false000139431900013943192023-08-142023-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 14, 2023 |

Tracon Pharmaceuticals, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36818 |

34-2037594 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

4350 La Jolla Village Drive, Suite 800 |

|

San Diego, California |

|

92122 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (858) 550-0780 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

TCON |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 14, 2023, TRACON Pharmaceuticals, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended June 30, 2023. A copy of this press release is furnished as Exhibit 99.1 hereto.

The information provided in this Item 2.02 of this Current Report on Form 8-K, including the exhibits, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

August 14, 2023 |

By: |

/s/ Charles P. Theuer, M.D., Ph.D. |

|

|

|

Charles P. Theuer, M.D., Ph.D.

President and Chief Executive Officer |

Exhibit 99.1

TRACON Pharmaceuticals Reports Second Quarter 2023 Financial Results and

Provides Corporate Update

San Diego, CA – August 14, 2023 – TRACON Pharmaceuticals, Inc. (Nasdaq: TCON), a clinical stage biopharmaceutical company utilizing a cost-efficient, CRO-independent product development platform to advance its pipeline of novel targeted cancer therapeutics and to partner with other life science companies, today announced financial results for the second quarter ended June 30, 2023. The Company will host a conference call and webcast today at 4:30 PM Eastern Time / 1:30 PM Pacific Time.

“We were pleased to collect the arbitration award of $22M, the initial net proceeds of which extend our cash runway into early 2024 and past expected full accrual of the ENVASARC pivotal trial,” said Charles Theuer, M.D., Ph.D., TRACON’s Chief Executive Officer. “We look forward to reporting the interim efficacy assessment from ENVASARC later this quarter, which includes a futility threshold that has already been achieved based on responses seen to date. In June, we reported that envafolimab treatment continues to generate a double-digit objective response rate (ORR) and has been well tolerated, and as such we believe that we remain on track to achieve the primary endpoint of the study, which is a minimum 11.25% ORR. Achieving a double-digit ORR with a well-tolerated safety profile positions envafolimab to become a potentially compelling treatment option for patients with the refractory sarcoma subtypes of UPS and MFS. The sole approved treatment for these patients is Votrient, which achieved a 4% ORR and carries a black box warning for fatal liver toxicity.”

Recent Corporate Highlights

•In June, we announced an ongoing double-digit ORR for single agent envafolimab in patients with two on-study scans in the ongoing ENVASARC Phase 2 pivotal trial without any > Grade 2 drug related toxicity. The single agent envafolimab ORR exceeded the futility rule that will be applied at the interim efficacy analysis expected later this quarter, and full ENVASARC accrual is expected in the fourth quarter.

•In July, we announced collection of the arbitration award of $22M from I-Mab Biopharma, with the initial net proceeds of $7.1 million expected to fund the Company’s operations, as currently planned, into early 2024.

4350 La Jolla Village Drive • Suite 800 • San Diego, California 92122 • P: 858.550.0780 • F: 858.550.0786

URL: www.traconpharma.com

Expected Upcoming Milestones

•Report the second and final interim efficacy analysis from the ENVASARC pivotal trial following the review of more than 12 weeks of efficacy data (including two on-study CT scans) by the IDMC from 46 patients who receive envafolimab as a single agent, which we expect later this quarter as the ENVASARC trial has enrolled 180 patients to date, including 56 of the 80 expected patients in cohort C of single agent envafolimab treatment that is the basis for determination of the primary endpoint of the study, which is a minimum 11.25% ORR.

•Complete accrual of the ENVASARC pivotal trial in the fourth quarter of 2023.

•Leverage TRACON’s cost-efficient, CRO-independent product development platform to generate non-dilutive capital by the end of 2024.

•Final data from ENVASARC pivotal trial in mid-2024.

Second Quarter 2023 Financial Results

•Cash, cash equivalents and restricted cash were $1.9 million at June 30, 2023, compared to $17.5 million at December 31, 2022, which does not include the $7.1 million in initial net proceeds from the arbitration award that was received in July. TRACON’s pro forma cash position of $9.0 million is expected to fund the Company into the first quarter of 2024.

•An additional $4.4M of the arbitration award remains in a client trust account administered by our law firm at this time, the disbursement of which is predicated on discussions as to the amount of success-based deferred legal fees the firm is due.

•Collaboration revenue was $9.0 million for the second quarter of 2023, compared to nil for the second quarter of 2022. The increase was related to the termination of the TJ4309 license.

•Research and development expenses for the second quarter of 2023 were $3.5 million, compared to $2.9 million for the second quarter of 2022. The increase was primarily related to increased enrollment into the ENVASARC pivotal trial.

•General and administrative expenses for the second quarter of 2023 were $1.9 million, compared to $3.3 million for the second quarter of 2022. The decrease was primarily attributable to lower legal expenses.

•Net loss for the second quarter of 2023 was $6.3 million, compared to $6.2 million for the second quarter of 2022. In July we collected the arbitration award from I-Mab which will result in a one-time gain in the third quarter of 2023 of $13.0 million.

Conference Call Details

To access the call by phone, please register using this link and you will be provided with dial-in details.

A live webcast of the conference call will be available online from the Investor/Events and Presentation page of the Company’s website at www.traconpharma.com.

After the live webcast, a replay will remain available on TRACON’s website for 60 days.

About Envafolimab

Envafolimab (KN035), a single-domain antibody against PD-L1 invented by Alphamab Oncology and licensed by TRACON, is the first approved subcutaneously injected PD-(L)1 inhibitor. Envafolimab was approved by the Chinese NMPA in November 2021 in adult patients with MSI-H/dMMR advanced solid tumors who failed systemic treatment and have no satisfactory alternative treatment options. In December 2019, Alphamab Oncology, 3D Medicines and TRACON entered into a collaboration whereby TRACON has the right to develop and commercialize envafolimab in soft tissue sarcoma in North America. Envafolimab is currently being studied in the pivotal ENVASARC Phase 2 trial in the United States sponsored by TRACON and a Phase 3 pivotal trial in combination with gemcitabine and oxaliplatin in advanced biliary tract cancer patients as well as multiple Phase 1 and Phase 2 clinical trials in China sponsored by TRACON’s corporate partners, Alphamab Oncology and 3D Medicines. TRACON has received orphan drug designation from the U.S. Food and Drug Administration for envafolimab for patients with soft tissue sarcoma and fast track designation from the U.S. Food and Drug Administration for envafolimab for patients with locally advanced, unresectable or metastatic undifferentiated pleomorphic sarcoma (UPS) and myxofibrosarcoma (MFS) who have progressed on one or two prior lines of chemotherapy.

About ENVASARC (NCT04480502)

The ENVASARC pivotal trial is a multicenter, open label, randomized, non-comparative, parallel cohort study at 30 top cancer centers in the United States and the United Kingdom that began dosing in December 2020. TRACON expects the trial to enroll more than 160 patients with UPS or MFS who have progressed following one or two lines of prior treatment and have not received an immune checkpoint inhibitor, with 80 patients enrolled into a cohort of treatment with single agent envafolimab at 600 mg every three weeks and 80 patients enrolled into a cohort of treatment with envafolimab at 600 mg every three weeks with Yervoy®. The primary endpoint is objective response rate by central review with duration of response a key secondary endpoint.

About YH001

YH001 is an IgG1 antibody against CTLA-4 that has shown enhanced antibody dependent cellular cytotoxicity and complement dependent cytotoxicity in vitro. In preclinical studies YH001 demonstrated superior T cell activation and superior tumor growth inhibition activity compared to ipilimumab. YH001 also demonstrated superior activity compared to ipilimumab in human transgenic mouse tumor models when combined with a PD-(L)1 antibody. In these models, single agent YH001 depleted regulatory T cells and increased CD8+ T cells in tumor tissue. YH001 is being studied with envafolimab and doxorubicin in a Phase 1/2 clinical trial sponsored by TRACON (NCT05448820), and has been studied in multiple Phase 1 trials in China and Australia sponsored by TRACON’s corporate partner Eucure, a division of Biocytogen.

About TRC102

TRC102 (methoxyamine) is a novel small molecule inhibitor of the DNA base excision repair pathway, which is a pathway that causes resistance to alkylating and antimetabolite chemotherapeutics. TRC102 is currently being studied in multiple Phase 1 and Phase 2 clinical trials sponsored by the National Cancer Institute through a Cooperative Research and Development Agreement (CRADA) and has orphan drug designation from the FDA in malignant glioma, including glioblastoma.

About TRACON

TRACON is a clinical-stage biopharmaceutical company utilizing a cost-efficient, CRO-independent, product development platform to advance its pipeline of novel targeted cancer therapeutics and to partner with other life science companies. The Company’s clinical-stage pipeline includes: Envafolimab, a PD-L1 single-domain antibody given by rapid subcutaneous injection that is being studied in the pivotal ENVASARC trial for sarcoma; YH001, a potential best-in-class CTLA-4 antibody in Phase 1/2 development; and TRC102, a Phase 2 small molecule drug candidate for the treatment of lung cancer. TRACON is actively seeking additional corporate partnerships through a profit-share or revenue-share partnership, or through franchising TRACON’s product development platform. TRACON believes it can serve as a solution for companies without clinical and commercial capabilities in the United States or who wish to become CRO-independent. To learn more about TRACON and its product pipeline, visit TRACON’s website at www.traconpharma.com.

Forward-Looking Statements

Statements made in this press release regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward‐looking statements. Such statements include, but are not limited to, expectations regarding TRACON’s cash runway, inclusive of the amounts the Company recovered pursuant to its arbitration award; TRACON’s and its collaboration partners’ plans to further develop product candidates; expectations regarding the timing and scope of clinical trials and availability of clinical data, including the timing and results of accrual and data from TRACON’s ENVASARC Phase 2 pivotal trial, and a report of the IDMC on its second interim efficacy analysis; expectations regarding the envafolimab treatment continuing to generate a double-digit objective response rates; expected results of the ad hoc safety review analysis from the ENVASARC pivotal trial and the timing of those results; expected development, regulatory and commercial milestones and timing thereof; potential utility of product candidates; and TRACON’s business development strategy and goals, including the ability to enter into additional collaborations. Risks that could cause actual results to differ from those expressed in these forward‐looking statements include: the risk that TRACON’s cash runway will be less than currently anticipated; risks associated with clinical development and regulatory approval of novel pharmaceutical product candidates; whether TRACON or others will be able to complete or initiate clinical trials on TRACON’s expected timelines, if at all, including due to risks associated with geopolitical and macroeconomic events, ; the fact that future preclinical studies and clinical trials may not be successful or otherwise consistent with results from prior studies; the fact that TRACON has limited control over whether or when third party collaborators complete on-going trials or initiate additional trials of TRACON’s product candidates; the fact that TRACON’s collaboration agreements are subject to early termination; whether TRACON will be able to enter into additional collaboration agreements on favorable terms or at all; potential changes in regulatory requirements in the United States and foreign countries; TRACON’s reliance on third parties for the development of its product candidates, including the conduct of its clinical trials and manufacture of its product candidates; whether TRACON will be able to obtain additional financing; and other risks described in TRACON’s filings with the Securities and Exchange Commission under the heading “Risk Factors”. All forward‐looking statements contained in this press release speak only as of the date on which they were made and are based on management’s assumptions and estimates as of such date. TRACON undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made except as required by law.

TRACON Pharmaceuticals, Inc.

Unaudited Condensed Consolidated Statements of Operations

(in thousands, except share and per share data)

|

|

|

|

|

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|

2023 |

2022 |

2023 |

2022 |

Collaboration revenue |

$9,000 |

$- |

$9,000 |

$- |

Operating expenses: |

|

|

|

|

Research and development |

3,488 |

2,923 |

8,457 |

5,916 |

General and administrative |

1,916 |

3,316 |

4,260 |

9,769 |

Arbitration success fees |

4,375 |

- |

4,375 |

- |

Total operating expenses |

9,779 |

6,239 |

17,092 |

15,685 |

Loss from operations |

(779) |

(6,239) |

(8,092) |

(15,685) |

Total other income (expense) |

(5,507) |

9 |

(6,698) |

(18) |

Net loss |

$(6,286) |

$(6,230) |

$(14,790) |

$(15,703) |

Net loss per share, basic and diluted |

$(0.20) |

$(0.31) |

$(0.54) |

$(0.79) |

Weighted‑average common shares outstanding, basic and diluted |

30,711,381 |

20,268,220 |

27,256,308 |

19,940,424 |

|

|

|

|

|

Pro forma adjustment for arbitration award collected in Q3: |

|

|

|

|

Other income |

$13,000 |

- |

$13,000 |

- |

Net income (loss) |

$6,714 |

$(6,230) |

$(1,790) |

$(15,703) |

Net income (loss) per share, basic and diluted |

$0.22 |

$(0.31) |

$(0.07) |

$(0.79) |

|

|

TRACON Pharmaceuticals, Inc.

Unaudited Condensed Consolidated Balance Sheets

(in thousands)

|

|

|

|

|

|

|

June 30, |

|

December 31, |

|

Pro Forma June 30, |

|

2023 |

|

2022 |

|

2023 |

Assets |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

$1,735 |

|

$17,433 |

|

$8,860 |

Collaboration receivable |

9,000 |

|

- |

|

- |

Prepaid and other assets |

256 |

|

795 |

|

256 |

Total current assets |

10,991 |

|

18,228 |

|

9,116 |

Property and equipment, net |

44 |

|

51 |

|

44 |

Restricted Cash |

139 |

|

67 |

|

139 |

Other assets |

1,016 |

|

1,123 |

|

1,016 |

Total assets |

$12,190 |

|

$19,469 |

|

$10,315 |

Liabilities and Stockholders’ Deficit |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable and accrued expenses |

$16,211 |

|

$11,107 |

|

$11,836 |

Accrued compensation and related expenses |

1,031 |

|

1,457 |

|

1,031 |

Arbitration financing payable |

9,831 |

|

- |

|

- |

Long‑term debt, current portion |

- |

|

9,807 |

|

- |

Total current liabilities |

27,073 |

|

22,371 |

|

12,867 |

Other long-term liabilities |

856 |

|

969 |

|

856 |

Arbitration financing payable |

- |

|

3,280 |

|

- |

Commitments and contingencies |

|

|

|

|

|

Stockholders’ deficit: |

|

|

|

|

|

Common stock |

27 |

|

23 |

|

27 |

Additional paid‑in capital |

235,935 |

|

229,737 |

|

235,935 |

Accumulated deficit |

(251,701) |

|

(236,911) |

|

(239,370) |

Total stockholders’ deficit |

(15,739) |

|

(7,151) |

|

(3,408) |

Total liabilities and stockholders’ deficit |

$12,190 |

|

$19,469 |

|

$10,315 |

|

|

Company Contact: |

Investor Contact: |

Charles Theuer |

Brian Ritchie |

Chief Executive Officer |

LifeSci Advisors LLC |

(858) 550-0780 |

(212) 915-2578 |

ctheuer@traconpharma.com |

britchie@lifesciadvisors.com |

v3.23.2

Document And Entity Information

|

Aug. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 14, 2023

|

| Entity Registrant Name |

Tracon Pharmaceuticals, Inc.

|

| Entity Central Index Key |

0001394319

|

| Entity Emerging Growth Company |

false

|

| Securities Act File Number |

001-36818

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

34-2037594

|

| Entity Address, Address Line One |

4350 La Jolla Village Drive, Suite 800

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92122

|

| City Area Code |

(858)

|

| Local Phone Number |

550-0780

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

TCON

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

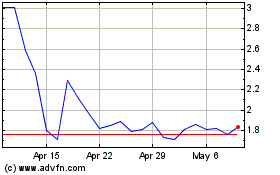

TRACON Pharmaceuticals (NASDAQ:TCON)

Historical Stock Chart

From Oct 2024 to Nov 2024

TRACON Pharmaceuticals (NASDAQ:TCON)

Historical Stock Chart

From Nov 2023 to Nov 2024