Seres Therapeutics, Inc. (Nasdaq: MCRB), (“Seres” or “the

Company”), a leading live biotherapeutics company, today reported

second quarter 2024 financial results and provided business

updates.

“Our recently announced VOWST asset sale will, pending approval

by stockholders and upon closing, significantly strengthen Seres’

balance sheet and advance our goal to improve patient outcomes in

medically vulnerable patient populations through the use of our

wholly-owned cultivated live biotherapeutics,” said Eric Shaff,

President and Chief Executive Officer of Seres. “We intend to

leverage our clinical, CMC, and regulatory successes by applying

our therapeutic approach to new patient groups that face heightened

risks of serious bacterial infections, which frequently lead to

extensive and costly treatments and, unfortunately too often,

death.”

Mr. Shaff continued, “Our lead SER-155 program remains on track

for a clinical data readout from the placebo-controlled study

Cohort 2 in patients receiving allogeneic hematopoietic stem cell

transplant (allo-HSCT) in September. This dataset has the potential

to highlight the extensive clinical value and commercial

opportunities of both our SER-155 program and our biotherapeutic

approach more generally. Multiple patient groups are known to

experience a disrupted gastrointestinal (GI) microbiome and a high

risk of life-threatening enteric-derived bacterial infections as

well as blood stream infections arising from translocated bacteria.

Our development efforts are targeting multiple medically vulnerable

patient groups, including potentially those with chronic liver

disease, cancer neutropenia and solid organ transplants. In the

longer term, we plan to develop our biotherapeutics to treat

GI-related immune diseases such as inflammatory bowel disease.”

Corporate Highlights

- In April, the Company announced the completed enrollment of

Cohort 2 of the SER-155 Phase 1b study, which included 45

participants. Cohort 2 study data are anticipated in September and

will include safety, drug pharmacology and efficacy-related

measures, including the rates of bacterial infections and febrile

neutropenia, through day 100 following allo-HSCT—a period in which

patients frequently experience serious infections. SER-155 is

designed to prevent GI-derived infections and resulting bloodstream

infections, enhance epithelial barrier integrity and induce immune

tolerance responses to reduce the incidence of

graft-versus-host-disease (GvHD). The Company previously announced

SER-155 Phase 1b Cohort 1 clinical data that showed SER-155 was

well-tolerated, resulted in successful drug bacteria engraftment

and a substantial reduction in pathogen domination in the GI

microbiome compared to a reference cohort of patients. SER-155

received FDA Fast Track Designation. The Company’s cultivated

biotherapeutics are manufactured from single strain bacteria

isolates through fermentation methods that allow for efficient,

scalable processes.

- On August 6, the Company announced that

it signed an agreement with Société des Produits Nestlé S.A

(“SPN”), a wholly-owned subsidiary of Nestlé S.A., for the sale of

its VOWST business to SPN (the “Purchase Agreement”). Under the

terms of the Purchase Agreement, upon the deal close, Seres will

receive capital infusions, including an upfront payment, a prepaid

milestone payment and an equity investment. In addition, Seres is

due to receive installment payments in 2025, contingent upon the

Company’s material compliance with transition obligations, as well

as potential future milestone payments based on VOWST net sales

targets. The completion of the transaction, which is subject to

Seres’ stockholder approval and other customary conditions, is

expected to occur within 90 days following the signing of the

Purchase Agreement. Seres continues to support VOWST commercial

supply, and production capacity remains strong. Following the

expected close of the asset sale transaction, Seres will provide

transition services through the first quarter of 2025 and

manufacturing support through the end of 2025, subject to SPN’s

limited ability to extend, and will continue to share 50/50 in the

profits or losses of the business through the fourth quarter of

2025.

- Seres intends to evaluate SER-155 and other cultivated live

biotherapeutic candidates in additional medically vulnerable

patient populations, including chronic liver disease, cancer

neutropenia, and solid organ transplants. Future development plans

will be informed by pending SER-155 Cohort 2 results, and the

Company plans to share more information regarding its SER-155

development plans later in 2024.

- Seres is also developing another proprietary live

biotherapeutic composition, SER-147, designed to prevent GI-derived

infections and resulting bloodstream infections and to improve

clinical outcomes in patients with metabolic disease, including

those with chronic liver disease and at high risk of bacterial

infections. We anticipate IND readiness for SER-147 in the second

half of 2025.

VOWST Commercial Performance Seres collaborator

SPN and certain of its affiliates (collectively, “Nestlé Health

Science”) have continued to lead VOWST commercialization efforts.

Since the VOWST product launch in June 2023, the breadth of

utilization has steadily increased among healthcare providers.

Second quarter 2024 net sales were approximately $14.4 million,

reflecting an increase of approximately 43% compared to first

quarter net sales of $10.1 million. Seres shares equally with

Nestlé Health Science in the VOWST commercial profits or losses.

Seres’ share of the VOWST net loss for the second quarter of 2024

was $6.6 million, which was included in the Company’s

operating results within Collaboration (profit) loss

sharing-related party.

Financial Results

- Seres reported a net loss of $32.9 million for the

second quarter of 2024, as compared to net income of $46.6

million for the same period in 2023. The difference is

primarily the result of a $125 million milestone payment received

from Nestlé in the second quarter of 2023, upon the FDA approval of

VOWST, offset by operating expense reductions.

- Research and development (R&D) expenses for the second

quarter of 2024 were $17.9 million, compared with $46.8

million for the same period in 2023. The decrease in R&D

expenses was primarily driven by VOWST commercial manufacturing

costs no longer being recognized in the Seres profit and loss

(P&L) following the product approval in April 2023, but

instead being capitalized and recognized on the Company’s balance

sheet, as well as lower personnel and other costs as a result of

the restructuring plan announced in November 2023.

- General and administrative (G&A) expenses for the second

quarter of 2024 were $16.1 million, compared with $28.1

million for the same period in 2023. The decrease in G&A

expenses was primarily driven by a reduction in professional fees

and lower personnel costs as a result of the restructuring

plan.

Cash RunwaySeres plans to use the capital

obtained from the VOWST asset sale transaction to fully retire its

senior secured debt facility with Oaktree Capital Management.

Additionally, the Bacthera manufacturing contract will be

terminated upon close of the transaction, and Seres will have no

further obligations to Bacthera.

Various VOWST-related capabilities, including product

manufacturing, will transition to Nestlé Health Science as part of

the asset sale. As a result, Seres expects that more than a third

of its employees will transfer to Nestlé Health Science following

the close of the transaction. Moving forward, Seres will be a

streamlined and more focused organization, and the Company’s cash

burn rate is expected to be reduced.

As of June 30, 2024, Seres had $71.2 million in

cash and cash equivalents. Based on existing cash and operating

plans, expected cash to be received upon the close of the VOWST

sale and related installment payments due in 2025, and ongoing

transaction-related obligations, the Company expects to fund

operations into the fourth quarter of 2025. Absent the VOWST sale,

the Company expects to fund operations into the fourth quarter of

2024.

Conference Call InformationSeres’ management

will host a conference call today, August 13, 2024,

at 8:30 a.m. ET. The conference call may be accessed by

calling 1-800-715-9871 (international callers dial 1-646-307-1963)

and referencing the conference ID number 4877586. To join the live

webcast, please visit the “Investors and News” section of the Seres

website at www.serestherapeutics.com. A webcast replay will be

available on the Seres website beginning approximately two hours

after the event and will be archived for at least 21 days.

INDICATION AND IMPORTANT SAFETY INFORMATION FOR

VOWSTINDICATIONVOWST (fecal microbiota

spores, live-brpk) is indicated to prevent the recurrence

of Clostridioides difficile infection (CDI) in

individuals 18 years of age and older following antibacterial

treatment for recurrent CDI (rCDI).

Limitation of Use: VOWST is not indicated for treatment of

CDI.

IMPORTANT SAFETY INFORMATION

WARNINGS AND PRECAUTIONS

Transmissible infectious agents: Because

VOWST is manufactured from human fecal matter, it may carry a risk

of transmitting infectious agents. Report any infection that is

suspected to have been transmitted by VOWST to Aimmune

Therapeutics, Inc. at 1-833-246-2566.

Potential presence of food

allergens: VOWST may contain food allergens. The

potential to cause adverse reactions due to food allergens is

unknown.

ADVERSE REACTIONS

The most common adverse reactions (reported in ≥5% of

participants) were abdominal distension (31.1%), fatigue (22.2%),

constipation (14.4%), chills (11.1%) and diarrhea (10.0%).

To report SUSPECTED ADVERSE REACTIONS, contact Aimmune

Therapeutics at 1-833-AIM-2KNO (1-833-246-2566), or the FDA at

1-800-FDA-1088, or visit www.fda.gov/MedWatch.

DRUG INTERACTIONS

Do not administer antibacterials concurrently with VOWST.

Please see Full Prescribing

Information and Patient

Information

About SER-155 The SER-155

composition is designed to prevent GI-derived infections and

resulting bloodstream infections, enhance epithelial barrier

integrity, and induce immune tolerance responses, to reduce the

incidence of GvHD. SER-155 is being evaluated in a Phase 1b

placebo-controlled study in patients undergoing allo-HSCT. SER-155

is a consortium of bacterial species selected and optimized using

Seres’ reverse translation discovery and development platform

technologies. The design incorporates biomarker data from human

clinical data, nonclinical human cell-based assays and in vivo

disease models. SER-155 has received FDA Fast Track

Designation.

About Seres Therapeutics Seres

Therapeutics, Inc. (Nasdaq: MCRB) is a commercial-stage company

focused on improving patient outcomes in medically vulnerable

populations through novel live biotherapeutics. Seres led the

successful development and approval of VOWST™, the first

FDA-approved orally administered microbiome therapeutic. The

Company is evaluating SER-155 in a Phase 1b study in patients

receiving allo-HSCT. SER-155 is designed to prevent GI-derived

infections and resulting bloodstream infections, enhance epithelial

barrier integrity and induce immune tolerance responses to reduce

the incidence of GvHD. The Company is also advancing additional

cultivated oral microbiome therapeutic candidates for medically

vulnerable populations, including those with chronic liver disease,

cancer neutropenia and solid organ transplants. For more

information, please visit www.serestherapeutics.com.

Important Additional Information About the Transaction

and Where to Find It

This communication is being made in respect of the proposed

transaction involving Seres Therapeutics, Inc., a Delaware

corporation (“Seres”) and Société des Produits Nestlé S.A., a

société anonyme organized under the laws of Switzerland (“SPN”).

Seres intends to file a proxy statement and other relevant

documents with the Securities and Exchange Commission (the “SEC”)

in connection with a special meeting of Seres’ stockholders for

purposes of obtaining, stockholder approval of the proposed

transaction. The definitive proxy statement will be sent or given

to the stockholders of Seres and will contain important information

about the proposed transaction and related matters. INVESTORS AND

STOCKHOLDERS OF SERES ARE URGED TO READ THE DEFINITIVE PROXY

STATEMENT AND OTHER RELEVANT MATERIALS CAREFULLY AND IN THEIR

ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT SERES AND THE PROPOSED TRANSACTION.

Investors may obtain a free copy of these materials (when they are

available) and other documents filed by Seres with the SEC at the

SEC’s website at www.sec.gov or from Seres at its website at

ir.serestherapeutics.com.

Participants in the Solicitation

Seres and certain of its directors, executive officers and other

members of management and employees may be deemed to be

participants in soliciting proxies from its stockholders in

connection with the proposed transaction. Information regarding the

persons who may, under the rules of the SEC, be considered to be

participants in the solicitation of Seres’ stockholders in

connection with the proposed transaction will be set forth in

Seres’ definitive proxy statement for its stockholder meeting at

which the proposed transaction will be submitted for approval by

Seres’ stockholders. You may also find additional information about

Seres’ directors and executive officers in Seres’ Annual Report on

Form 10-K for the fiscal year ended December 31, 2023, which was

filed with the SEC on March 5, 2024, Seres’ Definitive Proxy

Statement for its 2024 annual meeting of stockholders, which was

filed with the SEC on March 5, 2024, and in subsequently filed

Current Reports on Form 8-K and Quarterly Reports on Form 10-Q.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including statements about the

financial terms, timing and completion of the sale of VOWST assets

to Nestlé Health Science; the receipt of future payments and the

use of proceeds of the transaction; the timing and results of our

clinical studies and data readouts; future product candidates,

development plans and commercial opportunities; operating plans and

our future cash runway; our ability to generate additional capital;

our planned strategic focus; anticipated timing of any of the

foregoing and other statements which are not historical fact.

These forward-looking statements are based on management’s

current expectations. These statements are neither promises nor

guarantees, but involve known and unknown risks, uncertainties and

other important factors that may cause our actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements, including, but not limited to, the

following: (1) we have incurred significant losses, are not

currently profitable and may never become profitable; (2) our need

for additional funding; (3) our history of operating losses; (4)

the restrictions in our debt agreement; (5) our novel approach to

therapeutic intervention; (6) our reliance on third parties to

conduct our clinical trials and manufacture our product candidates;

(7) the competition we will face; our ability to protect our

intellectual property; (8) our ability to retain key personnel and

to manage our growth; (9) the occurrence of any event, change or

other circumstance that could give rise to the termination of the

Purchase Agreement; (10) our failure to obtain stockholder approval

for the proposed transaction or to satisfy any of the other

conditions to the completion of the proposed transaction; (11) the

effect of the announcement of the proposed transaction on our

ability to retain and hire key personnel and maintain relationships

with our customers, suppliers, advertisers, partners and others

with whom we do business, or on our operating results and

businesses generally; (12) the risks associated with the disruption

of management’s attention from ongoing business operations due to

the proposed transaction and the obligation to provide transition

services; (13) our failure to receive the installment payments or

the milestone payments in the future; (14) the significant costs,

fees and expenses related to the proposed transaction; (15) the

uncertainty of impact of the 50/50 profit or loss sharing

arrangement on our reported results and liquidity; (16) the risk

that the proposed transaction will not be completed within the

expected time period or at all; and (17) we may not be able to

realize the anticipated benefits of the proposed transaction. These

and other important factors discussed under the caption “Risk

Factors” in our Quarterly Report on Form 10-Q filed with the

Securities and Exchange Commission (SEC) on May 8, 2024, and our

other reports filed with the SEC could cause actual results to

differ materially from those indicated by the forward-looking

statements made in this press release. Any such forward-looking

statements represent management’s estimates as of the date of this

press release. While we may elect to update such forward-looking

statements at some point in the future, we disclaim any obligation

to do so, even if subsequent events cause our views to change.

These forward-looking statements should not be relied upon as

representing our views as of any date subsequent to the date of

this press release.

|

SERES THERAPEUTICS, INC. |

|

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(unaudited, in thousands, except share and per share

data) |

|

|

|

|

|

June 30, |

|

|

December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

| Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

71,232 |

|

|

$ |

127,965 |

|

|

Collaboration receivable - related party |

|

|

18,601 |

|

|

|

8,674 |

|

|

Inventories |

|

|

52,997 |

|

|

|

29,647 |

|

|

Prepaid expenses and other current assets |

|

|

6,435 |

|

|

|

9,124 |

|

|

Total current assets |

|

|

149,265 |

|

|

|

175,410 |

|

| Property and equipment,

net |

|

|

17,794 |

|

|

|

22,457 |

|

| Operating lease assets |

|

|

103,282 |

|

|

|

109,793 |

|

| Restricted cash |

|

|

9,873 |

|

|

|

8,185 |

|

| Restricted investments |

|

|

— |

|

|

|

1,401 |

|

| Other non-current assets

(1) |

|

|

41,517 |

|

|

|

41,354 |

|

|

Total assets |

|

$ |

321,731 |

|

|

$ |

358,600 |

|

| Liabilities and

Stockholders’ Deficit |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

4,809 |

|

|

$ |

3,641 |

|

|

Accrued expenses and other current liabilities (2) |

|

|

86,356 |

|

|

|

80,611 |

|

|

Operating lease liabilities |

|

|

9,195 |

|

|

|

6,677 |

|

|

Deferred income - related party |

|

|

7,922 |

|

|

|

7,730 |

|

|

Total current liabilities |

|

|

108,282 |

|

|

|

98,659 |

|

| Long term portion of note

payable, net of discount |

|

|

102,494 |

|

|

|

101,544 |

|

| Operating lease liabilities,

net of current portion |

|

|

100,936 |

|

|

|

105,715 |

|

| Deferred revenue - related

party |

|

|

95,364 |

|

|

|

95,364 |

|

| Warrant liabilities |

|

|

— |

|

|

|

546 |

|

| Other long-term

liabilities |

|

|

1,729 |

|

|

|

1,628 |

|

|

Total liabilities |

|

|

408,805 |

|

|

|

403,456 |

|

| Commitments and contingencies

(Note 15) |

|

|

|

|

|

|

| Stockholders’ deficit: |

|

|

|

|

|

|

| Preferred stock, $0.001 par

value; 10,000,000 shares authorized at June 30, 2024 and

December 31, 2023; no shares issued and outstanding at

June 30, 2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

|

| Common stock, $0.001 par

value; 360,000,000 shares authorized at June 30, 2024 and

240,000,000 shares authorized at December 31, 2023;

151,633,922 and 135,041,467 shares issued and outstanding at

June 30, 2024 and December 31, 2023, respectively |

|

|

152 |

|

|

|

135 |

|

|

Additional paid-in capital |

|

|

964,012 |

|

|

|

933,244 |

|

|

Accumulated other comprehensive loss |

|

|

— |

|

|

|

— |

|

|

Accumulated deficit |

|

|

(1,051,238 |

) |

|

|

(978,235 |

) |

|

Total stockholders’ deficit |

|

|

(87,074 |

) |

|

|

(44,856 |

) |

|

Total liabilities and stockholders’ deficit |

|

$ |

321,731 |

|

|

$ |

358,600 |

|

[1] Includes $38,877 as of June 30, 2024 and

December 31, 2023, of milestones related to the construction

of the Company's dedicated manufacturing suite at BacThera AG, or

Bacthera. Such amounts will form part of the right-of-use asset

upon lease commencement.[2] Includes related party amounts of

$43,075 and $28,053 at June 30, 2024 and

December 31, 2023, respectively (see Note 17, Related Party

Transactions).

|

SERES THERAPEUTICS, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSS (INCOME) |

|

(unaudited, in thousands, except share and per share

data) |

|

|

|

|

Three Months

EndedJune 30, |

|

|

Six Months

EndedJune 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

Collaboration revenue - related party |

$ |

— |

|

|

$ |

126,473 |

|

|

$ |

— |

|

|

$ |

125,951 |

|

|

Total revenue |

|

— |

|

|

|

126,473 |

|

|

|

— |

|

|

|

125,951 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses |

|

17,875 |

|

|

|

46,792 |

|

|

$ |

39,577 |

|

|

|

90,761 |

|

|

General and administrative expenses |

|

16,059 |

|

|

|

28,051 |

|

|

$ |

31,525 |

|

|

|

50,521 |

|

|

Collaboration (profit) loss sharing - related party |

|

(2,589 |

) |

|

|

2,106 |

|

|

$ |

(171 |

) |

|

|

5,713 |

|

|

Total operating expenses |

|

31,345 |

|

|

|

76,949 |

|

|

$ |

70,931 |

|

|

|

146,995 |

|

| (Loss) income from

operations |

|

(31,345 |

) |

|

|

49,524 |

|

|

$ |

(70,931 |

) |

|

|

(21,044 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

1,230 |

|

|

|

1,726 |

|

|

$ |

2,878 |

|

|

|

2,758 |

|

|

Interest expense |

|

(3,447 |

) |

|

|

(3,187 |

) |

|

$ |

(8,110 |

) |

|

|

(5,135 |

) |

|

Other income (expense) |

|

692 |

|

|

|

(1,511 |

) |

|

$ |

3,160 |

|

|

|

(1,201 |

) |

|

Total other expense, net |

|

(1,525 |

) |

|

|

(2,972 |

) |

|

$ |

(2,072 |

) |

|

|

(3,578 |

) |

| Net (loss) income |

$ |

(32,870 |

) |

|

$ |

46,552 |

|

|

$ |

(73,003 |

) |

|

$ |

(24,622 |

) |

| Net (loss) income per share

attributable to common stockholders, basic |

$ |

(0.22 |

) |

|

$ |

0.36 |

|

|

$ |

(0.49 |

) |

|

$ |

(0.19 |

) |

| Net (loss) income per share

attributable to common stockholders, diluted |

$ |

(0.22 |

) |

|

$ |

0.36 |

|

|

$ |

(0.49 |

) |

|

$ |

(0.19 |

) |

| Weighted average common shares

outstanding, basic |

|

151,514,597 |

|

|

|

127,713,486 |

|

|

|

148,808,089 |

|

|

|

126,793,342 |

|

| Weighted average common shares

outstanding, diluted |

|

151,514,597 |

|

|

|

129,844,931 |

|

|

|

148,808,089 |

|

|

|

126,793,342 |

|

| Other comprehensive (loss)

income: |

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized (loss) income on investments, net of tax of $0 |

|

— |

|

|

|

(2 |

) |

|

|

— |

|

|

|

10 |

|

|

Currency translation adjustment |

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

|

1 |

|

|

Total other comprehensive (loss) income |

|

— |

|

|

|

(3 |

) |

|

|

— |

|

|

|

11 |

|

| Comprehensive loss

(income) |

$ |

(32,870 |

) |

|

$ |

46,549 |

|

|

$ |

(73,003 |

) |

|

$ |

(24,611 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investor and Media

Contact: IR@serestherapeutics.com

Carlo Tanzi, Ph.D.Kendall Investor

Relationsctanzi@kendallir.com

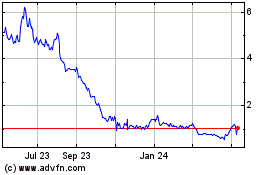

Seres Therapeutics (NASDAQ:MCRB)

Historical Stock Chart

From Oct 2024 to Nov 2024

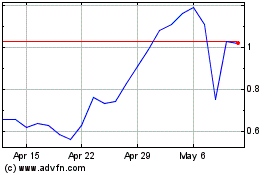

Seres Therapeutics (NASDAQ:MCRB)

Historical Stock Chart

From Nov 2023 to Nov 2024