false

0000095574

0000095574

2024-08-06

2024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 6, 2024

Superior Group of Companies, Inc.

(Exact name of registrant as specified in its charter)

|

Florida

|

001-05869

|

11-1385670

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

| |

|

|

|

200 Central Avenue, Suite 2000, St. Petersburg, Florida

(Address of principal executive offices)

|

33701

(Zip Code)

|

Registrant's telephone number including area code: (727) 397-9611

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230 .425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

SGC

|

NASDAQ

|

Item 2.02 Results of Operations and Financial Condition

The following information is being furnished under Item 2.02 of Form 8-K: Press release by Superior Group of Companies, Inc. (the “Company”) announcing its results of operations for the quarter ended June 30, 2024. A copy of this press release is attached as Exhibit 99.1 to this Form 8-K.

Item 7.01 Regulation FD Disclosure

On August 6, 2024, the Company posted an investor presentation on its website. A copy of this presentation is attached as Exhibit 99.2 to this Form 8-K.

The information furnished pursuant to Items 2.02 and 7.01 of this Form 8-K, including Exhibits 99.1 and 99.2 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.0l Financial Statements and Exhibits

(d) Exhibits

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunder duly authorized.

|

|

SUPERIOR GROUP OF COMPANIES, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Michael Koempel

|

|

|

|

|

Michael Koempel

|

|

|

|

|

Chief Financial Officer

|

|

Date: August 6, 2024

Exhibit 99.1

FOR IMMEDIATE RELEASE

SUPERIOR GROUP OF COMPANIES REPORTS SECOND QUARTER 2024 RESULTS

| – Total net sales of $131.7 million up from $129.2 million in prior year second quarter – |

| – Net income of $0.6 million compared to $1.2 million in prior year second quarter – |

| – EBITDA of $5.6 million compared to $7.4 million in prior year second quarter – |

| – Board of Directors approves $0.14 per share quarterly dividend – |

| – Maintains full-year outlook – |

ST. PETERSBURG, Fla., August 6, 2024 – Superior Group of Companies, Inc. (NASDAQ: SGC) (the “Company”), today announced its second quarter 2024 results.

“We delivered a second consecutive quarter of revenue growth along with robust free cash flow, continuing our commitment to maintaining a strong financial position,” said Michael Benstock, Chief Executive Officer. “While second quarter results were below our expectations, we are poised to generate stronger performance in the second half of the year and are maintaining our full-year outlook. In addition, the steps we’re taking now will clearly benefit our growth and profitability over the long-term. I’m pleased that our Board has again approved our quarterly dividend, reflecting our shared confidence in the compelling opportunities ahead to further penetrate all three of the large and growing end markets we serve, which will ultimately benefit our efforts to further enhance long-term shareholder value.”

Second Quarter Results

For the second quarter ended June 30, 2024, net sales increased 2.0% to $131.7 million, compared to second quarter 2023 net sales of $129.2 million. Pretax income was $0.7 million compared to $1.4 million in the second quarter of 2023. Net income was $0.6 million or $0.04 per diluted share compared to $1.2 million, or $0.08 per diluted share for the second quarter of 2023.

Third Quarter 2024 Dividend

The Board of Directors declared a quarterly dividend of $0.14 per share, payable August 30, 2024 to shareholders of record as of August 17, 2024.

2024 Full-Year Outlook

The Company is maintaining its full year 2024 sales outlook range of $563 million to $570 million, versus 2023 sales of $543 million, and maintaining its full-year earnings per diluted share forecast of $0.73 to $0.79 versus $0.54 in 2023.

Webcast and Conference Call

The Company will host a webcast and conference call at 5:00 pm Eastern Time today. The live webcast and archived replay can be accessed in the investor relations section of the Company's website at https://ir.superiorgroupofcompanies.com/Presentations. Interested individuals may also join the teleconference by dialing 1-844-861-5505 for U.S. dialers and 1-412-317-6586 for International dialers. The Canadian Toll-Free number is 1-866-605-3852. Please ask to be joined to the Superior Group of Companies call. A telephone replay of the teleconference will be available through August 20, 2024. To access the replay, dial 1-877-344-7529 in the United States or 1-412-317-0088 from international locations. Canadian dialers can access the replay at 855-669-9658. Please reference conference number 9654569 for replay access.

Disclosure Regarding Forward Looking Statements

Certain matters discussed in this press release are “forward-looking statements” intended to qualify for the safe harbors from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements can generally be identified by use of the words “may,” “will,” “should,” “could,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” “project,” “potential,” or “plan” or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements in this press release may include, without limitation: (1) projections of revenue, income, and other items relating to our financial position and results of operations, including short term and long term plans for cash, (2) statements of our plans, objectives, strategies, goals and intentions, (3) statements regarding the capabilities, capacities, market position and expected development of our business operations and (4) statements of expected industry and general economic trends.

Such forward-looking statements are subject to certain risks and uncertainties that may materially adversely affect the anticipated results. Such risks and uncertainties include, but are not limited to, the following: the impact of competition; uncertainties related to supply disruptions, inflationary environment (including with respect to the cost of finished goods and raw materials and shipping costs), employment levels (including labor shortages), and general economic and political conditions in the areas of the world in which the Company operates or from which it sources its supplies or the areas of the United States of America (“U.S.” or “United States”) in which the Company’s customers are located; changes in the healthcare, retail chain, food service, transportation and other industries where uniforms and service apparel are worn; our ability to identify suitable acquisition targets, discover liabilities associated with such businesses during the diligence process, successfully integrate any acquired businesses, or successfully manage our expanding operations; the price and availability of raw materials; attracting and retaining senior management and key personnel; the effect of the Company’s previously disclosed material weakness in internal control over financial reporting; the Company’s ability to successfully remediate its material weakness in internal control over financial reporting and to maintain effective internal control over financial reporting; and other factors described in the Company’s filings with the Securities and Exchange Commission, including those described in the “Risk Factors” section of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and the Quarterly Report on Form 10-Q for the quarter ended June 30, 2024. Shareholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements made herein and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are only made as of the date of this press release and we disclaim any obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances, except as may be required by law.

About Superior Group of Companies, Inc. (SGC):

Established in 1920, Superior Group of Companies is comprised of three attractive business segments each serving large, fragmented and growing addressable markets. Across Healthcare Apparel, Branded Products and Contact Centers, each segment enables businesses to create extraordinary brand engagement experiences for their customers and employees. SGC’s commitment to service, quality, advanced technology, and omnichannel commerce provides unparalleled competitive advantages. We are committed to enhancing shareholder value by continuing to pursue a combination of organic growth and strategic acquisitions. For more information, visit www.superiorgroupofcompanies.com.

Investor Relations Contact:

Investors@Superiorgroupofcompanies.com

Comparative figures are as follows:

|

SUPERIOR GROUP OF COMPANIES, INC. AND SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

(Unaudited)

|

(In thousands, except shares and per share data)

| |

|

Three Months Ended June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Net sales

|

|

$ |

131,736 |

|

|

$ |

129,162 |

|

| |

|

|

|

|

|

|

|

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

Cost of goods sold

|

|

|

80,981 |

|

|

|

81,566 |

|

|

Selling and administrative expenses

|

|

|

48,375 |

|

|

|

43,382 |

|

|

Other periodic pension costs

|

|

|

189 |

|

|

|

214 |

|

|

Interest expense

|

|

|

1,541 |

|

|

|

2,624 |

|

| |

|

|

131,086 |

|

|

|

127,786 |

|

|

Income before income tax expense

|

|

|

650 |

|

|

|

1,376 |

|

|

Income tax expense

|

|

|

50 |

|

|

|

163 |

|

|

Net income

|

|

$ |

600 |

|

|

$ |

1,213 |

|

| |

|

|

|

|

|

|

|

|

|

Net income per share:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.04 |

|

|

$ |

0.08 |

|

|

Diluted

|

|

$ |

0.04 |

|

|

$ |

0.08 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding during the period:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

16,221,073 |

|

|

|

15,987,007 |

|

|

Diluted

|

|

|

16,769,297 |

|

|

|

16,124,816 |

|

| |

|

|

|

|

|

|

|

|

|

Cash dividends per common share

|

|

$ |

0.14 |

|

|

$ |

0.14 |

|

|

SUPERIOR GROUP OF COMPANIES, INC. AND SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

(Unaudited)

|

(In thousands, except shares and per share data)

| |

|

Six Months Ended June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Net sales

|

|

$ |

270,578 |

|

|

$ |

259,935 |

|

| |

|

|

|

|

|

|

|

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

Cost of goods sold

|

|

|

164,506 |

|

|

|

165,231 |

|

|

Selling and administrative expenses

|

|

|

97,124 |

|

|

|

86,761 |

|

|

Other periodic pension costs

|

|

|

378 |

|

|

|

428 |

|

|

Interest expense

|

|

|

3,328 |

|

|

|

5,194 |

|

| |

|

|

265,336 |

|

|

|

257,614 |

|

|

Income before income tax expense

|

|

|

5,242 |

|

|

|

2,321 |

|

|

Income tax expense

|

|

|

730 |

|

|

|

220 |

|

|

Net income

|

|

$ |

4,512 |

|

|

$ |

2,101 |

|

| |

|

|

|

|

|

|

|

|

|

Net income per share:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.28 |

|

|

$ |

0.13 |

|

|

Diluted

|

|

$ |

0.27 |

|

|

$ |

0.13 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding during the period:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

16,124,553 |

|

|

|

15,935,001 |

|

|

Diluted

|

|

|

16,611,375 |

|

|

|

16,121,573 |

|

| |

|

|

|

|

|

|

|

|

|

Cash dividends per common share

|

|

$ |

0.28 |

|

|

$ |

0.28 |

|

|

SUPERIOR GROUP OF COMPANIES, INC. AND SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

(In thousands, except shares and par value data)

|

| |

|

June 30,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

(Unaudited)

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

13,374 |

|

|

$ |

19,896 |

|

|

Accounts receivable, less allowance for doubtful accounts of $3,591 and $4,237, respectively

|

|

|

92,628 |

|

|

|

103,494 |

|

|

Inventories

|

|

|

93,031 |

|

|

|

98,067 |

|

|

Contract assets

|

|

|

53,027 |

|

|

|

48,715 |

|

|

Prepaid expenses and other current assets

|

|

|

10,197 |

|

|

|

9,188 |

|

|

Total current assets

|

|

|

262,257 |

|

|

|

279,360 |

|

|

Property, plant and equipment, net

|

|

|

44,267 |

|

|

|

46,890 |

|

|

Operating lease right-of-use assets

|

|

|

16,774 |

|

|

|

17,909 |

|

|

Deferred tax asset

|

|

|

12,341 |

|

|

|

12,356 |

|

|

Intangible assets, net

|

|

|

49,125 |

|

|

|

51,160 |

|

|

Other assets

|

|

|

15,558 |

|

|

|

14,775 |

|

|

Total assets

|

|

$ |

400,322 |

|

|

$ |

422,450 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

46,949 |

|

|

$ |

50,520 |

|

|

Other current liabilities

|

|

|

39,336 |

|

|

|

43,978 |

|

|

Current portion of long-term debt

|

|

|

5,625 |

|

|

|

4,688 |

|

|

Current portion of acquisition-related contingent liabilities

|

|

|

1,026 |

|

|

|

1,403 |

|

|

Total current liabilities

|

|

|

92,936 |

|

|

|

100,589 |

|

|

Long-term debt

|

|

|

72,100 |

|

|

|

88,789 |

|

|

Long-term pension liability

|

|

|

13,439 |

|

|

|

13,284 |

|

|

Long-term acquisition-related contingent liabilities

|

|

|

673 |

|

|

|

557 |

|

|

Long-term operating lease liabilities

|

|

|

11,655 |

|

|

|

12,809 |

|

|

Other long-term liabilities

|

|

|

8,609 |

|

|

|

8,784 |

|

|

Total liabilities

|

|

|

199,412 |

|

|

|

224,812 |

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $.001 par value - authorized 300,000 shares (none issued)

|

|

|

- |

|

|

|

- |

|

|

Common stock, $.001 par value - authorized 50,000,000 shares, issued and outstanding 16,792,577 and 16,564,712 shares, respectively

|

|

|

16 |

|

|

|

16 |

|

|

Additional paid-in capital

|

|

|

82,759 |

|

|

|

77,443 |

|

|

Retained earnings

|

|

|

122,106 |

|

|

|

122,464 |

|

|

Accumulated other comprehensive loss, net of tax:

|

|

|

|

|

|

|

|

|

|

Pensions

|

|

|

(1,077 |

) |

|

|

(1,122 |

) |

|

Foreign currency translation adjustment

|

|

|

(2,894 |

) |

|

|

(1,163 |

) |

|

Total shareholders’ equity

|

|

|

200,910 |

|

|

|

197,638 |

|

|

Total liabilities and shareholders’ equity

|

|

$ |

400,322 |

|

|

$ |

422,450 |

|

|

SUPERIOR GROUP OF COMPANIES, INC. AND SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

(Unaudited)

|

|

(In thousands)

|

| |

|

Six Months Ended June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

4,512 |

|

|

$ |

2,101 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

6,620 |

|

|

|

6,816 |

|

|

Inventory write-downs

|

|

|

888 |

|

|

|

144 |

|

|

Provision for bad debts - accounts receivable

|

|

|

(383 |

) |

|

|

(628 |

) |

|

Share-based compensation expense

|

|

|

1,620 |

|

|

|

2,420 |

|

|

Change in fair value of acquisition-related contingent liabilities

|

|

|

296 |

|

|

|

(733 |

) |

|

Change in fair value of written put options

|

|

|

653 |

|

|

|

(145 |

) |

|

Changes in assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

10,578 |

|

|

|

8,854 |

|

|

Contract assets

|

|

|

(4,526 |

) |

|

|

5,447 |

|

|

Inventories

|

|

|

3,936 |

|

|

|

10,555 |

|

|

Prepaid expenses and other current assets

|

|

|

(1,309 |

) |

|

|

2,747 |

|

|

Other assets

|

|

|

(639 |

) |

|

|

(1,468 |

) |

|

Accounts payable and other current liabilities

|

|

|

(6,424 |

) |

|

|

1,280 |

|

|

Long-term pension liability

|

|

|

217 |

|

|

|

379 |

|

|

Other long-term liabilities

|

|

|

261 |

|

|

|

326 |

|

|

Net cash provided by operating activities

|

|

|

16,300 |

|

|

|

38,095 |

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Additions to property, plant and equipment

|

|

|

(1,974 |

) |

|

|

(3,643 |

) |

|

Net cash used in investing activities

|

|

|

(1,974 |

) |

|

|

(3,643 |

) |

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Proceeds from borrowings of debt

|

|

|

10,000 |

|

|

|

1,000 |

|

|

Repayment of debt

|

|

|

(25,875 |

) |

|

|

(29,875 |

) |

|

Debt issuance costs

|

|

|

- |

|

|

|

(300 |

) |

|

Payment of cash dividends

|

|

|

(4,657 |

) |

|

|

(4,590 |

) |

|

Payment of acquisition-related contingent liabilities

|

|

|

(557 |

) |

|

|

- |

|

|

Proceeds received on exercise of stock options

|

|

|

1,076 |

|

|

|

43 |

|

|

Net cash used in financing activities

|

|

|

(20,013 |

) |

|

|

(33,722 |

) |

| |

|

|

|

|

|

|

|

|

|

Effect of currency exchange rates on cash

|

|

|

(835 |

) |

|

|

297 |

|

|

Net increase (decrease) in cash and cash equivalents

|

|

|

(6,522 |

) |

|

|

1,027 |

|

|

Cash and cash equivalents balance, beginning of period

|

|

|

19,896 |

|

|

|

17,722 |

|

|

Cash and cash equivalents balance, end of period

|

|

$ |

13,374 |

|

|

$ |

18,749 |

|

|

SUPERIOR GROUP OF COMPANIES, INC. AND SUBSIDIARIES

|

| NON-GAAP FINANCIAL MEASURES |

|

(Unaudited)

|

| (In thousands, except shares and per share data) |

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Net income

|

|

$ |

600 |

|

|

$ |

1,213 |

|

|

$ |

4,512 |

|

|

$ |

2,101 |

|

|

Interest expense

|

|

|

1,541 |

|

|

|

2,624 |

|

|

|

3,328 |

|

|

|

5,194 |

|

|

Income tax expense

|

|

|

50 |

|

|

|

163 |

|

|

|

730 |

|

|

|

220 |

|

|

Depreciation and amortization

|

|

|

3,368 |

|

|

|

3,428 |

|

|

|

6,620 |

|

|

|

6,816 |

|

|

EBITDA(1)

|

|

$ |

5,559 |

|

|

$ |

7,428 |

|

|

$ |

15,190 |

|

|

$ |

14,331 |

|

|

EBITDA margin(1)

|

|

|

4.2 |

% |

|

|

5.8 |

% |

|

|

5.6 |

% |

|

|

5.5 |

% |

(1) EBITDA, which is a non-GAAP financial measure, is defined as net income excluding interest expense, income tax expense and depreciation and amortization expense. EBITDA margin is defined as EBITDA divided by net sales. The Company believes EBITDA is an important measure of operating performance because it allows management, investors and others to evaluate and compare the Company’s core operating results from period to period by removing (i) the impact of the Company’s capital structure (interest expense from outstanding debt), (ii) tax consequences and (iii) asset base (depreciation and amortization). The Company uses EBITDA internally to monitor operating results and to evaluate the performance of its business. In addition, the compensation committee has used EBITDA in evaluating certain components of executive compensation, including performance-based annual incentive programs. EBITDA is not a measure of financial performance under GAAP and should not be considered in isolation or as an alternative to net income, cash flows from operating activities or any other measure determined in accordance with GAAP. The items excluded to calculate EBITDA are significant components in understanding and assessing the Company’s results of operations. The presentation of the Company’s EBITDA may change from time to time, including as a result of changed business conditions, new accounting pronouncements or otherwise. If the presentation changes, the Company undertakes to disclose any change between periods and the reasons underlying that change. The Company’s EBITDA may not be comparable to a similarly titled measure of another company because other entities may not calculate EBITDA in the same manner.

|

SUPERIOR GROUP OF COMPANIES, INC. AND SUBSIDIARIES

|

| SUPPLEMENTAL INFORMATION - REPORTABLE SEGMENTS |

|

(Unaudited)

|

| (In thousands) |

| |

|

Branded Products

|

|

|

Healthcare Apparel

|

|

|

Contact Centers

|

|

|

Intersegment Eliminations

|

|

|

Other

|

|

|

Total

|

|

|

For the Three Months Ended June 30, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$ |

81,296 |

|

|

$ |

26,592 |

|

|

$ |

24,832 |

|

|

$ |

(984 |

) |

|

$ |

- |

|

|

$ |

131,736 |

|

|

Cost of goods sold

|

|

|

53,170 |

|

|

|

16,392 |

|

|

|

11,871 |

|

|

|

(452 |

) |

|

|

- |

|

|

|

80,981 |

|

|

Gross margin

|

|

|

28,126 |

|

|

|

10,200 |

|

|

|

12,961 |

|

|

|

(532 |

) |

|

|

- |

|

|

|

50,755 |

|

|

Selling and administrative expenses

|

|

|

22,969 |

|

|

|

9,879 |

|

|

|

10,533 |

|

|

|

(532 |

) |

|

|

5,526 |

|

|

|

48,375 |

|

|

Other periodic pension cost

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

189 |

|

|

|

189 |

|

|

Add: Depreciation and amortization

|

|

|

1,567 |

|

|

|

956 |

|

|

|

753 |

|

|

|

- |

|

|

|

92 |

|

|

|

3,368 |

|

|

Segment EBITDA(1)

|

|

$ |

6,724 |

|

|

$ |

1,277 |

|

|

$ |

3,181 |

|

|

$ |

- |

|

|

$ |

(5,623 |

) |

|

$ |

5,559 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Branded Products

|

|

|

Healthcare Apparel

|

|

|

Contact Centers

|

|

|

Intersegment Eliminations

|

|

|

Other

|

|

|

Total

|

|

|

For the Three Months Ended June 30, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$ |

79,592 |

|

|

$ |

28,072 |

|

|

$ |

22,758 |

|

|

$ |

(1,260 |

) |

|

$ |

- |

|

|

$ |

129,162 |

|

|

Cost of goods sold

|

|

|

53,952 |

|

|

|

17,653 |

|

|

|

10,554 |

|

|

|

(593 |

) |

|

|

- |

|

|

|

81,566 |

|

|

Gross margin

|

|

|

25,640 |

|

|

|

10,419 |

|

|

|

12,204 |

|

|

|

(667 |

) |

|

|

- |

|

|

|

47,596 |

|

|

Selling and administrative expenses

|

|

|

20,362 |

|

|

|

9,466 |

|

|

|

9,614 |

|

|

|

(667 |

) |

|

|

4,607 |

|

|

|

43,382 |

|

|

Other periodic pension cost

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

214 |

|

|

|

214 |

|

|

Add: Depreciation and amortization

|

|

|

1,710 |

|

|

|

976 |

|

|

|

662 |

|

|

|

- |

|

|

|

80 |

|

|

|

3,428 |

|

|

Segment EBITDA(1)

|

|

$ |

6,988 |

|

|

$ |

1,929 |

|

|

$ |

3,252 |

|

|

$ |

- |

|

|

$ |

(4,741 |

) |

|

$ |

7,428 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Branded Products |

|

|

Healthcare Apparel |

|

|

Contact Centers |

|

|

Intersegment Eliminations |

|

|

Other |

|

|

Total |

|

|

For the Six Months Ended June 30, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$ |

168,364 |

|

|

$ |

55,829 |

|

|

$ |

48,384 |

|

|

$ |

(1,999 |

) |

|

$ |

- |

|

|

$ |

270,578 |

|

|

Cost of goods sold

|

|

|

108,497 |

|

|

|

34,119 |

|

|

|

22,779 |

|

|

|

(889 |

) |

|

|

- |

|

|

|

164,506 |

|

|

Gross margin

|

|

|

59,867 |

|

|

|

21,710 |

|

|

|

25,605 |

|

|

|

(1,110 |

) |

|

|

- |

|

|

|

106,072 |

|

|

Selling and administrative expenses

|

|

|

46,263 |

|

|

|

19,691 |

|

|

|

20,954 |

|

|

|

(1,110 |

) |

|

|

11,326 |

|

|

|

97,124 |

|

|

Other periodic pension cost

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

378 |

|

|

|

378 |

|

|

Add: Depreciation and amortization

|

|

|

3,067 |

|

|

|

1,893 |

|

|

|

1,476 |

|

|

|

- |

|

|

|

184 |

|

|

|

6,620 |

|

|

Segment EBITDA(1)

|

|

$ |

16,671 |

|

|

$ |

3,912 |

|

|

$ |

6,127 |

|

|

$ |

- |

|

|

$ |

(11,520 |

) |

|

$ |

15,190 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Branded Products |

|

|

Healthcare Apparel |

|

|

Contact Centers |

|

|

Intersegment Eliminations |

|

|

Other |

|

|

Total |

|

|

For the Six Months Ended June 30, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$ |

161,443 |

|

|

$ |

56,226 |

|

|

$ |

44,814 |

|

|

$ |

(2,548 |

) |

|

$ |

- |

|

|

$ |

259,935 |

|

|

Cost of goods sold

|

|

|

109,904 |

|

|

|

35,707 |

|

|

|

20,821 |

|

|

|

(1,201 |

) |

|

|

- |

|

|

|

165,231 |

|

|

Gross margin

|

|

|

51,539 |

|

|

|

20,519 |

|

|

|

23,993 |

|

|

|

(1,347 |

) |

|

|

- |

|

|

|

94,704 |

|

|

Selling and administrative expenses

|

|

|

40,415 |

|

|

|

18,968 |

|

|

|

19,278 |

|

|

|

(1,347 |

) |

|

|

9,447 |

|

|

|

86,761 |

|

|

Other periodic pension cost

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

428 |

|

|

|

428 |

|

|

Add: Depreciation and amortization

|

|

|

3,374 |

|

|

|

1,950 |

|

|

|

1,330 |

|

|

|

- |

|

|

|

162 |

|

|

|

6,816 |

|

|

Segment EBITDA(1)

|

|

$ |

14,498 |

|

|

$ |

3,501 |

|

|

$ |

6,045 |

|

|

$ |

- |

|

|

$ |

(9,713 |

) |

|

$ |

14,331 |

|

(1) Segment EBITDA is our primary measure of segment profitability under U.S. GAAP ASC 280 “Segment Reporting”. Amounts included in income before income tax expense and excluded from Segment EBITDA include: interest expense and depreciation and amortization expense. Total Segment EBITDA is a non-GAAP financial measure. Please see reconciliation of EBITDA included in the Non-GAAP Financial Measures table above.

Exhibit 99.2

v3.24.2.u1

Document And Entity Information

|

Aug. 06, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Superior Group of Companies, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 06, 2024

|

| Entity, Incorporation, State or Country Code |

FL

|

| Entity, File Number |

001-05869

|

| Entity, Tax Identification Number |

11-1385670

|

| Entity, Address, Address Line One |

200 Central Avenue, Suite 2000

|

| Entity, Address, City or Town |

St. Petersburg

|

| Entity, Address, State or Province |

FL

|

| Entity, Address, Postal Zip Code |

33701

|

| City Area Code |

727

|

| Local Phone Number |

397-9611

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

SGC

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000095574

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

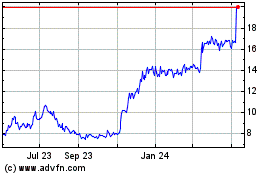

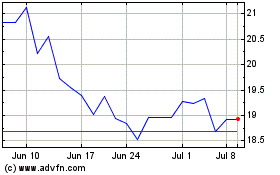

Superior Group of Compan... (NASDAQ:SGC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Superior Group of Compan... (NASDAQ:SGC)

Historical Stock Chart

From Nov 2023 to Nov 2024