Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

August 14 2024 - 7:30AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of: August 2024

Commission File Number: 001-40412

VICINITY

MOTOR CORP.

(Translation

of registrant’s name into English)

3168, 262nd Street

Aldergrove, British Columbia, Canada V4W 2Z6

Telephone: (604) 607-4000

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

The information

contained in Exhibit 99.1 of this Form 6-K is

incorporated by reference into, or as an additional exhibit to, as applicable, the registrant’s Registration Statement on

Form F-3 (File No. 333-272964).

DOCUMENTS INCLUDED AS PART OF THIS REPORT

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Vicinity Motor Corp.

(Registrant) |

| |

|

| Date: August 14, 2024 |

By: |

/s/ Tina Stewart |

| |

|

Name: |

Tina Stewart |

| |

|

Title: |

Chief Financial Officer |

EXHIBIT 99.1

Vicinity Motor Corp. Applies for Management Cease

Trade Order

VANCOUVER, BC / ACCESSWIRE / August

14, 2024 / Vicinity Motor Corp. (NASDAQ:VEV) (TSXV:VMC) (“Vicinity” or the “Company”), a North American supplier

of commercial electric vehicles today announces that it has requested a temporary Management Cease Trade Order (“MCTO”) from

the British Columbia Securities Commission (“BCSC”) in connection with the Company’s filing of its interim financial

statements (the “Interim Financial Statements”) and MD&A for the six months ended June 30, 2024.

The Company is requesting the MCTO in order

to secure additional time to finalize its Interim Financial Statements, the related MD&A and the applicable CEO and CFO certifications

(the “Interim Filings”). The anticipated delay in filing the Interim Filings is a result of the news on August 9, 2024 that

the Company’s secured creditors demanded payment of outstanding debt and issued a notice of intention to enforce security. The Company

needs the additional time to appropriately reflect the subsequent events resulting from the current situation with the Company’s

secured lenders. The Company is assessing options to complete preparation of the Interim Financial Statements and to respond to all queries.

It is the Company’s reasonable expectation that the Interim Filings will be finalized on or before September 13, 2024.

By way of background and as required by

the BCSC, the Company notes the following:

| 1. | The Company is required to file its Interim Filings within 45 days after the end

the interim period ended June 30, 2024, such date being August 14, 2024 (the “Interim Filing Deadline”) as required by National

Instrument 51-102 Continuous Disclosure Obligations (“NI 51-102”). The Company does not anticipate that it will be

able to complete the Interim Filings on or before the Interim Filing Deadline. |

| 2. | The Company is working diligently to prepare and file the Interim Filings, on or

before September 13, 2024. |

| 3. | The Company confirms that it intends to issue a status report on a bi-weekly basis,

for as long as it remains in default of the Interim Filing Deadline in respect of the Interim Filings. |

| 4. | The Company is not subject to any insolvency proceedings as of the date of this

news release, though the Company is presently evaluating all potential solutions available to it as a result of the demand from its creditors. |

| 5. | There is no other material information concerning the affairs of the Company that

has not been generally disclosed. |

The Company has imposed an insider trading

blackout pending the filing of the Interim Filings and will comply with the alternative information guidelines described in National Policy

12-203 Management Cease Trade Orders during such period. The public will continue to be able to trade in the Company’s common

shares and the Company’s previously scheduled second quarter 2024 earnings conference call will be rescheduled to a future date.

The Company has put an estimated 45 employees

located in Canada and 10 employees located in the United States on temporary layoff as a result of the creditor situation to address immediate

liquidity concerns and reduction of available cash.

About Vicinity Motor Corp.

Vicinity Motor Corp. (NASDAQ:VEV) (TSXV:VMC) (“VMC”)

is a North American supplier of electric vehicles for both public and commercial enterprise use. The Company leverages a dealer network

and close relationships with world-class manufacturing partners to supply its flagship electric, CNG and clean-diesel Vicinity buses,

as well as the VMC 1200 electric truck to the transit and industrial markets. For more information, please visit www.vicinitymotorcorp.com.

Company Contact:

John LaGourgue

VP Corporate Development

604-288-8043

IR@vicinitymotor.com

Investor Relations Contact:

Lucas Zimmerman

MZ Group - MZ North America

949-259-4987

VMC@mzgroup.us

www.mzgroup.us

Neither the TSX-V nor its Regulation Service Provider

(as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This press release includes certain “forward-looking

information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning

of applicable securities laws. All statements, other than statements of historical fact, included herein are forward-looking statements.

Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”,

“believes”, “intends”, “estimates”, “potential”, “possible”, and similar expressions,

or statements that events, conditions, or results “will”, “may”, “could”, or “should”

occur or be achieved. In particular, and without limitation, this news release contains forward-looking statements respecting the Company’s

reasonable expectation that the Interim Filings will be finalized on or before September 13, 2024 and the success of the Company’s

discussions with its creditors to evaluate potential solutions to enable the Company to carry on.

Forward-looking statements involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate,

and actual results and future events could differ materially from those anticipated in such statements.

Important factors that could cause actual results

to differ materially from Vicinity’s expectations include uncertainties relating to the economic conditions in the markets in which

Vicinity operates, vehicle sales volume, anticipated future sales growth, the success of Vicinity’s operational strategies, production

prospects at Vicinity’s assembly facility in the State of Washington, the success of Vicinity’s strategic partnerships; and

other risk and uncertainties disclosed in Vicinity’s reports and documents filed with applicable securities regulatory authorities

from time to time. Vicinity’s forward-looking statements reflect the beliefs, opinions and projections on the date the statements

are made. Vicinity assumes no obligation to update the forward-looking statements or beliefs, opinions, projections, or other factors,

should they change, except as required by law.

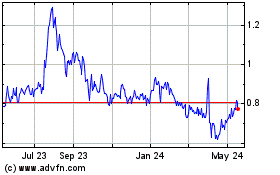

Vicinity Motor (NASDAQ:VEV)

Historical Stock Chart

From Dec 2024 to Jan 2025

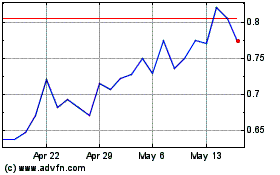

Vicinity Motor (NASDAQ:VEV)

Historical Stock Chart

From Jan 2024 to Jan 2025