false

0001089907

0001089907

2024-07-17

2024-07-17

0001089907

swkh:CommonStockParValueMember

2024-07-17

2024-07-17

0001089907

swkh:Sec9.00SeniorNotesDue2027Member

2024-07-17

2024-07-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to

Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report

(Date of Earliest Event Reported): July 17, 2024

SWK HOLDINGS

CORPORATION

(Exact Name

of the Registrant as Specified in Its Charter)

Delaware

(State or

Other Jurisdiction of Incorporation)

| 001-39184 |

77-0435679 |

| (Commission File

Number) |

(IRS Employer Identification

No.) |

| |

|

| 5956 Sherry Lane,

Suite 650, Dallas, TX |

75225 |

| (Address of Principal

Executive Offices) |

(Zip Code) |

| |

|

(972) 687-7250

(Registrant’s

Telephone Number, Including Area Code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

|

Securities registered pursuant to

Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on

which

registered |

Common

Stock, par value

$0.001

per share |

SWKH |

The

Nasdaq Stock Market LLC |

| 9.00% Senior Notes due 2027 |

SWKHL |

The Nasdaq Stock Market LLC |

Indicate by

check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company

☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations |

On July 17, 2024, SWK Holdings Corporation (the “Company”)

issued a press release reporting the Company’s 2024 corporate update and information regarding the company’s portfolio companies.

A copy of the press release in connection with the announcement is being furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Such information, including the Exhibit attached hereto,

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange

Act, except as shall be expressly set forth by specific reference in such filing.

| Item

9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits

SIGNATURE(S)

Pursuant to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

SWK Holdings Corporation |

| |

|

|

| Dated: July 18, 2024 |

By: |

/s/ Joe D.

Staggs |

| |

|

Joe D. Staggs |

| |

|

President and Chief Executive Officer |

Exhibit 99.1

FOR

IMMEDIATE RELEASE

SWK Holdings

Highlights Recent Achievements and Provides Portfolio Update

DALLAS—ACCESSWIRE--July

17, 2024--SWK Holdings Corporation (Nasdaq: SWKH) (“SWK” or the “Company”), a life science-focused specialty

finance company catering to small and mid-sized commercial-stage companies, today provided a corporate progress update as well as a summary

of the achievements of its borrower portfolio companies.

“During

the second quarter we advanced capital to two existing borrowers and are working towards an additional closing in the next month,”

said SWK President and CEO Jody Staggs.

“Importantly,

several of our borrower partners took advantage of the strong capital markets to raise equity or other forms of non-dilutive financing.

We also repurchased $1 million of stock during the quarter and in July welcomed Adam Rice, CPA as our new Chief Financial Officer.”

SWK anticipates

reporting second quarter 2024 results on Thursday, August 15 and will hold a conference call on Friday, August 16.

Summary of Recent Corporate Highlights:

| · | Adam Rice joined SWK as Chief Financial Officer in July. |

| · | Courtney Baker was promoted from Assistant Controller to Controller in June. |

| · | During the second quarter of 2024, SWK repurchased 58,567 shares of stock

for a total cost of $1.0 million. |

| · | Year-to-date 2024 through July 15, 2024, SWK has repurchased 197,969 shares

of stock for a total cost of $3.4 million. |

New Financings:

| · | In May, we funded an additional $2.0 million of term loan to AOTI, Inc. to

support the company’s continued growth. |

| · | In June, Journey Medical Corporation (“Journey”) drew the $5.0M

of additional term loan available under its existing credit agreement with SWK. In July, SWK closed an amendment to allow Journey to draw

an incremental $5.0M upon FDA approval of DFD-29, a treatment for rosacea. The FDA’s current Prescription Drug User Fee Act (PDUFA)

goal date for DFD-29 is November 4, 2024. |

Portfolio Company Updates:

AOTI, Inc.

Advanced Oxygen Therapeutics, Inc. (AIM: AOTI) is a medical technology company

that develops and markets proprietary wound care therapies.

| · | Successfully completed an IPO on the London Stock Exchange’s AIM in

June 2024, raising gross proceeds of £35.1 million. |

| · | Generated $43.9M million in revenues for the year ended December 31, 2023. |

Biolase, Inc.

Biolase, Inc. (OTC: BIOL) is a medical device company that develops, manufactures,

and markets proprietary dental laser systems.

| · | Generated increased adoption of its industry-leading laser, with approximately

67% of U.S. Waterlase sales coming from new customers and approximately 42% from dental specialists. |

| · | Third strongest consumable sales quarter in company history, with consumable

sales increasing 14% year over year, largely driven by over 600 subscriptions. |

| · | Lowered adjusted EBITDA loss by 21% during quarter ended March 31, 2024, versus

the same quarter last year. |

Biotricity, Inc.

Biotricity, Inc. (Nasdaq: BTCY) is a medical technology company focused

on delivering remote biometric monitoring solutions to the medical and consumer markets.

| · | For the fiscal year ending March 31, 2024, revenues rose by 25% to $12.1 million

compared to $9.6 million in the prior year. Gross margin was 69.3% for the fiscal year ending March 31, 2024, as compared to 56.5% in

the corresponding prior year, as a result of expansion in recurring technology fee revenue base. |

| · | In July announced an accelerated timeline to achieve EBITDA positive before

the end of calendar 2024 |

Elutia

Elutia Inc. (Nasdaq: ELUT) is a biologics company with a portfolio of regenerative

products aimed at improving compatibility between medical devices and the patients they treat.

| · | For the quarter ended March 31, 2024, reported year-over-year sales growth

of ~28% for proprietary products (specifically CanGaroo and SimpliDerm). |

| · | In June 2024, announced FDA approval of EluPro (the company’s next-generation,

drug-eluting version of CanGaroo) and raised gross proceeds of $13.3 million via the sale of common stock and prefunded warrants. |

Eton Pharmaceuticals, Inc.

Eton (Nasdaq: ETON) is an innovative pharmaceutical company focused on developing

and commercializing treatments for rare diseases.

| · | Eton reported revenue for the quarter ended March 31, 2024, of $8.0 million,

representing 50% growth over March 31, 2023, marking the 13th consecutive quarter of sequential product sales growth. |

| · | On April 30, 2024, Eton announced the submission to the FDA of New Drug Application

(“NDA”) for ET-400, Eton’s proprietary patented formulation of hydrocortisone oral solution. |

| · | Acquired the U.S. rights to PKU GOLIKE, which is indicated for Phenylketonuria,

from Relief Therapeutics. |

Journey Medical Corporation

Journey Medical Corporation (Nasdaq: DERM) is a commercial-stage pharmaceutical

company focused on commercializing FDA-approved, prescription dermatology products.

| · | Total revenues for the first quarter ended March 31, 2024, were $13.0 million,

a 7% increase from the $12.2 million reported in the first quarter of 2023. |

| · | Flagship products, Qbrexza and Accutane, grew by greater than 20% year-over-year. |

| · | Adjusted EBITDA of $11,000 for the first quarter ended March 31, 2024, compared

to Adjusted EBITDA of $(5.3 million) for the first quarter of 2023. |

Shield Therapeutics plc (LSE: STX)

Shield (LSE: STX) is a commercial-stage specialty pharmaceutical company

focused on addressing iron deficiency with its lead product Accrufer®/Feraccru® (ferric maltol).

| · | For the quarter ended March 31, 2024, total Accrufer® prescriptions of

~28.8k, up 174% year-over-year. |

| · | First quarter 2024 Accrufer® revenue of $4.0M at an average net selling

price of ~$140/prescription. |

| · | Established $10.0 million accounts receivable facility with Sallyport Commercial

Finance. |

| · | In May 2024, Korean partner for Accrufer® submitted

an NDA with the Korean Ministry of Food and Drug Safety. |

| · | In July 2024 announced receipt of $5.7 million through the monetization of

a China approval milestone payment with AOP Health International Management AG. |

About SWK Holdings Corporation

SWK Holdings Corporation is a life science focused

specialty finance company partnering with small- and mid-sized commercial-stage healthcare companies. SWK provides non-dilutive financing

to fuel the development and commercialization of lifesaving and life-enhancing medical technologies and products. SWK’s unique financing

structures provide flexible financing solutions at an attractive cost of capital to create long-term value for all SWK stakeholders. SWK’s

solutions include structured debt, traditional royalty monetization, synthetic royalty transactions, and asset purchases typically ranging

in size from $5.0 million to $25.0 million. SWK also owns Enteris BioPharma, a clinical development and manufacturing organization providing

development services to pharmaceutical partners. Additional information on the life science finance market is available on the Company’s

website at www.swkhold.com.

Safe Harbor Statement

This press release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. Statements including words such as “believes,” “expects,”

“anticipates,” “intends,” “estimates,” “plan,” “will,” “may,” “look forward,”

“intend,” “guidance,” “future” or similar expressions are forward-looking statements. Because these statements

reflect SWK’s current views, expectations and beliefs concerning future events, these forward-looking statements involve risks and uncertainties.

Investors should note that many factors, as more fully described under the caption “Risk Factors” and elsewhere in SWK’s Form

10-K, Form 10-Q and Form 8-K filings with the Securities and Exchange Commission and as otherwise enumerated herein, could affect the

Company’s future financial results and could cause actual results to differ materially from those expressed in such forward-looking statements.

The forward-looking statements in this press release are qualified by these risk factors. These are factors which, individually or in

the aggregate, could cause the Company’s actual results to differ materially from expected and historical results. You should not place

undue reliance on any forward-looking statements, which speak only as of the date they are made. We assume no obligation to publicly update

any forward-looking statements, whether as a result of new information, future developments or otherwise.

For more information, please contact:

Ira M. Gostin, MBA, APR

Investor Relations

775-391-0213

Investorrelations@swkhold.com

v3.24.2

Cover

|

Jul. 17, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 17, 2024

|

| Entity File Number |

001-39184

|

| Entity Registrant Name |

SWK HOLDINGS

CORPORATION

|

| Entity Central Index Key |

0001089907

|

| Entity Tax Identification Number |

77-0435679

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

5956 Sherry Lane

|

| Entity Address, Address Line Two |

Suite 650

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75225

|

| City Area Code |

(972)

|

| Local Phone Number |

687-7250

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, par value |

|

| Title of 12(b) Security |

Common

Stock, par value

|

| Trading Symbol |

SWKH

|

| Security Exchange Name |

NASDAQ

|

| 9.00% Senior Notes due 2027 |

|

| Title of 12(b) Security |

9.00% Senior Notes due 2027

|

| Trading Symbol |

SWKHL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=swkh_CommonStockParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=swkh_Sec9.00SeniorNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

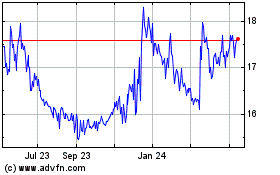

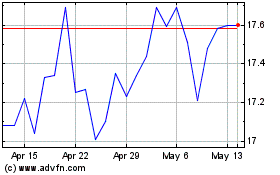

SWK (NASDAQ:SWKH)

Historical Stock Chart

From Feb 2025 to Mar 2025

SWK (NASDAQ:SWKH)

Historical Stock Chart

From Mar 2024 to Mar 2025