ToughBuilt Industries, Inc. (“ToughBuilt”) (NASDAQ: TBLT;

TBLTW), a leading designer, manufacturer and distributor

of innovative tools and accessories for the building industry,

today provided a business update and announced financial results

for the quarter ended March 31, 2019.

Michael Panosian, Chief Executive Officer of

ToughBuilt, commented, “We are off to a strong start in 2019 with

revenue of over $5 million in the first quarter, a 27.9% increase

compared to the same period last year. These results reflect our

success expanding ToughBuilt’s retail footprint across North

America and internationally, on the heels of our November 2018

IPO. In January, we announced we had formally launched sales

within Menards®, a mid-western home improvement chain, with more

than 300 retail locations. We subsequently announced entering into

a distribution agreement with Toolbank, one of Europe’s leading

specialist distributors of hand and power tools. We also announced

a partnership with Bull Sales, Inc., a third-party logistics and

wholesale services company in Canada supplying home improvement

chains, independent retailers, as well as the construction,

contractor, and automotive markets. We are in discussions with a

number of additional major retail chains and international

distributors, which we believe will help catapult our business to

the next level.”

“In addition to expanding our retail footprint,

we recently initiated our e-commerce platform. During the

first quarter, we launched our U.S. Amazon storefront, which has

become a significant driver of demand for our products. In

fact, we achieved a $2.5 million annualized run-rate and over

$200,000 worth of sales in the first month —with just our first 10

products. We plan to dramatically expand the number of SKUs

and aggressively market our Amazon storefront. Building on

this success, we are now preparing to launch our Amazon Canada

storefront, as well as a much broader business-to-consumer global

e-commerce initiative to expand our online presence.”

“We are also advancing our mobile strategy with

the launch of a new subsidiary, ToughBuilt Technologies, Inc.,

which is focusing on the development of new technologies geared

toward ruggedized mobile devices. We were recently awarded

two new design patents from the United States Patent and Trademark

Office to cover our ruggedized mobile devices. In addition to

mobile devices, we are launching a suite of mobile applications

that will streamline workflow through trade specific solutions,

thereby increasing workforce profitability by cutting time and

labor costs across a wide array of industries, although our primary

focus continues to be the construction and Do-It-Yourself

industries.”

First Quarter 2019 Financial

Highlights

Revenues for the three months ended March 31,

2019 and 2018 were $5,022,471 and $3,928,125, respectively.

Revenues increased $1,094,346, or 27.9%, primarily due to wide

acceptance of our products in the tools industry, receipt of

recurring sales orders for metal goods and soft goods from our

existing customers and new customers, and introduction and sale of

new soft goods products to our customers. Gross profit for the

three months ended March 31, 2019 was $1,177,714 compared to

$965,434 for the three months ended March 31, 2018. The Company

reported net income of $500,213 for the three months ended March

31, 2019, as compared to a net loss of $1,412,686 for the three

months ended March 31, 2018.

About ToughBuilt Industries,

Inc.

ToughBuilt is a designer, manufacturer and

distributor of innovative tools and accessories to the building

industry. We market and distribute various home improvement and

construction product lines for both the do-it-yourself and

professional markets under the TOUGHBUILT® brand name, within the

global multibillion dollar per year tool market industry. All of

our products are designed by our in-house design team. Since

launching product sales in 2013, we have experienced significant

annual sales growth. Our current product line includes three

major categories, with several additional categories in various

stages of development, consisting of Soft Goods & Kneepads and

Sawhorses & Work Products. Our mission is to provide products

to the building and home improvement communities that are

innovative, of superior quality derived in part from enlightened

creativity for our end users while enhancing performance, improving

well-being and building high brand loyalty. Additional

information about the Company is available at:

https://www.toughbuilt.com/.

Forward-Looking Statements

This press release contains “forward-looking

statements.” Such statements may be preceded by the words

“intends,” “may,” “will,” “plans,” “expects,” “anticipates,”

“projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,”

“potential” or similar words. Forward-looking statements are not

guarantees of future performance, are based on certain assumptions

and are subject to various known and unknown risks and

uncertainties, many of which are beyond the Company’s control, and

cannot be predicted or quantified and consequently, actual results

may differ materially from those expressed or implied by such

forward-looking statements. Such risks and uncertainties include,

without limitation, risks and uncertainties associated with (i)

market acceptance of our existing and new products, (ii) negative

clinical trial results or lengthy product delays in key markets,

(iii) an inability to secure regulatory approvals for the sale of

our products, (iv) intense competition in the medical device

industry from much larger, multinational companies, (v) product

liability claims, (vi) product malfunctions, (vii) our limited

manufacturing capabilities and reliance on subcontractors for

assistance, (viii) insufficient or inadequate reimbursement by

governmental and other third party payers for our products, (ix)

our efforts to successfully obtain and maintain intellectual

property protection covering our products, which may not be

successful, (x) legislative or regulatory reform of the healthcare

system in both the U.S. and foreign jurisdictions, (xi) our

reliance on single suppliers for certain product components, (xii)

the fact that we will need to raise additional capital to meet our

business requirements in the future and that such capital raising

may be costly, dilutive or difficult to obtain and (xiii) the fact

that we conduct business in multiple foreign jurisdictions,

exposing us to foreign currency exchange rate fluctuations,

logistical and communications challenges, burdens and costs of

compliance with foreign laws and political and economic instability

in each jurisdiction. More detailed information about the Company

and the risk factors that may affect the realization of forward

looking statements is set forth in the Company’s filings with the

Securities and Exchange Commission (SEC), including the Company’s

Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q.

Investors and security holders are urged to read these documents

free of charge on the SEC’s web site at http://www.sec.gov. The

Company assumes no obligation to publicly update or revise its

forward-looking statements as a result of new information, future

events or otherwise.

Contact:

Crescendo Communications, LLC Email: TBLT@crescendo-ir.com Tel:

(212) 671-1021

(tables follow)

TOUGHBUILT INDUSTRIES,

INC.CONDENSED BALANCE SHEETS

| |

March 31, 2019 |

|

|

December 31,2018 |

|

| |

(UNAUDITED) |

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

|

|

Cash |

$ |

2,446,029 |

|

|

$ |

5,459,884 |

|

|

Accounts receivable |

|

2,010,989 |

|

|

|

985,854 |

|

|

Factor receivables, net of allowance for sales discounts of $13,000

at March 31, 2019 and December 31, 2018, respectively |

|

1,548,567 |

|

|

|

1,542,835 |

|

|

Inventory |

|

1,713,906 |

|

|

|

379,915 |

|

|

Prepaid assets |

|

390,237 |

|

|

|

222,000 |

|

| Total Current Assets |

|

8,109,728 |

|

|

|

8,590,488 |

|

| |

|

|

|

|

|

|

|

| Property and equipment,

net |

|

303,847 |

|

|

|

224,196 |

|

| Security deposit |

|

36,014 |

|

|

|

36,014 |

|

| Total Assets |

$ |

8,449,589 |

|

|

$ |

8,850,698 |

|

| |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

2,160,127 |

|

|

$ |

1,962,901 |

|

|

Accrued liabilities |

|

203,234 |

|

|

|

717,453 |

|

|

Accrued payroll taxes |

|

30,425 |

|

|

|

150,559 |

|

|

Other current liabilities |

|

104,340 |

|

|

|

167,333 |

|

|

Loan payable - Factor |

|

1,206,069 |

|

|

|

1,304,512 |

|

|

Warrant derivative |

|

15,273,579 |

|

|

|

23,507,247 |

|

| Total Current Liabilities |

|

18,977,774 |

|

|

|

27,810,005 |

|

| |

|

|

|

|

|

|

|

| Total Liabilities |

|

18,977,774 |

|

|

|

27,810,005 |

|

| |

|

|

|

|

|

|

|

| Commitments and contingencies

(Note 5) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Stockholders’ Deficit |

|

|

|

|

|

|

|

| Common stock, $0.0001 par

value, 100,000,000 shares authorized, 14,436,978 shares and

9,870,873 shares issued and outstanding at March 31, 2019 and

December 31, 2018, respectively |

|

1,443 |

|

|

|

987 |

|

| Additional paid in

capital |

|

28,082,560 |

|

|

|

20,152,107 |

|

| Accumulated deficit |

|

(38,612,188 |

) |

|

|

(39,112,401 |

) |

| Total Stockholders’

Deficit |

|

(10,528,185 |

) |

|

|

(18,959,307 |

) |

| |

|

|

|

|

|

|

|

| Total Liabilities and

Stockholders’ Deficit |

$ |

8,449,589 |

|

|

$ |

8,850,698 |

|

TOUGHBUILT INDUSTRIES,

INC.CONDENSED STATEMENTS OF

OPERATIONS(UNAUDITED)

| |

For the Three Months Ended March 31, |

|

| |

2019 |

|

|

2018 |

|

|

Revenues, Net of Allowances |

|

|

|

|

|

|

|

|

Metal goods |

$ |

1,641,272 |

|

|

$ |

2,101,980 |

|

|

Soft goods |

|

3,381,199 |

|

|

|

1,826,145 |

|

| Total Revenues, Net of

Allowances |

|

5,022,471 |

|

|

|

3,928,125 |

|

| |

|

|

|

|

|

|

|

| Cost of Goods Sold |

|

|

|

|

|

|

|

|

Metal goods |

|

1,293,671 |

|

|

|

1,628,577 |

|

|

Soft goods |

|

2,551,086 |

|

|

|

1,334,114 |

|

| Total Cost of Goods Sold |

|

3,844,757 |

|

|

|

2,962,691 |

|

| |

|

|

|

|

|

|

|

| Gross Profit |

|

1,177,714 |

|

|

|

965,434 |

|

| |

|

|

|

|

|

|

|

| Operating Expenses |

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

2,729,542 |

|

|

|

1,329,065 |

|

|

Research and development |

|

463,595 |

|

|

|

385,417 |

|

| Total Operating Expenses |

|

3,193,137 |

|

|

|

1,714,482 |

|

| |

|

|

|

|

|

|

|

| Operating Loss |

|

(2,015,423 |

) |

|

|

(749,048 |

) |

| |

|

|

|

|

|

|

|

| Other Income (Expense) |

|

|

|

|

|

|

|

|

Change in fair value of warrant derivative |

|

2,597,899 |

|

|

|

- |

|

|

Interest expense |

|

(82,263 |

) |

|

|

(663,638 |

) |

| Total Other Income

(Expense) |

|

2,515,636 |

|

|

|

(663,638 |

) |

| |

|

|

|

|

|

|

|

| Net Income (Loss) Before

Income Tax |

|

500,213 |

|

|

|

(1,412,686 |

) |

| |

|

|

|

|

|

|

|

| Income tax |

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

| Net Income (Loss) |

$ |

500,213 |

|

|

$ |

(1,412,686 |

) |

| |

|

|

|

|

|

|

|

| Basic and Diluted Net Loss Per

Share Attributed to Common Stockholders (Note 2): |

|

|

|

|

|

|

|

|

Basic net loss per common share |

$ |

(0.14 |

) |

|

$ |

(0.38 |

) |

|

Basic weighted average common shares outstanding |

|

11,693,381 |

|

|

|

3,679,500 |

|

| |

|

|

|

|

|

|

|

|

Diluted Net Loss per Common Share |

$ |

(0.25 |

) |

|

$ |

(0.38 |

) |

|

Diluted weighted average common shares outstanding |

|

16,718,998 |

|

|

|

3,679,500 |

|

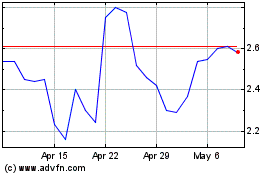

ToughBuilt Industries (NASDAQ:TBLT)

Historical Stock Chart

From Oct 2024 to Nov 2024

ToughBuilt Industries (NASDAQ:TBLT)

Historical Stock Chart

From Nov 2023 to Nov 2024