false

0001499717

0001499717

2025-01-22

2025-01-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

January

22, 2025

Date

of Report (Date of earliest event reported)

STAFFING

360 SOLUTIONS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-37575 |

|

68-0680859 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

| 757

Third Avenue |

|

|

| 27th

Floor |

|

|

| New

York, NY |

|

10017 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(646)

507-5710

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock |

|

STAF |

|

NASDAQ |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

On

January 22, 2025, Staffing 360 Solutions, Inc. (the “Company”) entered into that certain Conversion Agreement

and Waiver (the “Conversion Agreement”) with Jackson Investment Group, LLC (“Jackson”).

Pursuant to the Conversion Agreement and in connection with the transactions to be consummated pursuant to that certain Agreement and

Plan of Merger, dated as of November 1, 2024 (as amended, the “Merger Agreement”), by and among the Company,

Atlantic International Corp. (“Atlantic”) and A36 Merger Sub Inc., the Company and Jackson have agreed to

(i) convert all outstanding principal of (a) that certain Third Amended and Restated 12% Senior Secured Note, dated as of October 27,

2022, as amended (the “2022 Jackson Note”), and (b) that certain 12% Senior Secured Promissory Note, dated

as of August 30, 2023 (the “2023 Jackson Note” and together with the 2022 Jackson Note, the “Jackson

Notes”) into an aggregate of 5,600,000 shares of newly designated Series I Preferred Stock of the Company (the “Series

I Preferred Stock”), which each such share of Series I Preferred Stock to be converted into Merger Consideration (as defined

in the Merger Agreement) as provided for pursuant to the terms and conditions of the Merger Agreement and (ii) waive all aggregate accrued

and unpaid interest as related to the Jackson Notes.

Additionally,

pursuant to the Conversion Agreement, if the average of the last closing price of Atlantic’s common stock, par value $0.00001 per

share (the “Atlantic Common Stock”) (as reported on the Nasdaq Stock Market LLC) over the five (5) trading

days immediately preceding the date of the closing of the transactions contemplated by the Merger Agreement (the “Average

Closing Price”) is below $5.00, then Atlantic shall issue to Jackson such number of additional shares of Atlantic Common

Stock equal to (i) 5,600,000 multiplied by the quotient of $5.00 and the Average Closing Price, minus (ii) 5,600,000 (the “Pro

Rata Shares”), which such Pro Rata Shares, if issued, shall be subject to a certain lock-up period.

The

foregoing description of the Conversion Agreement does not purport to be complete and is qualified in its entirety by reference to the

full text of the Conversion Agreement, a copy of which is attached hereto as Exhibit 10.1, and incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

January 28, 2025 |

STAFFING

360 SOLUTIONS, INC. |

| |

|

|

| |

By: |

/s/

Brendan Flood |

| |

|

Brendan

Flood |

| |

|

Chairman

and Chief Executive Officer |

Exhibit

10.1

Conversion

agreement and Waiver

January

22, 2025

Reference

is made to that certain Third Amended and Restated Note Purchase Agreement, dated as of October 27, 2022, among Staffing 360 Solutions,

Inc. (the “Company”), the subsidiary guarantors party thereto (the “Guarantors”)

and Jackson Investment Group, LLC, as the purchaser (“Jackson”) (as amended by that certain First Omnibus Amendment

and Reaffirmation Agreement to the Note Documents, dated as of August 30, 2023, that certain Second Omnibus Amendment and Reaffirmation

Agreement to the Note Documents, dated as of September 18, 2024 (the “Second Omnibus Amendment”), and as the

same may be further amended, restated, supplemented or otherwise modified from time to time, the “Purchase Agreement”),

pursuant to which the Company issued to Jackson (i) that certain Third Amended and Restated 12% Senior Secured Note, dated as of October

27, 2022, as amended (the “2022 Jackson Note”), and (ii) that certain 12% Senior Secured Promissory Note, dated

as of August 30, 2023, as amended (the “2023 Jackson Note” and, together with the 2022 Jackson Note, the “Jackson

Notes”).

WITNESSETH

WHEREAS,

pursuant to the Second Omnibus Amendment, the Jackson Notes each have a maturity date of January 13, 2025;

WHEREAS,

as of January 22, 2025, the Jackson Notes have (i) an aggregate outstanding principal balance of $10,116,249 (the “Outstanding

Principal”) and (ii) aggregate accrued and unpaid interest of $1,099.733.92 (the “Outstanding Interest”);

WHEREAS,

the obligations of the Company to Jackson under the Jackson Notes and the Note Documents (as defined in the Purchase Agreement) are (a)

guaranteed by the Guarantors party thereto pursuant to the provisions of Article 4 of the Purchase Agreement (the “Guarantee”),

and (b) secured pursuant to (i) that certain Amended and Restated Security Agreement, dated as of September 15, 2017 (as amended, restated,

supplemented or otherwise modified from time to time, the “Security Agreement”), by and among the Company, the guarantors

party thereto from time to time and Jackson, (ii) that certain Amended and Restated Pledge Agreement, dated as of September 15, 2017

(as amended, restated, supplemented or otherwise modified from time to time, the “Pledge Agreement”), by and

among the Company, the guarantors party thereto from time to time and Jackson, (iii) that certain Mortgage over shares dated February

2, 2018, by the Company in favor of Jackson in respect of the shares of S360 Holdings Ltd. pledged pursuant thereto (as amended, restated,

supplemented or otherwise modified from time to time, the “Existing Share Mortgage”), and (iv) the other Security

Documents (as defined in the Purchase Agreement) (collectively, with the Security Agreement, the Pledge Agreement and the Existing Share

Mortgage, the “Security Instruments”);

WHEREAS,

the Company entered into that certain Agreement and Plan of Merger (the “Merger Agreement”), dated as of November

1, 2024, by and among Atlantic International Corp (“Atlantic”), A36 Merger Sub Inc., a wholly-owned subsidiary

of Atlantic, and the Company; and

WHEREAS,

pursuant to Section 3.2(f) of the Merger Agreement, at or prior to the Closing, the Company is obligated to deliver to Atlantic this

(x) Conversion Agreement and Waiver (this “Agreement”) and (y) that certain Lock-Up Agreement (as defined herein),

whereby: (i) all Outstanding Interest will be waived or forgiven; and (ii) all Outstanding Principal will be converted into 5,600,000

shares of newly designated Series I preferred stock of the Company, as adjusted pursuant to Section 3 below (“Company Preferred

Stock”) in accordance with this Agreement, and (iii) each share of Company Preferred Stock will be converted into Merger Consideration as provided for in the Merger Agreement.

Now,

therefore, in consideration of the premises and mutual

covenants and obligations hereinafter set forth, the parties hereto, intending legally to be bound, hereby agree as follows:

| 1. | Definitions.

Capitalized terms used herein but not otherwise defined herein shall have the respective

meanings given such terms in the Merger Agreement. |

| | | |

| 2. | Conversion

and Waiver. In connection with Sections 2.2(a) and 3.2(f) of the Merger Agreement, immediately

prior to the Closing (the “Effective Time”), Jackson hereby expressly

agrees to: (i) convert all Outstanding Principal into the Company Preferred Stock, which

shall have the terms and characteristics set forth in the Certificate of Designation of Preferences,

Rights and Limitations of Series I Preferred Stock, in the form of Exhibit A attached

hereto; (ii) waive all Outstanding Interest; and (iii) deliver that certain lock-up agreement

(the “Lock-Up Agreement”) as related to certain shares of Atlantic

Common Stock. |

| | | |

| 3. | Additional

Pro Rata Shares. Notwithstanding anything to the contrary in the Merger Agreement, if

the average of the last closing price of Atlantic Common Stock (as reported on the Nasdaq

Stock Market LLC) over the five (5) trading days immediately preceding the date of the Closing

(the “Average Closing Price”) is below $5.00, then Atlantic shall

issue to Jackson such number of additional shares of Atlantic Common Stock equal to (i) 5,600,000

multiplied by the quotient of $5.00 and the Average Closing Price, minus (ii) 5,600,000

(the “Pro Rata Shares”), which such Pro Rata Shares, if issued,

shall be subject to the Lock-Up Period (as defined in the Lock-Up Agreement). |

| 4. | Company

Representations. |

| a) | Authority;

Authorization; Execution. The Company has all requisite corporate power and authority

to execute and deliver this Agreement and any related documents to which the Company is a

party, to perform the Company’s obligations hereunder and thereunder, and to consummate

the transactions contemplated hereby and thereby. The execution, delivery, and performance

by the Company of this Agreement and any related documents to which the Company is a party,

and the consummation of the transactions contemplated hereby and thereby, have been duly

authorized by all requisite corporate action on the part of the Company. This Agreement and

each related document to which the Company is a party has been duly executed and delivered

by the Company. |

| b) | Due

Issuance. The shares of Company Preferred to be issued to Jackson pursuant to the conversions

described in Section 2 above will, on or prior to the Effective Time, have been validly issued

free and clear of all encumbrances (other than those arising under securities laws), and

without violating any purchase or call option, right of first refusal, subscription right,

preemptive right, encumbrance or any similar right of any other person. |

| | | |

| c) | Enforceability.

This Agreement and each related document to which the Company is a party constitutes the

valid and binding obligation of the Company, enforceable against the Company in accordance

with its terms, subject to applicable bankruptcy, insolvency, fraudulent conveyance, reorganization,

moratorium, receivership, and similar Laws from time to time in effect affecting the enforcement

of creditors’ rights generally and general equitable principles. |

| | | |

| d) | Conflicts;

Consents of Third Parties. The execution and delivery by the Company of this Agreement

and any Ancillary Documents to which the Company is a party, and the consummation of the

transactions contemplated hereby and thereby, do not and will not (a) violate any law or

order to which the Company is subject or by which the Company is bound, (b) require the Company

to obtain any consent or approval of, or give any notice to, or make any filing with, any

governmental authority, or (c) result in a violation or breach of (with or without due notice

or lapse of time or both), or require any notice to or consent or approval of any third party

to, any contract to which the Company is a party or by which the Company is bound. |

| |

4. | Release

of Security Interest. At the Effective Time, the security interest granted to Jackson

pursuant to the Security Instruments and the guarantee of the obligations of the Company

to Jackson under the Jackson Notes and the Note Documents under the Guarantee, and all other

obligations of the Company and the Guarantors under the Security Instruments and the Guarantee

are hereby expressly and unconditionally released and terminated in all respects with no

further consent or action required on the part of any person, and such Security Instruments

and the Guarantee shall be terminated and no longer considered of any force and effect. Jackson

further agrees that there is no obligation of the Company or any Guarantor to enter into

a replacement agreement with respect to such documents or the security interest created thereby.

The parties hereto further agree to promptly prepare, execute, deliver and file or authorize

for filing all documents and other instruments necessary to effectuate such release and termination,

including, without limitation, UCC-3 termination statements and Jackson hereby authorizes

the Company and the Guarantors to file and/or record any such UCC-3 termination statements. |

| |

| |

| |

5. | Acknowledgement.

Notwithstanding anything to the contrary contained in the Jackson Notes, the Guarantee or

the Security Instruments, Jackson hereby expressly agrees and acknowledges that upon the

effectiveness of the conversions described in section 2 above and the closing of the merger

transaction pursuant to the Merger Agreement, all obligations of the Company under the Jackson

Notes, the Guarantee and the Security Instruments shall be considered satisfied or waived,

as applicable, after which the Company and the Guarantors shall have no further obligations

under the Jackson Notes, the Guarantee and the Security Instruments and the other Note Documents

whatsoever and the Jackson Notes, the Guarantee and the Security Instruments and the other

Note Documents shall be considered satisfied in full and terminated and will no longer have

any binding effect on the Company or any Guarantor. |

| |

6. | Enforcement

of Agreement. Each party hereto acknowledges and agrees that the other party hereto would

be irreparably damaged if any of the provisions of this Agreement are not performed in accordance

with their specific terms and that any breach of this Agreement could not be adequately compensated

in all cases by monetary damages alone. Accordingly, in addition to any other right or remedy

to which a party hereto may be entitled, at law or in equity, it may be entitled to enforce

any provision of this Agreement by a decree of specific performance and to temporary, preliminary

and permanent injunctive relief to prevent breaches or threatened breaches of any of the

provisions of this Agreement, without posting preliminary and permanent injunctive relief

to prevent breaches or threatened breaches of any of the provisions of this Agreement, without

posting any bond or other undertaking. |

| |

| |

| |

7. | Entire

Agreement and Modification. This Agreement supersedes all prior agreements, whether written

or oral, between the parties hereto with respect to its subject matter (including, without

limitation, the Jackson Notes, the Guarantee and the Security Instruments) and constitutes

a complete and exclusive statement of the terms of the agreement between the parties hereto

with respect to its subject matter. In the event of a conflict between the terms of the Jackson

Notes, the Guarantee or the Security Instruments, on the one hand, and this Agreement, on

the other hand, the terms of this Agreement shall prevail. This Agreement may not be amended,

supplemented, or otherwise modified except by a written agreement executed by the parties

hereto. |

| |

| |

| |

8. | Assignments,

Successors and No Third-Party Rights. No party hereto may assign any of its rights or

delegate any of its obligations under this Agreement without the prior written consent of

the other party hereto. Subject to the preceding sentence, this Agreement will apply to,

be binding in all respects upon and inure to the benefit of the successors and permitted

assigns of the parties hereto. Any attempted assignment in violation of this Section 8 shall

be void ab initio. Nothing expressed or referred to in this Agreement will be construed to

give any person other than the parties to this Agreement any legal or equitable right, remedy

or claim under or with respect to this Agreement or any provision of this Agreement, except

such rights as shall inure to a successor or permitted assignee pursuant to this Section

8. |

| |

| |

| |

9. | Severability.

If any provision of this Agreement is held invalid or unenforceable by any court of competent

jurisdiction, the other provisions of this Agreement will remain in full force and effect.

Any provision of this Agreement held invalid or unenforceable only in part or degree will

remain in full force and effect to the extent not held invalid or unenforceable. |

| |

| |

| |

10. | Governing

Law. This Agreement and all disputes or controversies arising out of or relating to this

Agreement, including the applicable statute of limitations, shall be governed by and construed

in accordance with the laws of the State of Delaware, without giving effect to any choice

of law or conflict of law provision or rule (whether of the State of Delaware or any other

jurisdiction) that would cause the application of the law of any jurisdiction other than

the State of Delaware. |

| |

11. | Waiver

of Jury Trial. THE PARTIES HERETO HEREBY WAIVE ANY RIGHT TO TRIAL BY JURY IN ANY ACTION

ARISING OUT OF OR RELATING TO THIS AGREEMENT, WHETHER NOW EXISTING OR HEREAFTER ARISING,

AND WHETHER SOUNDING IN CONTRACT, TORT OR OTHERWISE. THE PARTIES HERETO AGREE THAT ANY OF

THEM MAY FILE A COPY OF THIS PARAGRAPH WITH ANY COURT AS WRITTEN EVIDENCE OF THE KNOWING,

VOLUNTARY AND BARGAINED-FOR AGREEMENT AMONG THE PARTIES HERETO IRREVOCABLY TO WAIVE TRIAL

BY JURY AND THAT ANY ACTION WHATSOEVER BETWEEN THEM RELATING TO THIS AGREEMENT SHALL INSTEAD

BE TRIED IN A COURT OF COMPETENT JURISDICTION BY A JUDGE SITTING WITHOUT A JURY. |

| |

| |

| |

12. | Execution

of Agreement. This Agreement may be executed in one or more counterparts, each of which

will be deemed to be an original copy of this Agreement and all of which, when taken together,

will be deemed to constitute one and the same agreement. The exchange of copies of this Agreement

and of signature pages by electronic mail in PDF format shall constitute effective execution

and delivery of this Agreement as to the parties hereto and may be used in lieu of the original

Agreement for all purposes. Signatures of the parties hereto transmitted by electronic mail

in PDF or DocuSign formats shall be deemed to be their original signatures for all purposes. |

| |

| |

| |

13. | Fees.

The Company agrees to pay all reasonable legal and other expenses incurred by Jackson in

negotiating and entering into this Agreement and all related documents, which payment shall

be made by wire transfer into an account designated by Jackson prior to the Effective Time,

subject to Jackson providing invoices for such expenses prior thereto. |

[Signature

pages follow immediately.]

In

witness whereof, the undersigned have executed and delivered

this Agreement as of the date first above written.

| |

STaffing 360 solutions, inc. |

| |

|

|

| |

By: |

/s/ Brendan Flood |

| |

Name: |

Brendan Flood |

| |

Title: |

Chairman and Chief Executive Officer |

| |

|

|

| |

JACKSON INVESTMENT GROUP, LLC |

| |

|

|

| |

By: |

/s/ Richard L.

Jackson |

| |

Name: |

Richard L. Jackson |

| |

Title: |

Chief Executive Officer |

[Signature Page to Conversion

Agreement and Waiver]

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

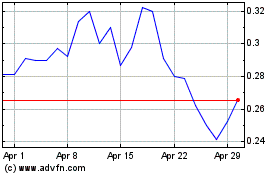

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Dec 2024 to Jan 2025

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Jan 2024 to Jan 2025