Highlights * Restructuring efforts remain on track * Taking

significant actions to respond to market conditions * Significant

new business wins * Long-term financing completed VAN BUREN

TOWNSHIP, Mich., Oct. 31 /PRNewswire-FirstCall/ -- Visteon

Corporation (NYSE:VC) today reported third quarter 2006 results

that included a net loss of $177 million, or $1.38 per share, an

improvement over the third quarter 2005's net loss of $207 million,

or $1.64 per share. The company also reported continued progress in

implementing its three-year plan, which includes restructuring,

improving base operations and profitably growing its business.

(Logo: http://www.newscom.com/cgi-bin/prnh/20001201/DEF008LOGO )

"Our third quarter results came under pressure due, in part, to

significant reductions in vehicle production by a number of our

customers. We are taking aggressive actions to resize the business

in light of these declines, and we expect conditions to continue to

be challenging for the remainder of the year and into 2007," said

Michael F. Johnston, chairman and chief executive officer. "Through

the efforts of our employees around the world, we continued to make

solid progress implementing our three-year plan which is key to

positioning Visteon for the long-term." Third Quarter Results For

third quarter 2006, product sales were $2.48 billion. Sales for the

same period a year ago totaled $4.12 billion. Lower product sales

were primarily due to the Oct. 1, 2005 transaction with Ford Motor

Co. that transferred 23 Visteon facilities to Automotive Components

Holdings, LLC (ACH), a Ford-managed business entity. Services sales

for third quarter 2006 were $133 million; no sales for services

were recorded in third quarter 2005. Visteon reported a net loss of

$177 million, or $1.38 per share, for the quarter which included

$14 million of restructuring expenses that qualify for

reimbursement from the escrow account established to fund

restructuring activities. In the third quarter 2005, Visteon

reported a net loss of $207 million, or $1.64 per share, which

included $11 million of restructuring expenses. EBIT-R, as defined

below, for the third quarter was a loss of $127 million, improving

$10 million from the same period a year ago. Nine Month Results For

the first nine months of 2006, product sales were $8.16 billion.

More than half of the company's product sales were generated from

customers other than Ford, demonstrating continued progress in

diversifying Visteon's customer base. Sales for the same period a

year ago totaled $14.11 billion, of which non-Ford sales were 35

percent. Product sales were lower by $5.95 billion, primarily due

to the transfer of certain plants to ACH in October 2005. Services

sales for the first nine months of 2006 were $416 million; no sales

for services were recorded in the first nine months of 2005.

Visteon's net loss of $124 million, or $0.97 per share, for the

first nine months reflects cost savings net of customer price

reductions, the financial benefit of the elimination of the plants

transferred to ACH and lower depreciation and amortization expense.

The results include $22 million of non-cash asset impairments

related to the company's restructuring actions and an extraordinary

gain of $8 million associated with the acquisition of a lighting

facility in Mexico, both of which were recognized in the second

quarter of 2006. Also, as previously indicated, Visteon recognized

a cumulative benefit of $72 million in the first half of 2006

related to the relief of post-employment benefits for Visteon

salaried employees associated with two ACH manufacturing facilities

transferred to Ford. For the first nine months of 2005, Visteon

reported a net loss of $1.61 billion, or $12.78 per share. These

results included $1.18 billion, or $9.35 per share, of non-cash

asset impairments and $18 million of restructuring expenses. EBIT-R

for the first nine months of 2006 totaled $64 million, an increase

of $339 million compared to an EBIT-R loss of $275 million for the

first nine- months of 2005. New Business Wins During the first nine

months of the year, Visteon was awarded new incremental business

totaling nearly $1 billion, more than 20 percent of which will go

into production in 2007. The company continues to win new business

from a diverse range of customers around the world and across each

of the company's key product lines of climate, electronics,

including lighting, and interiors. "Our business wins highlight the

strength of our global footprint, our innovation, the capability of

our people and the growing diversification of our customer base,"

said Donald J. Stebbins, president and chief operating officer.

"Growing the business profitably and leveraging technology for our

customers are key elements of our three-year plan." Free Cash Flow

and Financing Activities Free cash flow of negative $116 million

for the quarter was an improvement of $137 million over third

quarter 2005. For the first nine months of 2006, free cash flow was

negative $223 million, compared with negative $25 million for the

same period in 2005 in which Visteon received the benefit of

accelerated payment terms from Ford as part of the funding

agreement. During the third quarter, Visteon closed on a new U.S.

secured five-year revolving credit facility with an aggregate

availability of up to $350 million and a European accounts

receivable securitization facility that provides for up to $325

million of funding for qualified trade receivables, both of which

expire in 2011. These facilities replaced the company's multi-year

secured revolving credit facility of $500 million that was to

expire in June 2007. The completion of these financings, including

the seven-year $800 million secured term loan closed earlier this

year, provides Visteon with additional flexibility as it implements

its three-year plan. Restructuring and Other Actions Visteon's

three-year restructuring plan remains on track. In January of this

year, the company announced plans to fix, sell or close 23

facilities, of which 11 were to be addressed in 2006. To date, the

company has addressed seven of the 11 facilities. The company

continues to evaluate alternatives and solutions for the remaining

facilities, including divestitures, that yield acceptable returns

to the company. In the third quarter, the company announced two

additional restructuring actions that were not in the original

plan. These actions were the announcement of the closure of

Visteon's Chicago facility and the exit of its Vitro Flex glass

joint venture. Visteon is also announcing that it expects to reduce

its salaried workforce by approximately 900 people, primarily in

higher cost countries. A charge of up to $65 million is expected to

be recorded in the fourth quarter of 2006, and the related costs

will qualify for reimbursement from the escrow account. The company

anticipates that this action will generate up to $75 million of

annual savings when completed. "We are making good progress

implementing our restructuring activities," said James F. Palmer,

executive vice president and chief financial officer. "In addition

to the original actions identified, we have addressed more

facilities and announced plans to further reduce our salaried

workforce to continue improving performance. We know we have to do

more to meet our objectives, and we are taking the necessary

actions." Outlook The fourth quarter of 2006 is expected to be

challenged by low production volumes from several key customers

globally. Visteon currently estimates that its 2006 full year

EBIT-R will be in the range of $40 million to $50 million,

reflecting lower production levels and other cost pressures in the

second half of the year. Additionally, the company currently

expects free cash flow to be negative $100 million for full year

2006. Full year product sales are expected to be $10.9 billion.

Visteon Corporation is a leading global automotive supplier that

designs, engineers and manufactures innovative climate, interior,

electronic and lighting products for vehicle manufacturers, and

also provides a range of products and services to aftermarket

customers. With corporate offices in Van Buren Township, Mich.

(U.S.); Shanghai, China; and Kerpen, Germany; the company has more

than 170 facilities in 26 countries and employs approximately

46,000 people. Forward-looking Information This press release

contains "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995. Forward- looking

statements are not guarantees of future results and conditions but

rather are subject to various factors, risks and uncertainties that

could cause our actual results to differ materially from those

expressed in these forward-looking statements, including general

economic conditions, changes in interest rates and fuel prices; the

automotive vehicle production volumes and schedules of our

customers, and in particular Ford's vehicle production volumes; our

ability to satisfy our future capital and liquidity requirements

and comply with the terms of our existing credit agreements and

indentures; the financial distress of our suppliers, or other

significant suppliers to our customers, and possible disruptions in

the supply of commodities to us or our customers due to financial

distress or work stoppages; our ability to timely implement, and

realize the anticipated benefits of, restructuring and other

cost-reduction initiatives, including our three-year improvement

plan, and our successful execution of internal performance plans

and other productivity efforts; the timing and expenses related to

restructurings, employee reductions, acquisitions or dispositions;

increases in raw material and energy costs and our ability to

offset or recover these costs; the effects of reorganization and/or

restructuring plans announced by our customers; the effect of

pension and other post-employment benefit obligations; increases in

our warranty, product liability and recall costs; the outcome of

legal or regulatory proceedings to which we are or may become a

party; as well as those factors identified in our filings with the

SEC (including our Annual Report on Form 10-K for the fiscal year

ended December 31, 2005). We assume no obligation to update these

forward-looking statements. Use of Non-GAAP Financial Information

This press release contains information about Visteon's financial

results which is not presented in accordance with accounting

principles generally accepted in the United States ("GAAP"). Such

non-GAAP financial measures are reconciled to their closest GAAP

financial measures at the end of this press release. The provision

of these comparable GAAP financial measures for full- year 2006 is

not intended to indicate that Visteon is explicitly or implicitly

providing projections on those GAAP financial measures, and actual

results for such measures are likely to vary from those presented.

The reconciliations include all information reasonably available to

the company at the date of this press release and the adjustments

that management can reasonably predict. VISTEON CORPORATION AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (Dollars in

Millions, Except Per Share Data) (Unaudited) Three-Months Ended

Nine-Months Ended September 30 September 30 2006 2005 2006 2005 Net

sales Products $2,482 $4,121 $8,161 $14,111 Services 133 - 416 -

2,615 4,121 8,577 14,111 Cost of sales Products 2,437 4,021 7,563

13,621 Services 131 - 412 - 2,568 4,021 7,975 13,621 Gross margin

47 100 602 490 Selling, general and administrative expenses 177 239

539 763 Asset impairments - - 22 1,176 Restructuring expenses 14 11

35 18 Reimbursement from Escrow Account 14 - 35 - Operating income

(loss) (130) (150) 41 (1,467) Interest expense, net 40 38 117 98

Equity in net income of non-consolidated affiliates 8 8 27 22 Loss

before income taxes, minority interests, change in accounting and

extraordinary item (162) (180) (49) (1,543) Provision for income

taxes 10 21 57 41 Minority interests in consolidated subsidiaries 5

6 22 24 Net loss before change in accounting and extraordinary item

(177) (207) (128) (1,608) Cumulative effect of change in

accounting, net of tax - - (4) - Net loss before extraordinary item

(177) (207) (132) (1,608) Extraordinary item, net of tax - - 8 -

Net loss $(177) $(207) $(124) $(1,608) Per share data: Basic and

diluted loss per share before change in accounting and

extraordinary item $(1.38) $(1.64) $(1.00) $(12.78) Cumulative

effect of change in accounting, net of tax - - (0.03) - Basic and

diluted net loss before extraordinary item (1.38) (1.64) (1.03)

(12.78) Extraordinary item, net of tax - - 0.06 - Basic and diluted

loss per share $(1.38) $(1.64) $(0.97) $(12.78) Average shares

outstanding (millions) Basic 128.1 126.2 127.7 125.8 Diluted 128.1

126.2 127.7 125.8 VISTEON CORPORATION AND SUBSIDIARIES CONSOLIDATED

BALANCE SHEETS (Dollars in Millions) (Unaudited) September 30

December 31 2006 2005 ASSETS Cash and equivalents $740 $865

Accounts receivable, net Ford Motor Company 607 618 Non-Ford Motor

Company 1,190 1,120 Inventories, net 543 537 Other current assets

223 205 Total current assets 3,303 3,345 Equity in net assets of

non-consolidated affiliates 218 226 Property and equipment, net

2,997 2,973 Other non-current assets 203 192 Total assets $6,721

$6,736 LIABILITIES AND SHAREHOLDERS' DEFICIT Short-term debt,

including current portion of long-term debt $143 $485 Accounts

payable 1,681 1,803 Employee benefits, including pensions 212 233

Other current liabilities 446 438 Total current liabilities 2,482

2,959 Long-term debt 1,932 1,509 Postretirement benefits other than

pensions 702 724 Postretirement benefits payable to Ford Motor

Company 125 154 Employee benefits, including pensions 703 647

Deferred income taxes 204 175 Other non-current liabilities 418 382

Minority interests in consolidated subsidiaries 257 234

Shareholders' deficit Preferred stock (par value $1.00, 50 million

shares authorized, none outstanding) - - Common stock (par value

$1.00, 500 million shares authorized, 131 million shares issued,

129 million and 129 million shares outstanding, respectively) 131

131 Stock warrants 127 127 Additional paid-in capital 3,396 3,396

Accumulated deficit (3,564) (3,440) Accumulated other comprehensive

loss (168) (234) Other (24) (28) Total shareholders' deficit (102)

(48) Total liabilities and shareholders' deficit $6,721 $6,736

VISTEON CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF

CASH FLOWS (Dollars in Millions) (Unaudited) Three-Months Ended

Nine-Months Ended September 30 September 30 2006 2005 2006 2005

Operating activities Net loss $(177) $(207) $(124) $(1,608)

Adjustments to reconcile net loss to net cash (used by) provided

from operating activities: Depreciation and amortization 107 117

315 473 Postretirement benefit relief - - (72) - Asset impairments

- - 22 1,176 Gain on debt extinguishment - - (8) - Extraordinary

item, net of tax - - (8) - Equity in net income of non-consolidated

affiliates, net of dividends remitted (7) (5) (4) 11 Other non-cash

items 7 6 3 29 Changes in assets and liabilities: Accounts

receivable 34 59 23 107 Inventories 30 18 11 1 Accounts payable

(30) (122) (203) (14) Other assets and liabilities 2 4 87 200 Net

cash (used by) provided from operating activities (34) (130) 42 375

Investing activities Capital expenditures (82) (123) (265) (400)

Proceeds from sales of assets 7 4 18 39 Net cash proceeds from ACH

transactions - 311 - 311 Other investments (6) (4) (6) (20) Net

cash (used by) provided from investing activities (81) 188 (253)

(70) Financing activities Short-term debt, net 9 307 (364) 191

Proceeds from debt, net of issuance costs 6 6 1,182 40 Principal

payments on debt (2) (20) (612) (39) Repurchase of unsecured debt

securities - (250) (141) (250) Other, including book overdrafts 4

(24) (5) (78) Net cash provided from (used by) financing activities

17 19 60 (136) Effect of exchange rate changes on cash 2 (2) 26

(23) Net (decrease) increase in cash and equivalents (96) 75 (125)

146 Cash and equivalents at beginning of period 836 823 865 752

Cash and equivalents at end of period $740 $898 $740 $898 VISTEON

CORPORATION AND SUBSIDIARIES RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES (Dollars in Millions) (Unaudited) In this press release

the Company has provided information regarding non- GAAP financial

measures of "EBIT-R" and "free cash flow." Such non-GAAP financial

measures are reconciled to their closest US GAAP financial measure

below. EBIT-R: EBIT-R represents net income (loss) before net

interest expense, provision for income taxes and extraordinary item

and excludes impairment of long-lived assets and net unreimbursed

restructuring charges. Management believes EBIT-R is useful to

investors because the excluded items may vary significantly in

timing or amounts and/or may obscure trends useful in evaluating

and comparing the Company's continuing operating activities.

Three-Months Ended Nine-Months Ended FY 2006 September 30 September

30 Estimate 2006 2005 2006 2005 Net Loss $(177) $(207) $(124)

$(1,608) $ Interest expense, net 40 38 117 98 Provision for income

taxes 10 21 57 41 Asset impairments - - 22 1,176 Extraordinary

item, net of tax - - (8) - Net unreimbursed restructuring expense -

11 - 18 EBIT-R $(127) $(137) $64 $(275) $ EBIT-R is not a

recognized term under U.S. GAAP and does not purport to be an

alternative to net income (loss) as an indicator of operating

performance or to cash flows from operating activities as a measure

of liquidity. Because not all companies use identical calculations,

this presentation of EBIT-R may not be comparable to other

similarly titled measures of other companies. Additionally, EBIT-R

is not intended to be a measure of free cash flow for management's

discretionary use, as it does not consider certain cash

requirements such as interest payments, tax payments and debt

service requirements. Free Cash Flow: Free cash flow represents

cash flow from operating activities less capital expenditures.

Management believes that free cash flow is useful in analyzing the

Company's ability to service and repay its debt and it uses the

measure for planning and forecasting future periods, as well as in

compensation decisions. Three-Months Ended Nine-Months Ended FY

2006 September 30 September 30 Estimate 2006 2005 2006 2005 Cash

(used by) provided from operating activities $(34) $(130) $42 $375

$ Capital expenditures (82) (123) (265) (400) Free cash flow $(116)

$(253) $(223) $(25) $ Free cash flow is not a recognized term under

U.S. GAAP and does not reflect cash used to service debt and does

not reflect funds available for investment or other discretionary

uses. http://www.newscom.com/cgi-bin/prnh/20001201/DEF008LOGO

DATASOURCE: Visteon Corporation CONTACT: Media Inquiries: Kimberley

Goode, +1-734-710-5000, , or Analyst Inquiries: Derek Fiebig,

+1-734-710-5800, , both of Visteon Corporation Web site:

http://www.visteon.com/

Copyright

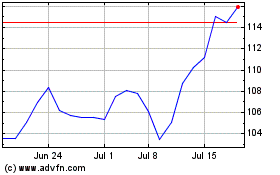

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024