Vor Bio Reports Fourth Quarter and Full Year 2022 Financial Results and Provides Company Update

March 23 2023 - 4:01PM

Vor Bio (Nasdaq: VOR), a clinical-stage cell and genome engineering

company, today reported financial results for the three-month

period and full year ended December 31, 2022, and provided a

business update.

“We are encouraged with the initial proof of concept

demonstrated in patients treated in our VBP101 study,” said Dr.

Robert Ang, Vor Bio’s President and Chief Executive Officer. “We

remain focused on rapid enrollment and plan to share additional

clinical data later this year. Our IND for VCAR33ALLO is on-track

for submission in the first half of 2023 which, together with

trem-cel, has the potential to transform outcomes for patients with

blood cancers.”

Corporate Highlights

Initial VBP101 clinical data represents an important

milestone for Vor Bio’s founding vision and further validates the

Company’s novel platform. Clinical data presented at the

2023 TANDEM meetings (Transplantation & Cellular Therapy

Meetings of ASTCT™ and CIBMTR®) in February 2023 demonstrated

sustained hematopoiesis in the first patient treated with trem-cel

five months (147 days) post-transplant and Mylotarg (gemtuzumab

ozogamicin) was well-tolerated through three cycles of treatment at

the initial dose level of 0.5 mg/m2. Mylotarg first-dose

pharmacokinetics revealed 0.5 mg/m2 achieved Cmax and AUC

parameters equivalent to Mylotarg doses of 1-2 and 4-5 mg/m2,

respectively, potentially due to the decreased CD33 antigen sink.

CD33 deletion was observed in donor cells of myeloid and lymphoid

origin which were both enriched following Mylotarg, suggesting that

CD33 is expressed early in hematopoietic differentiation and that

Mylotarg treatment effectively removes CD33-positive cells. Due to

detectable measurable residual disease (MRD), the patient was moved

to other therapies following administration of the third dose of

Mylotarg and subsequently relapsed with CD33+ blasts.

A second patient successfully received a trem-cel transplant and

showed robust cell recovery with neutrophil engraftment occurring

at Day 11 and platelet recovery on Day 17. Trem-cel was well

tolerated in both patients.

$116 million financing extends Company’s expected cash

runway into Q1 2025. In December 2022, Vor Bio announced

the pricing of an underwritten offering and a private placement,

with combined gross proceeds of approximately $115.8 million. Vor

Bio intends to use the net proceeds from the financing primarily to

fund the continued clinical development of pipeline programs and

for working capital and general corporate purposes.

GMP qualification of in-house clinical manufacturing

facility underway. Current Good Manufacturing

Practices (cGMP) qualification activities at the new facility

are well underway, and the Company is on track to begin clinical

manufacturing of VCAR33ALLO post IND submission. The Company plans

to commence trem-cel production at the in-house facility in

2023.

Strategic additions to Clinical and Scientific Advisory

Board. As the Company continues to evolve toward providing

next-generation transplants for patients, it is building out a

world-class Clinical and Scientific Advisory Board comprised of

luminaries in the field who can provide the Company with deep

advisory expertise in genome engineering, hematopoietic stem cell

(HSC) biology, cancer immunotherapy and clinical development of

therapies to treat blood cancers. Scientific and Clinical Advisors

currently include Siddhartha Mukherjee, MD, DPhil; Hans-Peter Kiem,

MD, PhD; Malcolm K Brenner, MD, PhD; Steven Devine, MD; Rob

Soiffer, MD; Eric Sievers, MD; and Yi-Bin Chen, MD.

For more information, visit our website at:

https://www.vorbio.com/about/scientific-clinical-advisors/.

Program Updates

Trem-cel (formerly VOR33): Trem-cel is a

genome-edited allogeneic hematopoietic stem cell transplant (HSCT),

that is lacking the CD33 protein. It is designed to replace

standard of care transplants for patients suffering from acute

myeloid leukemia (AML) and potentially other blood cancers.

Trem-cel has the potential to enable powerful targeted therapies in

the post-transplant setting including CD33-targeted CAR-Ts.

- The Company continues to actively enroll patients into the

VBP101 clinical study and is progressing as planned with dose

escalation of Mylotarg per the 3+3 schema in the protocol.

- An encore poster presentation of VBP101 data has been accepted

at the 49th Annual Meeting of the EBMT to be held in

Paris, France, April 23-26, 2023.

- The Company expects to share new data from additional patients

transplanted with trem-cel and treated with Mylotarg at

scientific/medical forums by year-end 2023.

VCAR33ALLO:

VCAR33ALLO is a T-cell therapy derived from allogeneic healthy

donors using a chimeric antigen receptor (CAR) specifically binding

to CD33.

- The Company is on-track to submit an IND in the first half of

2023.

- The initial clinical trial will focus on patients who have

relapsed following allogeneic stem cell transplant, where T cells

harvested from the original donor are used as starting material for

the drug product.

- The Company intends to evaluate VCAR33ALLO in combination with

trem-cel as a Treatment System, aiming at prolonged remissions or

cures following transplant.

Upcoming Milestones

- VCAR33ALLO IND submission expected in the first half of

2023

- Additional trem-cel engraftment and hematologic protection data

updates expected by year-end 2023

Fourth Quarter and Full Year 2022 Financial

Results

- Cash Position: Cash, cash equivalents and

investments were $230.2 million as of December 31, 2022, which is

projected to fund operations into the first quarter of 2025.

- Research & Development (R&D)

Expenses: R&D expenses for the fourth quarter of

2022 were $17.1 million, compared to $12.7 million for the fourth

quarter of 2021, and for the year ended December 31, 2022, were

$64.6 million, compared to $47.5 million for the year ended

December 31, 2021. The increase in R&D expenses was primarily

due to an increase in personnel expenses, including an increase in

stock compensation expense, an increase in facility costs from our

laboratory and cGMP manufacturing facility expansion, and an

increase in clinical, manufacturing and consulting expenses as a

result of the ongoing trem-cel clinical trial and the development

of the VCAR33ALLO program.

- General & Administrative (G&A)

Expenses: G&A expenses for the fourth quarter of

2022 were $7.7 million, compared to $5.6 million for the fourth

quarter of 2021, and for the year ended December 31, 2022, were

$28.9 million, compared to $21.5 million for the year ended

December 31, 2021. The increase in G&A expense was primarily

due to increased personnel expenses, including an increase in in

stock compensation expense, an increase in facilities and other

expenses as a result of our corporate headquarters office

expansion, and an increase in professional fees.

- Net Loss: Net loss for the fourth quarter

of 2022 was $23.9 million, compared to $18.3 million for the fourth

quarter of 2021, and for the year ended December 31, 2022, was

$92.1 million, compared to $68.9 million for the year ended

December 31, 2021.

About Vor BioVor Bio is a clinical-stage cell

and genome engineering company that aims to change the standard of

care for patients with blood cancers by engineering hematopoietic

stem cells to enable targeted therapies post-transplant. For more

information, visit: www.vorbio.com.

Forward-Looking StatementsThis press release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. The words “aim,”

“anticipate,” “can,” “continue,” “could,” “design,” “enable,”

“expect,” “initiate,” “intend,” “may,” “on-track,” “ongoing,”

“plan,” “potential,” “should,” “target,” “update,” “will,” “would,”

and similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain

these identifying words. Forward-looking statements in this press

release include Vor Bio’s statements regarding the potential of its

product candidates to positively impact quality of life and alter

the course of disease in the patients it seeks to treat, the timing

of patient enrollment in clinical trials and the availability of

data therefrom, the timing of regulatory filings, the expected

safety profile of its product candidates, the potential cGMP

qualification of its manufacturing facility and the success and

timing of manufacturing clinical supply for its product candidates,

its intentions to use VCAR33ALLO in combination with trem-cel as a

Treatment System, its potential upcoming milestones, its intended

use of proceeds from capital raising activities, cash runway and

expected capital requirements. Vor Bio may not actually achieve the

plans, intentions, or expectations disclosed in these

forward-looking statements, and you should not place undue reliance

on these forward-looking statements. Actual results or events could

differ materially from the plans, intentions and expectations

disclosed in these forward-looking statements as a result of

various factors, including: uncertainties inherent in the

initiation and completion of preclinical studies and clinical

trials and clinical development of Vor Bio’s product candidates;

availability and timing of results from preclinical studies and

clinical trials; whether interim results from a clinical trial will

be predictive of the final results of the trial or the results of

future trials; expectations for regulatory approvals to conduct

trials or to market products; the success of Vor Bio’s in-house

manufacturing capabilities and efforts; and availability of funding

sufficient for its foreseeable and unforeseeable operating expenses

and capital expenditure requirements. These and other risks are

described in greater detail under the caption “Risk Factors”

included in Vor Bio’s most recent annual or quarterly report and in

other reports it has filed or may file with the Securities and

Exchange Commission. Any forward-looking statements contained in

this press release speak only as of the date hereof, and Vor Bio

expressly disclaims any obligation to update any forward-looking

statements, whether because of new information, future events or

otherwise, except as may be required by law.

|

Condensed Consolidated Balance Sheet Data |

|

(in thousands) |

| |

| |

December 31, |

|

December 31, |

| |

2022 |

|

2021 |

|

Cash, cash equivalents and marketable securities |

$ |

230,245 |

|

$ |

207,469 |

| Total assets |

299,366 |

|

242,590 |

| Total liabilities |

48,759 |

|

26,327 |

| Total stockholders'

equity |

250,607 |

|

216,263 |

|

Consolidated Statement of Operations |

|

(in thousands, except share and per share

data) |

| |

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December 31, |

|

December 31, |

| |

2022 |

|

2021 |

|

2022 |

|

2021 |

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

$ |

17,062 |

|

|

$ |

12,693 |

|

|

$ |

64,550 |

|

|

$ |

47,529 |

|

|

General and administrative |

7,663 |

|

|

5,613 |

|

|

28,868 |

|

|

21,489 |

|

|

Total operating expenses |

$ |

24,725 |

|

|

$ |

18,306 |

|

|

$ |

93,418 |

|

|

$ |

69,018 |

|

| Loss from operations |

$ |

(24,725 |

) |

|

$ |

(18,306 |

) |

|

$ |

(93,418 |

) |

|

$ |

(69,018 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

814 |

|

|

54 |

|

|

1,324 |

|

|

119 |

|

|

Total other income |

814 |

|

|

54 |

|

|

1,324 |

|

|

119 |

|

| Net loss |

$ |

(23,911 |

) |

|

$ |

(18,252 |

) |

|

$ |

(92,094 |

) |

|

$ |

(68,899 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Cumulative dividends

on redeemable convertible preferred stock |

- |

|

|

- |

|

|

- |

|

|

(1,228 |

) |

| Net loss attributable to

common stockholders |

$ |

(23,911 |

) |

|

$ |

(18,252 |

) |

|

$ |

(92,094 |

) |

|

$ |

(70,127 |

) |

| Net loss per share

attributable to common stockholders, basic and

diluted |

$ |

(0.53 |

) |

|

$ |

(0.49 |

) |

|

$ |

(2.33 |

) |

|

$ |

(2.10 |

) |

| Weighted-average common

shares outstanding, basic and diluted |

45,394,089 |

|

|

37,088,835 |

|

|

39,551,420 |

|

|

33,433,214 |

|

Contact:Investors & MediaSarah Spencer+1

857-242-6076sspencer@vorbio.com

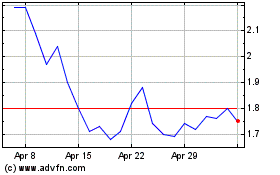

Vor Biopharma (NASDAQ:VOR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Vor Biopharma (NASDAQ:VOR)

Historical Stock Chart

From Feb 2024 to Feb 2025