– Company Exceeds Third Quarter SaaS Revenue

and SaaS Adjusted EBITDA Guidance

Thryv Holdings, Inc. (NASDAQ:THRY) (“Thryv” or the “Company”),

the provider of Thryv®, based on information available as of

October 29 2024, is providing preliminary, unaudited results for

the third quarter of 2024 in conjunction with the proposed Keap

acquisition announced today. The Company plans to release its full

third quarter 2024 results before the market opens on November 7,

2024.

Based on preliminary, unaudited results for the third quarter

ended September 30, 2024 compared to the 2023 third quarter:

- SaaS Revenue is expected to be in the range of $86 million to

$88 million, compared to $67 million in the prior period.

- SaaS Gross Margin is expected to be in the range of 69% to 70%,

compared to 64% in the prior period. SaaS Adjusted Gross Margin is

expected to be in the range of 72% to 73%, compared to 67% in the

prior period.

- Net Income (Loss) is expected to be in the range of ($95)

million to ($97) million, which includes an $83 million non-cash

goodwill impairment charge related to our Marketing Services

segment, compared to ($27) million in the prior period.

- SaaS Adjusted EBITDA is expected to be in the range of $10

million to $11 million, compared to ($1) million in the prior

period.

- Seasoned Net Dollar Retention1 is expected to be approximately

100%, compared to 92% in the prior period.

Thryv's Chairman and CEO Joe Walsh commented, "We are pleased to

share our preliminary, unaudited third quarter results and look

forward to providing more details about our strong third quarter

results on November 7th."

The following financial results are preliminary, unaudited

estimates and are subject to change until the filing of the

Company’s Form 10-Q for the quarter ended September 30, 2024. The

Company is currently finalizing its third quarter 2024 results, and

as a result, these preliminary estimates are based solely on

information available to management as of the date of this press

release. The Company’s actual results may differ from these

estimates due to the completion of its quarter-end closing

procedures, final adjustments and developments that may arise or

information that may become available between now and the time the

Company’s financial results are finalized and included in its Form

10-Q for the quarter ended September 30, 2024.

Three Months Ended September

30,

2024

2023

% Change

Consolidated Results (in

millions)

(Low)

(High)

(Low)

(High)

Revenue

$178

$182

$184

(3)%

(1)%

Gross Profit

$111

$113

$104

7%

9%

Adjusted Gross Profit2

$116

$118

$111

4%

6%

Net (Loss)*

($97)

($95)

($27)

NM

NM

Adjusted EBITDA

$19

$21

$7

160%

188%

*Net Income (Loss) impacted by ~$83

million non-cash goodwill write-down related to our Marketing

Services segment. Excluding the impact of this goodwill write-down,

Net Income (Loss) would have been a loss of approximately $12

million to approximately $14 million.

Three Months Ended September

30,

2024

2023

% or bps Change

SaaS Results (in millions, except

margin data)

(Low)

(High)

(Low)

(High)

Revenue

$86

$88

$67

28%

31%

Gross Profit

$60

$62

$43

39%

43%

Gross Margin

69%

70%

64%

560 bps

630 bps

Adjusted Gross Profit2

$62

$64

$45

38%

42%

Adjusted Gross Margin

72%

73%

67%

530 bps

590 bps

Adjusted EBITDA

$10

$11

($1)

NM

NM

Adjusted EBITDA Margin

12%

13%

(1)%

1,230 bps

1,320 bps

Rule of 403

40%

44%

18%

2,140 bps

2,530 bps

Three Months Ended September

30,

2024

2023

% or bps Change

SaaS Metrics

(Low)

(High)

(Low)

(High)

Clients

96,000

97,000

66,000

45%

47%

Seasoned Net Dollar Retention4

100%

101%

92%

800 bps

900 bps

Clients with 2 or More Paid Centers

12%

13%

5%

700 bps

800 bps

Three Months Ended September

30,

2024

2023

% Change

Marketing Services Results (in

millions)

(Low)

(High)

(Low)

(High)

Revenue

$92

$94

$116

(21)%

(19)%

Adjusted EBITDA

$9

$10

$8

15%

28%

September 30,

Consolidated Balance Sheet (in

millions)

2024

2023

Debt5

$320

$392

Cash

$13

$15

Net Debt6

$307

$377

Satisfied Term Loan Amortization Payments

until 6/30/25.

September 30,

2024

2023

Leverage Ratio

(Low)

(High)

Total Net Leverage Ratio7

1.6x

1.7x

1.8x

Non-GAAP Measures

Our results included in this press release include Adjusted

EBITDA, Adjusted EBITDA Margin, Adjusted Gross Profit, Adjusted

Gross Margin and Net Debt, which are not presented in accordance

with U.S. generally accepted accounting principles (“GAAP”). These

non-GAAP measures are presented for supplemental informational

purposes only and are not intended to be considered in isolation or

as a substitute for, or superior to, financial information prepared

and presented in accordance with GAAP. Please refer to the

supplemental information presented in the tables below for a

reconciliation of Adjusted EBITDA to Net income (loss) and Adjusted

Gross Profit to Gross profit. Net income (loss) and Gross profit

are the most comparable GAAP financial measures to Adjusted EBITDA

and Adjusted Gross Profit, respectively. Debt is the most directly

comparable GAAP financial measure to Net Debt.

We have included Adjusted EBITDA, Adjusted EBITDA Margin,

Adjusted Gross Profit and Adjusted Gross Margin because management

believes they provide useful information to investors in gaining an

overall understanding of our current financial performance and

provide consistency and comparability with past financial

performance. Specifically, we believe Adjusted EBITDA provides

useful information to management and investors by excluding certain

non-operating items that we believe are not indicative of our core

operating results. In addition, Adjusted EBITDA, Adjusted EBITDA

Margin, Adjusted Gross Profit and Adjusted Gross Margin are used by

management for budgeting and forecasting as well as measuring the

Company’s performance. We believe Adjusted EBITDA, Adjusted EBITDA

Margin, Adjusted Gross Profit and Adjusted Gross Margin provide

investors with the financial measures that closely align with our

internal processes.

We define Adjusted EBITDA as Net income (loss) plus Interest

expense, Income tax expense, Depreciation and amortization expense,

Restructuring and integration expenses, Transaction costs,

Stock-based compensation expense, and non-operating expenses, such

as, Other components of net periodic pension cost, Loss on early

extinguishment of debt, Non-cash loss from remeasurement of

indemnification asset, and certain unusual and non-recurring

charges that might have been incurred. Adjusted EBITDA should not

be considered as an alternative to Net income (loss) as a

performance measure. We define Adjusted EBITDA Margin as Adjusted

EBITDA divided by revenue. We define Adjusted Gross Profit as Gross

profit adjusted to exclude the impact of Depreciation and

amortization expense and Stock-based compensation expense. We

define Adjusted Gross Margin as Adjusted Gross Profit divided by

revenue.

Non-GAAP financial information has limitations as an analytical

tool and is presented for supplemental informational purposes only.

Such information should not be considered a substitute for

financial information presented in accordance with U.S. GAAP and

may be different from similarly-titled non-GAAP measures used by

other companies.

Three Months Ended September

30,

2024

2023

(in millions)

(Low)

(High)

Reconciliation of Adjusted

EBITDA

Net (loss)

$

(97.0

)

$

(95.0

)

$

(27.0

)

Interest expense

11.5

11.5

15.1

Depreciation and amortization expense

12.5

12.5

15.8

Stock-based compensation expense (1)

6.0

6.0

5.5

Restructuring and integration expenses

(2)

4.9

4.9

3.6

Income tax (benefit)

(5.4

)

(5.4

)

(10.2

)

Transaction costs (3)

1.7

1.7

—

Other components of net periodic pension

cost (4)

1.6

1.6

1.9

Impairment charges (5)

83.1

83.1

—

Other (6)

(0.2

)

(0.2

)

2.7

Adjusted EBITDA

$

19.0

$

21.0

$

7.3

(1)

We record stock-based compensation expense

related to the amortization of grant date fair value of the

Company’s stock-based compensation awards.

(2)

For the three months ended September 30,

2024 and 2023, expenses relate to periodic efforts to enhance

efficiencies and reduce costs, and include severance benefits, and

costs associated with abandoned facilities and system

consolidation.

(3)

Expenses related to the Yellow acquisition

and other transaction costs.

(4)

Other components of net periodic pension

cost is from our non-contributory defined benefit pension plans

that are currently frozen and incur no additional service costs.

The most significant component of Other components of net periodic

pension cost relates to periodic mark-to-market pension

remeasurement.

(5)

During the third quarter of 2024, Thryv

recognized a non-cash goodwill impairment related to its Marketing

Services segment.

(6)

Other primarily represents foreign

exchange-related expense (income).

Three Months Ended September

30, 2024

SaaS

Consolidated

(in millions)

(Low)

(High)

(Low)

(High)

Reconciliation of Adjusted Gross

Profit

Gross profit

$

59.5

$

61.5

$

111.0

$

113.0

Plus:

Depreciation and amortization expense

2.2

2.2

4.7

4.7

Stock-based compensation expense

0.1

0.1

0.2

0.2

Adjusted Gross Profit

$

61.8

$

63.8

$

115.9

$

117.9

Gross Margin

69.2

%

69.9

%

62.4

%

62.1

%

Adjusted Gross Margin

71.9

%

72.5

%

65.1

%

64.8

%

Three Months Ended September

30, 2023

(in millions)

SaaS

Consolidated

Reconciliation of Adjusted Gross

Profit

Gross profit

$

42.9

$

103.6

Plus:

Depreciation and amortization expense

1.9

6.8

Stock-based compensation expense

0.1

0.2

Adjusted Gross Profit

$

44.8

$

110.6

Gross Margin

63.6

%

56.4

%

Adjusted Gross Margin

66.6

%

60.2

%

Supplemental Financial Information

The following supplemental financial information provides

Revenue, Adjusted EBITDA and Adjusted EBITDA Margin by (i)

Marketing Services businesses and (ii) SaaS businesses. Total SaaS

Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial

measures. Total Marketing Services Adjusted EBITDA and Adjusted

EBITDA margin are also non-GAAP financial measures. These non-GAAP

financial measures are presented for supplemental informational

purposes only and are not intended to be considered in isolation or

as a substitute for, or superior to, financial information prepared

and presented in accordance with GAAP. Please refer to the

supplemental information presented in the tables below for a

reconciliation of these non-GAAP financial measures to the

corresponding segment financial measures presented in accordance

with GAAP.

We believe that these non-GAAP financial measures provide useful

information about our global SaaS and Marketing Services financial

performance, enhance the overall understanding of our global SaaS

and Marketing Services past financial performance and allow for

greater transparency with respect to important metrics used by our

management for financial and operational decision-making. We

believe that these measures provide additional tools for investors

to use in comparing our core financial performance over multiple

periods.

Three Months Ended September

30, 2024

Marketing Services

(in millions)

(Low)

(High)

Revenue

$

92.0

$

94.0

Adjusted EBITDA

9.0

10.0

Adjusted EBITDA Margin

9.8

%

10.6

%

Three Months Ended September

30, 2024

SaaS

(in millions)

(Low)

(High)

Revenue

$

86.0

$

88.0

Adjusted EBITDA

10.0

11.0

Adjusted EBITDA Margin

11.6

%

12.5

%

Three Months Ended September

30, 2024

Consolidated

(in millions)

(Low)

(High)

Revenue

$

178.0

$

182.0

Net (Loss)

(97.0

)

(95.0

)

Net (Loss) Margin

(54.5

)%

(52.2

)%

Adjusted EBITDA

19.0

21.0

Adjusted EBITDA Margin

10.7

%

11.5

%

Three Months Ended September

30, 2023

(in millions)

Marketing Services

SaaS

Total

Revenue

$

116.5

$

67.4

$

183.8

Net (Loss)

(27.0

)

Net (Loss) Margin

(14.7

)%

Adjusted EBITDA (1)

7.8

(0.5

)

7.3

Adjusted EBITDA Margin

6.7

%

(0.7

)%

4.0

%

(1)

Total Adjusted EBITDA equals the sum of

Marketing Services Adjusted EBITDA and SaaS Adjusted EBITDA.

Forward-Looking Statements

Certain statements contained herein are not historical facts,

constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995 and involve a

number of risks and uncertainties. Statements that include the

words “may”, “will”, “could”, “should”, “would”, “believe”,

“anticipate”, “forecast”, “estimate”, “expect”, “preliminary”,

“intend”, “plan”, “target”, “project”, “outlook”, “future”,

“forward”, “guidance” and similar statements of a future or

forward-looking nature identify forward-looking statements. These

statements are not guarantees of future performance. These

forward-looking statements are based on our current expectations

and beliefs concerning future developments and their potential

effect on us. While management believes that these forward-looking

statements are reasonable as and when made, there can be no

assurance that future developments affecting us will be those that

we anticipate. Accordingly, there are or will be important factors

that could cause our actual results to differ materially from those

indicated in these statements. We believe that these factors

include, but are not limited to, the risks related to the

following: the Company’s ability to maintain adequate liquidity to

fund operations; the Company’s future operating and financial

performance; the Company’s ability to consummate acquisitions, or,

if consummated, to successfully integrate acquired businesses into

the Company’s operations, the Company’s ability to recognize the

benefits of acquisitions, or the failure of an acquired company to

achieve its plans and objectives; limitations on our operating and

strategic flexibility and the ability to operate our business,

finance our capital needs or expand business strategies under the

terms of our credit facilities; our ability to retain existing

business and obtain and retain new business; general economic or

business conditions affecting the markets we serve; declining use

of print yellow page directories by consumers; our ability to

collect trade receivables from clients to whom we extend credit;

credit risk associated with our reliance on small and medium sized

businesses as clients; our ability to attract and retain key

managers; increased competition in our markets; our ability to

obtain future financing due to changes in the lending markets or

our financial position; our ability to maintain agreements with

major Internet search and local media companies; reduced

advertising spending and increased contract cancellations by our

clients, which causes reduced revenue; and our ability to

anticipate or respond effectively to changes in technology and

consumer preferences as well as the risks and uncertainties set

forth in the Company's most recent Annual Report on Form 10-K filed

with the Securities and Exchange Commission. All subsequent written

and oral forward-looking statements attributable to us or persons

acting on our behalf are expressly qualified in their entirety by

such cautionary statements.

If one or more events related to these or other risks or

uncertainties materialize, or if our underlying assumptions prove

to be incorrect, actual results may differ materially from what we

anticipate. For these reasons, we caution you against relying on

forward-looking statements. All forward-looking statements included

in this press release are expressly qualified in their entirety by

the foregoing cautionary statements. These forward-looking

statements speak only as of the date hereof and, other than as

required by law, we undertake no obligation to publicly update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

About Thryv

Thryv Holdings, Inc. (NASDAQ:THRY) is the provider of the

leading do-it-all small business software platform that empowers

small businesses to modernize how they work. It offers small

business owners everything they need to communicate effectively,

manage their day-to-day operations, and grow — all in one place —

giving up to 20 hours back in their week. Thryv’s customizable

platform features three centers: Thryv Command Center, a freemium

central communications hub, Business Center™ and Marketing Center™.

Approximately 300,000 businesses globally use Thryv to connect with

local customers and take care of everything they do, start to

finish. For more information, visit thryv.com.

1 Seasoned Net Dollar Retention is calculated by dividing the

recurring revenue of all SaaS clients as of the last month of the

quarter (net of expansions, downsell, and churns) by the same

customer's recurring revenue one year ago, removing clients

acquired over the last 12 months. 2 Defined as Gross profit

adjusted to exclude the impact of depreciation and amortization

expense and stock-based compensation expense. 3 Rule of 40 is

defined as year-over-year revenue growth plus Adjusted EBITDA

Margin. 4 Seasoned Net Dollar Retention is calculated by dividing

the recurring revenue of all SaaS clients as of the last month of

the quarter (net of expansions, downsell, and churns) by the same

customer's recurring revenue one year ago, removing clients

acquired over the last 12 months. 5 Outstanding balances on our

Term Loan and ABL Facility excluding unamortized original issue

discount and debt issuance costs. 6 Defined as debt outstanding,

excluding any unamortized original issue discount and debt issuance

costs, less cash balance as of the end of the quarter. 7 Net

Leverage Ratio is calculated based on trailing twelve-month EBITDA

as defined in our term loan credit agreement to Net Debt.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029313143/en/

Media Contact: Julie Murphy Thryv, Inc. 617.967.5426

julie.murphy@thryv.com

Investor Contact: Cameron Lessard Thryv, Inc.

214.773.7022 cameron.lessard@thryv.com

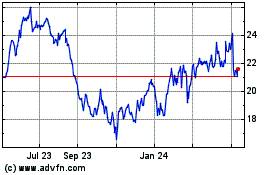

Thryv (NASDAQ:THRY)

Historical Stock Chart

From Nov 2024 to Dec 2024

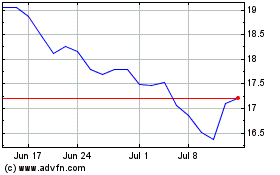

Thryv (NASDAQ:THRY)

Historical Stock Chart

From Dec 2023 to Dec 2024