0001386716

false

0001386716

2023-01-01

2023-06-30

0001386716

2022-12-31

0001386716

2023-06-30

0001386716

us-gaap:LongTermDebtMember

2022-12-31

0001386716

us-gaap:LongTermDebtMember

2023-06-30

0001386716

us-gaap:CapitalLeaseObligationsMember

2022-12-31

0001386716

us-gaap:CapitalLeaseObligationsMember

2023-06-30

0001386716

us-gaap:PreferredStockMember

2022-12-31

0001386716

us-gaap:PreferredStockMember

2023-06-30

0001386716

us-gaap:CommonStockMember

2022-12-31

0001386716

us-gaap:CommonStockMember

2023-06-30

0001386716

2022-01-01

2022-06-30

0001386716

us-gaap:CommonStockMember

2021-12-31

0001386716

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001386716

us-gaap:RetainedEarningsMember

2021-12-31

0001386716

2021-12-31

0001386716

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001386716

us-gaap:CommonStockMember

2022-06-30

0001386716

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001386716

us-gaap:RetainedEarningsMember

2022-06-30

0001386716

2022-06-30

0001386716

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-06-30

0001386716

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001386716

us-gaap:RetainedEarningsMember

2022-12-31

0001386716

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001386716

us-gaap:CommonStockMember

2022-01-01

2022-06-30

0001386716

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-06-30

0001386716

us-gaap:RetainedEarningsMember

2022-01-01

2022-06-30

0001386716

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-06-30

0001386716

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001386716

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-06-30

0001386716

us-gaap:RetainedEarningsMember

2023-01-01

2023-06-30

0001386716

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-06-30

0001386716

us-gaap:CommonStockMember

sblk:SongaSharesMember

2023-01-01

2023-06-30

0001386716

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001386716

us-gaap:RetainedEarningsMember

2023-06-30

0001386716

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0001386716

srt:MinimumMember

2023-06-30

0001386716

srt:MaximumMember

2023-06-30

0001386716

sblk:FleetMember

2023-06-30

0001386716

sblk:FleetMember

2023-01-01

2023-06-30

0001386716

2022-01-01

2022-12-31

0001386716

sblk:ChangeInAccountingEstimateMember

2023-01-01

2023-06-30

0001386716

sblk:InterchartShippingMember

2022-12-31

0001386716

sblk:InterchartShippingMember

2023-06-30

0001386716

sblk:StarOceanManningPhilipinesIncMember

2022-12-31

0001386716

sblk:StarOceanManningPhilipinesIncMember

2023-06-30

0001386716

sblk:CCLPoolMember

2022-12-31

0001386716

sblk:CCLPoolMember

2023-06-30

0001386716

sblk:OceanbulkMaritimeMember

2022-12-31

0001386716

sblk:OceanbulkMaritimeMember

2023-06-30

0001386716

sblk:ManagementAndDirectorsFeesMember

2022-12-31

0001386716

sblk:ManagementAndDirectorsFeesMember

2023-06-30

0001386716

sblk:IbleaShipManagementLimitedMember

2022-12-31

0001386716

sblk:IbleaShipManagementLimitedMember

2023-06-30

0001386716

sblk:InterchartShippingMember

2022-01-01

2022-06-30

0001386716

sblk:InterchartShippingMember

2023-01-01

2023-06-30

0001386716

sblk:CombineMarineLtdAndAlmaMember

2022-01-01

2022-06-30

0001386716

sblk:CombineMarineLtdAndAlmaMember

2023-01-01

2023-06-30

0001386716

sblk:OceanbulkMaritimeMember

2022-01-01

2022-06-30

0001386716

sblk:OceanbulkMaritimeMember

2023-01-01

2023-06-30

0001386716

sblk:AugusteaVesselsMember

2022-01-01

2022-06-30

0001386716

sblk:AugusteaVesselsMember

2023-01-01

2023-06-30

0001386716

sblk:IbleaShipManagementLimitedMember

2022-01-01

2022-06-30

0001386716

sblk:IbleaShipManagementLimitedMember

2023-01-01

2023-06-30

0001386716

sblk:StarOceanManningPhilipinesIncMember

2022-01-01

2022-06-30

0001386716

sblk:StarOceanManningPhilipinesIncMember

2023-01-01

2023-06-30

0001386716

sblk:VesselCostMember

2022-12-31

0001386716

sblk:AccumulatedDepreciationMember

2022-12-31

0001386716

sblk:NetBookValueMember

2022-12-31

0001386716

sblk:VesselCostMember

2023-01-01

2023-06-30

0001386716

sblk:NetBookValueMember

2023-01-01

2023-06-30

0001386716

sblk:AccumulatedDepreciationMember

2023-01-01

2023-06-30

0001386716

sblk:VesselCostMember

2023-06-30

0001386716

sblk:AccumulatedDepreciationMember

2023-06-30

0001386716

sblk:NetBookValueMember

2023-06-30

0001386716

sblk:StarPavlinaConstructiveTotalLossMember

2023-01-01

2023-06-30

0001386716

sblk:StarPavlinaWarRiskInsuranceMember

2023-01-01

2023-06-30

0001386716

sblk:StarBorealisStarPolarisMember

2023-01-01

2023-06-30

0001386716

sblk:StarBorealisMember

2023-01-01

2023-06-30

0001386716

sblk:StarCentaurusStarColumbaStarAquilaStarHerculesStarCephueusMember

2023-01-01

2023-06-30

0001386716

sblk:StarCentaurusStarColumbaStarAquilaStarHerculesStarCephueusMember

2023-01-01

2023-09-30

0001386716

sblk:FirstPriorityMortgageMember

2023-06-30

0001386716

us-gaap:LeaseAgreementsMember

2023-06-30

0001386716

sblk:SecondPriorityMortgageMember

2023-06-30

0001386716

sblk:CharterInVesselsMember

2022-12-31

0001386716

sblk:CharterInVesselsMember

2023-06-30

0001386716

sblk:CharterInVesselsMember

2022-01-01

2022-06-30

0001386716

sblk:CharterInVesselsMember

2023-01-01

2023-06-30

0001386716

sblk:OfficeRentalMember

2022-12-31

0001386716

sblk:OfficeRentalMember

2023-06-30

0001386716

sblk:OfficeRentalMember

2022-01-01

2022-06-30

0001386716

sblk:OfficeRentalMember

2023-01-01

2023-06-30

0001386716

sblk:TimeCharterInVesselsMember

2023-06-30

0001386716

sblk:FinancingLeaseMember

2023-06-30

0001386716

sblk:StandardChartered47kFacilityMember

sblk:TrancheAMember

2023-01-01

2023-01-13

0001386716

sblk:StandardChartered47kFacilityMember

sblk:TrancheBMember

2023-01-01

2023-01-13

0001386716

sblk:StandardChartered47kFacilityMember

2023-06-30

0001386716

sblk:ING310600FacilityMember

sblk:StarPavlinaMember

2023-03-10

0001386716

sblk:DNB107500FacilityMember

sblk:StarBorealisStarPolarisMember

2023-03-29

0001386716

sblk:Citi100kFacilityMember

sblk:StarColumbaMember

2023-06-27

0001386716

sblk:SEB30000Member

2023-01-01

2023-05-30

0001386716

sblk:SEB30000Member

2023-01-01

2023-03-31

0001386716

sblk:SEB30000Member

2023-03-31

0001386716

sblk:Nordea50000Member

2023-01-01

2023-07-12

0001386716

sblk:Nordea50000Member

2023-01-01

2023-03-31

0001386716

sblk:Nordea50000Member

2023-03-31

0001386716

sblk:NotLegallyRestrictedMember

2022-12-31

0001386716

sblk:NotLegallyRestrictedMember

2023-06-30

0001386716

sblk:RestrictedCashCashEquivalentsMember

2022-12-31

0001386716

sblk:RestrictedCashCashEquivalentsMember

2023-06-30

0001386716

sblk:AllBankLoansExceptFiveMember

2023-01-01

2023-06-30

0001386716

us-gaap:InterestRateSwapMember

2023-06-30

0001386716

us-gaap:InterestRateSwapMember

2023-01-01

2023-06-30

0001386716

us-gaap:DebtMember

2023-01-01

2023-06-30

0001386716

sblk:PerformanceIncentiveProgramMember

2023-06-30

0001386716

sblk:ShareRepurchaseProgramMember

sblk:OpenMarketTransactionsMember

sblk:UntilMay162023Member

2023-01-01

2023-06-30

0001386716

sblk:ShareRepurchaseProgramMember

2023-05-16

0001386716

sblk:ShareRepurchaseProgramMember

sblk:OpenMarketTransactionsMember

2023-01-01

2023-06-30

0001386716

sblk:EquityIncentivePlan2023Member

2023-05-16

0001386716

sblk:EquityIncentivePlan2023Member

2023-01-01

2023-05-16

0001386716

sblk:EquityIncentivePlan2023Member

sblk:VestNovember2023Member

2023-05-16

0001386716

sblk:EquityIncentivePlan2023Member

sblk:VestMay2024Member

2023-05-16

0001386716

sblk:EquityIncentivePlan2023Member

sblk:VestMay2026Member

2023-05-16

0001386716

sblk:FutureMinimumNonCancellableCharterRevenueMember

us-gaap:LeaseAgreementsMember

2023-06-30

0001386716

us-gaap:LeaseAgreementsMember

2023-06-30

0001386716

sblk:CharterInExpenseNewbuildingVesselsMember

us-gaap:CommitmentsMember

2023-06-30

0001386716

sblk:BWTSMember

us-gaap:CommitmentsMember

2023-06-30

0001386716

us-gaap:CommitmentsMember

2023-06-30

0001386716

srt:ScenarioForecastMember

2024-01-01

2024-06-30

0001386716

us-gaap:DerivativeMember

2022-12-31

0001386716

us-gaap:DerivativeMember

2023-06-30

0001386716

us-gaap:FairValueInputsLevel2Member

2023-06-30

0001386716

sblk:ForwardFreightAgreementsMember

2022-01-01

2022-06-30

0001386716

sblk:ForwardFreightAgreementsMember

2023-01-01

2023-06-30

0001386716

sblk:BunkerSwapsMember

2022-01-01

2022-06-30

0001386716

sblk:BunkerSwapsMember

2023-01-01

2023-06-30

0001386716

us-gaap:FairValueInputsLevel1Member

us-gaap:NondesignatedMember

sblk:ForwardFreightAgreementsMember

2022-12-31

0001386716

us-gaap:FairValueInputsLevel1Member

us-gaap:DesignatedAsHedgingInstrumentMember

sblk:ForwardFreightAgreementsMember

2022-12-31

0001386716

us-gaap:FairValueInputsLevel1Member

us-gaap:NondesignatedMember

sblk:ForwardFreightAgreementsMember

2023-06-30

0001386716

us-gaap:FairValueInputsLevel1Member

us-gaap:DesignatedAsHedgingInstrumentMember

sblk:ForwardFreightAgreementsMember

2023-06-30

0001386716

us-gaap:FairValueInputsLevel1Member

us-gaap:NondesignatedMember

sblk:BunkerSwapsMember

2022-12-31

0001386716

us-gaap:FairValueInputsLevel1Member

us-gaap:DesignatedAsHedgingInstrumentMember

sblk:BunkerSwapsMember

2022-12-31

0001386716

us-gaap:FairValueInputsLevel1Member

us-gaap:NondesignatedMember

sblk:BunkerSwapsMember

2023-06-30

0001386716

us-gaap:FairValueInputsLevel1Member

us-gaap:DesignatedAsHedgingInstrumentMember

sblk:BunkerSwapsMember

2023-06-30

0001386716

us-gaap:FairValueInputsLevel1Member

us-gaap:NondesignatedMember

sblk:DerivativeFinancialInstrumentsMember

2022-12-31

0001386716

us-gaap:FairValueInputsLevel1Member

us-gaap:DesignatedAsHedgingInstrumentMember

sblk:DerivativeFinancialInstrumentsMember

2022-12-31

0001386716

us-gaap:FairValueInputsLevel1Member

us-gaap:NondesignatedMember

sblk:DerivativeFinancialInstrumentsMember

2023-06-30

0001386716

us-gaap:FairValueInputsLevel1Member

us-gaap:DesignatedAsHedgingInstrumentMember

sblk:DerivativeFinancialInstrumentsMember

2023-06-30

0001386716

us-gaap:FairValueInputsLevel2Member

us-gaap:NondesignatedMember

us-gaap:InterestRateSwapMember

2022-12-31

0001386716

us-gaap:FairValueInputsLevel2Member

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:InterestRateSwapMember

2022-12-31

0001386716

us-gaap:FairValueInputsLevel2Member

us-gaap:NondesignatedMember

us-gaap:InterestRateSwapMember

2023-06-30

0001386716

us-gaap:FairValueInputsLevel2Member

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:InterestRateSwapMember

2023-06-30

0001386716

sblk:TimeCharterMember

2022-01-01

2022-06-30

0001386716

sblk:TimeCharterMember

2023-01-01

2023-06-30

0001386716

sblk:VoyageContractsMember

2022-01-01

2022-06-30

0001386716

sblk:VoyageContractsMember

2023-01-01

2023-06-30

0001386716

sblk:PoolingArrangementsMember

2022-01-01

2022-06-30

0001386716

sblk:PoolingArrangementsMember

2023-01-01

2023-06-30

0001386716

sblk:VoyageCharterAgreementsMember

2022-12-31

0001386716

sblk:VoyageCharterAgreementsMember

2023-06-30

0001386716

sblk:RevenueContractsMember

2023-01-01

2023-06-30

0001386716

sblk:RevenueContractsMember

2022-12-31

0001386716

sblk:RevenueContractsMember

2023-06-30

0001386716

sblk:ScrubberFittedVesselsMember

2022-01-01

2022-06-30

0001386716

sblk:ScrubberFittedVesselsMember

2023-01-01

2023-06-30

0001386716

sblk:VesselsOperatingInCCLPoolMember

2022-01-01

2022-06-30

0001386716

sblk:VesselsOperatingInCCLPoolMember

2023-01-01

2023-06-30

0001386716

us-gaap:SubsequentEventMember

2023-08-03

0001386716

us-gaap:SubsequentEventMember

2022-01-01

2023-08-03

0001386716

sblk:StarPolarisMember

us-gaap:SubsequentEventMember

2023-01-01

2023-07-07

0001386716

sblk:StarCentaurusMember

us-gaap:SubsequentEventMember

2023-01-01

2023-07-10

0001386716

sblk:StarColumbaMember

us-gaap:SubsequentEventMember

2023-01-01

2023-07-14

0001386716

sblk:StarAquilaMember

us-gaap:SubsequentEventMember

2023-01-01

2023-07-24

0001386716

sblk:Nordea50000Member

us-gaap:SubsequentEventMember

2023-01-01

2023-07-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of August 2023

Commission

File Number 001-33869

STAR BULK CARRIERS CORP.

--12-31

(Translation of registrant’s name

into English)

Star Bulk Carriers Corp.

c/o Star Bulk Management

Inc.

40 Agiou Konstantinou Street,

15124 Maroussi,

Athens, Greece

(Address of principal executive

offices)

June

30, 2023

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Indicate by check mark if

the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if

the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

INFORMATION

CONTAINED IN THIS FORM 6-K REPORT

Attached

as Exhibit 99.1 to this Form 6-K is a Management's Discussion and Analysis of Financial Condition and Results of Operations and the unaudited

interim condensed consolidated financial statements of Star Bulk Carriers Corp. (the “Company”) as of and for the six months

ended June 30, 2022 and 2023.

Attached

as Exhibit 99.2 to this Form 6-K is a copy of the Company's press release (the “Press Release”) announcing its unaudited

financial and operating results for the Company's three and six months ended June 30, 2023, which was issued on August 3, 2023.

The

information contained in Exhibit 99.1 of this Form 6-K is hereby incorporated by reference into the registrant's Registration Statements

on Form F-3 (File Nos. 333-264226, 333-232765, 333-234125 and 333-252808) and Registration Statement on Form S-8 (File No. 333-176922),

in each case to the extent not superseded by information subsequently filed or furnished (to the extent we expressly state that we incorporate

such furnished information by reference) by the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934, in each

case as amended.

CAUTIONARY

STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

This

Form 6-K, and the documents to which the Company refers in this Form 6-K, as well as information included in oral statements or other

written statements made or to be made by the Company, contain “forward-looking statements,” within the meaning of Section

27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act, with respect to

our financial condition, results of operations and business and our expectations or beliefs concerning future events. Words such as,

but not limited to, “believe,” “expect,” “anticipate,” “estimate,” “intend,”

“plan,” “targets,” “projects,” “likely,” “will,” “would,” “could”

and similar expressions or phrases may identify forward-looking statements.

All

forward-looking statements involve risks and uncertainties. The occurrence of the events described, and the achievement of the expected

results, depend on many events, some or all of which are not predictable or within our control. Actual results may differ materially

from expected results.

In

addition, important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking

statements include:

| • | general

dry bulk shipping market conditions, including fluctuations in charter rates and vessel values; |

| • | the

strength of world economies; |

| • | the

stability of Europe and the Euro; |

| • | fluctuations

in currencies, interest rates and foreign exchange rates, and the impact of the discontinuance

of remaining London Interbank Offered Rate tenors for US Dollars, or LIBOR, after June 30,

2023 on any of our debt referencing LIBOR in the interest rate; |

| • | business

disruptions due to natural and other disasters or otherwise, such as the ongoing impacts from the novel coronavirus

(“COVID-19”) (and variants that may emerge); |

| • | the

length and severity of epidemics and pandemics, including COVID-19 and its impact on the

demand for seaborne transportation in the dry bulk sector; |

| • | changes

in supply and demand in the dry bulk shipping industry, including the market for our vessels

and the number of new buildings under construction; |

| • | the

potential for technological innovation in the sector in which we operate and any corresponding

reduction in the value of our vessels or the charter income derived therefrom; |

| • | changes

in our expenses, including bunker prices, dry docking, crewing and insurance costs; |

| • | changes

in governmental rules and regulations or actions taken by regulatory authorities; |

| • | potential

liability from pending or future litigation and potential costs due to environmental damage

and vessel collisions; |

| • | the

impact of increasing scrutiny and changing expectations from investors, lenders, charterers

and other market participants with respect to our Environmental, Social and Governance (“ESG”)

practices; |

| • | our

ability to carry out our ESG initiatives and thereby meet our ESG goals and targets including

as set forth under Item 4. Information on the Company—B. Business Overview—Our

ESG Performance in the Company's annual report on Form 20-F for the fiscal year ended 2022; |

| • | new

environmental regulations and restrictions, whether at a global level stipulated by the International

Maritime Organization, and/or regional/national imposed by regional authorities such as the

European Union or individual countries; |

| • | potential

cyber-attacks which may disrupt our business operations; |

| • | general

domestic and international political conditions or events, including “trade wars”

and the ongoing conflict between Russia and Ukraine; |

| • | the

impact on our common shares and reputation if our vessels were to call on ports located in

countries that are subject to restrictions imposed by the U.S. or other governments; |

| • | our

ability to successfully compete for, enter into and deliver our vessels under time charters

or other employment arrangements for our existing vessels after our current charters expire

and our ability to earn income in the spot market; |

| • | potential

physical disruption of shipping routes due to accidents, climate-related reasons (acute and

chronic), political events, public health threats, international hostilities and instability,

piracy or acts by terrorists; |

| • | the

availability of financing and refinancing; |

| • | the

failure of our contract counterparties to meet their obligations; |

| • | our

ability to meet requirements for additional capital and financing to grow our business; |

| • | the

impact of our indebtedness and the compliance with the covenants included in our debt agreements; |

| • | vessel

breakdowns and instances of off-hire; |

| • | potential

exposure or loss from investment in derivative instruments; |

| • | potential

conflicts of interest involving our Chief Executive Officer, his family and other members

of our senior management; |

| • | our

ability to complete acquisition transactions as and when planned and upon the expected terms; |

| • | the

impact of port or canal congestion or disruptions; and |

| • | the

risk factors and other factors referred to in the Company's reports filed with or furnished

to the U.S. Securities and Exchange Commission (“SEC”). |

Consequently, all

of the forward-looking statements we make in this document are qualified by the information contained or referred to herein, including,

but not limited to, (i) the information contained under this heading and (ii) the information disclosed in the Company's annual report

on Form 20-F for the fiscal year ended 2022, filed with the SEC on March 7, 2023.

You

should carefully consider the cautionary statements contained or referred to in this section in connection with any subsequent written

or oral forward-looking statements that may be issued by us or persons acting on our behalf. Except as required by law, the Company undertakes

no obligation to update any of these forward-looking statements, whether as a result of new information, future events, a change in the

Company’s views or expectations or otherwise, except as required by applicable law. New factors emerge from time to time, and it

is not possible for the Company to predict all of these factors. Further, the Company cannot assess the impact of each such factor on

its business or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those

contained in any forward-looking statement.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Dated:

August 3, 2023

| |

|

|

|

|

COMPANY NAME |

| |

|

|

|

|

|

| |

|

|

|

|

By: |

/s/

Simos Spyrou |

| |

|

|

|

|

|

Name:

Simos Spyrou |

| |

|

|

|

|

|

Title:

Co-Chief Financial Officer |

| |

|

|

|

|

|

| |

|

|

|

|

|

Exhibit

99.1

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The

following is a discussion of the financial condition and results of operations of Star Bulk Carriers Corp. (“Star Bulk”)

for the six-month periods ended June 30, 2022 and 2023. Unless otherwise specified herein, references to the “Company,” “we,”

“us” or “our” shall include Star Bulk and its subsidiaries. You should read the following discussion and analysis

together with the unaudited interim condensed consolidated financial statements and related notes included elsewhere herein. For additional

information relating to our management’s discussion and analysis of financial conditions and results of operations, please see

our Annual Report on Form 20-F for the year ended December 31, 2022, which was filed with the U.S. Securities and Exchange Commission

(the “Commission”) on March 7, 2023 (the “2022 Annual Report”). Unless otherwise defined herein, capitalized

words and expressions used herein shall have the same meanings ascribed to them in the 2022 Annual Report. This discussion includes forward-looking

statements which, although based on assumptions that we consider reasonable, are subject to risks and uncertainties which could cause

actual events or conditions to differ materially from those currently anticipated and expressed or implied by such forward-looking statements.

Overview

We

are a global shipping company providing worldwide seaborne transportation solutions in the dry bulk sector. Our vessels transport major

bulks, which include iron ore, coal and grain, and minor bulks which include bauxite, fertilizers and steel products. We were incorporated

in the Marshall Islands on December 13, 2006 and, on December 3, 2007, we commenced operations when we took delivery of our first vessel.

We maintain offices in Athens, New York, Limassol, Singapore and Germany. Our common shares trade on the Nasdaq Global Select Market

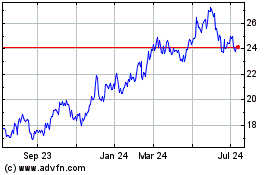

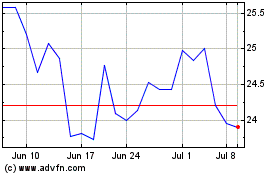

under the symbol “SBLK.”

Our

Fleet

During

the first quarter of 2023, we agreed with the war risk insurers of the vessel Star Pavlina, that the vessel became a constructive

total loss on February 24, 2023, given its prolonged detainment in Ukraine following the commencement of Russia’s military action

against Ukraine on February 24, 2022.

During the six-month period ended June 30, 2023, we decided

to sell opportunistically certain vessels and renew our fleet taking advantage of the elevated vessel market values.

In

particular, on March 24, 2023, we agreed to sell the vessels Star Borealis and Star Polaris which were delivered to their

new owner on May 4, 2023 and on July 7, 2023, respectively.

In

addition, on May 26, 2023, we agreed to sell the vessels Star Centaurus, Star Columba, Star Aquila, Star Hercules and Star Cepheus.

Star Centaurus, Star Columba and Star Aquila were delivered to their new owner in July 2023 and it is expected that the remaining

two vessels will be delivered within August 2023.

As

of August 2, 2023 and as adjusted for the delivery of Star Hercules and Star Cepheus, as further discussed above, our

owned fleet consisted of 120 operating vessels with an aggregate carrying capacity of approximately 13.3 million dwt, consisting

of Newcastlemax, Capesize, Post Panamax, Kamsarmax, Panamax, Ultramax and Supramax vessels.

The

following tables present summary information relating to our fleet as of August 2, 2023 (as adjusted for the delivery of Star Hercules

and Star Cepheus to their new owner as discussed above):

Operating

Fleet:

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

Wholly

Owned Subsidiaries |

Vessel

Name |

DWT |

Date

Delivered to Star Bulk |

Year

Built |

| 1 |

Pearl Shiptrade LLC |

Gargantua

(1) |

209,529 |

April

2, 2015 |

2015 |

| 2 |

Star Ennea LLC |

Star

Gina 2GR |

209,475 |

February

26, 2016 |

2016 |

| 3 |

Coral Cape Shipping LLC |

Maharaj

(1) |

209,472 |

July

15, 2015 |

2015 |

| 4 |

Sea Diamond Shipping LLC |

Goliath

(1) |

209,537 |

July

15, 2015 |

2015 |

| 5 |

Star Castle II LLC |

Star

Leo |

207,939 |

May

14, 2018 |

2018 |

| 6 |

ABY Eleven LLC |

Star

Laetitia |

207,896 |

August

3, 2018 |

2017 |

| 7 |

Domus Shipping LLC |

Star

Ariadne |

207,812 |

March

28, 2017 |

2017 |

| 8 |

Star Breezer LLC |

Star

Virgo |

207,810 |

March

1, 2017 |

2017 |

| 9 |

Star Seeker LLC |

Star

Libra |

207,765 |

June

6, 2016 |

2016 |

| 10 |

ABY Nine LLC |

Star

Sienna |

207,721 |

August

3, 2018 |

2017 |

| 11 |

Clearwater Shipping LLC |

Star

Marisa |

207,709 |

March

11 2016 |

2016 |

| 12 |

ABY Ten LLC |

Star

Karlie |

207,566 |

August

3, 2018 |

2016 |

| 13 |

Star Castle I LLC |

Star

Eleni |

207,555 |

January

3, 2018 |

2018 |

| 14 |

Festive Shipping LLC |

Star

Magnanimus |

207,526 |

March

26, 2018 |

2018 |

| 15 |

New Era II Shipping LLC |

Debbie

H |

206,861 |

May

28, 2019 |

2019 |

| 16 |

New Era III Shipping LLC |

Star

Ayesha |

206,852 |

July

15, 2019 |

2019 |

| 17 |

New Era I Shipping LLC |

Katie

K |

206,839 |

April

16, 2019 |

2019 |

| 18 |

Cape Ocean Maritime LLC |

Leviathan

|

182,511 |

September 19,

2014 |

2014 |

| 19 |

Cape Horizon Shipping LLC |

Peloreus

|

182,496 |

July 22,

2014 |

2014 |

| 20 |

Star Nor I LLC |

Star

Claudine |

181,258 |

July

6, 2018 |

2011 |

| 21 |

Star Nor II LLC |

Star

Ophelia |

180,716 |

July

6, 2018 |

2010 |

| 22 |

Sandra Shipco LLC |

Star

Pauline |

180,274 |

December

29, 2014 |

2008 |

| 23 |

Christine Shipco LLC |

Star

Martha |

180,274 |

October

31, 2014 |

2010 |

| 24 |

Pacific Cape Shipping LLC |

Pantagruel

|

180,181 |

July 11,

2014 |

2004 |

| 25 |

Star Nor III LLC |

Star

Lyra |

179,147 |

July

6, 2018 |

2009 |

| 26 |

Star Regg V LLC |

Star

Borneo |

178,978 |

January

26, 2021 |

2010 |

| 27 |

Star Regg VI LLC |

Star

Bueno |

178,978 |

January

26, 2021 |

2010 |

| 28 |

Star Regg IV LLC |

Star

Marilena |

178,978 |

January

26, 2021 |

2010 |

| 29 |

Star Regg I LLC |

Star

Marianne |

178,906 |

January

14, 2019 |

2010 |

| 30 |

Star Regg II LLC |

Star

Janni |

178,978 |

January

7, 2019 |

2010 |

| 31 |

Star Trident V LLC |

Star

Angie |

177,931 |

October

29, 2014 |

2007 |

| 32 |

Sky Cape Shipping LLC |

Big

Fish |

177,662 |

July 11,

2014 |

2004 |

| 33 |

Global Cape Shipping LLC |

Kymopolia

|

176,990 |

July 11,

2014 |

2006 |

| 34 |

Star Trident XXV LLC |

Star

Triumph |

176,343 |

December

8, 2017 |

2004 |

| 35 |

ABY Fourteen LLC |

Star

Scarlett |

175,649 |

August

3, 2018 |

2014 |

| 36 |

ABY Fifteen LLC |

Star

Audrey |

175,125 |

August

3, 2018 |

2011 |

| 37 |

Sea Cape Shipping LLC |

Big

Bang |

174,109 |

July 11,

2014 |

2007 |

| 38 |

ABY I LLC |

Star

Paola |

115,259 |

August

3, 2018 |

2011 |

| |

|

|

|

|

|

| |

Wholly

Owned Subsidiaries |

Vessel

Name |

DWT |

Date

Delivered to Star Bulk |

Year

Built |

| 39 |

ABM One LLC |

Star

Eva |

106,659 |

August

3, 2018 |

2012 |

| 40 |

Nautical Shipping LLC |

Amami

|

98,681 |

July 11,

2014 |

2011 |

| 41 |

Majestic Shipping LLC |

Madredeus

|

98,681 |

July 11,

2014 |

2011 |

| 42 |

Star Sirius LLC |

Star

Sirius |

98,681 |

March 7,

2014 |

2011 |

| 43 |

Star Vega LLC |

Star

Vega |

98,681 |

February 13,

2014 |

2011 |

| 44 |

ABY II LLC |

Star

Aphrodite |

92,006 |

August

3, 2018 |

2011 |

| 45 |

Augustea Bulk Carrier LLC |

Star

Piera |

91,951 |

August

3, 2018 |

2010 |

| 46 |

Augustea Bulk Carrier LLC |

Star

Despoina |

91,945 |

August

3, 2018 |

2010 |

| 47 |

Star Trident I LLC |

Star

Kamila |

82,769 |

September 3,

2014 |

2005 |

| 48 |

Star Nor IV LLC |

Star

Electra |

83,494 |

July

6, 2018 |

2011 |

| 49 |

Star Alta I LLC |

Star

Angelina |

82,981 |

December

5, 2014 |

2006 |

| 50 |

Star Alta II LLC |

Star

Gwyneth |

82,790 |

December

5, 2014 |

2006 |

| 51 |

Star Nor VI LLC |

Star

Luna |

82,687 |

July

6, 2018 |

2008 |

| 52 |

Star Nor V LLC |

Star

Bianca |

82,672 |

July

6, 2018 |

2008 |

| 53 |

Grain Shipping LLC |

Pendulum

|

82,619 |

July 11,

2014 |

2006 |

| 54 |

Star Trident XIX LLC |

Star

Maria |

82,598 |

November

5, 2014 |

2007 |

| 55 |

Star Trident XII LLC |

Star

Markella |

82,594 |

September 29,

2014 |

2007 |

| 56 |

ABY Seven LLC |

Star

Jeannette |

82,566 |

August

3, 2018 |

2014 |

| 57 |

Star Trident IX LLC |

Star

Danai |

82,574 |

October

21, 2014 |

2006 |

| 58 |

Star Sun I LLC |

Star

Elizabeth |

82,403 |

May

25, 2021 |

2021 |

| 59 |

Star Trident XI LLC |

Star

Georgia |

82,298 |

October

14, 2014 |

2006 |

| 60 |

Star Trident VIII LLC |

Star

Sophia |

82,269 |

October

31, 2014 |

2007 |

| 61 |

Star Trident XVI LLC |

Star

Mariella |

82,266 |

September 19,

2014 |

2006 |

| 62 |

Star Trident XIV LLC |

Star

Moira |

82,257 |

November

19, 2014 |

2006 |

| 63 |

Star Trident X LLC |

Star

Renee |

82,221 |

December

18, 2014 |

2006 |

| 64 |

Star Trident XIII LLC |

Star

Laura |

82,209 |

December

8, 2014 |

2006 |

| 65 |

Star Trident XV LLC |

Star

Jennifer |

82,209 |

April

15, 2015 |

2006 |

| 66 |

Star Nor VIII LLC |

Star

Mona |

82,188 |

July

6, 2018 |

2012 |

| 67 |

Star Trident II LLC |

Star

Nasia |

82,220 |

August 29,

2014 |

2006 |

| 68 |

Star Nor VII LLC |

Star

Astrid |

82,158 |

July

6, 2018 |

2012 |

| 69 |

Star Trident XVII LLC |

Star

Helena |

82,187 |

December

29, 2014 |

2006 |

| 70 |

Star Trident XVIII LLC |

Star

Nina |

82,224 |

January

5, 2015 |

2006 |

| 71 |

Waterfront Two LLC |

Star

Alessia |

81,944 |

August

3, 2018 |

2017 |

| 72 |

Star Nor IX LLC |

Star

Calypso |

81,918 |

July

6, 2018 |

2014 |

| 73 |

Star Elpis LLC |

Star

Suzanna |

81,711 |

May

15, 2017 |

2013 |

| 74 |

Star Gaia LLC |

Star

Charis |

81,711 |

March

22, 2017 |

2013 |

| 75 |

Mineral Shipping LLC |

Mercurial

Virgo |

81,545 |

July 11,

2014 |

2013 |

| 76 |

Star Nor X LLC |

Stardust |

81,502 |

July

6, 2018 |

2011 |

| 77 |

Star Nor XI LLC |

Star

Sky |

81,466 |

July

6, 2018 |

2010 |

| 78 |

Star Zeus VI LLC |

Star

Lambada |

81,272 |

March

16, 2021 |

2016 |

| 79 |

Star Zeus I LLC |

Star

Capoeira |

81,253 |

March

16, 2021 |

2015 |

| 80 |

Star Zeus II LLC |

Star

Carioca |

81,262 |

March

16, 2021 |

2015 |

| 81 |

Star Zeus VII LLC |

Star

Macarena |

81,198 |

March

6, 2021 |

2016 |

| 82 |

ABY III LLC |

Star

Lydia |

81,187 |

August

3, 2018 |

2013 |

| 83 |

ABY IV LLC |

Star

Nicole |

81,120 |

August

3, 2018 |

2013 |

| 84 |

ABY Three LLC |

Star

Virginia |

81,061 |

August

3, 2018 |

2015 |

| |

|

|

|

|

|

| |

Wholly

Owned Subsidiaries |

Vessel

Name |

DWT |

Date

Delivered to Star Bulk |

Year

Built |

| 85 |

Star Nor XII LLC |

Star

Genesis |

80,705 |

July

6, 2018 |

2010 |

| 86 |

Star Nor XIII LLC |

Star

Flame |

80,448 |

July

6, 2018 |

2011 |

| 87 |

Star Trident III LLC |

Star

Iris |

76,466 |

September 8,

2014 |

2004 |

| 88 |

Star Trident XX LLC |

Star

Emily |

76,417 |

September 16,

2014 |

2004 |

| 89 |

Orion Maritime LLC |

Idee

Fixe |

63,458 |

March

25, 2015 |

2015 |

| 90 |

Primavera Shipping LLC |

Roberta |

63,426 |

March

31, 2015 |

2015 |

| 91 |

Success Maritime LLC |

Laura |

63,399 |

April

7, 2015 |

2015 |

| 92 |

Star Zeus III LLC |

Star

Athena |

63,371 |

May

19, 2021 |

2015 |

| 93 |

Ultra Shipping LLC |

Kaley |

63,283 |

June

26, 2015 |

2015 |

| 94 |

Blooming Navigation LLC |

Kennadi

(1) |

63,262 |

January

8, 2016 |

2016 |

| 95 |

Jasmine Shipping LLC |

Mackenzie

(1) |

63,226 |

March

2, 2016 |

2016 |

| 96 |

Star Lida I Shipping LLC |

Star

Apus |

63,123 |

July

16, 2019 |

2014 |

| 97 |

Star Zeus V LLC |

Star

Bovarius |

61,602 |

March

16, 2021 |

2015 |

| 98 |

Star Zeus IV LLC |

Star

Subaru |

61,571 |

March

16, 2021 |

2015 |

| 99 |

Star Nor XV LLC |

Star

Wave |

61,491 |

July

6, 2018 |

2017 |

| 100 |

Star Challenger I LLC |

Star

Challenger (1) |

61,462 |

December 12,

2013 |

2012 |

| 101 |

Star Challenger II

LLC |

Star

Fighter (1) |

61,455 |

December 30,

2013 |

2013 |

| 102 |

Aurelia Shipping LLC |

Honey

Badger (1) |

61,320 |

February

27, 2015 |

2015 |

| 103 |

Star Axe II LLC |

Star

Lutas (1) |

61,347 |

January

6, 2016 |

2016 |

| 104 |

Rainbow Maritime LLC |

Wolverine

(1) |

61,292 |

February

27, 2015 |

2015 |

| 105 |

Star Axe I LLC |

Star

Antares (1) |

61,258 |

October

9, 2015 |

2015 |

| 106 |

ABY Five LLC |

Star

Monica |

60,935 |

August

3, 2018 |

2015 |

| 107 |

Star Asia I LLC |

Star

Aquarius |

60,916 |

July

22, 2015 |

2015 |

| 108 |

Star Asia II LLC |

Star

Pisces |

60,916 |

August

7, 2015 |

2015 |

| 109 |

Star Nor XIV LLC |

Star

Glory |

58,680 |

July

6, 2018 |

2012 |

| 110 |

Star Lida XI Shipping LLC |

Star

Pyxis |

56,615 |

August

19, 2019 |

2013 |

| 111 |

Star Lida VIII Shipping

LLC |

Star

Hydrus |

56,604 |

August

8, 2019 |

2013 |

| 112 |

Star Lida IX Shipping LLC |

Star

Cleo |

56,582 |

July

15, 2019 |

2013 |

| 113 |

Star Trident VII LLC |

Diva |

56,582 |

July

24, 2017 |

2011 |

| 114 |

Star Lida X Shipping LLC |

Star

Pegasus |

56,540 |

July

15, 2019 |

2013 |

| 115 |

Star Lida V Shipping LLC |

Star

Dorado |

56,507 |

July

16, 2019 |

2013 |

| 116 |

Star Regg III LLC |

Star

Bright |

55,569 |

October

10, 2018 |

2010 |

| 117 |

Glory Supra Shipping LLC |

Strange

Attractor |

55,742 |

July 11,

2014 |

2006 |

| 118 |

Star Omicron LLC |

Star

Omicron |

53,489 |

April 17,

2008 |

2005 |

| 119 |

Star Zeta LLC |

Star

Zeta |

52,994 |

January 2,

2008 |

2003 |

| 120 |

Star Theta LLC |

Star

Theta |

52,425 |

December 6,

2007 |

2003 |

| |

|

Total

dwt |

13,347,973 |

|

|

| (1) | Subject

to a sale and leaseback financing transaction as further described in Note 7 to our consolidated

financial statements included in the 2022 Annual Report. |

In

addition, we have entered into long-term charter-in arrangements with respect to four Kamsarmax newbuildings and two Ultramax newbuildings

which are expected to be delivered during 2024 with an approximate duration of seven years per vessel plus optional years. Furthermore,

in November 2021 we took delivery of the Capesize vessel Star Shibumi, under a long-term charter-in contract for a period up to

November 2028. Please see below a summary table of the respective contracts:

| # |

Name |

DWT |

Built |

Yard |

Country |

Delivery

/ Estimated Delivery (1) |

Minimum

Period |

| 1 |

Star Shibumi |

180,000 |

2021 |

JMU |

Japan |

November

2021 |

November

2028 |

| 2 |

NB Kamsarmax # 1 |

82,000 |

2024 |

Tsuneishi |

Japan |

Q1

- 2024 |

7

years |

| 3 |

NB Kamsarmax # 2 |

82,000 |

2024 |

Tsuneishi |

Japan |

Q4

- 2024 |

7

years |

| 4 |

NB Kamsarmax # 3 |

82,000 |

2024 |

JMU |

Japan |

Q2

- 2024 |

7

years |

| 5 |

NB Kamsarmax # 4 |

82,000 |

2024 |

JMU |

Japan |

Q3

- 2024 |

7

years |

| 6 |

NB Ultramax #1 |

66,000 |

2024 |

Tsuneishi,

Cebu |

Philippines |

Q1

- 2024 |

7

years |

| 7 |

NB Ultramax #2 |

66,000 |

2024 |

Tsuneishi,

Cebu |

Philippines |

Q4

- 2024 |

7

years |

| |

|

640,000 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

| (1)

We have also entered into a charter-in agreement for the vessel Tai Kudos which is expected to be redelivered to its owners in October

2023. |

Liquidity

and Capital Resources

Our

principal sources of funds have been cash flow from operations, equity offerings, borrowings under secured credit facilities, debt securities

or bareboat lease financings and proceeds from vessel sales. Our principal uses of funds have been capital expenditures to establish

and grow our fleet, maintain the quality of our dry bulk carriers, comply with international shipping standards, environmental laws and

regulations, fund working capital requirements, make principal and interest payments on outstanding indebtedness and make dividend payments

when approved by the Board of Directors.

Our

short-term liquidity requirements include paying operating costs, funding working capital requirements and the short-term equity portion

of the cost of vessel acquisitions and vessel upgrades, interest and principal payments on outstanding indebtedness and maintaining cash

reserves to strengthen our position against adverse fluctuations in operating cash flows. Our primary source of short-term liquidity

is cash generated from operating activities, available cash balances and portions from new debt and refinancings as well as equity financings.

Our

medium- and long-term liquidity requirements are funding the equity portion of our newbuilding vessel installments and secondhand vessel

acquisitions, if any, funding required payments under our vessel financing and other financing agreements and paying cash dividends when

declared. Sources of funding for our medium- and long-term liquidity requirements include cash flows from operations, new debt and refinancings

or bareboat lease financings, sale and lease back arrangements, equity issuances and vessel sales. Please

also refer to Note 12 to our unaudited interim condensed consolidated financial statements, included elsewhere herein, for further discussion

on our commitments as of June 30, 2023.

As

of August 2, 2023, we had total cash of $456.5 million and outstanding borrowings (including bareboat lease financing) of $1,181.7 million,

as adjusted for the proceeds from vessel sales and repayment of loans/leases, as further described in Notes 8 and 15 to our unaudited

interim condensed consolidated financial statements as of June 30, 2023, included herein. In addition, following a number of interest

rates swaps that we have entered into, we have converted a total of $349.3 million of such debt from floating to an average fixed rate

of 42 bps with average maturity of 1.3 year.

Our

debt agreements contain financial covenants and undertakings requiring us to maintain various ratios. A summary of these terms is included

in Note 8 of the Company’s consolidated financial statements for the year ended December 31, 2022, included in the 2022 Annual

Report.

We

believe that our current cash balance and our operating cash flows to be generated over the short-term period will be sufficient to meet

our liquidity needs for the foreseeable future (and at least through the end of the third quarter of 2024), including funding the operations

of our fleet, capital expenditure requirements and any other present financial requirements, including the cost for the installation

of ballast water treatment systems (“BWTS”) and Energy Saving Devices (“ESD”). In addition, we may sell and issue

shares under our two effective At-the-Market offering programs of up to $150.0 million at any time and from time to time. As of August

2, 2023, cumulative gross proceeds under our At-the-Market offering programs were $20.2 million. We may seek additional indebtedness

to finance future vessel acquisitions in order to maintain our cash position or to refinance our existing debt on more favorable terms.

Our practice has been to fund the cash portion of the acquisition of dry bulk carriers using a combination of funds from operations and

bank debt or lease financing secured by mortgages or title of ownership on our dry bulk carriers held by the relevant lenders, respectively.

We may also use the proceeds from potential equity or debt offerings to finance future vessel acquisitions. Our business is capital-intensive

and its future success will depend on our ability to maintain a high-quality fleet through the acquisition of newer dry bulk carriers

and the selective sale of older dry bulk carriers. These acquisitions will be principally subject to management’s expectation of

future market conditions as well as our ability to acquire dry bulk carriers on favorable terms. However our ability to obtain bank or

lease financing, to refinance our existing debt or to access the capital markets for offerings in the future, may be limited by our financial

condition at the time of any such financing or offering, including the market value of our fleet, as well as by adverse market conditions

resulting from, among other things, general economic conditions, weakness in the financial and equity markets and contingencies and uncertainties

that are beyond our control. Our liquidity is also impacted by our dividend policy, as discussed below.

The

2019 Novel Coronavirus (“COVID-19”) pandemic resulted in a significant reduction in global economic activity and extreme

volatility in the global financial market. During the second half of 2022, freight rates declined from highs seen earlier in the year as China’s

COVID-related lockdown measures intensified. The end of the zero COVID-19 policy by the Chinese authorities during the first quarter of

2023 fueled markets with optimism that resulted in the rebound of freight levels. During the second quarter of 2023, freight rates have

receded, as despite the uplift of the exporting activity, the relaxation of COVID-19 related inefficiencies resulted in the increase of

effective ship supply. Concurrently, Chinese macro data are implying a stalling economy, while the outlook of the western economies is getting

worse as a result of the tightening cycle that central banks are implementing in order to fight inflation. There continues to be a high

level of uncertainty relating to how the COVID-19 pandemic will evolve, the evolution and emergence of existing and future variants,

the availability of vaccines and their global deployment, the development of effective treatments, the imposition of effective public

safety and other protective measures and the public's and government's responses to such measures. As a result of the COVID-19 pandemic

restrictions imposed since 2020, additional crew expenses have been incurred. An increase in the severity or duration or a resurgence

of the COVID-19 pandemic and any significant disruption of wide-scale vaccine distribution could have a material adverse effect on our

business, results of operations, cash flows, financial condition, the carrying value of our assets, the fair values of our vessels, and

our ability to pay dividends.

Dividend

Policy

Our

dividend policy is described in Item 8. Financial Information-A. Consolidated statements and other financial information—Dividend

Policy of our 2022 Annual Report.

On

August 3, 2023, pursuant to our dividend policy, our Board of Directors declared a quarterly cash dividend of $0.40 per share, payable

on or about September 7, 2023 to all shareholders of record as of August 22, 2023. The ex-dividend date is expected to be August 21,

2023.

Since

Star Bulk is a holding company with no material assets other than the shares of its subsidiaries through which it conducts its

operations, Star Bulk’s ability to pay dividends in the future will depend on its subsidiaries’ ability to distribute

funds to it. Any future dividends declared will be at the discretion and remain subject to approval of our Board of Directors each

quarter after its review of our financial condition and other factors, including but not limited to our earnings, the prevailing

charter market conditions, capital requirements, limitations under our debt agreements and applicable provisions of Marshall Islands

law, which generally prohibits the payment of dividends other than from operating surplus or while a company is insolvent or would

be rendered insolvent upon the payment of such dividend. Star Bulk’s dividend policy and declaration and payment of dividends

may be changed at any time and are subject to legally available funds and our Board of Directors’ determination that each

declaration and payment is at the time in the best interests of Star Bulk and its shareholders after its review of our

financial performance. There can be no assurance that our Board of Directors will declare or pay any dividend in the

future.

Other

Recent Developments

Please

refer to Note 15 to our unaudited interim condensed consolidated financial statements, included elsewhere herein, for developments that

took place after June 30, 2023.

Operating

Results

Factors

Affecting Our Results of Operations

We

deploy our vessels on a mix of short to medium time charters or voyage charters, contracts of affreightment or in dry bulk carrier pools,

according to our assessment of market conditions. We adjust the mix of these charters to take advantage of the relatively stable cash

flow and high utilization rates associated with medium to long-term time charters, or to profit from attractive spot charter rates during

periods of strong charter market conditions, or to maintain employment flexibility that the spot market offers during periods of weak

charter market conditions. The following table reflects certain operating data of our fleet, including our ownership days and TCE rates,

which we believe are important measures for analyzing trends in our results of operations, for the periods indicated:

| |

Six-month

period ended June 30, |

| (TCE

rates expressed in U.S. Dollars) |

2022 |

|

2023 |

| Average number

of vessels (1) |

|

128.0 |

|

|

127.0 |

| Number of vessels (2) |

|

128 |

|

|

126 |

| Average age of operational

fleet (in years) (3) |

|

10.4 |

|

|

11.4 |

| Ownership days (4) |

|

23,169 |

|

|

22,982 |

| Available days (5) |

|

22,211 |

|

|

22,082 |

| Charter-in days (6) |

|

506 |

|

|

429 |

| Time Charter Equivalent

Rate (TCE rate) (7) |

$ |

28,924 |

|

$ |

15,020 |

____________________

| (1) | Average

number of vessels is the number of vessels that constituted our owned fleet for the relevant

period, as measured by the sum of the number of days each operating vessel was a part of

our owned fleet during the period divided by the number of calendar days in that period. |

| (2) | As

of the last day of the periods reported. |

| (3) | Average

age of our operational fleet is calculated as of the end of each period. |

| (4) | Ownership

days are the total calendar days each vessel in the fleet was owned by us for the relevant

period, including vessels subject to sale and leaseback transactions and finance leases. |

| (5) | Available

days for the fleet are the Ownership days after subtracting off-hire days for major repairs,

dry docking or special or intermediate surveys, change of management and for vessels’ improvements and upgrades.

The available days for each period presented were also decreased by off-hire days relating

to disruptions in connection with crew changes as a result of COVID-19. Available Days as

presented above may not necessarily be comparable to Available Days of other companies due

to differences in methods of calculation. |

| (6) | Charter-in

days are the total days that we charter-in vessels not owned by us. |

| (7) | Time

charter equivalent rate represents the weighted average daily TCE rates of our operating

fleet (including owned fleet and fleet under charter-in arrangements). TCE rate is a measure

of the average daily net revenue performance of our vessels. Our method of calculating TCE

rate is determined by dividing (a) TCE Revenues, which consists of: voyage revenues (net

of voyage expenses, charter-in hire expense, amortization of fair value of above/below market

acquired time charter agreements, if any, as well as adjusted for the impact of realized

gain/(loss) on forward freight agreements (“FFAs”) and bunker swaps) by (b) Available

days for the relevant time period. Available days do not include the Charter-in days as per

the relevant definitions provided above. Voyage expenses primarily consist of port, canal

and fuel costs that are unique to a particular voyage, which would otherwise be paid by the

charterer under a time charter contract, as well as commissions. In the calculation of TCE

Revenues, we also include the realized gain/(loss) on FFAs and bunker swaps as we believe

that this method better reflects the chartering result of our fleet and is more comparable

to the method used by our peers. TCE Revenues and TCE rate, which are non-GAAP measures,

provide additional meaningful information in conjunction with voyage revenues, the most directly

comparable GAAP measure, because they assist our management in making decisions regarding

the deployment and use of our vessels and because we believe that they provide useful information

to investors regarding our financial performance. TCE rate is a standard shipping industry

performance measure used primarily to compare period-to-period changes in a shipping company's

performance despite changes in the mix of charter types (i.e., voyage charters, time charters,

bareboat charters and pool arrangements) under which its vessels may be employed between

the periods. TCE Revenues and TCE rate, as presented above, may not necessarily be comparable

to those of other companies due to differences in methods of calculation. |

The

following table reflects the calculation of our TCE rates as discussed in footnote (7) above. The table presents reconciliation of TCE

Revenues to voyage revenues as reflected in the unaudited interim condensed consolidated income statements.

| |

Six-month

period ended June 30, |

| |

2022 |

|

2023 |

| (In thousands

of U.S. Dollars, except as otherwise stated) |

|

|

|

|

|

| Voyage revenues |

$ |

778,217 |

|

$ |

462,721 |

| Less: |

|

|

|

|

|

| Voyage expenses |

|

(119,785) |

|

|

(128,635) |

| Charter-in hire expenses |

|

(12,950) |

|

|

(9,695) |

| Realized gain/(loss) on FFAs/bunker swaps |

|

(3,062) |

|

|

7,272 |

| Time

charter equivalent revenues (“TCE Revenues”) |

$ |

642,420 |

|

$ |

331,663 |

| Available days |

|

22,211 |

|

|

22,082 |

| Daily

time charter equivalent rate (“TCE rate”) |

$ |

28,924 |

|

$ |

15,020 |

Voyage

Revenues

Voyage

revenues are driven primarily by the number of vessels in our operating fleet, the duration of our charters, the number of charter-in

days, the amount of daily charter hire or freight rates that our vessels earn under time and voyage charters, respectively, which, in

turn, are affected by a number of factors, including our decisions relating to vessel acquisitions and disposals, the number of vessels

chartered-in, the amount of time that we spend positioning our vessels, the amount of time that our vessels spend in dry dock undergoing

repairs, maintenance and upgrade work, the age, condition and specifications of our vessels, levels of supply and demand in the seaborne

transportation market.

Vessels

operating on time charters for a certain period of time provide more predictable cash flows over that period of time, but can yield lower

profit margins than vessels operating in the spot charter market during periods characterized by favorable market conditions. Vessels

operating in the spot charter market generate revenues that are less predictable, but may enable us to capture increased profit margins

during periods of improvements in charter rates, although we would be exposed to the risk of declining vessel rates, which may have a

materially adverse impact on our financial performance. If we employ vessels on period time charters, future spot market rates may be

higher or lower than the rates at which we have employed our vessels on period time charters.

Voyage

Expenses

Voyage

expenses may include port and canal charges, agency fees, fuel (bunker) expenses and brokerage commissions payable to related and third

parties. Voyage expenses are incurred for our owned and chartered-in vessels during voyage charters or when the vessel is unemployed.

Bunker expenses, port and canal charges primarily increase in periods during which vessels are employed on voyage charters because these

expenses are paid by the owners. Our voyage expenses primarily consist of bunkers cost, port expenses and commissions paid in connection

with the chartering of our vessels.

Charter-in

Hire Expenses

Charter-in

hire expenses represent hire expenses for chartering-in third and related party vessels, either under time charters or voyage charters.

Vessel

Operating Expenses

Vessel

operating expenses include crew wages and related costs, the cost of insurance and vessel registry, expenses relating to repairs and

maintenance, the cost of spares and consumable stores, tonnage taxes, regulatory fees, vessel scrubbers and BWTS maintenance expenses,

lubricants and other miscellaneous expenses. Other factors beyond our control, some of which may affect the shipping industry in general,

including for instance, developments relating to market prices for crew wages, lubricants and insurance, may also cause these expenses

to increase.

Dry

Docking Expenses

Dry

docking expenses relate to regularly scheduled intermediate survey or special survey dry docking necessary to preserve the quality of

our vessels as well as to comply with international shipping standards and environmental laws and regulations. Dry docking expenses can

vary according to the age of the vessel and its condition, the location where the dry docking takes place, shipyard availability and

the number of days the vessel is under dry dock. We utilize the direct expense method, under which we expense all dry docking costs as

incurred.

Depreciation

We

depreciate our vessels on a straight-line basis over their estimated useful lives, which is determined to be 25 years from the date of

their initial delivery from the shipyard. Depreciation is calculated based on a vessel’s cost less the estimated residual value.

Effective January 1, 2023, following management’s reassessment of the residual value of our vessels, we increased the estimated

scrap rate per lightweight ton from $300 to $400. The current value of $400 was based on the historical average demolition prices prevailing

in the market in the last 20 years. The change in this accounting estimate, which pursuant to ASC 250 “Accounting Changes and Error

Corrections” was applied prospectively and did not require retrospective application, decreased the depreciation expense and increased

the net income for the six-month period ended June 30, 2023 by $8.0 million or $0.08 per basic and diluted share.

General

and Administrative Expenses

We

incur general and administrative expenses, including our onshore personnel related expenses, directors’ and executives’ compensation,

share based compensation, legal, consulting, audit and accounting expenses.

Management

Fees

Management

fees include fees paid to third parties as well as related parties providing certain procurement services to our fleet.

(Gain)

/ Loss on Forward Freight Agreements and Bunker Swaps, net

When

deemed appropriate from a risk management perspective, we take positions in freight derivatives, including freight forward agreements

(the “FFAs”) and freight options, with an objective to utilize those instruments as economic hedges to reduce the risk on

specific vessels trading in the spot market and to take advantage of short term fluctuations in the market prices. Upon the settlement,

if the contracted charter rate is less than the average of the rates, as reported by an identified index, for the specified route and

time period, the seller of the FFA is required to pay the buyer the settlement sum. The settlement amount is an amount equal to the difference

between the contracted rate and the settlement rate, multiplied by the number of days in the specified period covered by the FFA. Conversely,

if the contracted rate is greater than the settlement rate, the buyer is required to pay the seller the settlement sum. Our FFAs are

settled mainly through reputable exchanges such as European Energy Exchange (“EEX”) or Singapore Exchange

(“SGX”) so as to limit our exposure in over-the-counter transactions. Customary requirements for trading in FFAs include

the maintenance of initial and variation margins based on expected volatility, open position and mark to market of the contracts. The

fair value of the FFAs or freight options is treated as asset or liability until they are settled. Any such settlements by us or settlements

to us under FFAs or freight options, if any, are recorded under (Gain)/ Loss on forward freight agreements and bunker swaps, net.

Also,

when deemed appropriate from a risk management perspective, we enter into bunker swap contracts to manage our exposure to fluctuations

of bunker prices associated with the consumption of bunkers by our vessels. Bunker swaps are agreements between two parties to exchange

cash flows at a fixed price on bunkers, where volume, time period and price are agreed in advance. Our bunker swaps are settled

mainly through reputable exchanges such as Intercontinental Exchange (“ICE”) so as to limit our counterparty exposure

in over the counter transactions. Bunker price differentials paid or received under the swap agreements are recognized under (Gain)/Loss

on forward freight agreements and bunker swaps, net.

The

fair value of freight derivatives and bunker swaps is determined through Level 1 inputs of the fair value hierarchy (quoted prices from

the applicable exchanges such as EEX, SGX or ICE). Our FFAs and bunker swaps do not

qualify for hedge accounting and therefore unrealized gains or losses are recognized under (Gain)/Loss on forward freight agreements

and bunker swaps, net.

Impairment loss

When indicators of impairment

are present for the Company’s vessels and the undiscounted cash flows estimated to be generated by those vessels are less than their

carrying value, the carrying value is reduced to its estimated fair value and the difference is recorded under “Impairment loss”

in the consolidated statements of operations.

Other operational gain/(loss)

Other operational gain/(loss)

includes gain/loss from all other operating activities which are not related to the principal activities of the Company, such as gain/loss

from insurance claims.

Loss

on Write-Down of Inventory

Loss

on write-down of inventory results from the valuation of the bunkers remaining onboard our vessels following the decrease of bunkers’

net realizable value compared to their historical cost as of each period end.

Interest

and Finance Costs

We

incur interest expense and financing costs in connection with our outstanding indebtedness under our existing loan facilities (including

sale and leaseback financing transactions). We also incur financing costs in connection with establishing those facilities, which are

presented as a direct deduction from the carrying amount of the relevant debt liability and amortize them to interest and financing costs

over the term of the underlying obligation using the effective interest method.

Interest

Income

We

earn interest income on our cash deposits with our lenders and other financial institutions.

Gain

/ (Loss) on Interest Rate Swaps, net

We

enter into interest rate swap transactions to manage interest costs and risk associated with changing interest rates with respect to

our variable interest loans and credit facilities. Interest rate swaps are recorded in the balance sheet as either assets or liabilities,

measured at their fair value (Level 2), with changes in such fair value recognized in earnings under Gain/(Loss) on interest rate swaps,

net, unless specific hedge accounting criteria are met. When interest rate swaps are designated and qualify as cash flow hedges, the

effective portion of the unrealized gains/losses from those swaps is recorded in Other Comprehensive Income / (Loss) while any ineffective

portion is recorded as Gain/(loss) on interest rate swaps, net.

Results

of Operations

The

six-month period ended June 30, 2023 compared to the six-month period ended June 30, 2022

Voyage

revenues net of Voyage expenses: Voyage revenues for the six months ended June 30, 2023 decreased to $462.7 million from $778.2

million in the corresponding period in 2022. Time charter equivalent revenues (“TCE Revenues”) (as defined above) were $331.7

million compared to $642.4 million for the corresponding period in 2022. As a result, the TCE rate for the first half of 2023 was $15,020

compared to $28,924 for the corresponding period in 2022, which is indicative of the weaker market conditions prevailing during the recent

period. Please refer to the table above for the calculation of the TCE Revenues and TCE and their reconciliation with Voyage Revenues,

which is the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP.

Charter-in

hire expenses: Charter-in hire expenses for the six months ended June 30, 2023 and 2022 were $9.7 million and $13.0 million,

respectively. This decrease is mainly attributable to the decrease in charter-in days to 429 in the six months ended June 30, 2023 from

506 in the corresponding period in 2022 as well as lower charter-in rates prevailing in the market following the weaker market conditions discussed

above.

Vessel

operating expenses: For the six months ended June 30, 2023 and 2022, vessel operating expenses were $112.3

million and $115.8 million, respectively. The decrease is mainly due to the decrease in the average number of vessels in our fleet

to 127.0 in the six months ended June 30, 2023 from 128.0 for the respective period of 2022. Vessel operating expenses for the first

half of 2023 included additional i) crew expenses related to the increased number and cost of crew changes performed during the

period as a result of COVID-19 related restrictions, estimated to be $2.1 million and ii) $1.4 million pre-delivery expenses, due to

change of management of certain vessels from third party to in-house. For the first half of 2022, the additional COVID-19 related

costs and pre-delivery expenses were estimated to be $5.6 million and $1.1 million, respectively.

Dry

docking expenses: Dry docking expenses for the six months ended June 30, 2023 and 2022 were $18.9 million and $19.2 million,

respectively. During the first half of 2023, 16 vessels completed their periodic dry-docking surveys while during the corresponding period

in 2022, 15 vessels completed their periodic dry docking surveys.

Depreciation: Depreciation

expense decreased to $70.1 million for the six-month period ended June 30, 2023 compared to $77.5 million for the corresponding period

in 2022. The decrease is primarily driven by the change in the estimated scrap rate per light weight tonnage from $300 to $400 effective

January 1, 2023, which resulted in lower depreciation expense by $8.0 million together with the decrease in the average number of

vessels in our fleet, discussed above.

Impairment

loss: During the six months ended June 30, 2023, an impairment loss of $7.7 million was incurred, resulting from the agreement

to sell the vessels Star Borealis and Star Polaris described above as part of our fleet update under “Our Fleet”.

Other

operational gain: Other operational gain for the six months ended June 30, 2023 of $33.7 million includes: a) gain from

insurance proceeds relating to Star Pavlina’s total loss discussed in our fleet update above of $28.2 million, b) daily

detention compensation for Star Pavlina pursuant to its war risk insurance policy of $2.7 million in aggregate and c) other

gains from insurance claims relating to other vessels of $2.8 million in aggregate. Other operational gain for the six months ended

June 30, 2022 of $2.1 million included a) daily detention compensation for two vessels blocked in Ukraine pursuant to their war risk

insurance policy of $1.7 million and b) other gains from insurance claims relating to other vessels of $0.4 million.

Management

fees: Management fees decreased to $8.5 million for the six-month period ended June 30, 2023 compared to $9.8 million for the

corresponding period in 2022 due to the change of management of certain vessels, from third party to in-house.

General

and administrative expenses: General and administrative expenses for the six-month periods ended June 30, 2023 and