Is Splunk Inc a Buy After Losing More than 20% in 2022?

June 29 2022 - 5:58AM

Finscreener.org

The decade-high inflation levels

and the consistently increasing interest rates have led to bearish

market sentiment and many growth stocks have tanked miserably. The

tech sector has been one of the most affected ones due to these

macro factors.

California-based

Splunk Inc (NASDAQ: SPLK),

a data management company

is one such beaten-down growth

stock. It has lost close to 20% in the first six months of 2022 and

is trading close to its 52-week low.

However, the stock is still

attractive and the company has a lot of upside potential. Its

Splunk Platform is a real-time data platform for the collection of

data, streaming, indexing, search, reporting, analysis, machine

learning, alerting, and monitoring, and also possesses data

management capabilities. The company also has Splunk Solutions,

Splunk IT Solutions, as well as an ecosystem of solutions

containing various pre-built tools.

Splunk is growing through innovation

It is often said that innovation

is the key to success and Splunk through its consistent innovation

has been heading towards its goals. The company has been actively

innovating its platform and is entering into newer agreements with

more organizations to speed up its growth process.

At the recently held

Global Partner

Summit, Splunk announced

several partnerverse programs to help its 2400+ partners expand and

differentiate their offerings. As per the said program, Splunk will

provide many new features and resources such as the development of

necessary skills, achievement of correct certifications, or

building up capabilities to help the customers in order to support

the expansion of its global partner network.

Apart from the companyU+02019s

partners, the customers will also be able to realize their vision

for security, resilience, and innovation through this

program.

Again, as per another recent

agreement, the company will also help

Nubank, which is also one of the largest digital

financial services platforms in the world, to support about 60

million digital banking customers in the Latin America region. The

said partnership will let Nubank use Splunk’s cloud platform to

improve its interaction across departments. Moreover, the company

will also provide Nubank with its information

requirements.

The pandemic had caused a ruckus

in the market but there have been indeed a few industries that have

actually got benefitted. The cloud computing industry is one of

them. According to a survey by the

Markets and

Markets, the global cloud

computing market might reach $947.3 billion by 2026 from $445.3

billion in 2021 growing at a CAGR of 16.3% between the said

period.

The

machine learning segment

might grow ten-fold to $209 billion

by 2029. Splunk is one of the more notable companies in this space

and should be able to take immense benefit out of these emerging

opportunities.

Splunk beat revenues expectations in Q1

Splunk’s earnings for

Q1 of fiscal 2023

beat market estimates. The company’s

revenue for the quarter grew 34% year-over-year to $674 million

with the revenue from the cloud segment that formed approximately

50% of the total revenue increasing by 66%. It also raised its

full-year revenue and profitability outlook and is expecting to

earn between $3.3 billion and $3.35 billion in revenues and at

least $400 million in operating cash flows by the end of this

year.

Further, the retention rate for

the quarter was as high as 130% and the company had 329 customers

having cloud ARR greater than $1 million showing a 62%

year-over-year increment during the quarter. However, Splunk is

still booking operating losses and for the last quarter alone it

was almost $292 million.

As of this report, Splunk is

trading at $93 and the average analyst target price for the stock

is $135.73, a potential upside of over 45%.

Splunk might not be profitable

now but the above-mentioned factors indicate the company is moving

in the right direction. It has been substantially progressing

towards delivering game-changing technology which is increasing its

popularity further. Splunk is a good addition for a long-term

investor.

Splunk (NASDAQ:SPLK)

Historical Stock Chart

From Jun 2024 to Jul 2024

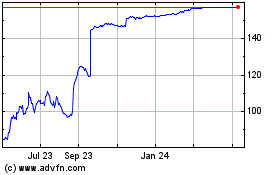

Splunk (NASDAQ:SPLK)

Historical Stock Chart

From Jul 2023 to Jul 2024