Versus Systems Receives NASDAQ Notification Regarding Minimum Stockholders’ Equity Deficiency

August 27 2024 - 5:43PM

Versus Systems, Inc. (NASDAQ: VS) (the “Company”) announces that it

has received a letter from the listing qualifications department

staff of the NASDAQ Stock Market (“NASDAQ”), notifying the Company

that the stockholders’ equity of $1,797,764 as reported in the

Company’s Quarterly Report on Form 10-Q for the period ended June

30, 2024 was below the minimum stockholders’ equity of $2,500,000.

The minimum stockholders’ equity of $2,500,000 is required for

continued listing on the NASDAQ Capital Market as set forth in

NASDAQ listing rule 5550(b)(1), and the Company does not meet the

alternatives of market value of listed securities or net income

from continuing operations.

The Company has been provided until October 7, 2024, to submit a

plan to regain compliance with the minimum stockholders’ equity

standard. If the Company’s plan to regain compliance is accepted,

NASDAQ may grant an extension of up to 180 calendar days from the

date of the notification letter to evidence compliance with the

minimum stockholders’ equity standard.

The Company is developing a plan with options to increase

stockholder equity and regain compliance, with the goal of filing

the plan with NASDAQ by the stated deadline. The Company will

provide further updates as required.

About Versus Systems

Versus Systems, Inc. has developed a proprietary in-game prizing

and promotions engine that allows game developers and publishers to

offer real-world rewards inside their games. Players can choose

from a variety of rewards that match their interests, including

merchandise, events, and digital goods. Versus Systems is

headquartered in Los Angeles, California.

For more information, please

visit www.versussystems.com.

For media inquiries, please contact:

Cody Slach, Gateway Group, Inc.949-574-3860IR@versussystems.com

orpress@versussystems.com

Forward-Looking Statements

This news release contains “forward-looking statements”.

Statements in this news release which are not purely historical are

forward-looking statements and include any statements regarding

beliefs, plans, outlook, expectations or intentions regarding the

future, including statements regarding the Company’s plans to

regain compliance. It is important to note that actual outcomes and

the Company’s actual results could differ materially from those in

such forward-looking statements. Actual results could differ from

those projected in any forward-looking statements due to numerous

factors. Such factors include, among others: uncertainty whether

the Company can come up with a plan to regain compliance or whether

a plan, if any, to regain compliance submitted to Nasdaq will be

accepted or if accepted, whether the Company will regain compliance

with the minimum stockholders equity rule within the timelines

required by Nasdaq, failing which, the Company’s securities will be

delisted by Nasdaq; uncertainty whether the Company would appeal

any delisting notice or whether any such appeal would be

successful, failing which, the Company’s securities will be

delisted by Nasdaq; the risk that delisting of the Company’s

securities may have a material adverse effect on the Company’s

share liquidity and trading price and on the Company’s ability to

obtain financing and continue its business; and the risk of changes

in business strategy or plans. Readers should also refer to the

risk disclosures outlined in the Company’s quarterly reports on

Form 10-Q, the Company’s annual reports on Form 10-K, and the

Company’s other disclosure documents filed from time-to-time with

the Securities and Exchange Commission at www.sec.gov and the

Company’s interim and annual filings and other disclosure documents

filed in Canada from time-to-time under the Company's profile on

SEDAR+ at https://www.sedarplus.ca.

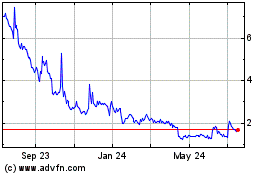

Versus Systems (NASDAQ:VS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Versus Systems (NASDAQ:VS)

Historical Stock Chart

From Nov 2023 to Nov 2024