Scilex Holding Company (Nasdaq: SCLX, “Scilex” or “Company”),

an innovative revenue-generating company focused on acquiring,

developing and commercializing non-opioid pain management products

for the treatment of acute and chronic pain, today announced that

the U.S. Patent and Trademark Office has allowed numerous claims

from U.S. patent application no. 17/562,229 and will issue a new

patent containing those claims related to the treatment of acute

pain (the “Patent”), to Scilex in late 2024, further strengthening

the Company’s intellectual property position and coverage for its

acute migraine treatment drug product, ELYXYB®, a liquid,

micro-encapsulation formulation of celecoxib. The Patent, titled

“Methods of Treating Pain,” covers methods of treating acute pain.

Clinicians in a recent market research study expressed their

desire for fast and safe alternatives for two large pools of acute

migraine patients – those who have an insufficient response to

triptan therapy and those who have contraindications to triptan

use. ELYXYB®’s product profile mapped with a high degree of

certainty to these stated unmet needs. In clinical studies,

patients treated with ELYXYB® demonstrated pain relief in as little

as 15 minutes, and significant pain relief compared to placebo

within 45 minutes in approximately 50% of patients.6,7

“We are very excited about the potential of ELYXYB® since

launching the product in the U.S. in April 2023. This is a highly

complementary commercial asset that allows us to provide physicians

with another tool in their pain management armamentarium to treat

migraines earlier in the patient’s journey. These new patents will

provide the ability to file application in the future for acute

pain,” said Jaisim Shah, Chief Executive Officer and President of

Scilex.

For more information on Scilex Holding Company, refer to

www.scilexholding.com

For more information on Semnur Pharmaceuticals, Inc., refer to

www.semnurpharma.com

For more information on Scilex Holding Company Sustainability

Report, refer to www.scilexholding.com/investors/sustainability

For more information on ZTlido® including Full Prescribing

Information, refer to www.ztlido.com.

For more information on ELYXYB®, including Full Prescribing

Information, refer to www.elyxyb.com.

For more information on Gloperba®, including Full Prescribing

Information, refer to www.gloperba.com.

https://www.facebook.com/scilex.pharm

https://www.linkedin.com/company/scilex-holding-company/

info@scilexholding.com

About Scilex Holding Company

Scilex Holding Company is an innovative revenue-generating

company focused on acquiring, developing and commercializing

non-opioid pain management products for the treatment of acute and

chronic pain. Scilex targets indications with high unmet needs and

large market opportunities with non-opioid therapies for the

treatment of patients with acute and chronic pain and are dedicated

to advancing and improving patient outcomes. Scilex’s commercial

products include: (i) ZTlido® (lidocaine topical system) 1.8%, a

prescription lidocaine topical product approved by the U.S. Food

and Drug Administration (the “FDA”) for the relief of neuropathic

pain associated with postherpetic neuralgia, which is a form of

post-shingles nerve pain; (ii) ELYXYB®, a potential first-line

treatment and the only FDA-approved, ready-to-use oral solution for

the acute treatment of migraine, with or without aura, in adults;

and (iii) Gloperba®, the first and only liquid oral version of the

anti-gout medicine colchicine indicated for the prophylaxis of

painful gout flares in adults.

In addition, Scilex has three product candidates: (i) SP-102 (10

mg, dexamethasone sodium phosphate viscous gel) (“SEMDEXATM” or

“SP-102”), a novel, viscous gel formulation of a widely used

corticosteroid for epidural injections to treat lumbosacral

radicular pain, or sciatica, for which Scilex has completed a Phase

3 study and was granted Fast Track status from the FDA in 2017;

(ii) SP-103 (lidocaine topical system) 5.4%, (“SP-103”), a

next-generation, triple-strength formulation of ZTlido, for the

treatment of chronic neck pain and for which Scilex has recently

completed a Phase 2 trial in low back pain. SP-103 has been granted

Fast Track status from the FDA in low back pain; and (iii) SP-104

(4.5 mg, low-dose naltrexone hydrochloride delayed-release

capsules) (“SP-104”), a novel low-dose delayed-release naltrexone

hydrochloride being developed for the treatment of fibromyalgia,

for which Phase 1 trials were completed in the second quarter of

2022.

Scilex Holding Company is headquartered in Palo Alto,

California.

About Semnur Pharmaceuticals, Inc.

Semnur Pharmaceuticals, Inc. (“Semnur”) is a clinical-late stage

specialty pharmaceutical company focused on the development and

commercialization of novel non-opioid pain therapies. Semnur’s lead

program, SP-102 (SEMDEXA™), is the first non-opioid novel gel

formulation administered epidurally in development for patients

with moderate to severe chronic radicular pain/sciatica.

Semnur Pharmaceuticals, Inc. is headquartered in Palo Alto,

California.

About Denali Capital Acquisition Corp.

Denali Capital Acquisition Corp. (“SPAC”) is a blank check

company formed for the purpose of effecting a merger, share

exchange, asset acquisition, share purchase, reorganization or

similar business combination with one or more businesses or

entities.

Important Information and Where to Find It

This press release relates to a proposed transaction between

Semnur and the SPAC and does not contain all the information that

should be considered concerning the potential business combination

and is not intended to form the basis of any investment decision or

any other decision in respect of the potential business

combination. This press release does not constitute an offer to

sell or exchange, or the solicitation of an offer to buy or

exchange, any securities, nor shall there be any sale of securities

in any jurisdiction in which such offer, sale or exchange would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. In connection with the

transaction described herein, the SPAC will file relevant materials

with the SEC, including a registration statement on Form S-4, which

will include a proxy statement/prospectus. Investors and

security holders of the SPAC are urged to read these materials

(including any amendments or supplements thereto) and any other

relevant documents in connection with the transaction that the SPAC

files with the SEC when, and if, they become available because they

will contain important information about the SPAC, Semnur and the

proposed transaction. The preliminary proxy

statement/prospectus, the definitive proxy statement/prospectus and

other relevant materials in connection with the transaction (when

and if they become available), and any other documents filed by the

SPAC with the SEC, may be obtained free of charge at the SEC’s

website (www.sec.gov). The documents filed by the SPAC with the SEC

also may be obtained free of charge upon written request to:

Denali Capital Acquisition Corp.437 Madison Avenue, 27th

FloorNew York, NY 10022

Participants in the Solicitation

The SPAC and its directors and executive officers may be deemed

participants in the solicitation of proxies from the SPAC’s

shareholders with respect to the proposed business combination.

Information about the SPAC’s directors and executive officers and a

description of their interests in the SPAC will be included in the

proxy statement/prospectus for the proposed transaction and will be

available at the SEC’s website (www.sec.gov). Additional

information regarding the interests of such participants will be

contained in the proxy statement/prospectus for the proposed

transaction when available.

Semnur and its directors and executive officers may also be

deemed to be participants in the solicitation of proxies from the

shareholders of the SPAC in connection with the proposed business

combination. Information about Semnur’s directors and executive

officers and information regarding their interests in the proposed

transaction will be included in the proxy statement/prospectus for

the proposed transaction.

Non-Solicitation

This press release is not a proxy statement or solicitation of a

proxy, consent or authorization with respect to any securities or

in respect of the potential transaction and shall not constitute an

offer to sell or a solicitation of an offer to buy the securities

of the SPAC, the combined company or Semnur, nor shall there be any

sale of any such securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of such

state or jurisdiction. No offer of securities shall be made except

by means of a prospectus meeting the requirements of the Securities

Act of 1933, as amended.

Forward-Looking Statements

This press release and any statements made for and during any

presentation or meeting concerning the matters discussed in this

press release contain forward-looking statements related to Scilex

and its subsidiaries and the SPAC and are subject to risks and

uncertainties that could cause actual results to differ materially

from those projected. Forward-looking statements include statements

regarding the SPAC, Scilex and its subsidiaries, including but not

limited to Semnur, statements regarding the proposed business

combination between Semnur and the SPAC, including the potential

listing of the combined company’s common stock and warrants on

Nasdaq, obtaining the approval from the SPAC’s shareholders, the

expectation that the SPAC will file a registration statement on

Form S-4 with the SEC, which would include a proxy

statement/prospectus, the estimated or anticipated future results

and benefits of the combined company following the proposed

business combination, including the ability of the parties to

successfully consummate the proposed business combination, the

timing of the closing of the proposed business combination, future

opportunities for the combined company, Semnur and the combined

company’s proposed business strategies, the estimated

pre-transaction equity valuation of Semnur, the estimated sales for

SP-102, the Company’s outlook, goals and expectations for 2024, and

the Company’s development and commercialization plans. Although

each of the SPAC and Scilex and its subsidiaries believes that it

has a reasonable basis for each forward-looking statement contained

in this press release, each of the SPAC and Scilex and its

subsidiaries caution you that these statements are based on a

combination of facts and factors currently known and projections of

the future, which are inherently uncertain. In addition, there will

be risks and uncertainties described in the proxy

statement/prospectus included in the registration statement on Form

S-4 relating to the proposed transaction, which is expected to be

filed by the SPAC with the SEC, and described in other documents

filed by the SPAC or Scilex from time to time with the SEC. These

filings may identify and address other important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking statements.

Neither the SPAC nor Scilex and its subsidiaries can assure you

that the forward-looking statements in this communication will

prove to be accurate.

Risks and uncertainties that could cause actual results of

Scilex and the SPAC to differ materially and adversely from those

expressed in our forward-looking statements, include, but are not

limited to: the inability of the parties to consummate any proposed

business combination transaction for any reason, including any

failure to meet applicable closing conditions; changes in the

structure, timing and completion of the proposed transaction

between the SPAC and Semnur; the SPAC’s ability to continue its

listing on the Nasdaq Capital Market until closing of the proposed

transaction; the combined company’s ability to list its securities

on Nasdaq after closing of the proposed transaction; the ability of

the parties to achieve the benefits of the proposed transaction,

including future financial and operating results of the combined

company; the ability of the parties to realize the expected

synergies from the proposed transaction; risks related to the

outcome of any legal proceedings that may be instituted against the

parties following the announcement of the proposed business

combination; risks associated with the unpredictability of trading

markets; general economic, political and business conditions; the

risk that the potential product candidates that Scilex develops may

not progress through clinical development or receive required

regulatory approvals within expected timelines or at all; risks

relating to uncertainty regarding the regulatory pathway for

Scilex’s product candidates; the risk that Scilex will be unable to

successfully market or gain market acceptance of its product

candidates; the risk that Scilex’s product candidates may not be

beneficial to patients or successfully commercialized; the risk

that Scilex has overestimated the size of the target patient

population, their willingness to try new therapies and the

willingness of physicians to prescribe these therapies; risks that

the outcome of the trials and studies for SP-102, SP-103 or SP-104

may not be successful or reflect positive outcomes; risks that the

prior results of the clinical and investigator-initiated trials of

SP-102 (SEMDEXA™), SP-103 or SP-104 may not be replicated;

regulatory and intellectual property risks; and other risks and

uncertainties indicated from time to time and other risks described

in Scilex’s and the SPAC’s most recent periodic reports filed with

the SEC, including their Annual Reports on Form 10-K for the year

ended December 31, 2023 and subsequent Quarterly Reports on Form

10-Q that the Company and the SPAC have respectively filed or may

file, including the risk factors set forth in those filings.

Investors are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

release, and Scilex and the SPAC undertakes no obligation to update

any forward-looking statement in this press release except as may

be required by law.

Contacts:

Investors and MediaScilex Holding Company 960 San Antonio

RoadPalo Alto, CA 94303Office: (650) 516-4310

Email: investorrelations@scilexholding.com

Website: www.scilexholding.com

Investors and MediaDenali Capital Acquisition Corp. 437 Madison

Avenue, 27th FloorNew York, NY 10022

Reference

1) Source: Celecoxib Oral Solution Approved for

Acute Migraine March

2020. https://www.neurologylive.com/view/celecoxib-oral-solution-gets-goahead-for-acute-migraine2) Source:

Evaluate Pharma data February 16,

20233) Bunchorntavakul C, Reddy K. Acetaminophen

(APAP or N-Acetyl-p-Aminophenol) and Acute Liver Failure. Clin

Liver Dis. 2018 May;22(2):325-346. PMID:

296050694) DelveInsight Acute Pain - Market

Insight, Epidemiology And Market Forecast – 2032; Dec 2022;

https://www.delveinsight.com/report-store/acute-pain-market#:~:text=The%20DelveInsight's%20acute%20pain%20market,be%20either%20acute%20or%20chronic 5) Source:

Acute Migraine Headache: Treatment Strategies.

https://www.aafp.org/pubs/afp/issues/2018/0215/p243.html6) Data

on file. Scilex Holding Company7) Lipton RB, et

al. J Pain Res 2021; 14:549-560.

SEMDEXA™ (SP-102) is a trademark owned by Semnur

Pharmaceuticals, Inc., a wholly-owned subsidiary of Scilex Holding

Company. A proprietary name review by the FDA is planned.

ZTlido® is a registered trademark owned by

Scilex Pharmaceuticals Inc., a wholly-owned subsidiary of Scilex

Holding Company.

Gloperba® is the subject of an exclusive,

transferable license to Scilex Holding Company to use the

registered trademark.

ELYXYB® is a registered trademark owned by

Scilex Holding Company.

All other trademarks are the property of their

respective owners.

© 2024 Scilex Holding Company All Rights

Reserved.

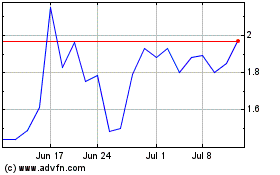

Scilex (NASDAQ:SCLX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Scilex (NASDAQ:SCLX)

Historical Stock Chart

From Dec 2023 to Dec 2024