SeaStar Medical Announces $10 Million Registered Direct Offering Priced At-the-Market Under Nasdaq Rules

July 10 2024 - 9:00AM

SeaStar Medical Holding Corporation (Nasdaq: ICU) (SeaStar

Medical), today announced it has entered into a definitive

agreement for the issuance and sale of an aggregate of 947,868

shares of its common stock (or common stock equivalents in lieu

thereof) at a purchase price of $10.55 per share of common stock

(or per common stock equivalent in lieu thereof), in a registered

direct offering priced at-the-market under Nasdaq rules. In

addition, in a concurrent private placement, SeaStar Medical will

issue and sell unregistered warrants to purchase up to 947,868

shares of common stock. The warrants will have an exercise price of

$10.55 per share, will be exercisable immediately upon issuance and

will expire five years following the issuance date.

H.C. Wainwright & Co. is acting as the

exclusive placement agent for the offering.

The closing of the offering is expected to occur

on or about July 11, 2024, subject to the satisfaction of customary

closing conditions. The gross proceeds from the offering are

expected to be approximately $10 million. SeaStar Medical intends

to use the net proceeds of this offering for general corporate

purposes, which may include additions to working capital and

capital expenditures.

The shares of common stock (or common stock

equivalents) described above (but not the unregistered warrants

issued in the concurrent private placement or the shares of common

stock underlying such unregistered warrants) are being offered by

SeaStar Medical pursuant to a shelf registration statement on Form

S-3 (File No. 333-275968) that was previously filed with the

Securities and Exchange Commission (“SEC”) on December 8, 2023, and

subsequently declared effective on December 22, 2023. The shares of

common stock (or common stock equivalents) offered in the

registered direct offering are being offered only by means of a

prospectus, including a prospectus supplement, forming a part of

the effective registration statement. A final prospectus supplement

and accompanying base prospectus relating to, and describing the

terms of, the registered direct offering will be filed with the SEC

and will be available on the SEC's website at www.sec.gov.

Electronic copies of the final prospectus supplement and the

accompanying base prospectus relating to the offering, when

available, may also be obtained by contacting H.C. Wainwright &

Co., LLC, at 430 Park Ave., New York, New York 10022, by telephone

at (212) 856-5711, or by email at placements@hcwco.com.

The unregistered warrants described above are

being made in a transaction not involving a public offering and

have not been registered under Section 4(a)(2) of the Securities

Act of 1933, as amended (the “Securities Act”) and/or Rule 506(b)

of Regulation D promulgated thereunder and, along with the shares

of common stock underlying such unregistered warrants, have not

been registered under the Securities Act or applicable state

securities laws. Accordingly, the unregistered warrants and

underlying shares of common stock may not be offered or sold in the

United States except pursuant to an effective registration

statement with the SEC or an applicable exemption from the

registration requirements of the Securities Act and such applicable

state securities laws.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy the securities in this

offering, nor shall there be any sale of these securities in any

state or other jurisdiction in which such offer, solicitation or

sale would be unlawful prior to the registration or qualification

under the securities laws of any such state or other

jurisdiction.

About SeaStar Medical

SeaStar Medical is a commercial-stage medical

technology company that is redefining how extracorporeal therapies

may reduce the consequences of excessive inflammation on vital

organs. SeaStar Medical’s novel technologies rely on science and

innovation to provide life-saving solutions to critically ill

patients. The Company is developing and commercializing

cell-directed extracorporeal therapies that target the effector

cells that drive systemic inflammation, causing direct tissue

damage and secreting a range of pro-inflammatory cytokines that

initiate and propagate imbalanced immune responses.

For more information visit

www.seastarmedical.com or visit us on LinkedIn or X.

Forward-Looking Statements

This press release contains certain

forward-looking statements within the meaning of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1955.

These forward-looking statements include, without limitation,

statements related to the timing and completion of the registered

direct offering and concurrent private placement, the satisfaction

of customary closing conditions related to the registered direct

offering and concurrent private placement and the intended use of

proceeds therefrom. Words such as “believe,” “project,” “expect,”

“anticipate,” “estimate,” “intend,” “strategy,” “future,”

“opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,”

“will continue,” “will likely result,” and similar expressions are

intended to identify such forward-looking statements.

Forward-looking statements are predictions, projections and other

statements about future events that are based on current

expectations and assumptions and, as a result, are subject to

significant risks and uncertainties that could cause the actual

results to differ materially from the expected results. Most of

these factors are outside SeaStar Medical’s control and are

difficult to predict. Factors that may cause actual future events

to differ materially from the expected results include, but are not

limited to: (i) the risk that SeaStar Medical may not be able to

obtain regulatory approval of its SCD product candidates; (ii) the

risk that SeaStar Medical may not be able to raise sufficient

capital to fund its operations, including current or future

clinical trials; (iii) the risk that SeaStar Medical and its

current and future collaborators are unable to successfully develop

and commercialize its products or services, or experience

significant delays in doing so, including failure to achieve

approval of its products by applicable federal and state

regulators, (iv) the risk that SeaStar Medical may never achieve or

sustain profitability; (v) the risk that SeaStar Medical may not be

able to access funding under existing agreements; (vi) the risk

that third-parties suppliers and manufacturers are not able to

fully and timely meet their obligations, (vii) the risk of product

liability or regulatory lawsuits or proceedings relating to SeaStar

Medical’s products and services, (viii) the risk that SeaStar

Medical is unable to secure or protect its intellectual property,

(ix) market and other conditions; and (x) other risks and

uncertainties indicated from time to time in SeaStar Medical’s

Annual Report on Form 10-K, including those under the “Risk

Factors” section therein and in SeaStar Medical’s other filings

with the SEC. The foregoing list of factors is not exhaustive.

Forward-looking statements speak only as of the date they are made.

Readers are cautioned not to put undue reliance on forward-looking

statements, and SeaStar Medical assumes no obligation and do not

intend to update or revise these forward-looking statements,

whether as a result of new information, future events, or

otherwise.

SeaStar Medical Contact:LHA

Investor Relations Jody Cain (310) 691-7100 Jcain@lhai.com

# # #

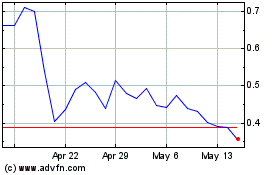

SeaStar Medical (NASDAQ:ICU)

Historical Stock Chart

From Dec 2024 to Jan 2025

SeaStar Medical (NASDAQ:ICU)

Historical Stock Chart

From Jan 2024 to Jan 2025