Ford Motor Stays Neutral - Analyst Blog

May 17 2013 - 6:50AM

Zacks

On May 16, we maintained our Neutral recommendation on

Ford Motor Co. (F) based on its higher profits in

the first quarter of 2013 and strong performance in North America

and Asia Pacific Africa. However, we are concerned about the higher

structural costs and economic weakness around the world,

particularly in Europe.

Why the Reiteration?

On Apr 24, Ford posted an increase of 4.1% in earnings to $1.6

billion and a 5.1% rise in earnings per share to 41 cents in the

first quarter of 2013, beating the Zacks Consensus Estimate by 3

cents.

Revenues improved 10.5% to $35.8 billion, exceeding the Zacks

Consensus Estimate of $32.8 billion. The improvement in revenues

and earnings was mainly attributable to Ford’s strong performance

in North America and Asia Pacific Africa, partially offset by

unfavorable exchange rate in South America and uncertainties in

Europe.

Following the release of the first-quarter results, the Zacks

Consensus Estimate for 2013 increased 0.7% to $1.44 per share.

Meanwhile, the Zacks Consensus Estimate for fiscal 2014 declined

1.7% to $1.71 per share. With the Zacks Consensus Estimates for

both 2013 and 2014 remaining almost flat, Ford currently carries a

Zacks Rank #3 (Hold).

The company is expanding its foothold in the emerging global

markets including Argentina, Brazil, China, India and Thailand.

Ford expects 70% of its global expansion to be in Asia, primarily

China and India. Ford anticipates that these investments will

eventually bear fruit with a 50% improvement in sales to 8 million

vehicles in 2015. Small car sales, as a percentage of total sales,

are expected to go up to 55% by 2020 from the current level of

48%.

Ford continues to focus on hybrid vehicles. The company plans to

invest $135 million for its next-generation hybrid-electric

vehicles. It expects hybrid sales to improve owing to the new

launches and plans to triple production capacity of electrified

vehicles by 2013.

However, rising commodity and structural costs for replacing older

vehicles with new models are apprehended to mar the company’s

results. In addition, pension and health care are some of the major

issues concerning the profitability of the company in the current

competitive industry.

Other Stocks to Consider

Few stocks that are performing well in the broader industry where

Ford operates include Tower International, Inc.

(TOWR), Visteon Corp. (VC) and STRATTEC

Security Corp. (STRT). All the stocks carry a Zacks Rank

#1 (Strong Buy).

FORD MOTOR CO (F): Free Stock Analysis Report

STRATTEC SEC CP (STRT): Free Stock Analysis Report

TOWER INTL INC (TOWR): Free Stock Analysis Report

VISTEON CORP (VC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

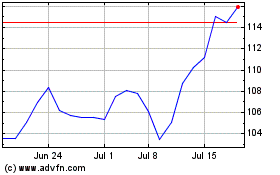

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024