Taiwan Semiconductor Manufacturing Company

(NYSE:TSM) – TSMC evacuated some factories and suspended operations

after a 7.4 magnitude earthquake hit Taiwan, raising concerns about

the global technology supply chain. Companies like

Apple (NASDAQ:AAPL) and Nvidia

(NASDAQ:NVDA) are affected. Taiwan is crucial for chips but

vulnerable to natural disasters and geopolitical tensions. TSMC

shares are down 0.9% in pre-market trading.

Cal-Maine Foods (NASDAQ:CALM) – Shares of the

U.S.’s leading egg producer rose 8.3% in pre-market trading after

beating Wall Street’s quarterly estimates, with record sales volume

due to high demand and price reductions. The company earned $146.4

million, or $3.01 per share, in the fiscal third quarter. Cal-Maine

reported temporarily closing a Texas plant due to an avian flu

outbreak, resulting in the culling of 1.6 million chickens.

Walt Disney (NYSE:DIS) – Disney and Bob Iger

are expected to win the proxy battle against Nelson Peltz’s Trian

Fund Management. With over 60% of the votes counted, the support

from Vanguard and BlackRock gives a significant boost to Disney in

the board dispute. The dispute will be resolved at Disney’s

shareholder meeting on Wednesday.

Paramount Global (NASDAQ:PARA) – Paramount

Global’s shares rose 3.7% in pre-market trading after reports that

the media giant might be moving forward with a possible sale. The

New York Times revealed that Paramount is considering exclusive

negotiations with Skydance, led by David Ellison.

Trump Media & Technology Group (NASDAQ:DJT)

– Donald Trump sued the co-founders of Trump Media for allegedly

violating a corporate structure agreement and not deserving 8.6% of

the shares, valued at $606 million. The co-founders, in turn, sued

Trump for trying to dilute their stakes. The dispute comes amid

fluctuations in Trump Media’s shares following its merger with a

SPAC. Trump holds 57% of the company, valued at $4.02 billion, but

his ability to sell shares is temporarily blocked. The Delaware

judge did not expedite the co-founders’ process but will consider

possible sanctions against Trump due to the lawsuit filed in

Florida.

DraftKings (NASDAQ:DKNG) and MGM

Resorts International (NYSE:MGM) – DraftKings and MGM

Resorts International are exploring the rapidly growing Brazilian

online gambling market, following legalizations in 2018. Over 130

companies, including Hard Rock International, are seeking licenses.

High fees and taxes could pose challenges for smaller companies.

Formalization attracts global giants but challenges locals.

Microsoft (NASDAQ:MSFT) – The U.S.

Cybersecurity Review Board blamed Microsoft for security lapses

that allowed a Chinese attack on senior government officials’

emails in 2023, calling it “preventable.” Microsoft has pledged

improvements and reforms to strengthen its systems.

Alphabet (NASDAQ:GOOGL) – Google agreed to

delete “billions” of user browsing activity records as part of a

class-action settlement. Although plaintiffs sought $5 billion, the

settlement involves no payment. Plaintiff lawyers consider the

agreement “groundbreaking.”

Intel (NASDAQ:INTC) – Intel announced on

Tuesday an increase in operational losses in its foundry business

as it seeks to regain the technological lead lost to TSMC. Shares

fell with forecasts of worse losses in 2024 and a search for

operational balance by 2027.

Amazon (NASDAQ:AMZN) – Amazon Web Services

(AWS) expanded its free credits program for startups, now covering

the use of leading AI models’ costs, in an effort to strengthen its

Bedrock platform. The initiative includes partnerships with

Anthropic, Meta, Mistral AI, and Cohere, boosting AWS adoption

among startups. Moreover, Amazon.com is phasing out its Just Walk

Out supermarket system, removing a technology that allowed

customers to skip lines. The focus will now be on its Dash Cart,

reducing complexity. The technology will still be used in Amazon Go

stores and licensed to other retailers.

Alibaba (NYSE:BABA) – Alibaba Group announced a

$4.8 billion share buyback in the last quarter, the company’s

second largest, boosting its buyback plan after increasing it by an

additional $25 billion. The move aims to reassure investors amid

market challenges and competition.

PVH Corp (NYSE:PVH) – PVH Corp’s shares plunged

on Tuesday after the Calvin Klein owner forecasted a sharper than

expected annual revenue decline due to weakened demand in Europe.

The company plans to scale back online platforms in Europe,

anticipating a 5% sales drop on the continent.

Tesla (NASDAQ:TSLA) – Tesla experienced its

first quarterly delivery drop in nearly four years, falling below

Wall Street estimates and causing a drop in shares on Tuesday.

Challenges include ineffective price cuts and intense competition.

The company faces a potential slowdown in 2024. Shares are down

-0.82% in pre-market trading. Despite a quarterly drop in car

sales, its energy storage business set a record. Battery

deployments reached 4,053 megawatt-hours, nearly 2% above the

previous record. CEO Elon Musk seeks to convert this success into

more significant revenues.

General Motors (NYSE:GM) – On Tuesday, GM

reported a 1.5% decline in U.S. vehicle sales in the first quarter,

mainly due to reduced deliveries to commercial customers. The

Detroit automaker sold 594,233 units in the first three months of

2024, compared to 603,208 vehicles in the same period last

year.

Toyota Motor (NYSE:TM) – Toyota Motor North

America (TMNA) recorded about a 20% growth in U.S. vehicle sales in

the first quarter, driven by demand for its sedans, crossover SUVs,

and affordable pickups, totaling 565,098 units sold. The RAV4

crossover led sales, increasing 47.4%, while electrified vehicles

grew about 74%. The automaker is also updating its long-standing

models, such as the Land Cruiser, 4Runner, Tundra, and Prius.

Boeing (NYSE:BA) – The U.S. Department of

Justice plans to meet with families of the victims of the 737 MAX

crashes that resulted in 346 deaths, as it evaluates the

possibility of pursuing a criminal lawsuit.

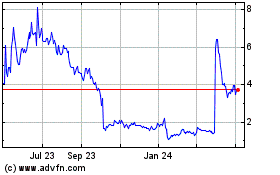

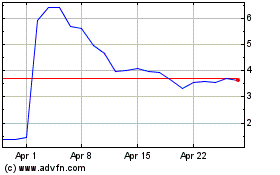

VivoPower International (NASDAQ:VVPR),

Cactus Acquisition (NASDAQ:CCTS) – Shares of

VivoPower International PLC skyrocketed on Tuesday after announcing

the profitable sale of its Tembo subsidiary, in a deal with Cactus

Acquisition Corp. for $838 million. Shares surged 323.4%. In

Wednesday’s pre-market trading, shares are down -17.80%.

General Electric (NYSE:GE) – General Electric

completed its split into three $191.9 billion companies on Tuesday,

ending a 132-year conglomerate. The aerospace and energy entities

began trading on the New York Stock Exchange, marking the end of a

transformation led by CEO Larry Culp. Optimistic investors hope

this will challenge the weak stock performance after many splits.

GE shares have risen almost 37% this year.

Rivian Automotive (NASDAQ:RIVN) – Rivian

Automotive delivered 13,588 vehicles in the first quarter,

exceeding the expectations of 16 analysts for 12,415 units,

according to Visible Alpha. The company reaffirmed its annual

production projections.

Honeywell International (NASDAQ:HON) –

Honeywell International is evaluating the sale of its Personal

Protective Equipment (PPE) division in a deal that could exceed $2

billion, according to Bloomberg sources. The company is seeking

strategic alternatives for the business.

United States Steel (NYSE:X) – The United

Steelworkers (USW) union rejected support for the proposed

acquisition deal by Nippon Steel to acquire United States Steel,

citing a lack of substantial grounds to resolve the ongoing

dispute.

Schlumberger (NYSE:SLB) and

ChampionX (NYSE:CHX) – SLB announced the

acquisition of smaller rival ChampionX in a stock deal valued at

$7.75 billion, reflecting the increasing consolidation in the U.S.

energy sector. This is SLB’s second acquisition in a week and its

largest since 2016.

Exxon Mobil (NYSE:XOM) and

Chevron (NYSE:CVX) – Stabroek, an oil reserve off

the coast of Guyana, is at the center of a legal battle involving

ExxonMobil and Chevron. Chevron’s acquisition of Hess, with access

to Stabroek, is contested by Exxon. The outcome reshapes the global

oil landscape.

Endeavor Group Holdings (NYSE:EDR) – Silver

Lake, the main investor in Endeavor Group Holdings, announced on

Tuesday a deal to take the talent and entertainment agency private

for $13 billion, offering Endeavor shareholders $27.50 per share in

cash.

Citigroup (NYSE:C) – Citigroup asked a federal

judge on Tuesday to dismiss the lawsuit by New York Attorney

General Letitia James, claiming that charges of failing to

reimburse online defrauded customers are based on a

misunderstanding of federal law.

UBS Group (NYSE:UBS) – UBS appointed three

banking industry veterans to lead its Capital Markets (ECM) unit in

the U.S., aiming to strengthen other divisions following last

year’s acquisition of Credit Suisse. The new leaders will take

their positions in July 2024. Additionally, UBS unveiled a new

share buyback program worth up to $2 billion, with half expected to

be completed by 2024, starting on Wednesday. The Swiss bank had

previously announced a $1 billion buyback in February.

Goldman Sachs (NYSE:GS), JPMorgan

Chase (NYSE:JPM), and Wells Fargo

(NYSE:WFC) – Goldman Sachs highlighted JPMorgan and Wells Fargo as

top picks among seven major banks. Goldman raised Wells Fargo’s

target price from $57 to $65 per share, and JPMorgan Chase’s from

$215 to $229, citing promising net interest income. Analysts

maintained buy ratings for several banks, anticipating potential

revenue growth and effective capital management.

Eli Lilly (NYSE:LLY) – Due to high demand, the

four doses of Eli Lilly’s diabetes medication, Mounjaro, will

continue to be in limited supply until 2024, as indicated on the

U.S. Food and Drug Administration’s website.

Abbott Laboratories (NYSE:ABT) – Abbott

announced U.S. FDA approval for its TriClip heart valve repair

device, designed to treat tricuspid regurgitation. This approval

followed a similar one for rival Edwards Lifesciences. TriClip

offers a less invasive option for high-risk patients.

WeWork (USOTC:WEWKQ) – WeWork announced on

Tuesday its plan to emerge from Chapter 11 bankruptcy in the U.S.

and Canada by May 31, after successful negotiations secured over $8

billion in lease commitment reductions, reflecting a drop in demand

during the pandemic. The plan involved modifying about 150 leases

to more favorable economic terms, including reduced rent payments,

while ending another 150 and maintaining 150 unchanged. WeWork aims

to emerge as a leaner company, focused on providing flexible

workspace in an uncertain commercial real estate market.

Autodesk (NASDAQ:ADSK) – Autodesk revealed an

internal investigation into its accounting practices and postponed

its annual financial report, raising concerns about accounting

practices around free cash flow and non-GAAP operating margin.

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Oct 2024 to Nov 2024

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Nov 2023 to Nov 2024