UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of August 2023

Commission File Number: 001-36158

Wix.com Ltd.

(Translation of registrant’s name into English)

5 Yunitsman St.,

Tel Aviv, Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): __

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): __

EXPLANATORY NOTE

On August 3, 2023, Wix.com Ltd. (NASDAQ: WIX) issued a press release titled “Wix Reports Second Quarter 2023 Results”. A copy of this press release is attached to this Form 6-K as Exhibit 99.1.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: August 3, 2023

WIX.COM LTD.

By: /s/ Naama Kaenan

Name: Naama Kaenan

Title: General Counsel

EXHIBIT INDEX

The following exhibit is filed as part of this Form 6-K:

Exhibit 99.1

Wix Reports Second Quarter 2023 Results

•Outperformance continued in the second quarter with total revenue of $390.0 million exceeding expectations, up 13% y/y as Creative Subscriptions and Business Solutions revenue growth accelerated for third consecutive quarter

•Growing number of Partners1 building on Wix and higher usage of Wix for projects with improved monetization driving growth acceleration of Partners revenue to $115.2 million, up 36% y/y

•Benefits from operational efficiencies completed over the past year across the organization drove profitability improvements, resulting in higher than expected FCF2 margin of 13% and leading to expected acceleration of FCF margin in 2H23

◦Total non-GAAP gross profit up 23% y/y leading to non-GAAP gross margin of 68% and non-GAAP Creative Subscriptions gross margin of 83%, both well ahead of expectations

◦First quarter of positive GAAP operating income in our history totaling $13.0 million, or 3% of revenue and new high-water mark for non-GAAP operating income

•Launched Wix Studio, a revolutionary all-in-one new platform with deep design control, advanced capabilities, workflow management tools and AI products designed specifically for professionals to create, manage and grow more efficiently than ever before

•Expansion of AI and genAI-driven product suite with the introduction of AI Site Generator, AI Assistant for Business, and more

NEW YORK, August 3rd, 2023 -- Wix.com Ltd. (Nasdaq: WIX) today reported financial results for the second quarter of 2023. In addition, the Company provided its outlook for the third quarter and updated outlook for full year 2023. Please visit the Wix Investor Relations website at https://investors.wix.com/ to view the Q2'23 Shareholder Update and other materials.

“It has been an incredible past six months at Wix on many fronts as we generated accelerating profitable growth through execution excellence and focused operational discipline. As a result, Q2 again performed above expectations and exceeded our revenue growth and FCF margin guides. In addition to this outperformance, we also made remarkable strides in our product evolution with the introduction of our new cornerstone Partner product, Wix Studio,” said Avishai Abrahami, Wix Co-founder and CEO. “Wix Studio revolutionizes the way professionals build and manage projects at scale by combining AI-powered features, the latest design and development capabilities and seamless workflows for multi-site management to help freelancers and agencies complete projects with greater quality and velocity and scale their business faster. Our innovation did not stop there this quarter, as we continued to be at the forefront of AI technology with the introduction of exciting AI and gen-AI-driven products coming soon to all Wix users, including AI Site Generator and AI Assistant for Business, among others. With these incredible accomplishments and the momentum we’ve generated this year so far, I am very excited for what is still to come as we continue to build a place for any business, community or person to create their dreams online.”

Lior Shemesh, CFO at Wix, added, “Strong results in Q2 capped off an outstanding first half of 2023 as we delivered consecutive quarters of accelerating profitable growth. Underpinned by strong momentum in our Partners business, improved GPV growth, and encouraging performance of our new cohorts, we exceeded the top end of our guidance expectations with Q2 revenue increasing 13% y/y. In addition, we delivered improved profitability driven by the benefits of the cost actions completed over the past year. As a result, we finished Q2 with non-GAAP gross margin of 68% well ahead of expectations, the first quarter of positive GAAP operating income in our history, demonstrating our progress toward achieving sustained GAAP profitability in the coming years, and higher than expected FCF margin of 13%. We expect to build on the strong performance and momentum of the past six months and anticipate accelerating revenue growth and higher FCF margin in 2H vs. 1H, putting us further down the path of achieving the Rule of 40 in 2025.”

Wix's management team and business leaders will host a virtual Analyst & Investor Day and will share more about Wix's newest product releases, Wix's plans to further incorporate generative AI into our platform, an updated financial framework and commitment to achieving the Rule of 40 in 2025, and planned initiatives to enhance shareholder value.

Prepared video presentations along with accompanying materials will be available after market close on Wednesday, August 9 on https://investors.wix.com/ with a live Q&A event accessible through https://investors.wix.com/ on Thursday, August 10 at 8:30 a.m. ET. Wix management will answer both live and submitted questions. Upon viewing the prepared presentations, analysts and investors are encouraged to submit questions to ir@wix.com. The RSVP form for the Q&A event can be found here.

Q2 2023 Financial Results

•Total revenue in the second quarter of 2023 was $390.0 million, up 13% y/y

•Creative Subscriptions revenue in the second quarter of 2023 was $287.1 million, up 11% y/y

◦Creative Subscriptions ARR increased to $1.16 billion as of the end of the quarter, up 10% y/y

•Business Solutions revenue in the second quarter of 2023 was $102.9 million, up 18% y/y

◦Transaction revenue3 was $44.5 million, up 21% y/y

•Partners revenue1 in the second quarter of 2023 was $115.2 million, up 36% y/y

•Total bookings in the second quarter of 2023 were $398.5 million, up 12% y/y

•Creative Subscriptions bookings in the second quarter of 2023 were $293.9 million, up 9% y/y

•Business Solutions bookings in the second quarter of 2023 were $104.6 million, up 23% y/y

•Total gross margin on a GAAP basis in the second quarter of 2023 was 67%

◦Creative Subscriptions gross margin on a GAAP basis was 82%

◦Business Solutions gross margin on a GAAP basis was 26%

•Total non-GAAP gross margin in the second quarter of 2023 was 68%

◦Creative Subscriptions gross margin on a non-GAAP basis was 83%

◦Business Solutions gross margin on a non-GAAP basis was 28%

•GAAP net income in the second quarter of 2023 was $33.6 million, or $0.59 per share basic share or $0.56 per diluted share

•Non-GAAP net income in the second quarter of 2023 was $78.1 million, or $1.38 per share or $1.26 per diluted share

•Net cash provided by operating activities for the second quarter of 2023 was $47.8 million, while capital expenditures totaled $15.8 million, leading to free cash flow of $32.0 million

•Excluding one-time cash restructuring charges and the capex investment associated with our new headquarters office build out, free cash flow for the second quarter of 2023 would have been $49.1 million, or 13% of revenue

•Completed $300 million share repurchase program authorized by the Board of Directors in September 2022. Repurchased 3.6 million ordinary Wix shares in total, representing 6% of total shares outstanding, at an approximate volume-weighted average price per share of $82.48

•Total employee count at the end of Q2’23 was 5,036, down 14% y/y

____________________

1 Partners revenue is defined as revenue generated through agencies and freelancers that build sites or applications for other users as well as revenue generated through B2B partnerships, such as LegalZoom or Vistaprint, and enterprise partners. We identify agencies and freelancers building sites or applications for others using multiple criteria including but not limited to the number of sites built, participation in the Wix Partner Program and/or the Wix Marketplace or Wix products used. Partners revenue includes revenue from both the Creative Subscriptions and Business Solutions businesses

2 Free cash flow excluding one-time cash restructuring charges and expenses associated with the buildout of our new corporate headquarters

3 Transaction revenue is a portion of Business Solutions revenue, and we define transaction revenue as all revenue generated through transaction facilitation, primarily from Wix Payments as well as Wix POS, shipping solutions and multi-channel commerce and gift card solutions

Financial Outlook

Our outperformance in Q2 builds on the momentum we experienced in the first quarter and provides confidence in our ability to exceed our prior guidance for the year. We expect to accelerate top-line growth and margin expansion through the back half of the year on top of a very strong first half.

We remain committed to achieving the Rule of 40 in 2025, with expectations of continued revenue and free cash flow growth.

We expect Q3 revenue to be $386 - $391 million, or 12 - 13% growth y/y.

Due to the outperformance we experienced in the first half of 2023, we are increasing our full year revenue outlook to $1,543 - $1,558 million, or 11 - 12% y/y growth, an increase from our previous outlook of $1,522 - $1,543 million or 10 - 11% y/y growth. Strong execution on our strategy and continued momentum from our cohorts give us confidence that revenue growth will accelerate in H2 even when compared to an outstanding 1H that exceeded expectations. The mid-point of our guidance range implies acceleration of revenue growth in the second half of the year compared to the first half.

We expect this higher revenue growth outlook will drive increasing profitability throughout 2023 and beyond.

We now anticipate non-GAAP gross margin of approximately 68% for the full year, up from our previous expectation of approximately 67% for the full year 2023, driven by increased profitability across both Creative Subscriptions and Business Solutions.

We now anticipate Creative Subscriptions non-GAAP gross margin of approximately 82% for the full year, up from our previous expectation of approximately 81%. We now anticipate Business Solutions non-GAAP gross margin of approximately 28% for the full year, up from our previous expectation of approximately 27%.

Non-GAAP operating expenses are expected to decrease to 56-57% of revenue for the full year, down from our previous expectation of 58-59% of revenue. This decrease is primarily driven by lower marketing expenses than previously anticipated.

Non-GAAP sales and marketing expenses are now expected to be approximately 25-26% of revenue in 2023, down from our previous expectation of approximately 27% of revenue.

As a result of accelerating revenue and incremental profitability improvements through the back half of the year, we are increasing our outlook for free cash flow, excluding HQ and cash restructuring costs, for the year to $200 - $210 million, or 13% of revenue, and we expect to exit 2023 with a free cash flow margin of approximately 15%. This compares to our previous free cash flow outlook of $172 - $180 million, or 11 - 12% of revenue and an exit rate of more than 13%. Our revised guidance for FCF implies acceleration of FCF margin in the second half of the year.

Note that our revised outlook excludes $4.5 million in cash restructuring costs.

Finally, stock-based compensation is expected to decrease to 14% of revenue in 2023, previously anticipated to be 14-15%. We expect stock-based compensation as a percentage of revenue to continue to decline y/y through 2025.

Conference Call and Webcast Information

Wix will host a conference call to discuss the results at 8:30 a.m. ET on Thursday, August 3rd, 2023. To participate on the live call, analysts and investors should register and join at https://register.vevent.com/register/BI43da875845cc4cc985840bc36c0cd273. A replay of the call will be available through August 2nd, 2024 via the registration link.

Wix will also offer a live and archived webcast of the conference call, accessible from the "Investor Relations" section of the Company’s website at https://investors.wix.com/.

About Wix.com Ltd.

Wix is a leading platform to create, manage and grow a digital presence. What began as a website builder in 2006 is now a complete platform providing users with enterprise-grade performance, security and a reliable infrastructure. Offering a wide range of commerce and business solutions, advanced SEO and marketing tools, Wix enables users to take full ownership of their brand, their data and their relationships with their customers. With a focus on continuous innovation and delivery of new features and products, anyone can build a powerful digital presence to fulfill their dreams on Wix.

For more about Wix, please visit our Press Room

Investor Relations:

ir@wix.com

Media Relations:

pr@wix.com

Non-GAAP Financial Measures and Key Operating Metrics

To supplement its consolidated financial statements, which are prepared and presented in accordance with U.S. GAAP, Wix uses the following non-GAAP financial measures: bookings, cumulative cohort bookings, bookings on a constant currency basis, revenue on a constant currency basis, non-GAAP gross margin, non-GAAP operating income (loss), non-GAAP operating margin, non-GAAP net income (loss), non-GAAP net income (loss) per share, free cash flow, free cash flow, as adjusted, free cash flow margins, non-GAAP R&D expenses, non-GAAP S&M expenses, non-GAAP G&A expenses, non-GAAP operating expenses, non-GAAP cost of revenue expense, non-GAAP financial expense, non-GAAP tax expense (collectively the "Non-GAAP financial measures"). Measures presented on a constant currency or foreign exchange neutral basis have been adjusted to exclude the effect of y/y changes in foreign currency exchange rate fluctuations. Bookings is a non-GAAP financial measure calculated by adding the change in deferred revenues and the change in unbilled contractual obligations for a particular period to revenues for the same period. Bookings include cash receipts for premium subscriptions purchased by users as well as cash we collect from business solutions, as well as payments due to us under the terms of contractual agreements for which we may have not yet received payment. Cash receipts for premium subscriptions are deferred and recognized as revenues over the terms of the subscriptions. Cash receipts for payments and the majority of the additional products and services (other than Google Workspace) are recognized as revenues upon receipt. Committed payments are recognized as revenue as we fulfill our obligation under the terms of the contractual agreement. Non-GAAP gross margin represents gross profit calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, acquisition-related expenses and amortization, divided by revenue. Non-GAAP operating income (loss) represents operating income (loss) calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, amortization, acquisition-related expenses and sales tax expense accrual and other G&A expenses (income). Non-GAAP net income (loss) represents net loss calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, amortization, sales tax expense accrual and other G&A expenses (income), amortization of debt discount and debt issuance costs and acquisition-related expenses and non-operating foreign exchange expenses (income). Non-GAAP net income (loss) per share represents non-GAAP net income (loss) divided by the weighted average number of shares used in computing GAAP loss per share. Free cash flow represents net cash provided by (used in) operating activities less capital expenditures. Free cash flow, as adjusted, represents free cash flow further adjusted to exclude one-time cash restructuring charges and the capital expenditures and other expenses associated with the buildout of our new corporate headquarters. Free cash flow margins represent free cash flow divided by revenue. Non-GAAP cost of revenue represents cost of revenue calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, acquisition-related expenses and amortization. Non-GAAP R&D expenses represent R&D expenses calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, acquisition-related expenses and amortization. Non-GAAP S&M expenses represent S&M expenses calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, acquisition-related expenses and amortization. Non-GAAP G&A expenses represent G&A expenses calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, acquisition-related expenses and amortization. Non-GAAP operating expenses represent operating expenses calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, acquisition-related expenses and amortization. Non-GAAP financial expense represents financial expense calculated in accordance with GAAP as adjusted for unrealized gains of equity investments, amortization of debt discount and debt issuance costs and non-operating foreign exchange expenses. Non-GAAP tax expense represents tax expense calculated in accordance with GAAP as adjusted for provisions for income tax effects related to non-GAAP adjustments.

The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. The Company uses these non-GAAP financial measures for financial and operational decision making and as a means to evaluate period-to-period comparisons. The Company believes that these measures provide useful information about operating results, enhance the overall understanding of past financial performance and future prospects, and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making.

For more information on the non-GAAP financial measures, please see the reconciliation tables provided below. The accompanying tables have more details on the GAAP financial measures that are most directly comparable to non-GAAP financial measures and the related reconciliations between these financial measures. The Company is unable to provide reconciliations of free cash flow, free cash flow, as adjusted, cumulative cohort bookings, non-GAAP gross margin, and non-GAAP tax expense to their most directly comparable GAAP financial measures on a forward-looking basis without unreasonable effort because items that impact those GAAP financial measures are out of the Company's control and/or cannot be reasonably predicted. Such information may have a significant, and potentially unpredictable, impact on our future financial results.

Wix also uses Creative Subscriptions Annualized Recurring Revenue (ARR) as a key operating metric. Creative Subscriptions ARR is calculated as Creative Subscriptions Monthly Recurring Revenue (MRR) multiplied by 12. Creative Subscriptions MRR is calculated as the total of (i) all Creative Subscriptions in effect on the last day of the period, multiplied by the monthly revenue of such Creative Subscriptions, other than domain registrations; (ii) the average revenue per month from domain registrations in effect on the last day of the period; and (iii) monthly revenue from other partnership agreements and enterprise partners.

Forward-Looking Statements

This document contains forward-looking statements, within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. Such forward-looking statements may include projections regarding our future performance, including, but not limited to revenue, bookings and free cash flow, and may be identified by words like “anticipate,” “assume,” “believe,” “aim,” “forecast,” “indication,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “outlook,” “future,” “will,” “seek” and similar terms or phrases. The forward-looking statements contained in this document, including the quarterly and annual guidance, are based on management’s current expectations, which are subject to uncertainty, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Important factors that could cause our actual results to differ materially from those indicated in the forward-looking statements include, among others, our expectation that we will be able to attract and retain registered users and generate new premium subscriptions, in particular as we continuously adjust our marketing strategy and as the macro-economic environment continues to be turbulent; our expectation that we will be able to increase the average revenue we derive per premium subscription, including through our partners; our expectations related to our ability to develop relevant and required products using Artificial Intelligence (“AI”), the regulatory environment impacting AI related activities including privacy and intellectual property aspects, and potential competition from third-party AI tools which may impact our business; our expectation that new products and developments, as well as third-party products we will offer in the future within our platform, will receive customer acceptance and satisfaction, including the growth in market adoption of our online commerce solutions; our assumption that historical user behavior can be extrapolated to predict future user behavior, in particular during the current turbulent macro-economic environment; our expectation regarding the successful impact of our previously announced Cost-Efficiency Plan and other cost saving measures we may take in the future; our prediction of the future revenues generated by our user cohorts and our ability to maintain and increase such revenue growth, as well as our ability to generate and maintain elevated levels of free cash flow and profitability; our expectation to maintain and enhance our brand and reputation; our expectation that we will effectively execute our initiatives to improve our user support function through our Customer Care team, and that our recent downsizing of our Customer Care team will not affect our ability to continue attracting registered users and increase user retention, user engagement and sales; our plans to successfully localize our products, including by making our product, support and communication channels available in additional languages and to expand our payment infrastructure to transact in additional local currencies and accept additional payment methods; our expectation regarding the impact of fluctuations in foreign currency exchange rates, interest rates, potential illiquidity of banking systems, and other recessionary trends on our business; our expectations relating to the repurchase of our ordinary shares and/or Convertible Notes pursuant to our repurchase program; our expectation that we will effectively manage our infrastructure; changes we expect may occur to technologies used in our solutions, including through newly emerging AI technologies; our expectations regarding the outcome of any regulatory investigation or litigation, including class actions; our expectations regarding future changes in our cost of revenues and our operating expenses on an absolute basis and as a percentage of our revenues, as well as our ability to achieve profitability; our expectations regarding changes in the global, national, regional or local economic, business, competitive, market, and regulatory landscape, including as a result of COVID-19 and as a result of the military invasion of Ukraine by Russia; our planned level of capital expenditures and our belief that our existing cash and cash from operations will be sufficient to fund our operations for at least the next 12 months and for the foreseeable future; our expectations with respect to the integration and performance of acquisitions; our ability to attract and retain qualified employees and key personnel;

and our expectations about entering into new markets and attracting new customer demographics, including our ability to successfully attract new partners large enterprise-level users and to grow our activities with these customer types as anticipated and other factors discussed under the heading “Risk Factors” in the Company’s annual report on Form 20-F for the year ended December 31, 2022 filed with the Securities and Exchange Commission on March 30, 2023. The preceding list is not intended to be an exhaustive list of all of our forward-looking statements. Any forward-looking statement made by us in this press release speaks only as of the date hereof. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise.

###

| | |

| Wix.com Ltd. |

| CONSOLIDATED STATEMENTS OF OPERATIONS - GAAP |

| (In thousands, except loss per share data) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended | | Six Months Ended | | | | | | | | |

| | | | June 30, | | June 30, | | | | | | | | |

| | | | | | 2023 | | 2022 | | 2023 | | 2022 | | | | | | | | | | | | | | | | |

| | | | (unaudited) | | (unaudited) | | | | | | | | |

| Revenues | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Creative Subscriptions | | | | | $ | 287,089 | | | $ | 258,177 | | | $ | 565,219 | | | $ | 513,145 | | | | | | | | | | | | | | | | | |

| Business Solutions | | | | | 102,888 | | | 87,047 | | | 198,834 | | | 173,676 | | | | | | | | | | | | | | | | | |

| | | | | 389,977 | | | 345,224 | | | 764,053 | | | 686,821 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cost of Revenues | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Creative Subscriptions | | | | | 52,050 | | | 66,252 | | | 109,534 | | | 131,125 | | | | | | | | | | | | | | | | | |

| Business Solutions | | | | | 75,844 | | | 68,605 | | | 147,838 | | | 138,481 | | | | | | | | | | | | | | | | | |

| | | | | 127,894 | | | 134,857 | | | 257,372 | | | 269,606 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross Profit | | | | | 262,083 | | | 210,367 | | | 506,681 | | | 417,215 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Research and development | | | | | 115,490 | | | 121,618 | | | 230,433 | | | 241,483 | | | | | | | | | | | | | | | | | |

| Selling and marketing | | | | | 96,037 | | | 120,780 | | | 195,170 | | | 277,494 | | | | | | | | | | | | | | | | | |

| General and administrative | | | | | 37,250 | | | 42,991 | | | 75,767 | | | 88,677 | | | | | | | | | | | | | | | | | |

| Impairment, restructuring and other costs | | | | | 330 | | | — | | | 25,668 | | | — | | | | | | | | | | | | | | | | | |

| Total operating expenses | | | | | 249,107 | | | 285,389 | | | 527,038 | | | 607,654 | | | | | | | | | | | | | | | | | |

| Operating income (loss) | | | | | 12,976 | | | (75,022) | | | (20,357) | | | (190,439) | | | | | | | | | | | | | | | | | |

| Financial income (expenses), net | | | | | 20,053 | | | (46,926) | | | 41,430 | | | (191,399) | | | | | | | | | | | | | | | | | |

| Other income | | | | | 118 | | | 58 | | | 175 | | | 104 | | | | | | | | | | | | | | | | | |

| Income (loss) before taxes on income | | | | | 33,147 | | | (121,890) | | | 21,248 | | | (381,734) | | | | | | | | | | | | | | | | | |

| Income tax benefit | | | | | (430) | | | (10,652) | | | (1,960) | | | (43,207) | | | | | | | | | | | | | | | | | |

| Net income (loss) | | | | | $ | 33,577 | | | $ | (111,238) | | | $ | 23,208 | | | $ | (338,527) | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic net income (loss) per share | | | | | $ | 0.59 | | | $ | (1.92) | | | $ | 0.41 | | | $ | (5.87) | | | | | | | | | | | | | | | | | |

| Basic weighted-average shares used to compute net income (loss) per share | | | | | 56,744,007 | | | 57,943,140 | | 56,576,286 | | | 57,712,372 | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Diluted net income (loss) per share | | | | | $ | 0.56 | | | $ | (1.92) | | | $ | 0.40 | | | $ | (5.87) | | | | | | | | | | | | | | | | | |

| Diluted weighted-average shares used to compute net income (loss) per share | | | | | 62,186,895 | | | 57,943,140 | | 58,180,044 | | | 57,712,372 | | | | | | | | | | | | | | | | |

| | |

| Wix.com Ltd. |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (In thousands) |

| | | | | | | | | | | | | | | | | |

| | | Period ended |

| | | | June 30, | | | | | | December 31, |

| | | | 2023 | | | | | | 2022 |

| Assets | | | (unaudited) | | | | | | (audited) |

| Current Assets: | | | | | | | | | |

| Cash and cash equivalents | | | $ | 468,037 | | | | | | | $ | 244,686 | |

| Short-term deposits | | | 176,429 | | | | | | | 526,328 | |

| Restricted deposits | | | 3,219 | | | | | | | 13,669 | |

| Marketable securities | | | 184,458 | | | | | | | 292,449 | |

| Trade receivables | | | 53,268 | | | | | | | 42,086 | |

| Prepaid expenses and other current assets | | | 38,819 | | | | | | | 28,519 | |

| Total current assets | | | 924,230 | | | | | | | 1,147,737 | |

| | | | | | | | | |

| Long-Term Assets: | | | | | | | | | |

| Prepaid expenses and other long-term assets | | | 23,766 | | | | | | | 23,027 | |

| Property and equipment, net | | | 125,401 | | | | | | | 108,738 | |

| Marketable securities | | | 101,520 | | | | | | | 194,964 | |

| Intangible assets and goodwill, net | | | 80,316 | | | | | | | 83,293 | |

| Operating lease right-of-use assets | | | 420,073 | | | | | | | 200,608 | |

| Total long-term assets | | | 751,076 | | | | | | | 610,630 | |

| | | | | | | | | |

| Total assets | | | $ | 1,675,306 | | | | | | | $ | 1,758,367 | |

| | | | | | | | | | |

| Liabilities and Shareholders' Deficiency | | | | | | | | | |

| Current Liabilities: | | | | | | | | | |

| Trade payables | | | $ | 41,467 | | | | | | | $ | 96,071 | |

| Employees and payroll accruals | | | 58,139 | | | | | | | 86,113 | |

| Deferred revenues | | | 584,028 | | | | | | | 529,205 | |

| Current portion of convertible notes, net | | | — | | | | | | | 361,621 | |

| Accrued expenses and other current liabilities | | | 88,414 | | | | | | | 88,194 | |

| Operating lease liabilities | | | 18,461 | | | | | | | 29,268 | |

| Total current liabilities | | | 790,509 | | | | | | | 1,190,472 | |

| Long Term Liabilities: | | | | | | | | | |

| Long-term deferred revenues | | | 88,789 | | | | | | | 70,594 | |

| Long-term deferred tax liability | | | 8,725 | | | | | | | 14,902 | |

| Convertible notes, net | | | 568,138 | | | | | | | 566,566 | |

| Other long-term liabilities | | | 9,708 | | | | | | | 6,093 | |

| Long-term operating lease liabilities | | | 386,608 | | | | | | | 172,982 | |

| Total long-term liabilities | | | 1,061,968 | | | | | | | 831,137 | |

| | | | | | | | | |

| Total liabilities | | | 1,852,477 | | | | | | | 2,021,609 | |

| | | | | | | | | | |

| Shareholders' Deficiency | | | | | | | | | |

| Ordinary shares | | | 104 | | | | | | | 108 | |

| Additional paid-in capital | | | 1,404,479 | | | | | | | 1,274,968 | |

| Treasury Stock | | | (500,174) | | | | | | | (431,862) | |

| Accumulated other comprehensive loss | | | (31,787) | | | | | | | (33,455) | |

| Accumulated deficit | | | (1,049,793) | | | | | | | (1,073,001) | |

| Total shareholders' deficiency | | | (177,171) | | | | | | | (263,242) | |

| | | | | | | | | |

| Total liabilities and shareholders' deficiency | | | $ | 1,675,306 | | | | | | | $ | 1,758,367 | |

| | |

| Wix.com Ltd. |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (In thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended | | Six Months Ended | | | | | | | | |

| | | | June 30, | | June 30, | | | | | | | | |

| | | | | | 2023 | | 2022 | | 2023 | | 2022 | | | | | | | | | | | | | | | | |

| | | | (unaudited) | | (unaudited) | | | | | | | | |

| OPERATING ACTIVITIES: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) | | | | | $ | 33,577 | | | $ | (111,238) | | | $ | 23,208 | | | $ | (338,527) | | | | | | | | | | | | | | | | | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Depreciation | | | | | 4,497 | | | 4,022 | | | 9,419 | | | 7,557 | | | | | | | | | | | | | | | | | |

| Amortization | | | | | 1,489 | | | 1,580 | | | 2,977 | | | 3,154 | | | | | | | | | | | | | | | | | |

| Share based compensation expenses | | | | | 53,660 | | | 59,139 | | | 108,181 | | | 120,123 | | | | | | | | | | | | | | | | | |

| Amortization of debt discount and debt issuance costs | | | | | 1,310 | | | 1,302 | | | 2,618 | | | 2,603 | | | | | | | | | | | | | | | | | |

| Changes in accrued interest and exchange rate on short term and long term deposits | | | | | 133 | | | (210) | | | 108 | | | (165) | | | | | | | | | | | | | | | | | |

| Non-cash impairment, restructuring and other costs | | | | | 330 | | | — | | | 21,164 | | | — | | | | | | | | | | | | | | | | | |

| Amortization of premium and discount and accrued interest on marketable securities, net | | | | | 4,132 | | | 1,256 | | | 4,672 | | | 2,805 | | | | | | | | | | | | | | | | | |

| Remeasurement loss (gain) on Marketable equity | | | | | (8,814) | | | 54,920 | | | (22,712) | | | 206,565 | | | | | | | | | | | | | | | | | |

| Deferred income taxes, net | | | | | (6,318) | | | (12,644) | | | (10,462) | | | (48,219) | | | | | | | | | | | | | | | | | |

| Changes in operating lease right-of-use assets | | | | | 5,356 | | | 9,737 | | | 11,152 | | | 18,575 | | | | | | | | | | | | | | | | | |

| Changes in operating lease liabilities | | | | | (26,208) | | | (15,525) | | | (34,329) | | | (25,172) | | | | | | | | | | | | | | | | | |

| Decrease (increase) in trade receivables | | | | | (708) | | | 1,216 | | | (11,182) | | | (10,433) | | | | | | | | | | | | | | | | | |

| Decrease (increase) in prepaid expenses and other current and long-term assets | | | | | 8,000 | | | (15,032) | | | (2,858) | | | (27,345) | | | | | | | | | | | | | | | | | |

| Increase (decrease) in trade payables | | | | | (11,301) | | | (9,573) | | | (52,971) | | | 12,113 | | | | | | | | | | | | | | | | | |

| Decrease in employees and payroll accruals | | | | | (17,932) | | | (342) | | | (27,974) | | | (5,082) | | | | | | | | | | | | | | | | | |

| Increase in short term and long term deferred revenues | | | | | 12,043 | | | 7,731 | | | 73,018 | | | 45,283 | | | | | | | | | | | | | | | | | |

| Increase (decrease) in accrued expenses and other current liabilities | | | | | (5,485) | | | 20,974 | | | (307) | | | 19,816 | | | | | | | | | | | | | | | | | |

| Net cash provided by (used in) operating activities | | | | | 47,761 | | | (2,687) | | | 93,722 | | | (16,349) | | | | | | | | | | | | | | | | | |

| INVESTING ACTIVITIES: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proceeds from short-term deposits and restricted deposits | | | | | 367,610 | | | 126,259 | | | 423,701 | | | 231,259 | | | | | | | | | | | | | | | | | |

| Investment in short-term deposits and restricted deposits | | | | | (4,480) | | | (240,972) | | | (63,460) | | | (390,972) | | | | | | | | | | | | | | | | | |

| Investment in marketable securities | | | | | — | | | (92,408) | | | — | | | (164,563) | | | | | | | | | | | | | | | | | |

| Proceeds from marketable securities | | | | | 115,979 | | | 78,870 | | | 174,369 | | | 140,250 | | | | | | | | | | | | | | | | | |

| Purchase of property and equipment and lease prepayment | | | | | (15,175) | | | (12,629) | | | (34,749) | | | (31,912) | | | | | | | | | | | | | | | | | |

| Capitalization of internal use of software | | | | | (576) | | | (588) | | | (1,934) | | | (1,229) | | | | | | | | | | | | | | | | | |

| Investment in other assets | | | | | (111) | | | — | | | (111) | | | — | | | | | | | | | | | | | | | | | |

| Proceeds from sale of equity securities | | | | | 17,607 | | | — | | | 49,468 | | | 3,193 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Purchases of investments in privately held companies | | | | | — | | | (1,000) | | | (7,500) | | | (1,160) | | | | | | | | | | | | | | | | | |

| Net cash provided by (used in) investing activities | | | | | 480,854 | | | (142,468) | | | 539,784 | | | (215,134) | | | | | | | | | | | | | | | | | |

| FINANCING ACTIVITIES: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proceeds from exercise of options and ESPP shares | | | | | 1,176 | | | 432 | | | 20,831 | | | 22,014 | | | | | | | | | | | | | | | | | |

| Purchase of treasury stock | | | | | (50,000) | | | — | | | (68,319) | | | — | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Repayment of convertible notes | | | | | (362,667) | | | — | | | (362,667) | | | — | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net cash provided by (used in) financing activities | | | | | (411,491) | | | 432 | | | (410,155) | | | 22,014 | | | | | | | | | | | | | | | | | |

| INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | | | | | 117,124 | | | (144,723) | | | 223,351 | | | (209,469) | | | | | | | | | | | | | | | | | |

| CASH AND CASH EQUIVALENTS—Beginning of period | | | | | 350,913 | | | 386,609 | | | 244,686 | | | 451,355 | | | | | | | | | | | | | | | | | |

| CASH AND CASH EQUIVALENTS—End of period | | | | | $ | 468,037 | | | $ | 241,886 | | | $ | 468,037 | | | $ | 241,886 | | | | | | | | | | | | | | | | | |

| | | | | | |

| Wix.com Ltd. |

| KEY PERFORMANCE METRICS |

| (In thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended | | Six Months Ended | | | | | | | | |

| | | | June 30, | | June 30, | | | | | | | | |

| | | | | | 2023 | | 2022 | | 2023 | | 2022 | | | | | | | | | | | | | | | | |

| | | | (unaudited) | | (unaudited) | | | | | | | | |

| Creative Subscriptions | | | | | 287,089 | | | 258,177 | | | 565,219 | | | 513,145 | | | | | | | | | | | | | | | | | |

| Business Solutions | | | | | 102,888 | | | 87,047 | | | 198,834 | | | 173,676 | | | | | | | | | | | | | | | | | |

| Total Revenues | | | | | $ | 389,977 | | | $ | 345,224 | | | $ | 764,053 | | | $ | 686,821 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Creative Subscriptions | | | | | 293,929 | | | 269,921 | | | 607,358 | | | 569,708 | | | | | | | | | | | | | | | | | |

| Business Solutions | | | | | 104,570 | | | 84,673 | | | 206,046 | | | 178,134 | | | | | | | | | | | | | | | | | |

| Total Bookings | | | | | $ | 398,499 | | | $ | 354,594 | | | $ | 813,404 | | | $ | 747,842 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Free Cash Flow | | | | | $ | 32,010 | | | $ | (15,904) | | | $ | 57,039 | | | $ | (49,490) | | | | | | | | | | | | | | | | | |

| Free Cash Flow excluding HQ build out, impairment and restructuring costs | | | | | $ | 49,093 | | | $ | (5,993) | | | $ | 93,122 | | | $ | (24,141) | | | | | | | | | | | | | | | | | |

| Creative Subscriptions ARR | | | | | $ | 1,159,744 | | | $ | 1,052,852 | | | $ | 1,159,744 | | | $ | 1,052,852 | | | | | | | | | | | | | | | | | |

| | | | | | |

| Wix.com Ltd. |

| RECONCILIATION OF REVENUES TO BOOKINGS |

| (In thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended | | Six Months Ended | | | | | | | | |

| | | | June 30, | | June 30, | | | | | | | | |

| | | | | | 2023 | | 2022 | | 2023 | | 2022 | | | | | | | | | | | | | | | | |

| | | | (unaudited) | | (unaudited) | | | | | | | | |

| Revenues | | | | | $ | 389,977 | | | $ | 345,224 | | | $ | 764,053 | | | $ | 686,821 | | | | | | | | | | | | | | | | | |

| Change in deferred revenues | | | | | 12,043 | | | 7,731 | | | 73,018 | | | 45,283 | | | | | | | | | | | | | | | | | |

| Change in unbilled contractual obligations | | | | | (3,521) | | | 1,639 | | (23,667) | | | 15,738 | | | | | | | | | | | | | | | | | |

| Bookings | | | | | $ | 398,499 | | | $ | 354,594 | | | $ | 813,404 | | | $ | 747,842 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended | | Six Months Ended | | | | | | | | |

| | | | June 30, | | June 30, | | | | | | | | |

| | | | | | 2023 | | 2022 | | 2023 | | 2022 | | | | | | | | | | | | | | | | |

| | | | (unaudited) | | (unaudited) | | | | | | | | |

| Creative Subscriptions Revenues | | | | | $ | 287,089 | | | $ | 258,177 | | | $ | 565,219 | | | $ | 513,145 | | | | | | | | | | | | | | | | | |

| Change in deferred revenues | | | | | 10,361 | | | 10,105 | | | 65,806 | | | 40,825 | | | | | | | | | | | | | | | | | |

| Change in unbilled contractual obligations | | | | | (3,521) | | | 1,639 | | | (23,667) | | | 15,738 | | | | | | | | | | | | | | | | | |

| Creative Subscriptions Bookings | | | | | $ | 293,929 | | | $ | 269,921 | | | $ | 607,358 | | | $ | 569,708 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended | | Six Months Ended | | | | | | | | |

| | | | June 30, | | June 30, | | | | | | | | |

| | | | | | 2023 | | 2022 | | 2023 | | 2022 | | | | | | | | | | | | | | | | |

| | | | (unaudited) | | (unaudited) | | | | | | | | |

| Business Solutions Revenues | | | | | $ | 102,888 | | | $ | 87,047 | | | $ | 198,834 | | | $ | 173,676 | | | | | | | | | | | | | | | | | |

| Change in deferred revenues | | | | | 1,682 | | | (2,374) | | | 7,212 | | | 4,458 | | | | | | | | | | | | | | | | | |

| Business Solutions Bookings | | | | | $ | 104,570 | | | $ | 84,673 | | | $ | 206,046 | | | $ | 178,134 | | | | | | | | | | | | | | | | | |

| | | | | | |

| Wix.com Ltd. |

| RECONCILIATION OF COHORT BOOKINGS |

| (In millions) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended | | | | | | | | | | |

| | | June 30, | | | | | | | | | | |

| | | | | | 2023 | | 2022 | | | | | | | | | | | | | | | | | | | | |

| | | | | (unaudited) | | | | | | | | | | |

| Q1 Cohort revenues | | | | | $20 | | $19 | | | | | | | | | | | | | | | | | | | | |

| Q1 Change in deferred revenues | | | | | 23 | | 21 | | | | | | | | | | | | | | | | | | | | |

| Q1 Cohort Bookings | | | | | $ | 43 | | | $ | 40 | | | | | | | | | | | | | | | | | | | | | |

| | |

| Wix.com Ltd. |

| RECONCILIATION OF REVENUES AND BOOKINGS EXCLUDING FX IMPACT |

| (In thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | Three Months Ended | | | | | | | | | | |

| | | | June 30, | | | | | | | | | | | | | | | | | | | | |

| | | | | 2023 | | 2022 | | | | | | | | | | |

| Revenues | | | (unaudited) | | | | | | | | | | | | | | | | | | | | |

| FX impact on Q2/23 using Y/Y rates | | | | | $ | 389,977 | | | $ | 345,224 | | | | | | | | | | | | | | | | | | | | | |

| Revenues excluding FX impact | | | | | 1,157 | | | — | | | | | | | | | | | | | | | | | | | | | |

| | | | | $ | 391,134 | | | $ | 345,224 | | | | | | | | | | | | | | | | | | | | | |

| Y/Y growth | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | 13 | % | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | | | | | | | | | | | | | | |

| | | June 30, | | | | | | | | | | | | | | | | | | | | |

| | | | | 2023 | | 2022 | | | | | | | | | | | | | | | | |

| Bookings | | | (unaudited) | | | | | | | | | | | | | | | | | | | | |

| FX impact on Q2/23 using Y/Y rates | | | | | $ | 398,499 | | | $ | 354,594 | | | | | | | | | | | | | | | | | | | | | |

| Bookings excluding FX impact | | | | | (135) | | | — | | | | | | | | | | | | | | | | | | | | | |

| | | | | $ | 398,364 | | | $ | 354,594 | | | | | | | | | | | | | | | | | | | | | |

| Y/Y growth | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | 12 | % | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Wix.com Ltd. |

| TOTAL ADJUSTMENTS GAAP TO NON-GAAP |

| (In thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Six Months Ended | | | | | | | | |

| | | June 30, | | June 30, | | | | | | | | |

| | | | | | 2023 | | 2022 | | 2023 | | 2022 | | | | | | | | | | | | | | | | |

| (1) Share based compensation expenses: | | | (unaudited) | | (unaudited) | | | | | | | | |

| Cost of revenues | | | | | $ | 3,479 | | | $ | 4,555 | | | $ | 7,717 | | | $ | 8,786 | | | | | | | | | | | | | | | | | |

| Research and development | | | | | 28,778 | | | 29,919 | | | 57,072 | | | 58,639 | | | | | | | | | | | | | | | | | |

| Selling and marketing | | | | | 9,652 | | | 10,019 | | | 19,210 | | | 19,894 | | | | | | | | | | | | | | | | | |

| General and administrative | | | | | 11,751 | | | 14,646 | | | 24,182 | | | 32,804 | | | | | | | | | | | | | | | | | |

| Total share based compensation expenses | | | | | 53,660 | | | 59,139 | | | 108,181 | | | 120,123 | | | | | | | | | | | | | | | | | |

| (2) Amortization | | | | | 1,489 | | | 1,580 | | | 2,977 | | | 3,154 | | | | | | | | | | | | | | | | | |

| (3) Acquisition related expenses | | | | | 244 | | | 1,187 | | 440 | | | 2,886 | | | | | | | | | | | | | | | | | |

| (4) Amortization of debt discount and debt issuance costs | | | | | 1,310 | | | 1,302 | | 2,618 | | | 2,603 | | | | | | | | | | | | | | | | | |

| (5) Impairment, restructuring and other costs | | | | | 330 | | | 0 | | 25,668 | | | — | | | | | | | | | | | | | | | | | |

| (6) Sales tax accrual and other G&A expenses (income) | | | | | 157 | | | 189 | | 465 | | | 361 | | | | | | | | | | | | | | | | | |

| (7) Unrealized loss (gain) on equity and other investments | | | | | (8,814) | | | 54,920 | | | (22,712) | | | 206,565 | | | | | | | | | | | | | | | | | |

| (8) Non-operating foreign exchange expenses (income) | | | | | (1,843) | | | (2,274) | | | (5,505) | | | 1,858 | | | | | | | | | | | | | | | | | |

| (9) Provision for income tax effects related to non-GAAP adjustments | | | | | (2,022) | | | (12,632) | | | (6,153) | | | (48,244) | | | | | | | | | | | | | | | | | |

| Total adjustments of GAAP to Non GAAP | | | | | $ | 44,511 | | | $ | 103,411 | | | $ | 105,979 | | | $ | 289,306 | | | | | | | | | | | | | | | | | |

| | | | | | |

| Wix.com Ltd. |

| RECONCILIATION OF GAAP TO NON-GAAP GROSS PROFIT |

| (In thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Six Months Ended | | | | | | | | |

| | | June 30, | | June 30, | | | | | | | | |

| | | | | | 2023 | | 2022 | | 2023 | | 2022 | | | | | | | | | | | | | | | | |

| | | (unaudited) | | (unaudited) | | | | | | | | |

| Gross Profit | | | | | $ | 262,083 | | | $ | 210,367 | | | $ | 506,681 | | | $ | 417,215 | | | | | | | | | | | | | | | | | |

| Share based compensation expenses | | | | | 3,479 | | | 4,555 | | | 7,717 | | | 8,786 | | | | | | | | | | | | | | | | | |

| Acquisition related expenses | | | | | 183 | | | 59 | | 207 | | | 140 | | | | | | | | | | | | | | | | | |

| Amortization | | | | | 667 | | | 759 | | 1,334 | | | 1,520 | | | | | | | | | | | | | | | | | |

| Non GAAP Gross Profit | | | | | 266,412 | | | 215,740 | | | 515,939 | | | 427,661 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non GAAP Gross margin | | | | | 68 | % | | 62 | % | | 68 | % | | 62 | % | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Six Months Ended | | | | | | | | |

| | | June 30, | | June 30, | | | | | | | | |

| | | | | | 2023 | | 2022 | | 2023 | | 2022 | | | | | | | | | | | | | | | | |

| | | (unaudited) | | (unaudited) | | | | | | | | |

| Gross Profit - Creative Subscriptions | | | | | $ | 235,039 | | | $ | 191,925 | | | $ | 455,685 | | | $ | 382,020 | | | | | | | | | | | | | | | | | |

| Share based compensation expenses | | | | | 2,562 | | | 3,608 | | 5,713 | | | 6,993 | | | | | | | | | | | | | | | | | |

| Non GAAP Gross Profit - Creative Subscriptions | | | | | 237,601 | | | 195,533 | | | 461,398 | | | 389,013 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non GAAP Gross margin - Creative Subscriptions | | | | | 83 | % | | 76 | % | | 82 | % | | 76 | % | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Six Months Ended | | | | | | | | |

| | | June 30, | | June 30, | | | | | | | | |

| | | | | | 2023 | | 2022 | | 2023 | | 2022 | | | | | | | | | | | | | | | | |

| | | (unaudited) | | (unaudited) | | | | | | | | |

| Gross Profit - Business Solutions | | | | | $ | 27,044 | | | $ | 18,442 | | | $ | 50,996 | | | $ | 35,195 | | | | | | | | | | | | | | | | | |

| Share based compensation expenses | | | | | 917 | | | 947 | | | 2,004 | | | 1,793 | | | | | | | | | | | | | | | | | |

| Acquisition related expenses | | | | | 183 | | | 59 | | | 207 | | | 140 | | | | | | | | | | | | | | | | | |

| Amortization | | | | | 667 | | | 759 | | | 1,334 | | | 1,520 | | | | | | | | | | | | | | | | | |

| Non GAAP Gross Profit - Business Solutions | | | | | 28,811 | | | 20,207 | | | 54,541 | | | 38,648 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non GAAP Gross margin - Business Solutions | | | | | 28 | % | | 23 | % | | 27 | % | | 22 | % | | | | | | | | | | | | | | | | |

| | | | | | |

| Wix.com Ltd. |

| RECONCILIATION OF OPERATING INCOME (LOSS) TO NON-GAAP OPERATING INCOME (LOSS) |

| (In thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended | | Six Months Ended | | | | | | | | |

| | | | June 30, | | June 30, | | | | | | | | |

| | | | | | 2023 | | 2022 | | 2023 | | 2022 | | | | | | | | | | | | | | | | |

| | | | (unaudited) | | (unaudited) | | | | | | | | |

| Operating income (loss) | | | | | $ | 12,976 | | | $ | (75,022) | | | $ | (20,357) | | | $ | (190,439) | | | | | | | | | | | | | | | | | |

| Adjustments: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share based compensation expenses | | | | | 53,660 | | | 59,139 | | | 108,181 | | | 120,123 | | | | | | | | | | | | | | | | | |

| Amortization | | | | | 1,489 | | | 1,580 | | | 2,977 | | | 3,154 | | | | | | | | | | | | | | | | | |

| Impairment, restructuring and other charges | | | | | 330 | | | — | | | 25,668 | | | — | | | | | | | | | | | | | | | | | |

| Sales tax accrual and other G&A expenses | | | | | 157 | | | 189 | | | 465 | | | 361 | | | | | | | | | | | | | | | | | |

| Acquisition related expenses | | | | | 244 | | | 1,187 | | | 440 | | | 2,886 | | | | | | | | | | | | | | | | | |

| Total adjustments | | | | | $ | 55,880 | | | $ | 62,095 | | | $ | 137,731 | | | $ | 126,524 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non GAAP operating income (loss) | | | | | $ | 68,856 | | | $ | (12,927) | | | $ | 117,374 | | | $ | (63,915) | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non GAAP operating margin | | | | | 18 | % | | (4) | % | | 15 | % | | (9) | % | | | | | | | | | | | | | | | | |

| | | | | | |

| Wix.com Ltd. |

| RECONCILIATION OF NET INCOME (LOSS) TO NON-GAAP NET INCOME (LOSS) AND NON-GAAP NET INCOME (LOSS) PER SHARE |

| (In thousands, except per share data) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended | | Six Months Ended | | | | | | | | |

| | | | June 30, | | June 30, | | | | | | | | |

| | | | | | 2023 | | 2022 | | 2023 | | 2022 | | | | | | | | | | | | | | | | |

| | | | (unaudited) | | (unaudited) | | | | | | | | |

| Net INCOME (loss) | | | | | $ | 33,577 | | | $ | (111,238) | | | $ | 23,208 | | | $ | (338,527) | | | | | | | | | | | | | | | | | |

| Share based compensation expenses and other Non GAAP adjustments | | | | | 44,511 | | | 103,411 | | | 105,979 | | | 289,306 | | | | | | | | | | | | | | | | | |

| Non-GAAP net income (loss) | | | | | $ | 78,088 | | | $ | (7,827) | | | $ | 129,187 | | | $ | (49,221) | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic Non GAAP net income (loss) per share | | | | | $ | 1.38 | | | (0.14) | | 2.28 | | (0.85) | | | | | | | | | | | | | | | | |

| Weighted average shares used in computing basic Non GAAP net income (loss) per share | | | | | 56,744,007 | | | 57,943,140 | | | 56,576,286 | | | 57,712,372 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Diluted Non GAAP net income (loss) per share | | | | | $ | 1.26 | | | (0.14) | | 2.08 | | (0.85) | | | | | | | | | | | | | | | | |

| Weighted average shares used in computing diluted Non GAAP net income (loss) per share | | | | | 62,186,895 | | | 57,943,140 | | | 62,149,558 | | | 57,712,372 | | | | | | | | | | | | | | | | | |

| | | | | | |

| Wix.com Ltd. |

| RECONCILIATION OF NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES TO FREE CASH FLOW |

| (In thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended | | Six Months Ended | | | | | | | | |

| | | | June 30, | | June 30, | | | | | | | | |

| | | | | | 2023 | | 2022 | | 2023 | | 2022 | | | | | | | | | | | | | | | | |

| | | | (unaudited) | | (unaudited) | | | | | | | | |

| Net cash provided by (used in) operating activities | | | | | $ | 47,761 | | | $ | (2,687) | | | $ | 93,722 | | | $ | (16,349) | | | | | | | | | | | | | | | | | |

| Capital expenditures, net | | | | | (15,751) | | | (13,217) | | | (36,683) | | | (33,141) | | | | | | | | | | | | | | | | | |

| Free Cash Flow | | | | | $ | 32,010 | | | $ | (15,904) | | | $ | 57,039 | | | $ | (49,490) | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Impairment, restructuring and other costs | | | | | 2,453 | | | — | | | 4,504 | | | — | | | | | | | | | | | | | | | | | |

| Capex related to HQ build out | | | | | 14,630 | | | 9,911 | | 31,579 | | | 25,349 | | | | | | | | | | | | | | | | | |

| Free Cash Flow excluding HQ build out, impairment and restructuring costs | | | | | $ | 49,093 | | | $ | (5,993) | | | $ | 93,122 | | | $ | (24,141) | | | | | | | | | | | | | | | | | |

| | | | | | |

| Wix.com Ltd. |

| RECONCILIATION OF BASIC WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING AND THE DILUTED WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended | | Six Months Ended | | | | | | | | |

| | | | June 30, | | June 30, | | | | | | | | |

| | | | | | 2023 | | 2022 | | 2023 | | 2022 | | | | | | | | | | | | | | | | |

| | | | (unaudited) | | (unaudited) | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic weighted-average shares used to compute net income (loss) per share | | | | | 56,744,007 | | | 57,943,140 | | | 56,576,286 | | | 57,712,372 | | | | | | | | | | | | | | | | | |

| Effect of dilutive securities (included in the effect of dilutive securities is the assumed conversion of employee stock options, employee RSUs and the Notes) | | | | | 5,442,888 | | | — | | | 1,603,758 | | | — | | | | | | | | | | | | | | | | | |

| Diluted weighted-average shares used to compute net income (loss) per share | | | | | 62,186,895 | | | 57,943,140 | | | 58,180,044 | | | 57,712,372 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| The following items have been excluded from the diluted weighted average number of shares outstanding because they are anti-dilutive: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock options | | | | | 1,982,546 | | | 5,024,271 | | | 1,982,546 | | | 5,024,271 | | | | | | | | | | | | | | | | | |

| Restricted share units | | | | | 1,263,342 | | | 3,009,354 | | | 1,263,342 | | | 3,009,354 | | | | | | | | | | | | | | | | | |

| Convertible Notes (if-converted) | | | | | — | | | 3,969,514 | | | 1,426,748 | | | 3,969,514 | | | | | | | | | | | | | | | | | |

| | | | | 65,432,783 | | | 69,946,279 | | | 62,852,680 | | | 69,715,511 | | | | | | | | | | | | | | | | | |

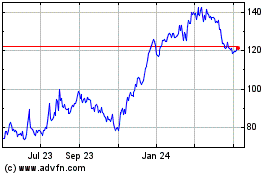

Wix com (NASDAQ:WIX)

Historical Stock Chart

From Jun 2024 to Jul 2024

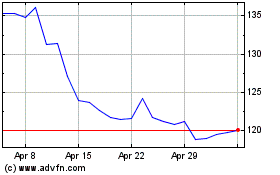

Wix com (NASDAQ:WIX)

Historical Stock Chart

From Jul 2023 to Jul 2024