UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

August 6, 2015

Sprouts Farmers Market, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-36029 |

|

32-0331600 |

| (State or other jurisdiction of incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

5455 E. High Street, Suite 111

Phoenix, Arizona 85054

(Address of principal executive offices and zip code)

(480) 814-8016

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On August 6, 2015, Sprouts Farmers Market, Inc. (the “Company”) issued a press release announcing its results of operations for its

second fiscal quarter ended June 28, 2015. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated into this Item 2.02 by reference.

The information furnished in this Item 2.02, including Exhibit 99.1 attached hereto and incorporated herein, is being furnished and shall not

be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any

registration statement or other document filed pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

The text of this Current Report on Form 8-K is available on the Company’s investor relations website located at http://investors.sprouts.com, although the Company reserves the right to discontinue that

availability at any time.

Item 9.01. Financial Statements and Exhibits.

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Press release of Sprouts Farmers Market, Inc., dated August 6, 2015, entitled “Sprouts Farmers Market, Inc. Reports Second Quarter 2015 Results” |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

SPROUTS FARMERS MARKET, INC. |

|

|

|

|

| Date: August 6, 2015 |

|

|

|

By: |

|

/s/ Brandon F. Lombardi |

|

|

|

|

Name: |

|

Brandon F. Lombardi |

|

|

|

|

Title: |

|

Chief Legal Officer and Corporate Secretary |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Press release of Sprouts Farmers Market, Inc., dated August 6, 2015, entitled “Sprouts Farmers Market, Inc. Reports Second Quarter 2015 Results” |

Exhibit 99.1

|

|

|

|

|

| Investor Contact: |

|

Media Contact: |

| Susannah Livingston |

|

Donna Egan |

| (602) 682-1584 |

|

(602) 682-3152 |

| susannahlivingston@sprouts.com |

|

donnaegan@sprouts.com |

SPROUTS FARMERS MARKET, INC. REPORTS SECOND QUARTER 2015 RESULTS

PHOENIX, Ariz. – (Globe Newswire) – August 6, 2015 – Sprouts Farmers Market, Inc. (the “Company”) (Nasdaq: SFM) today reported

results for its 13-week second quarter ended June 28, 2015.

Second Quarter Highlights:

| |

• |

|

Net sales of $902.2 million; a 21% increase from the same period in 2014 |

| |

• |

|

Comparable store sales growth of 5.1% and two-year comparable store sales growth of 14.6% |

| |

• |

|

Net income of $31.3 million and diluted earnings per share of $0.20 |

| |

• |

|

Adjusted net income of $35.0 million; a 16% increase from the same period in 2014 |

| |

• |

|

Adjusted diluted earnings per share of $0.22; a 10% increase from the same period in 2014 |

| |

• |

|

Adjusted EBITDA of $77.6 million; a 12% increase from the same period in 2014 |

| |

• |

|

New $450 million revolving credit facility; $160 million outstanding after $100 million voluntary pay down |

“Sprouts’ healthy products at affordable prices continue to appeal to a broad base of customers. Our focus on driving top-line revenue

resulted in solid sales growth, including strong new store performance,” said Doug Sanders, president and chief executive officer of Sprouts Farmers Market. “With a store count of 212 stores today and our planned 14% annual unit growth

going forward, we continue to focus on our tremendous growth opportunities in existing markets and new markets like Tennessee, and remain confident in our long-term target of 1,200 stores across the country.”

In order to aid understanding of the Company’s business performance, it has presented results in conformity with accounting principles

generally accepted in the United States (“GAAP”) and has also presented adjusted net income, adjusted earnings per share and adjusted EBITDA, which are non-GAAP measures that are explained and reconciled to the comparable GAAP measures in

the tables included in this release. Where applicable, results are first presented on a GAAP basis and then on an adjusted basis.

Second Quarter

2015 Financial Results

Net sales for the second quarter of 2015 were $902.2 million, a 21% increase compared to the same period in

2014. Net sales growth was driven by strong performance in new stores opened and a 5.1% increase in comparable store sales.

Gross profit for the quarter increased 18% to $263.6 million, resulting in a gross profit margin of

29.2% of sales, a decrease of 90 basis points compared to the same period in 2014. This was primarily driven by the impact of continued price investments in certain categories, partially offset by leverage in buying costs.

Direct store expense (“DSE”) as a percentage of sales for the quarter increased 50 basis points to 19.7% compared to the same period in

2014. This was the result of higher labor costs and depreciation primarily driven by a greater number of new stores open for less than twelve months in 2015 as compared to 2014 and increased utilization of medical benefits, partially offset by

leverage in labor and store operating costs at pre-2014 vintages.

Selling, general and administrative expenses (“SG&A”)

as a percentage of sales for the quarter decreased 50 basis points to 2.6%, compared to the same period in 2014. This improvement was primarily driven by lower bonus expense partially offset by increased advertising costs for new stores.

Net income for the quarter was $31.3 million, or diluted earnings per share of $0.20, up $1.2 million from the same period in 2014. Net income for

the quarter included $5.5 million pre-tax loss on extinguishment of debt, $0.3 million of pre-tax store closure and exit costs and $0.1 million of pre-tax loss on disposal of assets. Net income for the second quarter of 2014 included $0.3 million of

pre-tax loss on disposal of assets and $0.2 million pre-tax store closure and exit costs benefit. Excluding these items, adjusted net income for the quarter increased 16% to $35.0 million, compared to $30.2 million for the same period in 2014, and

adjusted EBITDA totaled $77.6 million, up $8.5 million, or 12%, from the same period in 2014. These increases were driven by higher sales and the benefit from lower interest expense due to a voluntary pay-down on our revolver and a more favorable

interest rate from our April 2015 refinancing. Adjusted diluted earnings per share was $0.22, a 10% increase from adjusted diluted earnings per share of $0.20 for the same period in 2014.

Fiscal Year-to-Date Financial Results

For the 26-week period ended June 28, 2015, net

sales were $1.8 billion, or a 20% increase compared to the same period in 2014. Growth was driven by a 4.9% increase in comparable store sales and strong performance in new stores opened. Net income was $68.8 million, up $4.9 million from the same

period in 2014. Net income year-to-date included $5.5 million pre-tax loss on extinguishment of debt; $1.5 million pre-tax store closure and exit costs; $0.3 million pre-tax secondary offering expenses; and $0.3 million pre-tax loss on disposal of

assets. Net income for the first half of 2014 included $1.4 million pre-tax secondary offering expenses; $1.0 million pre-tax loss on disposal of assets; and $0.3 million pre-tax store closure and exit costs. Excluding these items, adjusted net

income increased 12% to $73.6 million compared to $65.6 million in the same period in 2014. Adjusted EBITDA totaled $161.9 million, up $15.3 million or 11% from the same period in 2014. Adjusted diluted earnings per share was $0.47, a 9% increase

from adjusted diluted earnings per share of $0.43 from the same period in 2014.

Growth and Development

During the second quarter of 2015, the Company opened eight new stores: one each in Alabama, Arizona, California, Colorado, Georgia, Oklahoma, Missouri and its first store in Tennessee. Four additional stores have

been opened in the third quarter to date, bringing 2015 new store openings to 22, for a total of 212 stores in 13 states as of August 6, 2015. The Company expects to open a total of 27 stores in 2015.

Leverage and Liquidity

The Company

generated cash from operations of $120.9 million year-to-date through June 28, 2015 and invested $60.5 million in capital expenditures net of landlord reimbursement, primarily for new stores.

During the second quarter, the Company completed a new five-year, $450 million revolving credit facility to replace its existing term loan and

revolving credit facility. The Company utilized the initial drawing of $260 million under the new credit facility to pay off its existing $258 million term loan and transaction costs associated with the refinancing. As a result of this transaction,

the Company recorded a loss on extinguishment of debt totaling $5.5 million related to the write-off of deferred financing costs and issue discount.

During the second quarter the Company voluntarily paid down $100 million of outstanding debt resulting in a balance on its revolving credit facility of $160 million, $2.5 million of letters of credit outstanding

under the facility, and $97.3 million in cash and cash equivalents as of June 28, 2015.

2015 Outlook

The Company notes that fiscal year 2015 will be a 53-week year, with the extra week falling in the fourth quarter. The Company

estimates the impact on earnings from the 53rd week to be approximately $0.02

per diluted share. The following provides information on the Company’s guidance for 2015:

|

|

|

| |

|

Q3 2015

Guidance |

| Comparable store sales growth |

|

4% to 5% |

| Two-year combined comparable store sales growth |

|

13% to 14% |

|

|

|

| |

|

Full-year 2015

53-Week Guidance |

| Net sales

growth(1) |

|

19% to 21% |

| Unit growth |

|

27 new stores |

| Comparable store sales growth (2) |

|

4% to 5% |

| Adjusted EBITDA growth |

|

10% to 12% |

| Adjusted net income growth |

|

13% to 15% |

| Adjusted diluted earnings per share (3) |

|

$0.80 to $0.82 |

| Capital expenditures |

|

$100M - $110M |

| (net of landlord reimbursements) |

|

|

The Company’s adjusted diluted earnings per share, adjusted net income and adjusted EBITDA guidance for the year do not

include charges and costs which are expected to be similar to those charges and costs excluded from adjusted diluted earnings per share, adjusted net income and adjusted EBITDA in prior periods. Please see the explanation and reconciliation of these

non-GAAP measures to the comparable GAAP measures for the thirteen and twenty-six weeks ended June 28, 2015 and June 29, 2014 in the tables included below.

| (1) |

On a 52-week to 52-week basis

the Company expects total sales growth of 17% to 19%. |

| (2) |

Comparable store sales growth is on an equal 52-week to 52-week basis. |

| (3) |

Based on a weighted average share count of approximately 156 million shares for 2015. |

Second Quarter Conference Call

The Company will hold a conference call at 2 p.m. Pacific Daylight Time (5 p.m. Eastern Daylight Time) on Thursday, August 6, 2015, during which Sprouts’ executives will further discuss the Company’s

second quarter 2015 financial results.

A webcast of the conference call will be available through Sprouts’ investor webpage

located at http://investors.sprouts.com. Participants should register on the website approximately 10 minutes prior to the start of the webcast.

The conference call will be available via the following dial- in numbers:

| |

• |

|

U.S. Participants: 877-398-9481 |

| |

• |

|

International Participants: Dial +1-408-337-0130 |

| |

• |

|

Conference ID: 82688819 |

The audio replay will

remain available for 72 hours and can be accessed by dialing 855-859-2056 (toll-free) or 404-537-3406 (international) and entering the confirmation code: 82688819.

Important Information Regarding Outlook

There

is no guarantee that Sprouts will achieve its projected financial expectations, which are based on management estimates, currently available information and assumptions that management believes to be reasonable. These expectations are inherently

subject to significant economic, competitive and other uncertainties and contingencies, many of which are beyond the control of management. See “Forward-Looking Statements” below.

Forward-Looking Statements

Certain statements in this press release are forward-looking as defined in the

Private Securities Litigation Reform Act of 1995. Any statements contained herein that are not statements of historical fact (including, but not limited to, statements to the effect that Sprouts Farmers Market or its management

“anticipates,” “plans,” “estimates,” “expects,” or “believes,” or the negative of these terms and other similar expressions) should be considered forward-looking statements, including, without

limitation, statements regarding planned unit growth and long-term unit target and the Company’s guidance and outlook for 2015. These statements involve certain risks and uncertainties that may cause actual results to differ materially from

expectations as of the date of this release. These risks and uncertainties include, without limitation, risks associated with the Company’s ability to successfully compete in its intensely competitive industry; the Company’s ability to

successfully open new stores; the Company’s ability to manage its rapid growth; the Company’s ability to maintain or improve its operating margins; the Company’s ability to identify and react to trends in consumer preferences; product

supply disruptions; general economic conditions; and other factors as set forth from time to time in the Company’s Securities and Exchange Commission filings, including, without limitation, the Company’s Annual Report on Form 10-K. The

Company intends these forward-looking statements to speak only as of the time of this release and does not undertake to update or revise them as more information becomes available, except as required by law.

Corporate Profile

Sprouts Farmers Market, Inc. is a healthy

grocery store offering fresh, natural and organic foods at great prices. We offer a complete shopping experience that includes fresh produce, bulk foods, vitamins and supplements, packaged groceries, meat and seafood, baked goods, dairy products,

frozen foods, natural body care and household items catering to consumers’ growing interest in health and wellness. Headquartered in Phoenix, Arizona, Sprouts employs more than 20,000 team members and operates more than 200 stores in thirteen

states. For more information, visit www.sprouts.com or @sproutsfm on Twitter.

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

|

|

Twenty-Six Weeks Ended |

|

| |

|

June 28,

2015 |

|

|

June 29,

2014 |

|

|

June 28,

2015 |

|

|

June 29,

2014 |

|

| Net sales |

|

$ |

902,153 |

|

|

$ |

743,810 |

|

|

$ |

1,759,659 |

|

|

$ |

1,466,416 |

|

| Cost of sales, buying and occupancy |

|

|

638,514 |

|

|

|

519,762 |

|

|

|

1,238,227 |

|

|

|

1,018,509 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

263,639 |

|

|

|

224,048 |

|

|

|

521,432 |

|

|

|

447,907 |

|

| Direct store expenses |

|

|

177,381 |

|

|

|

143,155 |

|

|

|

340,571 |

|

|

|

281,386 |

|

| Selling, general and administrative expenses |

|

|

23,390 |

|

|

|

23,100 |

|

|

|

47,417 |

|

|

|

45,579 |

|

| Store pre-opening costs |

|

|

2,507 |

|

|

|

2,420 |

|

|

|

5,280 |

|

|

|

3,367 |

|

| Store closure and exit costs |

|

|

315 |

|

|

|

(200 |

) |

|

|

1,544 |

|

|

|

333 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from operations |

|

|

60,046 |

|

|

|

55,573 |

|

|

|

126,620 |

|

|

|

117,242 |

|

| Interest expense |

|

|

(4,437 |

) |

|

|

(6,520 |

) |

|

|

(10,305 |

) |

|

|

(12,987 |

) |

| Other income |

|

|

112 |

|

|

|

100 |

|

|

|

174 |

|

|

|

196 |

|

| Loss on extinguishment of debt |

|

|

(5,481 |

) |

|

|

— |

|

|

|

(5,481 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

50,240 |

|

|

|

49,153 |

|

|

|

111,008 |

|

|

|

104,451 |

|

| Income tax provision |

|

|

(18,918 |

) |

|

|

(19,002 |

) |

|

|

(42,219 |

) |

|

|

(40,567 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

31,322 |

|

|

$ |

30,151 |

|

|

$ |

68,789 |

|

|

$ |

63,884 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.20 |

|

|

$ |

0.20 |

|

|

$ |

0.45 |

|

|

$ |

0.43 |

|

| Diluted |

|

$ |

0.20 |

|

|

$ |

0.20 |

|

|

$ |

0.44 |

|

|

$ |

0.42 |

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

153,393 |

|

|

|

149,681 |

|

|

|

152,814 |

|

|

|

148,720 |

|

| Diluted |

|

|

155,949 |

|

|

|

154,039 |

|

|

|

155,728 |

|

|

|

153,670 |

|

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(IN THOUSANDS,

EXCEPT SHARE AND PER SHARE AMOUNTS)

|

|

|

|

|

|

|

|

|

| |

|

June 28,

2015 |

|

|

December 28,

2014 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

97,258 |

|

|

$ |

130,513 |

|

| Accounts receivable, net |

|

|

18,722 |

|

|

|

14,091 |

|

| Inventories |

|

|

158,179 |

|

|

|

142,793 |

|

| Prepaid expenses and other current assets |

|

|

9,035 |

|

|

|

11,152 |

|

| Deferred income tax asset |

|

|

34,898 |

|

|

|

35,580 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

318,092 |

|

|

|

334,129 |

|

| Property and equipment, net of accumulated depreciation |

|

|

474,949 |

|

|

|

454,889 |

|

| Intangible assets, net of accumulated amortization |

|

|

193,530 |

|

|

|

194,176 |

|

| Goodwill |

|

|

368,078 |

|

|

|

368,078 |

|

| Other assets |

|

|

24,654 |

|

|

|

17,801 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

1,379,303 |

|

|

$ |

1,369,073 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

138,032 |

|

|

$ |

112,877 |

|

| Accrued salaries and benefits |

|

|

21,994 |

|

|

|

29,687 |

|

| Other accrued liabilities |

|

|

39,348 |

|

|

|

41,394 |

|

| Current portion of capital and financing lease obligations |

|

|

9,442 |

|

|

|

29,136 |

|

| Current portion of long-term debt |

|

|

— |

|

|

|

7,746 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

208,816 |

|

|

|

220,840 |

|

| Long-term capital and financing lease obligations |

|

|

119,271 |

|

|

|

121,562 |

|

| Long-term debt |

|

|

160,000 |

|

|

|

248,611 |

|

| Other long-term liabilities |

|

|

89,804 |

|

|

|

74,071 |

|

| Deferred income tax liability |

|

|

19,538 |

|

|

|

18,600 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

597,429 |

|

|

|

683,684 |

|

|

|

|

|

|

|

|

|

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

| Undesignated preferred stock; $0.001 par value; 10,000,000 shares authorized, no shares issued and outstanding |

|

|

— |

|

|

|

— |

|

| Common stock, $0.001 par value; 200,000,000 shares authorized, 153,565,809 and 151,833,334 shares issued and outstanding, June 28,

2015 and December 28, 2014, respectively |

|

|

154 |

|

|

|

152 |

|

| Additional paid-in capital |

|

|

570,742 |

|

|

|

543,048 |

|

| Retained earnings |

|

|

210,978 |

|

|

|

142,189 |

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

781,874 |

|

|

|

685,389 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

1,379,303 |

|

|

$ |

1,369,073 |

|

|

|

|

|

|

|

|

|

|

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

(IN THOUSANDS)

|

|

|

|

|

|

|

|

|

| |

|

Twenty-Six Weeks Ended |

|

| |

|

June 28,

2015 |

|

|

June 29,

2014 |

|

| Cash flows from operating activities |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

68,789 |

|

|

$ |

63,884 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization expense |

|

|

32,816 |

|

|

|

26,071 |

|

| Accretion of asset retirement obligation and closed facility reserve |

|

|

178 |

|

|

|

83 |

|

| Amortization of financing fees and debt issuance costs |

|

|

501 |

|

|

|

785 |

|

| Loss on disposal of property and equipment |

|

|

405 |

|

|

|

994 |

|

| Equity-based compensation |

|

|

2,434 |

|

|

|

2,995 |

|

| Loss on extinguishment of debt |

|

|

5,481 |

|

|

|

— |

|

| Deferred income taxes |

|

|

1,620 |

|

|

|

11,025 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

(4,874 |

) |

|

|

(1,860 |

) |

| Inventories |

|

|

(15,386 |

) |

|

|

(16,399 |

) |

| Prepaid expenses and other current assets |

|

|

2,220 |

|

|

|

5,524 |

|

| Other assets |

|

|

(6,149 |

) |

|

|

(636 |

) |

| Accounts payable |

|

|

26,527 |

|

|

|

34,012 |

|

| Accrued salaries and benefits |

|

|

(7,694 |

) |

|

|

859 |

|

| Other accrued liabilities and income taxes payable |

|

|

(2,079 |

) |

|

|

594 |

|

| Other long-term liabilities |

|

|

16,151 |

|

|

|

9,958 |

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

120,940 |

|

|

|

137,889 |

|

|

|

|

|

|

|

|

|

|

| Cash flows from investing activities |

|

|

|

|

|

|

|

|

| Purchases of property and equipment |

|

|

(74,541 |

) |

|

|

(57,793 |

) |

| Proceeds from sale of property and equipment |

|

|

2 |

|

|

|

115 |

|

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(74,539 |

) |

|

|

(57,678 |

) |

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities |

|

|

|

|

|

|

|

|

| Proceeds from revolving credit facility |

|

|

260,000 |

|

|

|

— |

|

| Payments on revolving credit facility |

|

|

(100,000 |

) |

|

|

— |

|

| Payments on term loan |

|

|

(261,250 |

) |

|

|

(3,500 |

) |

| Payments on capital lease obligations |

|

|

(316 |

) |

|

|

(244 |

) |

| Payments on financing lease obligations |

|

|

(1,700 |

) |

|

|

(1,423 |

) |

| Payments of deferred financing costs |

|

|

(1,896 |

) |

|

|

— |

|

| Cash from landlords related to financing lease obligations |

|

|

— |

|

|

|

577 |

|

| Excess tax benefit for exercise of stock options |

|

|

19,288 |

|

|

|

26,214 |

|

| Proceeds from the exercise of stock options |

|

|

6,218 |

|

|

|

4,786 |

|

|

|

|

|

|

|

|

|

|

| Net cash (used in) provided by financing activities |

|

|

(79,656 |

) |

|

|

26,410 |

|

|

|

|

|

|

|

|

|

|

| Net (decrease) increase in cash and cash equivalents |

|

|

(33,255 |

) |

|

|

106,621 |

|

| Cash and cash equivalents at beginning of the period |

|

|

130,513 |

|

|

|

77,652 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at the end of the period |

|

$ |

97,258 |

|

|

$ |

184,273 |

|

|

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures

In addition to reporting financial results in accordance with GAAP, the Company has presented adjusted net income, adjusted earnings per share and adjusted EBITDA. These measures are not in accordance with, and are

not intended as an alternative to, GAAP. The Company’s management believes that these presentations provide useful information to management, analysts and investors regarding certain additional financial and business trends relating to its

results of operations and financial condition. In addition, management uses these measures for reviewing the financial results of the Company, and they are a component of incentive compensation. The Company defines adjusted net income as net income

excluding store closure and exit costs, gain and losses from disposal of assets, expenses incurred by the Company in its secondary public offerings and employment taxes paid by the Company in connection with options exercised in those offerings

(“Public Offering Expenses”), the loss on extinguishment of debt and the related tax impact of those adjustments. The Company defines adjusted basic and diluted earnings per share as adjusted net income divided by the weighted average

basic and diluted shares outstanding. The Company defines EBITDA as net income before interest expense, provision for income tax, and depreciation and amortization, and defines adjusted EBITDA as EBITDA excluding store closure and exit costs, gains

and losses from disposal of assets, Public Offering Expenses and the loss on extinguishment of debt.

These non-GAAP measures are

intended to provide additional information only and do not have any standard meanings prescribed by GAAP. Use of these terms may differ from similar measures reported by other companies. Because of their limitations, none of these non-GAAP measures

should be considered as a measure of discretionary cash available to use to reinvest in growth of the Company’s business, or as a measure of cash that will be available to meet the Company’s obligations. Each of these non-GAAP measures has

its limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of the Company’s results as reported under GAAP.

The following table shows a reconciliation of adjusted net income and adjusted EBITDA to net income, and adjusted earnings per share to net income per share, for the thirteen and twenty-six weeks ended

June 28, 2015 and June 29, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

|

|

Twenty-Six Weeks Ended |

|

| |

|

June 28,

2015 |

|

|

June 29,

2014 |

|

|

June 28,

2015 |

|

|

June 29,

2014 |

|

| Net income |

|

$ |

31,322 |

|

|

$ |

30,151 |

|

|

$ |

68,789 |

|

|

$ |

63,884 |

|

| Income tax provision |

|

|

18,918 |

|

|

|

19,002 |

|

|

|

42,219 |

|

|

|

40,567 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income before income taxes |

|

|

50,240 |

|

|

|

49,153 |

|

|

|

111,008 |

|

|

|

104,451 |

|

| Store closure and exit costs (a) |

|

|

315 |

|

|

|

(200 |

) |

|

|

1,544 |

|

|

|

333 |

|

| Loss on disposal of assets (b) |

|

|

133 |

|

|

|

267 |

|

|

|

405 |

|

|

|

994 |

|

| Secondary offering expenses including employment taxes on options exercises (c) |

|

|

— |

|

|

|

42 |

|

|

|

335 |

|

|

|

1,446 |

|

| Loss on extinguishment of debt (d) |

|

|

5,481 |

|

|

|

— |

|

|

|

5,481 |

|

|

|

— |

|

| Adjusted income tax provision (e) |

|

|

(21,151 |

) |

|

|

(19,044 |

) |

|

|

(45,172 |

) |

|

|

(41,644 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income |

|

|

35,018 |

|

|

|

30,218 |

|

|

|

73,601 |

|

|

|

65,580 |

|

| Interest expense, net |

|

|

4,434 |

|

|

|

6,520 |

|

|

|

10,297 |

|

|

|

12,987 |

|

| Adjusted income tax provision (e) |

|

|

21,151 |

|

|

|

19,044 |

|

|

|

45,172 |

|

|

|

41,644 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted earnings before interest and taxes (EBIT) |

|

|

60,603 |

|

|

|

55,782 |

|

|

|

129,070 |

|

|

|

120,211 |

|

| Depreciation, amortization and accretion |

|

|

16,966 |

|

|

|

13,322 |

|

|

|

32,840 |

|

|

|

26,357 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) |

|

$ |

77,569 |

|

|

$ |

69,104 |

|

|

$ |

161,910 |

|

|

$ |

146,568 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Net Income Per Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per share—basic |

|

$ |

0.20 |

|

|

$ |

0.20 |

|

|

$ |

0.45 |

|

|

$ |

0.43 |

|

| Per share impact of net income adjustments |

|

$ |

0.03 |

|

|

$ |

— |

|

|

$ |

0.03 |

|

|

$ |

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income per share—basic |

|

$ |

0.23 |

|

|

$ |

0.20 |

|

|

$ |

0.48 |

|

|

$ |

0.44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per share—diluted |

|

$ |

0.20 |

|

|

$ |

0.20 |

|

|

$ |

0.44 |

|

|

$ |

0.42 |

|

| Per share impact of net income adjustments |

|

$ |

0.02 |

|

|

$ |

— |

|

|

$ |

0.03 |

|

|

$ |

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income per share—diluted |

|

$ |

0.22 |

|

|

$ |

0.20 |

|

|

$ |

0.47 |

|

|

$ |

0.43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

Store closure and exit costs represents reserves established for closed stores and facilities, adjustments to those reserves for changes in expectations for sublease or

actual subleases or settlements with landlords. Ongoing expenses related to the closed facilities are also included. The Company excludes store closure and exit costs from its adjusted EBITDA and adjusted net income to provide period-to-period

comparability of its operating results because management believes these costs do not directly reflect the ongoing performance of its store operations. |

| (b) |

Loss on disposal of assets represents the losses recorded in connection with the disposal of property and equipment. The Company excludes losses on disposals of assets

from its adjusted EBITDA and adjusted net income to provide period-to-period comparability of its operating results because management believes these costs do not directly reflect the ongoing performance of its store operations.

|

| (c) |

Secondary offering expenses including employment taxes on options exercises represents expenses the Company incurred in its secondary public offerings and employment taxes

paid by the Company in connection with options exercised in those offerings. The Company has excluded these items from its adjusted EBITDA and adjusted net income to provide period-to-period comparability of its operating results because management

believes these costs do not directly reflect the performance of its store operations. |

| (d) |

Loss on extinguishment of debt represents expenses the Company recorded in connection with its April 2015 refinancing, including write-off of deferred financing costs and

original issue discounts associated with the former credit agreement. The Company has excluded this item from its adjusted EBITDA and adjusted net income to provide period-to-period comparability of its operating results because management believes

these costs do not directly reflect the performance of its store operations. |

| (e) |

Adjusted income tax provision for all periods presented represents the income tax provision plus the tax effect of the adjustments described in notes (a) through

(d) above based on statutory tax rates for the period. The Company has excluded these items from its adjusted income tax provision because management believes they do not directly reflect the ongoing performance of its store operations and are

not reflective of its ongoing income tax provision. |

###

Source: Sprouts Farmers Market, Inc.

Phoenix, AZ

8/6/15

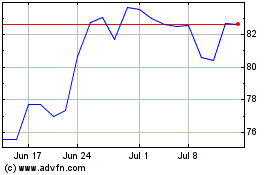

Sprouts Farmers Market (NASDAQ:SFM)

Historical Stock Chart

From Jun 2024 to Jul 2024

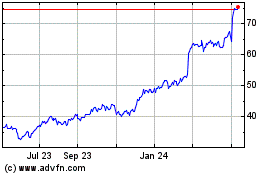

Sprouts Farmers Market (NASDAQ:SFM)

Historical Stock Chart

From Jul 2023 to Jul 2024