0001382101false00013821012024-08-132024-08-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 13, 2024

SUTRO BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

001-38662 |

47-0926186 |

(State or other jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

111 Oyster Point Blvd,

South San Francisco, California, 94080

(Address of principal executive offices) (Zip Code)

(650) 881-6500

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, $0.001 par value |

|

STRO |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 13, 2024, Sutro Biopharma, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended June 30, 2024. A copy of the press release is attached as Exhibit 99.1 to this report.

The information furnished with Item 2.02 of this report, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Exchange Act or under the Securities Act of 1933, as amended (the “Securities Act”), except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

Sutro Biopharma, Inc. |

|

|

|

Date: August 13, 2024 |

By: |

/s/ Edward Albini |

|

|

Edward Albini |

|

|

Chief Financial Officer |

Exhibit 99.1

Sutro Biopharma Reports Second Quarter 2024 Financial Results, Business Highlights and Select Anticipated Milestones

- Sutro will present updated data from the ongoing Phase 1b study of luvelta in combination with bevacizumab in a poster presentation at ESMO 2024; expansion study is ongoing with data expected in the first half of 2025 -

- REFRαME-O1 Part 2 (randomized portion) of the Phase 3 trial of luvelta for treatment of platinum-resistant ovarian cancer (PROC) is underway -

- REFRαME-P1, a registration-enabling trial of luvelta for pediatric patients with CBFA2T3::GLIS2 (CBF/GLIS; RAM phenotype) AML, is expected to be initiated in the second half of 2024 -

- A Phase 2 trial of luvelta for the treatment of NSCLC is expected to initiate in the second half of 2024, with initial data expected in the first half of 2025 -

- As of June 30, 2024, Sutro had $426.0 million, composed of cash, cash equivalents and marketable securities of $375.6 million and approximately 0.7 million shares of Vaxcyte common stock with a fair value of $50.4 million -

SOUTH SAN FRANCISCO, Calif., August 13, 2024 – Sutro Biopharma, Inc. (Sutro or the Company) (NASDAQ: STRO), a clinical-stage oncology company pioneering site-specific and novel-format antibody drug conjugates (ADCs), today reported its financial results for the second quarter of 2024, its recent business highlights, and a preview of select anticipated milestones.

“We continue to make meaningful progress with the development of luvelta across multiple indications, including enrollment of a patient expansion cohort in combination with bevacizumab, nearing initiation of our second registration-enabling trial, REFRaME-P1, for pediatric patients with a rare form of acute myeloid leukemia (AML) and approaching site activation of a Phase 2 trial in non-small cell lung cancer (NSCLC),” said Bill Newell, Sutro’s Chief Executive Officer. “We plan to share supplemental data from our Phase 1b trial of luvelta in combination with bevacizumab at the ESMO meeting in September.”

Mr. Newell added, “We are off to strong start in our new partnership with Ipsen for STRO-003 and continue to advance our preclinical pipeline of next-generation ADCs, including our tissue-factor targeting exatecan ADC, STRO-004. In parallel, we are exploring new partnership opportunities to maximize the potential of our platform and pipeline, led by our new Chief Business Development Officer Barbara Leyman. Additionally, we are delighted to welcome Sukhi Jagpal to our Board, as he brings a wealth of invaluable financial and strategic expertise.”

Recent Business Highlights and Select Anticipated Milestones

Luveltamab Tazevibulin (luvelta), FRα-Targeting ADC Franchise:

•Sutro will present updated data from the Phase 1b study of luvelta in combination with bevacizumab for patients with ovarian cancer in a poster presentation at the European Society for Medical Oncology (ESMO) Congress 2024 to be held September 13-17 in Barcelona, Spain.

Title: Luveltamab tazevibulin, an antifolate receptor alpha (FRα) antibody-drug conjugate (ADC), in combination with bevacizumab (bev) in patients with recurrent high-grade epithelial ovarian cancer (EOC): STRO-002-GM2 phase 1 study

Date: Saturday, September 14, 2024

•Part 2 (randomized portion) of the Phase 3 trial, REFRαME-O1, for treatment of platinum-resistant ovarian cancer (PROC), is underway.

•REFRαME-P1, a registration-enabling trial for pediatric patients with CBFA2T3::GLIS2 (CBF/GLIS; RAM phenotype) AML, is expected to be initiated in the second half of 2024.

•A Phase 2 expansion study in combination with bevacizumab is ongoing, with data expected in the first half of 2025.

•A Phase 2 trial for the treatment of NSCLC is expected to initiate in the second half of 2024, with initial data expected in the first half of 2025.

Additional Pipeline Development and Collaboration Updates:

•In April 2024, Sutro announced a global licensing agreement for STRO-003, a ROR1-targeting ADC, with Ipsen.

•Sutro plans to submit an IND for STRO-004 in 2025.

•Sutro continues to seek to maximize the value of its proprietary cell-free platform by working with partners on programs in multiple disease spaces and geographies and has generated from collaborators an aggregate of approximately $970 million in payments through June 30, 2024, including equity investments.

Corporate Updates:

•In August, Sutro strengthened its Board of Directors with the appointment of Sukhi Jagpal, MBA, CPA, CBV. Mr. Jagpal brings 20 years of experience in the life sciences industry, with expertise in financial management, communication, and organizational effectiveness, including financial analysis, mergers and acquisitions, and cost optimization.

•In July, Sutro appointed Barbara Leyman, Ph.D., as Chief Business Development Officer, with a focus on building value and executing the Company’s business development strategy, in addition to serving on Sutro’s senior management team.

Upcoming Events: Sutro will participate in two upcoming investor conferences. Webcasts of the presentations will be accessible through the News & Events page of the Investor Relations section of the Company’s website at www.sutrobio.com. Archived replays will be available for at least 30 days after the events.

•Wedbush PacGrow Healthcare Conference in New York, August 13-14, 2024

•Wells Fargo Healthcare Conference in Boston, September 4-6, 2024

Second Quarter 2024 Financial Highlights

Cash, Cash Equivalents and Marketable Securities and Vaxcyte Common Stock

As of June 30, 2024, Sutro had $426.0 million, composed of cash, cash equivalents and marketable securities of $375.6 million and approximately 0.7 million shares of Vaxcyte common stock with a fair value of $50.4 million.

Unrealized Gain from Increase in Value of Vaxcyte Common Stock

The non-operating, unrealized gain of $4.8 million for the quarter ended June 30, 2024 was due to the increase since March 31, 2024 in the estimated fair value of Sutro’s holdings of Vaxcyte common stock. Vaxcyte common stock held by Sutro will be remeasured at fair value based on the closing price of Vaxcyte’s common stock on the last trading day of each reporting period, with any non-operating, unrealized gains and losses recorded in Sutro’s statements of operations.

Revenue

Revenue was $25.7 million for the quarter ended June 30, 2024, as compared to $10.4 million for the same period in 2023, with the 2024 amount related principally to the Astellas collaboration and the Vaxcyte agreement. Future collaboration and license revenue under existing agreements, and from any additional collaboration and license partners, will fluctuate as a result of the amount and timing of revenue recognition of upfront, milestones, and other agreement payments.

Operating Expenses

Total operating expenses for the quarter ended June 30, 2024 were $74.4 million, as compared to $56.6 million for the same period in 2023. The 2024 quarter includes non-cash expenses for stock-based compensation of $6.2 million and depreciation and amortization of $1.8 million, as compared to $6.7 million and $1.7 million, respectively, in the comparable 2023 period. Total operating expenses for the quarter ended June 30, 2024 were comprised of research and development expenses of $62.0 million and general and administrative expenses of $12.4 million.

About Sutro Biopharma

Sutro Biopharma, Inc., is a clinical-stage company relentlessly focused on the discovery and development of precisely designed cancer therapeutics, to transform what science can do for patients. Sutro’s fit-for-purpose technology, including cell-free XpressCF®, provides the opportunity for broader patient benefit and an improved patient experience. Sutro has multiple clinical stage candidates, including luveltamab tazevibulin, or luvelta, a registrational-stage folate receptor alpha (FolRα)-targeting ADC in clinical studies. A robust pipeline, coupled with high-value collaborations and industry partnerships, validates Sutro’s continuous product innovation. Sutro is headquartered in South San Francisco. For more information, follow Sutro on social media @Sutrobio, or visit www.sutrobio.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including, but not limited to, anticipated preclinical and clinical development activities, including enrollment and site activation; timing of announcements of clinical results, trial initiation, and regulatory filings; outcome of regulatory decisions; potential benefits of luvelta and the Company’s other product candidates and platform; timing of payments under our collaboration agreements; potential expansion into other indications and combinations, including the timing and development activities related to such expansion; potential market opportunities for luvelta and the Company’s other product candidates; and the Company’s expected cash runway. All statements other than statements of historical fact are statements that could be deemed forward-looking statements. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, the Company cannot guarantee future events, results, actions, levels of activity, performance or achievements, and the timing and results of biotechnology development and potential regulatory approval is inherently uncertain. Forward-looking statements are subject to risks and uncertainties that may cause the Company’s actual activities or results to differ significantly from those expressed in any forward-looking statement, including risks and uncertainties related to the Company’s ability to advance its product candidates, the receipt and timing of potential regulatory designations, approvals and commercialization of product candidates and the Company’s ability to successfully leverage Fast Track designation, the market size for the Company’s product candidates to be smaller than anticipated, clinical trial sites, supply chain and manufacturing facilities, the Company’s ability to maintain and recognize the benefits of certain designations received by product candidates, the timing and results of preclinical and clinical trials, the Company’s ability to fund development activities and achieve development goals, the Company’s ability to protect intellectual property, the value of the Company’s holdings of Vaxcyte common stock, and the Company’s commercial collaborations with third parties and other risks and uncertainties described under the heading “Risk Factors” in documents the Company files from time to time with the Securities and Exchange Commission. These forward-looking statements speak only as of the date of this

press release, and the Company undertakes no obligation to revise or update any forward-looking statements to reflect events or circumstances after the date hereof.

Contact

Emily White

Sutro Biopharma

(650) 823-7681

ewhite@sutrobio.com

Sutro Biopharma, Inc.

Selected Statements of Operations Financial Data

(Unaudited)

(In thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

Six Months Ended |

|

|

|

June 30, |

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenues |

|

$ |

25,706 |

|

|

$ |

10,412 |

|

|

$ |

38,714 |

|

|

$ |

23,086 |

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

62,020 |

|

|

|

41,592 |

|

|

|

118,898 |

|

|

|

80,991 |

|

General and administrative |

|

|

12,371 |

|

|

|

14,999 |

|

|

|

25,092 |

|

|

|

30,511 |

|

Total operating expenses |

|

|

74,391 |

|

|

|

56,591 |

|

|

|

143,990 |

|

|

|

111,502 |

|

Loss from operations |

|

|

(48,685 |

) |

|

|

(46,179 |

) |

|

|

(105,276 |

) |

|

|

(88,416 |

) |

Interest income |

|

|

4,911 |

|

|

|

2,842 |

|

|

|

9,007 |

|

|

|

5,402 |

|

Unrealized gain on equity securities |

|

|

4,808 |

|

|

|

8,321 |

|

|

|

8,487 |

|

|

|

1,329 |

|

Non-cash interest expense related to the sale of future royalties |

|

|

(7,286 |

) |

|

|

(442 |

) |

|

|

(14,470 |

) |

|

|

(442 |

) |

Interest and other income (expense), net |

|

|

(1,758 |

) |

|

|

(2,915 |

) |

|

|

(3,971 |

) |

|

|

(5,901 |

) |

Loss before provision for income taxes |

|

|

(48,010 |

) |

|

|

(38,373 |

) |

|

|

(106,223 |

) |

|

|

(88,028 |

) |

Provision for income taxes |

|

|

8 |

|

|

|

151 |

|

|

|

8 |

|

|

|

546 |

|

Net loss |

|

$ |

(48,018 |

) |

|

$ |

(38,524 |

) |

|

$ |

(106,231 |

) |

|

$ |

(88,574 |

) |

Net loss per share, basic and diluted |

|

$ |

(0.59 |

) |

|

$ |

(0.64 |

) |

|

$ |

(1.49 |

) |

|

$ |

(1.49 |

) |

Weighted-average shares used in computing

basic and diluted loss per share |

|

|

81,224,628 |

|

|

|

60,339,475 |

|

|

|

71,341,211 |

|

|

|

59,535,918 |

|

Sutro Biopharma, Inc.

Selected Balance Sheets Financial Data

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024(1) |

|

|

December 31, 2023(2) |

|

Assets |

|

|

|

|

|

|

|

|

Cash, cash equivalents and marketable securities |

|

$ |

375,568 |

|

|

$ |

333,681 |

|

Investment in equity securities |

|

|

50,424 |

|

|

|

41,937 |

|

Accounts receivable |

|

|

6,950 |

|

|

|

36,078 |

|

Property and equipment, net |

|

|

19,414 |

|

|

|

21,940 |

|

Operating lease right-of-use assets |

|

|

20,333 |

|

|

|

22,815 |

|

Other assets |

|

|

16,354 |

|

|

|

14,285 |

|

Total Assets |

|

$ |

489,043 |

|

|

$ |

470,736 |

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

Accounts payable, accrued expenses and other liabilities |

|

$ |

50,782 |

|

|

$ |

64,293 |

|

Deferred revenue |

|

|

95,654 |

|

|

|

74,045 |

|

Operating lease liability |

|

|

26,526 |

|

|

|

29,574 |

|

Debt |

|

|

- |

|

|

|

4,061 |

|

Deferred royalty obligation related to the sale of future royalties |

|

|

163,905 |

|

|

|

149,114 |

|

Total liabilities |

|

|

336,867 |

|

|

|

321,087 |

|

Total stockholders’ equity |

|

|

152,176 |

|

|

|

149,649 |

|

Total Liabilities and Stockholders’ Equity |

|

$ |

489,043 |

|

|

$ |

470,736 |

|

(1) The condensed balance sheet as of June 30, 2024 was derived from the unaudited financial statements included in the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, filed with the Securities and Exchange Commission on August 13, 2024.

(2) The condensed balance sheet as of December 31, 2023 was derived from the unaudited financial statements included in the Company's Annual Report on Form 10-K for the year ended December 31, 2023, filed with the Securities and Exchange Commission on March 25, 2024.

v3.24.2.u1

Document and Entity Information

|

Aug. 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 13, 2024

|

| Entity Registrant Name |

SUTRO BIOPHARMA, INC.

|

| Entity Central Index Key |

0001382101

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-38662

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

47-0926186

|

| Entity Address, Address Line One |

111 Oyster Point Blvd,

|

| Entity Address, City or Town |

South San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94080

|

| City Area Code |

(650)

|

| Local Phone Number |

881-6500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

STRO

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

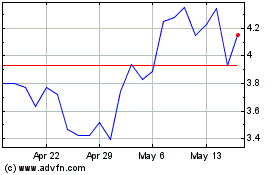

Sutro Biopharma (NASDAQ:STRO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sutro Biopharma (NASDAQ:STRO)

Historical Stock Chart

From Nov 2023 to Nov 2024