SuRo Capital Corp. (“SuRo Capital”, the

“Company”, “we”, “us”, and “our”) (Nasdaq:

SSSS) today announced its financial results for

the quarter ended June 30, 2024. Net assets totaled approximately

$162.3 million, or $6.94 per share, at June 30, 2024, as compared

to $7.17 per share at March 31, 2024 and $7.35 per share at June

30, 2023.

“The second quarter was broadly positive for the

U.S. economy and equity markets as investors became increasingly

confident in the prospect of rate cuts later in the year. However,

as of late last week, the market has become volatile due to a

confluence of domestic and global factors leading to a sharp change

in investor sentiment. Despite these fluctuations in the broader

public markets, in the second quarter, private technology companies

continued to see increasing interest from investors,” said Mark

Klein, Chairman and Chief Executive Officer of SuRo Capital.

Mr. Klein continued, “As we have previously

mentioned, with nearly $55.0 million in investable capital, we

remain incredibly enthusiastic about our investment pipeline.

During the second quarter, we completed a $10.0 million investment

in Canva, Inc., a leading design software and collaboration

platform with over 170 million monthly users, and a $15.0 million

investment in CW Opportunity 2 LP, an SPV invested in CoreWeave,

Inc., an AI cloud computing provider offering a suite of NVIDIA

GPUs on top of its fast and flexible infrastructure. We

believe that these investments strengthen our already

well-positioned existing portfolio for the re-opening of the IPO

window.”

“We are pleased to announce our Board of

Directors has approved a repurchase program of up to $35.0 million

for our 6.00% Notes due 2026. Additionally, the Board approved up

to $75.0 million of private 6.50% Convertible Notes due 2029, with

an initial issuance of up to $25.0 million. We believe the

refinancing of a portion of our current debt to a longer-dated

convertible instrument with favorable terms strengthens our balance

sheet,” Mr. Klein continued.

“As we have consistently demonstrated, SuRo

Capital is committed to initiatives that enhance shareholder value,

and we believe the market is currently undervaluing our portfolio.

Given the discount our stock has traded at compared to net asset

value per share, we believe our recently completed Modified Dutch

Auction Tender Offer was an efficient and accretive deployment of

capital,” concluded Mr. Klein.

Investment Portfolio as of June 30,

2024

At June 30, 2024, SuRo Capital held positions in

39 portfolio companies – 35 privately held and 4 publicly held,

some of which may be subject to certain lock-up provisions – with

an aggregate fair value of approximately $182.9 million. The

Company’s top five portfolio company investments accounted for

approximately 49% of the total portfolio at fair value as of June

30, 2024.

Top Five Investments as of June 30,

2024

|

Portfolio Company ($ in millions) |

Cost Basis |

Fair Value |

% of Total Portfolio |

|

Learneo, Inc. |

$ |

15.0 |

$ |

29.0 |

15.9 |

% |

| Blink Health, Inc. |

|

15.0 |

|

19.9 |

10.9 |

|

| CW Opportunity 2

LP |

|

15.0 |

|

15.0 |

8.2 |

|

| ServiceTitan, Inc. |

|

10.0 |

|

14.4 |

7.9 |

|

| Locus Robotics Corp. |

|

10.0 |

|

11.0 |

6.0 |

|

|

Total |

$ |

65.0 |

$ |

89.3 |

48.8 |

% |

| |

|

|

|

|

|

|

__________________

Note: Total may not

sum due to rounding.

Second Quarter 2024 Investment Portfolio

Activity

During the three months ended June 30, 2024,

SuRo Capital made the following investments:

|

Portfolio Company |

Investment |

Transaction Date |

Amount |

| Canva, Inc. |

Common Shares |

4/17/2024 |

$10.0 million |

| CW Opportunity 2 LP(1) |

Class A Interest |

5/7/2024 |

$15.0 million |

| |

|

|

|

__________________

(1) CW Opportunity 2

LP is a special purpose vehicle that is invested in the Series C

Preferred Shares of CoreWeave, Inc.

During the three months ended June 30, 2024,

SuRo Capital exited or received proceeds from the following

investments, excluding short-term US treasuries:

|

Portfolio Company |

Transaction Date |

Net Proceeds |

Realized Gain |

| Architect Capital PayJoy SPV,

LLC(1) |

6/28/2024 |

$10.0 million |

$- |

| True Global Ventures 4 Plus

Pte Ltd |

6/28/2024 |

$0.2 million |

$- |

| |

|

|

|

__________________

(1) On June 28, 2024,

SuRo Capital redeemed its Membership Interest in Architect Capital

PayJoy SPV, LLC.

Subsequent to quarter-end through August 7,

2024, SuRo Capital exited or received proceeds from the following

investments:

|

Portfolio Company |

Transaction Date |

Quantity |

Average Net Share

Price(1) |

Net Proceeds |

Realized Gain |

| PSQ Holdings, Inc. (d/b/a

PublicSquare) – Public Common Shares(2) |

Various |

220,000 |

$2.87 |

$0.6 million |

$0.5 million |

| |

|

|

|

|

|

__________________

(1) The average net share price is

the net share price realized after deducting all commissions and

fees on the sale(s), if applicable.

(2) As of August 7,

2024, SuRo Capital held 1,756,032 remaining PSQ Holdings, Inc.

(d/b/a PublicSquare) public common shares.

Second Quarter 2024 Financial

Results

|

|

Quarter EndedJune 30, 2024 |

Quarter EndedJune 30, 2023 |

| $ in

millions |

|

per share(1) |

|

$ in millions |

|

per share(1) |

|

|

|

|

|

|

|

Net investment loss |

$ |

(3.7 |

) |

|

$ |

(0.16 |

) |

|

$ |

(3.8 |

) |

|

$ |

(0.15 |

) |

| |

|

|

|

|

| Net realized loss on

investments |

|

(0.0 |

) |

|

|

(0.00 |

) |

|

|

(13.3 |

) |

|

|

(0.51 |

) |

| |

|

|

|

|

| Net change in unrealized

appreciation/(depreciation) of investments |

|

(7.0 |

) |

|

|

(0.30 |

) |

|

|

1.5 |

|

|

|

0.06 |

|

| |

|

|

|

|

| Net decrease in net assets

resulting from operations – basic (2) |

$ |

(10.7 |

) |

|

$ |

(0.45 |

) |

|

$ |

(15.6 |

) |

|

$ |

(0.60 |

) |

| |

|

|

|

|

| Repurchase of common stock |

|

(9.4 |

) |

|

|

0.20 |

|

|

|

(13.5 |

) |

|

|

0.33 |

|

| |

|

|

|

|

| Stock-based compensation |

|

0.6 |

|

|

|

0.03 |

|

|

|

0.8 |

|

|

|

0.03 |

|

| |

|

|

|

|

|

Decrease in net asset value(2) |

$ |

(19.4 |

) |

|

$ |

(0.23 |

) |

|

$ |

(28.4 |

) |

|

$ |

(0.24 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

__________________

(1) Based on basic

weighted-average number of shares outstanding for the relevant

period.(2) Total may not sum due to rounding.

Weighted-average common basic shares outstanding

were approximately 23.4 million and 26.0 million for the quarters

ended June 30, 2024 and 2023, respectively. As of June 30, there

were 23,378,002 shares of the Company’s common stock

outstanding.

SuRo Capital’s liquid assets were approximately

$57.6 million as of June 30, 2024, consisting of cash and

securities of publicly traded portfolio companies not subject to

lock-up restrictions at quarter-end.

Convertible Note Purchase

Agreement

On August 6, 2024, SuRo Capital entered into a

Note Purchase Agreement (the “Note Purchase Agreement”), by and

between the Company and the purchaser identified therein (the

“Purchaser”), pursuant to which we may issue up to a maximum of

$75.0 million in aggregate principal amount of 6.50% Convertible

Notes due 2029 (the “Convertible Notes”). Pursuant to the Note

Purchase Agreement, we agreed to issue and sell, and the Purchaser

agreed to purchase, up to $25.0 million in aggregate principal

amount of the Convertible Notes (the “Initial Notes”). Thereafter,

upon mutual agreement between the Company and the Purchaser, we may

issue additional Convertible Notes for sale in subsequent offerings

(the “Additional Notes”), or issue additional notes with modified

pricing terms (the “New Notes”), in the aggregate for both the

Additional Notes and the New Notes, up to a maximum of $50.0

million in one or more private offerings. The Purchaser will

acquire, and we will issue, up to $25.0 million of the Initial

Notes on or about August 14, 2024 (the “Initial Closing Date”), and

thereafter at such time and date as the Purchaser and we mutually

agree to purchase and sell any Additional Notes.

Interest on the Convertible Notes will be paid

quarterly in arrears on March 30, June 30, September 30, and

December 30, at a rate of 6.50% per year, beginning September 30,

2024. The Convertible Notes will mature on August 14, 2029 and may

be redeemed in whole or in part at any time or from time to time at

our option on or after August 6, 2027 upon the fulfillment of

certain conditions. The Convertible Notes will be convertible into

shares of our common stock at the Purchaser's sole discretion at an

initial conversion rate of 129.0323 shares of our common stock per

$1,000 principal amount of the Convertible Notes, subject to

adjustment as provided in the Note Purchase Agreement.

The net proceeds from the offering will be used to repay

outstanding indebtedness, make investments in accordance with our

investment objective and investment strategy, and for other general

corporate purposes. The Note Purchase Agreement includes customary

representations, warranties, and covenants by the Company.

Note Repurchase Program

On August 6, 2024, SuRo Capital’s Board of

Directors approved a discretionary note repurchase program (the

“Note Repurchase Program”) which allows the Company to repurchase

up to 46.67%, or $35.0 million in aggregate principal amount, of

our 6.00% Notes due 2026 through open market purchases, including

block purchases, in such manner as will comply with the provisions

of the Investment Company Act of 1940, as amended (the "1940 Act")

and the Securities Exchange Act of 1934, as amended (the "Exchange

Act"). As of August 7, 2024, we had not repurchased any of the

6.00% Notes due 2026 under the Note Repurchase Program.

Modified Dutch Auction Tender

Offer

On February 14, 2024, our Board of Directors

authorized a modified Dutch Auction tender offer (the “Tender

Offer”) to purchase up to 2.0 million shares of our common stock at

a price per share not less than $4.00 and not greater than $5.00 in

$0.10 increments, using available cash. In accordance with the

Tender Offer, following the expiration of the Tender Offer at 5:00

P.M. Eastern Time on April 1, 2024, the Company repurchased

2,000,000 shares at a price of $4.70 per share, representing 7.9%

of its outstanding shares. The per share purchase price of properly

tendered shares represents 65.6% of net asset value per share as of

March 31, 2024.

Share Repurchase Program

Under the Share Repurchase Program, the Company

may repurchase its outstanding common stock in the open market,

provided it complies with the prohibitions under its insider

trading policies and procedures and the applicable provisions of

the 1940 Act and the Exchange Act.

Since inception of the Share Repurchase Program

in August 2017, SuRo Capital has repurchased over 6.0 million

shares of its common stock for an aggregate purchase price of

approximately $39.3 million. This does not include repurchases

under various tender offers during this time period. The dollar

value of shares that may yet be purchased by SuRo Capital under the

Share Repurchase Program is approximately $20.7 million. The Share

Repurchase Program is authorized through October 31, 2024.

Conference Call and Webcast

Management will hold a conference call and

webcast for investors at 2:00 p.m. PT (5:00 p.m. ET) on August 7,

2024. The conference call access number for U.S. participants is

866-580-3963, and the conference call access number for

participants outside the U.S. is +1 786-697-3501. The conference ID

number for both access numbers is 6397974. Additionally, interested

parties can listen to a live webcast of the call from the "Investor

Relations" section of SuRo Capital’s website at www.surocap.com. An

archived replay of the webcast will also be available for 12 months

following the live presentation.

A replay of the conference call may be accessed

until 5:00 p.m. PT (8:00 p.m. ET) on August 14, 2024 by dialing

866-583-1035 (U.S.) or +44 (0) 20 3451 9993 (International) and

using conference ID number 6397974.

Forward-Looking Statements

Statements included herein, including statements

regarding SuRo Capital's beliefs, expectations, intentions, or

strategies for the future, may constitute "forward-looking

statements". SuRo Capital cautions you that forward-looking

statements are not guarantees of future performance and that actual

results or developments may differ materially from those projected

or implied in these statements. All forward-looking statements

involve a number of risks and uncertainties, including the impact

of any market volatility that may be detrimental to our business,

our portfolio companies, our industry, and the global economy, that

could cause actual results to differ materially from the plans,

intentions, and expectations reflected in or suggested by the

forward-looking statements. Risk factors, cautionary statements,

and other conditions which could cause SuRo Capital's actual

results to differ from management's current expectations are

contained in SuRo Capital's filings with the Securities and

Exchange Commission. SuRo Capital undertakes no obligation to

update any forward-looking statement to reflect events or

circumstances that may arise after the date of this press

release.

About SuRo Capital Corp.

SuRo Capital Corp. (Nasdaq: SSSS) is a publicly

traded investment fund that seeks to invest in high-growth,

venture-backed private companies. The fund seeks to create a

portfolio of high-growth emerging private companies via a

repeatable and disciplined investment approach, as well as to

provide investors with access to such companies through its

publicly traded common stock. SuRo Capital is headquartered in New

York, NY and has offices in San Francisco, CA. Connect with the

company on X, LinkedIn, and at www.surocap.com.

ContactSuRo Capital Corp.(212)

931-6331IR@surocap.com

SURO CAPITAL CORP. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

ASSETS AND LIABILITIES (UNAUDITED)

|

|

June 30, 2024 |

|

December 31, 2023 |

|

ASSETS |

|

|

|

| Investments at fair

value: |

|

|

|

|

Non-controlled/non-affiliate investments (cost of $195,251,769 and

$160,994,161, respectively) |

$ |

161,548,344 |

|

|

$ |

147,167,535 |

|

| Non-controlled/affiliate

investments (cost of $32,733,009 and $32,775,940,

respectively) |

|

19,386,536 |

|

|

|

24,931,333 |

|

| Controlled investments (cost

of $8,764,352 and $18,771,097, respectively) |

|

1,970,000 |

|

|

|

11,982,381 |

|

|

Total Portfolio Investments |

|

182,904,880 |

|

|

|

184,081,249 |

|

| Investments in U.S. Treasury

bills (cost of $0 and $63,792,704, respectively) |

|

— |

|

|

|

63,810,855 |

|

| Total Investments (cost of

$236,749,130 and $276,333,902, respectively) |

|

182,904,880 |

|

|

|

247,892,104 |

|

| Cash |

|

54,379,773 |

|

|

|

28,178,352 |

|

| Escrow proceeds

receivable |

|

71,044 |

|

|

|

309,293 |

|

| Interest and dividends

receivable |

|

83,844 |

|

|

|

132,607 |

|

| Deferred financing costs |

|

561,075 |

|

|

|

594,726 |

|

| Prepaid expenses and other

assets(1) |

|

282,555 |

|

|

|

494,602 |

|

|

Total Assets |

|

238,283,171 |

|

|

|

277,601,684 |

|

|

LIABILITIES |

|

|

|

| Accounts payable and accrued

expenses(1) |

|

2,002,539 |

|

|

|

346,308 |

|

| Dividends payable |

|

44,700 |

|

|

|

152,523 |

|

| 6.00% Notes due December 30,

2026(2) |

|

73,923,741 |

|

|

|

73,745,207 |

|

|

Total Liabilities |

|

75,970,980 |

|

|

|

74,244,038 |

|

| |

|

|

|

| Net

Assets |

$ |

162,312,191 |

|

|

$ |

203,357,646 |

|

| NET

ASSETS |

|

|

|

| Common stock, par value $0.01

per share (100,000,000 authorized; 23,378,002 and 25,445,805 issued

and outstanding, respectively) |

$ |

233,780 |

|

|

$ |

254,458 |

|

| Paid-in capital in excess of

par |

|

240,145,859 |

|

|

|

248,454,107 |

|

| Accumulated net investment

loss |

|

(11,182,638 |

) |

|

|

(4,304,111 |

) |

| Accumulated net realized loss

on investments, net of distributions |

|

(12,802,458 |

) |

|

|

(12,348,772 |

) |

| Accumulated net unrealized

appreciation/(depreciation) of investments |

|

(54,082,352 |

) |

|

|

(28,698,036 |

) |

|

Net Assets |

$ |

162,312,191 |

|

|

$ |

203,357,646 |

|

|

Net Asset Value Per Share |

$ |

6.94 |

|

|

$ |

7.99 |

|

__________________

|

(1) |

This balance includes a right of use asset and corresponding

operating lease liability, respectively. |

| (2) |

As of June 30, 2024, the 6.00%

Notes due December 30, 2026 (the "6.00% Notes due 2026") (effective

interest rate of 6.53%) had a face value $75,000,000. As of

December 31, 2023, the 6.00% Notes due 2026 (effective interest

rate of 6.53%) had a face value $75,000,000. |

| |

|

SURO CAPITAL CORP. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (UNAUDITED)

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| INVESTMENT

INCOME |

|

|

|

|

|

|

|

|

| Non-controlled/non-affiliate

investments: |

|

|

|

|

|

|

|

|

|

Interest income(1) |

|

$ |

290,750 |

|

|

$ |

40,394 |

|

|

$ |

532,757 |

|

|

$ |

89,869 |

|

|

Dividend income |

|

|

— |

|

|

|

63,145 |

|

|

|

21,875 |

|

|

|

126,290 |

|

| Controlled investments: |

|

|

|

|

|

|

|

|

|

Interest income |

|

|

376,667 |

|

|

|

318,425 |

|

|

|

811,667 |

|

|

|

554,425 |

|

| Interest income from U.S.

Treasury bills |

|

|

359,936 |

|

|

|

950,254 |

|

|

|

1,189,145 |

|

|

|

1,900,716 |

|

|

Total Investment Income |

|

|

1,027,353 |

|

|

|

1,372,218 |

|

|

|

2,555,444 |

|

|

|

2,671,300 |

|

| OPERATING

EXPENSES |

|

|

|

|

|

|

|

|

| Compensation expense |

|

|

2,198,509 |

|

|

|

2,117,872 |

|

|

|

4,383,827 |

|

|

|

4,254,626 |

|

| Directors’ fees |

|

|

167,825 |

|

|

|

161,661 |

|

|

|

338,938 |

|

|

|

322,226 |

|

| Professional fees |

|

|

586,825 |

|

|

|

916,579 |

|

|

|

1,315,384 |

|

|

|

1,907,413 |

|

| Interest expense |

|

|

1,214,267 |

|

|

|

1,214,267 |

|

|

|

2,428,534 |

|

|

|

2,427,553 |

|

| Income tax expense |

|

|

52,794 |

|

|

|

90,826 |

|

|

|

54,894 |

|

|

|

620,606 |

|

| Other expenses |

|

|

462,758 |

|

|

|

676,353 |

|

|

|

912,394 |

|

|

|

1,165,981 |

|

|

Total Operating Expenses |

|

|

4,682,978 |

|

|

|

5,177,558 |

|

|

|

9,433,971 |

|

|

|

10,698,405 |

|

|

Net Investment Loss |

|

|

(3,655,625 |

) |

|

|

(3,805,340 |

) |

|

|

(6,878,527 |

) |

|

|

(8,027,105 |

) |

| Realized Gain/(Loss)

on Investments: |

|

|

|

|

|

|

|

|

| Non-controlled/non-affiliated

investments |

|

|

(22,867 |

) |

|

|

(2,325,175 |

) |

|

|

(507,008 |

) |

|

|

(2,135,832 |

) |

| Non-controlled/affiliate

investments |

|

|

— |

|

|

|

(10,945,024 |

) |

|

|

60,067 |

|

|

|

(10,945,024 |

) |

| Controlled investments |

|

|

(6,745 |

) |

|

|

— |

|

|

|

(6,745 |

) |

|

|

— |

|

|

Net Realized Loss on Investments |

|

|

(29,612 |

) |

|

|

(13,270,199 |

) |

|

|

(453,686 |

) |

|

|

(13,080,856 |

) |

| Change in Unrealized

Appreciation/(Depreciation) of Investments: |

|

|

|

|

|

|

|

|

| Non-controlled/non-affiliated

investments |

|

|

(3,481,638 |

) |

|

|

(12,152,800 |

) |

|

|

(19,876,809 |

) |

|

|

(14,216,377 |

) |

| Non-controlled/affiliate

investments |

|

|

(3,485,172 |

) |

|

|

11,220,424 |

|

|

|

(5,501,871 |

) |

|

|

9,900,060 |

|

| Controlled investments |

|

|

864 |

|

|

|

2,387,891 |

|

|

|

(5,636 |

) |

|

|

14,420,763 |

|

|

Net Change in Unrealized Appreciation/(Depreciation) of

Investments |

|

|

(6,965,946 |

) |

|

|

1,455,515 |

|

|

|

(25,384,316 |

) |

|

|

10,104,446 |

|

|

Net Change in Net Assets Resulting from

Operations |

|

$ |

(10,651,183 |

) |

|

$ |

(15,620,024 |

) |

|

$ |

(32,716,529 |

) |

|

$ |

(11,003,515 |

) |

|

Net Change in Net Assets Resulting from Operations per

Common Share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.45 |

) |

|

$ |

(0.60 |

) |

|

$ |

(1.34 |

) |

|

$ |

(0.41 |

) |

|

Diluted(2) |

|

$ |

(0.45 |

) |

|

$ |

(0.60 |

) |

|

$ |

(1.34 |

) |

|

$ |

(0.41 |

) |

| Weighted-Average

Common Shares Outstanding |

|

|

|

|

|

|

|

|

|

Basic |

|

|

23,410,235 |

|

|

|

25,952,447 |

|

|

|

24,401,863 |

|

|

|

27,158,786 |

|

|

Diluted(2) |

|

|

23,410,235 |

|

|

|

25,952,447 |

|

|

|

24,401,863 |

|

|

|

27,158,786 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

__________________

| (1) |

Includes

interest income earned on cash. |

| (2) |

For the three and six months ended June 30, 2024 and June 30,

2023, there were no potentially dilutive securities

outstanding. |

| |

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Per Basic Share

Data |

|

|

|

|

|

|

|

|

| Net asset value at beginning

of the year |

|

$ |

7.17 |

|

|

$ |

7.59 |

|

|

$ |

7.99 |

|

|

$ |

7.39 |

|

|

Net investment loss(1) |

|

|

(0.16 |

) |

|

|

(0.15 |

) |

|

|

(0.28 |

) |

|

|

(0.30 |

) |

|

Net realized loss on investments(1) |

|

|

— |

|

|

|

(0.51 |

) |

|

|

(0.02 |

) |

|

|

(0.48 |

) |

|

Net change in unrealized appreciation/(depreciation) of

investments(1) |

|

|

(0.30 |

) |

|

|

0.06 |

|

|

|

(1.04 |

) |

|

|

0.37 |

|

|

Repurchase of common stock(1) |

|

|

0.20 |

|

|

|

0.33 |

|

|

|

0.23 |

|

|

|

0.33 |

|

|

Stock-based compensation(1) |

|

|

0.03 |

|

|

|

0.03 |

|

|

|

0.06 |

|

|

|

0.04 |

|

| Net asset value at end of

period |

|

$ |

6.94 |

|

|

$ |

7.35 |

|

|

$ |

6.94 |

|

|

$ |

7.35 |

|

| Per share market value at end

of period |

|

$ |

4.01 |

|

|

$ |

3.20 |

|

|

$ |

4.01 |

|

|

$ |

3.20 |

|

| Total return based on market

value(2) |

|

(11.87)% |

|

(11.60)% |

|

|

1.78 |

% |

|

(15.79)% |

| Total return based on net

asset value(2) |

|

(3.21)% |

|

(3.16)% |

|

(13.14)% |

|

(0.54)% |

| Shares outstanding at end of

period |

|

|

23,378,002 |

|

|

|

25,398,640 |

|

|

|

23,378,002 |

|

|

|

25,398,640 |

|

| Ratios/Supplemental

Data: |

|

|

|

|

|

|

|

|

| Net assets at end of

period |

|

$ |

162,312,191 |

|

|

$ |

186,692,724 |

|

|

$ |

162,312,191 |

|

|

$ |

186,692,724 |

|

| Average net assets |

|

$ |

175,240,305 |

|

|

$ |

205,097,855 |

|

|

$ |

188,879,950 |

|

|

$ |

207,210,870 |

|

| Ratio of net operating

expenses to average net assets(3) |

|

|

10.75 |

% |

|

|

10.13 |

% |

|

|

10.04 |

% |

|

|

10.41 |

% |

| Ratio of net investment loss

to average net assets(3) |

|

(8.39)% |

|

(7.44)% |

|

(7.32)% |

|

(7.81)% |

| Portfolio Turnover Ratio |

|

|

5.72 |

% |

|

|

2.09 |

% |

|

|

5.84 |

% |

|

|

3.89 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

__________________

|

(1) |

Based on weighted-average number of shares outstanding for the

relevant period. |

| (2) |

Total return based on market

value is based upon the change in market price per share between

the opening and ending market values per share in the period,

adjusted for dividends and equity issuances. Total return based on

net asset value is based upon the change in net asset value per

share between the opening and ending net asset values per share in

the period, adjusted for dividends and equity issuances. |

| (3) |

Financial highlights for periods

of less than one year are annualized and the ratios of operating

expenses to average net assets and net investment loss to average

net assets are adjusted accordingly. Because the ratios are

calculated for the Company’s common stock taken as a whole, an

individual investor’s ratios may vary from these ratios. |

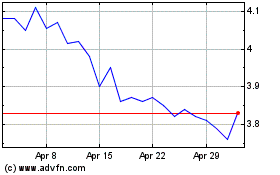

SuRo Capital (NASDAQ:SSSS)

Historical Stock Chart

From Jan 2025 to Feb 2025

SuRo Capital (NASDAQ:SSSS)

Historical Stock Chart

From Feb 2024 to Feb 2025