

to the Company’s results of operations. Management believes Adjusted EBITDA is also useful because this measure adjusts for certain

costs and other events that management believes are not representative of the Company’s core business operating results, and thus

this non-GAAP measure provides supplemental information to assist investors in evaluating the Company’s financial results.

Adjusted EBITDA should not be considered in isolation

or as an alternative to net income, or any other measure of financial performance calculated and presented in accordance with GAAP, given

that Adjusted EBITDA is a financial measure not deemed to be in accordance with GAAP and is susceptible to varying calculations. Adjusted

EBITDA may not be comparable to similarly titled measures of other companies, including companies in the Company’s industry, because

other companies may calculate these measures in a different manner than the Company does. In evaluating Adjusted EBITDA, you should be

aware that in the future the Company may or may not incur expenses similar to some of the adjustments in this document. The presentation

of Adjusted EBITDA does not imply that the Company’s future results will be unaffected by these expenses or any unusual or non-recurring

items. When evaluating the Company’s performance, you should consider Adjusted EBITDA alongside other financial performance measures,

including our net income and other GAAP results, and not rely on any single financial measure.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

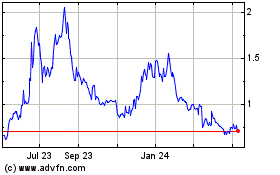

Xcel Brands (NASDAQ:XELB)

Historical Stock Chart

From Dec 2024 to Jan 2025

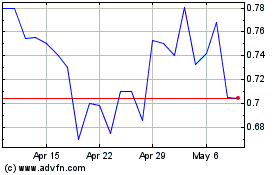

Xcel Brands (NASDAQ:XELB)

Historical Stock Chart

From Jan 2024 to Jan 2025