false

0001236275

0001236275

2024-05-24

2024-05-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 24, 2024

| SILVERSUN TECHNOLOGIES, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

|

001-38063 |

|

16-1633636 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

120 Eagle Rock Ave

East Hanover, NJ 07936

(Address of Principal Executive Offices)

(973) 396-1720

Registrant’s telephone number, including

area code

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common shares (par value $0.00001 per share) |

|

SSNT |

|

The NASDAQ Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01 Regulation FD Disclosure.

As previously disclosed, SilverSun Technologies,

Inc. (the “Company” or “SilverSun”) entered into an Amended and Restated Investment Agreement (the “Investment

Agreement”), dated April 14, 2024, with Jacobs Private Equity II, LLC, a Delaware limited liability company (“JPE”)

(on behalf of itself and on behalf of the other investors party thereto (collectively with JPE, the “Investors”)), providing

for, among other things, an aggregate investment by the Investors of $1,000,000,000 in cash in the

Company (collectively, the “Equity Investment”).

In connection with the anticipated closing

of the Equity Investment (the “Closing”), the board of directors of the Company announced today a conditional cash dividend

(the “Cash Dividend”) in an aggregate amount equal to $17,400,000, payable on June 12, 2024, to holders of shares of the Company’s

common stock, par value $0.00001 per share (“Company Common Stock”), of record as of the close of business on June 5, 2024

(the “Record Date”). The payment of the Cash Dividend is contingent upon, and subject to, the occurrence of the Closing and

the satisfaction of the conditions to the Closing, including receipt of approval by the Company’s stockholders at a special stockholders’

meeting to be held on May 30, 2024. The exact amount of the Cash Dividend on a per share basis will be equal to $17,400,000 divided by

the number of shares of Company Common Stock issued and outstanding as of the close of business on the Record Date, which will occur one

day after the effective time of the 8-1 reverse stock split contemplated by the Investment Agreement (the “Reverse Split”).

The per share Cash Dividend is expected to be approximately $26.19 (on a post-Reverse Split basis), based on 664,447 shares of Company

Common Stock expected to be outstanding as of the Record Date and giving effect to the Reverse Split. For reference and illustration only,

the expected Cash Dividend amount would be approximately $3.27 per share without giving effect to the Reverse Split.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking

statements. Statements that are not historical facts, including statements about beliefs, expectations, targets or goals, such as statements

regarding revenue goals, are forward-looking statements. These statements are based on plans, estimates, expectations and/or goals at

the time the statements are made, and readers should not place undue reliance on them. In some cases, readers can identify forward-looking

statements by the use of forward-looking terms such as “may,” “will,” “should,” “expect,”

“opportunity,” “intend,” “plan,” “anticipate,” “believe,” “estimate,”

“predict,” “potential,” “target,” “goal,” or “continue,” or the negative of

these terms or other comparable terms. Forward-looking statements involve inherent risks and uncertainties and readers are cautioned that

a number of important factors could cause actual results to differ materially from those contained in any such forward-looking statements.

Factors that could cause actual results to differ materially from those described herein include, among others:

| ● | uncertainties as to the completion of the Equity Investment and the other transactions contemplated by the Investment Agreement, including

the risk that one or more of the transactions may involve unexpected costs, liabilities or delays; |

| ● | risks associated with potential significant volatility and fluctuations in the market price of SilverSun’s common stock; |

| ● | risks associated with the Company’s relatively low public float, which may result in its common stock experiencing significant

price volatility; |

| ● | the possibility that competing transaction proposals for the Company may be made; |

| ● | risks associated with raising additional equity or debt capital from public or private markets to pursue the Company’s business

plan following the closing of the Equity Investment, including in an amount that may significantly exceed the amount of the Equity Investment,

and the effects that raising such capital may have on SilverSun and its business, including the risk of substantial dilution or that SilverSun’s

common stock may experience a substantial decline in trading price; |

| ● | the possibility that additional future financings may not be available to the Company on acceptable terms or at all; |

| ● | the effects that the announcement, pendency or consummation of the Equity Investment and the other transactions contemplated by the

Investment Agreement may have on the Company and its current or future business or on the price of the Company’s common stock; |

| ● | the possibility that an active, liquid trading market for the Company’s common stock may not develop or, if developed, may not

be sustained; |

| ● | the possibility that the warrants and the preferred stock contemplated by the Investment Agreement, if issued, may or may not be converted

or exercised, and the economic impact on the Company and the holders of common stock of the Company that may result from either such exercise

or conversion, including dilution, or the continuance of the preferred stock remaining outstanding, and the impact its terms, including

its dividend, may have on the Company and the common stock of the Company; |

| ● | the possibility that all of the closing conditions to the Equity Investment or the other transactions contemplated by the Investment

Agreement may not be satisfied or waived, or any other required third-party, regulatory or other consents or approvals may not be obtained

within the relevant timeframe, or at all, including the possibility that SilverSun may fail to obtain stockholder approval for the transactions

contemplated by the Investment Agreement; |

| ● | the effects that a termination of the Investment Agreement may have on the Company, including the risk that the price of the Company’s

common stock may decline significantly if the Equity Investment is not completed; |

| ● | uncertainties regarding the Company’s focus, strategic plans and other management actions; |

| ● | the risk that the Company, following the closing of the Equity Investment, is or becomes highly dependent on the continued leadership

of Brad Jacobs as chairman and chief executive officer and the possibility that the loss of Mr. Jacobs in these roles could have a material

adverse effect on the Company’s business, financial condition and results of operations; |

| ● | the risks associated with the Company’s succession plans; |

| ● | the risks associated with, following the closing of the Equity Investment, being a “controlled company” as defined under

applicable stock exchange rules, including that Mr. Jacobs will be able to influence the Company’s management and affairs and all

matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions; |

| ● | the risk that certain rules of the U.S. Securities and Exchange Commission (the “SEC”) may require that any registration

statement the Company may file with the SEC be subject to SEC review and potential delay in its effectiveness, and that a registration

statement must be filed and declared effective for any acquisition (including an all-cash acquisition), which would delay its consummation

and could reduce the Company’s attractiveness as an acquirer for potential acquisition targets; |

| ● | the possibility that the Company could elect to rely on the “controlled company” exemption under applicable stock exchange

rules and that the Company’s stockholders will not have the same protections afforded to stockholders of companies that are not

“controlled companies,” including that a majority of the members of the board of directors of the Company may not need to

be independent directors, that the Company’s nomination and corporate governance and compensation committees may not need to consist

entirely of independent directors and that the compensation of the Chief Executive Officer may not need to be determined or recommended

solely by an independent director; |

| ● | the possibility that the concentration of ownership by Mr. Jacobs may have the effect of delaying or preventing a change in control

of the Company and might affect the market price of shares of the common stock of the Company; |

| ● | the possibility that the Company’s status as a “controlled company” could cause the common stock of the Company

to be less attractive to certain investors; |

| ● | the risk that Mr. Jacobs’ past performance may not be representative of future results; |

| ● | uncertainties regarding the Company’s focus, strategic plans and other management actions; |

| ● | the risk that the Company is unable to attract or retain world-class talent; |

| ● | the risk that the failure to consummate any acquisition expeditiously, or at all, could have a material adverse effect on SilverSun’s

business prospects, financial condition, results of operations or the price of SilverSun’s common stock; |

| ● | the risks that the Company may not be able to enter into agreements with acquisition targets on attractive terms, or at all, that

agreed acquisitions may not be consummated, or, if consummated, that the anticipated benefits thereof may not be realized and that the

Company encounter difficulties in integrating and operating such acquired companies, or that matters related to an acquired business (including

operating results or liabilities or contingencies) may have a negative effect on the Company or its securities or ability to implement

its business strategy, including that any such transaction may be dilutive or have other negative consequences to the Company and its

value or the trading prices of its securities; |

| ● | risks associated with cybersecurity and technology, including attempts by third parties to defeat the security measures of the Company

and its business partners, and the loss of confidential information and other business disruptions; |

| ● | the possibility that new investors in any future financing transactions could gain rights, preferences and privileges senior to those

of SilverSun’s existing stockholders; |

| ● | the possibility that building products distribution industry demand may soften or shift substantially due to cyclicality or seasonality

or dependence on general economic conditions, including inflation or deflation, interest rates, consumer confidence, labor and supply

shortages, weather and commodity prices; |

| ● | the possibility that regional or global barriers to trade or a global trade war could increase the cost of products in the building

products distribution industry, which could adversely impact the competitiveness of such products and the financial results of businesses

in the industry; |

| ● | risks associated with potential litigation related to the transactions contemplated by the Investment Agreement or related to any

possible subsequent financing transactions or acquisitions or investments; |

| ● | uncertainties regarding general economic, business, competitive, legal, regulatory, tax and geopolitical conditions; and |

| ● | other factors, including those set forth in the Company’s filings with the SEC, including

its Annual Report on Form 10-K for the fiscal year ended December 31, 2023, Quarterly Report on Form 10-Q for the quarter ended March

31, 2024 and subsequent Quarterly Reports on Form 10-Q. |

Forward-looking statements herein speak only as of the date each statement is made. Neither the Company nor any person undertakes any

obligation to update any of these statements in light of new information or future events, except to the extent required by applicable

law.

Additional Information and Where to Find It

In connection with the Equity Investment, SilverSun filed with the

SEC a definitive proxy statement on Schedule 14A (the “Special Meeting Proxy Statement”) on April 30, 2024. SilverSun commenced

mailing the Special Meeting Proxy Statement and a form of proxy card to its stockholders on or about April 30, 2024. SILVERSUN’S

STOCKHOLDERS ARE URGED TO READ THE SPECIAL MEETING PROXY STATEMENT AND ALL OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC WHEN

THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED EQUITY INVESTMENT. SilverSun’s

stockholders are able to obtain, without charge, a copy of the Special Meeting Proxy Statement and other relevant documents filed with

the SEC from the SEC’s website at http://www.sec.gov. SilverSun’s stockholders are also able to obtain, without charge, a

copy of the Special Meeting Proxy Statement and other relevant documents from SilverSun’s website at https://www.silversuntech.com

or by written request to SilverSun at 120 Eagle Rock Avenue, East Hanover, New Jersey 07936.

Participants in the Solicitation

JPE and SilverSun and its directors and executive officers may be deemed

to be participants in the solicitation of proxies from SilverSun’s stockholders with respect to the Equity Investment and the other

transactions contemplated by the Investment Agreement. The interests of SilverSun and its directors and executive officers with regard

to the Equity Investment may differ from the interests of SilverSun’s stockholders generally, and stockholders may obtain additional

information by reading the Special Meeting Proxy Statement and other relevant documents regarding the Equity Investment and the other

transactions contemplated by the A&R Investment Agreement, when filed with the SEC. Information regarding the names of SilverSun’s

directors and executive officers and their respective interests in SilverSun by security holdings or otherwise is set forth in SilverSun’s

proxy statement for its 2023 Annual Meeting of Stockholders, filed with the SEC on November 27, 2023, in the sections captioned “Executive

Compensation” and “Director Compensation”, and in the Special Meeting Proxy Statement, filed with the SEC on April

30, 2024, in the section captioned “Security Ownership of Certain Beneficial Owners and Executive Officers and Directors of the

Company”.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

SILVERSUN TECHNOLOGIES, INC. |

| |

|

| Date: May 24, 2024 |

By: |

/s/ Mark Meller |

| |

|

Mark Meller |

| |

|

President, Chief Executive Officer |

5

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

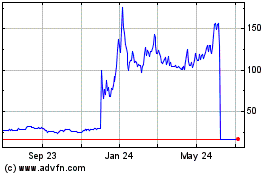

SilverSun Technologies (NASDAQ:SSNT)

Historical Stock Chart

From May 2024 to Jun 2024

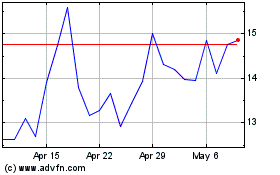

SilverSun Technologies (NASDAQ:SSNT)

Historical Stock Chart

From Jun 2023 to Jun 2024