Third-Quarter 2023 Highlights

- Total Assets Under Management (AUM) of $153.5 billion1

- Long-term gross flows of $5.3 billion

- Long-term net flows of ($1.7) billion

- GAAP operating margin of 38%

- Adjusted EBITDA margin of 51.1%2

- GAAP net income of $0.77 per diluted share

- Adjusted net income with tax benefit of $1.18 per diluted

share2

- Board authorizes regular $0.32 quarterly cash dividend

Victory Capital Holdings, Inc. (NASDAQ: VCTR) (“Victory Capital”

or “the Company”) today reported financial results for the quarter

ended September 30, 2023.

“Adjusted EBITDA margin expanded further to 51.1% in the third

quarter,” said David Brown, Chairman and Chief Executive Officer.

“This was the 13th consecutive quarter above our target of 49%, and

the 9th quarter over that period that our margins were 50% or

higher.

“Additionally, we recorded the highest level of quarterly

revenue in more than a year, and the highest levels of quarterly

Adjusted EBITDA and Adjusted Net Income this calendar year.

“Our firmwide investment performance continues to be strong.

Through the end of September, the percentage of our AUM

outperforming benchmarks for the one-year period rose to 70%, up

from 63% at the end of June. For the respective 3-, 5-, and 10-year

periods 65%, 82%, and 78% of our AUM outperformed their respective

benchmarks.

“In the third quarter, net long-term outflows totaled $1.7

billion, which was an improvement from the second quarter.

“During the quarter we accumulated cash on our balance sheet,

which rose to $108 million as of September 30. Subsequent to

quarter-end, we monetized the floating-to-fixed swap on a portion

of our debt generating an additional $43 million of cash. These

actions are designed to increase our financial flexibility as we

continue to conduct due diligence activities on multiple inorganic

growth opportunities.

“As always, we continue to focus on serving our clients, which

is our top priority.”

1 Total AUM includes both discretionary

and non-discretionary client assets.

2 The Company reports its financial

results in accordance with generally accepted accounting principles

(“GAAP”). Adjusted EBITDA and Adjusted Net Income are not defined

by GAAP and should not be regarded as an alternative to any

measurement under GAAP. Please refer to the section “Information

Regarding Non-GAAP Financial Measures” at the end of this press

release for an explanation of Non-GAAP financial measures and a

reconciliation to the nearest GAAP financial measure.

The table below presents AUM, and certain GAAP and non-GAAP

(“adjusted”) financial results. Due to rounding, AUM values and

other amounts in this press release may not add up precisely to the

totals provided.

(in millions except per share amounts or as otherwise

noted)

For the Three Months

Ended

For the Nine Months

Ended

September 30,

June 30,

September 30,

September 30,

September 30,

2023

2023

2022

2023

2022

Assets Under Management1 Ending $

153,506

$

161,622

$

147,257

$

153,506

$

147,257

Average

161,147

157,372

158,903

158,779

167,157

Long-term Flows2 Long-term Gross $

5,255

$

5,591

$

6,601

$

16,694

$

26,812

Long-term Net

(1,700

)

(2,106

)

(553

)

(5,041

)

1,860

Money Market/Short-term Flows Money Market/Short-term Gross

$

193

$

231

$

194

$

666

$

441

Money Market/Short-term Net

(19

)

(316

)

(19

)

(345

)

(125

)

Total Flows Total Gross $

5,449

$

5,822

$

6,796

$

17,359

$

27,253

Total Net

(1,719

)

(2,422

)

(573

)

(5,386

)

1,734

Consolidated Financial Results (GAAP) Revenue $

209.7

$

204.2

$

207.3

$

615.2

$

653.3

Revenue realization (in bps)

51.6

52.1

51.8

51.8

52.3

Operating expenses

129.6

116.7

108.6

373.1

333.8

Income from operations

80.0

87.5

98.6

242.1

319.5

Operating margin

38.2

%

42.9

%

47.6

%

39.4

%

48.9

%

Net income

52.0

56.7

72.8

158.0

223.2

Earnings per diluted share $

0.77

$

0.83

$

1.01

$

2.30

$

3.07

Cash flow from operations

91.6

77.4

103.1

233.2

268.1

Adjusted Performance Results (Non-GAAP)3 Adjusted EBITDA $

107.2

$

104.0

$

103.6

$

310.4

$

324.1

Adjusted EBITDA margin

51.1

%

50.9

%

50.0

%

50.5

%

49.6

%

Adjusted net income

70.3

66.4

76.2

202.3

228.7

Tax benefit of goodwill and acquired intangible assets

9.5

9.5

9.3

28.6

28.0

Adjusted net income with tax benefit

79.8

75.9

85.6

230.9

256.7

Adjusted net income with tax benefit per diluted share $

1.18

$

1.11

$

1.19

$

3.36

$

3.53

_______________________

1 Total AUM includes both discretionary

and non-discretionary client assets.

2 Long-term AUM is defined as total AUM

excluding Money Market and Short-term assets.

3 The Company reports its financial

results in accordance with GAAP. Adjusted EBITDA and Adjusted Net

Income are not defined by GAAP and should not be regarded as an

alternative to any measurement under GAAP. Please refer to the

section “Information Regarding Non-GAAP Financial Measures” at the

end of this press release for an explanation of Non-GAAP financial

measures and a reconciliation to the nearest GAAP financial

measure.

AUM, Flows and Investment Performance

Victory Capital’s total AUM decreased by 5.0%, or $8.1 billion,

to $153.5 billion at September 30, 2023, compared with $161.6

billion at June 30, 2023. The decrease was attributable to the

combination of negative market action, net outflows and the

divestiture of certain INCORE accounts of $4.9 billion, $1.7

billion and $1.3 billion, respectively. Total gross flows were $5.4

billion for the third quarter and $17.4 billion for the

year-to-date period. For the third quarter and year-to-date

periods, the Company reported total net outflows of $1.7 billion

and $5.4 billion, respectively.

As of September 30, 2023, Victory Capital offered 116 investment

strategies through its 11 autonomous Investment Franchises and

Solutions Platform. The table below presents outperformance against

benchmarks by AUM as of September 30, 2023.

Percentage of AUM Outperforming Benchmark

Trailing

Trailing

Trailing

Trailing

1-Year

3-Years

5-Years

10-Years

70%

65%

82%

78%

Third Quarter 2023 Compared with Second Quarter 2023

Revenue increased 2.7% to $209.7 million in the third quarter,

compared with $204.2 million in the second quarter, primarily due

to an increase in average AUM and one extra day in the quarter.

GAAP operating margin contracted 470 basis points in the third

quarter to 38.2%, down from 42.9% in the second quarter primarily

due to the combination of a non-cash $8.8 million difference in

amounts recorded to the change in the fair value of consideration

payable for acquisitions and an increase in depreciation and

amortization expense due to the write-down of an intangible asset.

Reflecting these higher non-cash expenses, third quarter GAAP net

income decreased 8.2% to $52.0 million, down from $56.7 million in

the prior quarter. On a per-share basis, GAAP net income decreased

7.1% to $0.77 per diluted share in the third quarter, versus $0.83

per diluted share in the second quarter.

Adjusted net income with tax benefit increased 5.1% to $79.8

million in the third quarter, up from $75.9 million in the second

quarter. On a per-share basis, adjusted net income with tax benefit

increased 6.4% to $1.18 per diluted share in the third quarter,

from $1.11 per diluted share in the prior quarter. Adjusted EBITDA

increased 3.1% to $107.2 million in the third quarter, versus

$104.0 million in the second quarter. Adjusted EBITDA margin

expanded 20 basis points in the third quarter of 2023 to 51.1%

compared with 50.9% in the prior quarter.

Third Quarter 2023 Compared with Third Quarter 2022

Revenue for the three months ended September 30, 2023, increased

1.2% to $209.7 million, compared with $207.3 million in the same

quarter of 2022 as a result of higher average AUM over the

comparable period.

GAAP operating expenses increased 19.4% to $129.6 million,

compared with $108.6 million in last year’s third quarter due to a

non-cash $20.8 million difference in amounts recorded to the change

in the fair value of consideration payable for acquisitions as well

as an increase in depreciation and amortization expense, partially

offset by a reduction in compensation expense. GAAP operating

margin contracted 940 basis points to 38.2% in the third quarter,

from 47.6% in the same quarter of 2022. GAAP net income declined

28.5% to $52.0 million, or $0.77 per diluted share, in the third

quarter compared with $72.8 million, or $1.01 per diluted share, in

the same quarter of 2022.

Adjusted net income with tax benefit decreased 6.7% to $79.8

million, or $1.18 per diluted share, in the third quarter, compared

with $85.6 million, or $1.19 per diluted share in the same quarter

last year. Adjusted EBITDA increased 3.5% to $107.2 million,

compared with $103.6 million in last year’s same quarter.

Year-over-year, adjusted EBITDA margin expanded 110 basis points to

51.1% in the third quarter of 2023, compared with 50.0% in the same

quarter last year.

Nine Months Ended September 30, 2023 Compared with Nine

Months Ended September 30, 2022

Revenue for the nine months ended September 30, 2023, decreased

5.8% to $615.2 million, compared with $653.3 million in the same

period of 2022. The decrease was primarily due to lower average AUM

and a decrease in revenue realization.

GAAP operating expenses increased 11.8% to $373.1 million for

the nine months ended September 30, 2023, compared with $333.8

million in the same period in 2022 due to a non-cash $59.8 million

difference in amounts recorded to the change in the fair value of

consideration payable for acquisitions, partially offsetting was a

decrease in variable expenses including compensation, distribution

and other asset-based expenses. GAAP operating margin was 39.4% for

the nine months ended September 30, 2023, a 950 basis point

decrease from the 48.9% recorded in the same period in 2022. GAAP

net income decreased 29.3% to $158.0 million, or $2.30 per diluted

share, in the first nine months of 2023 compared with $223.2

million, or $3.07 per diluted share, in the same period in

2022.

Adjusted net income with tax benefit decreased 10.0% to $230.9

million, or $3.36 per diluted share, in the first nine months of

2023, compared with $256.7 million, or $3.53 per diluted share in

the same period in 2022. For the nine months ended September 30,

2023, adjusted EBITDA declined 4.2% to $310.4 million, compared

with $324.1 million for the same period in 2022. Year-over-year,

adjusted EBITDA margin expanded 90 basis points to 50.5% in the

first nine months of 2023, compared with 49.6% in the same period

last year.

Balance Sheet / Capital Management

The Company ended the third quarter with $108 million of cash on

its balance sheet.

Total debt outstanding as of September 30, 2023 was

approximately $1,002 million and consisted of an existing term loan

balance of $631 million and the 2021 Incremental Term Loans balance

of $371 million.

On October 30, 2023, the Company monetized the floating-to-fixed

swap on a portion of its debt generating an additional $43.4

million of cash net of costs.

The Company’s Board of Directors approved a regular quarterly

cash dividend of $0.32 per share. The dividend is payable on

December 22, 2023, to shareholders of record on December 11,

2023.

Conference Call, Webcast and Slide Presentation

The Company will host a conference call tomorrow morning,

November 3, at 8:00 a.m. ET to discuss the results. Analysts and

investors may participate in the question-and-answer session. To

participate in the conference call, please call (888) 330-3571

(domestic) or (646) 960-0657 (international), shortly before 8:00

a.m. ET and reference the Victory Capital Conference Call. A live,

listen-only webcast will also be available via the investor

relations section of the Company’s website at https://ir.vcm.com.

Prior to the call, a supplemental slide presentation that will be

used during the conference call will be available on the Events and

Presentations page of the Company’s investor relations website. For

anyone who is unable to join the live event, an archive of the

webcast will be available for replay shortly after the call

concludes.

About Victory Capital

Victory Capital is a diversified global asset management firm

with $153.5 billion in assets under management as of September 30,

2023. It was ranked No. 55 on the Fortune 100 Fastest-Growing

Companies list for 2022 and is one of only 24 companies to make the

list for the second consecutive year. The Company employs a

next-generation business strategy that combines boutique investment

qualities with the benefits of a fully integrated, centralized

operating and distribution platform.

Victory Capital provides specialized investment strategies to

institutions, intermediaries, retirement platforms and individual

investors. With 11 autonomous Investment Franchises and a Solutions

Business, Victory Capital offers a wide array of investment

products and services, including mutual funds, ETFs, separately

managed accounts, alternative investments, third-party ETF model

strategies, collective investment trusts, private funds, a 529

Education Savings Plan, and brokerage services.

Victory Capital is headquartered in San Antonio, Texas, with

offices nationwide and investment professionals in the U.S. and

abroad. To learn more please visit www.vcm.com or follow Victory

Capital on Facebook, Twitter, and LinkedIn.

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements may include, without limitation, any

statements preceded by, followed by or including words such as

“target,” “believe,” “expect,” “aim,” “intend,” “may,”

“anticipate,” “assume,” “budget,” “continue,” “estimate,” “future,”

“objective,” “outlook,” “plan,” “potential,” “predict,” “project,”

“will,” “can have,” “likely,” “should,” “would,” “could” and other

words and terms of similar meaning or the negative thereof. Such

forward-looking statements involve known and unknown risks,

uncertainties and other important factors beyond Victory Capital’s

control such as the conflict in Ukraine and Israel and its effect

on our business, operations and financial results going forward, as

discussed in Victory Capital’s filings with the SEC, that could

cause Victory Capital’s actual results, performance or achievements

to be materially different from the expected results, performance

or achievements expressed or implied by such forward-looking

statements.

Although it is not possible to identify all such risks and

factors, they include, among others, the following: reductions in

AUM based on investment performance, client withdrawals, difficult

market conditions and other factors such as a pandemic; the nature

of the Company’s contracts and investment advisory agreements; the

Company’s ability to maintain historical returns and sustain its

historical growth; the Company’s dependence on third parties to

market its strategies and provide products or services for the

operation of its business; the Company’s ability to retain key

investment professionals or members of its senior management team;

the Company’s reliance on the technology systems supporting its

operations; the Company’s ability to successfully acquire and

integrate new companies; the concentration of the Company’s

investments in long-only small- and mid-cap equity and U.S.

clients; risks and uncertainties associated with non-U.S.

investments; the Company’s efforts to establish and develop new

teams and strategies; the ability of the Company’s investment teams

to identify appropriate investment opportunities; the Company’s

ability to limit employee misconduct; the Company’s ability to meet

the guidelines set by its clients; the Company’s exposure to

potential litigation (including administrative or tax proceedings)

or regulatory actions; the Company’s ability to implement effective

information and cyber security policies, procedures and

capabilities; the Company’s substantial indebtedness; the potential

impairment of the Company’s goodwill and intangible assets;

disruption to the operations of third parties whose functions are

integral to the Company’s ETF platform; the Company’s determination

that Victory Capital is not required to register as an "investment

company" under the 1940 Act; the fluctuation of the Company’s

expenses; the Company’s ability to respond to recent trends in the

investment management industry; the level of regulation on

investment management firms and the Company’s ability to respond to

regulatory developments; the competitiveness of the investment

management industry; the level of control over the Company retained

by Crestview GP; the Company’s status as an emerging growth company

and a controlled company; and other risks and factors listed under

"Risk Factors" and elsewhere in the Company’s filings with the

SEC.

Such forward-looking statements are based on numerous

assumptions regarding Victory Capital’s present and future business

strategies and the environment in which it will operate in the

future. Any forward-looking statement made in this press release

speaks only as of the date hereof. Except as required by law,

Victory Capital assumes no obligation to update these

forward-looking statements, or to update the reasons actual results

could differ materially from those anticipated in the

forward-looking statements, even if new information becomes

available in the future.

From Fortune. © 2022 Fortune Media IP Limited All rights

reserved. Fortune is a registered trademark of Fortune Media IP

Limited and is used under license. Fortune and Fortune Media IP

Limited are not affiliated with, and do not endorse products or

services of, Victory Capital Holdings, Inc.

The Fortune annual list ranks the top performing, publicly

traded companies in revenues, profits and stock returns over the

three-year period ended April 30, 2022.

Victory Capital Holdings, Inc.

and Subsidiaries

Unaudited Consolidated

Statements of Operations

(in thousands except per share

data and percentages)

For the Three Months

Ended

For the Nine Months

Ended

September 30,

June 30,

September 30,

September 30,

September 30,

2023

2023

2022

2023

2022

Revenue Investment management fees $

163,953

$

159,410

$

160,770

$

480,199

$

508,364

Fund administration and distribution fees

45,735

44,816

46,490

135,035

144,921

Total revenue

209,688

204,226

207,260

615,234

653,285

Expenses Personnel compensation and benefits

54,501

54,940

56,869

167,043

179,352

Distribution and other asset-based expenses

38,160

37,344

39,019

113,158

123,471

General and administrative

13,947

13,250

12,301

39,585

38,984

Depreciation and amortization

12,333

9,650

10,686

33,663

32,051

Change in value of consideration payable for acquisition of

business

10,336

1,500

(10,500

)

19,236

(40,600

)

Acquisition-related costs

116

16

189

134

449

Restructuring and integration costs

246

—

56

275

73

Total operating expenses

129,639

116,700

108,620

373,094

333,780

Income from operations

80,049

87,526

98,640

242,140

319,505

Operating margin

38.2

%

42.9

%

47.6

%

39.4

%

48.9

%

Other income (expense) Interest income and other

income (expense)

1,452

1,971

(1,446

)

4,967

(5,096

)

Interest expense and other financing costs

(15,580

)

(14,902

)

(11,479

)

(44,721

)

(30,637

)

Loss on debt extinguishment

—

—

(369

)

—

(2,887

)

Total other income (expense), net

(14,128

)

(12,931

)

(13,294

)

(39,754

)

(38,620

)

Income before income taxes

65,921

74,595

85,346

202,386

280,885

Income tax expense

(13,914

)

(17,924

)

(12,582

)

(44,435

)

(57,643

)

Net income $

52,007

$

56,671

$

72,764

$

157,951

$

223,242

Earnings per share of common stock Basic $

0.79

$

0.85

$

1.06

$

2.38

$

3.25

Diluted

0.77

0.83

1.01

2.30

3.07

Weighted average number of shares outstanding Basic

65,774

66,466

68,609

66,504

68,625

Diluted

67,676

68,500

71,877

68,636

72,797

Dividends declared per share $

0.32

$

0.32

$

0.25

$

0.96

$

0.75

Victory Capital Holdings, Inc.

and Subsidiaries

Reconciliation of GAAP to

Non-GAAP Measures1

(unaudited; in thousands

except per share data and percentages)

For the Three Months

Ended

For the Nine Months

Ended

September 30,

June 30,

September 30,

September 30,

September 30,

2023

2023

2022

2023

2022

Net income (GAAP) $

52,007

$

56,671

$

72,764

$

157,951

$

223,242

Income tax expense

(13,914

)

(17,924

)

(12,582

)

(44,435

)

(57,643

)

Income before income taxes $

65,921

$

74,595

$

85,346

$

202,386

$

280,885

Interest expense

14,660

14,146

10,795

42,288

29,018

Depreciation

2,302

2,296

2,030

6,569

6,086

Other business taxes

636

382

539

1,402

1,670

Amortization of acquisition-related intangible assets

10,032

7,353

8,657

27,094

25,969

Stock-based compensation

1,451

1,538

2,230

4,993

7,723

Acquisition, restructuring and exit costs

11,463

2,949

(7,842

)

23,396

(32,719

)

Debt issuance costs

762

756

1,064

2,266

4,685

Losses from equity method investments

—

—

759

—

825

Adjusted EBITDA $

107,227

$

104,015

$

103,578

$

310,394

$

324,142

Adjusted EBITDA margin

51.1

%

50.9

%

50.0

%

50.5

%

49.6

%

Net income (GAAP) $

52,007

$

56,671

$

72,764

$

157,951

$

223,242

Adjustment to reflect the operating performance of the Company

Other business taxes

636

382

539

1,402

1,670

Amortization of acquisition-related intangible assets

10,032

7,353

8,657

27,094

25,969

Stock-based compensation

1,451

1,538

2,230

4,993

7,723

Acquisition, restructuring and exit costs

11,463

2,949

(7,842

)

23,396

(32,719

)

Debt issuance costs

762

756

1,064

2,266

4,685

Tax effect of above adjustments

(6,085

)

(3,244

)

(1,163

)

(14,786

)

(1,833

)

Adjusted net income $

70,266

$

66,405

$

76,249

$

202,316

$

228,737

Adjusted net income per diluted share $

1.04

$

0.97

$

1.06

$

2.95

$

3.14

Tax benefit of goodwill and acquired intangible

assets $

9,536

$

9,537

$

9,328

$

28,597

$

27,977

Tax benefit of goodwill and acquired intangible assets per

diluted share $

0.14

$

0.14

$

0.13

$

0.42

$

0.38

Adjusted net income with tax benefit $

79,802

$

75,942

$

85,577

$

230,913

$

256,714

Adjusted net income with tax benefit per diluted share

$

1.18

$

1.11

$

1.19

$

3.36

$

3.53

1 The Company reports its financial

results in accordance with GAAP. Adjusted EBITDA and Adjusted Net

Income are not defined by GAAP and should not be regarded as an

alternative to any measurement under GAAP. Please refer to the

section “Information Regarding Non-GAAP Financial Measures” at the

end of this press release for an explanation of Non-GAAP financial

measures and a reconciliation to the nearest GAAP financial

measure.

Victory Capital Holdings, Inc.

and Subsidiaries

Unaudited Condensed

Consolidated Balance Sheets

(In thousands, except for

shares)

September 30, 2023 December 31, 2022 Assets

Cash and cash equivalents $

107,987

$

38,171

Receivables

95,174

84,473

Prepaid expenses

6,458

8,443

Investments, at fair value

29,858

27,266

Property and equipment, net

21,203

21,146

Goodwill

981,805

981,805

Other intangible assets, net

1,287,542

1,314,637

Other assets

61,778

64,958

Total assets $

2,591,805

$

2,540,899

Liabilities and stockholders' equity Accounts payable

and accrued expenses $

59,552

$

50,862

Accrued compensation and benefits

52,167

58,458

Consideration payable for acquisition of business

249,636

230,400

Deferred tax liability, net

124,995

108,138

Other liabilities

40,996

42,117

Long-term debt, net1

988,323

985,514

Total liabilities

1,515,669

1,475,489

Stockholders' equity Common stock, $0.01 par value

per share:2023 - 600,000,000 shares authorized, 82,224,284 shares

issued and 65,911,628 shares outstanding; 2022 - 600,000,000 shares

authorized, 80,528,137 shares issued and 67,325,534 shares

outstanding

822

805

Additional paid-in capital

723,252

705,466

Treasury stock, at cost: 2023 - 16,312,656 shares; 2022 -

13,202,603 shares

(384,462

)

(285,425

)

Accumulated other comprehensive income

34,220

35,442

Retained earnings

702,304

609,122

Total stockholders' equity

1,076,136

1,065,410

Total liabilities and stockholders' equity $

2,591,805

$

2,540,899

1 Balances at September 30, 2023 and

December 31, 2022 are shown net of unamortized loan discount and

debt issuance costs in the amount of $13.4 million and $16.2

million, respectively. The gross amount of the debt outstanding was

$1,001.7 million as of September 30, 2023 and December 31, 2022,

respectively.

Victory Capital Holdings, Inc.

and Subsidiaries

Assets Under

Management

(unaudited; in millions except

for percentages)

For the Three Months Ended % Change from

September 30,

June 30,

September 30,

June 30,

September 30,

2023

2023

2022

2023

2022

Beginning assets under management $

161,622

$

158,621

$

154,947

2%

4%

Gross client cash inflows

5,449

5,822

6,796

-6%

-20%

Gross client cash outflows

(7,168

)

(8,244

)

(7,368

)

-13%

-3%

Net client cash flows

(1,719

)

(2,422

)

(573

)

-29%

200%

Market appreciation (depreciation)

(4,888

)

5,537

(7,066

)

N/A

-31%

Realizations and distributions

—

(73

)

(51

)

N/A

N/A

Acquired & divested assets / Net transfers1

(1,508

)

(41

)

—

3578%

N/A

Ending assets under management

153,506

161,622

147,257

-5%

4%

Average assets under management

161,147

157,372

158,903

2%

1%

For the Nine Months Ended

% Change from

September 30,

September 30,

September 30,

2023

2022

2022

Beginning assets under management $

152,952

$

183,654

-17%

Gross client cash inflows

17,359

27,253

-36%

Gross client cash outflows

(22,745

)

(25,518

)

-11%

Net client cash flows

(5,386

)

1,734

N/A

Market appreciation (depreciation)

7,563

(36,987

)

N/A

Realizations and distributions

(73

)

(80

)

-9%

Acquired & divested assets / Net transfers1

(1,549

)

(1,064

)

46%

Ending assets under management

153,506

147,257

4%

Average assets under management

158,779

167,157

-5%

1 The three and nine months ended

September 30, 2023 reflects divested assets of $1.3 billion

associated with the INCORE transaction.

Victory Capital Holdings, Inc.

and Subsidiaries

Assets Under Management by

Asset Class

(unaudited; in

millions)

For the Three Months Ended

By Asset Class

Global /

U.S. Mid

U.S. Small

Fixed

U.S. Large

Non-U.S.

Alternative

Total

Money Market/

Cap Equity

Cap Equity

Income

Cap Equity

Equity

Solutions

Investments

Long-term

Short-term

Total

September 30, 2023 Beginning assets under management $

30,007

$

15,664

$

26,098

$

12,170

$

15,392

$

55,836

$

3,301

$

158,469

$

3,152

$

161,622

Gross client cash inflows

1,224

458

892

51

392

1,988

249

5,255

193

5,449

Gross client cash outflows

(1,769

)

(920

)

(1,343

)

(282

)

(519

)

(1,720

)

(402

)

(6,955

)

(213

)

(7,168

)

Net client cash flows

(545

)

(462

)

(451

)

(231

)

(126

)

268

(153

)

(1,700

)

(19

)

(1,719

)

Market appreciation (depreciation)

(1,224

)

(547

)

(460

)

(287

)

(451

)

(2,028

)

71

(4,927

)

39

(4,888

)

Realizations and distributions

—

—

—

—

—

—

—

—

—

—

Acquired & divested assets / Net transfers1

(2

)

(5

)

(1,397

)

(57

)

(8

)

(78

)

3

(1,545

)

37

(1,508

)

Ending assets under management $

28,235

$

14,650

$

23,790

$

11,596

$

14,807

$

53,998

$

3,222

$

150,298

$

3,208

$

153,506

June 30, 2023 Beginning assets under management $

29,035

$

15,648

$

26,535

$

11,425

$

14,868

$

54,416

$

3,317

$

155,244

$

3,377

$

158,621

Gross client cash inflows

1,259

743

873

87

559

1,622

449

5,591

231

5,822

Gross client cash outflows

(1,126

)

(1,128

)

(1,324

)

(290

)

(585

)

(2,834

)

(408

)

(7,697

)

(547

)

(8,244

)

Net client cash flows

132

(386

)

(451

)

(204

)

(26

)

(1,212

)

41

(2,106

)

(316

)

(2,422

)

Market appreciation (depreciation)

824

404

48

954

575

2,682

12

5,499

38

5,537

Realizations and distributions

—

—

—

—

—

—

(73

)

(73

)

—

(73

)

Acquired & divested assets / Net transfers

16

(2

)

(34

)

(4

)

(25

)

(49

)

4

(94

)

53

(41

)

Ending assets under management $

30,007

$

15,664

$

26,098

$

12,170

$

15,392

$

55,836

$

3,301

$

158,469

$

3,152

$

161,622

September 30, 2022 Beginning assets under management

$

26,356

$

14,837

$

29,398

$

11,857

$

13,257

$

50,485

$

5,617

$

151,807

$

3,140

$

154,947

Gross client cash inflows

1,508

589

1,123

67

742

1,745

827

6,601

194

6,796

Gross client cash outflows

(1,176

)

(939

)

(1,958

)

(269

)

(636

)

(1,315

)

(863

)

(7,155

)

(214

)

(7,368

)

Net client cash flows

333

(349

)

(835

)

(203

)

107

430

(36

)

(553

)

(19

)

(573

)

Market appreciation (depreciation)

(938

)

(404

)

(829

)

(560

)

(1,248

)

(2,930

)

(165

)

(7,074

)

8

(7,066

)

Realizations and distributions

—

—

—

—

—

—

(51

)

(51

)

—

(51

)

Acquired & divested assets / Net transfers

3

26

(536

)

(333

)

178

566

(31

)

(127

)

127

—

Ending assets under management $

25,754

$

14,109

$

27,198

$

10,762

$

12,293

$

48,551

$

5,334

$

144,001

$

3,256

$

147,257

1 The three months ended September 30,

2023 reflects divested assets of $1.3 billion associated with the

INCORE transaction.

Victory Capital Holdings, Inc.

and Subsidiaries

Assets Under Management by

Asset Class

(unaudited; in

millions)

For the Nine Months Ended By Asset Class Global

/ U.S. Mid U.S. Small Fixed U.S.

Large Non-U.S. Alternative Total Money

Market/ Cap Equity Cap Equity Income

Cap Equity Equity Solutions Investments

Long-term Short-term Total September 30,

2023 Beginning assets under management $

27,892

$

15,103

$

26,353

$

10,973

$

14,160

$

51,507

$

3,663

$

149,649

$

3,302

$

152,952

Gross client cash inflows

4,083

2,186

2,952

222

1,329

4,827

1,095

16,694

666

17,359

Gross client cash outflows

(3,988

)

(2,921

)

(4,239

)

(957

)

(1,648

)

(6,332

)

(1,650

)

(21,735

)

(1,010

)

(22,745

)

Net client cash flows

95

(735

)

(1,287

)

(735

)

(319

)

(1,506

)

(555

)

(5,041

)

(345

)

(5,386

)

Market appreciation (depreciation)

237

280

203

1,488

1,044

4,020

180

7,452

111

7,563

Realizations and distributions

—

—

—

—

—

—

(73

)

(73

)

—

(73

)

Acquired & divested assets / Net transfers1

13

2

(1,479

)

(130

)

(79

)

(23

)

8

(1,689

)

140

(1,549

)

Ending assets under management $

28,235

$

14,650

$

23,790

$

11,596

$

14,807

$

53,998

$

3,222

$

150,298

$

3,208

$

153,506

September 30, 2022 Beginning assets under management

$

30,578

$

20,094

$

35,154

$

15,766

$

16,050

$

60,364

$

2,548

$

180,554

$

3,100

$

183,654

Gross client cash inflows

5,417

2,408

4,183

318

3,124

6,796

4,566

26,812

441

27,253

Gross client cash outflows

(4,659

)

(4,082

)

(6,851

)

(1,048

)

(2,344

)

(4,551

)

(1,417

)

(24,952

)

(567

)

(25,518

)

Net client cash flows

758

(1,674

)

(2,668

)

(730

)

780

2,246

3,149

1,860

(125

)

1,734

Market appreciation (depreciation)

(5,604

)

(4,343

)

(3,945

)

(4,008

)

(4,781

)

(14,052

)

(263

)

(36,998

)

11

(36,987

)

Realizations and distributions

—

—

—

—

—

—

(80

)

(80

)

—

(80

)

Acquired & divested assets / Net transfers

22

33

(1,342

)

(266

)

245

(6

)

(19

)

(1,334

)

270

(1,064

)

Ending assets under management $

25,754

$

14,109

$

27,198

$

10,762

$

12,293

$

48,551

$

5,334

$

144,001

$

3,256

$

147,257

1 The nine months ended September 30, 2023

reflects divested assets of $1.3 billion associated with the INCORE

transaction.

Victory Capital Holdings, Inc.

and Subsidiaries

Assets Under Management by

Vehicle

(unaudited; in

millions)

For the Three Months Ended

By Vehicle

Separate

Accounts and

Mutual

Other Pooled

Funds(1)

ETFs(2)

Vehicles(3)

Total

September 30, 2023 Beginning assets under management $

105,916

$

5,193

$

50,513

$

161,622

Gross client cash inflows

3,283

232

1,933

5,449

Gross client cash outflows

(5,119

)

(557

)

(1,492

)

(7,168

)

Net client cash flows

(1,836

)

(324

)

441

(1,719

)

Market appreciation (depreciation)

(2,925

)

(165

)

(1,799

)

(4,888

)

Realizations and distributions

—

—

—

—

Acquired & divested assets / Net transfers4

(17

)

6

(1,497

)

(1,508

)

Ending assets under management $

101,138

$

4,710

$

47,658

$

153,506

June 30, 2023 Beginning assets under management $

103,246

$

5,555

$

49,819

$

158,621

Gross client cash inflows

3,639

175

2,008

5,822

Gross client cash outflows

(4,863

)

(421

)

(2,960

)

(8,244

)

Net client cash flows

(1,224

)

(246

)

(952

)

(2,422

)

Market appreciation (depreciation)

3,923

(117

)

1,731

5,537

Realizations and distributions

—

—

(73

)

(73

)

Acquired & divested assets / Net transfers

(28

)

—

(13

)

(41

)

Ending assets under management $

105,916

$

5,193

$

50,513

$

161,622

September 30, 2022 Beginning assets under management

$

102,297

$

5,155

$

47,494

$

154,947

Gross client cash inflows

4,277

515

2,003

6,796

Gross client cash outflows

(5,689

)

(196

)

(1,484

)

(7,368

)

Net client cash flows

(1,411

)

319

519

(573

)

Market appreciation (depreciation)

(4,290

)

(383

)

(2,393

)

(7,066

)

Realizations and distributions

—

—

(51

)

(51

)

Acquired & divested assets / Net transfers

(5

)

18

(13

)

—

Ending assets under management $

96,591

$

5,110

$

45,557

$

147,257

1 Includes institutional and retail share

classes, money market and VIP funds.

2 Represents only ETF assets held by third

parties. Excludes ETF assets held by other Victory Capital

products.

3 Includes collective trust funds, wrap

program accounts, UMAs, UCITS, private funds and non-U.S. domiciled

pooled vehicles.

4 The three months ended September 30,

2023 reflects divested assets of $1.3 billion associated with the

INCORE transaction.

Victory Capital Holdings, Inc.

and Subsidiaries

Assets Under Management by

Vehicle

(unaudited; in

millions)

For the Nine Months

Ended

By Vehicle Separate Accounts Mutual

and Other Funds(1) ETFs(2) Vehicles(3)

Total September 30, 2023 Beginning assets under

management $

99,447

$

5,627

$

47,877

$

152,952

Gross client cash inflows

11,468

625

5,266

17,359

Gross client cash outflows

(15,388

)

(1,211

)

(6,146

)

(22,745

)

Net client cash flows

(3,921

)

(586

)

(880

)

(5,386

)

Market appreciation (depreciation)

5,648

(329

)

2,244

7,563

Realizations and distributions

—

—

(73

)

(73

)

Acquired & divested assets / Net transfers4

(36

)

(3

)

(1,510

)

(1,549

)

Ending assets under management $

101,138

$

4,710

$

47,658

$

153,506

September 30, 2022 Beginning assets under management

$

124,142

$

4,871

$

54,641

$

183,654

Gross client cash inflows

16,981

1,666

8,606

27,253

Gross client cash outflows

(19,750

)

(394

)

(5,374

)

(25,518

)

Net client cash flows

(2,769

)

1,271

3,231

1,734

Market appreciation (depreciation)

(23,712

)

(1,051

)

(12,225

)

(36,987

)

Realizations and distributions

—

—

(80

)

(80

)

Acquired & divested assets / Net transfers

(1,071

)

18

(11

)

(1,064

)

Ending assets under management $

96,591

$

5,110

$

45,557

$

147,257

1 Includes institutional and retail share

classes, money market and VIP funds.

2 Represents only ETF assets held by third

parties. Excludes ETF assets held by other Victory Capital

products.

3 Includes collective trust funds, wrap

program accounts, UMAs, UCITS, private funds and non-U.S. domiciled

pooled vehicles.

4 The nine months ended September 30, 2023

reflects divested assets of $1.3 billion associated with the INCORE

transaction.

Information Regarding Non-GAAP

Financial Measures

Victory Capital uses non-GAAP financial measures referred to as

Adjusted EBITDA and Adjusted Net Income to measure the operating

profitability of the Company. These measures eliminate the impact

of one-time acquisition, restructuring and integration costs and

demonstrate the ongoing operating earnings metrics of the Company.

The Company has included these non-GAAP measures to provide

investors with the same financial metrics used by management to

assess the operating performance of the Company.

Adjusted EBITDA

Adjustments made to GAAP Net Income to calculate Adjusted

EBITDA, as applicable, are:

- Adding back income tax expense;

- Adding back interest paid on debt and other financing costs,

net of interest income;

- Adding back depreciation on property and equipment;

- Adding back other business taxes;

- Adding back amortization expense on acquisition-related

intangible assets;

- Adding back stock-based compensation expense associated with

equity awards issued from pools created in connection with the

management-led buyout and various acquisitions and as a result of

equity grants related to the IPO;

- Adding back direct incremental costs of acquisitions, including

restructuring costs;

- Adding back debt issuance cost expense;

- Adjusting for earnings/losses on equity method

investments.

Adjusted Net Income

Adjustments made to GAAP Net Income to calculate Adjusted Net

Income, as applicable, are:

- Adding back other business taxes;

- Adding back amortization expense on acquisition-related

intangible assets;

- Adding back stock-based compensation expense associated with

equity awards issued from pools created in connection with the

management-led buyout and various acquisitions and as a result of

any equity grants related to the IPO;

- Adding back direct incremental costs of acquisitions, including

restructuring costs;

- Adding back debt issuance cost expense;

- Subtracting an estimate of income tax expense applied to the

sum of the adjustments above.

Tax Benefit of Goodwill and Acquired

Intangible Assets

Due to Victory Capital’s acquisitive nature, tax deductions

allowed on acquired intangible assets and goodwill provide it with

additional significant supplemental economic benefit. The tax

benefit of goodwill and intangible assets represent the tax

benefits associated with deductions allowed for intangible assets

and goodwill generated from prior acquisitions in which the Company

received a step-up in basis for tax purposes. Acquired intangible

assets and goodwill may be amortized for tax purposes, generally

over a 15-year period. The tax benefit from amortization on these

assets is included to show the full economic benefit of deductions

for all acquired intangible assets with a step-up in tax basis.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231102912692/en/

Investors: Matthew Dennis, CFA Chief of Staff Director,

Investor Relations 216-898-2412 mdennis@vcm.com

Media: Jessica Davila Director, Global Communications

210-694-9693 jessica_davila@vcm.com

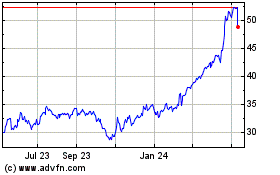

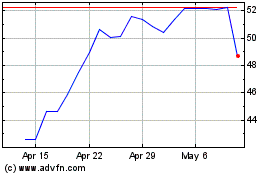

Victory Capital (NASDAQ:VCTR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Victory Capital (NASDAQ:VCTR)

Historical Stock Chart

From Nov 2023 to Nov 2024