0001701756

false

0001701756

2023-08-07

2023-08-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities and Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 7, 2023

Commission

File Number 001-39223

SADOT

GROUP INC.

(Exact

name of small business issuer as specified in its charter)

| Nevada |

|

47-2555533 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

1751

River Run, Suite 200, Fort Worth, Texas 76107

(Address

of principal executive offices)

(832)

604-9568

(Issuer’s

telephone number)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instructions A.2. below):

| ☐ |

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common Stock, $0.0001 par

value |

|

GRIL |

|

The Nasdaq Stock Market |

Item

2.02 Results of Operations and Financial Condition.

On

August 7, 2023, Sadot Group Inc. (the “Company”) issued a corporate update announcing certain unaudited preliminary revenue

and net income results for Sadot LLC, a Delaware limited liability company and a wholly owned subsidiary of the Company. A copy of the

corporate update is being furnished as Exhibit 99.1 to this Current Report on Form 8-K.

As

provided in General Instruction B.2 of Form 8-K, the information in this Item 2.02 of this Current Report on Form 8-K (including Exhibit

99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into any registration

statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set

forth by specific reference in such filing.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

| |

|

SADOT GROUP INC. |

| |

|

|

|

| |

|

By: |

/s/ Michael

Roper |

| |

|

Name: |

Michael Roper |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

|

| Date: |

August 7, 2023 |

|

|

Exhibit

99.1

August

7, 2023

Dear

Shareholders,

I

am pleased to share a comprehensive corporate update for the last eight months at Sadot Group Inc. (the “Sadot Group” or

the “Company”) (Nasdaq: SDOT), which recently changed its name from “Muscle Maker Inc.” (Nasdaq: GRIL). With

the addition of Sadot LLC (“Sadot Agri-Foods”) in November 2022, the Company executed a strategic pivot into the global agri-foods

supply chain sector. This shift has resulted in a period of remarkable growth and progress for the Company. As noted in our Q1 2023 filings,

Q1 2023 revenues were $213 million compared to Q1 2022 revenues of $3 million. Our Sadot Agri-Foods unit achieved $515 million in total

revenue since November 2022 by generating over $45.7 million in top line revenue for the month of June 2023. This marks the eighth consecutive

month in which Sadot Agri-Foods’ top line revenue exceeded $45 million. We look forward to sharing our continued revenue growth

for Q2, 2023 on our upcoming earnings call that is scheduled for Thursday, August 10. To register and attend, please use this link: https://audience.mysequire.com/webinar-view?webinar_id=190e174d-78f6-40ef-b756-7bcc24eca200

It

has been an extremely busy period with numerous developments and I would like to outline and highlight some of the significant milestones

achieved during this time. We are proud of our people and partnerships, as well as the successful execution of our growth strategy that

has transformed us into a global, food-focused organization, sourcing and providing healthier food options.

To

underscore the strategic pivot into the global agri-foods supply chain sector, the Company took the momentous step of changing our name

from Muscle Maker Inc. to Sadot Group Inc. effective July 27, 2023. The name change recognizes the Company’s evolution of our core

business and aligns with our strategic vision as we transform into a global supply chain organization focused on sustainable agri-foods.

In addition, the Company’s common stock began trading on NASDAQ under the ticker symbol “SDOT.”

Of

note, the Sadot Group reported a net loss for Q1 2023 of $1,066,000. However, this net loss was primarily due to the non-cash charges

we are required to incur under GAAP of $3,359,000 related to stock issuance expense incurred for the Company’s service agreement

with Aggia LLC FZ who is providing operational management of Sadot Agri-Foods. I am pleased to inform you that we have amended the terms

of the Aggia agreement effective April 1, 2023, allowing us to better reflect the true operational and financial performance of the Sadot

Group. We have now issued the remaining shares. Additional details are provided below.

In

addition to our remarkable financial performance, I would also like to reiterate and highlight that the Sadot Group was recently added

to the Russell Microcap Index. This inclusion is a testament to our continued progress and growing market presence, and it further enhances

our visibility among investors and the investment community.

Strategic

Vision and Global Expansion

Late

in 2022, the Sadot Group embarked on a strategic journey to become a global agri-foods supply chain organization, focused on sustainable

solutions to the world’s food security issues. This vision propelled us to expand internationally, with headquarters in Ft. Worth,

Texas, and operations and offices spanning across the United States, Dubai, Singapore, Ukraine, and Zambia. This expansion opened new

avenues for growth and solidified the Company’s position as a global player in the food supply chain sector.

The

Sadot Group is now a Truly Diversified Company with Multiple Verticals in the Food Supply Chain Sector

The

Sadot Group has rapidly evolved and now operates within three key verticals of the global food supply chain, reinforcing our market presence

and enhancing our capabilities:

1.

TRADING OPERATIONS: This includes the global sourcing and trading of food and feed products such as soybean meal, wheat, and corn.

2.

FARM OPERATIONS: We have ventured into crop farm production in Southern Africa with a focus on major commodities like wheat, soy,

and corn, alongside high-value tree crops such as avocado and mango.

3.

FOOD SERVICE OPERATIONS: Encompasses 47 fast casual restaurants across the United States and an international presence in Kuwait,

with our flagship Pokémoto brand leading our food service operations.

Major

Highlights, Milestones and Updates

| 1. | The

formation of the Sadot Agri-Foods subsidiary and our strategic service agreement with Aggia

to manage and operate the division. |

The

Sadot Group and Aggia entered into a service agreement in November of 2022 which has led to the steady and sustained revenue generation

from of our Sadot Agri-Foods subsidiary since its formation. The Sadot Agri-Foods generated approximately $515 million to date and has

contributed in excess of $9.9 million in net income for the Company. As per the terms of the service agreement with Aggia, Aggia has

also nominated eight directors to our board and received Sadot Group common stock for their performance since Sadot Agri-Foods’

inception.

| 2. |

Improved agreement with Aggia. |

Recently,

we made an important announcement regarding the amendment of our agreement with Aggia. The primary objective of this amendment is to

provide clearer and more accurate financial reporting, ensuring our stakeholders have a transparent view of our progress and achievements.

The effect of these changes will be reflected in the Sadot Group’s Q2 2023 earnings.

The

revisions will streamline reporting processes and improve financial transparency. The amended agreement includes the following key changes:

A.

Adjustment in Stock Issuance: For accounting purposes, the allocation of Sadot Agri-Foods’ net income for stock issuance has

been modified from 80% down to 40%.

B.

Debt Accumulation Formula: The formula for debt accumulation has also been revised to be based on 40% of Sadot Agri-Foods’

net income.

C.

Immediate Issuance of Remaining Shares: To address the changes, the Sadot Group has issued all remaining shares (approximately 8.8

million shares) to Aggia, which will hold voting rights.

D.

Claw Back Provision: In order to ensure fairness, a claw back provision has been implemented. The Sadot Group retains the right to

reclaim any of the issued shares at the end of five years if they haven’t been earned as outlined above.

E.

The primary objectives of these revisions are to simplify reporting processes, increase the Sadot Group’s allocation of Sadot

Agri-Foods’ net income, and provide greater clarity regarding the Company’s financial performance.

To

illustrate the potential impact of the amended agreement, below is a hypothetical scenario based on the Sadot Group’s actual Q1

2023 figures.

| Q1 2023 Comparison of Revised to Previous Aggia agreement using |

| Sadot Agri-Foods’ actual Q1 2023 financials to illustrate the change to the Sadot Group’s Net Income. |

| | |

| | |

| |

| | |

Revised Agreement | | |

Previous Agreement | |

| Sadot Agri-Foods Net Income | |

$ | 4,300,000 | | |

$ | 4,300,000 | |

| Stock allocation expense in % | |

| 40 | % | |

| 80 | % |

| Stock allocation expense in $ | |

$ | -1,720,000 | | |

$ | -3,440,000 | |

| Sadot Agri-Foods income contribution to the Sadot Group’s overall net income | |

$ | 2,580,000 | | |

$ | 860,000 | |

Under

the amended agreement, Sadot Agri-Foods’ net income of $4.3 million for Q1 of 2023 would have contributed $2,580,000 to the Sadot

Group’s overall net income as opposed to only $860,000 under the Previous agreement. As a result, the amended agreement would have

transformed Sadot Group’s Q1 2023 overall reported net loss of -$1,066,000 into a positive net income gain of $654,000.

In

conclusion, the amended service agreement aligns Sadot Group’s financial reporting with its operational performance, improves financial

stability, and demonstrates the Company’s potential for sustained growth. The changes made provide a clearer representation of

the Sadot Group’s true financial position, allowing stakeholders to make better-informed decisions. We are confident that these

revisions position the Sadot Group on a path towards greater financial success.

| 3. |

Establishing Farm Operations |

In

Q2’23, the Sadot Group acquired a 2000ha (hectares) commercial farm in Zambia’s Mkushi Region. The farm produces grains such

as wheat, corn and soy, as well as avocado and mango. The farm is currently in its second annual planting cycle that will be harvested

towards the end of the year. Additional land will be planted in the coming years to increase revenues and market presence.

The

acquisition of the farm aligns with the Sadot Group’s strategic vision of vertical integration, a step that could provide certain

advantages in our goal to enhance profitability, if any. By incorporating practical vertical integration, the Company aims to boost margins.

One key benefit is the farm’s capability to ensure a steady and reliable supply of grains and tree crops, which are currently experiencing

high demand in the market with potential for higher margins.

Once

the farm transaction is fully executed, the farm could serve as an asset for collateral, potentially enabling the Sadot Group to access

credit facilities more effectively. This financial leverage could allow the Company to pursue further growth opportunities and invest

in various ventures.

Moreover,

the newly acquired farm has the potential to provide a fresh source of revenue by operating as a regional hub for smaller farmers. By

providing future warehousing and distribution services for their products, the Sadot Group will not only aid these farmers in reaching

wider markets but may also help them optimize their agricultural practices and adopt innovative technologies (Ag-tech). The goal of this

symbiotic relationship is to foster a collaborative environment, strengthening the agricultural community as a whole while also contributing

to the Company’s bottom line.

In

conclusion, the strategic decision to vertically integrate through the farm acquisition is expected to yield multiple benefits. It has

the potential to secure a stable supply chain and establish a mutually beneficial ecosystem that fosters innovation and growth in the

agricultural sector.

| 4. |

Optimizing Food Service Operations (Pokémoto / Muscle

Maker Grill / Superfit Foods) |

Pokémoto

The

Sadot Group’s flagship fast casual restaurant brand, recently celebrated the grand opening of its 32nd location, marking a significant

milestone in its expansion journey. With operations already established in 15 states, Pokémoto’s popularity is on the rise.

The brand’s success is further reflected in securing over an additional 55 signed franchise agreements to date, a testament to

its appeal and brand recognition, and potential for growth throughout the USA. The Sadot Group is determined to become a leader in the

industry with Pokémoto, aspiring to become the premier brand in the rapidly growing fast casual “Poke” segment. As

part of its strategic vision, the Sadot Group is actively working to transition corporate locations into a streamlined franchise model.

This move aims to enhance efficiency while providing a localized brand experience across all Pokémoto outlets, projecting the

Company toward being a leading player in the “Poke” fast casual dining restaurant segment.

Muscle

Maker Grill

The

Sadot Group is actively pursuing an optimization strategy for its current locations, aiming to maximize efficiency and focus on Pokémoto’s

growth. To achieve this strategic position, the Company is exploring various options, including converting and rebranding some of its

existing locations to Pokémoto outlets, leveraging the brand’s success and popularity. Additionally, the Company is considering

co-branding certain locations with Pokémoto to leverage synergies and expand its customer base. However, in cases where optimization

may not be feasible, the Company is open to making tough decisions, even considering the possibility of closing down some locations to

redirect resources towards the expansion of Pokémoto, which it has recently done with five Muscle Maker Grill locations. By carefully

evaluating each option, the Sadot Group is confident that taking this fiscally responsible path will enable them to concentrate all efforts

on propelling Pokémoto towards becoming a dominant force in the fast-casual “Poke” market segment.

Superfit

Foods

In

line with our strategic vision, the Company has made the decision to explore strategic alternatives for its Superfit Foods brand. Recognizing

that Superfit Foods is not a core segment of its overall Food Service Operations business plan moving forward, the Company is seeking

to streamline its focus and resources towards the growth and expansion of Pokémoto, its flagship fast casual restaurant brand.

By evaluating strategic alternatives for Superfit Foods, the Company aims to ensure a more concentrated effort on its primary objective

of solidifying Pokémoto’s position as a leading player in the fast casual dining industry. This strategic shift reflects

Sadot Group’s commitment to maximizing opportunities in its core areas of strength and innovation.

Summary

In

conclusion, the past eight months have been eventful and transformative for Sadot Group Inc. We are proud of the dedicated efforts of

our people and the strength of our partnerships that have fueled our growth and expansion into the global food market. We want to take

this opportunity to express our heartfelt gratitude to all of the shareholders for their unwavering support throughout this journey.

Your belief in our vision has been instrumental in driving us forward.

As

we move ahead, we value your feedback and encourage you to share your thoughts, helping us effectively communicate our story and progress.

We truly believe that our success is a result of the collective effort of our people and our stakeholders, and we are committed to creating

value for each and every one of you.

Looking

back on the work accomplished to date, we are extremely proud of our achievements, but the real excitement lies in our future. The path

ahead is filled with boundless opportunities, and we are enthusiastic about the possibilities that await us.

Moreover,

we are thrilled to share that the coming days, weeks, and months will be filled with additional exciting news as we continue to grow

and shape the future of Sadot Group Inc. Your continued support and engagement are invaluable to us, and we eagerly anticipate sharing

our progress and milestones with you.

Once

again, thank you for being an integral part of our journey. Together, we will continue to build a stronger, more innovative, and impactful

Sadot Group Inc.

Sincerely,

Michael

Roper

Michael

Roper

Chief

Executive Officer

Sadot

Group Inc.

About

this Corporate Update

The

preliminary, unaudited financial results included in this Corporate Update are based on information available as of June 30, 2023, and

management’s initial review of operations and financial results as of such date. They remain subject to change based on the completion

of the Company’s customary quarterly financial closing and review procedures and are forward-looking statements. The Company assumes

no obligation to update these statements, except as may be required by law. The actual results may be materially different and are affected

by the risk factors and uncertainties identified in this Corporate Update and in the Company’s annual and quarterly filings with

the Securities and Exchange Commission. Further, the Company’s independent auditor has not reviewed or performed any procedures

on the preliminary, unaudited financial results.

Forward-Looking

Statements

This

Corporate Update may include “forward-looking statements” pursuant to the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. To the extent that the information presented in this Corporate Update discusses financial

projections, information, or expectations about our business plans, results of operations, products, or markets, or otherwise makes statements

about future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such

as “should”, “may,” “intends,” “anticipates,” “believes,” “estimates,”

“projects,” “forecasts,” “expects,” “plans,” and “proposes.” Although we

believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of

risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. You are urged to carefully

review and consider any cautionary statements and other disclosures, including the statements made under the heading “Risk Factors”

and elsewhere in documents that we file from time to time with the SEC. Forward-looking statements speak only as of the date of the document

in which they are contained, and Sadot Group, Inc., does not undertake any duty to update any forward-looking statements except as may

be required by law.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

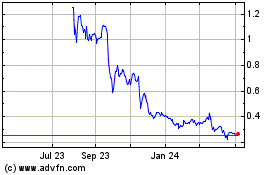

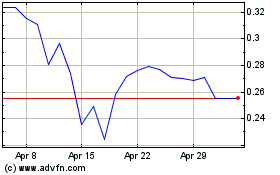

Sadot (NASDAQ:SDOT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sadot (NASDAQ:SDOT)

Historical Stock Chart

From Jul 2023 to Jul 2024