TeraWulf Announces Beneficial Debt Modifications and Approximately $32 Million of New Equity Proceeds

February 02 2023 - 8:42AM

Business Wire

Deal will Eliminate principal payments and

defer amortization to April 2024 with ability to extend to

maturity.

Company expects to be fully funded to positive

free cash flow from bitcoin mining operations in Q2 2023.

Advances industry leading growth rate to

achieve targeted 160 MW and 5.5 EH of capacity in Q2 2023.

TeraWulf Inc. (Nasdaq: WULF) (“TeraWulf” or the “Company”),

which owns and operates vertically integrated, domestic Bitcoin

mining facilities powered by more than 91% zero-carbon energy,

today announced that it has (i) reached a binding agreement in

principle with its existing lenders on certain debt modifications,

subject to the equity capital raise condition, and (ii) raised

approximately $32 million of equity proceeds, which together are

expected to bring the Company to positive free cash flow and enable

a timely path to achieving the Company’s operational objectives in

2023.

Recent Developments Greatly Enhance Financial Position and

Operating Leverage

- Beneficial Debt Restructuring: On January 27, 2023, the

Company entered into a binding term sheet with its existing lenders

that will, among other things, replace amortization of the term

loan with a free cash flow sweep mechanism through April 2024,

subject to the Company raising the requisite amount of equity

proceeds by March 15, 2023.

- Public Equity Offering: today, the Company announced the

pricing of an underwritten follow-on offering of common stock (the

“Offering”) for gross proceeds of $25 million, before deducting

underwriter discounts and commissions and offering expenses. The

Offering is expected to close on or about February 6, 2023, subject

to the satisfaction of customary closing conditions.

- Management Investment: today, TeraWulf also announced

that its co-founders, Paul Prager, Chief Executive Officer, and

Nazar Khan, Chief Operating Officer, purchased $2.5 million in a

private placement at a market price of $1.05 per share (the last

reported sale price of the Company’s common stock on the Nasdaq on

January 26, 2023). The Management Investment is in addition to the

more than $15 million of personal capital previously invested in

the Company by management.

- Other Equity Proceeds: the Company announced it has

received approximately $4.25 million in proceeds from the exercise

of certain private placement warrants issued in December 2022 and a

non-brokered private placement of equity securities on terms

substantially similar to the Offering.

The Company intends to use net equity proceeds to complete

buildout of the Lake Mariner and Nautilus facilities and for

general corporate purposes, which may include working capital. The

net equity proceeds, together with the expected proceeds from the

exercise of the underwriters’ option to purchase additional shares,

are expected to fulfill requirements of the beneficial debt

restructuring. Additionally, in order to facilitate the Offering,

management exchanged 12 million shares of common stock for warrants

that will be immediately exercised upon stockholder approval of the

increase in the Company’s authorized common stock.

JonesTrading Institutional Services LLC acted as the sole

book-running manager for the Public Offering. Additional

information regarding the transactions is provided in the Company’s

Current Report on Form 8-K filed on February 1, 2023 with the

Securities and Exchange Commission.

Management Commentary

"We reached two transformational milestones already in 2023 – an

agreement in principle for restructuring our debt to more

effectively align with our operational buildout and market

dynamics, and securing additional capital to achieve positive

operating cash flow and EBITDA,” said Paul Prager. “In reaching

these achievements, we believe more than ever that TeraWulf is

positioned to deliver profitable growth and compelling returns. We

are confident in our ability to raise additional funds needed to

obtain debt relief and committed to creating shareholder

value.”

Patrick Fleury, Chief Financial Officer of TeraWulf, added,

“Flexibility is a key attribute of any business, and we believe

these modified repayment terms should further differentiate

TeraWulf as the preeminent vertically integrated, lowest-cost, and

zero carbon bitcoin miner.”

About TeraWulf

TeraWulf (Nasdaq: WULF) owns and operates vertically integrated,

environmentally clean Bitcoin mining facilities in the United

States. Led by an experienced group of energy entrepreneurs, the

Company is currently operating and/or completing construction of

two mining facilities: Lake Mariner in New York, and Nautilus

Cryptomine in Pennsylvania. TeraWulf generates domestically

produced Bitcoin powered by 91% nuclear, hydro, and solar energy

with a goal of utilizing 100% zero-carbon energy. With a core focus

on ESG that ties directly to its business success, TeraWulf expects

to offer attractive mining economics at an industrial scale.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, as amended. Such

forward-looking statements include statements concerning

anticipated future events and expectations that are not historical

facts. All statements, other than statements of historical fact,

are statements that could be deemed forward-looking statements. In

addition, forward-looking statements are typically identified by

words such as “plan,” “believe,” “goal,” “target,” “aim,” “expect,”

“anticipate,” “intend,” “outlook,” “estimate,” “forecast,”

“project,” “continue,” “could,” “may,” “might,” “possible,”

“potential,” “predict,” “should,” “would” and other similar words

and expressions, although the absence of these words or expressions

does not mean that a statement is not forward-looking.

Forward-looking statements are based on the current expectations

and beliefs of TeraWulf’s management and are inherently subject to

a number of factors, risks, uncertainties and assumptions and their

potential effects. There can be no assurance that future

developments will be those that have been anticipated. Actual

results may vary materially from those expressed or implied by

forward-looking statements based on a number of factors, risks,

uncertainties and assumptions, including, among others: (1)

conditions in the cryptocurrency mining industry, including

fluctuation in the market pricing of Bitcoin and other

cryptocurrencies, and the economics of cryptocurrency mining,

including as to variables or factors affecting the cost, efficiency

and profitability of cryptocurrency mining; (2) competition among

the various providers of cryptocurrency mining services; (3)

changes in applicable laws, regulations and/or permits affecting

TeraWulf’s operations or the industries in which it operates,

including regulation regarding power generation, cryptocurrency

usage and/or cryptocurrency mining; (4) the ability to implement

certain business objectives and to timely and cost-effectively

execute integrated projects; (5) failure to obtain adequate

financing on a timely basis and/or on acceptable terms with regard

to growth strategies or operations; (6) loss of public confidence

in Bitcoin or other cryptocurrencies and the potential for

cryptocurrency market manipulation; (7) the potential of

cybercrime, money-laundering, malware infections and phishing

and/or loss and interference as a result of equipment malfunction

or break-down, physical disaster, data security breach, computer

malfunction or sabotage (and the costs associated with any of the

foregoing); (8) the availability, delivery schedule and cost of

equipment necessary to maintain and grow the business and

operations of TeraWulf, including mining equipment and

infrastructure equipment meeting the technical or other

specifications required to achieve its growth strategy; (9)

employment workforce factors, including the loss of key employees;

(10) litigation relating to TeraWulf, RM 101 f/k/a IKONICS

Corporation and/or the business combination; (11) the ability to

recognize the anticipated objectives and benefits of the business

combination; and (12) other risks and uncertainties detailed from

time to time in the Company’s filings with the Securities and

Exchange Commission (“SEC”). Potential investors, stockholders and

other readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date on

which they were made. TeraWulf does not assume any obligation to

publicly update any forward-looking statement after it was made,

whether as a result of new information, future events or otherwise,

except as required by law or regulation. Investors are referred to

the full discussion of risks and uncertainties associated with

forward-looking statements and the discussion of risk factors

contained in the Company’s filings with the SEC, which are

available at www.sec.gov.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230201006127/en/

Sandy Harrison harrison@terawulf.com (410) 770-9500

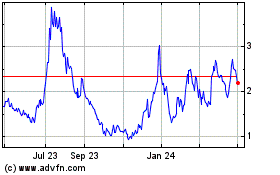

TeraWulf (NASDAQ:WULF)

Historical Stock Chart

From Dec 2024 to Jan 2025

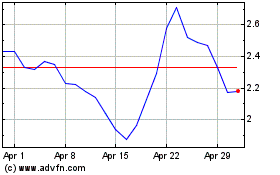

TeraWulf (NASDAQ:WULF)

Historical Stock Chart

From Jan 2024 to Jan 2025