0000788611

false

0000788611

2023-07-14

2023-07-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE

THE

SECURITIES EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported): July 14, 2023

SIGMA

ADDITIVE SOLUTIONS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-38015 |

|

27-1865814 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

3900

Paseo del Sol

Santa

Fe, New Mexico 87507

(Address

of Principal Executive Offices) (Zip Code)

Registrant’s

telephone number, including area code: (505) 438-2576

Former

name or former address, if changed since last report

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

SASI |

|

The

NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

Departure

of Certain Officers

On

July 14, 2023, the employment of Stephan Kuehr, General Manager of European Operations of Sigma Additive Solutions, Inc. (“we,”

“us,” “Sigma” or the “company”) terminated.

Item

8.01 Other Information

Following

is an update on Sigma’s strategic initiatives announced last year and the status of its current business and operations:

Background

On

November 11, 2022, we filed with the SEC our Quarterly Report on Form 10-Q for the quarter ended September 30, 2022, in which we reported

a perceived trend toward consolidation in the additive manufacturing, or AM, industry as companies align for profitability and that a

connection with a strategic partner might augment our ability to scale, support the greater AM marketplace needs, and create stockholder

value. We also reported that alignment with a strategic partner might allow for common growth, vision, and funding of the company to

achieve its mission, and provide an opportunity for other strategic relationships, including potential acquisitions. In the same Quarterly

Report, we stated our updated estimate that our existing cash on hand, together with expected revenue,

would be sufficient to fund our anticipated operating costs and capital expenditure requirements through at least the first quarter of

2023. We also stated that we were engaged in identifying sources of financing either in the form of equity or debt, or a combination

thereof, but that no assurance could be given as to the availability of such financing, or, if available, that such financing would be

on terms acceptable to us.

Management

subsequently identified a list of approximately 20 candidates for a potential strategic investment in Sigma. After initial talks, management

engaged in further discussions with three candidates that expressed the greatest interest in the opportunity and corresponding strategy.

We received a verbal commitment for an investment from one candidate, but after a decline in Sigma’s market capitalization the

candidate indicated that it could not provide the cash that it believed would be necessary to accomplish the parties’ strategic

objectives. None of the leading candidates submitted a proposal to invest in the company. During

the same period, we separately pursued a possible stand-alone financing with several potential investors, including certain existing

security holders of the company, prospective underwriters and institutional investors, as a bridge to a potential strategic transaction.

Management was advised by the prospective underwriters, however, that it would be necessary to restructure our outstanding shares

of convertible preferred stock and certain outstanding warrants in order to facilitate a possible financing.

On

January 27, 2023, we reported in a Current Report on Form 8-K our agreement to issue to the holder

of the remaining outstanding shares of our Series D Preferred Stock a warrant to purchase common stock in consideration of the holder’s

agreement to convert, in full, its shares of Series D Preferred Stock. After several rounds of discussions, however, we were unable to

reach an agreement with the holders of our outstanding warrants to restructure the warrants in order to facilitate a possible financing.

In light of this development, rising interest rates and deteriorating capital market conditions, management was advised by our prospective

underwriter that it was unlikely that we would be able to raise capital in the public or private market in the near term. Also on January

27, 2023, we reiterated our previous advice that alignment with a strategic partner may allow for common growth, vision, and funding

of the company, as well as an opportunity for other strategic relationships, including potential acquisitions, and that we had recently

furloughed several of our workforce to conserve existing cash while we continued to pursue possible strategic or financing transactions.

On

March 1, 2023, we issued a press release and reported in a Current Report on Form 8-K that we had retained Lake Street Capital Markets,

or Lake Street, as our financial advisor in connection with the consideration of a range of strategic alternatives designed to enhance

stockholder value, including a possible strategic investment, acquisition, merger, business combination or similar transaction.

Management

and Lake Street subsequently undertook to solicit indications of interest in a possible strategic transaction from approximately 90 potential

strategic and financial acquirers, including many companies in the AM industry in the U.S. and Europe. Approximately a third of the potential

acquirers who responded subsequently entered into confidentiality agreements, or CDAs, to facilitate discussions with our management

and advisers and diligence regarding a possible strategic transaction, including the possible merger or acquisition of the company, the

sale of all or part of the company’s business and assets, and a possible bridge financing to allow the company to retain its key

employees and preserve its customers and other business pending a possible transaction.

Of

the potential acquirers that entered into CDAs, four have submitted written, non-binding proposals to purchase assets or acquire the

company in a merger or reverse merger. These proposals all have varying economic and other terms, degrees of complexity and timelines,

and are subject to the negotiation and execution of a mutually agreeable definitive agreement and other conditions. None of the proposals

include bridge financing for Sigma pending completion of a possible transaction, and for reasons unique to each proposal, we have been

unable to come to terms with any of the potential acquirers. Our management and advisers continue in talks regarding the respective proposals,

as well as possible alternative transactions with other parties that have expressed interest as we work to formally close our strategic

transaction process.

Liquidity

In

our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, we estimated that our cash on hand at March 31, 2023 and anticipated

revenues would be sufficient to fund our operating costs through June 2023 after having taken previously reported steps to reduce our

employee headcount and other costs while we pursued a possible strategic transaction. We also reported that we would need to raise additional

financing to fund our operations and that to the extent that financing was not available to us,

we may be required to delay, limit, or terminate our business operations.

We

have now reduced our employee headcount via furloughs and layoffs to five employees, including our President and Chief Executive Officer

and Chief Financial Officer and two key employees considered important to a possible sale of the company or all or a portion of its assets

and support of current customers. With these moves, Sigma has discontinued all product development activities and ceased to pursue new

customers. As of July 14, 2023, we had cash on hand of approximately $434,500, which we believe will be sufficient to support our current

customers and pay employee costs and other anticipated expenses through August 2023. In the meantime, we continue to explore a possible

reverse merger, sale of the company or all or a portion of its assets, and other alternatives. There is no assurance, however, that we

will be able to sell the company or any of its assets or, if so, on what terms, or avoid the dissolution and liquidation or bankruptcy

of the company.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

| Exhibit

Number |

|

Description |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

July 20, 2023 |

SIGMA

ADDITIVE SOLUTIONS, INC. |

| |

|

|

| |

By:

|

/s/

Jacob Brunsberg |

| |

Name:

|

Jacob

Brunsberg |

| |

Title: |

President

and Chief Executive Officer |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

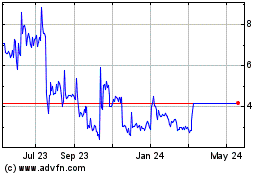

Sigma Additive Solutions (NASDAQ:SASI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sigma Additive Solutions (NASDAQ:SASI)

Historical Stock Chart

From Jan 2024 to Jan 2025