Common Stock, $0.001 par value per share false 0001701108 0001701108 2024-10-29 2024-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 29, 2024

SPERO THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-38266 |

|

46-4590683 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

| 675 Massachusetts Avenue, 14th Floor Cambridge, Massachusetts |

|

02139 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (857) 242-1600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value |

|

SPRO |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On October 29, 2024, Spero Therapeutics, Inc. (the “Company”) issued a press release related to the restructuring of its operations, as described below in Item 2.05, in which it disclosed that it had estimated cash and cash equivalents of approximately $76.3 million as of September 30, 2024. A copy of the press release is filed as Exhibit 99.1 hereto.

The estimated cash and cash equivalents as of September 30, 204 are preliminary and may change, are based on information available to management as of the date of this Report and are subject to completion by management of the financial statements as of and for the quarter ended September 30, 2024. There can be no assurance that the Company’s cash and cash equivalents as of September 30, 2024 will not differ from these estimates and any such changes could be material. The preliminary financial data included in this Report has been prepared by and is the responsibility of the Company’s management. The Company’s auditor, PricewaterhouseCoopers LLP, has not audited, reviewed, compiled, or applied agreed-upon procedures with respect to the preliminary financial data. Accordingly, PricewaterhouseCoopers LLP does not express an opinion or any other form of assurance with respect thereto. Complete quarterly results will be included in the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024.

| Item 2.05 |

Costs Associated with Exit or Disposal Activities |

On October 29, 2024, the Company announced an update to its strategic priorities and corresponding reduction in workforce by approximately 39%. The reduction in force reflects the Company’s determination to refocus its strategic priorities around tebipenem HBr and other research and development efforts. The workforce reduction is expected to be substantially completed by the fourth quarter of 2024.

The Company estimates that it will incur aggregate restructuring charges of approximately $1.1 million in cash expenditures in connection with the reduction in workforce related to severance pay and other related termination benefits. The Company may incur additional costs not currently contemplated due to events associated with or resulting from the workforce reduction. As a result of these initiatives, the Company now expects that its existing cash and cash equivalents will enable it to fund its operating expenses and capital expenditure requirements into mid-2026. The charges that the Company expects to incur in connection with the workforce reduction and expectations with respect to reduction in net cash required for operating activities are estimates and subject to a number of assumptions, and actual results may differ materially.

| Item 7.01 |

Regulation FD Disclosure. |

On October 29, 2024, the Company released an investor presentation (the “Investor Presentation”), which includes updates regarding the Company’s business and operations that management intends to use from time to time in investor communications and conferences. A copy of the Investor Presentation is attached and furnished hereto as Exhibit 99.2 and is also available on the “Investor Relations” portion of the Company’s website at https://www.sperotherapeutics.com/investor-relations/stock-information.

The information in this Item 7.01 and Exhibit 99.2, is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section or sections 11 and 12(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

On October 29, 2024, the Company issued a press release related to the restructuring of its operations titled “Spero Therapeutics Announces SPR720 Phase 2a Interim Results and Provides a Business Update.” A copy of the press release is filed as Exhibit 99.1 hereto and is incorporated herein by reference.

Cautionary Note Regarding Forward Looking Statements

This report, including the exhibit hereto, contains forward-looking statements. These statements include, but are not limited to, statements about the timing, progress and results of the Company’s preclinical studies, clinical trials and research and development programs; management’s assessment of the results of such preclinical studies and clinical trials; and the expected cost-savings from the Company’s reduction in workforce and restructuring of its operations, the Company’s anticipated expenses and its anticipated cash runway. In some cases, forward-looking statements can be identified by terms such as “may,” “will,” “should,” “expect,” “plan,” “aim,” “anticipate,” “could,” “intent,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including whether the Company’s product candidates will advance through the clinical trial process on a timely basis, or at all, taking into account the effects of possible regulatory delays, slower than anticipated patient enrollment, manufacturing challenges, clinical trial design and clinical outcomes; whether the FDA will ultimately approve tebipenem HBr and, if so, the timing of any such approval; whether the FDA will require any additional clinical data or place labeling restrictions on the use of tebipenem HBr that would delay approval and/or reduce the commercial prospects of tebipenem HBr; the Company’s need for additional funding; the Company’s ability to successfully implement the Restructuring; the impact of

2

the Restructuring on the Company’s business, including estimated costs related thereto; the lengthy, expensive, and uncertain process of clinical drug development; whether a successful commercial launch can be achieved and market acceptance of tebipenem HBr can be established; whether results obtained in preclinical studies and clinical trials will be indicative of results obtained in future clinical trials; the Company’s reliance on third parties to manufacture, develop, and commercialize its product candidates, if approved; the ability to commercialize the Company’s product candidates, if approved; the Company’s ability to retain key personnel; whether the Company’s cash resources will be sufficient to fund its continuing operations for the periods and/or trials anticipated; and other factors discussed in the “Risk Factors” set forth in filings that the Company periodically makes with the U.S. Securities and Exchange Commission. The forward-looking statements included in this report, including the exhibit hereto, represent the Company’s views as of the date of this report. The Company anticipates that subsequent events and developments will cause its views to change. However, while the Company may elect to update these forward-looking statements at some point in the future, it specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date of this report.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: October 29, 2024 |

|

|

|

SPERO THERAPEUTICS, INC. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Esther Rajavelu |

|

|

|

|

|

|

Esther Rajavelu |

|

|

|

|

|

|

Chief Financial Officer and Chief Business Officer |

4

Exhibit 99.1

Spero Therapeutics Announces SPR720 Phase 2a Interim Results and Provides a Business Update

Phase 2a proof-of-concept study of SPR720 for the treatment

of Nontuberculous Mycobacterial Pulmonary Disease (NTM-PD) did not meet its primary endpoint, based on planned interim analysis of 16 patients

Phase 3 PIVOT-PO trial of tebipenem HBr remains on track for enrollment completion in 2H 2025

Cash runway extended into mid-2026 following a reduction in workforce and restructuring of

operations; Unaudited Q3 2024 ending cash balance of $76.3M

CAMBRIDGE, Mass., October 29, 2024 — Spero

Therapeutics, Inc. (Nasdaq: SPRO), a multi-asset clinical-stage biopharmaceutical company, focused on identifying and developing novel treatments for rare diseases and multi-drug resistant (MDR) bacterial infections, today announced that a

planned interim analysis of the Phase 2a proof-of-concept study of SPR720 for the treatment of NTM-PD demonstrated that the

program did not meet its primary endpoint. While the data showed antimicrobial activity associated with SPR720, the interim analysis did not show sufficient separation from placebo and highlighted potential dose limiting safety issues in subjects

dosed at 1,000 mg orally once daily, including three cases of reversible grade 3 hepatotoxicity. In evaluating the totality of both the efficacy and safety data, the Company has elected to suspend its current development program for SPR720 and will

evaluate other potential paths forward as the remaining data are collected and analyzed.

As a result of the suspension of the current SPR720 development

program, Spero will undergo a restructuring and reduction in force of approximately 39%, which will extend cash runway and support operations into mid-2026, to further support the development of tebipenem HBr,

SPR206, and potential strategic activities.

“Spero launched its

proof-of-concept clinical study for SPR720 as a monotherapy to evaluate its potential efficacy and safety in treating NTM-PD.

While a planned interim analysis provided evidence of antimicrobial activity, the trial unfortunately did not meet the primary endpoint,” said Sath Shukla, Spero’s President and Chief Executive Officer. “We are therefore suspending

development of the SPR720 program and making adjustments to our organization accordingly. I want to offer my sincere thanks to all our Spero SPR720 colleagues, along with our investigators and patients, for their dedication in seeking new treatment

options for this devastating disease. We remain committed to bringing forward new treatment options for patients in need, as we continue to advance our tebipenem HBr and SPR206 programs.”

Restructuring to Prioritize Programs and Capital Allocation

Spero closed the third quarter ended September 30, 2024, with an unaudited cash estimate of $76.3 million. Following the reduction in force and

restructuring, Spero estimates that its existing cash and cash equivalents, together with earned and non-contingent development milestone payments from GSK, as well as other

non-dilutive funding commitments, will be sufficient to fund its operating expenses and capital expenditures into mid-2026. During this period, the Company remains

focused on advancing tebipenem HBr in the ongoing global PIVOT-PO Phase 3 clinical trial and preparing for a Phase 2 clinical trial for SPR206 contingent on continued

non-dilutive funding.

SPR720

SPR720 is an oral, chemically stable phosphate ester prodrug that is converted rapidly in vivo to SPR719, the active moiety. SPR719 targets the ATPase site of

DNA gyrase B in mycobacteria, a mechanism that is distinct from that of other antibiotics in use for Non Tuberculous Mycobacterial-Pulmonary Disease (NTM-PD).

Recent updates:

| |

• |

|

Phase 2a trial – enrollment concluded in July 2024, with 25

non-refractory patients enrolled in the proof-of-concept trial evaluating SPR720 in

NTM-PD. A planned interim analysis based on 16 patients indicated the trial did not meet its primary endpoint of differentiation from placebo in the rate of change in log10 colony forming units per milliliter (CFU/mL). In addition, analysis of the full 25 patient safety data highlighted potential dose limiting safety issues in patients dosed at 1,000mg orally once

daily, including three cases of reversible grade 3 hepatotoxicity. The Company plans to complete data analysis of all enrolled patients (n=25) and determine the next steps for the SPR720 program over the next several months. For more information on

the trial, see ClinicalTrials.gov identifier NCT05496374. |

Tebipenem HBr

Tebipenem HBr is an investigational oral carbapenem antibiotic being developed for the treatment of cUTI including acute pyelonephritis (AP) to help patients

avoid hospitalizations or reduce duration of in-patient therapy. Spero granted GSK an exclusive license to commercialize tebipenem HBr in all territories, except certain Asian territories. Spero received

$66 million upfront from GSK when the license agreement was signed in 2022, $30 million when the Company reached the Special Protocol Assessment milestone in Q3 2023, and was entitled to receive $95 million in development milestones

upon enrollment of the first patient in the PIVOT-PO Phase 3 trial, $47.5 million of which have been received thus far. Spero is further eligible to receive up to $400 million in development, sales,

and commercial milestones payments, as well as low single-digit to low double-digit tiered royalties on net product sales.

| |

• |

|

Enrollment on track in PIVOT-PO, the global Phase 3 clinical trial of

tebipenem HBr in patients with cUTI. This randomized, double-blinded trial compares oral tebipenem HBr with intravenous imipenem cilastatin, in hospitalized adult patients with cUTI/AP. The primary endpoint is overall response (a combination of

clinical cure and favorable microbiological response) at the Test-of-Cure (TOC) visit. Target enrollment for the trial is approximately 2,648 patients, with enrollment

completion expected in the second half of 2025. For more information on PIVOT-PO, refer to ClinicalTrials.gov ID NCT06059846. |

SPR206

SPR206 is an investigational, intravenously administered next-generation polymyxin that has shown antibiotic activity against MDR Gram-negative pathogens,

including carbapenem-resistant Enterobacterales, Acinetobacter baumannii and Pseudomonas aeruginosa in preclinical studies.

| |

• |

|

The U.S. Food and Drug Administration (FDA) cleared the Company’s IND for a Phase 2 trial in participants

with hospital-acquired or ventilator-associated bacterial pneumonia (HABP/VABP). The Company maintains its guidance to initiate the trial, contingent on availability of non-dilutive funding.

|

About Spero Therapeutics

Spero

Therapeutics, headquartered in Cambridge, Massachusetts, is a multi-asset clinical-stage biopharmaceutical company focused on identifying and developing novel treatments for rare diseases and MDR bacterial infections with high unmet need. For more

information, visit www.sperotherapeutics.com

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including,

without limitation, the timing, progress and results of the Company’s preclinical studies, clinical trials and research and development programs; management’s assessment of the results of such preclinical studies and clinical trials; and

the expected cost-savings from the Company’s reduction in workforce and restructuring of its operations, the Company’s anticipated expenses and its anticipated cash runway . In some cases, forward-looking statements may be identified by

terms such as “may,” “will,” “should,” “expect,” “plan,” “aim,” “anticipate,” “could,” “intent,” “target,” “project,”

“contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue,” the negative of these terms or other similar expressions. Any forward-looking statements in this press release

are based on management’s current expectations and beliefs and are subject to a number of important risks, uncertainties and other factors that may cause actual results to differ materially from those indicated by such forward looking

statements, including whether tebipenem HBr, SPR720 and SPR206 will advance through the clinical trial process on a timely basis, or at all, taking into account the effects of possible regulatory delays, slower than anticipated patient enrollment,

manufacturing challenges, clinical trial design and clinical outcomes; whether the results of such trials will warrant submission for approval from the FDA or equivalent foreign regulatory agencies; whether the FDA will ultimately approve tebipenem

HBr and, if so, the timing of any such approval; whether the FDA will require any additional clinical data or place labeling restrictions on the use of tebipenem HBr that would delay approval and/or reduce the commercial prospects of tebipenem HBr;

whether a successful commercial launch can be achieved and market acceptance of tebipenem HBr can be established; whether results obtained in preclinical studies and clinical trials will be indicative of results obtained in future clinical trials;

Spero’s reliance on third parties to manufacture, develop, and commercialize its product candidates, if approved; Spero’s need for additional funding; the ability to commercialize Spero’s product candidates, if approved; Spero’s

ability to

retain key personnel; Spero’s leadership transitions; whether Spero’s cash resources will be sufficient to fund its continuing operations for the periods and/or trials anticipated; and

other factors discussed in the “Risk Factors” set forth in filings that Spero periodically makes with the SEC. The forward-looking statements included in this press release represent Spero’s views only as of the date hereof and should

not be relied upon as representing its views as of any subsequent date. Except as required by law, Spero explicitly disclaims any obligation to update any forward-looking statements.

Investor Relations Contact:

Shai Biran, PhD

Spero Therapeutics

IR@Sperotherapeutics.com

Media Inquiries:

media@sperotherapeutics.com

Corporate Presentation October 2024

Exhibit 99.2

Forward-looking Statement This

presentation contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995 regarding, among other things, the future development and commercialization of SPR720 and SPR206; the potential number of patients

who could be treated by SPR 720 and tebipenem HBr and market demand for SPR720 and tebipenem HBr generally; the potential regulatory path forward for tebipenem HBr, the potential approval of tebipenem HBr by the U.S. Food and Drug

Administration (FDA) and the timing thereof; the potential commercialization of tebipenem HBr and its future value, the potential receipt of milestone payments and royalties on future sales of tebipenem HBr under the GlaxoSmithKline Intellectual

Property (No. 3) Limited (GSK) license agreement; the effectiveness of tebipenem HBr and its potential impact on healthcare resource utilizations; the anticipated shift in treating patients from intravenous to oral administration; the initiation,

timing, progress and results of the Company’s preclinical studies and clinical trials and its research and development programs, including management’s assessment of such results; the timing of the availability of data from the

Company’s clinical trials; the timing of the Company’s filings with regulatory agencies; product candidate benefits; competitive position; business strategies; potential growth opportunities; potential market size; projected

costs and the availability of additional non-dilutive funding from governmental agencies beyond any initially funded awards. In some cases, forward-looking statements can be identified by terms such as “may,” “will,”

“should,” “expect,” “plan,” “aim,” “anticipate,” “could,” “intent,” “target,” “project,” “contemplate,” “believe,”

“estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. All statements other than statements of historical facts contained in this presentation are

forward-looking statements. The Company may not actually achieve the plans, intentions or expectations disclosed in these forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations

disclosed in these forward-looking statements as a result of various factors, including whether the FDA will ultimately approve tebipenem HBr and, if so, the timing of any such approval; whether the FDA will require any additional clinical data or

place labeling restrictions on the use of tebipenem HBr that would add costs for the Company, delay approval and/or reduce the commercial prospects of tebipenem HBr; the Company’s need for additional funding; the lengthy, expensive, and

uncertain process of clinical drug development; the Company’s reliance on third parties to manufacture, develop, and commercialize its product candidates, if approved; the ability to develop and commercialize the Company’s product

candidates, if approved; the Company’s ability to retain key personnel; whether results obtained in preclinical studies and clinical trials will be indicative of results obtained in future clinical trials and whether preliminary data from

the Company’s clinical trials will be predictive of final results from such trials; the Company’s dependence on raising capital and whether the Company’s product candidates will advance through the preclinical development and

clinical trial process on a timely basis, or at all, taking into account such factors as the effects of possible regulatory delays, slower than anticipated patient enrollment, manufacturing challenges, clinical trial design, clinical data

requirements and clinical outcomes; whether the results of such clinical trials will warrant submission for approval from the FDA or equivalent foreign regulatory agencies; decisions made by the FDA and equivalent foreign regulatory

agencies with respect to the development and commercialization of the Company’s product candidates; the commercial potential of the Company’s product candidates; the Company’s ability to obtain adequate third-party

reimbursement for its product candidates; whether the Company will satisfy all of the pre-conditions to receipt of the milestone payments under its various license and collaboration agreements; the Company’s ability to implement its strategic

plans; the Company’s ability to obtain, maintain and enforce intellectual property and other proprietary rights for its product candidates; the risks and uncertainties related to market conditions; whether the Company’s cash

resources will be sufficient to fund its continuing operations for the periods and/or trials anticipated; and other factors discussed in the “Risk Factors” section of the Company’s periodic reports filed with the U.S. Securities

and Exchange Commission (SEC), and risks described in other filings the Company may make with the SEC in the future. The forward-looking statements included in this presentation represent the Company’s views as of the date of this

presentation. The Company anticipates that subsequent events and developments will cause its views to change. However, while the Company may elect to update these forward-looking statements at some point in the future, it specifically disclaims any

obligation to do so. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date of this presentation.

Indications with high unmet need

in addressable patient populations Orphan drug and/or QIDP designations Strong global intellectual property Late-stage development pipeline Diversified clinical stage portfolio Developing Therapies for Rare and Multi-drug Resistant

Infectious Diseases QIDP: qualified infectious disease product Cash runway into mid-2026 enables delivery of key milestones Commercial partnerships could provide significant upside Strong financial foundation

Asset Indication Preclinical Phase 1

Phase 2 Phase 3 Anticipated Milestone Partnered Assets Tebipenem HBr cUTI Complete Enrollment (2H 2025) SPR206 HABP/VABP Initiate Phase 21 Wholly Owned SPR720 First-line NTM-PD Program suspended2 Maturing Pipeline with Differentiated Clinical Assets

Non-dilutive Funding Alliances Worldwide Rights (ex. Asia) Spero Retains Rights in United States China OUS, ex. China NTM-PD: non-tuberculous mycobacterial pulmonary disease; cUTI: complicated urinary tract infection; HABP: hospital-acquired

bacterial pneumonia; VABP: ventilator-associated bacterial pneumonia 1.Contingent on non-dilutive funding. 2. The company has elected to suspend its current development program for SPR720.

Tebipenem HBr Oral

Carbapenem

cUTI Patients Often Cycle through

Multiple Therapies Lack of effective oral treatment options has resulted in increased – Outpatient visits Emergency department visits Unwarranted outpatient IV use Unnecessary hospitalizations Hospital days Home health and long-term care

stays post-hospitalization IV: intravenous; tebipenem HBr: tebipenem pivoxil hydrobromide (formerly SPR994); UTI: urinary tract infection 1. GSK Epidemiology data - fy-2023-epidemiology-report.xlsx (live.com) Annual cUTI treatment episodes estimated

to be 3.4M1 Tebipenem, in development to offer an oral alternative to cUTI patients All translating to patient suffering and high financial burden

Tebipenem HBr: Potential to Reduce

Treatment Burden for cUTI Patients Potential first-to-market oral carbapenem Phase 3 enrolling Global commercial partnership Potential treatment of complicated UTI in outpatient setting vs current hospitalized setting Expand prescriber base beyond

infectious disease specialists Robust IP through 2038 QIDP designation PIVOT-PO trial protocol approved under FDA Special Protocol Assessment (SPA) Enrollment began with first patient dosed in Q4 2023 Global trial with centers in the North and South

America, Europe, Africa, and Asia Out-licensed global commercial rights (except Japan and certain other Asian countries) to GSK Robust financial terms including developmental, regulatory, and commercial milestones, as well as tiered sales royalties

IP: intellectual property; tebipenem HBr: tebipenem pivoxil hydrobromide (formerly SPR994); QIDP: qualified infectious disease product; SPA: Special Protocol Assessment (by FDA); UTI: urinary tract infection

Phase 3 Clinical Trial PIVOT-PO:

Pivotal Design Entered FDA Special Protocol Assessment Agreement (SPA): The FDA has indicated that positive and persuasive results from PIVOT-PO, along with previously completed studies, could be sufficient to support approval of tebipenem HBr as a

treatment for cUTI, including pyelonephritis, for a limited use indication AP: acute pyelonephritis; cUTI: complicated urinary tract infection; NI: non-inferiority; TBP-PI-HBr/tebipenem HBr: tebipenem pivoxil hydrobromide (formerly SPR994) Study

Tebipenem HBr (NCT06059846): Phase 3 Clinical Trial in cUTI A Phase 3, Randomized, Double-blind, Double-dummy, Multi-center Study to Assess the Efficacy and Safety of Orally Administered Tebipenem Pivoxil Hydrobromide (TBP-PI-HBr), Compared to

Intravenously Administered Imipenem-cilastatin in Patients with Complicated Urinary Tract Infection (cUTI) or Acute Pyelonephritis (AP) Patients with a diagnosis of cUTI (incl. AP) Approximately 2648 patients (Stratified by age, baseline diagnosis,

etc.) 7-10 Days of Dosing Treatment Population Endpoints Primary Endpoint: Overall response at TOC in micro-ITT population Primary Analysis: Assessment of non-inferiority (NI) in micro-ITT population, based on a 10% NI margin

Treatment Arms patients randomized 1:1 (blinded) R TBP-PI-HBR (600 mg) orally and “dummy” infusion IV, every 6 hours, days 1-10 (n=1324) Imipenem-cilastatin (500 mg) IV and matched “dummy” tablets, orally every 6 hours, days

1-10, (n=1324)

Exclusive License Agreement with GSK

for Tebipenem HBr and Equity Investment Global Collaboration (ex-Asia) Financial Terms Spero is responsible for execution and costs of the Tebipenem HBr Phase 3 in the United States GSK received exclusive license to: Develop Tebipenem in territories

outside of United States (not including Japan and certain other Asian countries where rights are held by Meiji Seika); and Obtain regulatory approval and commercialize tebipenem HBr in all territories, except Meiji Seika Territories Received $66

Million upfront and $9 Million in common stock investment Received $30 Million upon SPA agreement with the FDA Upon FPFD, Spero qualified to receive $95 Million in development milestones payable in equal installments over two years Spero is eligible

to receive up to $400 Million in additional potential regulatory, commercial and sales milestone payments, as well as royalties $25 Million to be paid upon GSK’s submission of tebipenem HBr’s New Drug Application (NDA) Up to $150

million in potential commercial milestones based on first commercial sales (US/EU) Up to $225 million in sales related milestone payments Spero to receive tiered low-single digit to low-double digit (if sales exceed $1 billion) tiered

royalties on net product sales FPFD: first patient first dose. SPA: Special Protocol Assessment

SPR206 Direct Acting IV

Potentiator

SPR206: Ongoing Clinical

Development Lends Potential to Address Significant Unmet Need Innovative, investigational IV direct-acting polymyxin antibiotic Destabilization of phospholipids and lipopolysaccharides (LPS) present Increased permeability, cell membrane disruption,

bacterial cell death Received FDA Fast Track designation Next Steps: Phase 2 HABP/VABP Proof of Concept Study4 SPR206 has potential to fulfill unmet need for a well tolerated, efficacious therapeutic against carbapenem-resistant pathogens Current

standard of care involves drug combinations that are often associated with nephrotoxicity HABP: hospital-acquired bacterial pneumonia; MAD: multiple ascending dose; SAD: single ascending dose; VABP: ventilator-associated bacterial pneumonia. 1.

Bruss J, et al. Antimicrob Agents Chemother 2021;65:e0073921; 2.Rodvold KA, et al. Antimicrob Agents Chemother 2023;67:e0042623. 3. Bruss JB, et al. Antimicrob Agents Chemother 2023;67:e0050523; 4. Contingent on non-dilutive funding availability.

SAD/MAD Phase 1 Trial1 No evidence of nephrotoxicity at predicted therapeutic dose levels Bronchoalveolar Lavage Phase 1 Trial2 Well-tolerated and achieved lung exposures consistent with predicted therapeutic levels Preclinical Studies Support

increased efficacy beyond traditional antibiotics and potential for single agent activity Renal Impairment Phase 1 Trial3 Supportive of renal dosing in subsequent trials for patients impacted by differences in renal function

SPR720 Oral Antibiotic for

Non-Tuberculosis Mycobacterium Pulmonary Disease (NTM-PD) The company is suspending its current development for SPR720

First-line treatment options

include 6-12 months (or more) on a combination of antibiotics, including a macrolide NTM-PD is a Chronic Debilitating Disease with Significant Patient Burden NTM: non-tuberculous mycobacteria; NTM-PD: NTM pulmonary disease; *SPR720 is being

developed for MAC NTM-PD. 1. Marras TK, et al. Respir Med 2018; 145:80-88. 2. Kim RD, et al. Am J Respir Crit Care Med 2008; 178:1066-74; mortality rate represents midpoint of published range. Fatigue 83% Cough 78% Sputum (phlegm) 67% Short of

breath 65% Night sweats 54% Fever 44% Hemoptysis 29% Weight loss 3.7 ± 5.2 kg 5 High-Resolution CT Scans (HRCT) Confirms NTM-PD diagnosis and severity 4 Worsening of lung damage Select pre-existing indications include: Bronchiectasis COPD

Cystic fibrosis M. avium complex (80-85%)* Additional species, including M. abscessus Patient with existing structural lung damage and/or immunocompromised status 1 Exposure to NTM species 2 Presentation of signs and symptoms of NTM-PD 3

Drug-resistance &/or exacerbations eventually leads to 5-yr all-cause mortality rate of ~35%1,2 6

High Unmet Need

in First-Line Patients With Long Treatment Duration, and Lack of Efficacy and Tolerability from Current Treatment Options Rare Disease with High Unmet Need ~245,000 diagnosed patients in developed markets1 ~35% Five-year

all-cause mortality rate2 Chronic condition requiring long-term treatment No Approved First-Line Treatment Off-label use of Azithromycin Ethambutol Rifampin Inhaled amikacin in Phase 3 trial No other oral

agent in clinical development Current SOC Treatments Have Severe Limitations Poor outcomes driven by emergence of resistance Safety & tolerability concerns & high rate of treatment drop-offs ~50% of treated

patients experience infection recurrence3 Inhaled amikacin approved for refractory (2L) patients; 1.Winthrop KL, et al. Ann Am Thorac Soc 2020; 17:178-85 and Spero internal analysis. 2.Kim RD, et al. Am J Respir Crit Care Med

2008; 178:1066-74; mortality rate represents midpoint of published range 3. Hamed KA and Tillotson G. Expert Rev Respir Med 2023;17:973-88.

SPR720 is An Oral Small Molecule

Gyrase B Inhibitor M.: Mycobacterium; MAC: Mycobacterium avium complex; NTM: non-tuberculous mycobacteria; SOC: standard of care; QIDP: qualified infectious disease product 1. Brown-Elliott BA, et al. Antimicrob Agents Chemother. 2018;

62:e01503-18. 2. Aragaw WW, et al. Microbiol Spectr 2022;10:e0132121. 3. Pillar CM, et al. IDWeek poster presentation, available online. in vitro potency against multiple NTM pathogens, such as MAC (including macrolide-resistant MAC) and M.

abscessus1 Novel mechanism of action for NTM-PD not exploited by current antibiotics May be administered with or without food No evidence of cross resistance against marketed antibiotics1 Low propensity for development of resistance as monotherapy

and in combination with SOC antibiotics2,3 Data support epithelial lining fluid and lung macrophage penetration4 Composition of matter patent into 2032 Granted Orphan Drug, QIDP and Fast Track designations Phosphate ester prodrug Active moiety

Oral absorption SPR720 SPR719

SPR720's Novel Mechanism of Action

Not Exploited by Existing Antibiotics for NTM-PD SPR720/719 targets DNA gyrase (GyrB subunit), a critical enzyme for DNA replication and RNA transcription1 1 Azithromycin (AZM) disrupts ribosomal activity; AZM blocks passage of growing peptide &

RNA through ribosome 2 Ethambutol (EMB) disrupts Arabinogalactan formation, a critical cell wall component 3 Arabinosyl transferase Arabinose ethambutol Arabinogalactan DNA replication and transcription mRNA Ribosomes Translation Ribosome Peptide

AZM 1 2 3 SPR720/719 mRNA transcription DNA replication DNA gyrase Cell wall production and integrity Arabinogalactan Critical component of mycobacterial cell walls 1. Winthrop KL, et al. Expert Rev Anti Infect Ther 2023; 21:1177-87.

SPR720 Provides a Better Resistance

Profile When Used with SOC Agents MIC90: minimum inhibitory concentration at which 90% of isolates were inhibited; NTM: non-tuberculous mycobacteria; SPR719 is the active moiety of the prodrug SPR720 and is used for in vitro testing. Brown-Elliott

BA, et al. Antimicrob Agents Chemother 2018; 62:e01503-18. SPR720, Investigator Brochure Edition 5; 07Apr2022, on file with Spero Low MIC90 values for SPR719 suggest consistent activity against most clinically important NTM species Low variability

in MIC90 values across species support thesis that SPR719 has a novel mechanism with minimal pre-existing drug resistance MAC organism (n) Agent MIC 90% (µg/mL) M. avium (12) SPR719 2 Amikacin 64 Clarithromycin 8 Linezolid 64 Moxifloxacin 8 M.

intracellulare (19) SPR719 2 Amikacin >64 Clarithromycin >64 Linezolid 64 Moxifloxacin 8 MAC-X (10) SPR719 1 Amikacin 32 Clarithromycin 4 Linezolid 64 Moxifloxacin >8 SPR719 Inhibits Growth of MAC Isolates at Lower Concentrations (MICs)

than SOC Agents in vitro

SPR719 had a low propensity for

resistance development and showed no instances of antagonism when combined with SOC agents Selective agent Organism Putative mutant ID MIC (µg/mL) Clarithromycin SPR719 Clarithromycin at 4 x MIC M. avium ATCC 700898 Parent 1 1 Mutant 8* >256

1 Mutant 31 >256 1 Mutant 41 >256 1 MAC MMX-9461 Parent >256 2 Mutant 32 >256 2 Rifampin SPR719 Rifampin at 4 x MIC M. avium ATCC 700898 Parent 64 1 Mutant 35 >128 0.5 Mutant 36 >128 0.5 Mutant 37 >128 0.5

MAC MMX-9461 Parent 128 2 Mutant 40 >128 2 Resistance to CLR or RIF did not affect SPR719 MICs Mutant MAC strains, resistant to Clarithromycin or Rifampin, show no added resistance to SPR719, reaffirming the lack of overlap in the resistance

mechanisms. Pillar CM, IDWeek poster presentation, October 18, 2024

In Vivo Murine Data Demonstrate

Increased Potency When Combined with SOC SPR720 as monotherapy and in combination with SOC agents SPR720 active as monotherapy with evidence of dose response Demonstrates improved efficacy when used in combination with SOC agents BID:

twice daily; CFU: colony forming units; CLR: clarithromycin; EMB: ethambutol; SOC: standard of care; QD: once daily Cotroneo N, et al. J Antimicrob Chemother 2024; doi: 10.1093/jac/dkae046. Online ahead of print.

SAD: single ascending dose. N=6 per

group Talley AK, et al. Antimicrob Agents Chemother 2021; 65:e0120821. SPR720 Plasma Concentration Increases with Dose Escalation; No Clinically Significant Food Effect Observed Phase 1 SAD/MAD study Mean plasma concentration-time curves following

single ascending dosing (SAD) of SPR720

SPR719 Penetrates Well into

Epithelial Lining Fluid (ELF) and Alveolar Macrophages (AM) Ratios: ELF to plasma AUC0-24 ELF to plasma Cmax AM to plasma AUC0-24 AM to plasma Cmax Total Plasma 1.14 1.26 2.44 3.02 Unbound Plasmaa 19.87 21.88 42.50 52.53 a Corrected for 94.25%

protein-bound fraction and 5.75% unbound fraction1 Phase 1 healthy volunteer study to evaluate the intrapulmonary PK following oral administration of SPR720 1000mg QD for 7 days, including 30 subjects, demonstrated that SPR719 had significant lung

uptake and enhanced concentrations in the ELF and AM Reference Rodvold, KA, Antimicrobial Agents and Chemotherapy, https://doi.org/10.1128/aac.01103-24. 1.Spero Data on File

SPR720 Proof-of-Concept Phase 2a

Trial Design Overview Study SPR720-202 (NCT05496374): Phase 2a study in NTM-PD – suspended following interim analysis Intense PK sub-study (open label) Treatment-naïve/ experienced (non-refractory) patients with NTM due to M.

avium complex 25 patients enrolled 56 Days of Dosing Treatment Population Endpoints Primary Endpoint: 1. The rate of change in log10 Colony Forming Units per milliliter (CFU/ml) Secondary Endpoints: The rate of change in time to

positivity (TTP) Safety & tolerability 3. Plasma PK Treatment Groups patients randomized 1:1:1 (blinded) R Placebo SPR720 (500 mg) A study to evaluate the efficacy, safety, tolerability, and pharmacokinetics of SPR720, as compared

with placebo for the treatment of patients with mycobacterium avium complex (MAC) pulmonary disease SPR720 (1000 mg) SPR720 (1000 mg) SPR720 (500 mg BID) BID: twice daily; MAC: Mycobacterium avium complex; NTM-PD: non-tuberculous

mycobacterial pulmonary disease; PK: pharmacokinetics. *interim analysis of the Phase 2a proof-of-concept study of SPR720 for the treatment of NTM-PD demonstrated that the program did not meet its primary endpoint. The interim analysis did not show

sufficient separation from placebo and highlighted potential dose limiting safety issues in subjects dosed at 1,000mg orally once daily, including three cases of grade 3 hepatotoxicity.

Overview of CFU and TTP

Microbiological Endpoints Sputum CFU Analysis Diluted sputum inoculated on culture plate Visually count colonies TTP Analysis Diluted sputum inoculated in liquid medium Assay device incubates and detects growth Assay device automatically records

time to positive growth signal # of colonies Time of sample collection Decreasing values indicate lowering of NTM burden Time to positive signal Time of sample collection Increasing values indicate lowering of NTM burden 3-4 wk incubation Danho,

Rabi et al., CHEST, Volume 161, Issue 2, 370 - 372

Esther Rajavelu Chief Financial

Officer and Chief Business Officer Over two decades of life science sector experience, combining equities research, investment banking, strategy consulting, and M&A Prior CFO at Fulcrum Therapeutics. Senior equity research analyst at UBS,

Oppenheimer and Deutsche Bank. Healthcare Investment Banker at Bank of America Merrill Lynch Sath Shukla President and Chief Executive Officer Prior CFO at Spero Therapeutics; Prior CFO at Ziopharm Oncology; VP and Global Head of Corporate Finance

at Vertex Over 20 years of financial leadership, executing within commercial and clinical companies Leadership Team Timothy Keutzer Chief Operating Officer Previously, Spero’s Chief Development Officer Prior VP Program and Portfolio

Management, Cubist Extensive antibiotic development experience from pre-clinical to approval Over 30 years in the pharmaceutical industry James Brady Chief Human Resource Officer Prior CHRO at uniQure Therapeutics; Vice President, Human

Resources at Intarcia Therapeutics Close to 30 years of senior human resources experience with over 17 years in the life science space

Thank You

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

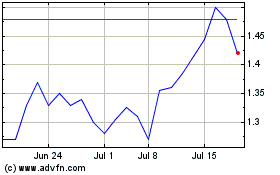

Spero Therapeutics (NASDAQ:SPRO)

Historical Stock Chart

From Oct 2024 to Nov 2024

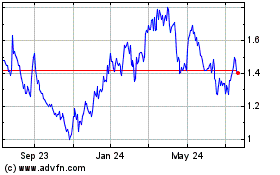

Spero Therapeutics (NASDAQ:SPRO)

Historical Stock Chart

From Nov 2023 to Nov 2024