FY 2020 Annual Report

Financial Summary EARNINGS (dollars in thousands) 2020 2019CHANGE (%) Net interest income Provision for loan losses Noninterest income Noninterest expense Income taxes Net income PER COMMON SHARE Net income: Basic Diluted Closing market price Cash dividends declared $80,136 6,002 14,750 54,452 6,887 27,545 E EE $3.00 2.99 24.30 0.60 $72,782 2,032 13,093 47,892 7,047 28,904 E EE $3.14 3.14 34.83 0.52 10.1 195.4 12.7 13.7 -2.3 -4.7 E -4.5 -4.8 -30.2 15.4 A T YEAR-END (dollars in thousands) E EE E EEE Total assets Loans, net of allowance Reserves as a percent of nonperforming loans Deposits Stockholder’s equity $ 2,542,157 2,141,929 290 % $ 2,184,847 258,347 $ 2,214,402 1,846,405 95 % $ 1,893,695 238,392 14.8 16.0 15.4 8.4 FINANCIAL RA TIOS Return on average shareholder equity Return on average assets Net interest margin Efficiency ratio Allowance for loan losses to loans Equity to average assets at year-end E EE 11.11 % 1.18 3.72 57.39 1.16 11.04 E EE 13.13 % 1.38 3.78 55.93 1.07 11.36 OTHER DA T A (1) E Common shares outstanding Common shares outstanding for book value calculation(2) Average common and dilutive shares outstanding Common stockholders record Full-time equivalent employees Assets per employee (in thousands) Banking offices E 9,127,390 9,099,365 9,199,169 251 475 $5,352 48 E E 9,289,308 9,261,058 9,203,909 277 454 $4,878 47 $1.98 $2.07 $2.39 $3.14 $2.99 $0.36 $0.40 $0.52 $0.44 $0.60 $17.02 $20.19 $22.38 $25.74 $28.39 20162017201820192020 DILUTED EARNINGS PER SHARE 20162017201820192020 CASH DIVIDENDS PER SHARE 20162017201820192020 BOOK V ALUE PER SHARE (1) Other data is as of year-end, except for average shares. (2) Excludes unvested restricted stock award shares.

DEAR SHAREHOLDER, In fiscal 2020, Southern Missouri Bancorp worked with our customers in responding to the COVID-19 pandemic, reduced nonperforming assets acquired in recent acquisitions, increased our allowance for loan losses, completed a small acquisition in an attractive market, and posted strong core results in a challenging environment. Southern Missouri Bancorp, Inc. (the “Company” or “SMBC”), reported net income of $27.5 million for fiscal 2020, a decrease of $1.4 million, or 4.7%, from fiscal 2019. Despite reporting a year-over-year decline, the Company was pleased to continue to show relatively strong core profitability excluding the increased provision for loan losses, with a return on average common equity of 11.1%, and a return on average assets of 1.18% for fiscal 2020, as compared to 13.1% and 1.38%, respectively, for fiscal 2019. RETURN ON COMMON EQUITY DECLINES DUE TO INCREASED PROVISIONING Peer banks1 figures are based on their twelve months ended December 31, 2019, coinciding with their typical fiscal year, and would not reflect increased provisioning for loan losses following the onset of the COVID-19 pandemic. Return on Average Common Equity 12.3% 11.7% 11.3% 13.1% 11.1% 8.8% 8.9% 8.0% 10.1% 9.6% SMBCpeer The Company saw a significant decrease in purchase accounting benefits reported on acquired loan and deposit portfolios, primarily due to inclusion in the prior year’s results of benefits from the resolution of particular purchased credit impaired loans, partially offset by a full-year’s results from the mid-fiscal 2019 acquisition of Gideon Bancshares Company and its subsidiary, First Commercial Bank (“Gideon”). In total, these benefits increased net interest income (pre-tax) by $1.8 million in fiscal 2020, as compared to $2.9 million in the prior fiscal year. Partially offsetting the decline in the accretion of fair value discount on acquired loans, the Company saw material benefits from the resolution of a limited number of nonperforming loans, at $767,000, while there was no comparable material item in the prior fiscal year. Fiscal 2020 results included $1.0 million (pre-tax) in merger-related expenses, net of a small bargain purchase gain, as compared to $829,000 in the prior fiscal year. Net interest income improved 10.1%, as our average earning asset balances increased by 11.8%, while net interest margin declined from 3.78% in fiscal 2019 to 3.72% in fiscal 2020. Average earning asset balance growth was due mostly to solid organic growth through the first three quarters of the fiscal year, the full-year effect of the mid-fiscal 2019 Gideon acquisition, and the SBA-guaranteed Paycheck Protection Program (“PPP”) loans originated relatively late in the fiscal year. Purchase accounting benefits from our three most recent acquisitions, noted above, contributed eight basis points to net interest margin in fiscal 2020, as compared to 15 basis points in the prior 1 Peer data is based on the median year-end figures (December) reported by S&P Global Market Intelligence for publicly-traded commercial banks and thrifts with assets of $1 billion to $3 billion as of December 31, 2019, headquartered in Missouri, Arkansas, Illinois, Iowa, Kansas, Kentucky, Nebraska, Oklahoma, and Tennessee. SMBC data is as of fiscal year-end (June).

fiscal year. An additional four basis points in net interest margin was the result of recognition of income on a limited number of nonperforming relationships favorably resolved during the year which had been on nonaccrual status. Noninterest income increased 12.7%, and the increase continued to be attributable in part to our growth through acquisitions. The increase consisted of higher bank card interchange income, deposit account service charges, gains on the sale of residential real estate loans originated for that purpose, and a small bargain purchase gain, partially offset by decreases in loan servicing income, gains realized on the sale of available-for-sale securities, and earnings on bank-owned life insurance, which decreased due to the inclusion in the prior year’s results of a nonrecurring benefit. Noninterest expense increased 13.7%, also due in part to our growth through acquisitions, as we saw increases in compensation expenses, occupancy, and data processing expenses, and expenses related to foreclosed properties, partially offset by decreases in assessments for deposit insurance, as the Company benefited from credits made available by the FDIC for smaller banks, such as the Company’s subsidiary, as required under the Dodd-Frank Act to offset the costs borne by smaller banks over several years in order to increase the deposit insurance fund to levels required under that law. Noninterest expenses attributable to mergers and acquisition were up modestly in fiscal 2020. The Company saw slight deterioration in its efficiency ratio for the year, as noninterest expenses grew faster than net interest income and noninterest income, on a combined basis. Increased expenses related to acquisition activities pushed the figure higher. EFFICIENCY DETERIORA TES, BUT REMAINS AHEAD OF PEERS Noninterest expenses grew faster than revenues, in part due to M&A expenses. Efficiency Ratio 70.8% 68.2% 65.1% 67.3% 66.3% 57.0% 60.8% 57.7% 55.9% 57.4% SMBCpeer Loan growth was strong in fiscal 2020, aided by the PPP lending activity, which added $132.3 to our portfolio at fiscal year end. In total, net loans increased $295.5 million, or 16.0%, inclusive of the May 2020 acquisition of Central Federal Bancshares (“Central Federal”), which contributed $51.4 million in loans at fair value as of the acquisition date. Inclusive of these acquired loans, growth consisted primarily of residential real estate loans, commercial loans, commercial real estate loans, and funded balances in construction loans, partially offset by declines in consumer loans. We had a very strong year for deposit growth, as businesses and consumers held more cash in the face of economic uncertainty, and as cash available from payments to taxpayers under the CARES Act, deferrals of payroll and other taxes due from businesses, and proceeds not yet utilized from PPP activity swelled account balances. Total deposit growth of $291.2 million, or 15.4%, included $46.7 million from the Central Federal acquisition, while traditional brokered deposit funding declined by $9.9 million. Total public unit deposits increased $38.4 million, with a minimal amount attributable to the Central Federal acquisition. The increase in public unit funding was primarily the result of higher nonmaturity balances held by our existing customer base.

LONG-TERM GROWTH IN LOANS, DEPOSITS, AND TOT AL ASSETS Loan growth was strong in fiscal 2020, ahead of the pandemic, and increased further with the PPP program. Nonmaturity deposit growth was also strong in advance of the pandemic, though CDs attracted fewer depositors due to falling rates. Total Assets (Dollars in millions) Total Loans, net of allowance for loan losses (Dollars in millions) Total Deposits (Dollars in millions) $1,404 $1,708 $1,886 $2,542 $2,214 $1,135 $1,398 $1,563 $1,846 $2,142 $1,121 $1,456 $1,580 $1,894 $2,185 20162017201820192020 20162017201820192020 20162017201820192020 The Company reported nonperforming assets of $11.2 million, or 0.44% of total assets, at June 30, 2020, as compared to $24.8 million, or 1.12% of total assets, at the previous fiscal year end. Nonperforming loans (NPLs) were 0.40% of gross loans at June 30, 2020, as compared to 1.13%, at the prior fiscal year end. The Company improved nonperformers due in large part to a reduction in problem loans and assets acquired in the Gideon acquisition, which included NPLs of $1.8 million, at fair value, as of June 30, 2020, down from $10.2 million a year earlier. Net charge-offs for fiscal 2020 remained low, at 0.04% of average loans outstanding, up from 0.02% in fiscal 2019. PROBLEM ASSET LEVELS IMPROVED Nonperforming asset (NPA) levels decreased as a percentage of average assets, as the Company resolved a number of NPAs acquired through the Gideon acquisition. 1.20% Non-performing Assets Ratio 1.12% 0.64% 0.71% 0.69% 0.69% 0.62% 0.51% Dec. 2015 June 2016 Dec. 2016 0.37% June 2017 Dec. 2017 June 2018 Dec. 2018 June 2019 Dec. 2019 0.44% June 2020 SMBCpeer Book value per common share at June 30, 2020, was $28.39, an increase of 10.3% from June 30, 2019. Tangible book value per common share, a non-GAAP measure, improved 12.0%, to $26.00 at June 30, 2020. Despite improvements in our book value and earnings per share, however, our closing stock price at the end of the fiscal year was $24.30, down 30.2% from $34.83 at the previous fiscal year end. Over that same period, the SNL U.S. Bank and Thrift Index reported a decline of 24.7%, while the S&P 500 increased 5.4%. Our total shareholder return over the five years ended June 30, 2020, assuming dividends had been reinvested, has been 39.3%, while the SNL U.S. Bank and Thrift Index has returned 7.1%, and the S&P 500 has returned 66.5%. We understand that bank stocks in general are out of favor in the market, with expectations for tighter margins in a lower rate environment coupled with the possibility of higher credit losses in coming periods. Further, the market has favored larger-cap stocks in the volatile economy. While we think our stock is attractively priced, we continue to remain paused on our stock repurchase plan, until we see more economic data that will allow us to better assess the possibility of credit losses and ensure that we preserve capital and liquidity to meet the credit needs of our customers. To date, we remain cautiously optimistic about the performance of our loan portfolio.

Our dividends paid during fiscal 2020 represented a 2.5% return on our closing stock price on the final day of the fiscal year, and a 1.9% return on our average closing stock price for fiscal 2020. In assessing our dividend payments in July 2020, the board determined that maintaining our current dividend level of $0.15 per quarter is appropriate and prudent at this time. The Company’s capital base grew somewhat slower than our assets in fiscal 2020, as the late-year surge of loans and deposits resulting from our PPP activity and the Central Federal acquisition combined to add to what would have otherwise been more contained growth levels relative to capital retention. As PPP loans are forgiven, we would expect capital ratios to rebound. Earlier in the fiscal year, the Company utilized $5.8 million in capital in its stock repurchase activity. We ended fiscal 2020 with a ratio of tangible common equity to tangible assets (TCE/TA) of 9.39%, down 43 basis points from 9.82% a year earlier. Regulatory risk-based ratios saw a minimal decrease, while the regulatory leverage ratio saw a larger decline, owing in large part to the increase in PPP loans. For fiscal 2021, we expect to be focused on credit management, assisting our borrowers as they work through this unprecedented environment. We expect to have less interest in growth through acquisitions, though we will continue to evaluate opportunities. We’re pleased with progress made in reduction of our nonperforming assets, and we’ll look to continue reducing the nonperformers we hold as we prepare for the possibility of increased credit difficulties in the coming year. We expect that growth will be difficult to achieve in fiscal 2021, due to the anticipated forgiveness of most of the PPP loans originated in the fiscal year just ended, but we do want to support our communities by continuing to originate loans based on sound underwriting. It’s too early to assess commercial borrower appetite as the economy attempts to recover, though homebuyer and refinancing activity remains strong at this time. We will work to improve our ability to serve our customers through digital channels and reduce reliance on in-branch services. Additionally, we will be focused on mitigating spread compression. I would like to take this opportunity to recognize the importance to our Company of John Abercrombie, who retired from our board last fall. Mr. Abercrombie served as Chairman, President & CEO of Capaha Bank prior to its merger with our Company in June of 2017. I knew John for many years prior to our merger, and I know how his leadership of Capaha Bank guided that institution from its roots as a small, rural Illinois savings bank to become a significant participant in the Cape Girardeau, Missouri, MSA. The Capaha acquisition provided Southern Bank with an opportunity to enter that market, which has been a key to our growth over the last three years. We’ve been very pleased with the continued expansion there from the great entry position from which we benefited. I extend my congratulations and best wishes to John for a long and happy retirement. In the last six months, Southern Missouri has required unprecedented contributions from our team members, and we are fortunate to have had the fantastic team available to meet our organization’s needs. I am grateful for each and every one of them. We continue to do our part to help limit the spread of COVID-19, maintain availability to meet the needs of our customers, and provide an essential service to our communities. Our Company always appreciates the opportunity to serve our customers, and I especially appreciate the flexibility they’ve shown in recent months as we follow the recommendations of our state and local authorities. Finally, I am thankful to you, our shareholders, for your investment and continued confidence in Southern Missouri. Sincerely, Greg Steffens President and Chief Executive Officer Southern Missouri Bancorp, Inc.

PLEASE JOIN US at our 2020 Annual Meeting, where shareholders will hear management review this year’s performance in detail. ANNUAL MEETING Monday, October 26, 2020 at 9:00 AM to be held at our headquarters facility, located at: 2991 Oak Grove Road Poplar Bluff, Missouri

Directors L. DOUGLAS BAGBY Chairman of the Board; Retired City Manager, City of Poplar Bluff SAMMY A. SCHALK Vice-Chairman of the Board; President, Gamblin Lumber Company RONNIE D. BLACK Retired Executive Director, General Association of General Baptists GREG A. STEFFENS President & CEO, Southern Missouri Bancorp, Inc. REBECCA M. BROOKS Financial Manager, McLane Transport CHARLES R. LOVE Certified Public Accountant, Kraft, Miles & Tatum DENNIS C. ROBISON President, Robison Farms, Inc. DA VID J. TOOLEY Retired President & CEO, Metropolitan National Bank TODD E. HENSLEY Investor/Former Chairman, Peoples Bank of the Ozarks Executive Officers GREG A. STEFFENS President Chief Executive Officer LORA L. DA VES Executive Vice President Chief Risk Officer RICK A. WINDES Executive Vice President Chief Lending Officer KIMBERLY A. CAPPS Executive Vice President Chief Operations Officer JUSTIN G. COX Executive Vice President Regional President BRETT A. DORTON Executive Vice President Chief Strategies Officer MA TTHEW T. FUNKE Executive Vice President Chief Financial Officer MARK E. HECKER Executive Vice President Chief Credit Officer MARTIN J. WEISHAAR Executive Vice President Chief Legal Officer

Southern Missouri Bancorp, Inc. offers community banking services in Missouri, Arkansas, and Illinois through its single bank subsidiary, Southern Bank. Southern Bank is... ACCESSIBLESouthern Bank is always accessible through our branches, website, mobile applications, ATMs and ITMs. DYNAMICWe are charismatic and progressive. We grow and adapt to meet the ever-changing needs of our customers and communities. INNOV A TIVEWe are unconventional pioneers. We offer cutting edge products, like Kasasa, to help our customers put their hard-earned money to work. COMPETITIVEWe are as ambitious and driven as the people we serve. We offer the same quality products of mega bank chains without losing personal service or outsourcing decisions. ROOTEDOur culture is rooted in more than 130 years of impeccable customer service, superior products, and philanthropy. INVOL VEDWe believe that our personal investment in the lives of our customers and in the communities we serve is just as important as our financial investments. Southern Missouri Bancorp, Inc. 2991 Oak Grove Road | Poplar Bluff, Missouri 63901 (573) 778-1800 www.bankwithsouthern.com

This page left intentionally blank.

Investor Relations Contact Lorna Brannum bancorp@bankwithsouthern.com

Southern Missouri Bancorp, Inc. 2991 Oak Grove Road Poplar Bluff, Missouri 63901 (573) 778-1800

Southern Missouri Bancorp (NASDAQ:SMBC)

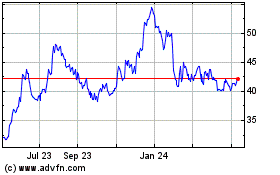

Historical Stock Chart

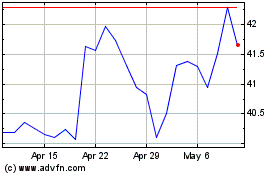

From Jul 2024 to Aug 2024

Southern Missouri Bancorp (NASDAQ:SMBC)

Historical Stock Chart

From Aug 2023 to Aug 2024