SeaStar

Medical Holding Corporation (Nasdaq: ICU)

(“SeaStar Medical” or the “Company”), a commercial-stage medical

device company developing proprietary solutions to reduce the

consequences of hyperinflammation on vital organs, reports

financial results for the three and nine months ended September 30,

2024, and provides a business update.

“We are delighted to report market demand and

our first commercial sales of QUELIMMUNE™, our pediatric SCD that

was cleared for sale by FDA in February 2024,” said Eric Schlorff,

SeaStar Medical CEO. "During the third quarter, we recognized

$67,500 of revenue from shipping QUELIMMUNE directly to

one end-user customer. We also shipped QUELIMMUNE to our former

distribution partner which had a contract value of approximately

$70,000. If such sales were made directly to the end user by us,

rather than under the distribution contract with our distribution

partner, this would have resulted in additional shipments of

QUELIMMUNE at a value of approximately $250,000.

“Beginning in the fourth quarter, we are able to

recognize 100% of the sales value to direct end-user customers as

revenue, and we expect to continue to add direct end-user customers

going forward,” continued Mr. Schlorff. “Last month we presented

economic data supporting the significant potential cost-saving

benefits of QUELIMMUNE to the healthcare system in treating

critically ill children with acute kidney injury (AKI), which we

believe will further aid in achieving our goal of adding two to

three or more hospital customers by 2024 yearend.

“The adult AKI patient population is 50 times

larger than the pediatric population, and our NEUTRALIZE-AKI

pivotal trial is gaining momentum with 59 subjects now enrolled.

This includes a record enrollment month in October, moving us

closer to the interim data review we anticipate at 100 subjects.

Three new medical centers have joined this trial in the fourth

quarter, increasing the number of clinical sites to 12 and

underscoring our confidence the pace of enrollment will

accelerate,” he added. “We continue to explore the potential of our

technology in multiple, high-value indications beyond AKI. To this

end, we received notice last week from the FDA of Breakthrough

Device Designation for the SCD in chronic dialysis. This is the

fourth indication to receive this designation and the first for a

chronic disease.”

“I’m pleased to report the elimination of more

than $9 million in long-term debt since the beginning of 2024,”

said David Green, SeaStar Medical CFO. “In addition, we believe our

new direct sales model for QUELIMMUNE will have a dramatic impact

on revenue by increasing sales recognized per unit by three to four

times.”

SeaStar Medical provides the following updates

on its commercial and development programs, and corporate

activities:

QUELIMMUNE and Pediatric Acute Kidney

Injury

Only about half of the patients in the pediatric

ICU with AKI who require renal replacement therapy (RRT) survive,

and those who do are at elevated risk of long-term,

life-threatening conditions such as chronic kidney disease. Pooled

analyses from two non-controlled studies, one of which was funded

by the FDA Office of Orphan Products Development, showed that

children weighing 10 kilograms or more with AKI requiring

continuous RRT (CRRT) who were treated with QUELIMMUNE (Selective

Cytopheretic Device or SCD-Pediatric) had a 77% survival rate, no

dialysis dependency at Day 60 and no device-related serious adverse

events or device-related infections.

In February 2024 we received our first U.S.

regulatory approval for the QUELIMMUNE device, the SCD specifically

for children with AKI and sepsis or septic condition weighing 10

kilograms or more who are being treated in the ICU with RRT.

QUELIMMUNE was approved under a Humanitarian Device Exemption (HDE)

application, having met the applicable criteria with clinical

results showing safety and probable clinical benefit to critically

ill children with AKI who have few treatment options. The U.S.

addressable population of about 4,000 pediatric patients falls

within the 8,000-patient HDE criteria.

We are working with hospitals to commercialize

QUELIMMUNE under Humanitarian Use Device (HUD) requirements.

Pediatric patients undergoing treatment with this therapy are

expected to require, on average, five to seven QUELIMMUNE units,

with the disposable portion of the unit being changed once every 24

hours.

- In July 2024 we announced the first

commercial sale of QUELIMMUNE to our previous U.S. distribution

partner, following the finalization of FDA labeling requirements

earlier in the month.

- In July 2024 we reported that the

first patient had been treated with QUELIMMUNE in a commercial

setting, which allowed us to meet the August 20, 2024 FDA deadline

to begin patient treatments as designated in the FDA’s approval of

QUELIMMUNE.

- In October 2024 we assumed all

responsibility for direct sales, marketing and distribution of

QUELIMMUNE to hospital customers, allowing us to recognize 100% of

revenue generated from commercial QUELIMMUNE sales.

- In October 2024 we introduced an

analysis of economic data supporting a projected cost savings of

approximately $30,000 per hospitalization for critically ill

pediatric patients with AKI on CRRT treated with QUELIMMUNE versus

standard of care. The cost savings is principally driven by the

lower expected death rate and shorter length of hospital stay. The

analysis was introduced at ASN Kidney Week 2024, the premier

nephrology conference.

- In October 2024 we shipped

QUELIMMUNE to a second commercial hospital customer.

Adult Acute Kidney Injury

We are conducting the pivotal NEUTRALIZE-AKI

(NEUTRophil and Monocyte

DeActivation via SeLective

CytopheretIc Device - a

RandomiZEd Clinical Trial in

Acute Kidney

Injury) clinical trial to evaluate the safety and

effectiveness of the SCD in adults with AKI in the ICU receiving

CRRT. The SCD-ADULT device has received FDA Breakthrough Device

Designation for this indication, which is awarded to a therapy to

treat a serious or life-threatening condition with preliminary

clinical evidence indicating it may demonstrate substantial

improvement over available therapies on clinically significant

endpoints.

The NEUTRALIZE-AKI trial is expected to enroll

up to 200 patients at up to 30 U.S. medical centers. The trial’s

primary endpoint is a composite of 90-day mortality or dialysis

dependency of patients treated with the SCD-ADULT in addition to

CRRT as the standard of care, compared with the control group

receiving only CRRT standard of care. Secondary endpoints include

mortality at 28 days, ICU-free days in the first 28 days, major

adverse kidney events at Day 90 and dialysis dependency at one

year. The study will also include subgroup analyses to explore the

effectiveness of SCD-ADULT therapy in AKI patients with sepsis and

acute respiratory distress syndrome.

- In July 2024 the U.S. Centers for

Medicare & Medicaid Services (CMS) granted Category B coverage

for certain expenses incurred by medical centers treating Medicare

or Medicaid patients enrolled in the adult AKI trial.

- We expect to receive U.S.

regulatory approval for the SCD for adults with AKI under a

Premarket Approval (PMA) application and to begin the commercial

product launch in 2026.

Additional SCD Indications

We continue to explore the application of our

SCD technology across a range of indications involving dysregulated

immune processes where proinflammatory activated neutrophils and

monocytes may contribute to disease progression or severity, in

both acute and chronic indications. The SCD has shown a measurable

reduction in excessive inflammatory responses such as the reduction

of solid organ dysfunction in a variety of preclinical and clinical

studies, including sepsis, acute kidney injury, hepatorenal

syndrome, cardiorenal syndrome, ischemia/reperfusion injury,

intracerebral hemorrhage, cardiopulmonary bypass, chronic kidney

disease, chronic dialysis, type 2 diabetes, acute respiratory

distress syndrome and COVID-19, among others.

- In November 2024 we received FDA

Breakthrough Device Designation for the SCD for use in chronic

dialysis, our first such designation for a chronic indication. This

is our fourth FDA award of Breakthrough Device Designation

including adult AKI, cardiorenal syndrome and hepatorenal

syndrome.

Scientific Presentations

In October 2024 the SCD was featured in four

poster presentations at ASN Kidney Week 2024, including the

following:

- Economic data indicating the

QUELIMMUNE substantially lowers hospitalization costs for

critically ill pediatric patients with AKI treated with CRRT.

- New data further explaining

mechanistically how the SCD addresses hyperinflammation and helps

restore immune balance in these critically ill AKI patients.

Corporate Developments

- In July 2024 we completed a

registered direct offering priced at-the-market, raising gross

proceeds of $10 million.

- In September we eliminated all

long-term debt, which was reported at more than $9 million at the

end of 2023.

- Since August 20, 2024, and through

November 10, 2024, we raised approximately $1.8 million, net of

fees, by issuing approximately 569 thousand shares our common

stock.

Third Quarter Financial

Results

Net revenue for the third quarter of 2024 was

$67,500 and was derived from the direct shipment of QUELIMMUNE to a

hospital customer following the commencement of commercial sales in

July 2024. Revenue from the previous distribution agreement was not

recognized during the quarter due to the termination of the

agreement. The Company reported no revenue for the third quarter of

2023.

Research and development (R&D) expenses for

the third quarter of 2024 were $2.3 million, compared with $1.1

million for the third quarter of 2023. The increase was primarily

driven by higher clinical trial costs and personnel expenses.

General and administrative (G&A) expenses for the third quarter

of 2024 were $2.2 million, compared with $1.9 million for the third

quarter of 2023, with the increase primarily due to fees related to

a contract termination settlement.

Other expenses, net for the third quarter of

2024 was $22,000, compared with other expense of $4.3 million for

the third quarter of 2023. The decrease was primarily attributable

to the loss on the change in fair value or extinguishments of

convertible notes during the 2023 quarter, with all convertible

notes fully redeemed or converted by June 30, 2024. The decrease

was partially offset by a decrease in the gain from the change in

the fair value of warrant liability.

The net loss for the third quarter of 2024 was

$4.5 million, or $1.10 per share on 4.1 million weighted-average

shares outstanding. This compares with a net loss for the third

quarter of 2023 of $7.2 million, or $9.02 per share on 0.8 million

weighted-average shares outstanding.

Nine Month Financial

Results

Net revenue for the first nine months of 2024

was $67,500. The Company reported no revenue for the first nine

months of 2023.

R&D expenses for the first nine months of

2024 were $6.4 million, compared with $4.8 million for the first

nine months of 2023. G&A expenses for the first nine months of

2024 were $6.8 million, compared with $6.5 million for the first

nine months of 2023.

Other expense, net for the nine months ended

September 30, 2024 was $7.3 million, compared with $5.5 million for

the nine months ended September 30, 2023.

The net loss for the first nine months of 2024

was $20.4 million, or $6.10 per share on 3.4 million

weighted-average shares outstanding, compared with a net loss for

the first nine months of 2023 of $16.8 million, or $26.16 per share

on 0.6 million weighted-average shares outstanding.

Cash as of September 30, 2024, was $2.1 million,

which included net proceeds of approximately $9.1 million from a

registered direct offering completed in July 2024 and approximately

$0.1 million raised under the Company’s at-the-market (ATM)

facility. The Company retired $3.1 million in convertible notes and

long-term interest-bearing debt during the third quarter of 2024,

and currently has no long-term debt.

About the Selective Cytopheretic Device

(SCD)

The SCD is a patented cell-directed

extracorporeal device that employs immunomodulating technology to

selectively target proinflammatory neutrophils and monocytes during

CRRT and reduces the hyperinflammatory milieu including the

cytokine storm that causes inflammation, organ failure and possible

death in critically ill patients. Unlike pathogen removal and other

blood-purification tools, the device is integrated with RRT

hemofiltration systems to selectively target and transition

proinflammatory monocytes to a reparative state and promote

activated neutrophils to be less inflammatory. The SCD selectively

targets the most highly activated proinflammatory neutrophils and

monocytes. These cells are then returned back into the body through

the blood, and the body is signaled to lower its inflammatory

environment and focus on repair. This unique immunomodulation

approach may promote long-term organ recovery and eliminate the

need for future RRT, including dialysis.

About SeaStar Medical

SeaStar Medical is a commercial-stage medical

technology company that is redefining how extracorporeal therapies

may reduce the consequences of excessive inflammation on vital

organs. SeaStar Medical’s novel technologies rely on science and

innovation to provide life-saving solutions to critically ill

patients. The Company is developing and commercializing

cell-directed extracorporeal therapies that target the effector

cells that drive systemic inflammation, causing direct tissue

damage and secreting a range of pro-inflammatory cytokines that

initiate and propagate imbalanced immune responses. For more

information visit www.seastarmedical.com or visit us on LinkedIn or

X.

Forward-Looking Statements

This press release contains certain

forward-looking statements within the meaning of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1955.

These forward-looking statements include, without limitation, our

ability to add additional direct end-user customers; the impact of

our direct sales model on revenue; the ability of SCD to treat

patients with AKI and other diseases; anticipated patient

enrollment and the expansion of the clinical trial sites;

anticipated patient populations and addressable markets for our

products; the application of our technology beyond AKI; the

anticipated Medicare and Medicaid reimbursement by CMS for patients

enrolled in clinical trials; the expected regulatory approval

process and timeline for commercialization; and the ability of

SeaStar Medical to meet the expected timeline. Words such as

“believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “opportunity,” “plan,” “may,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result,”

and similar expressions are intended to identify such

forward-looking statements. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions and, as a

result, are subject to significant risks and uncertainties that

could cause the actual results to differ materially from the

expected results. Most of these factors are outside SeaStar

Medical’s control and are difficult to predict. Factors that may

cause actual future events to differ materially from the expected

results include, but are not limited to: (i) the risk that SeaStar

Medical may not be able to obtain regulatory approval of its SCD

product candidates; (ii) the risk that SeaStar Medical may not be

able to raise sufficient capital to fund its operations, including

current or future clinical trials; (iii) the risk that SeaStar

Medical and its current and future collaborators are unable to

successfully develop and commercialize its products or services, or

experience significant delays in doing so, including failure to

achieve approval of its products by applicable federal and state

regulators, (iv) the risk that SeaStar Medical may never achieve or

sustain profitability; (v) the risk that SeaStar Medical may not be

able to access funding under existing agreements; (vi) the risk

that third-parties suppliers and manufacturers are not able to

fully and timely meet their obligations, (vii) the risk of product

liability or regulatory lawsuits or proceedings relating to SeaStar

Medical’s products and services, (viii) the risk that SeaStar

Medical is unable to secure or protect its intellectual property,

and (ix) other risks and uncertainties indicated from time to time

in SeaStar Medical’s Annual Report on Form 10-K, including those

under the “Risk Factors” section therein and in SeaStar Medical’s

other filings with the SEC. The foregoing list of factors is not

exhaustive. Forward-looking statements speak only as of the date

they are made. Readers are cautioned not to put undue reliance on

forward-looking statements, and SeaStar Medical assumes no

obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise.

Contact:Alliance Advisors

IRJody Cain(310) 691-7100Jcain@allianceadvisors.com

Financial Tables to Follow

SeaStar Medical Holding

CorporationCondensed Consolidated Balance

Sheets(in thousands, except for share and

per-share amounts)

|

|

|

As ofSeptember 30, 2024 |

|

|

As ofDecember 31, 2023 |

|

|

|

|

(unaudited) |

|

|

|

|

|

ASSETS |

|

| Current assets |

|

|

|

|

|

|

|

Cash |

|

$ |

2,082 |

|

|

$ |

176 |

|

|

Accounts receivable |

|

|

68 |

|

|

$ |

— |

|

|

Prepaid expenses |

|

|

1,466 |

|

|

|

2,132 |

|

|

Total current assets |

|

|

3,616 |

|

|

|

2,308 |

|

| Other assets |

|

|

970 |

|

|

|

1,205 |

|

|

Total assets |

|

$ |

4,586 |

|

|

$ |

3,513 |

|

| |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' DEFICIT |

|

| Current liabilities |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

3,687 |

|

|

$ |

4,372 |

|

|

Accrued expenses |

|

|

2,291 |

|

|

|

1,523 |

|

|

Contract liabilities |

|

|

550 |

|

|

|

100 |

|

|

Notes payable, net of deferred financing costs |

|

|

— |

|

|

|

565 |

|

|

Convertible notes, current portion |

|

|

— |

|

|

|

4,179 |

|

|

Liability classified warrants |

|

|

110 |

|

|

|

2,307 |

|

|

Total current liabilities |

|

|

6,638 |

|

|

|

13,046 |

|

| Notes payable, net of deferred

financing costs |

|

|

— |

|

|

|

4,143 |

|

| Convertible notes, net of

current portion |

|

|

— |

|

|

|

194 |

|

|

Total liabilities |

|

|

6,638 |

|

|

|

17,383 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

| Stockholders' deficit |

|

|

|

|

|

|

|

Preferred stock - $0.0001 par value per share; 10,000,000 shares

authorized at September 30, 2024 and December 31, 2023; no shares

issued and outstanding at September 30, 2024 and December 31,

2023 |

|

|

— |

|

|

|

— |

|

|

Common stock - $0.0001 par value per share; 500,000,000 shares

authorized; 4,214,399 and 2,016,045shares issued and outstanding at

September 30, 2024 and December 31, 2023, respectively |

|

|

1 |

|

|

|

1 |

|

|

Additional paid-in capital |

|

|

133,092 |

|

|

|

100,863 |

|

|

Accumulated deficit |

|

|

(135,145 |

) |

|

|

(114,734 |

) |

|

Total stockholders' deficit |

|

|

(2,052 |

) |

|

|

(13,870 |

) |

|

Total liabilities and stockholders' deficit |

|

$ |

4,586 |

|

|

$ |

3,513 |

|

SeaStar Medical Holding

CorporationCondensed Consolidated Statements of

Operations(unaudited)(in

thousands, except for share and per-share amounts)

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenue |

|

$ |

68 |

|

|

$ |

— |

|

|

$ |

68 |

|

|

$ |

— |

|

| Cost of goods sold |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Gross profit |

|

|

68 |

|

|

|

— |

|

|

|

68 |

|

|

|

— |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

2,336 |

|

|

|

1,087 |

|

|

|

6,367 |

|

|

|

4,798 |

|

| General and

administrative |

|

|

2,188 |

|

|

|

1,855 |

|

|

|

6,776 |

|

|

|

6,475 |

|

|

Total operating expenses |

|

|

4,524 |

|

|

|

2,942 |

|

|

|

13,143 |

|

|

|

11,273 |

|

| Loss from operations |

|

|

(4,456 |

) |

|

|

(2,942 |

) |

|

|

(13,075 |

) |

|

|

(11,273 |

) |

| Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

58 |

|

|

|

— |

|

|

|

82 |

|

|

|

— |

|

| Interest expense |

|

|

(272 |

) |

|

|

(224 |

) |

|

|

(497 |

) |

|

|

(882 |

) |

| Change in fair value of

convertible notes |

|

|

— |

|

|

|

(291 |

) |

|

|

(6,145 |

) |

|

|

(291 |

) |

| Change in fair value of

warrants liability |

|

|

192 |

|

|

|

1,025 |

|

|

|

(773 |

) |

|

|

1,784 |

|

| Change in fair value of

forward option-prepaid forward contracts |

|

|

— |

|

|

|

(1,308 |

) |

|

|

— |

|

|

|

(1,308 |

) |

| Loss on extinguishment of

convertible notes |

|

|

— |

|

|

|

(4,949 |

) |

|

|

— |

|

|

|

(4,949 |

) |

| Other income |

|

|

— |

|

|

|

149 |

|

|

|

— |

|

|

|

149 |

|

| Change in the fair value of

the forward purchase agreement derivative liability |

|

|

— |

|

|

|

1,308 |

|

|

|

— |

|

|

|

— |

|

|

Total other income (expense), net |

|

|

(22 |

) |

|

|

(4,290 |

) |

|

|

(7,333 |

) |

|

|

(5,497 |

) |

| Loss before provision for

income taxes |

|

|

(4,478 |

) |

|

|

(7,232 |

) |

|

|

(20,408 |

) |

|

|

(16,770 |

) |

| Provision for income

taxes |

|

|

— |

|

|

|

— |

|

|

|

3 |

|

|

|

5 |

|

| Net loss |

|

$ |

(4,478 |

) |

|

$ |

(7,232 |

) |

|

$ |

(20,411 |

) |

|

$ |

(16,775 |

) |

| Net loss per share of common

stock, basic and diluted |

|

$ |

(1.10 |

) |

|

$ |

(9.02 |

) |

|

$ |

(6.10 |

) |

|

$ |

(26.16 |

) |

| Weighted-average shares

outstanding, basic and diluted |

|

|

4,086,871 |

|

|

|

801,939 |

|

|

|

3,348,490 |

|

|

|

641,125 |

|

SeaStar Medical Holding

CorporationCondensed Consolidated Statements of

Cash Flows(unaudited)(in

thousands, except for shares and per-share amounts)

|

|

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

| Cash flows from operating

activities |

|

|

|

|

|

|

|

Net loss |

|

$ |

(20,386 |

) |

|

$ |

(16,775 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities |

|

|

|

|

|

|

|

Amortization of deferred financing costs |

|

|

102 |

|

|

|

37 |

|

|

Change in fair value of convertible notes (issued, converted and

outstanding) |

|

|

6,145 |

|

|

|

291 |

|

|

Change in fair value of forward purchase agreement derivative

liability |

|

|

— |

|

|

|

1,308 |

|

|

Change in fair value of liability classified warrants (exercised

and outstanding) |

|

|

773 |

|

|

|

(1,784 |

) |

|

Stock-based compensation |

|

|

675 |

|

|

|

1,544 |

|

|

Loss on extinguishment of convertible notes |

|

|

— |

|

|

|

4,949 |

|

|

Changes in operating assets and liabilities |

|

|

|

|

|

|

|

Accounts receivable |

|

|

(68 |

) |

|

|

— |

|

|

Other receivables |

|

|

— |

|

|

|

12 |

|

|

Prepaid expenses |

|

|

666 |

|

|

|

805 |

|

|

Other assets |

|

|

235 |

|

|

|

— |

|

|

Accounts payable |

|

|

(858 |

) |

|

|

3,115 |

|

|

Accrued expenses |

|

|

932 |

|

|

|

698 |

|

|

Other liabilities |

|

|

495 |

|

|

|

— |

|

| Net cash used in operating

activities |

|

|

(11,314 |

) |

|

|

(5,800 |

) |

| |

|

|

|

|

|

|

| Cash flows from financing

activities |

|

|

|

|

|

|

|

Proceeds from issuance of convertible notes |

|

|

979 |

|

|

|

6,500 |

|

|

Payment of convertible notes |

|

|

(700 |

) |

|

|

(282 |

) |

|

Proceeds from issuance of shares |

|

|

13,582 |

|

|

|

1,283 |

|

|

Proceeds from exercise of convertible note warrants |

|

|

853 |

|

|

|

— |

|

|

Proceeds of pre-funded warrants |

|

|

3,766 |

|

|

|

— |

|

|

Payment of commitment fee - equity line of credit |

|

|

— |

|

|

|

(500 |

) |

|

Proceeds from sale of recycled shares |

|

|

— |

|

|

|

1,870 |

|

|

Proceeds from notes payable |

|

|

— |

|

|

|

100 |

|

|

Payment of notes payable |

|

|

(5,260 |

) |

|

|

(3,145 |

) |

| Net cash provided by financing

activities |

|

|

13,220 |

|

|

|

5,826 |

|

| Net increase in cash |

|

|

1,906 |

|

|

|

26 |

|

| Cash, beginning of period |

|

|

176 |

|

|

|

47 |

|

| Cash, end of period |

|

$ |

2,082 |

|

|

$ |

73 |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Supplemental

disclosure of cash flow information |

|

|

|

|

|

|

| Cash paid for interest |

|

$ |

523 |

|

|

$ |

707 |

|

| Exercise of liability

classified warrants |

|

$ |

3,106 |

|

|

$ |

— |

|

| Shares issued as payment of

convertible notes |

|

$ |

10,210 |

|

|

$ |

4,348 |

|

| Shares issued to settle forward

option-prepaid forward contracts |

|

$ |

— |

|

|

$ |

558 |

|

| Board compensation settled in

shares of common stock in-lieu-of-cash |

|

$ |

210 |

|

|

$ |

— |

|

| Issuance of convertible note

warrants |

|

$ |

586 |

|

|

$ |

2,705 |

|

# # #

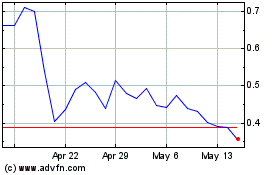

SeaStar Medical (NASDAQ:ICU)

Historical Stock Chart

From Nov 2024 to Dec 2024

SeaStar Medical (NASDAQ:ICU)

Historical Stock Chart

From Dec 2023 to Dec 2024