SuRo Capital Corp. (“SuRo Capital”, the

“Company”, “we”, “us”, and “our”) (Nasdaq:

SSSS) today announced its financial results for

the fourth quarter and fiscal year ended December 31, 2023. Net

assets totaled approximately $203.4 million, or $7.99 per share, at

December 31, 2023, as compared to $8.41 per share at September 30,

2023 and $7.39 per share at December 31, 2022.

“In 2023, public market indices were driven

higher by a handful of megacap stocks, while the private markets

saw decreased valuations and fundraising volume. We have stated for

several quarters that we believe valuations are becoming more

attractive and that we are continuing to see more investable

opportunities. We are now executing on these opportunities. During

the fourth quarter, we added one new portfolio company through a

$1.6 million investment in Colombier Sponsor II LLC and completed a

$2.7 million follow-on investment in FourKites, Inc. and a $0.3

million follow-on investment in XGroup Holdings Limited (d/b/a

Xpoint) through SuRo Capital Sports, LLC. Subsequent to year-end,

we added one new portfolio company through a $10.0 million primary

investment in Supplying Demand, Inc. (d/b/a Liquid Death), a CPG

brand focused on still water, sparkling water, and teas,” said Mark

Klein, Chairman and Chief Executive Officer of SuRo Capital.

“As we have consistently demonstrated, SuRo

Capital is committed to initiatives that enhance shareholder value,

and we believe the market is currently undervaluing our portfolio.

Accordingly, as previously announced on February 14, 2024, our

Board of Directors authorized a modified Dutch Auction tender offer

to purchase up to 2.0 million shares of our common stock at a price

per share between $4.00 and $5.00. Given that our stock is trading

at a significant discount to net asset value per share, we believe

the modified Dutch Auction tender offer to be an efficient and

accretive deployment of capital,” Mr. Klein concluded.

Investment Portfolio as of December 31,

2023

At December 31, 2023, SuRo Capital held

positions in 38 portfolio companies – 34 privately held and 4

publicly held, some of which may be subject to certain lock-up

provisions – with an aggregate fair value of approximately $184.1

million, excluding short-term US treasuries. The Company’s top five

portfolio company investments accounted for approximately 56% of

the total portfolio at fair value as of December 31, 2023.

Top Five Investments as of December 31,

2023

|

Portfolio Company ($ in millions) |

Cost Basis |

Fair Value |

% of Total Portfolio |

|

Learneo, Inc. |

$ |

15.0 |

|

$ |

56.0 |

30.4 |

% |

|

Stormwind, LLC |

|

6.4 |

|

|

12.5 |

6.8 |

|

|

ServiceTitan, Inc. |

|

10.0 |

|

|

12.0 |

6.5 |

|

| Blink

Health Inc. |

|

15.0 |

|

|

11.7 |

6.4 |

|

| Locus

Robotics Corp. |

|

10.0 |

|

|

10.7 |

5.8 |

|

|

Total (may not sum due to rounding) |

$ |

56.4 |

|

$ |

102.8 |

55.9 |

% |

Fourth Quarter 2023 Investment Portfolio

Activity

During the three months ended December 31, 2023,

SuRo Capital made the following investments, excluding short-term

US treasuries:

|

Portfolio Company |

Investment |

Transaction Date |

Amount |

| Colombier Sponsor II LLC |

Class B Units & Class W Units |

11/20/2023 |

$1.6 million |

| FourKites, Inc.(1) |

Common Shares |

12/21/2023 |

$2.7 million |

| Xgroup Holdings Limited (d/b/a

Xpoint)(2) |

Convertible Note |

10/26/2023 |

$0.3 million |

__________________(1) Represents a follow-on

investment.(2) Represents a follow-on investment made through

SuRo Capital Sports, LLC.

During the three months ended December 31, 2023,

SuRo Capital exited or received proceeds from the following

investments, excluding short-term US treasuries:

|

Portfolio Company |

Transaction Date |

Quantity |

Average Net Share Price(1) |

NetProceeds |

Realized Gain/(Loss) |

| Churchill Sponsor VI LLC |

12/4/2023 |

N/A |

N/A |

$- |

$(0.2 million) |

| Forge Global, Inc.(2) |

Various |

1,465,994 |

$3.56 |

$5.2 million |

$3.9 million |

| NewLake Capital Partners,

Inc.(3) |

Various |

105,820 |

$14.02 |

$1.5 million |

$(0.7 million) |

| Nextdoor Holdings,

Inc.(4) |

Various |

150,000 |

$1.98 |

$0.3 million |

$(0.5 million) |

| PSQ Holdings, Inc. (d/b/a

PublicSquare) – Public Warrants(5) |

Various |

303,963 |

$1.05 |

$0.3 million |

$0.2 million |

| Residential Homes For Rent,

LLC (d/b/a Second Avenue)(6) |

Various |

N/A |

N/A |

$0.3 million |

$- |

| True Global Ventures 4 Plus

Pte Ltd |

12/18/2023 |

N/A |

N/A |

$0.1 million |

$- |

__________________(1) The average net

share price is the net share price realized after deducting all

commissions and fees on the sale(s), if applicable.(2) As of

December 31, 2023, SuRo Capital held 1,145,875 remaining Forge

Global, Inc. public common shares.(3) As of December 15,

2023, SuRo Capital had sold its remaining NewLake Capital Partners,

Inc. public common shares.(4) As of December 31, 2023, SuRo

Capital held 112,420 remaining Nextdoor Holdings, Inc. public

common shares.(5) As of December 31, 2023, SuRo Capital held

2,396,037 remaining PSQ Holdings, Inc. (d/b/a PublicSquare) public

warrants.(6) On December 26, 2023, a final payment was

received from Residential Homes For Rent, LLC (d/b/a Second Avenue)

related to the 15% term loan due December 23, 2023. During the

three months ended December 31, 2023, approximately $0.3 million

was received, of which approximately $0.3 million repaid the

outstanding principal and the remaining was attributed to

interest.

Subsequent to year-end through March 13, 2024,

SuRo Capital made the following investment, excluding short-term US

treasuries:

|

Portfolio Company |

Investment |

Transaction Date |

Amount |

| Supplying Demand, Inc. (d/b/a

Liquid Death) |

Series F-1 Preferred Shares |

1/18/2024 |

$10.0 million |

Subsequent to year-end through March 13, 2024,

SuRo Capital exited or received proceeds from the following

investments, excluding short-term US treasuries:

|

Portfolio Company |

Transaction Date |

Quantity |

Average Net Share Price(1) |

Net Proceeds |

Realized Gain/(Loss) |

| Nextdoor Holdings,

Inc.(2) |

Various |

112,420 |

$1.92 |

$0.2 million |

$(0.4 million) |

| PSQ Holdings, Inc. (d/b/a

PublicSquare) – Public Warrants(3) |

Various |

100,000 |

$1.03 |

$0.1 million |

$0.1 million |

________________________________(1) The

average net share price is the net share price realized after

deducting all commissions and fees on the sale(s), if

applicable.(2) As of February 23, 2024, SuRo Capital had sold

its remaining Nextdoor Holdings, Inc. public common

shares.(3) As of March 13, 2024, SuRo Capital held 2,296,037

remaining PSQ Holdings, Inc. (d/b/a PublicSquare) public

warrants.

Fourth Quarter 2023 Financial

Results

|

|

Quarter EndedDecember 31,

2023 |

Quarter EndedDecember 31,

2022 |

|

$ in millions |

per share(1) |

$ in millions |

per share(1) |

|

|

|

|

|

|

| Net investment loss |

$(2.7) |

$(0.11) |

$(2.9) |

$(0.10) |

| |

|

|

|

|

| Net realized gain/(loss) on

investments |

2.6 |

0.10 |

(1.9) |

(0.07) |

| |

|

|

|

|

| Net change in unrealized

depreciation of investments |

(9.0) |

(0.36) |

(7.6) |

(0.27) |

| |

|

|

|

|

| Net decrease in net assets

resulting from operations – basic(2) |

(9.1) |

(0.37) |

(12.4) |

(0.44) |

| |

|

|

|

|

| Stock-based compensation |

0.5 |

(0.06) |

0.6 |

0.00 |

| |

|

|

|

|

|

Decrease in net asset value(2) |

$(8.7) |

$(0.43) |

$(11.8) |

$(0.44) |

________________________________(1) Based on

weighted-average number of shares outstanding for the relevant

period.(2) Total may not sum due to rounding.

Fiscal Year 2023 Financial

Results

|

|

Fiscal Year EndedDecember 31,

2023 |

Fiscal Year EndedDecember 31,

2022 |

|

$ in millions |

per share(1) |

$ in millions |

per share(1) |

|

|

|

|

|

|

| Net investment loss |

$(13.4) |

$(0.51) |

$(14.7) |

$(0.49) |

| |

|

|

|

|

| Net realized loss on

investments |

(11.9) |

(0.46) |

(5.9) |

(0.20) |

| |

|

|

|

|

| Net change in unrealized

appreciation/(depreciation) of investments |

30.5 |

1.16 |

(111.6) |

(3.72) |

| |

|

|

|

|

| Net increase/(decrease) in net

assets resulting from operations – basic(3) |

5.1 |

0.19 |

(132.2) |

(4.41) |

| |

|

|

|

|

| Dividends declared |

- |

- |

(3.4) |

(0.11) |

| |

|

|

|

|

| Issuance of common stock from

public offering |

- |

- |

0.2 |

0.01 |

| |

|

|

|

|

| Stock-based compensation |

2.4 |

0.09 |

2.0 |

0.07 |

| |

|

|

|

|

| Repurchase of common

stock(2) |

(14.2) |

0.32 |

(21.5) |

0.11 |

| |

|

|

|

|

|

Increase/(decrease) in net asset value(3) |

$(6.7) |

$0.60 |

$(154.8) |

$(4.33) |

________________________________(1) Based

on weighted-average number of shares outstanding for the relevant

period.(2) During the year ended December 31, 2023, under the

Company’s Share Repurchase Program, the Company repurchased 186,493

shares of its common stock for approximately $0.7 million in cash.

Additionally, pursuant to the modified Dutch Auction tender offer,

the Company repurchased 3,000,000 shares of its common stock on or

about April 17, 2023 at a price of $4.50 per share. The use of cash

in connection with the repurchases decreased net asset value as of

year-end; however, the reduction in shares outstanding as of

year-end resulted in an increase to net asset value per

share.(3) Total may not sum due to rounding.

Weighted-average common basic shares outstanding

were approximately 26.2 million and 30.0 million for the years

ended December 31, 2023 and 2022, respectively. As of December 31,

2023, there were 25,445,805 shares of the Company’s common stock

outstanding.

SuRo Capital’s liquid assets were approximately

$99.0 million as of December 31, 2023, consisting of cash,

short-term US Treasuries, and securities of publicly traded

portfolio companies not subject to lock-up restrictions at

year-end.

Modified Dutch Auction Tender

Offer

On February 14, 2024, the Company’s Board of

Directors authorized a modified Dutch Auction tender offer (the

“Tender Offer”) to purchase up to 2,000,000 shares of its common

stock at a price per share not less than $4.00 and not greater than

$5.00 in $0.10 increments, using available cash. The Tender Offer

commenced on February 20, 2024 and will expire at 5:00 P.M. Eastern

Time on April 1, 2024, unless extended. If the Tender Offer is

fully subscribed, the Company will purchase 2,000,000 shares, or

approximately 7.9%, of the Company’s outstanding shares of its

common stock. Any shares tendered may be withdrawn prior to

expiration of the Tender Offer. Stockholders that do not wish to

participate in the Tender Offer do not need to take any action.

Based on the number of shares tendered and the

prices specified by the tendering stockholders, the Company will

determine the lowest per-share price that will enable it to acquire

up to 2,000,000 shares of its common stock. All shares accepted in

the Tender Offer will be purchased at the same price even if

tendered at a lower price.

The Tender Offer is not contingent upon any

minimum number of shares being tendered. The Tender Offer is,

however, subject to other conditions, which are disclosed in the

Tender Offer documents filed with the U.S. Securities and Exchange

Commission on February 20, 2024. In the future, the Board of

Directors may consider additional tender offer(s) or other measures

to enhance shareholder value based upon a variety of factors,

including the market price of the Company’s common stock and its

net asset value.

The Company’s Board of Directors is not making

any recommendation to stockholders as to whether to tender or

refrain from tendering their shares into the Tender Offer.

Stockholders must decide how many shares they will tender, if any,

and the price within the stated range at which they will offer

their shares for purchase.

The information agent for the Tender Offer is

D.F. King & Co. Inc., and the depositary is Equiniti Trust

Company, LLC. The offer to purchase (the “Offer to Purchase”), a

letter of transmittal and related documents have been mailed to

registered holders and certain of our beneficial holders.

Beneficial holders may alternatively receive the Offer to Purchase

and a communication to consult with their bank, broker or custodian

if they wish to tender shares. For questions and information,

please contact the information agent at suro@dfking.com. Banks and

brokers may call the information agent at (212) 269-5550, and all

others may call the information agent toll-free at (877)

361-7972.

Share Repurchase Program

Under the Share Repurchase Program, the Company

may repurchase its outstanding common stock in the open market,

provided it complies with the prohibitions under its insider

trading policies and procedures and the applicable provisions of

the Investment Company Act of 1940, as amended, and the Securities

Exchange Act of 1934, as amended.

Since inception of the Share Repurchase Program

in August 2017, SuRo Capital has repurchased over 6.0 million

shares of its common stock for an aggregate purchase price of

approximately $39.3 million. This does not include repurchases

under various tender offers during this time period. During the

year ended December 31, 2023, SuRo Capital repurchased

approximately 0.2 million shares of common stock for approximately

$0.7 million through the Share Repurchase Program. The dollar value

of shares that may yet be purchased by SuRo Capital under the Share

Repurchase Program is approximately $20.7 million. The Share

Repurchase Program is authorized through October 31, 2024.

Conference Call and Webcast

Management will hold a conference call and

webcast for investors at 2:00 p.m. PT (5:00 p.m. ET) on March 13,

2024. The conference call access number for U.S. participants is

866-580-3963, and the conference call access number for

participants outside the U.S. is +1 786-697-3501. The conference ID

number for both access numbers is 4463363. Additionally, interested

parties can listen to a live webcast of the call from the "Investor

Relations" section of SuRo Capital’s website at www.surocap.com. An

archived replay of the webcast will also be available for 12 months

following the live presentation.

A replay of the conference call may be accessed

until 8:00 p.m. ET (5:00 p.m. PT) on March 20, 2024 by dialing

866-583-1035 (U.S.) or +44 (0) 20 3451 9993 (International) and

using conference ID number 4463363.

Forward-Looking Statements

Statements included herein, including statements

regarding SuRo Capital's beliefs, expectations, intentions, or

strategies for the future, may constitute "forward-looking

statements". SuRo Capital cautions you that forward-looking

statements are not guarantees of future performance and that actual

results or developments may differ materially from those projected

or implied in these statements. All forward-looking statements

involve a number of risks and uncertainties, including the impact

of any market volatility that may be detrimental to our business,

our portfolio companies, our industry, and the global economy, that

could cause actual results to differ materially from the plans,

intentions, and expectations reflected in or suggested by the

forward-looking statements. Risk factors, cautionary statements,

and other conditions which could cause SuRo Capital's actual

results to differ from management's current expectations are

contained in SuRo Capital's filings with the Securities and

Exchange Commission. SuRo Capital undertakes no obligation to

update any forward-looking statement to reflect events or

circumstances that may arise after the date of this press

release.

About SuRo Capital Corp.

SuRo Capital Corp. (Nasdaq: SSSS) is a publicly

traded investment fund that seeks to invest in high-growth,

venture-backed private companies. The fund seeks to create a

portfolio of high-growth emerging private companies via a

repeatable and disciplined investment approach, as well as to

provide investors with access to such companies through its

publicly traded common stock. SuRo Capital is headquartered in New

York, NY and has offices in San Francisco, CA. Connect with the

company on X, LinkedIn, and at www.surocap.com.

ContactSuRo Capital Corp.(212)

931-6331IR@surocap.com

|

|

|

SURO CAPITAL CORP. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF ASSETS AND

LIABILITIES |

|

|

| |

December 31, 2023 |

|

December 31, 2022 |

| ASSETS |

|

|

|

| Investments at fair

value: |

|

|

|

|

Non-controlled/non-affiliate investments (cost of $160,994,161 and

$155,103,810, respectively) |

$ |

147,167,535 |

|

|

$ |

130,901,546 |

|

| Non-controlled/affiliate

investments (cost of $32,775,940 and $41,140,804,

respectively) |

|

24,931,333 |

|

|

|

12,591,162 |

|

| Controlled investments (cost

of $18,771,097 and $19,883,894, respectively) |

|

11,982,381 |

|

|

|

13,695,870 |

|

|

Total Portfolio Investments |

|

184,081,249 |

|

|

|

157,188,578 |

|

| Investments in U.S. Treasury

bills (cost of $63,792,704 and $84,999,598, respectively) |

|

63,810,855 |

|

|

|

85,056,817 |

|

| Total Investments (cost of

$276,333,902 and $301,128,106, respectively) |

|

247,892,104 |

|

|

|

242,245,395 |

|

| Cash |

|

28,178,352 |

|

|

|

40,117,598 |

|

| Escrow proceeds

receivable |

|

309,293 |

|

|

|

628,332 |

|

| Interest and dividends

receivable |

|

132,607 |

|

|

|

138,766 |

|

| Deferred financing costs |

|

594,726 |

|

|

|

555,761 |

|

| Prepaid expenses and other

assets(1) |

|

494,602 |

|

|

|

727,006 |

|

|

Total Assets |

|

277,601,684 |

|

|

|

284,412,858 |

|

|

LIABILITIES |

|

|

|

| Accounts payable and accrued

expenses(1) |

|

346,308 |

|

|

|

708,827 |

|

| Dividends payable |

|

152,523 |

|

|

|

296,170 |

|

| 6.00% Notes due December 30,

2026(2) |

|

73,745,207 |

|

|

|

73,387,159 |

|

|

Total Liabilities |

|

74,244,038 |

|

|

|

74,392,156 |

|

| |

|

|

|

| Net

Assets |

$ |

203,357,646 |

|

|

$ |

210,020,702 |

|

| NET

ASSETS |

|

|

|

|

Common stock, par value $0.01 per share (100,000,000 authorized;

25,445,805 and 28,429,499 issued and outstanding,

respectively) |

$ |

254,458 |

|

|

$ |

284,295 |

|

| Paid-in capital in excess of

par |

|

248,454,107 |

|

|

|

330,899,254 |

|

| Accumulated net investment

loss |

|

(4,304,111 |

) |

|

|

(64,832,605 |

) |

| Accumulated net realized

gain/(loss) on investments, net of distributions |

|

(12,348,772 |

) |

|

|

2,552,465 |

|

| Accumulated net unrealized

appreciation/(depreciation) of investments |

|

(28,698,036 |

) |

|

|

(58,882,707 |

) |

|

Net Assets |

$ |

203,357,646 |

|

|

$ |

210,020,702 |

|

|

Net Asset Value Per Share |

$ |

7.99 |

|

|

$ |

7.39 |

|

________________________________(1) This

balance includes a right of use asset and corresponding operating

lease liability, respectively.(2) As of December 31, 2023,

the 6.00% Notes due December 30, 2026 (effective interest rate of

6.53%) had a face value $75,000,000. As of December 31, 2022, the

6.00% Notes due December 30, 2026 (effective interest rate of

6.13%) had a face value $75,000,000.

|

|

|

SURO CAPITAL CORP. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF

OPERATIONS |

|

|

| |

|

Year Ended December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2021 |

|

| INVESTMENT

INCOME |

|

|

|

|

|

|

| Non-controlled/non-affiliate

investments: |

|

|

|

|

|

|

|

Interest income(1) |

|

$ |

795,847 |

|

|

$ |

403,029 |

|

|

$ |

507,772 |

|

|

Dividend income |

|

|

211,310 |

|

|

|

541,239 |

|

|

|

470,438 |

|

| Non-controlled/affiliate

investments: |

|

|

|

|

|

|

|

Dividend income |

|

|

— |

|

|

|

— |

|

|

|

102,632 |

|

| Controlled investments: |

|

|

|

|

|

|

|

Interest income |

|

|

1,331,258 |

|

|

|

1,685,000 |

|

|

|

390,000 |

|

|

Dividend income |

|

|

500,000 |

|

|

|

— |

|

|

|

— |

|

| Interest income from U.S.

Treasury bills |

|

|

3,758,365 |

|

|

|

826,925 |

|

|

|

— |

|

|

Total Investment Income |

|

|

6,596,780 |

|

|

|

3,456,193 |

|

|

|

1,470,842 |

|

| OPERATING

EXPENSES |

|

|

|

|

|

|

| Compensation expense |

|

|

9,482,867 |

|

|

|

7,566,452 |

|

|

|

6,162,716 |

|

| Directors’ fees |

|

|

645,548 |

|

|

|

675,716 |

|

|

|

752,442 |

|

| Professional fees |

|

|

2,602,894 |

|

|

|

3,395,260 |

|

|

|

2,665,689 |

|

| Interest expense |

|

|

4,858,049 |

|

|

|

4,845,549 |

|

|

|

693,526 |

|

| Income tax expense |

|

|

624,049 |

|

|

|

82,238 |

|

|

|

9,347 |

|

| Other expenses |

|

|

1,822,982 |

|

|

|

1,598,986 |

|

|

|

1,117,941 |

|

|

Total Operating Expenses |

|

|

20,036,389 |

|

|

|

18,164,201 |

|

|

|

11,401,661 |

|

|

Net Investment Loss |

|

|

(13,439,609 |

) |

|

|

(14,708,008 |

) |

|

|

(9,930,819 |

) |

| Realized Gain/(Loss)

on Investments: |

|

|

|

|

|

|

| Non-controlled/non-affiliated

investments |

|

|

(1,185,273 |

) |

|

|

(5,835,074 |

) |

|

|

216,870,940 |

|

| Non-controlled/affiliate

investments |

|

|

(10,762,231 |

) |

|

|

(70,379 |

) |

|

|

1,864,564 |

|

|

Net Realized Gain/(Loss) on Investments |

|

|

(11,947,504 |

) |

|

|

(5,905,453 |

) |

|

|

218,735,504 |

|

| Change in Unrealized

Appreciation/(Depreciation) of Investments: |

|

|

|

|

|

|

| Non-controlled/non-affiliated

investments |

|

|

10,349,592 |

|

|

|

(109,553,034 |

) |

|

|

(59,057,641 |

) |

| Non-controlled/affiliate

investments |

|

|

20,705,035 |

|

|

|

(1,947,553 |

) |

|

|

(2,902,517 |

) |

| Controlled investments |

|

|

(600,692 |

) |

|

|

(63,005 |

) |

|

|

227,194 |

|

|

Net Change in Unrealized Appreciation/(Depreciation) of

Investments |

|

|

30,453,935 |

|

|

|

(111,563,592 |

) |

|

|

(61,732,964 |

) |

|

Net Change in Net Assets Resulting from

Operations |

|

$ |

5,066,822 |

|

|

$ |

(132,177,053 |

) |

|

$ |

147,071,721 |

|

|

Net Change in Net Assets Resulting from Operations per

Common Share: |

|

|

|

|

|

|

|

Basic |

|

$ |

0.19 |

|

|

$ |

(4.40 |

) |

|

$ |

5.69 |

|

|

Diluted(2) |

|

$ |

0.19 |

|

|

$ |

(4.40 |

) |

|

$ |

5.52 |

|

| Weighted-Average

Common Shares Outstanding |

|

|

|

|

|

|

|

Basic |

|

|

26,222,667 |

|

|

|

30,023,202 |

|

|

|

25,861,642 |

|

|

Diluted(2) |

|

|

26,222,667 |

|

|

|

30,023,202 |

|

|

|

26,758,367 |

|

________________________________(1)

Includes interest income earned on idle cash.(2) As of

December 31, 2023, 2022, and 2021, there were no potentially

dilutive securities outstanding.

|

|

|

SURO CAPITAL CORP. AND SUBSIDIARIESNOTES

TO CONSOLIDATED FINANCIAL STATEMENTSDecember 31,

2023 |

|

|

| |

|

Year Ended December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2019 |

|

| Per Basic Share

Data |

|

|

|

|

|

|

|

|

|

|

| Net asset value at beginning

of the year |

|

$ |

7.39 |

|

|

$ |

11.72 |

|

|

$ |

15.14 |

|

|

$ |

11.38 |

|

|

$ |

9.89 |

|

|

Net investment loss(1) |

|

|

(0.51 |

) |

|

|

(0.49 |

) |

|

|

(0.38 |

) |

|

|

(0.81 |

) |

|

|

(0.49 |

) |

|

Net realized gain/(loss) on investments(1) |

|

|

(0.46 |

) |

|

|

(0.20 |

) |

|

|

8.46 |

|

|

|

0.92 |

|

|

|

0.99 |

|

|

Net change in unrealized appreciation/(depreciation) of

investments(1) |

|

|

1.16 |

|

|

|

(3.72 |

) |

|

|

(2.39 |

) |

|

|

3.78 |

|

|

|

0.69 |

|

|

Benefit from taxes on unrealized depreciation of

investments(1) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.05 |

|

|

Dividends declared |

|

|

— |

|

|

|

(0.11 |

) |

|

|

(8.00 |

) |

|

|

(0.87 |

) |

|

|

(0.32 |

) |

|

Issuance of common stock from stock dividend |

|

|

— |

|

|

|

— |

|

|

|

0.74 |

|

|

|

— |

|

|

|

— |

|

|

Issuance of common stock from public offering(1) |

|

|

— |

|

|

|

0.01 |

|

|

|

0.01 |

|

|

|

0.30 |

|

|

|

— |

|

|

Issuance of common stock from conversion of 4.75% Convertible Notes

due 2023(1) |

|

|

— |

|

|

|

— |

|

|

|

(1.91 |

) |

|

|

(0.11 |

) |

|

|

— |

|

|

Repurchase of common stock(1) |

|

|

0.32 |

|

|

|

0.11 |

|

|

|

— |

|

|

|

0.43 |

|

|

|

0.52 |

|

|

Stock-based compensation(1) |

|

|

0.09 |

|

|

|

0.07 |

|

|

|

0.05 |

|

|

|

0.12 |

|

|

|

0.05 |

|

| Net asset value at end of

year |

|

$ |

7.99 |

|

|

$ |

7.39 |

|

|

$ |

11.72 |

|

|

$ |

15.14 |

|

|

$ |

11.38 |

|

| Per share market value at end

of year |

|

$ |

3.94 |

|

|

$ |

3.80 |

|

|

$ |

12.95 |

|

|

$ |

13.09 |

|

|

$ |

6.55 |

|

| Total return based on market

value(2) |

|

|

3.68 |

% |

|

(69.45)% |

|

|

60.05 |

% |

|

|

99.85 |

% |

|

|

31.61 |

% |

| Total return based on net

asset value(2) |

|

|

8.12 |

% |

|

(36.01)% |

|

|

30.25 |

% |

|

|

33.04 |

% |

|

|

15.08 |

% |

| Shares outstanding at end of

year |

|

|

25,445,805 |

|

|

|

28,429,499 |

|

|

|

31,118,556 |

|

|

|

19,914,023 |

|

|

|

17,564,244 |

|

| Ratios/Supplemental

Data: |

|

|

|

|

|

|

|

|

|

|

| Net assets at end of year |

|

$ |

203,357,646 |

|

|

$ |

210,020,702 |

|

|

$ |

364,846,624 |

|

|

$ |

301,583,073 |

|

|

$ |

199,917,289 |

|

| Average net assets |

|

$ |

207,608,591 |

|

|

$ |

310,086,061 |

|

|

$ |

396,209,139 |

|

|

$ |

205,430,809 |

|

|

$ |

209,261,190 |

|

| Ratio of gross operating

expenses to average net assets(3) |

|

|

9.70 |

% |

|

|

5.87 |

% |

|

|

2.88 |

% |

|

|

7.95 |

% |

|

|

6.08 |

% |

|

Ratio of income tax provision to average net assets |

|

|

— |

% |

|

|

— |

% |

|

|

— |

% |

|

|

— |

% |

|

(0.42)% |

| Ratio of net operating

expenses to average net assets(3) |

|

|

9.70 |

% |

|

|

5.87 |

% |

|

|

2.88 |

% |

|

|

7.95 |

% |

|

|

5.66 |

% |

| Ratio of net investment loss

to average net assets(3) |

|

(6.51)% |

|

(4.76)% |

|

(2.51)% |

|

(7.07)% |

|

(4.52)% |

| Portfolio Turnover Ratio |

|

|

9.34 |

% |

|

|

4.31 |

% |

|

|

28.34 |

% |

|

|

14.87 |

% |

|

|

12.95 |

% |

________________________________(1) Based

on weighted-average number of shares outstanding for the relevant

period.(2) Total return based on market value is based upon

the change in market price per share between the opening and ending

market values per share in the period, adjusted for dividends and

equity issuances. Total return based on net asset value is based

upon the change in net asset value per share between the opening

and ending net asset values per share in the period, adjusted for

dividends and equity issuances. (3) For the year ended

December 31, 2021, the Company excluded $100,274 of non-recurring

expenses. For the year ended December 31, 2020, the Company

excluded $1,962,431 of non-recurring expenses. For the year ended

December 31, 2019, the Company excluded $1,769,820 of non-recurring

expenses. Because the ratios are calculated for the Company’s

common stock taken as a whole, an individual investor’s ratios may

vary from these ratios.

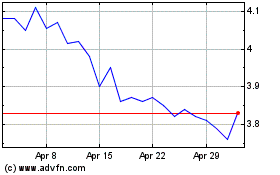

SuRo Capital (NASDAQ:SSSS)

Historical Stock Chart

From Dec 2024 to Jan 2025

SuRo Capital (NASDAQ:SSSS)

Historical Stock Chart

From Jan 2024 to Jan 2025