Silicon Motion Technology Corporation (NASDAQ: SIMO) (“Silicon

Motion”), a global leader in NAND flash controllers for solid state

storage devices, today announced the expiration of the waiting

period under the Hart-Scott-Rodino Antitrust Improvements Act of

1976, as amended (the “HSR Act”), with respect to the previously

announced agreement under which MaxLinear, Inc. (NASDAQ: MXL)

(“MaxLinear”) will acquire Silicon Motion in a cash and stock

transaction in which each American Depositary Share (ADS) of

Silicon Motion, which represents four ordinary shares of Silicon

Motion, will receive $93.54 in cash and 0.388 shares of MaxLinear

common stock, and each ordinary share of Silicon Motion will

receive $23.385 in cash and 0.097 shares of MaxLinear common stock.

The expiration of the HSR waiting period

occurred at 11:59 p.m. ET on June 27, 2022, which was a condition

to the closing of the pending transaction. The closing of the

transaction is subject to the satisfaction of the remaining

customary closing conditions, including approval by Silicon

Motion’s security holders and the receipt of regulatory approval in

the People’s Republic of China.

Cautionary Statement Regarding Forward-Looking

Statements

Information provided in this press

release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of

1934, as amended. These forward-looking statements are based on

Silicon Motion’s and MaxLinear’s current expectations, estimates

and projections about the expected date of closing of the proposed

transaction and the potential benefits thereof, their businesses

and industry, management’s beliefs and certain assumptions made by

Silicon Motion and MaxLinear, all of which are subject to change.

The forward-looking statements include, but are not limited to,

statements about the expected timing of the Merger, the

satisfaction or waiver of any conditions to the proposed Merger,

anticipated benefits, growth opportunities and other events

relating to the proposed Merger, and projections about Silicon

Motion’s business and its future revenues, expenses and

profitability, and, in some cases, you can identify forward-looking

statements by terminology such as “may,” “will,” “should,”

“expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,”

“predict,” “potential,” “potentially”, “continue,” “could”, “seek,”

“see”, “would”, “might”, “continue”, “target” or the negatives of

these terms or other comparable terminology that convey uncertainty

of future events or outcomes. All forward-looking statements by

their nature address matters that involve risks and uncertainties,

many of which are beyond our control, and are not guarantees of

future results, such as statements about the consummation of the

proposed transaction and the anticipated benefits thereof. These

and other forward-looking statements are not guarantees of future

results and are subject to risks, uncertainties and assumptions

that could cause actual results to differ materially from those

expressed in any forward-looking statements. Although such

statements are based on Silicon Motion’s own information and

information from other sources Silicon Motion believes to be

reliable, you should not place undue reliance on them and caution

must be exercised in relying on forward-looking statements. These

statements involve risks and uncertainties, and actual results may

differ materially from those expressed or implied in these

forward-looking statements for a variety of reasons. Potential

risks and uncertainties include, but are not limited to, the risk

that the transaction may not be completed on the anticipated terms

and timing, in a timely manner or at all, which may adversely

affect Silicon Motion’s or MaxLinear’s respective business and the

price of the ordinary shares, par value $0.01 per share, of Silicon

Motion, Silicon Motion’s American Depositary Shares (ADSs) and

shares of common stock, par value $0.0001, of MaxLinear (“MaxLinear

Common Stock”); uncertainties as to the timing of the consummation

of the transaction and the potential failure to satisfy the

conditions to the consummation of the transaction, including the

receipt of certain governmental and regulatory approvals,

anticipated tax treatment, unforeseen liabilities, future capital

expenditures, revenues, expenses, earnings, synergies, economic

performance, indebtedness, financial condition, losses, future

prospects, business and management strategies for the management,

expansion and growth of the parties’ businesses and other

conditions to the completion of the transaction; the occurrence of

any event, change or other circumstances that could give rise to

the termination of the Merger Agreement, including the receipt by

Silicon Motion of an unsolicited proposal from a third party; the

effect of the announcement or pendency of the transaction on the

Company’s or MaxLinear’s respective business relationships,

operating results, and business generally; the potential that the

Company’s security holders may not approve the Merger; expected

benefits, including financial benefits, of the transaction may not

be realized; integration of the acquisition post-closing may not

occur as anticipated, and the combined company’s ability to achieve

the growth prospects and synergies expected from the transaction,

as well as delays, challenges and expenses associated with

integrating the combined company’s existing businesses, may occur;

litigation related to the Merger or otherwise; unanticipated

restructuring costs may be incurred or undisclosed liabilities

assumed; attempts to retain key personnel and customers may not

succeed; risks related to diverting attention from the parties’

ongoing business, including current plans and operations; changes

in tax regimes, legislation or government regulations affecting the

acquisition or the parties or their businesses; economic, social or

political conditions that could adversely affect the Merger or the

parties, including trade and national security policies and export

controls and executive orders relating thereto, and worldwide

government economic policies, including trade relations between the

United States and China and the military conflict in Ukraine and

related sanctions against Russia and Belarus; unpredictability and

severity of catastrophic events, including, but not limited to,

acts of terrorism or outbreak of war or hostilities, as well as the

parties’ response to any of the aforementioned factors; exposure to

inflation, currency rate and interest rate fluctuations and risks

associated with doing business locally and internationally, as well

as fluctuations in the market prices of the parties’ traded

securities; potential business uncertainty or adverse reactions or

changes to business relationships resulting from the announcement

or completion of the Merger; potential negative changes in general

economic conditions and market developments in the regions or the

industries in which the parties’ operate; the loss of one or more

key customers or the significant reduction, postponement,

rescheduling or cancellation of orders from one or more customers

as a result or in anticipation of the Merger or otherwise; the

parties’ respective customers’ sales outlook, purchasing patterns,

and inventory adjustments based on consumer demands and general

economic conditions; risks associated with the ongoing global

outbreak of COVID-19, including, but not limited to, the

emergence of variants to the original COVID-19 strain such as the

Delta and Omicron variants and related private and public sector

measures; Silicon Motion’s ability to provide a safe working

environment for employees during the COVID-19 pandemic or

any other public health crises, including pandemics or epidemics;

Silicon Motion’s and MaxLinear’s abilities to implement their

business strategies; pricing trends, including Silicon Motion’s and

the MaxLinear’s abilities to achieve economies of scale;

uncertainty as to the long-term value of MaxLinear Common Stock;

restrictions during the pendency of the proposed transaction that

may impact the Company’s or MaxLinear’s ability to pursue certain

business opportunities or strategic transactions; and the other

risk factors discussed from time to time by Silicon Motion in the

most recent Annual Report on Form 20-F and in any

subsequent reports on Form 6-K, each of which is on file

with or furnished to the Securities and Exchange Commission (the

“SEC) and available at the SEC’s website at www.sec.gov. SEC

filings for Silicon Motion are available on Silicon Motion’s

website at https://www.siliconmotion.com/investor. We assume no

obligation to update any forward-looking statements, which apply

only as of the date of this press release.

Additional Information and Where to Find

It

This communication is being made in respect

of the proposed transaction. MaxLinear has filed a Registration

Statement on Form S-4 with the SEC and Silicon Motion

intends to provide to its security holders the

Form S-4 and a proxy statement (the “Proxy Statement”)

describing the Merger Agreement, the Merger, as well as the

procedure for voting in person or by proxy at a meeting of Silicon

Motion’s shareholders held for the purpose of seeking shareholder

approval of the Merger Agreement, the Merger and transactions

contemplated by the Merger Agreement (the “Silicon Motion Meeting”)

and various other details related to the Silicon Motion Meeting.

The Form S-4 is not complete and may be changed. Once finalized,

the Form S-4 and the Proxy Statement will be sent or

given to the security holders of Silicon Motion and will contain

important information about the proposed transaction and related

matters. This communication is not a substitute for the

Form S-4 or the Proxy Statement or any other document

that have been or may be filed or furnished by Silicon Motion or

MaxLinear with the SEC or provided to Silicon Motion’s security

holders. Investors and security holders are urged to read each of

the Form S-4 and the Proxy Statement in its entirety and

other relevant documents filed with or furnished to the SEC or

provided to Silicon Motion’s security holders in connection with

the proposed transaction or incorporated by reference therein when

they become available before making any voting or investment

decision with respect to the proposed transaction because they will

contain important information about the proposed transaction and

the parties to the proposed transaction.

About Silicon Motion

We are the global leader in supplying NAND flash

controllers for solid state storage devices. We supply more SSD

controllers than any other company in the world for servers, PCs

and other client devices and are the leading merchant supplier of

eMMC and UFS embedded storage controllers used in smartphones, IoT

devices and other applications. We also supply customized

high-performance hyperscale data center and specialized industrial

and automotive SSD solutions. Our customers include most of

the NAND flash vendors, storage device module makers and leading

OEMs. For further information on Silicon Motion, visit us at

www.siliconmotion.com.

Silicon Motion Contacts:Christopher

ChaneyDirector, Investor Relations &

Strategycchaney@siliconmotion.com

Selina HsiehInvestor Relationsir@siliconmotion.com

Thomas GerminarioD.F. King & Co.

Inc.tgerminario@dfking.com

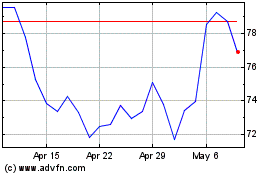

Silicon Motion Technology (NASDAQ:SIMO)

Historical Stock Chart

From Oct 2024 to Nov 2024

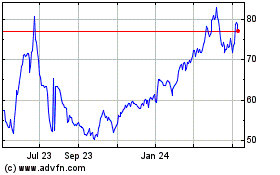

Silicon Motion Technology (NASDAQ:SIMO)

Historical Stock Chart

From Nov 2023 to Nov 2024