UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

(Amendment No. )

Filed by

the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary

Proxy Statement |

| ¨ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive

Proxy Statement |

| ¨ |

Definitive

Additional Materials |

| x |

Soliciting

Material Pursuant to § 240.14a-12 |

Splunk Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ |

Fee paid previously

with preliminary materials. |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1)

and 0-11. |

Splunk Employee FAQ

| · | We’re excited to

announce that Splunk has entered into a definitive transaction to be acquired by Cisco in

an all-cash transaction at approximately $30 billion in enterprise value and $28 billion

in equity value ($157 per share). |

| · | This will bring together

two established leaders with complementary capabilities in AI, security, and observability,

enabling us to better support organizations of all sizes to become more digitally resilient. |

| · | Together, Splunk and Cisco

will offer best-in-class technologies to protect, connect and advance the missions of organizations

and communities all over the world. |

| · | We are confident that our

advanced technologies, powered by Cisco’s extensive go-to-market capabilities and scale,

is a winning combination for our people, our customers, and our industry. |

| 2. | What

does this transaction mean for Splunk employees? |

| · | Cisco recognizes that the

passion of Splunkers is the bedrock of Splunk’s success. As we join the Cisco family,

we expect Splunkers will benefit from greater development and career opportunities as part

of a larger and more expansive global organization. |

| · | We believe our two organizations

are an excellent strategic and cultural fit. Like Splunk, Cisco embraces a customer-centric

culture focused on innovation and growth, while also prioritizing the importance of diversity,

equity, inclusion and belonging, and community among its people. |

| · | This announcement represents

the next phase in our journey as one of tech’s most innovative brands. |

| 3. | How

is this a good fit for the Splunk team? |

| · | This transaction would

unite two technology leaders with a shared passion for innovation and inclusion, and as we

create one of the largest global technology companies, we expect to remain a great place

to work (a distinction Cisco also shares) and a destination employer for top-tier talent. |

| · | We have always encouraged

our teams to be innovative, passionate, disruptive, open and fun. Cisco’s purpose is

to power an inclusive future for all, and embraces a conscious culture where diversity, employee

experience, and a principles-driven set of values shape the culture. |

| · | As we integrate our two

organizations, we expect that Splunkers will benefit from Cisco’s extensive and impactful

global programs that will open up new opportunities to develop and expand their careers. |

| · | In addition, with operations

in over 80 countries around the world, Cisco will extend our global reach, expanding how

we can support customers and attract talent. |

| 4. | What

are the strategic benefits? Why is this happening now? How does Splunk fit

into the Cisco strategy? |

| · | After building a product

portfolio and brand synonymous with innovation and exceptional customer value, this transaction

represents the next phase of Splunk’s growth journey while delivering immediate and

compelling value to Splunk shareholders. |

| · | Our companies’ products

fundamentally complement each other, and our combination extends both of our businesses and

ability to innovate. |

| · | Through this combination,

we will join forces with a long-time, trusted partner in Cisco who shares our passion for

innovation and customer success. |

| · | Together, we expect to

build on our customer promise through an expanded portfolio of products and a joint focus

on customer experience to accelerate success for organizations of all sizes: |

| o | Splunk will enhance Cisco’s

security offering by adding our leading SIEM, SOAR and Advanced Threat Detection solutions,

which leverage AI and data-driven insights, to deliver full-breadth threat intelligence and

vulnerability management. |

| o | Together Splunk and Cisco will

offer the leading end-to-end enterprise-grade full stack observability platform for a hybrid,

multi-cloud world. |

| o | Integrating Splunk’s data

and analytics platform with Cisco’s infrastructure, applications, and services will

provide customers operational data at scale to unlock more insights for IT, AppDev, DevOps,

and Security professionals. |

| · | We will be able to leverage

a best-in-class customer support / success infrastructure, global partner reach and access

to a direct GTM engine and installed base for upsell and cross-sell. |

| · | Together, we will create

the most comprehensive visibility and insights in the market by applying AI to security,

observability and network operations to deliver a high-performance user experience and help

drive better business results at scale. |

| · | In short, Splunk’s

advanced technologies, amplified by Cisco’s technology portfolio and extensive go-to-market

capabilities and scale, is a winning combination for our customers, our industry and our

people. |

| 5. | How

is this different from our existing business partnership with Cisco? |

| · | Instead of a business partnership,

Splunk will become a part of Cisco. |

| · | By bringing together two

established leaders with complementary capabilities in AI, security, and observability, we

will help make organizations of all sizes more digitally resilient. |

| · | This combination will allow

us to integrate and build on Splunk and Cisco’s industry-leading solutions to deliver

the most comprehensive visibility and insight in the market for security, observability,

and network operations, powered by AI. |

| · | Together, Cisco and Splunk

will offer best-in-class technologies to protect, connect, and advance the missions of organizations

and communities all over the world. |

| 6. | What happens after the transaction closes? |

| · | In our nearly 20 years

as a company, we’ve developed and delivered breakthrough innovations while also building

and nurturing a brand and culture that today stands among tech’s best. |

| · | Joining forces with Cisco

is the next phase of Splunk’s journey, and we’re excited to continue building

on our legacy and reputation with enhanced resources and support. |

| · | With that said, today is

just the first step and there is still a lot to work out as we move toward completing the

transaction. |

| · | Senior leaders from both

companies will work together to develop a thoughtful plan for how best to bring together

Splunk and Cisco. |

| · | In the meantime, we should

remain focused on executing our strategy and delivering for our customers. |

| · | We recognize that you will

have a lot of questions and we will keep you apprised of important updates throughout the

process. |

| 7. | What

does Cisco plan to do with Splunk? |

| · | Today is just the first

step and there is still a lot to work out as we move through the process to complete the

transaction. The transaction is expected to close by the end of the third quarter of calendar

year 2024, subject to regulatory approval and other customary closing conditions including

approval by Splunk shareholders. |

| · | Senior leaders of both

companies will work together during this period to develop a thoughtful plan for how best

to bring together Splunk and Cisco. |

| · | In the meantime, we continue

to operate as independent companies and it is business as usual. |

| 8. | How

do Splunk and Cisco’s cultures align? |

| · | Over the course of our

nearly 10-year partnership, we’ve gotten to know Cisco’s business and its leaders

very well, and we are confident our two organizations are like minded in many ways and share

similar values. |

| · | Splunk is known for its

company culture and values, and that’s part of what attracted Cisco. |

| · | Although our two companies

are different in size and scope, we have common goals and aspirations. Cisco is excited to

brainstorm how best to accelerate Splunk’s momentum through our newly combined teams

as part of Cisco. |

| · | Splunk and Cisco share

a deep customer-centric focus, an unwavering dedication to innovation and collaboration,

and a mission of empowering people and organizations across all sectors with the ability

to discover and use their data to generate positive impact. |

| · | We also share a commitment

to empowering our employees with the tools they need to succeed, valuing the growth and development

of our teams, and a culture of diversity, equity, inclusion and belonging. |

| 9. | What

will be the new organization structure as part of Cisco? |

| · | Until the transaction is

closed, Splunk’s org structure remains unchanged. |

| · | Over the coming months,

senior leaders of both companies will work together to develop a thoughtful plan for how

best to bring together Splunk and Cisco after the deal’s close. This includes org structure. |

| 10. | Will

Splunk leadership join Cisco? |

| · | Upon close of the acquisition,

Gary will be joining Cisco’s Executive Leadership Team reporting to Cisco CEO, Chuck

Robbins. |

| · | As we progress through

joint integration planning prior to the close of the acquisition, Cisco and Splunk leadership

will build thoughtful plans for how we will bring our organizations together after the deal's

close. |

| · | In the meantime, we continue

to operate as independent companies and Gary will continue to lead Splunk. |

| 11. | Where does the Splunk

team report? |

| · | Upon close of the acquisition, Gary will be joining Cisco’s

Executive Leadership Team reporting to Cisco CEO, Chuck Robbins. |

| · | As we progress through joint integration planning prior to the

close of the acquisition, Cisco and Splunk leadership will build thoughtful plans for how

we will bring our organizations together after the deal's close. |

| 12. | Does

this transaction impact Splunk’s strategic priorities in the near-term? |

| · | Our strategic priorities

remain the same. |

| · | We recently reported a

strong Q2, and as we move into the second half of FY24 with strong momentum, we’re

counting on all of you to stay focused on driving execution and performance, just as we’ve

been doing. |

| 13. | How does this impact my day-to-day responsibilities until

the transaction closes? What do we do between now and close? |

| · | Until the transaction closes,

which we expect to occur by the end of the third calendar quarter of calendar year 2024,

Splunk and Cisco will continue to operate as separate, independent companies. |

| · | This means that we remain

committed to advancing our strategic initiatives and building on our momentum. |

| · | There shouldn’t be

any impact to your day-to-day roles or responsibilities. In short, it remains business as

usual. |

| · | You should continue to

focus on your day-to-day responsibilities and do what you do best – helping our customers

enhance their digital resilience. |

| 14. | How does this impact my day-to-day responsibilities after

the transaction closes? |

| · | Today is just the first

step and there is still a lot to work out as we move through the process to complete the

transaction. |

| · | Senior leaders of both

companies will work together to develop a thoughtful plan for how we will bring our organizations

together after the deal’s close. |

| · | While there are details

we don’t know, what we can say is that Cisco recognizes that our employees are the

bedrock of our success. We expect employees to realize new and exciting opportunities once

the transaction closes. |

| · | We will keep you informed

as we work through the integration planning process. |

| 15. | Will

the Splunk brand be retained? |

| · | The Splunk brand is synonymous

with innovation and customer success. Our customers and employees feel a strong connection

to it, and Cisco understands its value and market recognition. |

| · | While branding decisions

will be determined after the close of the acquisition, we will in the meantime continue fostering

the distinct identity that sets Splunk apart. |

| · | As we become part of Cisco,

we expect a lot of the things that make Splunk unique to endure – while at the same

time continuing to evolve our culture of belonging. |

| 16. | Will there be layoffs? |

| · | This transaction is primarily

about growth and continuing to build on Splunk’s legacy. As part of Cisco, we’ll

have the ability to make the transformational investments that will accelerate Splunk’s

ability to help organizations worldwide become more resilient. |

| · | Until the transaction closes,

we will continue to maintain our focus on transforming the way Splunk operates to drive long-term

durable growth with increasing profitability. We’ve made significant progress on improving

our cost structure and operating model to drive growth and increased profitability. As we

look ahead, we need to continue to evolve to ensure our organizational design is sustainable

and cost-effective, and aligned to the needs of our customers and partners. |

| · | In addition, Cisco has

repeatedly recognized the value Splunkers contribute to the success of our company. |

| · | As we progress through

joint integration planning prior to the close of the acquisition, Cisco and Splunk leadership

will build thoughtful plans for how we will bring our organizations together after the deal's

close. |

| · | As the integration planning

proceeds, we will continue to keep you updated on any changes. |

| 17. | Does

this transaction affect Splunk’s mission or core values? |

| · | We are confident that this

transaction will accelerate our ability to deliver on our mission to enhance our customers’

digital resilience. This transaction reaffirms all that we have accomplished and fuels our

purpose to build a safer and more resilient digital world. |

| · | Once the transaction closes,

our teams will work together to map and define our combined product roadmap and GTM strategy. |

| 18. | Does Cisco have Employee Resource Groups like ours? |

| · | Yes, Cisco has ERG communities

similar to our own. |

| · | Cisco is extremely active

across social, economic, and other topics important to our world and local communities. |

| · | You

can read more about their efforts here. |

| 19. | Will Splunk adopt Cisco’s model on hybrid work? |

| · | Cisco and Splunk share a commitment to empowering our employees

with the tools they need to succeed, valuing the growth and development of our teams, and

a culture of inclusion. |

| · | Cisco employs hybrid work practices that provide employees opportunities

to work in ways that are most effective for their teams. |

| · | At Cisco, leaders and teams are responsible for determining

how to gather to deliver their best work, while the company provides a flexible set of tools

and resources including in-person sites, remote work, and a mix of the two. |

| 20. | Will my benefits change? |

| · | Until the transaction closes, your benefits, including your

time off benefits, will remain unchanged. |

| · | As integration planning proceeds, we will update you of any

changes or required actions needed after the close. |

| 21. | Will my compensation change? |

| · | Until the transaction is

complete, it is business as usual, and our current compensation and benefits programs remain

in effect. |

| · | We will continue to run

our current annual compensation programs including Mid-year Focal underway right now and

Annual Focal in Q1 FY25. |

| · | We are still in the early

days of this transaction and there are many details that still need to be determined. |

| · | As integration planning

proceeds, we will update you of any changes or required actions that may be needed after

the close. |

| 22. | What will happen to my outstanding equity or cash LTIP? |

| · | Until the transaction closes, there will be no change to your

equity or Cash LTIP awards. |

| · | When the transaction closes, RSUs will convert to Restricted

Cash at $157/share and will vest on the same terms as previously communicated for your equity

grant. Your converted stock award will be visible in eTrade at close. |

| · | For Cash LTIP on close, your unvested amount and vesting schedule

will remain unchanged and will continue to vest on the same terms as previously communicated.

Cash LTIP awards will continue to be visible in your Fidelity account. |

| 23. | Are we still planning to celebrate our 20th anniversary? |

| · | Absolutely – Splunk

has had an incredible 20 years and we will honor our company’s growth and success in

October. |

| · | Joining the Cisco family

is a testament to all that we have accomplished and sets us on a path for ongoing growth. |

| 24. | What should I tell my customers? |

| · | You should tell them that

we are excited about the transaction and the incredible opportunities ahead for Splunk, as

well as the many benefits it is expected to deliver for them. |

| · | Importantly, until the

transaction closes, Splunk will continue to operate as a separate, independent company. Customers

should expect no changes to the way we work with them or the solutions we provide. |

| · | Customer-facing employees

will receive separate materials with detailed guidelines and talking points on how to discuss

the transaction with customers. Please refer to those materials. |

| 25. | What should I tell partners? |

| · | You should tell them that

we are excited about the transaction and the incredible opportunities ahead for Splunk, as

well as the many benefits it is expected to deliver for them. |

| · | Importantly, until the

transaction closes, Splunk will continue to operate as a separate, independent company. Partners

should expect no changes to the way we work with them or the solutions we provide to our

shared customers. |

| · | Partner-facing employees

will receive separate materials with talking points to discuss the transaction with partners.

Please refer to those materials. |

| 26. | What do I do if I am approached by the media? |

| · | Our media and communications

protocol remains the same. |

| · | If a reporter or another

third party reaches out to you, please forward the inquiry to press@splunk.com and a member

of our communications team will respond on behalf of the company. |

| 27. | Who do I contact if I

have questions or want to know more about Cisco? Can I reach out to anyone at Cisco? |

| · | We encourage you to look up publicly available information on

Cisco if you want to learn more about them. |

| · | Additionally, you can reach out to the Cisco team via their

‘Ask a Question’ tool from the Welcome Hub launching in the near future. Please

stay tuned! |

| · | However, please do not reach out to individual Cisco employees

regarding the combination before the close of the transaction. To the extent your day-to-day

responsibilities require you to interact with Cisco employees, please reach out to your manager

for how to manage those conversations. |

| 28. | Who can I reach out to if I have additional questions? |

| · | We recognize that you may

have questions that aren’t covered in this FAQ. |

| · | As always, our HR team

and your manager are available as resources to you to answer questions. |

| · | While we are still in the

early stages of the transaction and we don’t have all the answers yet, we are committed

to doing our best to ensure Splunkers feel informed and supported throughout this process. |

| 29. | Will there be any changes

to the ESPP? |

We will continue

the two Offering Periods that are currently running (December 15, 2022 to December 15, 2024 and June 15, 2023 to June 15,

2025). If you are a participant in either offering period, you can continue to be enrolled. You will not be able to increase your participation

percentage in either offering period. We will not commence any new offering periods.

Forward-Looking Statements

This communication contains “forward-looking statements”

within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on Splunk’s current expectations,

estimates and projections about the expected date of closing of the transaction and the potential benefits thereof, its business and

industry, management’s beliefs and certain assumptions made by Splunk and Cisco, all of which are subject to change. In this context,

forward-looking statements often address expected future business and financial performance and financial condition, and often contain

words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “could,”

“seek,” “see,” “will,” “may,” “would,” “might,” “potentially,”

“estimate,” “continue,” “expect,” “target,” similar expressions or the negatives of these

words or other comparable terminology that convey uncertainty of future events or outcomes. All forward-looking statements by their nature

address matters that involve risks and uncertainties, many of which are beyond our control, and are not guarantees of future results,

such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. These and other forward-looking

statements, including the failure to consummate the proposed transaction or to make or take any filing or other action required to consummate

the transaction on a timely matter or at all, are not guarantees of future results and are subject to risks, uncertainties and assumptions

that could cause actual results to differ materially from those expressed in any forward-looking statements. Accordingly, there are or

will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore,

you should not place undue reliance on any such statements and caution must be exercised in relying on forward-looking statements. Important

risk factors that may cause such a difference include, but are not limited to: (i) the completion of the proposed transaction on

anticipated terms and timing, including obtaining shareholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities,

future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses,

future prospects, business and management strategies for the management, expansion and growth of Splunk’s business and other conditions

to the completion of the transaction; (ii) the impact of the COVID-19 pandemic on Splunk’s business and general economic conditions;

(iii) Splunk’s ability to implement its business strategy; (iv) significant transaction costs associated with the proposed

transaction; (v) potential litigation relating to the proposed transaction; (vi) the risk that disruptions from the proposed

transaction will harm Splunk’s business, including current plans and operations; (vii) the ability of Splunk to retain and

hire key personnel; (viii) potential adverse reactions or changes to business relationships resulting from the announcement or completion

of the proposed transaction; (ix) legislative, regulatory and economic developments affecting Splunk’s business; (x) general

economic and market developments and conditions; (xi) the evolving legal, regulatory and tax regimes under which Splunk operates;

(xii) potential business uncertainty, including changes to existing business relationships, during the pendency of the merger that

could affect Splunk’s financial performance; (xiii) restrictions during the pendency of the proposed transaction that may

impact Splunk’s ability to pursue certain business opportunities or strategic transactions; and (xiv) unpredictability and

severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as Splunk’s

response to any of the aforementioned factors. These risks, as well as other risks associated with the proposed transaction, are more

fully discussed in the Proxy Statement to be filed with the U.S. Securities and Exchange Commission in connection with the proposed transaction.

While the list of factors presented here is, and the list of factors presented in the Proxy Statement will be, considered representative,

no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant

additional obstacles to the realization of forward looking statements. Consequences of material differences in results as compared with

those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial

loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Splunk’s financial

condition, results of operations, or liquidity. Splunk does not assume any obligation to publicly provide revisions or updates to any

forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except

as otherwise required by securities and other applicable laws.

Important Information and Where to Find It

In connection with the proposed transaction between Splunk Inc. (“Splunk”)

and Cisco Systems, Inc. (“Cisco”), Splunk will file with the Securities and Exchange Commission (“SEC”)

a proxy statement (the “Proxy Statement”), the definitive version of which will be sent or provided to Splunk stockholders.

Splunk may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the Proxy

Statement or any other document which Splunk may file with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT

AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS,

CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED

MATTERS. Investors and security holders may obtain free copies of the Proxy Statement (when it is available) and other documents that

are filed or will be filed with the SEC by Splunk through the website maintained by the SEC at www.sec.gov, Splunk’s investor relations

website at https://investors.splunk.com or by contacting the Splunk investor relations department at the following:

Splunk Inc.

ir@splunk.com

(415) 848-8400

Participants in the Solicitation

Splunk and certain of its directors and executive officers may be

deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Splunk’s

directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is contained

in Splunk’s proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on May 9, 2023. Splunk

stockholders may obtain additional information regarding the direct and indirect interests of the participants in the solicitation of

proxies in connection with the proposed transaction, including the interests of Splunk directors and executive officers in the transaction,

which may be different than those of Splunk stockholders generally, by reading the Proxy Statement and any other relevant documents that

are filed or will be filed with the SEC relating to the transaction. You may obtain free copies of these documents using the sources

indicated above.

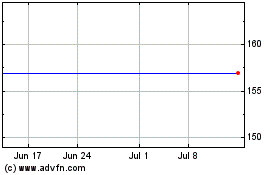

Splunk (NASDAQ:SPLK)

Historical Stock Chart

From Jun 2024 to Jul 2024

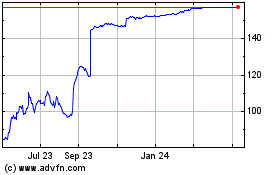

Splunk (NASDAQ:SPLK)

Historical Stock Chart

From Jul 2023 to Jul 2024