Roma Financial Corporation Announces Fourth Quarter 2010 Earnings

March 08 2011 - 10:30AM

Roma Financial Corporation (Nasdaq:ROMA) (the "Company"), the

holding company of Roma Bank and RomAsia Bank, announced today its

financial condition and results of operations for the three months

and year ended December 31, 2010.

The Company's consolidated net income, for the three months and

year ended December 31, 2010, was $1.2 million and $5.1 million,

respectively. These represented very substantial increases of $1.1

million and $2.5 million over the three months and year ended

December 31, 2009, respectively. The 95.3% increase in net income

reported for the full year 2010 caused a near doubling of net

income per share to $0.17 per share, compared to $0.09 per

share last year.

For the three months and year ended December 31, 2010, net

interest income was $13.2 million and $46.1 million, compared to

$9.4 million and $33.1 million for the same periods in 2009. For

the year ended December 31, 2010, this represented an increase of

39.3%, more than double the increase reported in 2009.

Net income in 2010 principally benefitted from a $13.0 million

improvement in net interest income and was given a boost by the

gain on securities held for sale which included a security that had

an impairment charge recorded in the last quarter of 2009 on an

available for sale equity security. Together, this income

helped soften the impact of a $3.6 million increase in the

provision for loan losses; the expenses associated with the

acquisition and merger of Sterling Bank into Roma Bank; and the

opportunity interest lost on an increase in non-performing loans,

including those acquired in the merger.

At December 31, 2010, the Company had consolidated assets,

deposits, borrowings and equity of $1.8 billion, $1.5 billion,

$75.0 million and $212.5 million, respectively.

"Performance comparisons between 2010 and the prior year are

skewed by the inclusion of the assets and liabilities acquired in

the merger, and the combined operating results since the date of

acquisition," commented Peter A. Inverso, President and

CEO. "However, even without the merger, assets, loans, and

deposits achieved record levels in 2010. In the aggregate,

assets increased 38.7%, net loans gained 52.6%, and deposits

swelled 48.0% over their respective 2009 year end levels.

"While we continued to grapple with the credit quality of our

commercial loan portfolio, and earnings were impacted by a sizable

increase in the level of non-performing loans to $40.4 million, of

which $17.9 million reflect loans acquired in the merger, we are

pleased that our capital ratios remain strong and, when measured

against regulatory capital ratio requirements, both our banks are

considered well capitalized. At the end of the year,

non-performing loans represented 4.44% of total loans, 2.22% of

total assets. Consequently, we prudently increased our

provisions for loan losses, lifting our allowance for loan losses

to 24.4% of non-performing loans and 1.1% of total loans at the end

of the year.

"Management is intently focused on converting these loans into

earning assets. While progress is being made, the agonizingly

slow pace in obtaining judicial remedies remains a costly obstacle

as collateral values securing these loans further erode and

expenses mount," added Inverso.

In closing, Inverso stated, "The Company remains strong, well

capitalized, and well equipped to contend with the vagaries of our

economy. Additionally, we have taken actions to maximize our

earnings potential. The acquisition of Sterling Bank is one

example as it provides us with expanded deposit and loan

opportunities."

Shares of the Company began trading on July 12, 2006, on the

NASDAQ Global Select Market under the symbol "ROMA."

Roma Financial Corporation (Nasdaq:ROMA) is the holding company

of Roma Bank, a community bank headquartered in Robbinsville, New

Jersey. Roma Bank has been serving families, businesses and

the communities of Central New Jersey for over 90 years with a

complete line of financial products and services, and today Roma

Bank operates branch locations in Mercer, Burlington, Camden, and

Ocean counties in New Jersey. Visit Roma online at

www.romabank.com.

Forward Looking Statements

The foregoing material contains forward-looking statements

concerning the financial condition, results of operations and

business of the Company. We caution that such statements are

subject to a number of uncertainties and actual results could

differ materially, and, therefore, readers should not place undue

reliance on any forward-looking statements. The Company does

not undertake, and specifically disclaims, any obligation to

publicly release the results of any revisions that may be made to

any forward-looking statements to reflect the occurrence of

anticipated or unanticipated events or circumstances after the date

of such statements.

CONTACT: Peter A. Inverso, President & CEO

609-223-8310

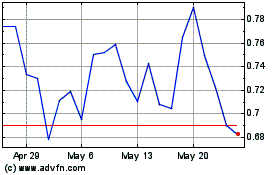

Roma Green Finance (NASDAQ:ROMA)

Historical Stock Chart

From Nov 2024 to Dec 2024

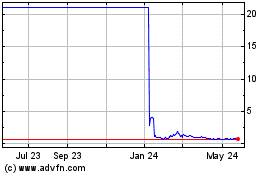

Roma Green Finance (NASDAQ:ROMA)

Historical Stock Chart

From Dec 2023 to Dec 2024