SMART Global Holdings, Inc. (“SGH,” “we,” or the “Company”)

(Nasdaq: SGH) today announced that it intends to offer $150.0

million in aggregate principal amount of convertible senior notes

due 2030 (the “Notes”) to qualified institutional buyers as defined

in Rule 144A under the Securities Act of 1933, as amended (the

“Securities Act”), subject to market and other conditions. The

Company also expects to grant to the initial purchasers of the

Notes an option to purchase, for settlement within a period of 13

days from, and including, the date the Notes are first issued, up

to an additional $22.5 million aggregate principal amount of

Notes.

The Notes will be senior, unsecured obligations of the Company

and will accrue interest payable semi-annually in arrears. The

Notes will mature on August 15, 2030, unless earlier converted,

redeemed or repurchased. Prior to February 15, 2030, the Notes will

be convertible at the option of the holders only upon satisfaction

of certain conditions and during certain periods. On or after

February 15, 2030, the Notes will be convertible at the option of

the holders at any time prior to the close of business on the

second scheduled trading day immediately before the maturity date.

The Company will settle conversions by paying or delivering, as

applicable, cash and, if applicable, ordinary shares, based on the

applicable conversion rate(s).

The Notes will be redeemable, in whole or in part, for cash at

SGH’s option at any time, and from time to time, on or after August

20, 2027 and on or before the 31st scheduled trading day

immediately before the maturity date, but only if the last reported

sale price per ordinary share of the Company exceeds 130% of the

conversion price for a specified period of time. In addition, the

Notes will be redeemable, in whole and not in part, at SGH’s option

at any time in connection with certain changes in tax law. The

redemption price will be equal to the principal amount of the Notes

to be redeemed, plus accrued and unpaid interest, if any, to, but

excluding, the redemption date.

If certain corporate events that constitute a “fundamental

change” occur, then, subject to a limited exception, noteholders

may require SGH to repurchase their Notes for cash. The repurchase

price will be equal to the principal amount of the Notes to be

repurchased, plus accrued and unpaid interest, if any, to, but

excluding, the applicable repurchase date.

SGH expects to use the net proceeds to fund the cost of entering

into the capped call transactions described below and to repurchase

a portion of the aggregate principal amount of SGH’s existing 2.25%

convertible senior notes due 2026 (the “Existing Convertible

Notes”) in privately negotiated transactions effected through one

of the initial purchasers or its affiliate, as SGH’s agent,

concurrently with the pricing of the offering. SGH intends to use

the remainder of the net proceeds from the offering to repay

certain amounts outstanding under SGH’s term loan credit facility,

dated as of February 7, 2022, among the Company, SMART Modular

Technologies, Inc., a wholly-owned subsidiary of SGH, the lenders

party thereto, Citizens Bank, N.A., as administrative agent and

collateral agent and the other parties thereto, as amended (the

“Credit Agreement”).

If the initial purchasers exercise their option to purchase

additional Notes, SGH intends to use a portion of the net proceeds

from the sale of the additional Notes to pay the cost of additional

capped call transactions, and any remaining net proceeds from the

sale of the additional Notes will be used to repay additional

amounts under SGH’s Credit Agreement, as described above.

Holders of the Existing Convertible Notes that are repurchased

in the concurrent repurchases described above may purchase ordinary

shares of the Company in the open market to unwind any hedge

positions they may have with respect to the Existing Convertible

Notes. These activities may affect the trading price of SGH’s

ordinary shares and, if conducted concurrently with the offering of

the Notes, may result in a higher initial conversion price of the

Notes SGH is offering.

The interest rate, initial conversion rate, offering price and

other terms of the Notes have not been finalized and will be

determined at the time of pricing of the offering.

In connection with the pricing of the Notes, SGH expects to

enter into privately negotiated capped call transactions with one

or more of the initial purchasers and/or their respective

affiliates and/or other financial institutions (the “Option

Counterparties”). The capped call transactions will cover, subject

to anti-dilution adjustments substantially similar to those

applicable to the Notes, the number of the Company’s ordinary

shares that will initially underlie the Notes. If the initial

purchasers exercise their option to purchase additional Notes, the

Company expects to enter into additional capped call transactions

with the Option Counterparties.

The capped call transactions are expected generally to reduce

the potential dilution to holders of ordinary shares of the Company

upon any conversion of the Notes and/or offset any cash payments

SGH is required to make in excess of the principal amount of

converted Notes, as the case may be, with such reduction and/or

offset subject to a cap based on the cap price of the capped call

transactions.

In connection with establishing their initial hedge positions

with respect to the capped call transactions, the Option

Counterparties and/or their respective affiliates expect to

purchase ordinary shares and/or enter into various derivative

transactions with respect to the ordinary shares concurrently with,

or shortly after, the pricing of the Notes. These hedging

activities could increase (or reduce the size of any decrease in)

the market price of the ordinary shares or the Notes at that

time.

In addition, the Option Counterparties and/or their respective

affiliates may modify their hedge positions by entering into or

unwinding various derivative transactions with respect to the

ordinary shares and/or purchasing or selling the ordinary shares or

other securities of the Company in secondary market transactions

following the pricing of the Notes and prior to the maturity of the

Notes (and are likely to do so during any observation period

related to a conversion of the Notes). This activity could also

cause or avoid an increase or a decrease in the market price of the

ordinary shares or the Notes, which could affect the ability of

holders to convert their Notes, and, to the extent the activity

occurs following conversion or during any observation period

related to a conversion of the Notes, it could affect the amount

and value of the consideration that holders will receive upon

conversion of their Notes.

The offer and sale of the Notes and the ordinary shares issuable

upon conversion of the Notes, if any, have not been and will not be

registered under the Securities Act or the securities laws of any

other jurisdiction and may not be offered or sold in the United

States absent registration or an applicable exemption from such

registration requirements.

This press release shall not constitute an offer to sell or a

solicitation of an offer to purchase any of these securities, in

the United States or elsewhere, and shall not constitute an offer,

solicitation or sale of the Notes or ordinary shares of the Company

in any state or jurisdiction in which such an offer, solicitation

or sale would be unlawful. This press release does not constitute

an offer to purchase or a notice of redemption with respect to the

Existing Convertible Notes, and SGH reserves the right to elect not

to proceed with the repurchase.

Use of Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act, Section 21E of

the Securities Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995. All statements contained

in this press release that do not relate to matters of historical

fact should be considered forward-looking statements. These

statements include, but are not limited to, statements regarding

the proposed terms of the Notes being offered and the capped call

transactions, the completion, timing and size of the proposed

offering and capped call transactions, the effects of entering into

the capped call transactions and the actions of the Option

Counterparties and their respective affiliates and the intended use

of net proceeds from the offering including the repurchase

transactions described above. Forward-looking statements often use

words such as “anticipate,” “target,” “expect,” “estimate,”

“intend,” “plan,” “believe,” “could,” “will,” “may” and other words

of similar meaning. These forward-looking statements are based on

current expectations and preliminary assumptions that are subject

to factors and uncertainties that could cause actual results to

differ materially from those described in these forward-looking

statements. These forward-looking statements are subject to a

number of risks, uncertainties and other factors, many of which are

outside SGH’s control, including, among others, failure to realize

opportunities relating to the company’s growth and stakeholder

value, whether the offering will be consummated, whether the capped

call transactions will become effective and other factors and risks

detailed in SGH’s filings with the U.S. Securities and Exchange

Commission (which include SGH’s most recent Annual Report on Form

10-K), including SGH’s future filings. Such factors and risks as

outlined above and in such filings do not constitute all factors

and risks that could cause actual results of SGH to be materially

different from SGH’s forward-looking statements. Accordingly,

investors are cautioned not to place undue reliance on any

forward-looking statements. SGH may not consummate the proposed

offering described in this press release and, if the proposed

offering is consummated, cannot provide any assurances regarding

the final terms of the offer or the Notes or its ability to

effectively apply the net proceeds as described above. These

forward-looking statements are made as of the date of this press

release, and SGH does not intend, and has no obligation, to update

or revise any forward-looking statements in order to reflect events

or circumstances that may arise after the date of this press

release, except as required by law.

About SGH

At SGH, we design, build, deploy and manage high-performance,

high-availability enterprise solutions that help our customers

solve for the future. Across our computing, memory, and LED lines

of business, we focus on serving our customers by providing deep

technical knowledge and expertise, custom design engineering,

build-to-order flexibility and a commitment to best-in-class

quality.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731452783/en/

Investor Contact Suzanne Schmidt Investor Relations

+1-510-360-8596 ir@sghcorp.com

PR Contact Maureen O’Leary Director, Communications

+1-602-330-6846 pr@sghcorp.com

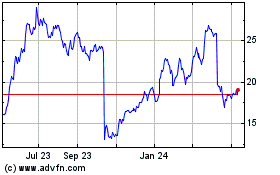

SMART Global (NASDAQ:SGH)

Historical Stock Chart

From Dec 2024 to Jan 2025

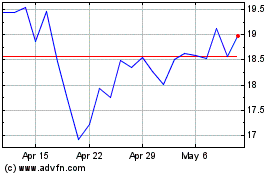

SMART Global (NASDAQ:SGH)

Historical Stock Chart

From Jan 2024 to Jan 2025