Continued Progress on Long-Term

Roadmap

Vroom, Inc. (Nasdaq:VRM), a leading ecommerce platform for

buying and selling used vehicles, today announced financial results

for the third quarter ended September 30, 2022.

HIGHLIGHTS OF THIRD QUARTER 2022 VERSUS SECOND QUARTER

2022

- Ecommerce gross profit per unit of $4,206, up 16%

- SG&A expenses decreased $18.3 million

- Net loss improved from $(115.1) million to $(51.1) million

- Adjusted EBITDA improved from $(85.6) million to $(73.3)

million

- Adjusted EBITDA excluding non-recurring costs improved from

$(77.3) million to $(57.5) million

Tom Shortt, Chief Executive Officer of Vroom, commented: “We

continued to make progress on our three key objectives and four

strategic initiatives as outlined during our Investor Day in May.

We are intensely focused on improving the customer experience. For

the month of October, 98% of our customers received their completed

registrations before the expiration of their initial temporary

tags. We will continue this focus as we work to achieve our goal of

becoming best-in-class in titling and registration. We achieved

Ecommerce gross profit per unit of $4,206, improved our Adjusted

EBITDA excluding non-recurring costs to $(57.5) million and reduced

our leverage by $56 million. I would like to thank all of our

Vroommates, UACC Colleagues and third-party partners for their

contributions in transforming our business and improving our

customer experience."

Bob Krakowiak, Vroom’s Chief Financial Officer, commented: “I am

pleased with our financial and operational performance in the third

quarter. We took several actions to maximize liquidity and

strengthen our balance sheet, including unlocking $59 million of

restricted cash, repurchasing a portion of our convertible notes

and completing our second securitization since the acquisition of

UACC. Based on our progress, we are forecasting year-end cash

liquidity near the midpoint of our previous guidance of $450 to

$565 million.”

THIRD QUARTER 2022 FINANCIAL RESULTS

All financial comparisons are on a year-over-year basis unless

otherwise noted.

Ecommerce Results

Three Months Ended September

30,

Nine Months Ended September

30,

2022

2021

Change

% Change

2022

2021

Change

% Change

(in thousands, except unit

data and average days to sale)

(in thousands, except unit

data and average days to sale)

Ecommerce units sold

6,428

19,683

(13,255

)

(67.3

)%

35,134

53,455

(18,321

)

(34.3

)%

Ecommerce revenue:

Vehicle revenue

$

212,980

$

677,170

$

(464,190

)

(68.5

)%

$

1,173,727

$

1,644,494

$

(470,767

)

(28.6

)%

Product revenue

12,461

24,508

(12,047

)

(49.2

)%

48,709

59,155

(10,446

)

(17.7

)%

Total ecommerce revenue

$

225,441

$

701,678

$

(476,237

)

(67.9

)%

$

1,222,436

$

1,703,649

$

(481,213

)

(28.2

)%

Ecommerce gross profit:

Vehicle gross profit

$

14,573

$

25,875

$

(11,302

)

(43.7

)%

$

46,153

$

72,704

$

(26,551

)

(36.5

)%

Product gross profit

12,461

24,508

(12,047

)

(49.2

)%

48,709

59,155

(10,446

)

(17.7

)%

Total ecommerce gross profit

$

27,034

$

50,383

$

(23,349

)

(46.3

)%

$

94,862

$

131,859

$

(36,997

)

(28.1

)%

Average vehicle selling price per

ecommerce unit

$

33,133

$

34,404

$

(1,271

)

(3.7

)%

$

33,407

$

30,764

$

2,643

8.6

%

Gross profit per ecommerce unit:

Vehicle gross profit per ecommerce

unit

$

2,267

$

1,315

$

952

72.4

%

$

1,314

$

1,360

$

(46

)

(3.4

)%

Product gross profit per ecommerce

unit

1,939

1,245

694

55.7

%

1,386

1,107

279

25.2

%

Total gross profit per ecommerce unit

$

4,206

$

2,560

$

1,646

64.3

%

$

2,700

$

2,467

$

233

9.4

%

Ecommerce average days to sale

186

68

118

173.5

%

118

73

45

61.6

%

Results by Segment

Three Months Ended September

30,

Nine Months Ended September

30,

2022

2021(1)

Change

% Change

2022

2021(1)

Change

% Change

(in thousands, except unit

data)

(in thousands, except unit

data)

Units:

Ecommerce

6,428

19,683

(13,255

)

(67.3

)%

35,134

53,455

(18,321

)

(34.3

)%

Wholesale

3,128

9,760

(6,632

)

(68.0

)%

19,108

28,421

(9,313

)

(32.8

)%

All Other (2)

662

1,583

(921

)

(58.2

)%

3,408

3,358

50

1.5

%

Total units

10,218

31,026

(20,808

)

(67.1

)%

57,650

85,234

(27,584

)

(32.4

)%

Revenue:

Ecommerce

$

225,441

$

701,678

$

(476,237

)

(67.9

)%

$

1,222,436

$

1,703,649

$

(481,213

)

(28.2

)%

Wholesale

47,604

131,306

(83,702

)

(63.7

)%

270,489

377,438

(106,949

)

(28.3

)%

Retail Financing (3)

40,654

—

40,654

100.0

%

120,005

—

120,005

100.0

%

All Other (4)

27,098

63,772

(36,674

)

(57.5

)%

126,622

168,677

(42,055

)

(24.9

)%

Total revenue

$

340,797

$

896,756

$

(555,959

)

(62.0

)%

$

1,739,552

$

2,249,764

$

(510,212

)

(22.7

)%

Gross profit (loss):

Ecommerce

$

27,034

$

50,383

$

(23,349

)

(46.3

)%

$

94,862

$

131,859

$

(36,997

)

(28.1

)%

Wholesale

(1,574

)

2,103

(3,677

)

(174.8

)%

(6,260

)

10,337

(16,597

)

(160.6

)%

Retail Financing (3)

35,954

—

35,954

100.0

%

109,637

—

109,637

100.0

%

All Other (4)

5,917

5,603

314

5.6

%

17,089

15,197

1,892

12.4

%

Total gross profit

$

67,331

$

58,089

$

9,242

15.9

%

$

215,328

$

157,393

$

57,935

36.8

%

Gross profit (loss) per unit

(5):

Ecommerce

$

4,206

$

2,560

$

1,646

64.3

%

$

2,700

$

2,467

$

233

9.4

%

Wholesale

$

(503

)

$

215

$

(718

)

(334.0

)%

$

(328

)

$

364

$

(692

)

(190.1

)%

(1)

In the second quarter of 2022, we

reevaluated our reporting segments based on relative revenue and

gross profit and significance in our long term strategy. As a

result of that analysis, we determined to no longer report TDA as a

separate operating segment. As of June 30, 2022, we are organized

into three reportable segments: Ecommerce, Wholesale, and Retail

Financing. We reclassified TDA revenue and TDA gross profit from

the TDA reportable segment to the “All Other” category to conform

to current year presentation.

(2)

All Other units consist of retail sales of

used vehicles from TDA.

(3)

The Retail Financing segment represents

UACC’s operations with its network of third-party dealership

customers as of the closing of the UACC acquisition in February

2022.

(4)

All Other revenues and gross profit

consist of retail sales of used vehicles from TDA and fees earned

on sales of value-added products associated with those vehicles

sales and the CarStory business.

(5)

Gross profit per unit metrics exclude the

Retail Financing gross profit and All Other gross profit.

SG&A

Three Months Ended September

30,

Nine Months Ended September

30,

2022

2021

Change

% Change

2022

2021

Change

% Change

(in thousands)

(in thousands)

Compensation & benefits

$

55,694

$

53,900

$

1,794

3.3

%

$

199,111

$

145,580

$

53,531

36.8

%

Marketing expense

14,945

35,214

(20,269

)

(57.6

)%

69,818

88,267

(18,449

)

(20.9

)%

Outbound logistics

4,945

22,717

(17,772

)

(78.2

)%

39,925

57,987

(18,062

)

(31.1

)%

Occupancy and related costs

6,041

4,635

1,406

30.3

%

17,408

12,599

4,809

38.2

%

Professional fees

6,459

7,694

(1,235

)

(16.1

)%

26,585

15,951

10,634

66.7

%

Software and IT costs

11,277

7,232

4,045

55.9

%

33,406

19,367

14,039

72.5

%

Other

35,282

17,326

17,956

103.6

%

89,374

41,731

47,643

114.2

%

Total selling, general &

administrative expenses

$

134,643

$

148,718

$

(14,075

)

(9.5

)%

$

475,627

$

381,482

$

94,145

24.7

%

Non-GAAP Financial Measures

In addition to our results determined in accordance with U.S.

GAAP, we believe the following non-GAAP financial measures are

useful in evaluating our operating performance:

- EBITDA;

- Adjusted EBITDA;

- Adjusted EBITDA excluding non-recurring costs to address

operational and customer experience issues;

- Adjusted EBITDA excluding securitization gain;

- Adjusted EBITDA excluding securitization gain and non-recurring

costs to address operational and customer experience issues;

- Non-GAAP net loss;

- Non-GAAP net loss per share;

- Non-GAAP net loss excluding securitization gain; and

- Non-GAAP net loss per share excluding securitization gain.

These non-GAAP financial measures have limitations as analytical

tools in that they do not reflect all of the amounts associated

with our results of operations as determined in accordance with

U.S. GAAP. Because of these limitations, these non-GAAP financial

measures should be considered along with other operating and

financial performance measures presented in accordance with U.S.

GAAP. The presentation of these non-GAAP financial measures is not

intended to be considered in isolation or as a substitute for, or

superior to, financial information prepared and presented in

accordance with U.S. GAAP. We have reconciled all non-GAAP

financial measures with the most directly comparable U.S. GAAP

financial measures.

EBITDA, Adjusted EBITDA, Adjusted EBITDA excluding non-recurring

costs to address operational and customer experience issues,

Adjusted EBITDA excluding securitization gain, Adjusted EBITDA

excluding securitization gain and non-recurring costs to address

operational and customer experience issues, Non-GAAP net loss,

Non-GAAP net loss per share, Non-GAAP net loss excluding

securitization gain, and Non-GAAP net loss per share excluding

securitization gain are supplemental performance measures that our

management uses to assess our operating performance and the

operating leverage in our business. Because each of these non-GAAP

financial measures facilitate internal comparisons of our

historical operating performance on a more consistent basis, we use

these measures for business planning purposes.

EBITDA

We calculate EBITDA as net loss before interest expense,

interest income, income tax expense and depreciation and

amortization expense.

Adjusted EBITDA

We calculate Adjusted EBITDA as EBITDA adjusted to exclude

realignment costs, acquisition related costs, change in fair value

of finance receivables, gain on debt extinguishment, goodwill

impairment charge and other costs, which relate to the write off of

the upfront shares issued as part of the Rocket Auto agreement and

previously recognized within "Other assets". Changes in fair value

of finance receivables can fluctuate significantly from period to

period and relate primarily to historical loans and debt which have

been securitized, and acquired on February 1, 2022 from UACC. Our

ongoing business model is to originate or purchase finance

receivables with the intent to sell which we recognize at the lower

of cost or fair value. Therefore, these historical finance

receivables acquired, which are accounted for under the fair value

option, will experience fluctuations in value from period to

period. We believe it is appropriate to remove this temporary

volatility from our Adjusted EBITDA results to better reflect our

ongoing business model. Additionally, these historical finance

receivables acquired from UACC are expected to run-off within

approximately 12 months.

Adjusted EBITDA excluding non-recurring costs to address

operational and customer experience issues

We calculate Adjusted EBITDA excluding non-recurring costs to

address operational and customer experience issues as Adjusted

EBITDA adjusted to exclude the non-recurring costs incurred to

address operational and customer experience issues, including

rental cars for our customers and legal settlements with customers

and state DMVs. While we expect to continue to incur these costs

over the next few quarterly periods, we do not expect these costs

to continue to be incurred once our operational issues have been

resolved.

Adjusted EBITDA excluding securitization gain

We calculate Adjusted EBITDA excluding securitization gain as

Adjusted EBITDA adjusted to exclude the securitization gain from

the sale of UACC's finance receivables, and believe that it

provides a useful perspective on the underlying operating results

and trends and a means to compare our period-over-period

results.

Adjusted EBITDA excluding securitization gain and

non-recurring costs to address operational and customer experience

issues

We calculate Adjusted EBITDA excluding securitization gain and

non-recurring costs to address operational and customer experience

issues as Adjusted EBITDA adjusted to exclude the securitization

gain from the sale of UACC’s finance receivables and the

non-recurring costs incurred to address operational and customer

experience issues.

The following table presents a reconciliation of the foregoing

non-GAAP financial measures to net loss, which is the most directly

comparable U.S. GAAP measure:

Three Months Ended September

30,

Nine Months Ended September

30,

2022

2021

2022

2021

(in thousands)

(in thousands)

Net loss

$

(51,127

)

$

(98,122

)

$

(476,675

)

$

(241,118

)

Adjusted to exclude the following:

—

—

—

—

Interest expense

9,704

7,028

28,617

14,720

Interest income

(5,104

)

(2,930

)

(12,991

)

(7,288

)

(Benefit) provision for income taxes

899

29

(22,085

)

379

Depreciation and amortization

9,995

3,469

28,005

9,497

EBITDA

$

(35,633

)

$

(90,526

)

$

(455,129

)

$

(223,810

)

Realignment costs

$

3,243

$

—

$

12,772

$

—

Acquisition related costs

—

3,412

5,653

3,412

Change in fair value of finance

receivables

(3,012

)

—

4,455

—

Goodwill impairment charge

—

—

201,703

—

Gain on debt extinguishment

(37,917

)

—

(37,917

)

—

Other

—

—

2,127

—

Adjusted EBITDA

$

(73,319

)

$

(87,114

)

$

(266,336

)

$

(220,398

)

Non-recurring costs to address operational

and customer experience issues

15,785

—

25,059

—

Adjusted EBITDA excluding non-recurring

costs to address operational and customer experience issues

$

(57,534

)

$

(87,114

)

$

(241,277

)

$

(220,398

)

Securitization gain

(15,972

)

—

(45,589

)

—

Adjusted EBITDA excluding securitization

gain

$

(89,291

)

$

(87,114

)

$

(311,925

)

$

(220,398

)

Adjusted EBITDA excluding securitization

gain and non-recurring costs to address operational and customer

experience issues

$

(73,506

)

$

(87,114

)

$

(286,866

)

$

(220,398

)

Non-GAAP net loss

We calculate Non-GAAP net loss as net loss adjusted to exclude

realignment costs, acquisition related costs, change in fair value

of finance receivables, goodwill impairment charge, gain on debt

extinguishment, and other costs, which relate to the write off of

the upfront shares issued as part of the Rocket Auto agreement and

previously recognized within "Other assets".

Non-GAAP net loss per share

We calculate Non-GAAP net loss per share as Non-GAAP net loss

divided by weighted average number of shares outstanding.

Non-GAAP net loss excluding securitization gain

We calculate Non-GAAP net loss excluding securitization gain as

Non-GAAP net loss adjusted to exclude the securitization gain from

the sale of UACC's finance receivables.

Non-GAAP net loss per share excluding securitization

gain

We calculate Non-GAAP net loss per share excluding

securitization gain as Non-GAAP net loss excluding securitization

gain divided by weighted average number of shares outstanding.

The following table presents a reconciliation of the foregoing

non-GAAP financial measures to net loss and net loss per share,

which are the most directly comparable U.S. GAAP measures:

Three Months Ended September

30,

Nine Months Ended September

30,

2022

2021

2022

2021

(in thousands, except share

and per share amounts)

Net loss

$

(51,127

)

$

(98,122

)

$

(476,675

)

$

(241,118

)

Net loss attributable to common

stockholders

$

(51,127

)

$

(98,122

)

$

(476,675

)

$

(241,118

)

Add: Realignment costs

3,243

—

12,772

—

Add: Acquisition related costs

—

3,412

5,653

3,412

Add: Change in fair value of finance

receivables

(3,012

)

—

4,455

—

Add: Goodwill impairment charge

—

—

201,703

—

Subtract: Gain on debt extinguishment

(37,917

)

—

(37,917

)

—

Add: Other

—

—

2,127

—

Non-GAAP net loss

$

(88,813

)

$

(94,710

)

$

(287,882

)

$

(237,706

)

Subtract: Securitization gain

(15,972

)

—

(45,589

)

—

Non-GAAP net loss excluding securitization

gain

$

(104,785

)

$

(94,710

)

$

(333,471

)

$

(237,706

)

—

—

—

—

Weighted-average number of shares

outstanding used to compute net loss per share, basic and

diluted

138,118,679

136,766,015

137,817,839

136,256,901

Net loss per share, basic and diluted

$

(0.37

)

$

(0.72

)

$

(3.46

)

$

(1.77

)

Impact of realignment costs

0.02

—

0.09

—

Impact of acquisition related costs

—

0.02

0.04

0.03

Impact of change in fair value of finance

receivables

(0.02

)

—

0.03

—

Impact of goodwill impairment charge

—

—

1.46

—

Impact of gain on debt extinguishment

(0.27

)

—

(0.28

)

—

Impact of other

—

—

0.02

—

Non-GAAP net loss per share, basic and

diluted

$

(0.64

)

$

(0.70

)

$

(2.10

)

$

(1.74

)

Impact of securitization gain

(0.12

)

—

(0.33

)

—

Non-GAAP net loss per share excluding

securitization gain and non-recurring costs to address operational

and customer experience issues, basic and diluted

$

(0.76

)

$

(0.70

)

$

(2.43

)

$

(1.74

)

THIRD QUARTER 2022 AS COMPARED TO SECOND QUARTER 2022

Three Months Ended September

30,

Three Months Ended June

30,

2022

2022

Change

% Change

(in thousands, except unit

data)

Total revenues

$

340,797

$

475,437

$

(134,640

)

(28.3

)%

Total gross profit

$

67,331

$

66,357

$

974

1.5

%

Ecommerce units sold

6,428

9,233

(2,805

)

(30.4

)%

Ecommerce revenue

$

225,441

$

321,632

$

(96,191

)

(29.9

)%

Ecommerce gross profit

$

27,034

$

33,509

$

(6,475

)

(19.3

)%

Vehicle gross profit per ecommerce

unit

$

2,267

$

2,166

$

101

4.7

%

Product gross profit per ecommerce

unit

1,939

1,463

476

32.5

%

Total gross profit per ecommerce unit

$

4,206

$

3,629

$

577

15.9

%

Wholesale units sold

3,128

5,867

(2,739

)

(46.7

)%

Wholesale revenue

$

47,604

$

82,901

$

(35,297

)

(42.6

)%

Wholesale gross loss

$

(1,574

)

$

(1,934

)

$

360

18.6

%

Wholesale gross loss per unit

$

(503

)

$

(330

)

$

(173

)

(52.4

)%

Retail Financing revenue

$

40,654

$

32,121

$

8,533

26.6

%

Retail Financing gross profit

$

35,954

$

28,720

$

7,234

25.2

%

Total selling, general, and administrative

expenses

$

134,643

$

152,990

$

(18,347

)

(12.0

)%

Three Months Ended September

30,

Three Months Ended June

30,

2022

2022

Change

% Change

(in thousands)

Net loss

$

(51,127

)

$

(115,089

)

$

63,962

55.6

%

Adjusted to exclude the following:

Interest expense

9,704

9,533

171

1.8

%

Interest income

(5,104

)

(3,935

)

(1,169

)

29.7

%

(Benefit) provision for income taxes

899

256

643

251.2

%

Depreciation and amortization

9,995

10,115

(120

)

(1.2

)%

EBITDA

$

(35,633

)

$

(99,120

)

$

63,487

64.1

%

Realignment costs

$

3,243

$

9,529

$

(6,286

)

(66.0

)%

Change in fair value of finance

receivables

(3,012

)

1,846

(4,858

)

(263.2

)%

Gain on debt extinguishment

(37,917

)

—

(37,917

)

100.0

%

Other

—

2,127

(2,127

)

(100.0

)%

Adjusted EBITDA

$

(73,319

)

$

(85,618

)

$

12,299

14.4

%

Non-recurring costs to address operational

and customer experience issues

15,785

8,274

7,511

90.8

%

Adjusted EBITDA excluding non-recurring

costs to address operational and customer experience issues

$

(57,534

)

$

(77,344

)

$

19,810

25.6

%

Securitization gain

(15,972

)

—

(15,972

)

100.0

%

Adjusted EBITDA excluding securitization

gain

$

(89,291

)

$

(85,618

)

$

(3,673

)

(4.3

)%

Adjusted EBITDA excluding securitization

gain and non-recurring costs to address operational and customer

experience issues

$

(73,506

)

$

(77,344

)

$

3,838

5.0

%

Conference Call & Webcast Information

Vroom management will discuss these results and other

information regarding the Company during a conference call and

audio webcast Tuesday, November 8, 2022 at 8:30 a.m. ET.

To access the conference call, please register at this embedded

link. Registered participants will be sent a unique PIN to access

the call. A listen-only webcast will also be available via the same

link and at ir.vroom.com. An archived webcast of the conference

call will be accessible on the website within 48 hours of its

completion.

About Vroom (Nasdaq: VRM)

Vroom is an innovative, end-to-end ecommerce platform that

offers a better way to buy and a better way to sell used vehicles.

The Company’s scalable, data-driven technology brings all phases of

the vehicle buying and selling process to consumers wherever they

are and offers an extensive selection of vehicles, transparent

pricing, competitive financing, and contact-free, at-home pick-up

and delivery. For more information visit www.vroom.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including without limitation statements

regarding expected timelines, our execution of and the expected

benefits from our business realignment plan and cost-saving

initiatives, including our ability to improve our transaction

processes and customer service experience, our expectations

regarding our business strategy and plans, including our ongoing

ability to integrate and develop United Auto Credit Corporation

into a captive finance operation, and, for future results of

operations and financial position, including our ability to improve

our unit economics and our outlook for the full year ended December

31, 2022, including with respect to our liquidity. These statements

are based on management’s current assumptions and are neither

promises nor guarantees, but involve known and unknown risks,

uncertainties and other important factors that may cause our actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the forward-looking statements. For factors that could

cause actual results to differ materially from the forward-looking

statements in this press release, please see the risks and

uncertainties identified under the heading "Risk Factors" in our

Annual Report on Form 10-K for the year ended December 31, 2021, as

updated by our Quarterly report on Form 10-Q for the quarter ended

September 30, 2022, each of which is available on our Investor

Relations website at ir.vroom.com and on the SEC website at

www.sec.gov. All forward-looking statements reflect our beliefs and

assumptions only as of the date of this press release. We undertake

no obligation to update forward-looking statements to reflect

future events or circumstances.

VROOM, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

and per share amounts)

(unaudited)

As of

As of

September 30,

December 31,

2022

2021

ASSETS

Current Assets:

Cash and cash equivalents

$

509,660

$

1,132,325

Restricted cash (including restricted cash

of consolidated VIEs of $19.5 million and $0 million,

respectively)

94,305

82,450

Accounts receivable, net of allowance of

$26.7 million and $8.9 million, respectively

23,733

105,433

Finance receivables at fair value

(including finance receivables of consolidated VIEs of $10.9

million and $0 million, respectively)

13,644

—

Finance receivables held for sale, net

(including finance receivables of consolidated VIEs of $137.1

million and $0 million, respectively)

210,729

—

Inventory

437,828

726,384

Beneficial interests in

securitizations

23,984

—

Prepaid expenses and other current

assets

58,576

55,700

Total current assets

1,372,459

2,102,292

Finance receivables at fair value

(including finance receivables of consolidated VIEs of $135.8

million and $0 million, respectively)

166,382

—

Property and equipment, net

50,520

37,042

Intangible assets, net

165,668

28,207

Goodwill

—

158,817

Operating lease right-of-use assets

24,392

15,359

Other assets

29,539

25,033

Total assets

$

1,808,960

$

2,366,750

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current Liabilities:

Accounts payable

$

36,800

$

52,651

Accrued expenses

103,903

121,508

Vehicle floorplan

345,272

512,801

Warehouse credit facilities of

consolidated VIEs

135,453

—

Current portion of securitization debt of

consolidated VIEs at fair value

54,652

—

Deferred revenue

16,313

75,803

Operating lease liabilities, current

8,268

6,889

Other current liabilities

19,061

57,604

Total current liabilities

719,722

827,256

Long term debt, net of current portion

(including securitization debt of consolidated VIEs of $40.8

million and $0 million at fair value, respectively)

607,790

610,618

Operating lease liabilities, excluding

current portion

20,620

9,592

Other long-term liabilities

15,696

4,090

Total liabilities

1,363,828

1,451,556

Commitments and contingencies (Note

13)

Stockholders’ equity:

Common stock, $0.001 par value;

500,000,000 shares authorized as of September 30, 2022 and December

31, 2021; 138,154,063 and 137,092,891 shares issued and outstanding

as of September 30, 2022 and December 31, 2021, respectively

135

135

Additional paid-in-capital

2,070,454

2,063,841

Accumulated deficit

(1,625,457

)

(1,148,782

)

Total stockholders’ equity

445,132

915,194

Total liabilities and stockholders’

equity

$

1,808,960

$

2,366,750

VROOM, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except share

and per share amounts)

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2022

2021

2022

2021

Revenue:

Retail vehicle, net

$

234,353

$

735,716

$

1,283,263

$

1,798,155

Wholesale vehicle

47,604

131,306

270,489

377,438

Product, net

13,181

26,544

51,954

64,422

Finance

40,654

—

120,005

—

Other

5,005

3,190

13,841

9,749

Total revenue

340,797

896,756

1,739,552

2,249,764

Cost of sales:

Retail vehicle

218,726

708,071

1,234,138

1,720,974

Wholesale vehicle

49,178

129,203

276,749

367,101

Finance

4,699

—

10,368

—

Other

863

1,393

2,969

4,296

Total cost of sales

273,466

838,667

1,524,224

2,092,371

Total gross profit

67,331

58,089

215,328

157,393

Selling, general and administrative

expenses

134,643

148,718

475,627

381,482

Depreciation and amortization

9,833

3,376

27,728

9,276

Impairment charges

1,017

—

206,127

—

Loss from operations

(78,162

)

(94,005

)

(494,154

)

(233,365

)

Gain on debt extinguishment

(37,917

)

—

(37,917

)

—

Interest expense

9,704

7,028

28,617

14,720

Interest income

(5,104

)

(2,930

)

(12,991

)

(7,288

)

Other loss (income), net

5,383

(10

)

26,897

(58

)

Loss before provision for income taxes

(50,228

)

(98,093

)

(498,760

)

(240,739

)

Provision (benefit) for income taxes

899

29

(22,085

)

379

Net loss

$

(51,127

)

$

(98,122

)

$

(476,675

)

$

(241,118

)

Net loss per share attributable to common

stockholders, basic and diluted

$

(0.37

)

$

(0.72

)

$

(3.46

)

$

(1.77

)

Weighted-average number of shares

outstanding used to compute net loss per share attributable to

common stockholders, basic and diluted

138,118,679

136,766,015

137,817,839

136,256,901

VROOM, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Nine Months Ended September

30,

2022

2021

Operating activities

Net loss

$

(476,675

)

$

(241,118

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Impairment charges

206,127

—

Gain on debt extinguishment

(37,917

)

—

Depreciation and amortization

28,005

9,497

Amortization of debt issuance costs

3,777

1,784

Realized gains on securitization

transactions

(45,589

)

—

Deferred taxes

(23,855

)

—

Losses on finance receivables and

securitization debt, net

39,464

—

Stock-based compensation expense

6,613

9,754

Provision to record inventory at lower of

cost or net realizable value

(5,033

)

5,625

Other, net

4,717

4,874

Changes in operating assets and

liabilities:

Finance receivables, held for sale

Originations of finance receivables held

for sale

(483,167

)

—

Principal payments received on finance

receivables held for sale

38,297

—

Proceeds from sale of finance receivables

held for sale, net

509,612

—

Other

(5,924

)

—

Accounts receivable

63,252

(32,936

)

Inventory

293,589

(183,731

)

Prepaid expenses and other current

assets

12,420

(39,356

)

Other assets

(2,678

)

(7,390

)

Accounts payable

(22,183

)

26,144

Accrued expenses

(27,020

)

43,512

Deferred revenue

(59,490

)

39,227

Other liabilities

(39,444

)

38,655

Net cash used in operating activities

(23,102

)

(325,459

)

Investing activities

Finance receivables at fair value

Originations of finance receivables at

fair value

(49,475

)

—

Principal payments received on finance

receivables at fair value

106,829

—

Proceeds from sale of finance receivables

at fair value, net

43,262

—

Principal payments received on beneficial

interests

5,571

—

Purchase of property and equipment

(19,968

)

(18,786

)

Acquisition of business, net of cash

acquired of $47.9 million

(267,488

)

(75,875

)

Net cash used in investing activities

(181,269

)

(94,661

)

Financing activities

Principal repayment under secured

financing agreements

(176,909

)

—

Proceeds from vehicle floorplan

1,286,000

1,901,457

Repayments of vehicle floorplan

(1,453,529

)

(1,789,215

)

Proceeds from warehouse credit

facilities

419,000

—

Repayments of warehouse credit

facilities

(460,566

)

—

Other financing activities

(1,977

)

—

Repayments of convertible senior notes

(18,458

)

—

Proceeds from issuance of convertible

senior notes

—

625,000

Issuance costs paid for convertible senior

notes

—

(16,129

)

Proceeds from exercise of stock

options

—

5,085

Net cash (used in) provided by financing

activities

(406,439

)

726,198

Net (decrease) increase in cash, cash

equivalents and restricted cash

(610,810

)

306,078

Cash, cash equivalents and restricted cash

at the beginning of period

1,214,775

1,090,039

Cash, cash equivalents and restricted

cash at the end of period

$

603,965

$

1,396,117

VROOM, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (continued)

(in thousands)

(unaudited)

Supplemental disclosure of cash flow

information:

Cash paid for interest

$

24,619

$

11,116

Cash paid for income taxes

$

2,062

$

329

Supplemental disclosure of non-cash

investing and financing activities:

Fair value of beneficial interests

received in securitization transactions

$

30,082

$

—

Accrued property and equipment

expenditures

$

538

$

1,652

Issuance of common stock for CarStory

acquisition

$

—

$

38,811

Fair value of unvested stock options

assumed for acquisition of business

$

—

$

1,017

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221107005758/en/

Investor Relations: Vroom Liam Harrington

investors@vroom.com Media Contact: Current Global Danny

Finlay dfinlay@currentglobal.com

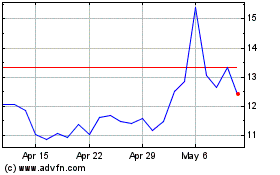

Vroom (NASDAQ:VRM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Vroom (NASDAQ:VRM)

Historical Stock Chart

From Jan 2024 to Jan 2025