Sono-Tek Corporation (Nasdaq: SOTK), the leading developer and

manufacturer of ultrasonic coating systems, today reported

financial results for its first quarter of fiscal year 2025, ended

May 31, 2024.

First Quarter FY2025 Financial Highlights:

(Compared with prior-year period unless otherwise noted)

- Net Sales for the quarter increased

40% to $5,031,000 compared to $3,603,000 in the prior year period,

driven by strong shipments to the Medical and Alternative/Clean

Energy markets.

- Gross Profit increased 38% to

$2,454,000 compared to $1,777,000 in the prior year period.

- Operating Income increased $330,000

to $238,000, from an operating loss of $92,000 at May 31, 2023. The

increase is due to the current period’s increase in gross profit

partially offset by an increase in operating expenses.

- Gross Margin decreased slightly to

48.8% compared to 49.3% in the prior year period due to a

realignment of organizational framework that started in Q4 FY2024

but remains strong and within its historical range.

- Income before taxes was $391,000

compared to $32,000 in the prior year period.

- Net income was $331,000, or $0.02

per share, compared with $53,000 or $0.00 per share, an increase of

525%

- Cash, cash equivalents and

marketable securities at quarter-end were $12.2 million, an

increase of $0.3 million from February 29, 2024 with no outstanding

debt.

- Combined Equipment and

service-related backlog at May 31, 2024 was $7.83 million, compared

to equipment and service-related backlog of $9.28 million at

February 29, 2024.

- Sales growth guidance for the

second quarter of FY2025, ending August 31, 2024, is for growth of

2%-5% above the first quarter ended May 31, 2024 and for continued

sales growth for the full fiscal year over the last fiscal

year.

“Sono-Tek began its fiscal year with strong

sales momentum and is looking forward to an excellent year with

increasing orders in green energy systems combined with strength in

the medical device coating market and the semiconductor/electronics

markets. We are aggressively moving forward with full production

systems with the potential for multiple repeat orders this year,”

according to Dr. Christopher L Coccio, Executive Chairman.

Steve Harshbarger, CEO & President of

Sono-Tek, remarked, “Our growth strategies are continuing to gain

momentum as our customers move from R&D and pilot machines to

our complex large-scale production systems with significantly

higher Average Selling Prices (ASP). We remain excited about our

prospects for attracting additional high-volume, high-ASP

production system orders in fiscal year 2025. Due to the increased

frequency of high ASP large platform machine orders, our revenue

can be highly variable from quarter to quarter resulting in large

fluctuations in backlog. With our strong sales momentum bolstered

by our solid balance sheet, we remain focused on continued

execution and look forward to building on our record revenues.”

First Quarter Fiscal 2025 Results

|

|

Three Months Ended May 31, |

Change |

|

|

|

2024 |

|

|

2023 |

|

|

$ |

|

% |

|

Net Sales |

$ |

5,031,000 |

|

$ |

3,603,000 |

|

|

1,428,000 |

|

40 |

% |

| Gross Profit |

|

2,454,000 |

|

|

1,777,000 |

|

|

677,000 |

|

38 |

% |

|

Gross Margin |

|

48.8% |

|

|

49.3% |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating Income |

$ |

238,000 |

|

$ |

(92,000) |

|

|

330,000 |

|

359 |

% |

|

Operating Margin |

|

4.7% |

|

|

(2.6%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

$ |

331,000 |

|

$ |

53,000 |

|

|

278,000 |

|

525 |

% |

|

Net Margin |

|

6.6% |

|

|

1.5% |

|

|

|

|

|

| Basic Earnings Per Share |

$ |

0.02 |

|

$ |

0.00 |

|

|

|

|

|

| Diluted Earnings Per

Share |

$ |

0.02 |

|

$ |

0.00 |

|

|

|

|

|

| Weighted Average Shares

-Basic |

|

15,751,000 |

|

|

15,742,000 |

|

|

|

|

|

| Weighted Average Shares -

Diluted |

|

15,774,000 |

|

|

15,769,000 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

First Quarter FY2025 Financial Overview

Net Sales for the quarter increased 40% to

$5,031,000 compared to $3,603,000 in the prior year period, driven

by strong shipments to the Medical and Alternative/Clean Energy

markets.

In the first quarter of fiscal 2025,

approximately 39% of sales originated outside of the United States

and Canada compared with 34% in the prior year period.

Equipment related backlog at May 31, 2024 was

$7.69 million, compared to backlog of $9.08 million at February 29,

2024, a decrease of $1.39 million or 15.4%. Combined equipment and

service-related backlog at May 31, 2024 was $7.83 million, compared

to equipment and service related backlog of $9.28 million at

February 29, 2024, a decrease of $1.5 million or 16%.

Gross Profit increased 38% to $2,454,000

compared to $1,777,000 in the prior year period. Gross profit

margin decreased 50 basis points to 48.8% in the first quarter of

fiscal 2025 compared to 49.3% in the prior year period due to

product mix changes and recharacterization of expenses associated

with evolving workforce roles, as successful development

initiatives transition toward mainstream manufacturing.

Operating income increased to $238,000 in the

first quarter of fiscal 2025 compared to an operating loss of

$92,000 for the prior year period, an increase of $330,000 or 359%.

The increase in operating income is a result of the improvement in

gross profit of $677,000, offset by an increase in operating

expenses of $347,000.

Net income for the first quarter was $331,000,

or $0.02 per share, compared with net income of $53,000 or $0.00

per share, for the prior year period, an increase of 525%. Diluted

weighted average shares outstanding totaled 15,774,376 compared to

15,769,442 for the prior year period.

Balance Sheet and Cash Flow Overview

Cash, cash equivalents and marketable securities

at quarter-end were $12.2 million, an increase of $0.3 million from

February 29, 2024, the end of fiscal year 2024. The increase was

the result of the current period’s net income and non-cash charges

partially offset by an increase in inventories and a decrease in

payables and customer deposits.

Capital expenditures in the first quarter

totaled $33,000 which were directed to ongoing upgrades to the

Company’s manufacturing facilities. Sono-Tek anticipates total

capital expenditures will be approximately $300,000 - $350,000 in

fiscal 2025.

At May 31, 2024, Sono-Tek had no debt on its

balance sheet.

About Sono-Tek

Sono-Tek Corporation is a global leader in the

design and manufacture of ultrasonic coating systems that are

shaping industries and driving innovation worldwide. Our ultrasonic

coating systems are used to apply thin films onto parts used in

diverse industries including microelectronics, alternative energy,

medical devices, advanced industrial manufacturing, and research

and development sectors worldwide. Sono-Tek's bold venture into the

clean energy sector is showing transformative results in next-gen

solar cells, fuel cells, green hydrogen generation, and carbon

capture applications as we shape a sustainable future.

Our product line is rapidly evolving,

transitioning from R&D to high-volume production machines with

significantly higher average selling prices, showcasing our market

leadership and adaptability. Our comprehensive suite of thin film

coating solutions and application consulting services ensures

unparalleled results for our clients and helps some of the world's

most promising companies achieve technological breakthroughs and

bring them to the market. The Company strategically delivers its

products to customers through a network of direct sales personnel,

carefully chosen independent distributors, and experienced sales

representatives, ensuring efficient market reach across diverse

sectors around the globe.

The Company’s solutions are environmentally

friendly, efficient and highly reliable, and enable dramatic

reductions in overspray, savings in raw material, water and energy

usage and provide improved process repeatability, transfer

efficiency, high uniformity and reduced emissions.

Sono-Tek’s growth strategy is focused on

leveraging its innovative technologies, proprietary know-how,

unique talent and experience, and global reach to further develop

thin film coating technologies that enable better outcomes for its

customers’ products and processes. For further information, visit

www.sono-tek.com.

Safe Harbor Statement

This news release contains forward looking

statements regarding future events and the future performance of

Sono-Tek Corporation that involve risks and uncertainties that

could cause actual results to differ materially. These

“forward-looking statements’ are based on currently available

competitive, financial and economic data and our operating plans.

They are inherently uncertain, and investors must recognize that

events could turn out to be significantly different from our

expectations and could cause actual results to differ materially.

These factors include, among other considerations, general economic

and business conditions, including political, regulatory, tax,

competitive and technological developments affecting our operations

or the demand for our products; inflationary and supply chain

pressures; the recovery of the Electronics/Microelectronics and

Medical markets; rebound of sales to the industrial market in the

second quarter of fiscal year 2025; maintenance of order backlog;

the imposition of tariffs; timely development and market acceptance

of new products and continued customer validation of our coating

technologies; adequacy of financing; capacity additions, the

ability to enforce patents; maintenance of operating leverage;

consummation of order proposals; completion of large orders on

schedule and on budget; continued sales growth in the medical and

alternative energy markets; successful transition from primarily

selling ultrasonic nozzles and components to a more complex

business providing complete machine solutions and higher value

subsystems; and realization of quarterly and annual revenues within

the forecasted range of sales guidance. We undertake no obligation

to update any forward-looking statement.

For more information:

Sono-Tek Corp.Stephen J. BagleyChief Financial OfficerPh: (845)

795-2020info@sono-tek.com

Investor Relations:Kirin SmithPCG AdvisoryPh: (646)

823-8656ksmith@pcgadvisory.com

http://www.sono-tek.com

FINANCIAL TABLES FOLLOW

| |

|

SONO-TEK CORPORATIONCONDENSED CONSOLIDATED

BALANCE SHEETS |

| |

| |

|

May 31, 2024 |

|

|

February 29, |

|

| |

|

(Unaudited) |

|

|

2024 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,402,007 |

|

|

$ |

2,134,786 |

|

|

Marketable securities |

|

|

9,749,483 |

|

|

|

9,711,351 |

|

|

Accounts receivable (less allowance of $12,225) |

|

|

1,401,582 |

|

|

|

1,470,711 |

|

|

Inventories |

|

|

5,479,368 |

|

|

|

5,221,980 |

|

|

Prepaid expenses and other current assets |

|

|

148,603 |

|

|

|

207,738 |

|

|

Total current assets |

|

|

19,181,043 |

|

|

|

18,746,566 |

|

| |

|

|

|

|

|

|

|

|

| Land |

|

|

250,000 |

|

|

|

250,000 |

|

| Buildings, equipment,

furnishings and leasehold improvements, net |

|

|

2,709,183 |

|

|

|

2,832,156 |

|

| Intangible assets, net |

|

|

45,020 |

|

|

|

47,566 |

|

| Deferred tax asset |

|

|

1,369,210 |

|

|

|

1,255,977 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

|

$ |

23,554,456 |

|

|

$ |

23,132,265 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,020,777 |

|

|

$ |

1,049,742 |

|

|

Accrued expenses |

|

|

1,711,800 |

|

|

|

1,739,478 |

|

|

Customer deposits |

|

|

3,339,816 |

|

|

|

3,419,706 |

|

|

Income taxes payable |

|

|

618,010 |

|

|

|

414,807 |

|

|

Total current liabilities |

|

|

6,690,403 |

|

|

|

6,623,733 |

|

| |

|

|

|

|

|

|

|

|

| Deferred tax liability |

|

|

199,987 |

|

|

|

229,534 |

|

|

Total liabilities |

|

|

6,890,390 |

|

|

|

6,853,267 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and Contingencies

(Note 9) |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Common stock, $.01 par value; 25,000,000 shares authorized,

15,750,880 shares issued and outstanding as of May 31 and February

29, 2024 |

|

|

157,509 |

|

|

|

157,509 |

|

|

Additional paid-in capital |

|

|

9,824,618 |

|

|

|

9,770,387 |

|

|

Accumulated earnings |

|

|

6,681,939 |

|

|

|

6,351,102 |

|

|

Total stockholders’ equity |

|

|

16,664,066 |

|

|

|

16,278,998 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

$ |

23,554,456 |

|

|

$ |

23,132,265 |

|

See notes to unaudited condensed consolidated

financial statements.

| |

|

SONO-TEK CORPORATIONCONDENSED CONSOLIDATED

STATEMENTS OF INCOME(Unaudited) |

| |

| |

|

Three Months Ended May 31, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

Net Sales |

|

$ |

5,031,038 |

|

|

$ |

3,603,018 |

|

| Cost of Goods Sold |

|

|

2,576,551 |

|

|

|

1,825,786 |

|

|

Gross Profit |

|

|

2,454,487 |

|

|

|

1,777,232 |

|

| |

|

|

|

|

|

|

|

|

| Operating Expenses |

|

|

|

|

|

|

|

|

|

Research and product development costs |

|

|

731,430 |

|

|

|

656,438 |

|

|

Marketing and selling expenses |

|

|

897,190 |

|

|

|

800,784 |

|

|

General and administrative costs |

|

|

587,571 |

|

|

|

411,626 |

|

|

Total Operating Expenses |

|

|

2,216,191 |

|

|

|

1,868,848 |

|

| |

|

|

|

|

|

|

|

|

| Operating Income/(Loss) |

|

|

238,296 |

|

|

|

(91,616 |

) |

| |

|

|

|

|

|

|

|

|

| Interest and Dividend

Income |

|

|

142,654 |

|

|

|

105,990 |

|

| Net unrealized gain on

marketable securities |

|

|

10,361 |

|

|

|

17,658 |

|

| |

|

|

|

|

|

|

|

|

| Income Before Income

Taxes |

|

|

391,311 |

|

|

|

32,032 |

|

| |

|

|

|

|

|

|

|

|

| Income Tax Expense/

(Benefit) |

|

|

60,474 |

|

|

|

(21,374 |

) |

| |

|

|

|

|

|

|

|

|

| Net Income |

|

$ |

330,837 |

|

|

$ |

53,406 |

|

| |

|

|

|

|

|

|

|

|

| Basic Earnings Per Share |

|

$ |

0.02 |

|

|

$ |

0.00 |

|

| |

|

|

|

|

|

|

|

|

| Diluted Earnings Per

Share |

|

$ |

0.02 |

|

|

$ |

0.00 |

|

| |

|

|

|

|

|

|

|

|

| Weighted Average Shares -

Basic |

|

|

15,750,880 |

|

|

|

15,742,073 |

|

| |

|

|

|

|

|

|

|

|

| Weighted Average Shares -

Diluted |

|

|

15,774,376 |

|

|

|

15,769,442 |

|

See notes to unaudited condensed consolidated

financial statements.

| |

|

SONO-TEK CORPORATIONCONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS(Unaudited) |

| |

| |

|

Three Months Ended May 31, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Net Income |

|

$ |

330,837 |

|

|

$ |

53,406 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

158,491 |

|

|

|

135,208 |

|

|

Stock based compensation expense |

|

|

54,231 |

|

|

|

48,295 |

|

|

Inventory reserve |

|

|

11,839 |

|

|

|

(10,582 |

) |

|

Unrealized (gain)/loss on marketable securities |

|

|

(10,361 |

) |

|

|

(17,658 |

) |

|

Deferred tax expense |

|

|

- |

|

|

|

(124,317 |

) |

|

Decrease (Increase) in: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

69,129 |

|

|

|

492,390 |

|

|

Inventories |

|

|

(269,227 |

) |

|

|

(501,566 |

) |

|

Prepaid expenses and other current assets |

|

|

59,135 |

|

|

|

64,746 |

|

|

(Decrease) Increase in: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

|

(28,965 |

) |

|

|

122,767 |

|

|

Accrued expenses |

|

|

(27,678 |

) |

|

|

(88,157 |

) |

|

Customer deposits |

|

|

(79,890 |

) |

|

|

772,410 |

|

|

Income taxes payable |

|

|

203,203 |

|

|

|

(118,850 |

) |

| Net Cash Provided by Operating

Activities |

|

|

327,964 |

|

|

|

828,092 |

|

| |

|

|

|

|

|

|

|

|

| CASH FLOWS FROM

INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Purchase of equipment, furnishings and leasehold improvements |

|

|

(32,972 |

) |

|

|

(149,004 |

) |

|

Sale of marketable securities |

|

|

5,211,058 |

|

|

|

3,707,074 |

|

|

Purchase of marketable securities |

|

|

(5,238,829 |

) |

|

|

(3,446,424 |

) |

|

Net Cash (Used)/Provided by Investing Activities |

|

|

(60,743 |

) |

|

|

111,646 |

|

| |

|

|

|

|

|

|

|

|

| NET INCREASE IN CASH

AND CASH EQUIVALENTS |

|

|

267,221 |

|

|

|

939,738 |

|

| |

|

|

|

|

|

|

|

|

| CASH AND CASH

EQUIVALENTS |

|

|

|

|

|

|

|

|

|

Beginning of period |

|

|

2,134,786 |

|

|

|

3,354,601 |

|

|

End of period |

|

$ |

2,402,007 |

|

|

$ |

4,294,339 |

|

| |

|

|

|

|

|

|

|

|

| SUPPLEMENTAL CASH FLOW

DISCLOSURE: |

|

|

|

|

|

|

|

|

|

Interest paid |

|

$ |

— |

|

|

$ |

— |

|

|

Taxes Paid |

|

$ |

— |

|

|

$ |

221,942 |

|

See notes to unaudited condensed consolidated

financial statements.

| |

|

SONO-TEK CORPORATIONADDITIONAL

INFORMATION – MARKET AND PRODUCT

SALES(Unaudited) |

| |

| Market

Sales: |

| |

|

Three Months Ended May 31, |

|

Change |

| |

|

2024 |

|

|

% of total |

|

2023 |

|

|

% of total |

|

$ |

|

|

% |

|

Electronics/Microelectronics |

|

$ |

1,568,000 |

|

|

31% |

|

$ |

1,375,000 |

|

|

38% |

|

|

193,000 |

|

|

14% |

| Medical |

|

|

857,000 |

|

|

17% |

|

|

383,000 |

|

|

11% |

|

|

474,000 |

|

|

124% |

| Alternative Energy/Clean |

|

|

2,282,000 |

|

|

46% |

|

|

833,000 |

|

|

23% |

|

|

1,449,000 |

|

|

174% |

| Emerging R&D and

Other |

|

|

11,000 |

|

|

0% |

|

|

126,000 |

|

|

3% |

|

|

(115,000) |

|

|

(91%) |

| Industrial |

|

|

313,000 |

|

|

6% |

|

|

886,000 |

|

|

25% |

|

|

(573,000) |

|

|

(65%) |

|

TOTAL |

|

$ |

5,031,000 |

|

|

|

|

$ |

3,603,000 |

|

|

|

|

$ |

1,428,000 |

|

|

40% |

| Product

Sales: |

| |

|

Three Months Ended May 31, |

|

Change |

| |

|

2024 |

|

|

% of total |

|

2023 |

|

|

% of total |

|

$ |

|

|

% |

|

Fluxing Systems |

|

$ |

134,000 |

|

|

2% |

|

$ |

236,000 |

|

|

6% |

|

|

(102,000) |

|

|

(43%) |

| Integrated Coating

Systems |

|

|

747,000 |

|

|

15% |

|

|

309,000 |

|

|

9% |

|

|

438,000 |

|

|

142% |

| Multi-Axis Coating

Systems |

|

|

2,664,000 |

|

|

53% |

|

|

1,763,000 |

|

|

49% |

|

|

901,000 |

|

|

51% |

| OEM Systems |

|

|

332,000 |

|

|

7% |

|

|

274,000 |

|

|

8% |

|

|

58,000 |

|

|

21% |

| Spare Parts, Services and

Other |

|

|

1,154,000 |

|

|

23% |

|

|

1,021,000 |

|

|

28% |

|

|

133,000 |

|

|

13% |

|

TOTAL |

|

$ |

5,031,000 |

|

|

|

|

$ |

3,603,000 |

|

|

|

|

$ |

1,428,000 |

|

|

40% |

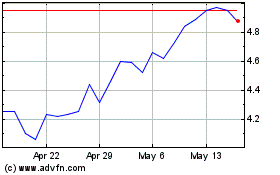

Sono Tek (NASDAQ:SOTK)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sono Tek (NASDAQ:SOTK)

Historical Stock Chart

From Nov 2023 to Nov 2024