Southern Missouri Bancorp, Inc. (“Company”) (NASDAQ: SMBC), the

parent corporation of Southern Bank (“Bank”), today announced

preliminary net income for the fourth quarter of fiscal 2023 of

$15.6 million, an increase of $2.5 million or 18.9%, as compared to

the same period of the prior fiscal year. The increase was due to

increases in net interest income and noninterest income, partially

offset by an increase in noninterest expense. Preliminary net

income was $1.37 per fully diluted common share for the fourth

quarter of fiscal 2023, a decrease of $.04 as compared to the $1.41

per fully diluted common share reported for the same period of the

prior fiscal year. The after-tax impact of non-recurring

merger-related charges are estimated to have reduced the current

quarter’s diluted earnings per share by $0.06. For the full fiscal

year 2023, preliminary net income of $39.2 million was a decrease

of $7.9 million as compared to fiscal 2022, while diluted earnings

per share for fiscal 2023 were $3.85, a decrease of $1.36 as

compared to the $5.21 per fully diluted common share for fiscal

2022. The after-tax impact of the provision for credit losses

(“PCL”) attributable to achieve the required “Day 1” allowance for

credit losses (“ACL”) on the acquired loans and off-balance sheet

credit exposures, and noninterest expense attributable to merger

and acquisition charges were estimated to have reduced diluted EPS

by $0.95.

Highlights for the fourth

quarter of fiscal

2023:

- Earnings per common share (diluted) were $1.37, down $.04, or

2.8%, as compared to the same quarter a year ago, and up $1.15, or

522.7% from the third quarter of fiscal 2023, the linked

quarter.

- Annualized return on average assets (“ROA”) was 1.44%, while

annualized return on average common equity (“ROE”) was 14.1%, as

compared to 1.62% and 16.2%, respectively, in the same quarter a

year ago, and 0.23% and 2.3%, respectively, in the third quarter of

fiscal 2023, the linked quarter.

- Net interest margin for the quarter was 3.60%, down from the

3.66% reported for the year ago period, and up from 3.48% reported

for the third quarter of fiscal 2023, the linked quarter. Net

interest income increased $8.5 million, or 30.5%, as compared to

the same quarter a year ago, and increased $2.5 million, or 7.3%,

as compared to the third quarter of fiscal 2023, the linked

quarter.

- Noninterest income was up 37.7% for the quarter, as compared to

the year ago period, and up 42.4% as compared to the third quarter

of fiscal 2023, the linked quarter, as several seasonal factors

improved revenues.

- Noninterest expense was up 43.5% for the quarter, as compared

to the year ago period, and down 7.8% from the third quarter of

fiscal 2023, the linked quarter. In the current quarter, charges

attributable to the merger activity totaled $829,000, as compared

to $3.3 million in the third quarter of fiscal 2023, the linked

quarter, and as compared to $117,000 in the same quarter a year

ago.

- The PCL was $795,000 in the quarter, as compared to $240,000 in

the same period of the prior fiscal year and $10.1 million in the

third quarter of fiscal 2023, the linked quarter. The PCL effects

of the Citizens merger added $7.0 million to the provision recorded

in the third quarter of fiscal 2023.

- Nonperforming assets were $11.3 million, 0.26% of total assets,

at June 30, 2023, as compared to $12.7 million, or .30% of total

assets reported for the third quarter of fiscal 2023, the linked

quarter, and as compared to $6.3 million, or 0.20% of total assets,

at June 30, 2022. The increase in nonperforming assets, as compared

to the year-ago period, was attributable primarily to the Citizens

merger, discussed in further detail below.

- Gross loan balances increased by $138.7 million during the

fourth quarter, and increased by $899.5 million during all of

fiscal 2023, which included a $447.4 million increase, net of fair

value adjustment, attributable to the Citizens merger, during the

third quarter of the fiscal year.

- Deposit balances decreased by $29.7 million during the fourth

quarter, and increased by $910.5 million during all of fiscal 2023,

which included a $851.1 million increase, net of fair value

adjustments, attributable to the Citizens merger during the third

quarter of the fiscal year.

- Uninsured deposits, excluding public unit funds which are

collateralized, were estimated at 14% of total deposits as of June

30, 2023.

Dividend Declared:

The Board of Directors, on July 18, 2023, declared a quarterly

cash dividend on common stock of $0.21, payable August 31, 2023, to

stockholders of record at the close of business on August 15, 2023,

marking the 117th consecutive quarterly dividend since the

inception of the Company. The Board of Directors and management

believe the payment of a quarterly cash dividend enhances

stockholder value and demonstrates our commitment to and confidence

in our future prospects.

Conference Call:

The Company will host a conference call to review the

information provided in this press release on Tuesday, July 25,

2023, at 9:30 a.m., central time. The call will be available live

to interested parties by calling 1-833-470-1428 in the United

States, or 1-929-526-1599 from all other locations. Participants

should use participant access code 351276. Telephone playback will

be available beginning one hour following the conclusion of the

call through July 30, 2023. The playback may be accessed in the

United States by dialing 1-866-813-9403, or 1-929-458-6194 from all

other locations, and using the conference passcode 595460.

Balance Sheet Summary:

The Company experienced significant balance sheet growth in

fiscal 2023, with total assets of $4.4 billion at June 30, 2023,

reflecting an increase of $1.1 billion, or 35.6%, as compared to

June 30, 2022. Growth primarily reflected an increase in net loans

receivable, available-for-sale securities, intangible assets, and

other assets. A significant portion of this growth was a result of

the Citizens merger.

Cash equivalents and time deposits were a combined $55.2 million

at June 30, 2023, a decrease of $36.4 million, or 39.7%, as

compared to June 30, 2022. AFS securities were $417.6 million at

June 30, 2023, up $182.2 million, or 77.4%, as compared to June 30,

2022, primarily a result of the Citizens merger.

Loans, net of the ACL, were $3.6 billion at June 30, 2023, an

increase of $884.9 million, or 32.9%, as compared to June 30, 2022.

Gross loans increased by $899.5 million, while the ACL attributable

to outstanding loan balances increased $14.6 million, or 44.1%, as

compared to June 30, 2022. An increase of $447.4 million in loan

balances, net of fair value adjustments, was attributable to the

Citizens merger. The Company also noted legacy growth in

residential and commercial real estate loans, drawn construction

loan balances, commercial loans, and a modest contribution from

consumer loans. Residential real estate loan balances increased

primarily due to growth in multi-family loans. Commercial real

estate balances increased primarily from an increase in loans

secured by nonresidential structures, along with growth in loans

secured by farmland, and in unimproved land loans. Construction

loan balances increased primarily due to increases in drawn

balances of nonowner-occupied nonresidential and multi-family real

estate loans. The increase in commercial loans was attributable to

commercial and industrial loans and agricultural loan balances.

The Company’s concentration in non-owner occupied commercial

real estate is estimated at 327% at June 30, 2023, as compared to

306% one year ago, representing 41% of total loans at June 30,

2023. Multi-family residential real estate, hospitality

(hotels/restaurants), retail stand-alone, and strip centers are the

most common collateral types within the non-owner occupied

commercial real estate portfolio. The multi-family residential real

estate portfolio commonly includes loans collateralized by

properties currently in the low-income housing tax credit (LIHTC)

program or having exited the program. The hospitality and retail

stand-alone segments include primarily franchised businesses, and

the strip centers can be defined as non-mall shopping centers with

a variety of tenants. Non-owner occupied office property types

included 34 loans totaling $30.5 million, or 0.9% of total loans at

June 30, 2023, none of which are adversely classified, and are

generally comprised of smaller spaces with diverse tenants. The

Company continues to monitor this concentration and the individual

segments closely.

Loans anticipated to fund in the next 90 days totaled $134.8

million at June 30, 2023, as compared to $164.4 million at March

31, 2023, and $121.6 million at June 30, 2022.

Nonperforming loans were $7.7 million, or 0.21% of gross loans,

at June 30, 2023, as compared to $4.1 million, or 0.15% of gross

loans at June 30, 2022. Nonperforming assets were $11.3 million, or

0.26% of total assets, at June 30, 2023, as compared to $6.3

million, or 0.20% of total assets, at June 30, 2022. The net change

in nonperforming assets was attributable to increases of $2.0

million in nonperforming loans and $2.1 million in other real

estate owned obtained via the Citizens merger, a net decrease of

$580,000 in legacy other real estate owned, and an increase of $1.5

million in legacy nonperforming loans.

Our ACL at June 30, 2023, totaled $47.8 million, representing

1.32% of gross loans and 625% of nonperforming loans, as compared

to an ACL of $33.2 million, representing 1.22% of gross loans and

806% of nonperforming loans at June 30, 2022. The ACL required for

purchased credit deteriorated (“PCD”) loans acquired in the

Citizens merger was $1.1 million, and was funded through purchase

accounting adjustments, while the ACL required for non-PCD loans

acquired in the Citizens merger was $5.2 million, and was funded

through a charge to PCL recognized in the third quarter of fiscal

2023. The Company has estimated its expected credit losses as of

June 30, 2023, under ASC 326-20, and management believes the ACL as

of that date is adequate based on that estimate. There remains,

however, significant uncertainty as the Federal Reserve tightens

monetary policy to address inflation risks. Management continues to

closely monitor, in particular, borrowers in the hotel industry

that were slow to recover from the COVID-19 pandemic.

Total liabilities were $3.9 billion at June 30, 2023, an

increase of $1.0 billion, or 35.3%, as compared to June 30,

2022.

Deposits were $3.7 billion at June 30, 2023, an increase of

$910.5 million, or 32.3%, as compared to June 30, 2022. An increase

of $851.1 million in deposit balances, net of fair value

adjustments, was attributable to the Citizens merger. Inclusive of

the merger, the deposit portfolio saw fiscal year-to-date increases

in certificates of deposit, interest-bearing transaction accounts,

money market deposit accounts, and noninterest bearing transaction

accounts, primarily as a result of the Citizens merger. Public unit

balances totaled $578.5 million at June 30, 2023, an increase of

$105.3 million compared to June 30, 2022, and a decrease of $58.1

million as compared to March 31, 2023. Brokered deposits totaled

$159.6 million at June 30, 2023, an increase of $136.7 million

compared to June 30, 2022, and an increase of $61.7 million as

compared to March 31, 2023. The loan-to-deposit ratio for the

fourth quarter of fiscal 2023 was 95.8%, as compared to 94.3% for

the same period of the prior fiscal year.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Summary Deposit Data

as of: |

|

June 30, |

|

Mar. 31, |

|

Dec. 31, |

|

Sep. 30, |

|

June 30, |

|

(dollars in thousands) |

|

2023 |

|

2023 |

|

2022 |

|

2022 |

|

2022 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-interest bearing

deposits |

|

$ |

597,600 |

|

$ |

618,598 |

|

$ |

447,621 |

|

$ |

417,233 |

|

$ |

426,930 |

| NOW accounts |

|

|

1,328,423 |

|

|

1,430,019 |

|

|

1,171,388 |

|

|

1,176,629 |

|

|

1,171,620 |

| MMDAs - non-brokered |

|

|

439,652 |

|

|

448,616 |

|

|

351,491 |

|

|

330,079 |

|

|

291,598 |

| Brokered MMDAs |

|

|

13,076 |

|

|

6 |

|

|

9,115 |

|

|

6,002 |

|

|

12,014 |

| Savings accounts |

|

|

282,753 |

|

|

304,663 |

|

|

247,679 |

|

|

263,767 |

|

|

274,283 |

|

Total nonmaturity deposits |

|

|

2,661,504 |

|

|

2,801,902 |

|

|

2,227,294 |

|

|

2,193,710 |

|

|

2,176,445 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Certificates of deposit -

non-brokered |

|

|

917,489 |

|

|

855,436 |

|

|

678,371 |

|

|

646,463 |

|

|

627,790 |

| Brokered certificates of

deposit |

|

|

146,547 |

|

|

97,855 |

|

|

100,110 |

|

|

10,840 |

|

|

10,840 |

| Total certificates of

deposit |

|

|

1,064,036 |

|

|

953,291 |

|

|

778,481 |

|

|

657,303 |

|

|

638,630 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total deposits |

|

$ |

3,725,540 |

|

$ |

3,755,193 |

|

$ |

3,005,775 |

|

$ |

2,851,013 |

|

$ |

2,815,075 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Public unit nonmaturity

accounts |

|

$ |

523,164 |

|

$ |

584,400 |

|

$ |

474,646 |

|

$ |

479,778 |

|

$ |

439,394 |

| Public unit certficates of

deposit |

|

|

55,344 |

|

|

52,212 |

|

|

49,391 |

|

|

41,117 |

|

|

33,858 |

| Total public unit

deposits |

|

$ |

578,508 |

|

$ |

636,612 |

|

$ |

524,037 |

|

$ |

520,895 |

|

$ |

473,252 |

FHLB advances were $133.5 million at June 30, 2023, an increase

of $95.6 million, or 251.8%, as compared to June 30, 2022, and an

increase of $88.5 million from March 31, 2023, the linked quarter,

as loan growth combined with deposit outflows required additional

funding. The increase in FHLB advances for the full fiscal year was

inclusive of $33.5 million in overnight borrowings, as compared to

no overnight borrowings at June 30, 2022, and was coupled with

$62.1 million in term advances.

The Company’s stockholders’ equity was $446.1 million at June

30, 2023, an increase of $125.3 million, or 39.1%, as compared to

June 30, 2022. The increase was attributable primarily to $98.3

million in equity issued to Citizens shareholders in connection

with the merger, as well as earnings retained after cash dividends

paid, partially offset by a modest increase in accumulated other

comprehensive losses (“AOCL”) as the market value of the Company’s

investments declined due to increases in market interest rates. The

AOCL increased from $17.5 million at June 30, 2022, to $21.9

million at June 30, 2023. The Company does not hold any securities

classified as held-to-maturity.

Quarterly Income Statement Summary:

The Company’s net interest income for the three-month period

ended June 30, 2023, was $36.2 million, an increase of $8.5

million, or 30.5%, as compared to the same period of the prior

fiscal year. The increase was attributable to a 32.8% increase in

the average balance of interest-earning assets in the current

three-month period, as compared to the same period a year ago,

partially offset by a six basis point decrease in net interest

margin from 3.66% to 3.60%. As PPP loan forgiveness declined, the

Company’s accretion of interest income from deferred origination

fees on these loans was immaterial in the current quarter, and had

no impact on net interest margin, which was consistent with the

linked quarter ended March 31, 2023, and as compared to $72,000 in

the same quarter a year ago, which added one basis point to net

interest margin in that period.

Loan discount accretion and deposit premium amortization related

to the Company’s August 2014 acquisition of Peoples Bank of the

Ozarks, the June 2017 acquisition of Capaha Bank, the February 2018

acquisition of Southern Missouri Bank of Marshfield, the November

2018 acquisition of First Commercial Bank, the May 2020 acquisition

of Central Federal Savings & Loan Association, the February

2022 merger of Fortune, and the January 2023 acquisition of

Citizens Bank & Trust resulted in $1.6 million in net interest

income for the three-month period ended June 30, 2023, as compared

to $606,000 in net interest income for the same period a year ago.

Combined, this component of net interest income contributed 16

basis points to net interest margin in the three-month period ended

June 30, 2023, as compared to an eight basis point contribution for

the same period of the prior fiscal year, and as compared to a 14

basis points contribution in the linked quarter, ended March 31,

2023, when net interest margin was 3.48%.

The Company recorded a PCL of $795,000 in the three-month period

ended June 30, 2023, as compared to a PCL of $240,000 in the same

period of the prior fiscal year. The current period PCL was the

result of a $2.3 million provision attributable to the ACL for loan

balances outstanding, partially offset by a recovery of $1.5

million in provision attributable to the allowance for off-balance

sheet credit exposures. The Company’s assessment of the economic

outlook at June 30, 2023, was little changed as compared to the

assessment as of March 31, 2023. Qualitative adjustments in the

Company’s ACL model were also little changed. The Company modestly

decreased adjustments related to classified hotel loans that have

been slow to recover from the COVID-19 pandemic and modestly

increased the ACL due to a small number of individually identified

loans. As a percentage of average loans outstanding, the Company

recorded net charge offs of 0.02% (annualized) during the current

period, up slightly from the same period of the prior fiscal

year.

The Company’s noninterest income for the three-month period

ended June 30, 2023, was $9.0 million, an increase of $2.5 million,

or 37.7%, as compared to the same period of the prior fiscal year.

In the current period, increases in deposit account service

charges, bank card interchange income, loan servicing fees, and

other income were partially offset by decreases in gains realized

on the sale of residential real estate loans originated for that

purpose, and gains realized on the sale of the guaranty portion of

government-guaranteed loans. Additionally, the Company recognized

benefits on its exit from a renewable energy tax credit and other

benefits on renewable and historic tax credit investments totaling

$709,000, as compared to $371,000 in similar benefits a year ago,

and recognized a benefit of $348,000 due to the increased fair

value of mortgage servicing rights held, as compared to a similar

benefit of $176,000 in the same period a year ago. Annual

incentives and reimbursements from the Company’s payment network

processor improved the amount of interchange income recognized in

the fourth quarter of fiscal 2023 and fiscal 2022. Origination of

residential real estate loans for sale on the secondary market was

down 52% as compared to the year ago period, as both refinancing

and purchase activity declined due to the increase in market

interest rates, resulting in a decrease to both gains on sale of

these loans and recognition of new mortgage servicing rights.

Noninterest expense for the three-month period ended June 30,

2023, was $24.9 million, an increase of $7.5 million, or 43.5%, as

compared to the same period of the prior fiscal year. In the

current quarter, this increase in noninterest expense was

attributable primarily to increases in compensation and benefits,

data processing fees, occupancy expenses, and other noninterest

expenses. Direct charges totaling $829,000 related to merger and

acquisition activity were reflected primarily in data processing

fees (including contract termination and data conversion fees),

compensation and benefits, and other miscellaneous merger operating

expenses. In the year ago period, similar charges totaled $117,000.

The increase in compensation and benefits as compared to the prior

year period was primarily due to increased headcount resulting from

the Citizen merger, and a trend increase in legacy employee

headcount, as well as annual merit increases which, for most team

members, took effect in January 2023. Occupancy expenses increased

primarily due to facilities added through the Citizens merger, and

other equipment purchases. Other noninterest expenses increased due

to miscellaneous merger-related expenses, expenses related to loan

originations, and deposit operations. The Company recognized a

recovery on foreclosed property expenses and losses, as compared to

a charge in the year-ago period.

The efficiency ratio for the three-month period ended June 30,

2023, was 55.1%, as compared to 50.6% in the same period of the

prior fiscal year, with the change attributable primarily to the

current period’s increase in noninterest expense, partially offset

by increases in net interest income and noninterest income.

The income tax provision for the three-month period ended June

30, 2023, was $3.9 million, an increase of 9.4%, as compared to the

same period of the prior fiscal year, primarily due to an increase

of net income before income taxes.

Forward-Looking Information:

Except for the historical information contained herein, the

matters discussed in this press release may be deemed to be

forward-looking statements that are subject to known and unknown

risks, uncertainties, and other factors that could cause the actual

results to differ materially from the forward-looking statements,

including: the remaining effects of the COVID-19 pandemic on

general changes in economic conditions, either nationally or in the

Company’s market and lending areas; expected cost savings,

synergies and other benefits from our merger and acquisition

activities might not be realized to the extent anticipated, within

the anticipated time frames, or at all, and costs or difficulties

relating to integration matters, including but not limited to

customer and employee retention and labor shortages, might be

greater than expected; the strength of the United States economy in

general and the strength of the local economies in which we conduct

operations; fluctuations in interest rates and the possibility of a

recession whether caused by Federal Reserve actions or otherwise;

the impact of bank failures or adverse developments at other banks

and related negative press about the banking industry in general on

investor and depositor sentiment; monetary and fiscal policies of

the FRB and the U.S. Government and other governmental initiatives

affecting the financial services industry; the risks of lending and

investing activities, including changes in the level and direction

of loan delinquencies and write-offs and changes in estimates of

the adequacy of the allowance for credit losses; our ability to

access cost-effective funding; the timely development of and

acceptance of our new products and services and the perceived

overall value of these products and services by users, including

the features, pricing and quality compared to competitors' products

and services; fluctuations in real estate values and both

residential and commercial real estate markets, as well as

agricultural business conditions; demand for loans and deposits;

legislative or regulatory changes that adversely affect our

business; the transition from LIBOR to new interest rate

benchmarks; natural disasters, war, terrorist activities or civil

unrest and their effects on economic and business environments in

which the Company operates; changes in accounting principles,

policies, or guidelines; results of regulatory examinations,

including the possibility that a regulator may, among other things,

require an increase in our reserve for loan losses or write-down of

assets; the impact of technological changes; and our success at

managing the risks involved in the foregoing. Any forward-looking

statements are based upon management’s beliefs and assumptions at

the time they are made. The Company wishes to advise readers that

the factors listed above and other risks described in the Company’s

most recent Annual Report on Form 10-K, including, without

limitation, those described under “Item 1A. Risk Factors,” and

Quarterly Reports on Form 10-Q and other documents filed or

furnished from time to time by the Company with the SEC (and are

available on our website at www.bankwithsouthern.com and on the

SEC’s website at www.sec.gov) could affect the Company’s financial

performance and cause the Company’s actual results for future

periods to differ materially from any opinions or statements

expressed with respect to future periods in any current statements.

We undertake no obligation to publicly update or revise any

forward-looking statements or to update the reasons why actual

results could differ from those contained in such statements,

whether as a result of new information, future events or otherwise.

In light of these risks, uncertainties and assumptions, the

forward-looking statements discussed might not occur, and you

should not put undue reliance on any forward-looking

statements.

Southern Missouri Bancorp,

Inc.UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

INFORMATION

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Summary Balance Sheet

Data as of: |

|

June 30, |

|

Mar. 31, |

|

Dec. 31, |

|

Sep. 30, |

|

June 30, |

|

|

(dollars in thousands, except per share data) |

|

2023 |

|

2023 |

|

2022 |

|

2022 |

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash equivalents and time

deposits |

|

$ |

55,220 |

|

$ |

115,791 |

|

$ |

55,143 |

|

$ |

49,736 |

|

$ |

91,560 |

|

| Available for sale (AFS)

securities |

|

|

417,554 |

|

|

429,798 |

|

|

231,389 |

|

|

235,116 |

|

|

235,394 |

|

| FHLB/FRB membership stock |

|

|

20,601 |

|

|

16,346 |

|

|

12,821 |

|

|

19,290 |

|

|

11,683 |

|

| Loans receivable, gross |

|

|

3,618,898 |

|

|

3,480,204 |

|

|

2,995,019 |

|

|

2,976,609 |

|

|

2,719,391 |

|

|

Allowance for credit losses |

|

|

47,820 |

|

|

45,685 |

|

|

37,483 |

|

|

37,418 |

|

|

33,193 |

|

| Loans receivable, net |

|

|

3,571,078 |

|

|

3,434,519 |

|

|

2,957,536 |

|

|

2,939,191 |

|

|

2,686,198 |

|

| Bank-owned life insurance |

|

|

71,684 |

|

|

71,202 |

|

|

49,074 |

|

|

49,024 |

|

|

48,705 |

|

| Intangible assets |

|

|

81,245 |

|

|

81,801 |

|

|

34,632 |

|

|

35,075 |

|

|

35,463 |

|

| Premises and equipment |

|

|

92,397 |

|

|

92,343 |

|

|

67,453 |

|

|

70,550 |

|

|

71,347 |

|

| Other assets |

|

|

50,432 |

|

|

50,866 |

|

|

42,542 |

|

|

46,861 |

|

|

34,432 |

|

|

Total assets |

|

$ |

4,360,211 |

|

$ |

4,292,666 |

|

$ |

3,450,590 |

|

$ |

3,444,843 |

|

$ |

3,214,782 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing deposits |

|

$ |

3,127,940 |

|

$ |

3,136,595 |

|

$ |

2,558,154 |

|

$ |

2,433,780 |

|

$ |

2,388,145 |

|

| Noninterest-bearing

deposits |

|

|

597,600 |

|

|

618,598 |

|

|

447,621 |

|

|

417,233 |

|

|

426,930 |

|

| FHLB advances |

|

|

133,514 |

|

|

45,002 |

|

|

61,489 |

|

|

224,973 |

|

|

37,957 |

|

| Other liabilities |

|

|

31,994 |

|

|

32,732 |

|

|

23,267 |

|

|

19,389 |

|

|

17,923 |

|

| Subordinated debt |

|

|

23,105 |

|

|

23,092 |

|

|

23,080 |

|

|

23,068 |

|

|

23,055 |

|

|

Total liabilities |

|

|

3,914,153 |

|

|

3,856,019 |

|

|

3,113,611 |

|

|

3,118,443 |

|

|

2,894,010 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders’ equity |

|

|

446,058 |

|

|

436,647 |

|

|

336,979 |

|

|

326,400 |

|

|

320,772 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

4,360,211 |

|

$ |

4,292,666 |

|

$ |

3,450,590 |

|

$ |

3,444,843 |

|

$ |

3,214,782 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity to assets ratio |

|

|

10.23 |

% |

|

10.17 |

% |

|

9.77 |

% |

|

9.48 |

% |

|

9.98 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common shares outstanding |

|

|

11,330,462 |

|

|

11,330,712 |

|

|

9,229,151 |

|

|

9,229,151 |

|

|

9,227,111 |

|

|

Less: Restricted common shares not vested |

|

|

50,510 |

|

|

50,760 |

|

|

41,270 |

|

|

41,270 |

|

|

39,230 |

|

| Common shares for book value

determination |

|

|

11,279,952 |

|

|

11,279,952 |

|

|

9,187,881 |

|

|

9,187,881 |

|

|

9,187,881 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Book value per common

share |

|

$ |

39.54 |

|

$ |

38.71 |

|

$ |

36.68 |

|

$ |

35.53 |

|

$ |

34.91 |

|

| Closing market price |

|

|

38.45 |

|

|

37.41 |

|

|

45.83 |

|

|

51.03 |

|

|

45.26 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming asset

data as of: |

|

June 30, |

|

Mar. 31, |

|

Dec. 31, |

|

Sep. 30, |

|

June 30, |

|

|

(dollars in thousands) |

|

2023 |

|

2023 |

|

2022 |

|

2022 |

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonaccrual loans |

|

$ |

7,543 |

|

$ |

7,397 |

|

$ |

4,459 |

|

$ |

3,598 |

|

$ |

4,118 |

|

| Accruing loans 90 days or more

past due |

|

|

109 |

|

|

— |

|

|

331 |

|

|

301 |

|

|

— |

|

|

Total nonperforming loans |

|

|

7,652 |

|

|

7,397 |

|

|

4,790 |

|

|

3,899 |

|

|

4,118 |

|

| Other real estate owned

(OREO) |

|

|

3,606 |

|

|

5,258 |

|

|

1,830 |

|

|

1,830 |

|

|

2,180 |

|

| Personal property

repossessed |

|

|

32 |

|

|

25 |

|

|

25 |

|

|

— |

|

|

11 |

|

|

Total nonperforming assets |

|

$ |

11,290 |

|

$ |

12,680 |

|

$ |

6,645 |

|

$ |

5,729 |

|

$ |

6,309 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total nonperforming assets to

total assets |

|

|

0.26 |

% |

|

0.30 |

% |

|

0.19 |

% |

|

0.17 |

% |

|

0.20 |

% |

| Total nonperforming loans to

gross loans |

|

|

0.21 |

% |

|

0.21 |

% |

|

0.16 |

% |

|

0.13 |

% |

|

0.15 |

% |

| Allowance for loan losses to

nonperforming loans |

|

|

624.93 |

% |

|

617.62 |

% |

|

782.53 |

% |

|

959.68 |

% |

|

806.05 |

% |

| Allowance for loan losses to

gross loans |

|

|

1.32 |

% |

|

1.31 |

% |

|

1.25 |

% |

|

1.26 |

% |

|

1.22 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Performing troubled debt

restructurings (1) |

|

$ |

29,765 |

|

$ |

30,359 |

|

$ |

30,250 |

|

$ |

30,220 |

|

$ |

30,606 |

|

(1) Nonperforming troubled debt restructurings

are included with nonaccrual loans or accruing loans 90 days or

more past due.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three-month period ended |

| Quarterly Summary

Income Statement Data: |

|

June 30, |

|

Mar. 31, |

|

Dec. 31, |

|

Sep. 30, |

|

June 30, |

|

(dollars in thousands, except per share data) |

|

2023 |

|

|

2023 |

|

2022 |

|

2022 |

|

|

2022 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash equivalents |

|

$ |

229 |

|

|

$ |

1,443 |

|

$ |

67 |

|

$ |

162 |

|

|

$ |

198 |

|

AFS securities and membership stock |

|

|

5,118 |

|

|

|

3,728 |

|

|

1,791 |

|

|

1,655 |

|

|

|

1,494 |

|

Loans receivable |

|

|

48,936 |

|

|

|

43,115 |

|

|

36,993 |

|

|

33,180 |

|

|

|

29,880 |

|

Total interest income |

|

|

54,283 |

|

|

|

48,286 |

|

|

38,851 |

|

|

34,997 |

|

|

|

31,572 |

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

16,331 |

|

|

|

13,705 |

|

|

8,594 |

|

|

5,761 |

|

|

|

3,395 |

|

Securities sold under agreements to repurchase |

|

|

— |

|

|

|

213 |

|

|

— |

|

|

— |

|

|

|

— |

|

FHLB advances |

|

|

1,327 |

|

|

|

206 |

|

|

1,657 |

|

|

438 |

|

|

|

180 |

|

Subordinated debt |

|

|

407 |

|

|

|

395 |

|

|

349 |

|

|

290 |

|

|

|

239 |

|

Total interest expense |

|

|

18,065 |

|

|

|

14,519 |

|

|

10,600 |

|

|

6,489 |

|

|

|

3,814 |

| Net interest income |

|

|

36,218 |

|

|

|

33,767 |

|

|

28,251 |

|

|

28,508 |

|

|

|

27,758 |

| Provision for credit

losses |

|

|

795 |

|

|

|

10,072 |

|

|

1,138 |

|

|

5,056 |

|

|

|

240 |

| Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposit account charges and related fees |

|

|

2,094 |

|

|

|

2,089 |

|

|

1,713 |

|

|

1,777 |

|

|

|

1,706 |

|

Bank card interchange income |

|

|

1,789 |

|

|

|

1,374 |

|

|

1,079 |

|

|

1,018 |

|

|

|

1,272 |

|

Loan late charges |

|

|

131 |

|

|

|

161 |

|

|

119 |

|

|

122 |

|

|

|

139 |

|

Loan servicing fees |

|

|

649 |

|

|

|

265 |

|

|

257 |

|

|

312 |

|

|

|

442 |

|

Other loan fees |

|

|

1,184 |

|

|

|

465 |

|

|

612 |

|

|

882 |

|

|

|

813 |

|

Net realized gains on sale of loans |

|

|

325 |

|

|

|

132 |

|

|

127 |

|

|

292 |

|

|

|

664 |

|

Earnings on bank owned life insurance |

|

|

511 |

|

|

|

368 |

|

|

319 |

|

|

318 |

|

|

|

314 |

|

Other noninterest income |

|

|

2,268 |

|

|

|

1,430 |

|

|

1,230 |

|

|

793 |

|

|

|

1,149 |

|

Total noninterest income |

|

|

8,951 |

|

|

|

6,284 |

|

|

5,456 |

|

|

5,514 |

|

|

|

6,499 |

| Noninterest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

|

13,162 |

|

|

|

14,188 |

|

|

9,793 |

|

|

9,752 |

|

|

|

9,867 |

|

Occupancy and equipment, net |

|

|

3,306 |

|

|

|

3,024 |

|

|

2,442 |

|

|

2,447 |

|

|

|

2,538 |

|

Data processing expense |

|

|

2,376 |

|

|

|

2,505 |

|

|

1,430 |

|

|

1,445 |

|

|

|

1,495 |

|

Telecommunications expense |

|

|

552 |

|

|

|

449 |

|

|

347 |

|

|

331 |

|

|

|

327 |

|

Deposit insurance premiums |

|

|

760 |

|

|

|

231 |

|

|

263 |

|

|

215 |

|

|

|

207 |

|

Legal and professional fees |

|

|

463 |

|

|

|

2,324 |

|

|

852 |

|

|

411 |

|

|

|

431 |

|

Advertising |

|

|

698 |

|

|

|

409 |

|

|

216 |

|

|

449 |

|

|

|

579 |

|

Postage and office supplies |

|

|

418 |

|

|

|

331 |

|

|

235 |

|

|

213 |

|

|

|

240 |

|

Intangible amortization |

|

|

1,018 |

|

|

|

812 |

|

|

402 |

|

|

402 |

|

|

|

402 |

|

Foreclosed property expenses (gains) |

|

|

(185 |

) |

|

|

280 |

|

|

35 |

|

|

(41 |

) |

|

|

74 |

|

Other noninterest expense |

|

|

2,307 |

|

|

|

2,439 |

|

|

1,623 |

|

|

1,296 |

|

|

|

1,171 |

|

Total noninterest expense |

|

|

24,875 |

|

|

|

26,992 |

|

|

17,638 |

|

|

16,920 |

|

|

|

17,331 |

|

Net income before income taxes |

|

|

19,499 |

|

|

|

2,987 |

|

|

14,931 |

|

|

12,046 |

|

|

|

16,686 |

| Income taxes |

|

|

3,939 |

|

|

|

578 |

|

|

3,267 |

|

|

2,443 |

|

|

|

3,602 |

|

Net income |

|

|

15,560 |

|

|

|

2,409 |

|

|

11,664 |

|

|

9,603 |

|

|

|

13,084 |

| Less: Distributed and

undistributed earnings allocated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to participating securities |

|

|

67 |

|

|

|

18 |

|

|

52 |

|

|

43 |

|

|

|

55 |

|

Net income available to common shareholders |

|

$ |

15,493 |

|

|

$ |

2,391 |

|

$ |

11,612 |

|

$ |

9,560 |

|

|

$ |

13,029 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per common

share |

|

$ |

1.37 |

|

|

$ |

0.22 |

|

$ |

1.26 |

|

$ |

1.04 |

|

|

$ |

1.41 |

| Diluted earnings per common

share |

|

|

1.37 |

|

|

|

0.22 |

|

|

1.26 |

|

|

1.04 |

|

|

|

1.41 |

| Dividends per common

share |

|

|

0.21 |

|

|

|

0.21 |

|

|

0.21 |

|

|

0.21 |

|

|

|

0.20 |

| Average common shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

11,281,000 |

|

|

|

10,844,000 |

|

|

9,188,000 |

|

|

9,188,000 |

|

|

|

9,241,000 |

|

Diluted |

|

|

11,286,000 |

|

|

|

10,858,000 |

|

|

9,210,000 |

|

|

9,210,000 |

|

|

|

9,252,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three-month period ended |

|

| Quarterly Average

Balance Sheet Data: |

|

June 30, |

|

Mar. 31, |

|

Dec. 31, |

|

Sep. 30, |

|

June 30, |

|

|

(dollars in thousands) |

|

2023 |

|

2023 |

|

2022 |

|

2022 |

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing cash

equivalents |

|

$ |

8,957 |

|

$ |

126,977 |

|

$ |

5,026 |

|

$ |

28,192 |

|

$ |

101,938 |

|

| AFS securities and membership

stock |

|

|

468,879 |

|

|

423,784 |

|

|

275,058 |

|

|

272,391 |

|

|

264,141 |

|

| Loans receivable, gross |

|

|

3,546,423 |

|

|

3,334,897 |

|

|

2,993,152 |

|

|

2,824,286 |

|

|

2,663,640 |

|

|

Total interest-earning assets |

|

|

4,024,259 |

|

|

3,885,658 |

|

|

3,273,236 |

|

|

3,124,869 |

|

|

3,029,719 |

|

| Other assets |

|

|

294,886 |

|

|

273,131 |

|

|

179,585 |

|

|

188,584 |

|

|

194,956 |

|

|

Total assets |

|

$ |

4,319,145 |

|

$ |

4,158,789 |

|

$ |

3,452,821 |

|

$ |

3,313,453 |

|

$ |

3,224,675 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing deposits |

|

$ |

3,094,594 |

|

$ |

3,046,163 |

|

$ |

2,464,093 |

|

$ |

2,433,935 |

|

$ |

2,384,767 |

|

| Securities sold under

agreements to repurchase |

|

|

— |

|

|

16,592 |

|

|

— |

|

|

— |

|

|

— |

|

| FHLB advances |

|

|

125,636 |

|

|

35,645 |

|

|

186,098 |

|

|

83,265 |

|

|

40,804 |

|

| Subordinated debt |

|

|

23,790 |

|

|

23,086 |

|

|

23,074 |

|

|

23,061 |

|

|

23,049 |

|

|

Total interest-bearing liabilities |

|

|

3,244,020 |

|

|

3,121,486 |

|

|

2,673,265 |

|

|

2,540,261 |

|

|

2,448,620 |

|

| Noninterest-bearing

deposits |

|

|

607,782 |

|

|

608,782 |

|

|

439,114 |

|

|

432,959 |

|

|

439,437 |

|

| Other noninterest-bearing

liabilities |

|

|

25,765 |

|

|

15,718 |

|

|

11,165 |

|

|

13,283 |

|

|

14,046 |

|

|

Total liabilities |

|

|

3,877,567 |

|

|

3,745,986 |

|

|

3,123,544 |

|

|

2,986,503 |

|

|

2,902,103 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders’ equity |

|

|

441,578 |

|

|

412,803 |

|

|

329,277 |

|

|

326,950 |

|

|

322,572 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

4,319,145 |

|

$ |

4,158,789 |

|

$ |

3,452,821 |

|

$ |

3,313,453 |

|

$ |

3,224,675 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

|

|

1.44 |

% |

|

0.23 |

% |

|

1.35 |

% |

|

1.16 |

% |

|

1.62 |

% |

| Return on average common

stockholders’ equity |

|

|

14.1 |

% |

|

2.3 |

% |

|

14.2 |

% |

|

11.7 |

% |

|

16.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin |

|

|

3.60 |

% |

|

3.48 |

% |

|

3.45 |

% |

|

3.65 |

% |

|

3.66 |

% |

| Net interest spread |

|

|

3.17 |

% |

|

3.11 |

% |

|

3.16 |

% |

|

3.46 |

% |

|

3.55 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Efficiency ratio |

|

|

55.1 |

% |

|

67.4 |

% |

|

52.3 |

% |

|

49.7 |

% |

|

50.6 |

% |

Matthew Funke, President

573-778-1800

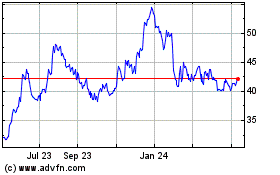

Southern Missouri Bancorp (NASDAQ:SMBC)

Historical Stock Chart

From Jun 2024 to Jul 2024

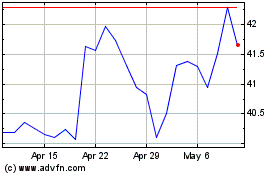

Southern Missouri Bancorp (NASDAQ:SMBC)

Historical Stock Chart

From Jul 2023 to Jul 2024