0001082554false00010825542023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 1, 2023

United Therapeutics Corporation

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

| Delaware | 000-26301 | 52-1984749 |

(State or Other

Jurisdiction of

Incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification Number) |

| | | | | |

| 1000 Spring Street | |

| Silver Spring, | |

| MD | 20910 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code:

(301) 608-9292

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

| Common Stock, par value $0.01 per share | UTHR | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 1, 2023, United Therapeutics Corporation issued a press release setting forth its earnings for the quarter ended September 30, 2023.

A copy of the press release is attached hereto as Exhibit 99.1.

Item 9.01. Exhibits

This information shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liability under that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| | | |

| | |

| 104 | | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | UNITED THERAPEUTICS CORPORATION |

| | |

| | |

| Dated: November 1, 2023 | By: | /s/ Paul A. Mahon |

| | Name: | Paul A. Mahon |

| | Title: | General Counsel |

Exhibit 99.1

For Immediate Release

United Therapeutics Corporation Reports Third Quarter 2023 Financial Results

SILVER SPRING, Md. and RESEARCH TRIANGLE PARK, N.C., November 1, 2023: United Therapeutics Corporation (Nasdaq: UTHR), a public benefit corporation, today announced its financial results for the quarter ended September 30, 2023. Total revenues in the third quarter of 2023 grew 18% year-over-year to $609.4 million, compared to $516.0 million in the third quarter of 2022.

“It’s a testament to our innovative research and commercial execution that we are again reporting record quarterly revenue and double-digit revenue growth,” said Martine Rothblatt, Ph.D., Chairperson and Chief Executive Officer. “On top of our record results, we continue to progress our near-term pipeline with the ongoing TETON 1 and TETON 2 studies of nebulized Tyvaso in idiopathic pulmonary fibrosis and the ADVANCE OUTCOMES study of ralinepag in pulmonary arterial hypertension, both of which could generate data in 2025.”

“With over $600 million in quarterly revenue, we’re well on our way to achieving our expected $4 billion annual run rate by mid-decade,” said Michael Benkowitz, President and Chief Operating Officer. “Our commercial teams achieved meaningful growth in all of our key products, and our recent field force expansion in PH-ILD will help us build on this momentum.”

Third Quarter 2023 Financial Results

Key financial highlights include (dollars in millions, except per share data):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Dollar Change | | Percentage Change |

| | 2023 | | 2022 | | |

| | | | | | | | |

| Total revenues | $ | 609.4 | | | $ | 516.0 | | | $ | 93.4 | | | 18 | % |

| Net income | $ | 267.6 | | | $ | 239.3 | | | $ | 28.3 | | | 12 | % |

| Net income, per basic share | $ | 5.71 | | | $ | 5.26 | | | $ | 0.45 | | | 9 | % |

| Net income, per diluted share | $ | 5.38 | | | $ | 4.91 | | | $ | 0.47 | | | 10 | % |

Revenues

The table below presents the components of total revenues (dollars in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Dollar Change | | Percentage

Change |

| | 2023 | | 2022 | | |

| Net product sales: | | | | | | | |

Tyvaso DPI®(1) | $ | 205.1 | | | $ | 63.1 | | | $ | 142.0 | | | 225 | % |

Nebulized Tyvaso®(1) | 120.7 | | | 194.6 | | | (73.9) | | | (38) | % |

Total Tyvaso | 325.8 | | | 257.7 | | | 68.1 | | | 26 | % |

Remodulin®(2) | 131.1 | | | 114.0 | | | 17.1 | | | 15 | % |

Orenitram® | 92.0 | | | 87.5 | | | 4.5 | | | 5 | % |

Unituxin® | 51.3 | | | 46.1 | | | 5.2 | | | 11 | % |

Adcirca® | 7.3 | | | 10.7 | | | (3.4) | | | (32) | % |

| Other | 1.9 | | | — | | | 1.9 | | | NM(3) |

| Total revenues | $ | 609.4 | | | $ | 516.0 | | | $ | 93.4 | | | 18 | % |

(1)Net product sales include both the drug product and the respective inhalation device.

(2)Net product sales include sales of infusion devices, such as the Remunity® Pump.

(3)Calculation is not meaningful.

Net product sales of our treprostinil-based products (Tyvaso DPI, nebulized Tyvaso, Remodulin, and Orenitram) grew by $89.7 million, or 20%, for the third quarter of 2023, as compared to the third quarter of 2022. The growth in total Tyvaso revenues resulted primarily from an increase in total quantities sold driven by the commercial launch of Tyvaso DPI in June 2022 and continued growth in utilization by patients with pulmonary hypertension associated with interstitial lung disease (PH-ILD). The growth in Tyvaso DPI revenues resulted from an increase in quantities sold. The decrease in nebulized Tyvaso revenues resulted primarily from a decrease in quantities sold following the commercial launch of Tyvaso DPI. The increase in Remodulin revenues resulted from an increase in quantities sold.

Expenses

Cost of sales. The table below summarizes cost of sales by major category (dollars in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Dollar Change | | Percentage Change |

| | 2023 | | 2022 | | |

| Category: | | | | | | | |

| Cost of sales | $ | 69.1 | | | $ | 37.1 | | | $ | 32.0 | | | 86 | % |

Share-based compensation expense(1) | 1.0 | | | 0.1 | | | 0.9 | | | 900 | % |

| Total cost of sales | $ | 70.1 | | | $ | 37.2 | | | $ | 32.9 | | | 88 | % |

(1)Refer to Share-based compensation below.

Cost of sales, excluding share-based compensation. Cost of sales for the three months ended September 30, 2023 increased as compared to the same period in 2022, primarily due to an increase in Tyvaso DPI royalty expense and product costs following its commercial launch in June 2022.

Research and development expense. The table below summarizes the nature of research and development expense by major expense category (dollars in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Dollar Change | | Percentage Change |

| | 2023 | | 2022 | | |

| Category: | | | | | | | |

External research and development(1) | $ | 47.2 | | | $ | 37.6 | | | $ | 9.6 | | | 26 | % |

Internal research and development(2) | 34.3 | | | 29.1 | | | 5.2 | | | 18 | % |

Share-based compensation expense(3) | 3.6 | | | 2.0 | | | 1.6 | | | 80 | % |

Impairments(4) | — | | | — | | | — | | | — | % |

Other(5) | (0.4) | | | (2.6) | | | 2.2 | | | 85 | % |

| Total research and development expense | $ | 84.7 | | | $ | 66.1 | | | $ | 18.6 | | | 28 | % |

(1)External research and development primarily includes fees paid to third parties (such as clinical trial sites, contract research organizations, and contract laboratories) for preclinical and clinical studies and payments to third-party contract manufacturers before FDA approval of the relevant product.

(2)Internal research and development primarily includes salary-related expenses for research and development functions, internal costs to manufacture product candidates before FDA approval, and internal facilities-related expenses, including depreciation, related to research and development activities.

(3)Refer to Share-based compensation below.

(4)Impairments primarily includes impairment charges to write down the carrying value of in-process research and development and of certain property, plant, and equipment as a result of research and development activities. There were no impairment charges during the three months ended September 30, 2023 and September 30, 2022.

(5)Other primarily includes upfront fees and milestone payments to third parties under license agreements related to development-stage products and adjustments to the fair value of our contingent consideration obligations.

Research and development expense, excluding share-based compensation. Research and development expense for the three months ended September 30, 2023 increased as compared to the same period in 2022, primarily due to increased expenditures related to: (1) the TETON 1 and TETON 2 clinical studies of nebulized Tyvaso in patients with idiopathic pulmonary fibrosis; and (2) organ manufacturing projects.

Selling, general, and administrative expense. The table below summarizes selling, general, and administrative expense by major category (dollars in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Dollar Change | | Percentage Change |

| 2023 | | 2022 | | |

| Category: | | | | | | | |

| General and administrative | $ | 90.4 | | | $ | 85.7 | | | $ | 4.7 | | | 5 | % |

| Sales and marketing | 20.7 | | | 17.2 | | | 3.5 | | | 20 | % |

Share-based compensation expense (benefit)(1) | 16.5 | | | (4.5) | | | 21.0 | | | 467 | % |

| Total selling, general, and administrative expense | $ | 127.6 | | | $ | 98.4 | | | $ | 29.2 | | | 30 | % |

(1) Refer to Share-based compensation below.

Share-based compensation. The table below summarizes share-based compensation expense (benefit) by major category (dollars in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Dollar Change | | Percentage Change |

| 2023 | | 2022 | | |

| Category: | | | | | | | |

| Stock options | $ | 6.0 | | | $ | 5.7 | | | $ | 0.3 | | | 5 | % |

| Restricted stock units | 12.5 | | | 9.9 | | | 2.6 | | | 26 | % |

Share tracking awards plan (STAP) | 2.1 | | | (18.5) | | | 20.6 | | | 111 | % |

| Employee stock purchase plan | 0.5 | | | 0.5 | | | — | | | — | % |

Total share-based compensation expense (benefit) | $ | 21.1 | | | $ | (2.4) | | | $ | 23.5 | | | 979 | % |

The increase in share-based compensation expense for the three months ended September 30, 2023, as compared to the same period in 2022, was primarily due to an increase in STAP expense driven by a two percent increase in our stock price for the three months ended September 30, 2023, as compared to an 11 percent decrease in our stock price for the same period in 2022.

Income tax expense. Income tax expense for the three months ended September 30, 2023 and 2022 was $84.2 million and $73.2 million, respectively. Our effective income tax rate for the three months ended September 30, 2023 and 2022 was 24 percent and 23 percent, respectively.

Inducement Restricted Stock Units

On October 30, 2023, we granted a total of 23,483 restricted stock units under our 2019 Inducement Stock Incentive Plan to 16 newly hired employees. One of the grants will vest in three equal installments on the third, fourth, and fifth anniversaries of the grant date on October 30, 2026, October 30, 2027, and October 30, 2028. All other grants cliff vest fully on the third anniversary of the grant date on October 30, 2026. These restricted stock unit grants assume continued employment on such dates, and are subject to the standard terms and conditions we filed with the SEC as Exhibit 10.2 to our Current Report on Form 8-K on March 1, 2019. We are providing this information in accordance with Nasdaq Listing Rule 5635(c)(4).

Webcast

We will host a webcast to discuss our third quarter 2023 financial results on Wednesday, November 1, 2023, at 9:00 a.m. Eastern Time. The webcast can be accessed live via our website at https://ir.unither.com/events-and-presentations/default.aspx. A replay of the webcast will also be available at the same location on our website approximately 12 hours after the conclusion of the call.

United Therapeutics: Enabling Inspiration

At United Therapeutics, our vision and mission are one. We use our enthusiasm, creativity, and persistence to innovate for the unmet medical needs of our patients and to benefit our other stakeholders. We are bold and unconventional. We have fun, we do good. We are the first publicly-traded biotech or pharmaceutical company to take the form of a public benefit corporation (PBC). Our public benefit purpose is to provide a brighter future for patients through (a) the development of novel pharmaceutical therapies; and (b) technologies that expand the availability of transplantable organs.

You can learn more about what it means to be a PBC here: unither.com/pbc.

Forward-Looking Statements

Statements included in this press release that are not historical in nature are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, among others, statements related to our future revenue expectations, including our anticipated $4 billion annual revenue run rate by mid-decade, and the expectation that our recent field force expansion will help us grow use of our products by PH-ILD patients; expectations regarding our TETON 1, TETON 2, and ADVANCE OUTCOMES clinical trials, including the possibility that these trials could generate data in 2025; and our goals of innovating for the unmet medical needs of our patients and to benefit our other stakeholders, furthering our public benefit purpose of developing novel pharmaceutical therapies and technologies that expand the availability of transplantable organs, providing superior financial performance for shareholders, and providing our communities with earth-sensitive energy utilization. These forward-looking statements are subject to certain risks and uncertainties, such as those described in our periodic reports filed with the Securities and Exchange Commission, that could cause actual results to differ materially from anticipated results. Consequently, such forward-looking statements are qualified by the cautionary statements, cautionary language and risk factors set forth in our periodic reports and documents filed with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. We claim the protection of the safe harbor contained in the Private Securities Litigation Reform Act of 1995 for forward-looking statements. We are providing this information as of November 1, 2023, and assume no obligation to update or revise the information contained in this press release whether as a result of new information, future events, or any other reason.

ORENITRAM, REMODULIN, REMUNITY, TYVASO, TYVASO DPI, and UNITUXIN are registered trademarks of United Therapeutics Corporation and/or its subsidiaries.

ADCIRCA is a registered trademark of Eli Lilly and Company.

For Further Information Contact:

Dewey Steadman at (202) 919-4097

https://ir.unither.com/contact-uthr/default.aspx

UNITED THERAPEUTICS CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(In millions, except per share data)

| | | | | | | | | | | |

| | Three Months Ended

September 30, |

| | 2023 | | 2022 |

| | (Unaudited) |

| | | |

| | | |

| | | |

| Total revenues | $ | 609.4 | | | $ | 516.0 | |

| Operating expenses: | | | |

| Cost of sales | 70.1 | | | 37.2 | |

| Research and development | 84.7 | | | 66.1 | |

| Selling, general, and administrative | 127.6 | | | 98.4 | |

| Total operating expenses | 282.4 | | | 201.7 | |

| Operating income | 327.0 | | | 314.3 | |

| Interest income | 45.3 | | | 13.3 | |

| Interest expense | (15.6) | | | (9.2) | |

| Other expense, net | (4.9) | | | (5.9) | |

| | | |

| Total other income (expense), net | 24.8 | | | (1.8) | |

| Income before income taxes | 351.8 | | | 312.5 | |

| Income tax expense | (84.2) | | | (73.2) | |

| Net income | $ | 267.6 | | | $ | 239.3 | |

| Net income per common share: | | | |

| Basic | $ | 5.71 | | | $ | 5.26 | |

| Diluted | $ | 5.38 | | | $ | 4.91 | |

| Weighted average number of common shares outstanding: | | | |

| Basic | 46.9 | | | 45.5 | |

| Diluted | 49.7 | | | 48.7 | |

SELECTED CONSOLIDATED BALANCE SHEET DATA

(Unaudited, in millions) | | | | | |

| September 30,

2023 |

| Cash, cash equivalents, and marketable investments | $ | 4,936.3 | |

| Total assets | 7,023.6 | |

| Total liabilities | 1,311.5 | |

| Total stockholders’ equity | 5,712.1 | |

Tyvaso Net Product Sales

The table below presents select historical net product sales for Tyvaso DPI and nebulized Tyvaso (dollars in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| | March 31,

2022 | | June 30,

2022 | | September 30,

2022 | | December 31,

2022 | | March 31,

2023 | | June 30, 2023 | | September 30,

2023 |

| Net product sales: | | | | | | | | | | | | | |

Tyvaso DPI(1) | $ | — | | | $ | 3.0 | | | $ | 63.1 | | | $ | 92.2 | | | $ | 118.7 | | | $ | 193.6 | | | $ | 205.1 | |

Nebulized Tyvaso(1) | 172.0 | | | 198.0 | | | 194.6 | | | 150.1 | | | 119.7 | | | 125.3 | | | 120.7 | |

| Total Tyvaso net product sales | $ | 172.0 | | | $ | 201.0 | | | $ | 257.7 | | | $ | 242.3 | | | $ | 238.4 | | | $ | 318.9 | | | $ | 325.8 | |

(1)Net product sales include both the drug product and the respective inhalation device.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

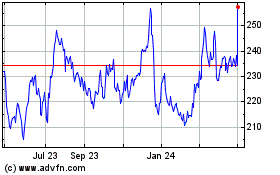

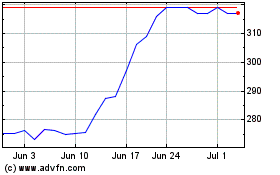

United Therapeutics (NASDAQ:UTHR)

Historical Stock Chart

From Jun 2024 to Jul 2024

United Therapeutics (NASDAQ:UTHR)

Historical Stock Chart

From Jul 2023 to Jul 2024