Silicon Motion Technology Corporation (NASDAQGS: SIMO)

(“Silicon Motion” or the “Company”) today issued a written notice

to MaxLinear, Inc. (NASDAQGS: MXL) (“MaxLinear”),

terminating the Agreement and Plan of Merger between the

parties dated as of May 5, 2022 (the “Merger Agreement”1).

Silicon Motion’s position is that MaxLinear’s

Willful and Material Breaches (as such term is defined in the

Merger Agreement) of the Merger Agreement prevented the merger from

being completed by August 7, 2023 (the “Outside

Date”). Silicon Motion reserves all of its contractual, legal,

equitable, and other rights under the Merger Agreement and

otherwise, including but not limited to the right to hold MaxLinear

liable for substantial money damages, well in excess of the

termination fee as provided in the Merger Agreement, suffered by

Silicon Motion as a result of MaxLinear’s Willful and Material

Breaches of the Merger Agreement.

Pursuant to Section 7.1(d) of the Merger

Agreement, the Company has the right to terminate the Merger

Agreement if the completion of the merger contemplated by the

Merger Agreement (the “Merger”) did not occur on or before the

“Outside Date”.

Tim Gardner, partner of Weil, Gotshal &

Manges LLP, counsel to the Company, commented as follows:

“MaxLinear’s purported termination of its Merger

Agreement with Silicon Motion will be the subject of an arbitration

for substantial damages in the Singapore International Arbitration

Centre, as provided under the parties’ agreement. MaxLinear’s

professed reason for terminating the agreement – that Silicon

Motion suffered a Material Adverse Effect (“MAE”) – is a pretext

and has been rejected in case after case under Delaware law, which

governs the MAE issue, where buyers have sought to back out of

merger agreements at the eleventh hour. The damages Silicon Motion

will seek to recover far exceed the termination fee.”

The Company also announced that it intends to

resume its policy of declaring and paying dividends on an

annual basis, at the discretion of its Board of

Directors, after the termination of the Merger Agreement, which

restricted the Company’s ability to declare and pay any

dividend.

“We are resuming Silicon Motion’s annual

dividend policy because of the resilience of our business, strength

of our balance sheet and our continuing commitment to return

capital to our shareholders,” said Wallace Kou, President and CEO

of Silicon Motion.

The Company‘s decision to declare any dividend,

and the timing and amounts thereof, will be subject to discretion

and approval of the Board of Directors and will depend on, among

other things, whether the dividend payment is in the best interests

of our shareholders, business visibility, results of operations,

capital availability and future capital requirements, financial

condition, statutory requirements, and other factors that the Board

may deem relevant.

About Silicon Motion

Silicon Motion is the global leader in supplying

NAND flash controllers for solid state storage devices. Silicon

Motion supplies more SSD controllers than any other company in the

world for servers, PCs and other client devices and is the leading

merchant supplier of eMMC and UFS embedded storage controllers used

in smartphones, IoT devices and other applications. Silicon Motion

also supplies customized high-performance hyperscale data center

and specialized industrial and automotive SSD solutions. Silicon

Motion’s customers include most of the NAND flash vendors, storage

device module makers and leading OEMs. For further information on

Silicon Motion, visit www.siliconmotion.com.

Cautionary Statement Regarding

Forward-Looking Statements:

Information provided in this press release

contains “forward-looking statements” within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. These

forward-looking statements are based on Silicon Motion’s current

expectations, estimates and projections about the expected date of

closing of the Merger and the potential benefits thereof, its

business and industry, management’s beliefs and certain assumptions

made by Silicon Motion, all of which are subject to change. The

forward-looking statements include, but are not limited to,

statements about the expected timing of the Merger, the

satisfaction or waiver of any conditions to the proposed Merger and

other events relating to the proposed Merger, and in some cases,

you can identify forward-looking statements by terminology such as

“may,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,”

“believe,” “estimate,” “predict,” “potential,” “potentially”,

“continue,” “could,” “seek,” “see,” “would,” “might,” “continue,”

“target” or the negatives of these terms or other comparable

terminology that convey uncertainty of future events or outcomes.

All forward-looking statements by their nature address matters that

involve risks and uncertainties, many of which are beyond our

control, and are not guarantees of future results. These and other

forward-looking statements are not guarantees of future results and

are subject to risks, uncertainties and assumptions that could

cause actual results to differ materially from those expressed in

any forward-looking statements. Although such statements are based

on Silicon Motion’s own information and information from other

sources Silicon Motion believes to be reliable, you should not

place undue reliance on them and caution must be exercised in

relying on forward-looking statements. These statements involve

risks and uncertainties, and actual results may differ materially

from those expressed or implied in these forward-looking statements

for a variety of reasons. Potential risks and uncertainties

include, but are not limited to, the risk that the Merger may not

be completed on the anticipated terms and timing, in a timely

manner or at all, which may adversely affect Silicon Motion’s

business and the value of the ordinary shares, par value $0.01 per

share, of Silicon Motion and Silicon Motion’s ADSs; uncertainties

as to the timing of the consummation of the Merger and the

potential failure to satisfy the conditions to the consummation of

the Merger, including anticipated tax treatment, unforeseen

liabilities, future capital expenditures, revenues, expenses,

earnings, synergies, economic performance, indebtedness, financial

condition, losses, future prospects, business and management

strategies for the management, expansion and growth of the parties’

businesses and other conditions to the completion of the Merger;

the occurrence of any event, change or other circumstances that

could give rise to the termination of the Merger Agreement; the

effect of the announcement, pendency or potential termination of

the Merger on Silicon Motion’s business relationships, operating

results, and business generally; expected benefits, including

financial benefits, of the Merger may not be realized; integration

of the acquisition post-closing may not occur as anticipated, and

the combined company’s ability to achieve the growth prospects and

synergies expected from the Merger, as well as delays, challenges

and expenses associated with integrating the combined company’s

existing businesses, may occur; litigation related to the Merger or

otherwise; unanticipated restructuring, costs may be incurred or

undisclosed liabilities assumed; attempts to retain key personnel

and customers may not succeed; risks related to diverting attention

from the parties’ ongoing business, including current plans and

operations; changes in tax regimes, legislation or government

regulations affecting the acquisition or the parties or their

businesses; economic, social or political conditions that could

adversely affect the Merger or the parties, including trade and

national security policies and export controls and executive orders

relating thereto, and worldwide government economic policies,

including trade relations between the United States and China and

the military conflict in Ukraine and related sanctions against

Russia and Belarus; unpredictability and severity of catastrophic

events, including, but not limited to, acts of terrorism or

outbreak of war or hostilities, as well as the parties’ response to

any of the aforementioned factors; exposure to inflation, currency

rate and interest rate fluctuations and risks associated with doing

business locally and internationally, as well as fluctuations in

the market prices of the parties’ traded securities; potential

business uncertainty or adverse reactions or changes to business

relationships resulting from the announcement or completion of the

Merger; potential negative changes in general economic conditions

and market developments in the regions or the industries in which

the parties operate; the loss of one or more key customers or the

significant reduction, postponement, rescheduling or cancellation

of orders from one or more customers as a result or in anticipation

of the Merger or otherwise; the parties’ respective customers’

sales outlook, purchasing patterns, and inventory adjustments based

on consumer demands and general economic conditions; risks

associated with COVID-19 and any public health crises; Silicon

Motion’s ability to provide a safe working environment for

employees during any public health crises, including pandemics or

epidemics; Silicon Motion’s ability to implement its business

strategies; pricing trends, including Silicon Motion’s ability to

achieve economies of scale; restrictions during the pendency of the

proposed Merger that may impact Silicon Motion’s ability to pursue

certain business opportunities or strategic transactions; and the

other risk factors discussed from time to time by Silicon Motion in

the most recent Annual Report on Form 20-F and in any

subsequent reports on Form 6-K, each of which is on file

with or furnished to the Securities and Exchange Commission (the

“SEC”) and available at the SEC’s website at www.sec.gov. SEC

filings for Silicon Motion are available on Silicon Motion’s

website at https://www.siliconmotion.com/investor. Silicon

Motion assumes no obligation to update any forward-looking

statements, which apply only as of the date of this press

release.

Silicon Motion Investor Contacts:Jason

Tsaijason.tsai@siliconmotion.com

Selina Hsieh ir@siliconmotion.com

Media Contact:Dan Scorpio, H/Advisors

AbernathyDan.scorpio@h-advisors.global

_________________________1 Capitalized terms used herein but not

otherwise defined shall have the meanings ascribed to such terms in

the Merger Agreement.

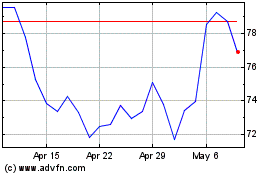

Silicon Motion Technology (NASDAQ:SIMO)

Historical Stock Chart

From Oct 2024 to Nov 2024

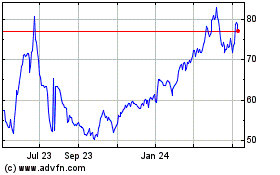

Silicon Motion Technology (NASDAQ:SIMO)

Historical Stock Chart

From Nov 2023 to Nov 2024