false

0001013934

0001013934

2024-02-29

2024-02-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): February 29, 2024

Strategic

Education, Inc.

(Exact Name of Registrant as Specified in

Charter)

| Maryland |

0-21039 |

52-1975978 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

2303 Dulles Station Boulevard

Herndon, VA 20171

(Address of Principal Executive Offices) (Zip Code)

(703)

561-1600

(Registrant’s

telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities Registered Pursuant to Section 12(b) of the Exchange

Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

|

STRA |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02. | Results of Operations and Financial Condition. |

On February 29, 2024, Strategic Education, Inc.

(“Strategic Education”) issued a press release announcing its financial results for the period ended December 31, 2023.

A copy of the press release is furnished as Exhibit 99.1 hereto and is hereby incorporated by reference into this Item 2.02.

The information furnished under this Item 2.02,

including Exhibit 99.1, shall not be deemed “filed” with the Securities and Exchange Commission nor incorporated by reference

in any registration statement filed by Strategic Education under the Securities Act of 1933, as amended.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

STRATEGIC EDUCATION, INC. |

| Date: February 29, 2024 |

|

|

| |

|

|

| |

By: |

/s/ Daniel W. Jackson |

| |

|

Daniel W. Jackson |

| |

|

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

sTRAtegic

eDUCATION, iNC. REPORTs FOURTH QUARTER 2023 rESULTS

HERNDON, Va., February 29, 2024 —

Strategic Education, Inc. (Strategic Education) (NASDAQ: STRA) today announced financial results for the period ended December

31, 2023.

“During 2023, we delivered strong enrollment, revenue, and earnings

growth and are proud of the organization’s ongoing commitment to the success of our students,” said Karl McDonnell, Chief

Executive Officer of Strategic Education. “As we begin a new year, we look toward continued strength in the U.S. Higher Education

segment driven by employer affiliated enrollment; strong growth in the Education Technology Services segment, including Sophia subscription

growth; and a return to total enrollment growth in the Australia/New Zealand segment.”

STRATEGIC EDUCATION CONSOLIDATED RESULTS

Three Months Ended December 31

| · | Revenue increased 12.1% to $302.7 million compared to $269.9 million for

the same period in 2022. Revenue on a constant currency basis increased 12.5% to $303.6 million in the fourth quarter of 2023 compared

to $269.9 million for the same period in 2022. |

| · | Income from operations was $54.2 million or 17.9% of revenue, compared to

$27.6 million or 10.2% of revenue for the same period in 2022. Adjusted income from operations, which is a non-GAAP financial measure,

was $56.6 million compared to $27.2 million for the same period in 2022. The adjusted operating income margin, which is a non-GAAP financial

measure, was 18.7% compared to 10.1% for the same period in 2022. For more details on non-GAAP financial measures, refer to the information

in the Non-GAAP Financial Measures section of this press release. |

| · | Net income was $39.1 million compared to $18.3 million for the same period

in 2022. Adjusted net income, which is a non-GAAP financial measure, was $40.4 million compared to $18.7 million for the same period in

2022. |

| · | Adjusted EBITDA, which is a non-GAAP financial measure, was $74.4 million

compared to $45.2 million for the same period in 2022. |

| · | Diluted earnings per share was $1.63 compared to $0.77 for the same period

in 2022. Adjusted diluted earnings per share, which is a non-GAAP financial measure, increased to $1.68 from $0.78 for the same period

in 2022. Adjusted diluted earnings per share on a constant currency basis, which is a non-GAAP financial measure, was $1.70. Diluted weighted

average shares outstanding increased slightly to 23,968,000 from 23,911,000 for the same period in 2022. |

Year Ended December

31

| · | Revenue increased 6.3% to $1,132.9 million compared to $1,065.5 million in

2022. Revenue on a constant currency basis increased 7.4% to $1,143.9 million in 2023 compared to $1,065.5 million in 2022. |

| · | Income

from operations was $95.3 million or 8.4% of revenue, compared to $70.8 million or 6.6% of revenue in 2022. Adjusted income from operations,

which is a non-GAAP financial measure, was $124.6 million in 2023 compared to $88.3 million in 2022.

The adjusted operating income margin, which is a non-GAAP financial measure, was 11.0% compared to

8.3% in 2022. For more details on non-GAAP financial measures, refer to the information in the Non-GAAP Financial Measures section

of this press release. |

| · | Net

income was $69.8 million in 2023 compared to $46.7 million in 2022. Adjusted net income, which is a non-GAAP financial measure, was $89.1

million compared to $60.3 million in 2022. |

| · | Adjusted

EBITDA, which is a non-GAAP financial measure, was $196.5 million compared to $163.1 million in 2022. |

| · | Diluted

earnings per share was $2.91 compared to $1.94 in 2022. Adjusted diluted earnings per share, which is a non-GAAP financial measure, increased

to $3.72 from $2.51 in 2022. Adjusted diluted earnings per share on a constant currency basis, which is a non-GAAP financial measure,

was $3.78. Diluted weighted average shares outstanding decreased slightly to 23,956,000 from 23,998,000 in 2022. |

U.S. Higher Education Segment Highlights

| · | The

U.S. Higher Education segment (USHE) is comprised of Capella University and Strayer University. |

| · | For

the fourth quarter, student enrollment within USHE increased 10.5% to 86,233 compared to 78,062 for the same period in 2022. Full-year

2023 student enrollment within USHE increased 6.8% compared to 2022. |

| · | For the fourth quarter, FlexPath enrollment was 21% of USHE enrollment compared

to 19% for the same period in 2022. |

| · | Revenue increased 8.9% to $217.6 million in the fourth quarter of 2023 compared

to $199.7 million for the same period in 2022, driven by higher fourth quarter enrollment. |

| · | Income from operations was $32.9 million in the fourth quarter of 2023 compared

to $13.2 million for the same period in 2022. The operating income margin was 15.1%, compared to 6.6% for the same period in 2022. |

Education Technology Services Segment Highlights

| · | The

Education Technology Services segment (ETS) is comprised primarily of Enterprise Partnerships, Sophia Learning, and Workforce Edge. |

| · | For

the fourth quarter, employer affiliated enrollment was 27.7% of USHE enrollment compared to 24.7% for the same period in 2022. Full-year

2023 employer affiliated enrollment was 27.2% of USHE enrollment compared to 24.4% in 2022. |

| · | For

the fourth quarter, average total subscribers at Sophia Learning increased approximately 44% from the same period in 2022. |

| · | As

of December 31, 2023, Workforce Edge had a total of 65 corporate agreements, collectively employing approximately 1,460,000 employees. |

| · | Revenue increased 30.7% to $21.9 million in the fourth quarter of 2023 compared

to $16.7 million for the same period in 2022, driven by growth in Sophia Learning subscriptions and employer affiliated enrollment. |

| · | Income from operations was $8.8 million in the fourth quarter of 2023 compared

to $4.0 million for the same period in 2022. The operating income margin was 40.3%, compared to 24.1% for the same period in 2022. |

Australia/New Zealand Segment Highlights

| · | The

Australia/New Zealand segment (ANZ) is comprised of Torrens University, Think Education, and Media Design School. |

| · | For

the fourth quarter, student enrollment within ANZ decreased 2.0% to 19,252 compared to 19,651 for the same period in 2022. Full-year

2023 student enrollment within ANZ decreased 3.6% compared to 2022. |

| · | Revenue

increased 18.2% to $63.3 million in the fourth quarter of 2023 compared to $53.5 million for the same period in 2022, driven by higher

revenue-per-student. Revenue on a constant currency basis increased 20.0% to $64.2 million in the fourth quarter of 2023 compared to

$53.5 million for the same period in 2022, driven by higher revenue-per-student. |

| · | Income from operations was $14.9 million in the fourth quarter of 2023 compared

to $10.0 million for the same period in 2022. The operating income margin was 23.5%, compared to 18.6% for the same period in 2022. Income

from operations on a constant currency basis was $15.2 million in the fourth quarter of 2023 compared to $10.0 million for the same period

in 2022. The operating income margin on a constant currency basis was 23.7%, compared to 18.6% for the same period in 2022. |

Balance Sheet and Cash

Flow

At December 31, 2023, Strategic Education had cash, cash equivalents,

and marketable securities of $208.7 million, and $61.4 million outstanding under its revolving credit facility. Cash provided by operations

in 2023 was $117.1 million compared to $126.1 million in 2022. Capital expenditures for 2023 were $36.9 million compared to $43.2 million

in 2022.

For the fourth quarter of 2023, consolidated bad debt expense as a

percentage of revenue was 3.7%, compared to 4.9% of revenue for the same period in 2022.

COMMON STOCK CASH DIVIDEND

Strategic Education announced today that it declared a regular, quarterly

cash dividend of $0.60 per share of common stock. This dividend will be paid on March 18, 2024 to shareholders of record as of March 11,

2024.

CONFERENCE CALL WITH MANAGEMENT

Strategic Education will host a conference

call to discuss its fourth quarter 2023 results at 10:00 a.m. (ET) today. This call will be available via webcast. To access the live

webcast of the conference call, please go to www.strategiceducation.com in the Investor Relations section 15 minutes

prior to the start time of the call to register. An earnings release presentation will also be posted to www.strategiceducation.com in

the Investor Relations section. Following the call, the webcast will be archived and available at www.strategiceducation.com in

the Investor Relations section. To participate in the live call, investors should register here prior to the call to receive

dial-in information and a PIN.

About Strategic Education, Inc.

Strategic Education, Inc. (NASDAQ: STRA) (www.strategiceducation.com)

is dedicated to helping advance economic mobility through higher education. We primarily serve working adult students globally through

our core focus areas: 1) U.S. Higher Education, including Capella University and Strayer University, each institutionally accredited,

and collectively offer flexible and affordable associate, bachelor’s, master’s, and doctoral programs including the Jack

Welch Management Institute at Strayer University, and non-degree web and mobile application development courses through Strayer University’s

Hackbright Academy and Devmountain; 2) Education Technology Services, developing and maintaining relationships with employers to build

education benefits programs providing employees access to affordable and industry-relevant training, certificate, and degree programs,

including through Workforce Edge, a full-service education benefits administration solution for employers, and Sophia Learning, enabling

education benefits programs through low-cost online general education-level courses that are ACE-recommended for college credit; and

3) Australia/New Zealand, comprised of Torrens University, Think Education, and Media Design School that collectively offer certificate

and degree programs in Australia and New Zealand. This portfolio of high quality, innovative, relevant, and affordable programs and institutions

helps our students prepare for success in today’s workforce and find a path to bettering their lives.

Forward-Looking Statements

This communication contains certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements may be identified by the use of words such

as “expect,” “estimate,” “assume,” “believe,” “anticipate,” “may,”

“will,” “forecast,” “outlook,” “plan,” “project,” “potential”

and other similar words, and include all statements that are not historical facts, including with respect to, among other things, the

future financial performance and growth opportunities of Strategic Education; Strategic Education’s plans, strategies and prospects;

and future events and expectations. The statements are based on Strategic Education’s current expectations and are subject to a

number of assumptions, uncertainties and risks, including but not limited to:

| · | the pace of student enrollment; |

| · | Strategic Education’s continued compliance with Title IV of the Higher Education Act, and the regulations thereunder, as well

as other federal laws and regulations, institutional accreditation standards and state regulatory requirements; |

| · | rulemaking and other action by the Department of Education or other governmental entities, including without limitation action related

to borrower defense to repayment applications, gainful employment, 90/10, and increased focus by the U.S. Congress on for-profit education

institutions; |

| · | risks associated with the ultimate impact of COVID-19 on people and economies; |

| · | risks associated with the opening of new campuses; |

| · | risks associated with the offering of new educational programs and adapting to other changes; |

| · | risks associated with the acquisition of existing educational institutions, including Strategic Education’s acquisition of Torrens

University and associated assets in Australia and New Zealand; |

| · | the risk that the benefits of the acquisition of Torrens University and associated assets in Australia and New Zealand may not be

fully realized or may take longer to realize than expected; |

| · | the risk that the acquisition of Torrens University and associated assets in Australia and New Zealand may not advance Strategic Education’s

business strategy and growth strategy; |

| · | risks relating to the timing of regulatory approvals; |

| · | Strategic Education’s ability to implement its growth strategy; |

| · | the risk that the combined company may experience difficulty integrating employees or operations; |

| · | risks associated with the ability of Strategic Education’s students to finance their education in a timely manner; |

| · | general economic and market conditions; and |

| · | additional factors described in Strategic Education’s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q

and Current Reports on Form 8-K. |

Many of these risks, uncertainties and assumptions

are beyond Strategic Education’s ability to control or predict. Because of these risks, uncertainties and assumptions, you should

not place undue reliance on these forward-looking statements. Furthermore, these forward-looking statements speak only as of the information

currently available to Strategic Education on the date they are made, and Strategic Education undertakes no obligation to update or revise

forward-looking statements, except as required by law. Actual results may differ materially from those projected in the forward-looking

statements.

For more information contact:

Terese Wilke

Director of Investor Relations

Strategic Education, Inc.

(612) 977-6331

terese.wilke@strategiced.com

STRATEGIC EDUCATION, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF INCOME

(in thousands, except per share data)

| | |

For the three months ended December 31, | | |

For the twelve months ended

December 31, | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| Revenues | |

$ | 269,938 | | |

$ | 302,702 | | |

$ | 1,065,480 | | |

$ | 1,132,924 | |

| Costs and expenses: | |

| | | |

| | | |

| | | |

| | |

| Instructional and support costs | |

| 152,167 | | |

| 153,751 | | |

| 597,321 | | |

| 623,903 | |

| General and administration | |

| 90,558 | | |

| 92,377 | | |

| 379,817 | | |

| 384,443 | |

| Amortization of intangible assets | |

| 3,396 | | |

| 1,093 | | |

| 14,350 | | |

| 11,457 | |

| Merger and integration costs | |

| 184 | | |

| 209 | | |

| 1,117 | | |

| 1,544 | |

| Restructuring costs | |

| (4,014 | ) | |

| 1,048 | | |

| 2,115 | | |

| 16,256 | |

| Total costs and expenses | |

| 242,291 | | |

| 248,478 | | |

| 994,720 | | |

| 1,037,603 | |

| Income from operations | |

| 27,647 | | |

| 54,224 | | |

| 70,760 | | |

| 95,321 | |

| Other income (expense) | |

| (58 | ) | |

| 994 | | |

| (1,191 | ) | |

| 5,405 | |

| Income before income taxes | |

| 27,589 | | |

| 55,218 | | |

| 69,569 | | |

| 100,726 | |

| Provision for income taxes | |

| 9,260 | | |

| 16,089 | | |

| 22,899 | | |

| 30,935 | |

| Net income | |

$ | 18,329 | | |

$ | 39,129 | | |

$ | 46,670 | | |

$ | 69,791 | |

| Earnings per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.78 | | |

$ | 1.67 | | |

$ | 1.97 | | |

$ | 2.98 | |

| Diluted | |

$ | 0.77 | | |

$ | 1.63 | | |

$ | 1.94 | | |

$ | 2.91 | |

| Weighted average shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 23,421 | | |

| 23,367 | | |

| 23,679 | | |

| 23,403 | |

| Diluted | |

| 23,911 | | |

| 23,968 | | |

| 23,998 | | |

| 23,956 | |

STRATEGIC EDUCATION, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

| | |

December 31,

2022 | | |

December 31,

2023 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 213,667 | | |

$ | 168,481 | |

| Marketable securities | |

| 9,156 | | |

| 39,728 | |

| Tuition receivable, net | |

| 62,953 | | |

| 76,102 | |

| Other current assets | |

| 43,285 | | |

| 44,758 | |

| Total current assets | |

| 329,061 | | |

| 329,069 | |

| Property and equipment, net | |

| 132,845 | | |

| 118,529 | |

| Right-of-use lease assets | |

| 125,248 | | |

| 119,202 | |

| Marketable securities, non-current | |

| 13,123 | | |

| 483 | |

| Intangible assets, net | |

| 260,541 | | |

| 251,623 | |

| Goodwill | |

| 1,251,277 | | |

| 1,251,888 | |

| Other assets | |

| 49,652 | | |

| 54,419 | |

| Total assets | |

$ | 2,161,747 | | |

$ | 2,125,213 | |

| | |

| | | |

| | |

| LIABILITIES & STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 90,588 | | |

$ | 90,888 | |

| Income taxes payable | |

| 6,989 | | |

| 2,200 | |

| Contract liabilities | |

| 88,488 | | |

| 92,341 | |

| Lease liabilities | |

| 23,879 | | |

| 24,190 | |

| Total current liabilities | |

| 209,944 | | |

| 209,619 | |

| Long-term debt | |

| 101,396 | | |

| 61,400 | |

| Deferred income tax liabilities | |

| 34,605 | | |

| 28,338 | |

| Lease liabilities, non-current | |

| 134,006 | | |

| 127,735 | |

| Other long-term liabilities | |

| 46,006 | | |

| 45,603 | |

| Total liabilities | |

| 525,957 | | |

| 472,695 | |

| Commitments and contingencies | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock, par value $0.01; 32,000,000 shares authorized; 24,402,891 and 24,406,816 shares issued and outstanding at December 31, 2022 and December 31, 2023, respectively | |

| 244 | | |

| 244 | |

| Additional paid-in capital | |

| 1,510,924 | | |

| 1,517,650 | |

| Accumulated other comprehensive loss | |

| (35,068 | ) | |

| (34,247 | ) |

| Retained earnings | |

| 159,690 | | |

| 168,871 | |

| Total stockholders’ equity | |

| 1,635,790 | | |

| 1,652,518 | |

| Total liabilities and stockholders’ equity | |

$ | 2,161,747 | | |

$ | 2,125,213 | |

STRATEGIC EDUCATION, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS

(in thousands)

| | |

For the year ended

December 31, | |

| | |

2022 | | |

2023 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income | |

$ | 46,670 | | |

$ | 69,791 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Gain on sale of property and equipment | |

| (2,886 | ) | |

| (2,136 | ) |

| Amortization of deferred financing costs | |

| 552 | | |

| 557 | |

| Amortization of investment discount/premium | |

| 32 | | |

| (65 | ) |

| Depreciation and amortization | |

| 63,124 | | |

| 57,313 | |

| Deferred income taxes | |

| (8,667 | ) | |

| (6,322 | ) |

| Stock-based compensation | |

| 21,792 | | |

| 19,772 | |

| Impairment of right-of-use lease assets | |

| 1,185 | | |

| 5,135 | |

| Changes in assets and liabilities: | |

| | | |

| | |

| Tuition receivable, net | |

| (12,558 | ) | |

| (12,874 | ) |

| Other assets | |

| 3,584 | | |

| (7,631 | ) |

| Accounts payable and accrued expenses | |

| (4,339 | ) | |

| 552 | |

| Income taxes payable and income taxes receivable | |

| 7,580 | | |

| (4,688 | ) |

| Contract liabilities | |

| 18,960 | | |

| 4,495 | |

| Other liabilities | |

| (8,977 | ) | |

| (6,780 | ) |

| Net cash provided by operating activities | |

| 126,052 | | |

| 117,119 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Cash paid for acquisition, net of cash acquired | |

| (800 | ) | |

| (530 | ) |

| Purchases of property and equipment | |

| (43,170 | ) | |

| (36,943 | ) |

| Purchases of marketable securities | |

| — | | |

| (26,905 | ) |

| Proceeds from marketable securities | |

| 6,420 | | |

| 9,800 | |

| Proceeds from sale of property and equipment | |

| 6,525 | | |

| 5,890 | |

| Proceeds from other investments | |

| — | | |

| 457 | |

| Other investments | |

| (335 | ) | |

| (314 | ) |

| Net cash used in investing activities | |

| (31,360 | ) | |

| (48,545 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Common dividends paid | |

| (59,240 | ) | |

| (58,780 | ) |

| Payments on long-term debt | |

| (40,000 | ) | |

| (40,000 | ) |

| Net payments for stock awards | |

| (3,004 | ) | |

| (4,828 | ) |

| Repurchase of common stock | |

| (40,116 | ) | |

| (9,999 | ) |

| Net cash used in financing activities | |

| (142,360 | ) | |

| (113,607 | ) |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | |

| (4,090 | ) | |

| (496 | ) |

| Net decrease in cash, cash equivalents, and restricted cash | |

| (51,758 | ) | |

| (45,529 | ) |

| Cash, cash equivalents, and restricted cash — beginning of period | |

| 279,212 | | |

| 227,454 | |

| Cash, cash equivalents, and restricted cash — end of period | |

$ | 227,454 | | |

$ | 181,925 | |

STRATEGIC EDUCATION, INC.

UNAUDITED SEGMENT REPORTING

(in thousands)

| | |

For the three months ended

December 31, | | |

For the twelve months ended

December 31, | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| Revenues: | |

| | |

| | |

| | |

| |

| U.S. Higher Education | |

$ | 199,688 | | |

$ | 217,551 | | |

$ | 770,979 | | |

$ | 818,953 | |

| Australia/New Zealand | |

| 53,515 | | |

| 63,279 | | |

| 230,747 | | |

| 233,518 | |

| Education Technology Services | |

| 16,735 | | |

| 21,872 | | |

| 63,754 | | |

| 80,453 | |

| Consolidated revenues | |

$ | 269,938 | | |

$ | 302,702 | | |

$ | 1,065,480 | | |

$ | 1,132,924 | |

| Income from operations: | |

| | | |

| | | |

| | | |

| | |

| U.S. Higher Education | |

$ | 13,219 | | |

$ | 32,886 | | |

$ | 38,605 | | |

$ | 59,628 | |

| Australia/New Zealand | |

| 9,967 | | |

| 14,878 | | |

| 30,473 | | |

| 35,862 | |

| Education Technology Services | |

| 4,027 | | |

| 8,810 | | |

| 19,264 | | |

| 29,088 | |

| Amortization of intangible assets | |

| (3,396 | ) | |

| (1,093 | ) | |

| (14,350 | ) | |

| (11,457 | ) |

| Merger and integration costs | |

| (184 | ) | |

| (209 | ) | |

| (1,117 | ) | |

| (1,544 | ) |

| Restructuring costs | |

| 4,014 | | |

| (1,048 | ) | |

| (2,115 | ) | |

| (16,256 | ) |

| Consolidated income from operations | |

$ | 27,647 | | |

$ | 54,224 | | |

$ | 70,760 | | |

$ | 95,321 | |

Non-GAAP Financial Measures

In our press release and schedules, we report certain financial measures

that are not required by, or presented in accordance with, accounting principles generally accepted in the United States of America (“GAAP”).

We discuss management’s reasons for reporting these non-GAAP measures below, and the press release schedules that follow reconcile

the most directly comparable GAAP measure to each non-GAAP measure that we reference. Although management evaluates and presents these

non-GAAP measures for the reasons described below, please be aware that these non-GAAP measures have limitations and should not be considered

in isolation or as a substitute for revenue, total costs and expenses, income from operations, operating margin, income before income

taxes, net income, earnings per share or any other comparable financial measure prescribed by GAAP. In addition, we may calculate and/or

present these non-GAAP financial measures differently than measures with the same or similar names that other companies report, and as

a result, the non-GAAP measures we report may not be comparable to those reported by others.

Management uses certain non-GAAP measures to evaluate financial performance

because those non-GAAP measures allow for period-over-period comparisons of the Company’s ongoing operations before the impact of

certain items described below. Management believes this information is useful to investors to compare the Company’s results of operations

period-over-period. These measures are Adjusted Revenue, Adjusted Total Costs and Expenses, Adjusted Income from Operations, Adjusted

Operating Margin, Adjusted Income Before Income Taxes, Adjusted Net Income, Earnings Before Interest, Taxes, Depreciation and Amortization

(EBITDA), Adjusted EBITDA and Adjusted Diluted Earnings Per Share (EPS). We define Adjusted Revenue, Adjusted Total Costs and Expenses,

Adjusted Income from Operations, Adjusted Operating Margin, Adjusted Income Before Income Taxes, Adjusted Net Income, and Adjusted Diluted

EPS to exclude (1) amortization and depreciation expense related to intangible assets and software assets associated with the Company’s

acquisition of Torrens University and associated assets in Australia and New Zealand, (2) integration expenses associated with the Company’s

merger with Capella Education Company and the Company’s acquisition of Torrens University and associated assets in Australia and

New Zealand, (3) severance costs, lease and fixed asset impairment charges, gains on sale of real estate and early termination of leased

facilities, and other costs associated with the Company’s restructuring activities, (4) income/loss recognized from the Company’s

investments in partnership interests and other investments, and (5) discrete tax adjustments utilizing an adjusted effective income tax

rate of 30.0% for the three months ended December 31, 2022 and 2023, and adjusted effective income tax rates of 30.4% and 30.0% for

the twelve months ended December 31, 2022 and 2023, respectively. To illustrate currency impacts to operating results, Adjusted Revenue,

Adjusted Total Costs and Expenses, Adjusted Income from Operations, Adjusted Operating Margin, Adjusted Income Before Income Taxes, Adjusted

Net Income, and Adjusted Diluted EPS for the three and twelve months ended December 31, 2023 are also presented on a constant currency

basis utilizing an exchange rate of 0.66 and 0.69 Australian Dollars to U.S. Dollars, respectively, which were the average exchange rates

for the same periods in 2022. We define EBITDA as net income before other income (expense), the provision for income taxes, gains on sale

of property and equipment, depreciation and amortization, and from this amount in arriving at Adjusted EBITDA we also exclude stock-based

compensation expense, amortization expense associated with deferred implementation costs incurred in cloud computing arrangements, and

the amounts in (2) and (3) above. These non-GAAP measures are reconciled to the most directly comparable GAAP measures in the sections

that follow. Non-GAAP measures should not be viewed as substitutes for GAAP measures.

STRATEGIC EDUCATION, INC.

UNAUDITED RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES

ADJUSTED REVENUE, ADJUSTED TOTAL COSTS AND EXPENSES,

ADJUSTED INCOME FROM

OPERATIONS, ADJUSTED OPERATING MARGIN, ADJUSTED INCOME BEFORE INCOME TAXES,

ADJUSTED NET INCOME, AND ADJUSTED EPS

(in thousands, except per share data)

| |

|

|

|

|

For the three months ended December 31, 2022

Non-GAAP Adjustments |

|

|

|

|

| |

|

As Reported

(GAAP) |

|

|

Amortization

of intangible

assets(1) |

|

|

Merger and

integration

costs(2) |

|

|

Restructuring

costs(3) |

|

|

Income from

other

investments(4) |

|

|

Tax

adjustments(5) |

|

|

As Adjusted

(Non-GAAP) |

|

| Revenues |

|

$ |

269,938 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

269,938 |

|

| Total costs and expenses |

|

$ |

242,291 |

|

|

$ |

(3,396 |

) |

|

$ |

(184 |

) |

|

$ |

4,014 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

242,725 |

|

| Income from operations |

|

$ |

27,647 |

|

|

$ |

3,396 |

|

|

$ |

184 |

|

|

$ |

(4,014 |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

27,213 |

|

| Operating margin |

|

|

10.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.1 |

% |

| Income before income taxes |

|

$ |

27,589 |

|

|

$ |

3,396 |

|

|

$ |

184 |

|

|

$ |

(4,014 |

) |

|

$ |

(401 |

) |

|

$ |

— |

|

|

$ |

26,754 |

|

| Net income |

|

$ |

18,329 |

|

|

$ |

3,396 |

|

|

$ |

184 |

|

|

$ |

(4,014 |

) |

|

$ |

(401 |

) |

|

$ |

1,246 |

|

|

$ |

18,740 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.77 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

0.78 |

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

23,911 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23,911 |

|

| |

|

|

|

|

For the three months ended December 31, 2023

Non-GAAP Adjustments |

|

|

|

|

| |

|

As Reported

(GAAP) |

|

|

Amortization

of intangible

assets(1) |

|

|

Merger and

integration

costs(2) |

|

|

Restructuring

costs(3) |

|

|

Loss from

other

investments(4) |

|

|

Tax

adjustments(5) |

|

|

As

Adjusted

(Non-GAAP) |

|

| Revenues |

|

$ |

302,702 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

302,702 |

|

| Total costs and expenses |

|

$ |

248,478 |

|

|

$ |

(1,093 |

) |

|

$ |

(209 |

) |

|

$ |

(1,048 |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

246,128 |

|

| Income from operations |

|

$ |

54,224 |

|

|

$ |

1,093 |

|

|

$ |

209 |

|

|

$ |

1,048 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

56,574 |

|

| Operating margin |

|

|

17.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18.7 |

% |

| Income before income taxes |

|

$ |

55,218 |

|

|

$ |

1,093 |

|

|

$ |

209 |

|

|

$ |

1,048 |

|

|

$ |

108 |

|

|

$ |

— |

|

|

$ |

57,676 |

|

| Net income |

|

$ |

39,129 |

|

|

$ |

1,093 |

|

|

$ |

209 |

|

|

$ |

1,048 |

|

|

$ |

108 |

|

|

$ |

(1,214 |

) |

|

$ |

40,373 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

1.63 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

1.68 |

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

23,968 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23,968 |

|

| |

|

|

|

|

For the twelve months ended December 31, 2022

Non-GAAP Adjustments |

|

|

|

|

| |

|

As Reported

(GAAP) |

|

|

Amortization

of intangible

assets(1) |

|

|

Merger and

integration

costs(2) |

|

|

Restructuring

costs(3) |

|

|

Income from

other

investments(4) |

|

|

Tax

adjustments(5) |

|

|

As Adjusted

(Non-GAAP) |

|

| Revenues |

|

$ |

1,065,480 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

1,065,480 |

|

| Total costs and expenses |

|

$ |

994,720 |

|

|

$ |

(14,350 |

) |

|

$ |

(1,117 |

) |

|

$ |

(2,115 |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

977,138 |

|

| Income from operations |

|

$ |

70,760 |

|

|

$ |

14,350 |

|

|

$ |

1,117 |

|

|

$ |

2,115 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

88,342 |

|

| Operating margin |

|

|

6.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8.3 |

% |

| Income before income taxes |

|

$ |

69,569 |

|

|

$ |

14,350 |

|

|

$ |

1,117 |

|

|

$ |

2,115 |

|

|

$ |

(579 |

) |

|

$ |

— |

|

|

$ |

86,572 |

|

| Net income |

|

$ |

46,670 |

|

|

$ |

14,350 |

|

|

$ |

1,117 |

|

|

$ |

2,115 |

|

|

$ |

(579 |

) |

|

$ |

(3,419 |

) |

|

$ |

60,254 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

1.94 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

2.51 |

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

23,998 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23,998 |

|

| |

|

|

|

|

For the twelve months ended December 31, 2023

Non-GAAP Adjustments |

|

|

|

|

| |

|

As Reported

(GAAP) |

|

|

Amortization

of intangible

assets(1) |

|

|

Merger and

integration

costs(2) |

|

|

Restructuring

costs(3) |

|

|

Income from

other

investments(4) |

|

|

Tax

adjustments(5) |

|

|

As Adjusted

(Non-GAAP) |

|

| Revenues |

|

$ |

1,132,924 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

1,132,924 |

|

| Total costs and expenses |

|

$ |

1,037,603 |

|

|

$ |

(11,457 |

) |

|

$ |

(1,544 |

) |

|

$ |

(16,256 |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

1,008,346 |

|

| Income from operations |

|

$ |

95,321 |

|

|

$ |

11,457 |

|

|

$ |

1,544 |

|

|

$ |

16,256 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

124,578 |

|

| Operating margin |

|

|

8.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11.0 |

% |

| Income before income taxes |

|

$ |

100,726 |

|

|

$ |

11,457 |

|

|

$ |

1,544 |

|

|

$ |

16,256 |

|

|

$ |

(2,718 |

) |

|

$ |

— |

|

|

$ |

127,265 |

|

| Net income |

|

$ |

69,791 |

|

|

$ |

11,457 |

|

|

$ |

1,544 |

|

|

$ |

16,256 |

|

|

$ |

(2,718 |

) |

|

$ |

(7,245 |

) |

|

$ |

89,085 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

2.91 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

3.72 |

|

| Weighted average shares outstanding: |

|

|

| Diluted |

|

|

23,956 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23,956 |

|

| (1) | Reflects amortization and depreciation expense of intangible assets and software assets acquired through the Company’s acquisition

of Torrens University and associated assets in Australia and New Zealand. |

| (2) | Reflects integration expenses associated with the Company’s merger with Capella Education Company and the Company’s acquisition

of Torrens University and associated assets in Australia and New Zealand. |

| (3) | Reflects severance costs, lease and fixed asset impairment charges, gains on sale of real estate and early termination of leased facilities,

and other costs associated with the Company’s restructuring activities. |

| (4) | Reflects income/loss recognized from the Company's investments in partnership interests and other investments. |

| (5) | Reflects tax impacts of the adjustments described above and discrete tax adjustments related to stock-based compensation and other

adjustments, utilizing an adjusted effective income tax rate of 30.0% for the three months ended December 31, 2022 and 2023, and

adjusted effective income tax rates of 30.4% and 30.0% for the twelve months ended December 31, 2022 and 2023, respectively. |

STRATEGIC EDUCATION, INC.

UNAUDITED RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES

2023 AS ADJUSTED WITH CONSTANT CURRENCY

(in thousands, except per share data)

| |

|

For the three months ended

December 31, 2023 |

|

|

For the twelve months ended

December 31, 2023 |

|

| |

|

As Adjusted

(Non-GAAP) |

|

|

Constant

currency

adjustment(1) |

|

|

As Adjusted

with Constant

Currency

(Non-GAAP) |

|

|

As Adjusted

(Non-GAAP) |

|

|

Constant

currency

adjustment(1) |

|

|

As Adjusted

with Constant

Currency

(Non-GAAP) |

|

| Revenues |

|

$ |

302,702 |

|

|

$ |

922 |

|

|

$ |

303,624 |

|

|

$ |

1,132,924 |

|

|

$ |

10,937 |

|

|

$ |

1,143,861 |

|

| Total costs and expenses |

|

$ |

246,128 |

|

|

$ |

555 |

|

|

$ |

246,683 |

|

|

$ |

1,008,346 |

|

|

$ |

8,925 |

|

|

$ |

1,017,271 |

|

| Income from operations |

|

$ |

56,574 |

|

|

$ |

367 |

|

|

$ |

56,941 |

|

|

$ |

124,578 |

|

|

$ |

2,012 |

|

|

$ |

126,590 |

|

| Operating margin |

|

|

18.7 |

% |

|

|

|

|

|

|

18.8 |

% |

|

|

11.0 |

% |

|

|

|

|

|

|

11.1 |

% |

| Income before income taxes |

|

$ |

57,676 |

|

|

$ |

369 |

|

|

$ |

58,045 |

|

|

$ |

127,265 |

|

|

$ |

2,106 |

|

|

$ |

129,371 |

|

| Net income |

|

$ |

40,373 |

|

|

$ |

258 |

|

|

$ |

40,631 |

|

|

$ |

89,085 |

|

|

$ |

1,475 |

|

|

$ |

90,560 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

1.68 |

|

|

|

|

|

|

$ |

1.70 |

|

|

$ |

3.72 |

|

|

|

|

|

|

$ |

3.78 |

|

| Weighted average shares outstanding: |

|

|

| Diluted |

|

|

23,968 |

|

|

|

|

|

|

|

23,968 |

|

|

|

23,956 |

|

|

|

|

|

|

|

23,956 |

|

| (1) | Reflects an adjustment to translate foreign currency results for the three and twelve months ended December 31, 2023 at a constant

exchange rate of 0.66 and 0.69 Australian Dollars to U.S. Dollars, respectively, which were the average exchange rates for the same periods

in 2022. |

STRATEGIC EDUCATION, INC.

UNAUDITED NON-GAAP SEGMENT REPORTING

(in thousands)

| | |

For the three months ended

December 31, | | |

For the twelve months ended

December 31, | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| Revenues: | |

| | |

| | |

| | |

| |

| U.S. Higher Education | |

$ | 199,688 | | |

$ | 217,551 | | |

$ | 770,979 | | |

$ | 818,953 | |

| Australia/New Zealand | |

| 53,515 | | |

| 63,279 | | |

| 230,747 | | |

| 233,518 | |

| Education Technology Services | |

| 16,735 | | |

| 21,872 | | |

| 63,754 | | |

| 80,453 | |

| Consolidated revenues | |

| 269,938 | | |

| 302,702 | | |

| 1,065,480 | | |

| 1,132,924 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income from operations: | |

| | | |

| | | |

| | | |

| | |

| U.S. Higher Education | |

$ | 13,219 | | |

$ | 32,886 | | |

$ | 38,605 | | |

$ | 59,628 | |

| Australia/New Zealand | |

| 9,967 | | |

| 14,878 | | |

| 30,473 | | |

| 35,862 | |

| Education Technology Services | |

| 4,027 | | |

| 8,810 | | |

| 19,264 | | |

| 29,088 | |

| Amortization of intangible assets | |

| (3,396 | ) | |

| (1,093 | ) | |

| (14,350 | ) | |

| (11,457 | ) |

| Merger and integration costs | |

| (184 | ) | |

| (209 | ) | |

| (1,117 | ) | |

| (1,544 | ) |

| Restructuring costs | |

| 4,014 | | |

| (1,048 | ) | |

| (2,115 | ) | |

| (16,256 | ) |

| Consolidated income from operations | |

| 27,647 | | |

| 54,224 | | |

| 70,760 | | |

| 95,321 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjustments to consolidated income from operations: | |

| | | |

| | | |

| | | |

| | |

| Amortization of intangible assets | |

| 3,396 | | |

| 1,093 | | |

| 14,350 | | |

| 11,457 | |

| Merger and integration costs | |

| 184 | | |

| 209 | | |

| 1,117 | | |

| 1,544 | |

| Restructuring costs | |

| (4,014 | ) | |

| 1,048 | | |

| 2,115 | | |

| 16,256 | |

| Total adjustments to consolidated income from operations | |

| (434 | ) | |

| 2,350 | | |

| 17,582 | | |

| 29,257 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted income from operations by segment: | |

| | | |

| | | |

| | | |

| | |

| U.S. Higher Education | |

| 13,219 | | |

| 32,886 | | |

| 38,605 | | |

| 59,628 | |

| Australia/New Zealand | |

| 9,967 | | |

| 14,878 | | |

| 30,473 | | |

| 35,862 | |

| Education Technology Services | |

| 4,027 | | |

| 8,810 | | |

| 19,264 | | |

| 29,088 | |

| Total adjusted income from operations | |

$ | 27,213 | | |

$ | 56,574 | | |

$ | 88,342 | | |

$ | 124,578 | |

STRATEGIC EDUCATION, INC.

UNAUDITED RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES

ADJUSTED EBITDA

(in thousands)

| | |

For the three months ended

December 31, | | |

For the twelve months ended

December 31, | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| Net income | |

$ | 18,329 | | |

$ | 39,129 | | |

$ | 46,670 | | |

$ | 69,791 | |

| Provision for income taxes | |

| 9,260 | | |

| 16,089 | | |

| 22,899 | | |

| 30,935 | |

| Other (income) expense | |

| 58 | | |

| (994 | ) | |

| 1,191 | | |

| (5,405 | ) |

| Gain on sale of property and equipment | |

| (2,886 | ) | |

| — | | |

| (2,886 | ) | |

| (2,136 | ) |

| Depreciation and amortization | |

| 13,931 | | |

| 12,432 | | |

| 63,124 | | |

| 57,313 | |

| EBITDA (1) | |

| 38,692 | | |

| 66,656 | | |

| 130,998 | | |

| 150,498 | |

| Stock-based compensation | |

| 5,583 | | |

| 4,570 | | |

| 21,792 | | |

| 19,772 | |

| Merger and integration costs (2) | |

| 184 | | |

| 209 | | |

| 1,170 | | |

| 1,208 | |

| Restructuring costs (3) | |

| (1,128 | ) | |

| 907 | | |

| 2,521 | | |

| 17,500 | |

| Cloud computing amortization (4) | |

| 1,898 | | |

| 2,024 | | |

| 6,640 | | |

| 7,547 | |

| Adjusted EBITDA (1) | |

$ | 45,229 | | |

$ | 74,366 | | |

$ | 163,121 | | |

$ | 196,525 | |

| (1) | Denotes non-GAAP financial measures. Please see the information in the Non-GAAP Financial Measures section of this press release for

more detail regarding these adjustments and management’s reasons for providing this information. |

| (2) | Reflects integration charges associated with the Company’s merger with Capella Education Company and the Company’s acquisition

of Torrens University and associated assets in Australia and New Zealand. Excludes $0.1 million and $0.3 million of depreciation and amortization

for the twelve months ended December 31, 2022 and 2023, respectively. |

| (3) | Reflects severance costs, lease and fixed asset impairment charges, gains on sale of real estate and early termination of leased facilities,

and other costs associated with the Company’s restructuring activities. Excludes $2.9 million of gain on the sale of property and

equipment for the three and twelve months ended December 31, 2022, and $2.1 million of gain on the sale of property and equipment for

the twelve months ended December 31, 2023. Excludes $2.5 million and $0.4 million of depreciation and amortization expense for the twelve

months ended December 31, 2022 and 2023, respectively. Excludes $0.1 million and $0.5 million of stock-based compensation expense for

the three and twelve months ended December 31, 2023, respectively. |

| (4) | Reflects amortization expense associated with deferred implementation costs incurred in cloud computing arrangements. |

v3.24.0.1

Cover

|

Feb. 29, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 29, 2024

|

| Entity File Number |

0-21039

|

| Entity Registrant Name |

Strategic

Education, Inc.

|

| Entity Central Index Key |

0001013934

|

| Entity Tax Identification Number |

52-1975978

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

2303 Dulles Station Boulevard

|

| Entity Address, City or Town |

Herndon

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

20171

|

| City Area Code |

703

|

| Local Phone Number |

561-1600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

STRA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

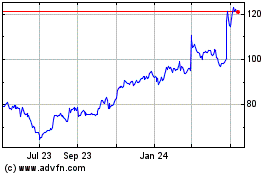

Strategic Education (NASDAQ:STRA)

Historical Stock Chart

From Dec 2024 to Jan 2025

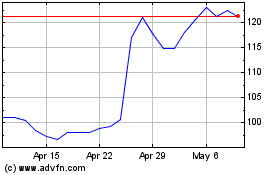

Strategic Education (NASDAQ:STRA)

Historical Stock Chart

From Jan 2024 to Jan 2025