Summit State Bank (Nasdaq: SSBI) today reported net income for the

quarter ended June 30, 2020 of $2,218,000 and diluted earnings per

share of $0.37. This compares to net income of $1,172,000 and

diluted earnings per share of $0.19 for the same quarter in 2019.

Additionally, a quarterly dividend of $0.12 per share was declared

for common shareholders.

Dividend

The Board of Directors declared a $0.12 per

share quarterly dividend on July 27, 2020 to be paid on August 21,

2020 to shareholders of record on August 14, 2020.

Net Income and Results of Operations

Net income increased $1,046,000 or 89% the

second quarter of 2020 compared to second quarter of 2019. Net

income increased $2,037,000 or 78% in the first six months of 2020

compared to the first six months of 2019.

Net interest income increased to $7,174,000 in

the second quarter of 2020 compared to $5,499,000 in the second

quarter of 2019. The increase in net interest income is primarily

attributable to increases in loan balances with a lesser portion of

this increase driven by the Paycheck Protection Program (“PPP”)

loans.

“The Bank is pleased to announce four

consecutive quarters of strong earnings totaling $8,514,000 or

$1.40 per share,” said Brian Reed, President and CEO. “Three and a

half years ago, we implemented a strategic plan to restructure and

grow the Bank’s balance sheet and this plan is now showing

consistently strong earnings and balance sheet growth.”

“The COVID-19 pandemic presents a number of

economic challenges and we continue to actively support our

customers and local businesses in these unprecedented times,” said

Reed. “To date we funded over $95,000,000 of PPP loans representing

13.5% of the June 30, 2020 loan portfolio. In these uncertain times

we feel fortunate to be a position to help our customers and

community. We stand ready to be a continue source of support for

them going forward.”

Nonperforming assets were $410,000 or 0.05% of

total assets at June 30, 2020 compared to $715,000 or 0.11% at June

30, 2019. Nonperforming assets at June 30, 2020 consist of loans

which are predominantly secured by real property. The Bank had a

provision expense of $500,000 in the second quarter of 2020. At

June 30, 2020 the allowance for loan losses to total loans

including SBA-guaranteed PPP loans was 1.11% at June 30, 2020 and

1.17% at June 30, 2019. Excluding $95,534,000 of PPP loans

increases the ratio of allowance for loans losses to 1.28% at June

30, 2020.

In the second quarter of 2020 the Bank deferred

payments on over $142,000,000 or 20% of loans in its portfolio. The

deferral process increases the total balance due on the loan and

re-amortizes the monthly payment through the original maturity

date. As of June 30, 2020, approximately $54,000,000 or 9% of the

loan portfolio excluding PPP loans were in deferral.

“The Bank has deliberately built its balance

sheet growth around strong-performing loans,” notes Reed. “At the

onset of the pandemic and continuing through today, the Bank has

experienced minimal credit problems. We are actively monitoring our

portfolio, assisting our customers through this economic downturn,

and ensuring we maintain sufficient loan loss reserves.”

Reed further explains “The Bank will continue

monitoring this fluid situation. We are watching trends in

high-risk industries including retail, restaurants, and lodging.

These high-risk industries comprise approximately 14% of our

portfolio and we are increasing our loan loss reserves due to the

increased risk of loss.”

Non-interest income increased in the second

quarter of 2020 to $693,000 compared to $340,000 in the second

quarter of 2019. The Bank recognized $320,000 in gains on sales of

SBA guaranteed loan balances in the second quarter of 2020 compared

to $0 in gains on sales of SBA guaranteed loans balances in the

second quarter of 2019.

Total loans and deposits also increased when

comparing the second quarter of 2020 to second quarter of 2019;

loans were $701,808,000 in 2020 (includes $95,534,000 of PPP loans)

compared to $536,674,000 in 2019 and deposits were $709,473,000 in

2020 compared to $532,257,000 in 2019. The net interest margin

increased to 3.71% for the second quarter of 2020 compared to 3.64%

for the second quarter of 2019.

Annualized return on average assets for the

second quarter of 2020 was 1.12%, annualized return on average

equity was 12.71% and the efficiency ratio was 53.59%. The second

quarter of 2019 had an annualized return on average assets of

0.75%, annualized return on average equity of 7.36% and efficiency

ratio of 68.34%.

There was a $221,000 or 6% increase in operating

expenses in the second quarter of 2020 compared to the second

quarter of 2019. The increase in expenses is primarily due to an

increase in employee expenses and occupancy costs. The Bank is

leveling off of a growth trend in operating expenses since the

middle of 2019 resulting in an improvement in the efficiency ratio

by 14.75% when comparing second quarter of 2020 to second quarter

of 2019.

About Summit State Bank

Summit State Bank, a local community bank, has

total assets of $850 million and total equity of $71 million at

June 30, 2020. Headquartered in Sonoma County, the Bank specializes

in providing exceptional customer service and customized financial

solutions to aid in the success of local small businesses and

nonprofits throughout Sonoma County.

Summit State Bank is committed to embracing the

diverse backgrounds, cultures and talents of its employees to

create high performance and support the evolving needs of its

customers and community it serves. At the center of diversity is

inclusion, collaboration, and a shared vision for delivering

superior service and results for shareholders. Presently, 73% of

management are women and minorities with 75% represented on the

Executive Management Team. Through the engagement of its team,

Summit State Bank has received many esteemed awards including: Best

Business Bank, Corporate Philanthropy Award and Best Places to Work

in the North Bay. Summit State Bank’s stock is traded on the Nasdaq

Global Market under the symbol SSBI. Further information can be

found at www.summitstatebank.com.

Forward-looking Statements

Except for historical information contained herein, the

statements contained in this news release, are forward-looking

statements within the meaning of the “safe harbor” provisions of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. This

release may contain forward-looking statements that are subject to

risks and uncertainties. Such risks and uncertainties may include

but are not necessarily limited to fluctuations in interest rates,

inflation, government regulations and general economic conditions,

and competition within the business areas in which the Bank will be

conducting its operations, including the real estate market in

California and other factors beyond the Bank’s control. Such risks

and uncertainties could cause results for subsequent interim

periods or for the entire year to differ materially from those

indicated. You should not place undue reliance on the

forward-looking statements, which reflect management’s view only as

of the date hereof. The Bank undertakes no obligation to publicly

revise these forward-looking statements to reflect subsequent

events or circumstances.

Contact: Brian Reed, President and CEO, Summit State

Bank (707) 568-4908

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| SUMMIT STATE

BANK AND SUBSIDIARY |

| CONSOLIDATED

STATEMENTS OF INCOME |

| (In thousands except

earnings per share data) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Three Months Ended |

|

Six Months Ended |

| |

|

|

|

|

June 30, 2020 |

|

June 30, 2019 |

|

June 30, 2020 |

|

June 30, 2019 |

| |

|

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income: |

|

|

|

|

|

|

|

|

|

| |

Interest and fees on loans |

$ |

8,329 |

|

|

$ |

6,630 |

|

|

$ |

16,148 |

|

|

$ |

13,081 |

|

| |

Interest on deposits with banks |

|

7 |

|

|

|

32 |

|

|

|

51 |

|

|

|

133 |

|

| |

Interest on investment securities |

|

393 |

|

|

|

476 |

|

|

|

762 |

|

|

|

1,066 |

|

| |

Dividends on FHLB stock |

|

87 |

|

|

|

53 |

|

|

|

146 |

|

|

|

108 |

|

|

|

|

|

Total interest income |

|

8,816 |

|

|

|

7,191 |

|

|

|

17,107 |

|

|

|

14,388 |

|

|

Interest expense: |

|

|

|

|

|

|

|

|

|

| |

Deposits |

|

1,343 |

|

|

|

1,581 |

|

|

|

2,788 |

|

|

|

3,052 |

|

| |

Federal Home Loan Bank advances |

|

299 |

|

|

|

111 |

|

|

|

621 |

|

|

|

290 |

|

| |

|

|

Total interest expense |

|

1,642 |

|

|

|

1,692 |

|

|

|

3,409 |

|

|

|

3,342 |

|

| |

|

|

Net interest income before provision for loan losses |

|

7,174 |

|

|

|

5,499 |

|

|

|

13,698 |

|

|

|

11,046 |

|

|

Provision for loan losses |

|

500 |

|

|

|

180 |

|

|

|

1,100 |

|

|

|

280 |

|

| |

|

|

Net interest income after provision for loan losses |

|

6,674 |

|

|

|

5,319 |

|

|

|

12,598 |

|

|

|

10,766 |

|

|

Non-interest income: |

|

|

|

|

|

|

|

|

|

| |

Service charges on deposit accounts |

|

178 |

|

|

|

219 |

|

|

|

393 |

|

|

|

409 |

|

| |

Rental income |

|

88 |

|

|

|

81 |

|

|

|

175 |

|

|

|

172 |

|

| |

Net gain on loan sales |

|

320 |

|

|

|

- |

|

|

|

1,017 |

|

|

|

167 |

|

| |

Net securities gain |

|

- |

|

|

|

(7 |

) |

|

|

871 |

|

|

|

(7 |

) |

| |

Other income |

|

107 |

|

|

|

47 |

|

|

|

167 |

|

|

|

92 |

|

| |

|

|

Total non-interest income |

|

693 |

|

|

|

340 |

|

|

|

2,623 |

|

|

|

833 |

|

|

Non-interest expense: |

|

|

|

|

|

|

|

|

|

| |

Salaries and employee benefits |

|

2,431 |

|

|

|

2,303 |

|

|

|

5,154 |

|

|

|

4,960 |

|

| |

Occupancy and equipment |

|

424 |

|

|

|

434 |

|

|

|

807 |

|

|

|

857 |

|

| |

Other expenses |

|

1,361 |

|

|

|

1,258 |

|

|

|

2,676 |

|

|

|

2,390 |

|

| |

|

|

Total non-interest expense |

|

4,216 |

|

|

|

3,995 |

|

|

|

8,637 |

|

|

|

8,207 |

|

| |

|

|

Income before provision for income taxes |

|

3,151 |

|

|

|

1,664 |

|

|

|

6,584 |

|

|

|

3,392 |

|

|

Provision for income taxes |

|

933 |

|

|

|

492 |

|

|

|

1,950 |

|

|

|

795 |

|

| |

|

|

Net income |

$ |

2,218 |

|

|

$ |

1,172 |

|

|

$ |

4,634 |

|

|

$ |

2,597 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per common share |

$ |

0.37 |

|

|

$ |

0.19 |

|

|

$ |

0.76 |

|

|

$ |

0.43 |

|

|

Diluted earnings per common share |

$ |

0.37 |

|

|

$ |

0.19 |

|

|

$ |

0.76 |

|

|

$ |

0.43 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic weighted average shares of common stock outstanding |

|

6,070 |

|

|

|

6,069 |

|

|

|

6,070 |

|

|

|

6,068 |

|

|

Diluted weighted average shares of common stock outstanding |

|

6,074 |

|

|

|

6,075 |

|

|

|

6,072 |

|

|

|

6,071 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| SUMMIT STATE

BANK AND SUBSIDIARY |

|

| CONSOLIDATED

BALANCE SHEETS |

|

| (In thousands except

share data) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

June 30, 2020 |

|

December 31, 2019 |

|

June 30, 2019 |

| |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

$ |

67,954 |

|

|

$ |

38,299 |

|

|

$ |

12,104 |

|

|

|

|

|

Total cash and cash equivalents |

|

67,954 |

|

|

|

38,299 |

|

|

|

12,104 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Investment securities: |

|

|

|

|

|

|

|

|

| |

Held-to-maturity, at amortized cost |

|

- |

|

|

|

7,998 |

|

|

|

7,995 |

|

| |

Available-for-sale (at fair value; amortized cost of $58,807, |

|

|

|

|

|

|

|

|

| |

|

$53,591 and $59,450) |

|

60,472 |

|

|

|

54,241 |

|

|

|

59,853 |

|

| |

|

|

Total

investment securities |

|

60,472 |

|

|

|

62,239 |

|

|

|

67,848 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Loans, less allowance for loan losses of $7,881, $6,769 and

$6,328 |

|

701,808 |

|

|

|

576,548 |

|

|

|

536,674 |

|

|

Bank premises and equipment, net |

|

6,191 |

|

|

|

6,301 |

|

|

|

6,324 |

|

|

Investment in Federal Home Loan Bank stock, at cost |

|

3,429 |

|

|

|

3,342 |

|

|

|

3,341 |

|

|

Goodwill |

|

4,119 |

|

|

|

4,119 |

|

|

|

4,119 |

|

|

Accrued interest receivable and other assets |

|

6,686 |

|

|

|

5,130 |

|

|

|

5,212 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Total

assets |

$ |

850,659 |

|

|

$ |

695,978 |

|

|

$ |

635,622 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES

AND |

|

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

|

|

| |

Demand - non interest-bearing |

$ |

202,012 |

|

|

$ |

129,084 |

|

|

$ |

119,535 |

|

| |

Demand - interest-bearing |

|

79,570 |

|

|

|

69,383 |

|

|

|

65,227 |

|

| |

Savings |

|

36,887 |

|

|

|

28,359 |

|

|

|

25,419 |

|

| |

Money market |

|

136,754 |

|

|

|

128,377 |

|

|

|

99,585 |

|

| |

Time deposits that meet or exceed the FDIC insurance limit |

|

44,092 |

|

|

|

76,564 |

|

|

|

85,315 |

|

| |

Other time deposits |

|

210,158 |

|

|

|

142,070 |

|

|

|

137,176 |

|

| |

|

|

Total

deposits |

|

709,473 |

|

|

|

573,837 |

|

|

|

532,257 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Federal Home Loan Bank advances |

|

58,500 |

|

|

|

45,600 |

|

|

|

29,300 |

|

|

Junior subordinated debt |

|

5,869 |

|

|

|

5,862 |

|

|

|

5,862 |

|

|

Accrued interest payable and other liabilities |

|

5,581 |

|

|

|

3,335 |

|

|

|

3,462 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Total

liabilities |

|

779,423 |

|

|

|

628,634 |

|

|

|

570,881 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' equity |

|

|

|

|

|

|

|

|

| |

Preferred stock, no par value; 20,000,000 shares authorized; |

|

|

|

|

|

|

|

|

| |

|

no shares issued and outstanding |

|

- |

|

|

|

- |

|

|

|

- |

|

| |

Common stock, no par value; shares authorized - 30,000,000

shares; |

|

|

|

|

|

|

|

| |

|

issued and outstanding 6,069,600, 6,069,600 and 6,067,975 |

|

36,981 |

|

|

|

36,981 |

|

|

|

36,974 |

|

| |

Retained earnings |

|

33,083 |

|

|

|

29,906 |

|

|

|

27,483 |

|

| |

Accumulated other comprehensive income, net |

|

1,172 |

|

|

|

457 |

|

|

|

284 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Total

shareholders' equity |

|

71,236 |

|

|

|

67,344 |

|

|

|

64,741 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Total

liabilities and shareholders' equity |

$ |

850,659 |

|

|

$ |

695,978 |

|

|

$ |

635,622 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

| Financial

Summary |

| (Dollars in

thousands except per share data) |

| |

|

|

|

|

|

|

|

|

| |

|

As of and

for the |

|

As of and

for the |

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June 30, 2020 |

|

June 30, 2019 |

|

June 30, 2020 |

|

June 30, 2019 |

| |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

Statement of Income Data: |

|

|

|

|

|

|

|

|

|

Net interest income |

|

$ |

7,174 |

|

|

$ |

5,499 |

|

|

$ |

13,698 |

|

|

$ |

11,046 |

|

| Provision

for loan losses |

|

|

500 |

|

|

|

180 |

|

|

|

1,100 |

|

|

|

280 |

|

| Non-interest

income |

|

|

693 |

|

|

|

340 |

|

|

|

2,623 |

|

|

|

833 |

|

| Non-interest

expense |

|

|

4,216 |

|

|

|

3,995 |

|

|

|

8,637 |

|

|

|

8,207 |

|

| Provision

for income taxes |

|

|

933 |

|

|

|

492 |

|

|

|

1,950 |

|

|

|

795 |

|

| Net

income |

|

$ |

2,218 |

|

|

$ |

1,172 |

|

|

$ |

4,634 |

|

|

$ |

2,597 |

|

| |

|

|

|

|

|

|

|

|

|

Selected per Common Share Data: |

|

|

|

|

|

|

|

|

| Basic

earnings per common share |

|

$ |

0.37 |

|

|

$ |

0.19 |

|

|

$ |

0.76 |

|

|

$ |

0.43 |

|

| Diluted

earnings per common share |

|

$ |

0.37 |

|

|

$ |

0.19 |

|

|

$ |

0.76 |

|

|

$ |

0.43 |

|

| Dividend per

share |

|

$ |

0.12 |

|

|

$ |

0.12 |

|

|

$ |

0.24 |

|

|

$ |

0.24 |

|

| Book value

per common share (2) |

|

$ |

11.74 |

|

|

$ |

10.67 |

|

|

$ |

11.74 |

|

|

$ |

10.67 |

|

| |

|

|

|

|

|

|

|

|

|

Selected Balance Sheet Data: |

|

|

|

|

|

|

|

|

| Assets |

|

$ |

850,659 |

|

|

$ |

635,622 |

|

|

$ |

850,659 |

|

|

$ |

635,622 |

|

| Loans,

net |

|

|

701,808 |

|

|

|

536,674 |

|

|

|

701,808 |

|

|

|

536,674 |

|

|

Deposits |

|

|

709,473 |

|

|

|

532,257 |

|

|

|

709,473 |

|

|

|

532,257 |

|

| Average

assets |

|

|

794,442 |

|

|

|

622,883 |

|

|

|

741,642 |

|

|

|

625,393 |

|

| Average

earning assets |

|

|

775,852 |

|

|

|

606,280 |

|

|

|

724,791 |

|

|

|

609,179 |

|

| Average

shareholders' equity |

|

|

69,969 |

|

|

|

63,855 |

|

|

|

69,269 |

|

|

|

63,126 |

|

|

Nonperforming loans |

|

|

410 |

|

|

|

715 |

|

|

|

410 |

|

|

|

715 |

|

| Total

nonperforming assets |

|

|

410 |

|

|

|

715 |

|

|

|

410 |

|

|

|

715 |

|

| Troubled

debt restructures (accruing) |

|

|

2,214 |

|

|

|

2,449 |

|

|

|

2,214 |

|

|

|

2,449 |

|

| |

|

|

|

|

|

|

|

|

|

Selected Ratios: |

|

|

|

|

|

|

|

|

| Return on

average assets (1) |

|

|

1.12 |

% |

|

|

0.75 |

% |

|

|

1.25 |

% |

|

|

0.84 |

% |

| Return on

average common shareholders' equity (1) |

|

|

12.71 |

% |

|

|

7.36 |

% |

|

|

13.42 |

% |

|

|

8.30 |

% |

| Efficiency

ratio (3) |

|

|

53.59 |

% |

|

|

68.34 |

% |

|

|

55.90 |

% |

|

|

69.05 |

% |

| Net interest

margin (1) |

|

|

3.71 |

% |

|

|

3.64 |

% |

|

|

3.81 |

% |

|

|

3.66 |

% |

| Common

equity tier 1 capital ratio |

|

|

10.11 |

% |

|

|

10.70 |

% |

|

|

10.11 |

% |

|

|

10.7 |

% |

| Tier 1

capital ratio |

|

|

10.11 |

% |

|

|

10.70 |

% |

|

|

10.11 |

% |

|

|

10.7 |

% |

| Total

capital ratio |

|

|

12.30 |

% |

|

|

13.00 |

% |

|

|

12.30 |

% |

|

|

13.0 |

% |

| Tier 1

leverage ratio |

|

|

8.23 |

% |

|

|

9.50 |

% |

|

|

8.23 |

% |

|

|

9.5 |

% |

| Common

dividend payout ratio (4) |

|

|

32.82 |

% |

|

|

62.12 |

% |

|

|

31.44 |

% |

|

|

56.06 |

% |

| Average

shareholders' equity to average assets |

|

|

8.81 |

% |

|

|

10.25 |

% |

|

|

9.34 |

% |

|

|

10.09 |

% |

|

Nonperforming loans to total loans |

|

|

0.06 |

% |

|

|

0.13 |

% |

|

|

0.06 |

% |

|

|

0.13 |

% |

|

Nonperforming assets to total assets |

|

|

0.05 |

% |

|

|

0.11 |

% |

|

|

0.05 |

% |

|

|

0.11 |

% |

| Allowance

for loan losses to total loans |

|

|

1.11 |

% |

|

|

1.17 |

% |

|

|

1.11 |

% |

|

|

1.17 |

% |

|

Allowance for loan losses to total loans excluding PPP |

|

1.28 |

% |

|

|

1.17 |

% |

|

|

1.28 |

% |

|

|

1.17 |

% |

| Allowance

for loan losses to nonperforming loans |

|

|

1923.52 |

% |

|

|

885.39 |

% |

|

|

1923.52 |

% |

|

|

885.39 |

% |

|

|

|

|

|

|

| (1)

Annualized. |

|

|

|

|

|

|

|

|

|

(2) Total shareholders' equity divided by total common shares

outstanding. |

|

|

|

|

|

(3) Non-interest expenses to net interest and non-interest income,

net of securities gains. |

|

|

|

|

|

(4) Common dividends divided by net income available for common

shareholders. |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures: |

|

|

|

|

|

|

|

|

|

This news release contains a non-GAAP (Generally Accepted

Accounting Principles) financial measure in addition to results

presented in accordance with GAAP for the allowance for loan losses

to total loans excluding PPP loans. The Bank has presented this

non-GAAP financial measure in the earnings release because it

believes that it provides useful information to assess the Bank’s

allowance for loan loss reserves. This non-GAAP financial measure

has inherent limitations, is not required to be uniformly applied,

and is not audited. Further, this non-GAAP financial measure should

not be considered in isolation or as a substitute for the allowance

for loan losses to total loans determined in accordance with GAAP

and may not be comparable to similarly titled measures reported by

other financial institutions. Reconciliation of the GAAP and

non-GAAP financial measurement is presented below. |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

June 30,

2020 |

|

March 31,

2020 |

|

December 31,

2019 |

|

September

30, 2019 |

|

June 30,

2019 |

| |

|

|

|

(In thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

ACL on loans to Loans receivable, excluding SBA PPP

loans |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for credit losses on loans |

|

|

|

$ |

(7,881 |

) |

|

$ |

(7,375 |

) |

|

$ |

(6,769 |

) |

|

$ |

(6,550 |

) |

|

$ |

(6,328 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Loans

receivable (GAAP) |

|

|

|

$ |

709,689 |

|

|

$ |

608,775 |

|

|

$ |

583,317 |

|

|

$ |

560,672 |

|

|

$ |

543,002 |

|

|

Excluding SBA PPP loans |

|

95,534 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Loans receivable, excluding SBA PPP (non-GAAP) |

$ |

614,155 |

|

|

$ |

608,775 |

|

|

$ |

583,317 |

|

|

$ |

560,672 |

|

|

$ |

543,002 |

|

| |

|

|

|

|

|

|

|

|

|

|

ACL on loans to Loans receivable (GAAP) |

|

1.11 |

% |

|

|

1.21 |

% |

|

|

1.16 |

% |

|

|

1.17 |

% |

|

|

1.17 |

% |

|

ACL on loans to Loans receivable, excluding SBA PPP loans

(non-GAAP) |

|

1.28 |

% |

|

|

1.21 |

% |

|

|

1.16 |

% |

|

|

1.17 |

% |

|

|

1.17 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

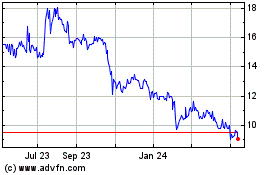

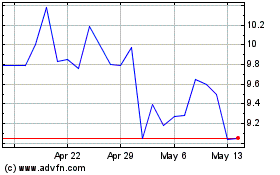

Summit State Bank (NASDAQ:SSBI)

Historical Stock Chart

From Apr 2024 to May 2024

Summit State Bank (NASDAQ:SSBI)

Historical Stock Chart

From May 2023 to May 2024