TOMI Environmental Solutions, Inc.® (“TOMI”) (NASDAQ:TOMZ), a

global company specializing in disinfection and decontamination

utilizing its premier Binary Ionization Technology (BIT) platform

through its SteraMist brand of products, today announced its

financial results for the second quarter and first six months of

2021.

TOMI Chief Executive Officer, Dr. Halden Shane stated, “As we

move through 2021, we continue to face sharp comparisons in the

context of last year’s results which were driven by extraordinary

demand for our products as customers, both existing and new, sought

disinfection and decontamination solutions during the height of the

COVID-19 pandemic. As COVID-19 concerns have eased, our sales

volumes have slowed, particularly in our Hospital-HealthCare, TOMI

Service Network, and Commercial divisions, and that slowdown

resulted in second quarter revenue performance that was in line

with pre-virus levels. However, as the economy continues to open

back up, we have seen positive indicators among our current and

prospective customers which we expect will drive increased demand

in the second half of 2021.”

“Specifically, we are seeing renewed interest and activity

around our environment and permanent customer engineered systems

(CES) in the Life Science market. On the product development front,

earlier this month we announced the launch of SteraPak, a backpack

system that represents the most mobile SteraMist unit available,

designed to create easy maneuverability in the smallest spaces.

Providing superior disinfection technology at a lower price point

than our competitors, we believe SteraPak will open up new sales

channels for our products and ultimately get our technology in the

hands of more businesses and consumers. Additionally we have made

solid progress with our SteraMist Select Plus and SteraMist

Transport CES units and believe we are nearing a release date for

these products.

“As we move through the balance of 2021, we view this as a

rebuilding period. The unprecedented Covid-related demand we

experienced in 2020 raised our profile in the marketplace and

allowed us to significantly broaden our customer base. We remain

focused on meeting the needs of our existing customers and further

expanding our customer relationships by continuing to provide our

state-of-the-art disinfection technology and solutions, while

attracting new audiences with our innovative new products. Our

second quarter results did not meet our expectations, but, with our

visibility today, we are optimistic that TOMI will deliver a strong

second half of the year. While we cannot predict with certainty the

course of the pandemic and how it will affect our industry, we

believe that a permanent shift in the disinfection practice of

commercial and business operations will continue to generate

healthy demand for our products.

“Accordingly, despite the decline of revenue during the second

quarter, we expect to see significant revenue growth in the second

half of the year over the first half. Based on momentum we

are seeing thus far this quarter across our product platform as

well as the Q3 launch of our new SteraPak, we are targeting strong

sequential growth in Q3 over Q2 and double-digit revenue in

Q4. As stated before our mission is and will always be to make

the world a safer place.”

Financial Results for the Three Months Ended June 30,

2021 compared to June 30, 2020

- Total net revenue was $1.5 million compared to $10.0

million.

- Gross margin was 64.3% compared to 55.5%. The increase in gross

margin is attributable to product mix.

- Operating loss was ($1.2 million) compared to operating income

of $3.7 million.

- Net loss was ($0.8 million) or ($0.05) per basic and diluted

share, compared to net income of $3.7 million or $0.22 per basic

share.

- EBITDA was a loss of ($0.7 million) compared to EBITDA of $3.8

million. A table reconciling EBITDA to the appropriate GAAP

financial measure is included with the Company's financial

information below.

- Adjusted EBITDA was a loss of ($0.7 million) compared to

Adjusted EBITDA of $3.9 million. A table reconciling Adjusted

EBITDA to the appropriate GAAP financial measure is included with

the Company's financial information below.

Balance sheet highlights

as of June 30, 2021

- Cash and cash equivalents were approximately $2.5 million

compared to $5.2 million at December 31, 2020, a decrease of $2.7

million.

- Working capital was $8.8 million compared to $11.5 million at

December 31, 2020.

- Shareholders’ equity was $11.1 million compared to $13.2

million at December 31, 2020, a decrease of $2.1 million.

Recent Business Highlights:

- Received an order which secured a project to install an iHP

Custom Engineered System (CES) for a major pharmaceutical Company

in Western Europe.

- Launched the SteraPak portable SteraMist System. The Company is

currently taking deposits from customers for the product and

expects to begin filling backlog orders in the third quarter 2021.

SteraPak is sold through all divisions including

Hospital-Healthcare, Life Sciences, TOMI Service Network (TSN),

Food Safety, and Commercial.

- Continued product development with the introduction of the

SteraMist Select Plus and the SteraMist Transport CES (Custom

Engineered System).

- Named to the Russell Microcap Index in June 2021

- The Company’s partnership with AV8R Solutions, a SteraMist

service provider and manufacturing representative with focus on

aviation industry, demonstrated continued traction with AV8R’s

announced intention to partner with insurance companies to expand

into the restoration and remediation industry.

Recent Progress with Scientific Studies and Industry

Testing:

- Finished gathering successful and critical data from our Shield

Study, a multi-year study comparing SteraMist with manual cleaning.

The Study was conducted by multiple well-established hospitals and

initial findings have been positive regarding ease of use, overall

efficacy, and quick turnaround time of patient rooms. TOMI looks

forward to announcing the full results as they are available to

make public.

- TOMI continues to work with its German aircraft partner and

Boeing in a third-party test required for the aviation industry.

TOMI incurs no cost for this work as both testing partners are

clients.

- Engaged HYGCEN Germany GmbH to perform a quantitative test of

germ carriers for airborne room disinfection and testing of the

effectiveness of a method for disinfecting room air to meet the new

EU norm (standard) EN 17272. Certification that Binary Ionization

Technology meets the new standard will continue to position iHP as

the premier decontamination/disinfection technology available on

the market today.

- The Company continues to work with the Virginia State

University Agricultural Research Station and its partner, Arkema on

a food safety pilot study based on novel, nonthermal, and

environmentally friendly technology to control foodborne pathogens

on industrial hemp seed as representative model foods. TOMI

anticipates the pilot will be completed by the third quarter of

2021.

- Partnered with the Department of Chemistry and Biochemistry of

Texas Tech University to conduct a wide range of studies on spray

pattern, deposition, and hydrogen peroxide content in order to

compare our 1% label to other similar products on the market.

- TOMI is working with University of Virginia on two separate

studies. The first, which explores SteraMist’s efficacy against

SARS-CoV-2, reported successful results and is currently awaiting

the final published paper. The second, using the handheld SteraMist

Surface Unit and testing spray and contact time variables against

Adenovirus is currently awaiting results. TOMI anticipates the

testing will be completed by the third quarter of 2021.

- TOMI's long term relationship with USDA Agricultural Research

Service continues to progress. Earlier this year, "Hydrogen

peroxide residue on tomato, apple, cantaloupe, and Romaine lettuce

after treatments with cold plasma-activated hydrogen peroxide” was

accepted for publication in the Journal of Food Microbiology. TOMI

has also begun discussions with another ARS facility to evaluate

the benefits of iHP on blueberries to prevent rot and reduce

post-harvest losses.

Conference Call Information

TOMI will hold a conference call to discuss second quarter 2021

results at 4:30 p.m. ET today, August 16, 2021.

To participate in the call by phone, dial (888) 506-0062 and

entry code 952095 approximately five minutes prior to the scheduled

start time. International callers please dial (973) 528-0011 and

entry code 952095. To access the live webcast or view the press

release, please visit the Investor Relations section of the TOMI

website at:

http://investor.tomimist.com/TOMZ/webcasts_and_events/2145

A replay of the teleconference will be available until August

23, 2021 and may be accessed by dialing (877) 481-4010.

International callers may dial (919) 882-2331. Callers should use

replay access code: 42439. A replay of the webcast will be

available for at least 90 days on the company’s website, starting

approximately one hour after the completion of the call.

TOMI™ Environmental Solutions, Inc.: Innovating for

a safer world®TOMI™ Environmental Solutions, Inc.

(NASDAQ:TOMZ) is a global decontamination and infection

prevention company, providing environmental solutions for indoor

surface disinfection through the manufacturing, sales and licensing

of its premier Binary Ionization Technology® (BIT™) platform.

Invented under a defense grant in association with the Defense

Advanced Research Projects Agency (DARPA) of the U.S. Department of

Defense, BIT™ solution utilizes a low percentage Hydrogen

Peroxide as its only active ingredient to produce a fog of ionized

Hydrogen Peroxide (iHP™). Represented by the SteraMist® brand

of products, iHP™ produces a germ-killing aerosol that works

like a visual non-caustic gas.TOMI products are designed to

service a broad spectrum of commercial structures, including, but

not limited to, hospitals and medical facilities, cruise ships,

office buildings, hotel and motel rooms, schools, restaurants, meat

and produce processing facilities, military barracks, police and

fire departments, and athletic facilities. TOMI products

and services have also been used in single-family homes and

multi-unit residences.

TOMI develops training programs and application protocols

for its clients and is a member in good standing with The American

Biological Safety Association, The American Association of Tissue

Banks, Association for Professionals in Infection Control and

Epidemiology, Society for Healthcare Epidemiology of America,

America Seed Trade Association, and The Restoration Industry

Association.

For additional information, please

visit http://www.tomimist.com/ or contact us

at info@tomimist.com.

Forward-Looking Statements

This press release contain forward-looking statements that are

based on current expectations, estimates, forecasts and projections

of future performance based on management’s judgment, beliefs,

current trends, and anticipated product performance. These

forward-looking statements include, without limitation, statements

relating to anticipated financial performance and operating

results; upcoming launch of new products; expected growth in sales

and market demand; timing and process relating to research studies

and testing; impact of COVID-19 pandemic on our business operation;

and our ability to execute sale strategies. Forward-looking

statements involve risks and uncertainties that may cause actual

results to differ materially from those contained in the

forward-looking statements. These factors include, but are not

limited to, the impact of COVID-19 pandemic on our business and

customers; our ability to maintain and manage growth and generate

sales, our reliance on a single or a few products for a majority of

revenues; the general business and economic conditions; and other

risks as described in our SEC filings, including our Annual Report

on Form 10-K for the fiscal year ended December 31, 2020 filed by

us with the SEC and other periodic reports we filed with the SEC.

The information provided in this document is based upon the facts

and circumstances known at this time. Other unknown or

unpredictable factors or underlying assumptions subsequently

proving to be incorrect could cause actual results to differ

materially from those in the forward-looking statements. Although

we believe that the expectations reflected in the forward-looking

statements are reasonable, we cannot guarantee future results,

level of activity, performance, or achievements. You should not

place undue reliance on these forward-looking statements. All

information provided in this press release is as of today’s date,

unless otherwise stated, and we undertake no duty to update such

information, except as required under applicable law.

Use of Non-GAAP Financial Measures

To supplement our unaudited consolidated financial statements

presented on a basis consistent with U.S. GAAP, we disclose certain

non-GAAP financial measures for our historical performance,

including EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin. We

define EBITDA as net income (loss), adjusted to exclude: interest,

taxes, depreciation and amortization (EBITDA) is a non-GAAP

financial measure and is intended to serve as a supplement to our

results provided in accordance with GAAP. We define Adjusted EBITDA

as net income (loss), adjusted to exclude: interest, taxes,

depreciation and amortization; stock-based compensation expense. We

define Adjusted EBITDA margin as Adjusted EBITDA divided by net

revenue. We believe that these historical non-GAAP financial

measures provide useful information to both management and

investors by excluding certain items and expenses that are not

indicative of our core operating results or do not reflect our

normal business operations. In addition, our management uses

non-GAAP measures to evaluate our performance internally and to

benchmark our performance externally against competitors. Our use

of non-GAAP financial measures has certain limitations in that such

non-GAAP financial measures may not be directly comparable to those

reported by other companies. Although we believe that the use of

non-GAAP financial measures enhances its investors’ understanding

of its business and performance, our use of non-GAAP financial

measures should not be considered an alternative to GAAP basis

financial measures and should be read in conjunction with the

relevant GAAP financial measures. Other companies may use the same

or similarly named measures, but exclude different items, which may

not provide investors with a comparable view of our performance in

relation to other companies. Because of these limitations, the

non-GAAP financial measure used in this release should not be

considered in isolation or as a substitute for performance measures

calculated in accordance with GAAP. We seek to compensate for the

limitation of our non-GAAP presentation by providing a detailed

reconciliation of the non-GAAP financial measures to the most

directly comparable U.S. GAAP as set forth below. Investors are

encouraged to review the related U.S. GAAP financial measures and

the reconciliation of these non-GAAP financial measures to their

most directly comparable U.S. GAAP financial measures.

|

|

|

TOMI ENVIRONMENTAL SOLUTIONS, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEET |

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current Assets: |

June 30, 2021 (Unaudited) |

|

December 31, 2020 |

|

Cash and Cash Equivalents |

$ |

2,488,413 |

|

|

$ |

5,198,842 |

|

|

Accounts Receivable - net |

|

2,980,292 |

|

|

|

3,716,701 |

|

|

Other Receivables |

|

- |

|

|

|

198,951 |

|

|

Inventories |

|

5,175,979 |

|

|

|

3,781,515 |

|

|

Vendor Deposits |

|

24,224 |

|

|

|

388,712 |

|

|

Prepaid Expenses |

|

388,271 |

|

|

|

421,305 |

|

|

Total Current Assets |

|

11,057,179 |

|

|

|

13,706,027 |

|

|

|

|

|

|

|

Property and Equipment – net |

|

1,280,092 |

|

|

|

1,298,103 |

|

|

|

|

|

|

|

Other Assets: |

|

|

|

|

Intangible Assets – net |

|

831,768 |

|

|

|

722,916 |

|

|

Operating Lease - Right of Use Asset |

|

608,111 |

|

|

|

631,527 |

|

|

Capitalized Software Development Costs - net |

|

31,426 |

|

|

|

52,377 |

|

|

Other Assets |

|

472,173 |

|

|

|

358,935 |

|

|

Total Other Assets |

|

1,943,478 |

|

|

|

1,765,755 |

|

|

Total Assets |

$ |

14,280,749 |

|

|

$ |

16,769,885 |

|

| |

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

| |

|

|

|

| Current Liabilities: |

|

|

|

|

Accounts Payable |

$ |

1,534,172 |

|

|

$ |

1,501,469 |

|

|

Accrued Expenses and Other Current Liabilities |

|

568,502 |

|

|

|

501,849 |

|

|

Customer Deposits |

|

41,827 |

|

|

|

118,880 |

|

|

Current Portion of Long-Term Operating Lease |

|

86,391 |

|

|

|

81,223 |

|

|

Total Current Liabilities |

|

2,230,892 |

|

|

|

2,203,421 |

|

|

|

|

|

|

| Long-Term Liabilities: |

|

|

|

|

Loan Payable |

|

- |

|

|

|

410,700 |

|

|

Long-Term Operating Lease, Net of Current Portion |

|

908,677 |

|

|

|

953,190 |

|

|

Total Long-Term Liabilities |

|

908,677 |

|

|

|

1,363,890 |

|

|

Total Liabilities |

|

3,139,569 |

|

|

|

3,567,311 |

|

|

|

|

|

|

| Commitments and

Contingencies |

|

- |

|

|

|

- |

|

|

|

|

|

|

| Shareholders’ Equity: |

|

|

|

|

Cumulative Convertible Series A Preferred Stock; |

|

|

|

|

par value $0.01 per share, 1,000,000 shares authorized; 63,750

shares issued |

|

|

|

and outstanding at June 30, 2021 and December 31, 2020 |

|

638 |

|

|

|

638 |

|

|

Cumulative Convertible Series B Preferred Stock; $1,000 stated

value; |

|

|

|

7.5% Cumulative dividend; 4,000 shares authorized; none issued |

|

|

|

and outstanding at June 30, 2021 and December 31, 2020 |

|

- |

|

|

|

- |

|

|

Common stock; par value $0.01 per share, 250,000,000 shares

authorized; |

|

|

|

16,811,513 and 16,761,513 shares issued and outstanding |

|

|

|

at June 30, 2021 and December 31, 2020, respectively. |

|

168,115 |

|

|

|

167,615 |

|

|

Additional Paid-In Capital |

|

52,369,899 |

|

|

|

52,142,399 |

|

|

Accumulated Deficit |

|

(41,397,471 |

) |

|

|

(39,108,078 |

) |

|

Total Shareholders’ Equity |

|

11,141,180 |

|

|

|

13,202,574 |

|

| Total Liabilities and

Shareholders’ Equity |

$ |

14,280,749 |

|

|

$ |

16,769,885 |

|

|

|

|

|

|

|

TOMI ENVIRONMENTAL SOLUTIONS, INC. |

|

CONDENSED CONSOLIDATED STATEMENT OF

OPERATIONS |

|

(UNAUDITED) |

|

|

|

|

For The Three Months Ended |

|

For The Six Months Ended |

|

|

June 30, |

|

June 30, |

|

|

2021 |

|

2020 (1) |

|

2021 |

|

2020 (1) |

|

|

|

|

|

|

|

|

|

|

Sales, net |

$ |

1,465,525 |

|

|

$ |

10,028,497 |

|

|

$ |

3,538,980 |

|

|

$ |

17,081,915 |

|

|

Cost of Sales |

|

523,563 |

|

|

|

4,463,602 |

|

|

|

1,361,860 |

|

|

|

7,029,012 |

|

|

Gross Profit |

|

941,962 |

|

|

|

5,564,895 |

|

|

|

2,177,120 |

|

|

|

10,052,903 |

|

|

|

|

|

|

|

|

|

|

| Operating Expenses: |

|

|

|

|

|

|

|

|

Professional Fees |

|

106,781 |

|

|

|

54,831 |

|

|

|

280,274 |

|

|

|

190,956 |

|

|

Depreciation and Amortization |

|

72,413 |

|

|

|

172,298 |

|

|

|

155,861 |

|

|

|

344,207 |

|

|

Selling Expenses |

|

335,444 |

|

|

|

388,827 |

|

|

|

809,833 |

|

|

|

767,472 |

|

|

Research and Development |

|

205,751 |

|

|

|

141,123 |

|

|

|

401,371 |

|

|

|

200,581 |

|

|

Equity Compensation Expense |

|

- |

|

|

|

114,293 |

|

|

|

- |

|

|

|

297,065 |

|

|

Consulting Fees |

|

95,609 |

|

|

|

69,705 |

|

|

|

201,783 |

|

|

|

151,250 |

|

|

General and Administrative |

|

1,319,194 |

|

|

|

967,158 |

|

|

|

3,031,560 |

|

|

|

1,785,303 |

|

| Total Operating Expenses |

|

2,135,192 |

|

|

|

1,908,235 |

|

|

|

4,880,682 |

|

|

|

3,736,834 |

|

| Income (loss) from

Operations |

|

(1,193,230 |

) |

|

|

3,656,660 |

|

|

|

(2,703,562 |

) |

|

|

6,316,069 |

|

|

|

|

|

|

|

|

|

|

| Other Income (Expense): |

|

|

|

|

|

|

|

|

Gain Upon Debt Extinguishment |

|

414,583 |

|

|

|

- |

|

|

|

414,583 |

|

|

|

- |

|

|

Interest Income |

|

192 |

|

|

|

1,043 |

|

|

|

619 |

|

|

|

1,585 |

|

|

Interest Expense |

|

- |

|

|

|

(787 |

) |

|

|

(1,034 |

) |

|

|

(41,476 |

) |

| Total Other Income

(Expense) |

|

414,776 |

|

|

|

256 |

|

|

|

414,169 |

|

|

|

(39,891 |

) |

|

|

|

|

|

|

|

|

|

| Income (loss) before income

taxes |

|

(778,454 |

) |

|

|

3,656,916 |

|

|

|

(2,289,394 |

) |

|

|

6,276,178 |

|

| Provision for Income

Taxes |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Net Income (loss) |

$ |

(778,454 |

) |

|

$ |

3,656,916 |

|

|

$ |

(2,289,394 |

) |

|

$ |

6,276,178 |

|

|

|

|

|

|

|

|

|

|

| Net income (loss) Per Common

Share |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.05 |

) |

|

$ |

0.22 |

|

|

$ |

(0.14 |

) |

|

$ |

0.39 |

|

|

Diluted |

$ |

(0.05 |

) |

|

$ |

0.20 |

|

|

$ |

(0.14 |

) |

|

$ |

0.35 |

|

|

|

|

|

|

|

|

|

|

| Basic Weighted Average Common

Shares Outstanding |

|

16,811,513 |

|

|

|

16,692,675 |

|

|

|

16,784,737 |

|

|

|

16,271,514 |

|

| Diluted Weighted Average

Common Shares Outstanding |

|

16,811,513 |

|

|

|

18,569,760 |

|

|

|

16,784,737 |

|

|

|

18,148,598 |

|

| |

(1) |

Share amounts with respect to the common stock and Convertible

Series A Preferred Stock have been retroactively restated to

reflect the reverse split thereof, which was effected as of the

close of business on September 10, 2020. |

| |

|

|

The following is a reconciliation of net income (loss) to EBITDA

and Adjusted EBITDA (in thousands, except percentages;

unaudited):

| |

For The Three Months Ended |

|

For The Six Months Ended |

| |

June 30, |

|

June 30, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

Net income (loss) |

$ |

(778,454 |

) |

|

$ |

3,656,916 |

|

|

$ |

(2,289,394 |

) |

|

$ |

6,276,178 |

|

|

|

|

|

|

|

|

|

|

|

Interest Income |

|

(192 |

) |

|

|

(1,043 |

) |

|

|

(619 |

) |

|

|

(1,585 |

) |

|

Interest Expense |

|

- |

|

|

|

787 |

|

|

|

1,034 |

|

|

|

41,476 |

|

|

Depreciation and Amortization |

|

72,413 |

|

|

|

172,298 |

|

|

|

155,861 |

|

|

|

344,207 |

|

|

Other |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

EBITDA |

$ |

(706,234 |

) |

|

$ |

3,828,958 |

|

|

$ |

(2,133,118 |

) |

|

$ |

6,660,276 |

|

|

|

|

|

|

|

|

|

|

|

Equity Compensation Expense |

|

- |

|

|

|

114,293 |

|

|

|

- |

|

|

|

297,065 |

|

|

Other |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Adjusted EBITDA |

$ |

(706,234 |

) |

|

$ |

3,943,251 |

|

|

|

$ (2,133,118 |

) |

|

$ |

6,957,341 |

|

|

|

|

|

|

|

|

|

|

|

Net revenue |

$ |

1,465,525 |

|

|

$ |

10,028,497 |

|

|

$ |

3,538,980 |

|

|

$ |

17, 081,915 |

|

|

Adjusted EBITDA Margin |

|

(48 |

%) |

|

|

39 |

% |

|

|

(60 |

%) |

|

|

41 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INVESTOR RELATIONS CONTACT:John Nesbett/Jennifer

BelodeauIMS Investor Relationsjnesbett@imsinvestorrelations.com

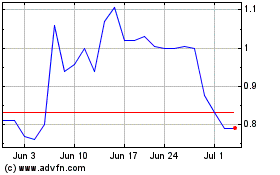

TOMI Environmental Solut... (NASDAQ:TOMZ)

Historical Stock Chart

From Aug 2024 to Sep 2024

TOMI Environmental Solut... (NASDAQ:TOMZ)

Historical Stock Chart

From Sep 2023 to Sep 2024