UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the

Securities Exchange Act of 1934

For

May 22, 2024

Commission

File Number: 001-41883

Roma

Green Finance Limited

(Exact

name of Registrant as specified in its charter)

Cayman

Islands

(Jurisdiction

of incorporation or organization)

Flat

605, 6/F., Tai Tung Building, 8 Fleming Road

Wanchai,

Hong Kong

(Address

of principal executive offices)

Luk

Huen Ling Claire, CEO

Tel:

+ 852 2529 6878

Email:

Claireluk@romagroup.com

Flat

605, 6/F., Tai Tung Building, 8 Fleming Road

Wanchai,

Hong Kong

(Name,

Telephone, email and/or fax number and address of Company Contact Person)

Indicate

by check mark whether the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note

: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual

report to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that

the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on

which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

Notice

of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On

May 17, 2024, Roma Green Finance Limited (“ROMA” and the “Company”) received a deficiency notice (the “Notice”)

from the Listing Qualifications Department (the “Staff”) of the Nasdaq Stock Market LLC (“Nasdaq”) notifying

the Company that, for the last 31 consecutive business days, the closing bid price for the Company’s ordinary shares (the

“Ordinary Shares”) had been below the minimum of $1.00 per Ordinary Share required for continued listing on The Nasdaq Capital

Market (the “Minimum Bid Price Rule”). The Notice has no immediate effect on the listing of the Ordinary Shares, which will

continue to trade on The Nasdaq Capital Market under the symbol “ROMA” without interruption at this time.

In

accordance with Nasdaq Listing Rules, the Company has 180 calendar days, or until November 13, 2024, to regain compliance with the Minimum

Bid Price Rule. If at any time before November 13, 2024, the closing bid price of the Ordinary Shares is at least $1.00 per Ordinary

Share for a minimum of 10 consecutive business days, the Staff will provide written confirmation that the Company has achieved compliance

and the matter will be closed.

If

the Company does not regain compliance with the Minimum Bid Price Rule by November 13, 2024, the Company may be eligible for an additional

180 day calendar period to regain compliance or be subject to delisting. To qualify for the additional time, the Company will be required

to meet the continued listing requirements regarding the market value of publicly held Ordinary Shares and all other initial listing

standards, except for the minimum bid price requirement. In addition, the Company will be required to notify Nasdaq of its intent to

cure the deficiency by effecting a reverse stock split, if necessary, during the additional compliance period.

The

Company intends to actively monitor the closing bid price for its Ordinary Shares and will consider available options to resolve the

deficiency and regain compliance with the Minimum Bid Price Rule. However, there can be no assurance that the Company will be able to

regain compliance with the Minimum Bid Price Rule.

EXHIBITS

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| Date:

May 22, 2024 |

ROMA

GREEN FINANCE LIMITED |

| |

|

| |

By: |

/s/

Luk Huen Ling Claire |

| |

Name: |

Luk

Huen Ling Claire |

| |

Title: |

Chairlady,

Executive Director and Chief Executive Officer |

Exhibit

99.1

Roma

Green Finance Limited Receives Nasdaq Deficiency Notice Regarding Minimum Bid Price Requirement

Ordinary

shares will continue to trade on the Nasdaq Capital Market, and the Company’s listing on such exchange is not affected by the receipt

of the Notice

HONG

KONG, May 21, 2024 – Roma Green Finance Limited (NASDAQ: ROMA) disclosed that it had received a notice (the “Notice”)

from the Nasdaq Stock Market LLC (“Nasdaq”) that ROMA is not currently in compliance with the $1.00 minimum bid price requirement

for continued listing of the Company’s ordinary shares (the “Ordinary Shares”) on the Nasdaq Capital Market, as set

forth in Nasdaq Listing Rules (the “Minimum Bid Price Requirement”). The Notice indicated that the Company has 180 days,

or until November 13, 2024 (the “Compliance Deadline”), to regain compliance with the Minimum Bid Price Requirement by having

the closing bid price of the Ordinary Shares meet or exceed $1.00 per Ordinary Share for at least ten consecutive business days.

The

Notice has no immediate effect on the listing of the Company’s Ordinary Shares, which continue to trade on The Nasdaq Capital Market

under the symbol “ROMA”. The Company intends to monitor the closing bid price of its Ordinary Shares and may, if appropriate,

consider implementing available options to regain compliance with the Minimum Bid Price Requirement, including a reverse stock split

(i.e., a share consolidation). If the Company does not regain compliance by the Compliance Deadline, the Company may be afforded an additional

180 calendar day period to regain compliance as provided by the Nasdaq Listing Rules.

About

Roma Green Finance Limited

The

Company is based in Hong Kong and is principally engaged in the provision of ESG, corporate governance and risk management as well as

sustainability and climate change related advisory services. Its service offering mainly comprise the following: (i) Sustainability Program

Development, (ii) ESG Reporting, (iii) Corporate Governance and Risk Management, (iv) Climate Change Strategies and Solutions, (v) Environmental

Audit, (vi) ESG Rating Support and Shareholder Communication: The Company helps clients to review and improve their ESG / sustainability

ratings with Bloomberg and other rating agencies, and (vii) Education and Training.

Additional

information about the Company is available at http://www.romaesg.com.

Forward-Looking

Statements

Certain

statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and

uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes

may affect its financial condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking

statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,”

“estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,”

“continue” or other similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking

statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law.

Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you

that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from

the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s registration

statement and other filings with the SEC, which are available for review at www.sec.gov.

Contact:

Roma

Green Finance Limited

Tel:

+852 2529 6878

Email:

ir@roma-international.com

Ms.

Katy Chan

Metaverse

Finance Limited

Tel:

+ 852 2156 0223

Email:

ir@hbkstrategy.com

Exhibit

99.2

Sent

via Electronic Delivery to: claireluk@roma-international.com; howardleung@roma- international.com; ds@schlueterintl.com;

hfs@schlueterintl.com

May

17, 2024

Ms.

Claire Luk

Chief

Executive Officer

Roma Green Finance Limited

Flat

605, 6/F., Tai Tung Building, 8 Fleming Road

Wanchai, Hong Kong

| Re: |

Roma Green Finance Limited (the “Company”)

Nasdaq Security: Ordinary Shares

Nasdaq

Symbol: ROMA |

Dear Ms. Luk:

As

we discussed, our Listing Rules (the “Rules”) require listed securities to maintain a minimum bid price of $1 per share.

Based upon the closing bid price for the last 31 consecutive business days, the Company no longer meets this requirement.1

However, the Rules also provide the Company a compliance period of 180 calendar days in which to regain compliance.

If

at any time during this 180 day period the closing bid price of the Company’s security is at least $1 for a minimum of

ten consecutive business days, we will provide you written confirmation of compliance and this matter will be closed. Please note

that if the Company chooses to implement a reverse stock split, it must complete the split no later than ten business days prior to

the expiration date in the table below in order to regain compliance.2

In

the event the Company does not regain compliance, the Company may be eligible for additional time. To qualify, the Company will be required

to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for The Nasdaq

Capital Market, with the exception of the bid price requirement, and will need to provide written notice of its intention to cure the

deficiency during the second compliance period, by effecting a reverse stock split, if necessary. If the Company meets these requirements,

we will inform the Company that it has been granted an additional 180 calendar days. However, if it appears to Staff that the Company

will not be able to cure the deficiency, or if the Company is otherwise not eligible, we will provide notice that its securities will

be subject to delisting.3

1 For online access to all Nasdaq

Rules, please see “Nasdaq Online Resources,” included with this letter.

2 For additional information

with respect to compliance periods please see the “Nasdaq Online Resources” on the attached page and access the link “Frequently

Asked Questions” related to “continued listing.”

3 At that time, the Company may

appeal the delisting determination to a Hearings Panel.

Ms.

Claire Luk

May 17, 2024

Page

2

Our

Rules require that the Company promptly disclose receipt of this letter by either filing a Form 8-K, where required by SEC rules, or

by issuing a press release. The announcement needs to be made no later than four business days from the date of this letter and must

include the continued listing criteria that the Company does not meet, and a description of each specific basis and concern identified

by Nasdaq in reaching the determination.4 The Company must also provide a copy of the announcement to Nasdaq’s MarketWatch

Department at least 10 minutes prior to its public release.5 Please note that if you do not make the required announcement

trading in your securities will be halted.6

The

following table summarizes the critical dates and information as related to this matter.

| Period

below $1.00 bid price |

|

Expiration

of 180 calendar day compliance period |

|

Public

Announcement Due Date |

|

Relevant

Listing Rules |

April

4, 2024 to May 16, 2024 |

|

November

13, 2024 |

|

May

23, 2024 |

|

5550(a)(2)

– bid price 5810(c)(3)(A)7 – compliance period

5810(b)

– public disclosure 5505 – Capital Market criteria |

Finally,

an indicator will be displayed with quotation information related to the Company’s securities on NASDAQ.com and NASDAQTrader.com

and may be displayed by other third party providers of market data information. Also, a list of all non-compliant Nasdaq companies and

the basis for such non-compliance is posted on our website at listingcenter.nasdaq.com. The Company will be included in this list

commencing five business days from the date of this letter.

If

you have any questions, please do not hesitate to contact me at +1 202 748 4488.

Sincerely,

Rachel

Scherr

Listing Analyst

Nasdaq

Listing Qualifications

4

Listing Rule 5810(b). See FAQ #428 available on the Nasdaq Listing Center.

5

The notice must be submitted to Nasdaq’s MarketWatch Department through the Electronic Disclosure service available at nasdaq.net/ED/IssuerEntry.

6

Listing Rule IM-5810-1.

7

Listing Rule 5810(c)(3)(A)(iii) states in part: “if during any compliance period specified in this Rule 5810(c)(3)(A) a Company’s

security has a closing bid price of $0.10 or less for ten consecutive trading days, the Listing Qualifications Department shall issue

a Staff Delisting Determination under Rule 5810 with respect to that security.”

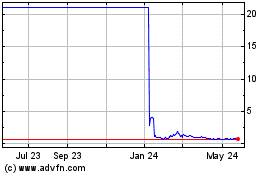

Roma Green Finance (NASDAQ:ROMA)

Historical Stock Chart

From Dec 2024 to Jan 2025

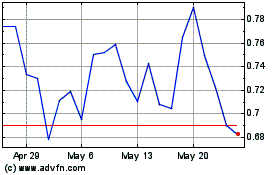

Roma Green Finance (NASDAQ:ROMA)

Historical Stock Chart

From Jan 2024 to Jan 2025